Revealed on March twenty eighth, 2023 by Aristofanis Papadatos

Figuring out cheaply valued shares is paramount in attaining excessive funding returns. Shares with low P/E ratios can supply engaging returns even when they don’t develop their earnings at a quick tempo.

On this article, we’ll talk about the prospects of 20 undervalued shares, that are presently buying and selling at P/E ratios underneath 15 and are providing dividend yields above 5.0%.

These shares are appropriate not just for worth oriented traders but additionally for income-oriented traders. We now have ranked the shares by P/E ratio, from lowest to highest. For REITs, we use P/FFO rather than the P/E ratio. And for MLPs, we use P/DCF (which is distributable money flows). These are comparable metrics just like earnings for widespread shares.

You may obtain your free copy of the Dividend Champions listing, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink beneath:

#1: Workplace Properties (OPI) – P/E ratio of two.5

Workplace Properties Revenue Belief is a REIT that presently owns greater than 160 buildings, that are situated in 31 states and are primarily leased to single tenants with excessive credit score high quality.

Supply: Investor Presentation

The portfolio of the REIT presently has a 90.6% occupancy charge and a mean constructing age of 17 years.

Workplace Properties generates 63% of its rental revenue from investment-grade tenants. This is without doubt one of the highest percentages of hire paid by investment-grade tenants within the REIT sector. Furthermore, the U.S. Authorities tenants generate roughly 20% of rental revenue whereas no different tenant accounts for greater than 4% of annual revenue. General, Workplace Properties has an distinctive credit score profile of tenants, which leads to dependable money flows and thus constitutes a major aggressive benefit.

Alternatively, Workplace Properties has a excessive debt load, with its curiosity expense presently consuming primarily all its working revenue. Consequently, the belief is within the technique of promoting belongings to scale back its leverage. The deleverage course of has been taking its toll on the efficiency of the REIT over the last three years.

Attributable to its excessive debt load, Workplace Properties is weak to the present atmosphere of rising rates of interest, which increase the curiosity expense of the REIT. The market is effectively conscious of this vulnerability and thus it has punished the inventory with a 55% plunge during the last 12 months.

On the intense facet, Workplace Properties has change into remarkably low cost. The inventory is buying and selling at an all-time low price-to-FFO ratio of two.5 and is providing an all-time excessive dividend yield of 19.2%. The payout is wholesome, at 49%, however the dividend isn’t secure as a result of weak steadiness sheet of the REIT. However, even after a dividend minimize, the inventory will likely be providing an above common yield. General, Workplace Properties appears extremely engaging from a long-term perspective.

Click on right here to obtain our most up-to-date Positive Evaluation report on Workplace Properties (OPI) (preview of web page 1 of three proven beneath):

#2: Brandywine Realty Belief (BDN) – P/E ratio of three.3

Brandywine Realty Belief is a REIT that owns, develops, leases and manages an city city middle and transit-oriented portfolio which incorporates 163 properties in Philadelphia, Austin and Washington, D.C. The REIT generates 75% of its working revenue in Philadelphia, 19% of its working revenue in Austin and the remaining 6% in Washington.

Supply: Investor Presentation

As Brandywine Realty Belief generates the huge portion of its working revenue in Philadelphia and Austin, it vastly advantages from the distinctive benefits of those two areas. In accordance with official studies, Philadelphia has the very best progress charge of extremely educated residents since 2008 whereas Austin is the fastest-growing metropolitan space, the most effective place to start out enterprise and it has retrieved all the roles misplaced as a result of pandemic.

Similar to most REITs, Brandywine Realty Belief is presently going through a robust headwind, specifically the influence of fast-rising rates of interest on the curiosity expense of the REIT. Consequently, the inventory has plunged to a 14-year low, buying and selling at an all-time low price-to-FFO ratio of three.3.

As well as, the inventory is providing an all-time excessive dividend yield of 17.8%. The payout ratio is first rate, at 66%, however Brandywine Realty Belief has a excessive leverage ratio (Web Debt to EBITDA) of seven.0. It additionally has a debt maturity in October-2024 and one other one in June-2026. Consequently, the dividend is prone to come underneath stress within the occasion of an unexpected downturn. The excessive debt load is the first cause behind the freeze of the dividend for 17 consecutive quarters. Furthermore, Brandywine Realty Belief is delicate to recessions because of its weak steadiness sheet and the sensitivity of its tenants to recessions. However, even when the REIT cuts its dividend, it would nonetheless offer an above common yield. As well as, each time inflation and rates of interest revert to regular ranges, the inventory is prone to rebound strongly because of its depressed valuation.

Click on right here to obtain our most up-to-date Positive Evaluation report on Brandywine Realty Belief (BDN) (preview of web page 1 of three proven beneath):

#3: SL Inexperienced Realty (SLG) – P/E ratio of three.7

Based in 1980, SL Inexperienced Realty is a REIT that’s targeted on buying and managing industrial properties in Manhattan. It’s the largest workplace landlord in Manhattan, with 61 buildings which have a complete floor space of 33 million sq. ft.

SL Inexperienced Realty has been severely harm by the coronavirus disaster, which has resulted in a work-from-home pattern. The pandemic has subsided since final 12 months, however workplace area occupancy in New York stays close to historic lows. Consequently, SL Inexperienced Realty is going through an unprecedented tenant-friendly atmosphere, and therefore it has been pressured to supply materials concessions to its tenants.

The persistence of the work-from-home pattern has elevated the uncertainty over the long run progress prospects of SL Inexperienced Realty. Nonetheless, we anticipate this pattern to attenuate within the upcoming years, because the financial slowdown will in all probability enhance the negotiation energy of employers over their staff.

SL Inexperienced Realty is buying and selling at an all-time low price-to-FFO ratio of three.7 and is providing an all-time excessive dividend yield of 15.9%. The corporate has a wholesome payout ratio of 59%, however its dividend isn’t secure because of its materials debt load. However, even after a dividend minimize, the inventory will supply a pretty yield. General, SL Inexperienced Realty has been severely harm by a persistent work-from-home pattern and high-interest charges, which have elevated the curiosity expense of the REIT, however the inventory appears deeply undervalued from a long-term perspective.

Click on right here to obtain our most up-to-date Positive Evaluation report on SL Inexperienced Realty (SLG) (preview of web page 1 of three proven beneath):

#4: Douglas Emmett (DEI) – P/E ratio of 6.0

Douglas Emmett is a REIT that was based in 1971. It’s the largest workplace landlord in Los Angeles and Honolulu, with a 38% common market share of workplace area in its submarkets. The REIT generates 86% of its income from its workplace portfolio and 14% of its income from its multifamily portfolio. It has roughly 2,700 workplace leases in its portfolio and generates annual income of $1 billion.

The deserves of being the biggest workplace landlord in Los Angeles are apparent, as Los Angeles County is the third-largest metropolis on the earth, with GDP of $1 trillion, behind solely Tokyo and New York. The dominant place of Douglas Emmett creates operational synergies. As well as, the REIT advantages from excessive limitations to entry, which cut back competitors. Furthermore, the proximity to premier housing attracts prosperous tenants, who supply dependable money flows to the corporate.

The markets of Douglas Emmett are characterised by excessive hire progress and comparatively low volatility. Rents within the West Los Angeles submarkets of the REIT have grown 150% during the last 25 years, at a 3.7% common annual charge, the very best progress charge amongst all of the U.S. gateway markets. Douglas Emmett definitely advantages from this pattern, as its leases embody 3%-5% annual hire hikes.

Supply: Investor Presentation

Sadly, Douglas Emmett has not recovered from the coronavirus disaster but, because the work-from-home pattern has persevered longer than initially anticipated. As well as, the REIT is harm by elevated curiosity expense, which has resulted from rising rates of interest.

Nonetheless, we view these headwinds as momentary and consider that the inventory has change into exceptionally low cost. Douglas Emmett is buying and selling at a 10-year low price-to-FFO ratio of 6.0, which is lower than half of the 10-year common price-to-FFO ratio of 15.5 of the inventory. Furthermore, the inventory is providing a virtually 10-year excessive dividend yield of 6.7%, with a stable payout ratio of 40%. To chop a protracted story quick, each time inflation subsides, Douglas Emmett is prone to supply extreme returns to the traders who can keep a long-term perspective through the ongoing downturn.

Click on right here to obtain our most up-to-date Positive Evaluation report on Douglas Emmett (DEI) (preview of web page 1 of three proven beneath):

#5: Annaly Capital Administration (NLY) – P/E ratio of 6.1

Annaly Capital Administration is a diversified capital supervisor that invests in and funds residential and industrial belongings. The belief invests in varied varieties of company mortgage-backed securities, non-agency residential mortgage belongings, and residential mortgage loans. The belief has elected to be taxed as a REIT.

Supply: Investor Presentation

Annaly borrows funds at short-term rates of interest and invests in long-term securities. Consequently, the corporate is extraordinarily delicate to the underlying rates of interest and the yield curve, i.e., the distinction between long-term and short-term rates of interest.

Annaly is presently going through an ideal storm as a result of aggressive rate of interest hikes applied by the Fed in an effort to revive inflation to regular ranges. As a result of efforts of the Fed to chill the financial system, short-term rates of interest have risen above long-term rates of interest. In different phrases, the market predicts {that a} recession will present up in the end.

As Annaly borrows funds at short-term rates of interest and invests funds at long-term charges, it has change into extraordinarily arduous for the corporate to make worthwhile new offers underneath the prevailing circumstances. However, the corporate is prone to stay worthwhile because of its existent funding portfolio. As well as, a lot of the injury has in all probability been achieved in reference to the inventory worth, because the Fed isn’t prone to increase rates of interest a lot additional.

Annaly is presently buying and selling at a price-to-earnings ratio of solely 6.1 and is providing an exceptionally excessive dividend yield of 13.7%. Whereas its dividend is much from secure, it’s prone to stay excessive even within the occasion of a dividend minimize. Given a budget valuation of the inventory, its excessive dividend and the truth that the more severe appears to be behind, Annaly is prone to extremely reward affected person traders within the upcoming years.

Click on right here to obtain our most up-to-date Positive Evaluation report on Annaly Capital Administration (NLY)(preview of web page 1 of three proven beneath):

#6: Chimera Funding Company (CIM) – P/E ratio of 6.1

Chimera Funding Company is a REIT that may be a specialty finance firm. It invests by its subsidiaries in a diversified portfolio of mortgage belongings, together with residential mortgage loans, non-agency residential mortgage belongings, and different actual property associated securities.

Supply: Investor Presentation

The revenue of Chimera is set by the distinction between the yield of its investments, which will depend on long-term rates of interest, and the rate of interest paid for its borrowed funds, which will depend on short-term rates of interest. Consequently, the corporate is extraordinarily delicate to the underlying rates of interest and the yield curve, i.e., the distinction between long-term and short-term rates of interest.

Similar to Annaly, Chimera has been severely harm by the aggressive rate of interest hikes applied by the Fed since early final 12 months. As a result of efforts of the Fed to chill the financial system, short-term rates of interest have risen above long-term rates of interest. In different phrases, the market expects a recession to indicate up within the close to future.

The detrimental slope of the yield curve has made it extraordinarily arduous for Chimera to make a revenue in new transactions. However, the corporate is prone to stay worthwhile because of its existent funding portfolio. As well as, a lot of the injury has in all probability been achieved, because the Fed isn’t prone to increase rates of interest a lot additional.

Chimera is buying and selling at a remarkably low P/E ratio of 6.1 and is providing a 10-year excessive dividend yield of 16.9%. Given the acute payout ratio of 102% and the vulnerability of Chimera to the present investing atmosphere, its dividend is much from secure. However, even after a dividend minimize, the inventory will nonetheless offer an above common yield. Due to its low cost valuation, the inventory is engaging from a long-term perspective, notably on condition that the more severe appears to be behind the corporate.

Click on right here to obtain our most up-to-date Positive Evaluation report on Chimera Funding Company (CIM) (preview of web page 1 of three proven beneath):

#7: Walgreens Boots Alliance (WBA) – P/E ratio of seven.3

Walgreens Boots Alliance is the biggest retail pharmacy in each the U.S. and Europe. Via its flagship Walgreens enterprise and different enterprise ventures, the corporate is current in additional than 9 international locations, with greater than 13,000 shops within the U.S., Europe and Latin America.

Walgreens has grown its earnings per share by 7.6% per 12 months on common during the last decade however it has stalled during the last 5 years, principally because of heating competitors, which has taken its toll on the margins of the corporate. As well as, the revenue margins within the pharmaceutical enterprise have change into an object underneath scrutiny in recent times. Consequently, traders shouldn’t anticipate significant margin growth for the foreseeable future.

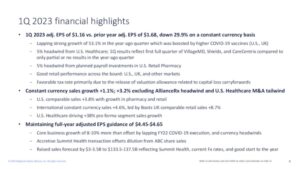

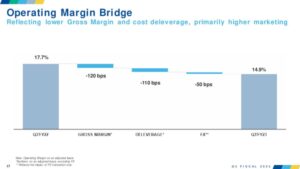

Walgreens can be going through one other headwind, specifically the fading optimistic impact of the pandemic. Within the first quarter of 2023, the corporate executed solely 8.4 million vaccinations, which have been a lot decrease than the 11.8 million vaccinations within the second quarter of 2022. Consequently, complete revenues decreased 1.5% and adjusted earnings per share plunged 30% over the prior 12 months’s quarter.

Supply: Investor Presentation

It’s also exceptional that Walgreens did not obtain a pretty bid for its Boots enterprise. Attributable to its lackluster progress prospects, Walgreens has been punished to the acute by the market. The inventory is presently buying and selling at a 10-year low P/E ratio of seven.3, which is about half of its 10-year common P/E ratio.

Furthermore, Walgreens has raised its dividend for 47 consecutive years and is presently providing a virtually 10-year excessive dividend yield of 5.9%. The corporate has a stable payout ratio of 42%, a wholesome steadiness sheet and it has proved resilient to recessions because of the important nature of its enterprise. Subsequently, traders can lock within the exceptionally excessive dividend yield of the inventory and relaxation assured that the dividend is secure. Given additionally the extraordinarily low cost valuation of Walgreens, we view the inventory as extremely engaging for affected person traders.

Click on right here to obtain our most up-to-date Positive Evaluation report on Walgreens Boots Alliance (WBA) (preview of web page 1 of three proven beneath):

#8: Cousins Properties (CUZ) – P/E ratio of seven.4

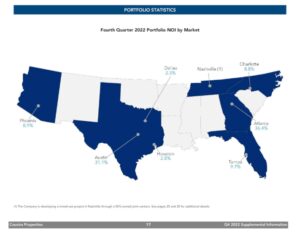

Cousins Properties is a self-managed REIT that was based in 1958 and acquires, develops and leases workplace buildings in high-growth Solar Belt markets.

Supply: Investor Presentation

The belief generates 36% of its working revenue in Atlanta and 31% of its working revenue in Austin. Solar Belt markets are engaging because of their superior financial progress in comparison with most different areas of the U.S.

Cousins Properties has been harm by the coronavirus disaster, which has led many corporations to undertake a work-from-home mannequin. This downturn has caught the REIT with a excessive debt load and therefore the belief has been pressured to promote some properties so as to endure the disaster. Its complete rentable sq. ft have decreased in every of the final three years. Furthermore, the belief has a excessive leverage ratio (Web Debt to EBITDA) of 4.9. However, we consider that the more severe is behind the corporate.

Aside from the work-from-home pattern, Cousins Properties is now going through one other robust headwind, specifically growing curiosity expense because of fast-rising rates of interest. Administration not too long ago offered steering for an approximate 5% lower in FFO per unit in 2023, primarily because of increased curiosity expense.

Whereas Cousins Properties is going through antagonistic enterprise circumstances proper now, traders ought to notice that the inventory has change into remarkably low cost. The REIT is buying and selling at a 10-year low price-to-FFO ratio of seven.4, which is much decrease than the 10-year common price-to-FFO ratio of 12.7 of the inventory. As well as, the inventory is providing a 10-year excessive dividend yield of 6.7%, with a wholesome payout ratio of 49%. As a result of weak steadiness sheet of the corporate, the dividend isn’t completely secure. Nonetheless, each time inflation and rates of interest revert to regular ranges, Cousins Properties is prone to extremely reward traders off its present depressed inventory worth.

Click on right here to obtain our most up-to-date Positive Evaluation report on Cousins Properties (CUZ) (preview of web page 1 of three proven beneath):

#9: AT&T (T) – P/E ratio of seven.6

AT&T is a diversified, world chief in telecommunications, serving greater than 100 million prospects. Nearly a 12 months in the past, AT&T accomplished the spin-off of WarnerMedia.

AT&T is a colossal enterprise, which generates roughly $120 billion of annual revenues. Nonetheless, the corporate has grown its earnings per share by solely 0.3% per 12 months on common during the last decade. Consequently, the inventory has dramatically underperformed the broad market during the last decade; it has shed 33% whereas the S&P 500 has rallied 153%.

The poor efficiency of AT&T has resulted primarily from some markedly poor investing selections. AT&T acquired DirecTV for $65 billion in 2015, near the height of the enterprise of the acquired firm. After having misplaced about 10 million subscribers, AT&T spun off DirecTV, with an implied enterprise worth of solely $16.25 billion. The same state of affairs was evidenced with Time Warner, which AT&T acquired in 2018 however spun off final 12 months. In each conditions, AT&T purchased excessive and offered low, thus decreasing shareholder worth.

Attributable to its poor efficiency file, AT&T is now buying and selling at a virtually 10-year low P/E ratio of seven.6. A budget valuation has resulted in an above common dividend yield of 6.0%. We consider that AT&T has change into exceptionally engaging from a long-term perspective.

After a sequence of failed investments, AT&T is now specializing in its core enterprise. Consequently, the corporate has already begun to enhance its efficiency.

Supply: Investor Presentation

Every time the market appreciates the virtues of the lean enterprise mannequin of AT&T, it’s prone to reward the inventory with a better P/E ratio.

Click on right here to obtain our most up-to-date Positive Evaluation report on AT&T (T) (preview of web page 1 of three proven beneath):

#10: American Property Belief (AAT) – P/E ratio of seven.6

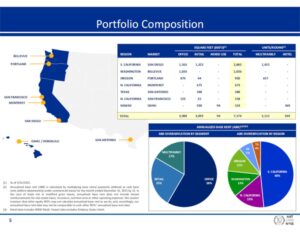

American Property Belief is a REIT that was fashioned in 2011 as a successor of American Property, a privately held firm based in 1967. American Property Belief is headquartered in San Diego, California, and has nice expertise in buying, bettering and creating workplace, retail and residential properties all through the U.S., primarily in Southern California, Northern California, Oregon, Washington and Hawaii.

Its workplace portfolio and its retail portfolio comprise of roughly 4.0 million and three.1 million sq. ft, respectively.

Supply: Investor Presentation

American Property Belief additionally owns greater than 2,000 multifamily models.

The expansion technique of American Property Belief entails the acquisition of properties in submarkets with favorable provide and demand traits, together with excessive limitations to entry. As well as, the REIT redevelops lots of its newly-acquired properties so as to improve their worth. It additionally has a capital recycling technique, which entails promoting properties whose returns appear to have been maximized and shopping for high-return properties.

Thanks to those progress drivers, American Property Belief has grown its FFO per unit each single 12 months during the last decade, apart from 2020 as a result of pandemic. The REIT has grown its FFO per unit at a 4.4% common annual charge throughout this era. Furthermore, it proved pretty resilient to the pandemic and has already recovered from that disaster.

American Property Belief seems resilient to excessive inflation because of its capability to lift rental charges considerably yearly. Alternatively, it has decelerated these days, because it has begun to face robust comparisons over exceptionally robust ends in the prior 12 months’s interval. Consequently, the inventory has been punished by the market.

American Property Belief is presently buying and selling at a 10-year low price-to-FFO ratio of seven.6, which is lower than half of the 5-year common price-to-FFO ratio of 17.1 of the inventory. As well as, the inventory is providing a 10-year excessive dividend yield of seven.7%. Given the wholesome payout ratio of 59% and the dependable progress trajectory of the REIT, the dividend is secure. The one concern is the fabric debt load of the REIT, which has an curiosity protection ratio of solely 2.0.

On the intense facet, American Property Belief has acquired funding grade rankings from the most important ranking companies. Given the promising progress potential of the REIT, we don’t anticipate it to face any issues servicing its debt. Subsequently, we anticipate American Property Belief to supply extreme returns to traders each time the financial system recovers from its newest slowdown.

Click on right here to obtain our most up-to-date Positive Evaluation report on American Property Belief (AAT) (preview of web page 1 of three proven beneath):

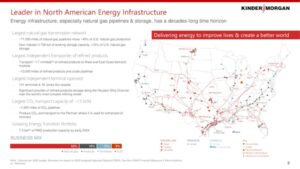

#11: Kinder Morgan (KMI) – P/E ratio of seven.9

Kinder Morgan is among the many largest vitality corporations within the U.S. It’s engaged in storage and transportation of oil and fuel and different merchandise. It owns an curiosity in or operates roughly 83,000 miles of pipelines and 140 terminals.

Supply: Investor Presentation

Kinder Morgan has a strong enterprise mannequin, because it generates almost all its money flows from fee-based contracts and minimum-volume contracts. The corporate generates almost 70% of its working revenue from minimum-volume contracts. In different phrases, its prospects pay a minimal quantity to Kinder Morgan yearly even when they transport a lot decrease volumes than regular.

Furthermore, Kinder Morgan is resilient to the secular shift from fossil fuels to scrub vitality sources. Whereas oil corporations are weak to this shift, which has vastly accelerated within the final three years, Kinder Morgan is targeted totally on pure fuel, which is a a lot cleaner gas than oil merchandise. Consequently, all of the environmental insurance policies that purpose to scale back oil consumption don’t purpose to scale back pure fuel consumption and therefore Kinder Morgan is hardly affected by environmental insurance policies.

The resilience of Kinder Morgan was additionally proved all through the coronavirus disaster. Most oil corporations incurred extreme losses in 2020 as a result of collapse of the costs of oil and fuel in that 12 months. Quite the opposite, Kinder Morgan incurred simply an 8% lower in its distributable money circulation (DCF) per unit in that 12 months. An 8% lower in one of many fiercest downturns of the vitality sector is definitely admirable. Furthermore, the corporate recovered strongly in 2021, with a file distributable money circulation per unit in that 12 months.

Kinder Morgan is presently buying and selling at a pretty price-to-DCF ratio of seven.9. The corporate has raised its dividend for five consecutive years and it’s providing an above common dividend yield of 6.6%. Due to its stable payout ratio of 52% and its defensive enterprise mannequin, Kinder Morgan is prone to preserve elevating its dividend for a lot of extra years. Subsequently, traders ought to reap the benefits of its exceptionally excessive yield and low cost valuation.

Click on right here to obtain our most up-to-date Positive Evaluation report on Kinder Morgan (KMI) (preview of web page 1 of three proven beneath):

#12: Verizon (VZ) – P/E ratio of 8.0

Verizon, which was created by the merger of Bell Atlantic with GTE in 2000, is without doubt one of the largest wi-fi carriers within the nation. Wi-fi generates three-quarters of the full revenues of the corporate whereas broadband and cable companies account for a couple of quarter of gross sales. The community of Verizon covers roughly 300 million individuals and 98% of the U.S.

Verizon enjoys a key aggressive benefit, specifically its repute as the most effective wi-fi provider within the U.S. That is clearly mirrored within the wi-fi internet additions of the corporate and its exceptionally low churn charge. This dependable service permits Verizon to take care of its buyer base and transfer some prospects to higher-priced plans.

Verizon displays lackluster enterprise momentum proper now. Final 12 months, the corporate posted primarily flat gross sales and noticed its earnings per share dip 6% because of excessive working bills in addition to excessive curiosity expense. Verizon has offered steering for earnings per share of $4.55-$4.85 in 2023, implying an extra 7% lower.

Supply: Investor Presentation

However, it is very important notice that the inventory has change into exceptionally low cost. To make certain, Verizon is presently buying and selling at a virtually 10-year low P/E ratio of 8.0 and is providing a 10-year excessive dividend yield of 6.9%. Due to the stable payout ratio of 56%, the robust enterprise place of the corporate and its resilience to recessions, its dividend must be thought-about secure. It’s also value noting that Verizon has grown its dividend for 18 consecutive years. General, each time Verizon returns to progress mode, it’s prone to supply extreme returns to those that buy the inventory round its present inventory worth.

Click on right here to obtain our most up-to-date Positive Evaluation report on Verizon (VZ) (preview of web page 1 of three proven beneath):

#13: Altria (MO) – P/E ratio of 8.8

Altria is a client staples big, with a historical past of 175 years. The corporate is the producer of the top-selling cigarette model on the earth, specifically Marlboro, in addition to some non-smokeable merchandise. The tobacco big has maintained a market share of about 40%-43% for a number of years in a row.

Supply: Investor Presentation

Altria additionally has massive stakes in world beer big Anheuser Busch InBev (BUD) and Cronos Group (CRON), a hashish firm.

Altria has a rock-solid enterprise mannequin in place. Due to the inelastic demand for its merchandise, the corporate has been elevating its costs 12 months after 12 months. Consequently, it has greater than offset the impact of the steadily declining consumption per capita of cigarettes on its earnings. Due to its robust pricing energy, Altria has grown its earnings per share each single 12 months during the last decade, at an 8.8% common annual charge. The constant progress file of Altria is a testomony to the energy of its enterprise mannequin.

Alternatively, Altria has been caught off-guard within the ongoing transition of shoppers in the direction of various tobacco merchandise, equivalent to vaping merchandise. About 5 years in the past, Altria acquired a 35% stake in Juul, a frontrunner in vaping merchandise, for $12.8 billion however that funding proved disastrous. After the acquisition, Juul incurred a number of hits because of restrictions from regulatory authorities. The corporate can be going through extreme potential fines from regulators sooner or later. Consequently, Altria not too long ago divested its stake in Juul and thus its complete funding within the firm evaporated.

Attributable to its failed funding and its weak place in various tobacco merchandise, Altria is presently buying and selling at a virtually 10-year low price-to-earnings ratio of 8.8 and is providing a virtually 10-year excessive dividend yield of 8.6%, with a 10-year low payout ratio of 75%. The inventory has change into extraordinarily low cost. It’s also exceptional that Altria continues rising its earnings per share to new all-time highs 12 months after 12 months. The corporate is on observe to develop its backside line by about 4% this 12 months. Every time the market shift its deal with the rock-solid enterprise mannequin of Altria, the inventory is prone to supply extreme returns to its shareholders off its present depressed worth.

Click on right here to obtain our most up-to-date Positive Evaluation report on Altria (MO) (preview of web page 1 of three proven beneath):

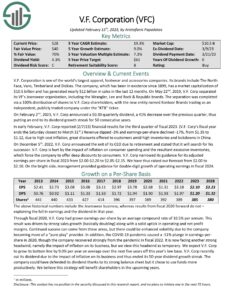

#14: V.F. Company (VFC) – P/E ratio of 9.7

V.F. Company has a historical past of greater than a century and is without doubt one of the largest attire, footwear and equipment corporations on the earth. Its manufacturers embody The North Face, Vans, Timberland and Dickies.

V.F. Company is presently going through a extreme downturn as a result of a number of influence of almost 40-year excessive inflation on the inventory. Extreme inflation has pronouncedly elevated the price of uncooked supplies, the freight prices and the labor prices of V.F. Company. Consequently, it exerts nice stress on the working margins of the retailer.

As well as, as a result of influence of inflation on the true buying energy of shoppers, the latter have change into conservative of their spending. Consequently, the inventories of V.F. Company have almost doubled over the prior 12 months. This has led the corporate to supply deep reductions in an effort to scale back its stock to more healthy ranges and thus the working margins of V.F. Company are underneath nice stress.

Supply: Investor Presentation

As a result of influence of sky-high inflation on its enterprise, V.F. Company not too long ago minimize its dividend by 41%, after 50 consecutive years of dividend progress. However, the inventory remains to be providing a virtually 10-year excessive dividend yield of 5.9%. It additionally has a stable payout ratio of 57% and a rock-solid steadiness sheet and therefore its new dividend must be thought-about secure.

Furthermore, V.F. Company is buying and selling at a recent 10-year low, at a virtually 10-year low P/E ratio of 9.7. Moreover, the Fed is set to revive inflation to its goal degree of two%. Due to the aggressive stance of the Fed, inflation has subsided each month because it peaked final summer time. When inflation reverts to regular ranges, V.F. Company is prone to get pleasure from a robust rebound in its enterprise and thus it would in all probability extremely reward affected person traders.

Click on right here to obtain our most up-to-date Positive Evaluation report on V.F. Company (VFC) (preview of web page 1 of three proven beneath):

#15: Lazard (LAZ) – P/E ratio of 10.0

Lazard is a monetary advisory firm, with a historical past of 175 years and operations in 43 cities worldwide.

Supply: Investor Presentation

The corporate has two enterprise divisions, specifically Monetary Advisory and Asset Administration. The previous consists of investor analytics, debt issuance, mergers and acquisitions, debt restructuring, chapter 11 and capital raises whereas the latter is targeted totally on institutional shoppers.

Lazard has an awesome repute in its enterprise, as it’s thought-about some of the dependable corporations within the monetary world. When an organization or a rustic faces monetary issues, it typically consults Lazard so as to consider its choices and restructure its debt in probably the most environment friendly method. The purchasers of Lazard pay considerable quantities to the corporate for its consulting companies however they earn much more because of the experience of Lazard.

Lazard is prone to incur a decline in its earnings this 12 months as a result of world financial slowdown brought on by the rate of interest hikes applied by most central banks, the resultant lower in belongings underneath administration and the decreased transaction exercise of the shoppers of the corporate.

With that stated, the inventory has change into exceptionally low cost. Lazard is presently buying and selling at a virtually 10-year low P/E ratio of 10.0 and is providing a 10-year excessive dividend yield of 6.1%. Lazard has an honest payout ratio of 61% and a robust steadiness sheet, with a BBB+ credit standing from S&P and Fitch. Furthermore, the corporate doesn’t have any debt maturities till 2025 whereas administration has repeatedly affirmed its dedication for a rising dividend. Given additionally its dependable enterprise mannequin, Lazard isn’t prone to minimize its 6.1% dividend. General, the inventory is prone to supply extreme returns to traders each time the worldwide financial system reveals indicators of restoration from its newest slowdown.

Click on right here to obtain our most up-to-date Positive Evaluation report on Lazard (LAZ) (preview of web page 1 of three proven beneath):

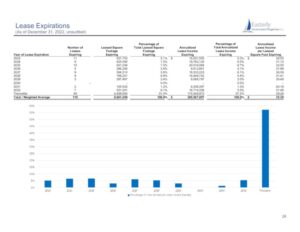

#16: Easterly Authorities Properties (DEA) – P/E ratio of 11.1

Easterly Authorities Properties is an internally managed REIT with a deal with acquisition, growth and administration of properties that are leased to U.S. Authorities companies. A lot of the properties of the REIT are leased to U.S. authorities companies, such because the FBI, IRS, and DEA.

Easterly Authorities Properties has discovered a profitable area of interest in the true property enterprise and has been working to change into a model identify in its discipline of U.S. Authorities leasing. Its operations are considered as secure investments, because the U.S. authorities is probably the most dependable tenant a landlord can discover. Throughout the U.S. Authorities, Easterly Authorities Properties leases to predominantly companies that are thought-about as important companies. This helps clarify how the belief has been capable of obtain an excellent 100% occupancy charge. Furthermore, the REIT has well-laddered lease maturities.

Supply: Investor Presentation

Sadly, Easterly Authorities Properties has a considerably lackluster efficiency file, because it has did not develop its FFO per unit meaningfully during the last 5 years. Alternatively, the inventory is markedly cheaply valued. It’s buying and selling at an 8-year low price-to-FFO ratio of 11.1 and is providing an 8-year excessive dividend yield of 8.3%. The payout ratio is excessive, at 93%, however the dividend could also be sustained because of the defensive enterprise mannequin of the REIT. We anticipate the inventory to rebound strongly each time inflation reverts to its long-term vary.

Click on right here to obtain our most up-to-date Positive Evaluation report on Easterly Authorities Properties (DEA) (preview of web page 1 of three proven beneath):

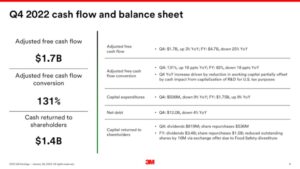

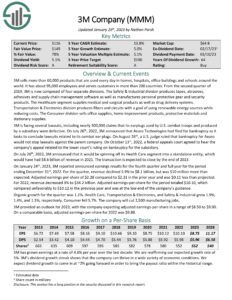

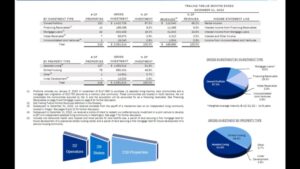

#17: 3M Firm (MMM) – P/E ratio of 11.5

3M Firm sells greater than 60,000 merchandise, that are used every single day in properties, hospitals, workplace buildings and faculties around the globe. The commercial producer has presence in additional than 200 international locations.

3M has a key aggressive benefit, specifically its exemplary division of Analysis & Growth (R&D). The corporate has persistently spent 5%-6% of its complete revenues (almost $2 billion per 12 months) on R&D so as to create new merchandise and thus meet altering client wants. This technique has definitely born fruit, because it has resulted in a portfolio of greater than 100,000 patents. Due to its deal with innovation, 3M generates almost one-third of its revenues from merchandise that didn’t exist 5 years in the past.

3M is presently going through a headwind because of excessive value inflation. Nonetheless, because of its dominant enterprise place, the corporate has robust pricing energy. Consequently, it has been capable of go its elevated prices to its prospects through materials worth hikes. That is clearly mirrored within the enterprise efficiency of 3M, as the corporate posted almost all-time excessive earnings per share in 2022.

3M is a Dividend King, with one of many longest dividend progress streaks within the investing universe. The corporate has raised its dividend for 64 consecutive years and is presently providing a 10-year excessive dividend yield of 5.9%. The inventory can be buying and selling at a 10-year low P/E ratio of 11.5.

The exceptionally low cost valuation of 3M has resulted from a robust headwind, specifically quite a few pending lawsuits. There are almost 300,000 claims that its earplugs, which have been utilized by U.S. fight troops and have been manufactured by Aearo Applied sciences, a subsidiary of 3M, have been faulty. The subsidiary of 3M filed for chapter however a U.S. choose dominated that this chapter wouldn’t stop lawsuits from burdening 3M. Consequently, no-one can predict the ultimate quantity of liabilities that 3M must pay to its plaintiffs.

However, because of its rock-solid steadiness sheet, 3M is prone to show able to enduring this headwind and rising stronger after this disaster is over. 3M has an curiosity protection ratio of 12.1 and internet debt to market cap of solely 32%.

Supply: Investor Presentation

Given additionally its wholesome payout ratio of 58% and its dependable enterprise efficiency, 3M is prone to proceed elevating its dividend for a lot of extra years.

Click on right here to obtain our most up-to-date Positive Evaluation report on 3M Firm (MMM) (preview of web page 1 of three proven beneath):

#18: LTC Properties (LTC) – P/E ratio of 12.2

LTC Properties is a REIT that invests in senior housing and expert nursing properties. Its portfolio consists of roughly 50% senior housing and 50% expert nursing properties. The REIT owns 216 investments in 29 states with 32 working companions.

Supply: Investor Presentation

LTC Properties has been harm by the chapter of Senior Care Facilities, which is the biggest expert nursing operator in Texas. Senior Care filed for Chapter 11 chapter in December-2018. Till 2018, it was producing 9.7% of the annual revenues of LTC Properties and was the fifth largest buyer of the belief.

On the intense facet, LTC Properties has most of its belongings in states with the very best projected will increase within the 80+ inhabitants cohort over the following decade. Furthermore, LTC Properties is presently recovering from the coronavirus disaster.

LTC Properties is presently providing a 10-year excessive dividend yield of 6.9%. The REIT has raised its dividend at a 2.3% common annual charge during the last decade. Nonetheless, it has frozen its dividend within the final six years as a result of absence of underlying progress. Consequently, it’s prudent to not anticipate dividend progress anytime quickly. The payout ratio is 84% and the steadiness sheet is leveraged, with a debt to adjusted EBITDA ratio of 5.0 and an curiosity protection ratio of three.5. Consequently, the dividend could come underneath stress if LTC Properties faces a robust headwind, equivalent to a recession. Happily, the REIT doesn’t have materials debt maturities for the following 5 years.

Furthermore, LTC Properties is buying and selling at a 10-year low price-to-FFO ratio of 12.2, which is far decrease than the 10-year common price-to-FFO ratio of 15.1 of the inventory. The exceptionally low cost valuation has resulted primarily from the impact of excessive rates of interest on the curiosity expense of the REIT. Every time rates of interest normalize, the inventory is prone to get pleasure from a robust rally off its depressed worth.

Click on right here to obtain our most up-to-date Positive Evaluation report on LTC Properties (LTC)(preview of web page 1 of three proven beneath):

#19: Philip Morris (PM) – P/E ratio of 14.8

Philip Morris was fashioned when its father or mother firm Altria spun off its worldwide operations. Philip Morris sells cigarettes underneath the Marlboro model and others manufacturers in worldwide markets.

Philip Morris has some of the worthwhile cigarette manufacturers on the earth, Marlboro, and is a frontrunner within the reduced-risk product class with iQOS.

Supply: Investor Presentation

Due to its robust enterprise place, it’s a low-risk enterprise. The one materials threat comes from potential restrictions from regulatory authorities however Philip Morris is safer than many different tobacco corporations on this regard because of its broad geographic diversification.

Philip Morris has grown its dividend for 15 consecutive years and is presently providing a virtually 10-year excessive dividend yield of 5.6%. Its payout ratio is just too excessive, at 83%, however the firm is probably going to have the ability to defend its dividend now that its previous investments have begun to bear fruit and capital necessities have decreased sharply. However, it’s prudent for traders to be ready for modest dividend progress going ahead.

Alternatively, because of the robust enterprise momentum of its various tobacco merchandise, Philip Morris expects to develop its currency-neutral earnings per share by about 6% this 12 months, from $5.81 to an all-time excessive of $6.09-$6.21. Furthermore, the inventory is buying and selling at a virtually 10-year low P/E ratio of 14.8. This earnings a number of is exceptionally low for this inventory, which has all the time loved a premium valuation because of its robust enterprise mannequin and its beneficiant dividends. The earnings of the corporate have been harm by a robust greenback however we anticipate the market to reward the inventory with a better P/E ratio each time the greenback depreciates vs. the opposite main currencies.

Click on right here to obtain our most up-to-date Positive Evaluation report on Philip Morris (PM) (preview of web page 1 of three proven beneath):

#20: Realty Revenue (O) – P/E ratio of 15.0

Realty Revenue is a retail REIT that’s well-known for its excellent dividend progress historical past. The belief owns greater than 4,000 retail properties.

Many traders keep away from retail REITs as a result of secular shift of shoppers from brick-and-mortar procuring to on-line purchases. Nonetheless, Realty Revenue continues to thrive within the present enterprise panorama. The REIT owns retail properties that aren’t a part of a wider retail growth, equivalent to a mall, however are standalone properties. Consequently, the properties of Realty Revenue can appeal to a number of varieties of tenants and therefore the corporate is basically proof against the secular decline of brick-and-mortar retailers.

The important thing aggressive benefit of Realty Revenue is its exemplary administration, which has nice experience in figuring out high-return properties. Due to its stable progress technique, Realty Revenue has grown its FFO per unit each single 12 months during the last decade, at a 5.5% common annual charge. It has achieved such a constant progress file because of the acquisition of high-return properties and predictable hire hikes 12 months after 12 months.

Furthermore, Realty Revenue has proved extraordinarily resilient to recessions. Within the Nice Recession, whereas different REITs minimize their dividends, Realty Revenue continued rising its dividend. The REIT has raised its dividend for 100 consecutive quarters.

Realty Revenue has grown its dividend at a 4.4% common annual charge since 1994, with 119 dividend hikes since then.

Supply: Investor Presentation

The REIT is presently providing a virtually 10-year excessive dividend yield of 5.0% and is buying and selling at a virtually 10-year low price-to-earnings ratio of 15.0. The exceptionally low cost valuation of the inventory has resulted primarily from the influence of inflation on the current worth of future money flows and the impact of excessive rates of interest on curiosity expense. Every time inflation and rates of interest revert to regular ranges, Realty Revenue will nearly definitely supply extreme returns.

Click on right here to obtain our most up-to-date Positive Evaluation report on Realty Revenue (O) (preview of web page 1 of three proven beneath):

Last Ideas

All of the above shares are buying and selling at remarkably low cost valuation ranges because of some enterprise headwinds. A few of them have been harm by excessive inflation or the most recent financial slowdown whereas others are going through their very own particular points. A lot of the above shares are prone to extremely reward traders off their present depressed ranges. Furthermore, all of the above shares are providing dividend yields above 5%. Thus, they make it a lot simpler for traders to attend patiently for the enterprise headwinds to subside.

In case you are eager about discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases will likely be helpful:

The key home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].