Printed on March thirty first, 2023 by Bob Ciura

Blue chip shares are usually people who have protected dividends, even throughout recessions, together with the flexibility to extend dividends over time.

At Positive Dividend, we qualify blue-chip shares as firms which can be members of 1 or extra of the next 3 lists:

You may obtain the entire checklist of all 350+ blue-chip shares (plus essential monetary metrics resembling dividend yield, P/E ratios, and payout ratios) by clicking beneath:

Along with the Excel spreadsheet above, this text covers our prime 20 protected blue-chip shares with excessive dividend yields and low volatility (measured by 5-year annualized customary deviation) from the Positive Evaluation Analysis Database.

On this part, shares had been additional screened for a passable Dividend Threat rating of ‘C’ or higher. The shares are listed by 5-year annualized customary deviation, from lowest to highest.

The desk of contents beneath permits for straightforward navigation.

Desk of Contents

Blue-Chip Inventory #1: Verizon Communications (VZ)

- Dividend Historical past: 18 years of consecutive will increase

- Dividend Yield: 6.8%

- 5-year Annualized Commonplace Deviation: 16.59%

Verizon is without doubt one of the largest wi-fi carriers within the nation. Wi-fi generates three-quarters of the overall revenues of the corporate whereas broadband and cable companies account for a few quarter of gross sales. The community of Verizon covers roughly 300 million folks and 98% of the U.S.

Verizon enjoys a key aggressive benefit, specifically its popularity as one of the best wi-fi service within the U.S. That is clearly mirrored within the wi-fi web additions of the corporate and its exceptionally low churn charge. This dependable service permits Verizon to keep up its buyer base and transfer some clients to higher-priced plans.

Verizon reveals lackluster enterprise momentum proper now. Final 12 months, the corporate posted basically flat gross sales and noticed its earnings per share dip 6% as a consequence of excessive working bills in addition to excessive curiosity expense. Verizon has supplied steering for earnings per share of $4.55-$4.85 in 2023, implying an extra 7% lower.

Supply: Investor Presentation

Verizon is at the moment buying and selling close to a 10-year excessive dividend yield. Due to the strong payout ratio of 56%, the sturdy enterprise place of the corporate and its resilience to recessions, its dividend must be thought of protected.

It is usually value noting that Verizon has grown its dividend for 18 consecutive years.

Click on right here to obtain our most up-to-date Positive Evaluation report on Verizon (VZ) (preview of web page 1 of three proven beneath):

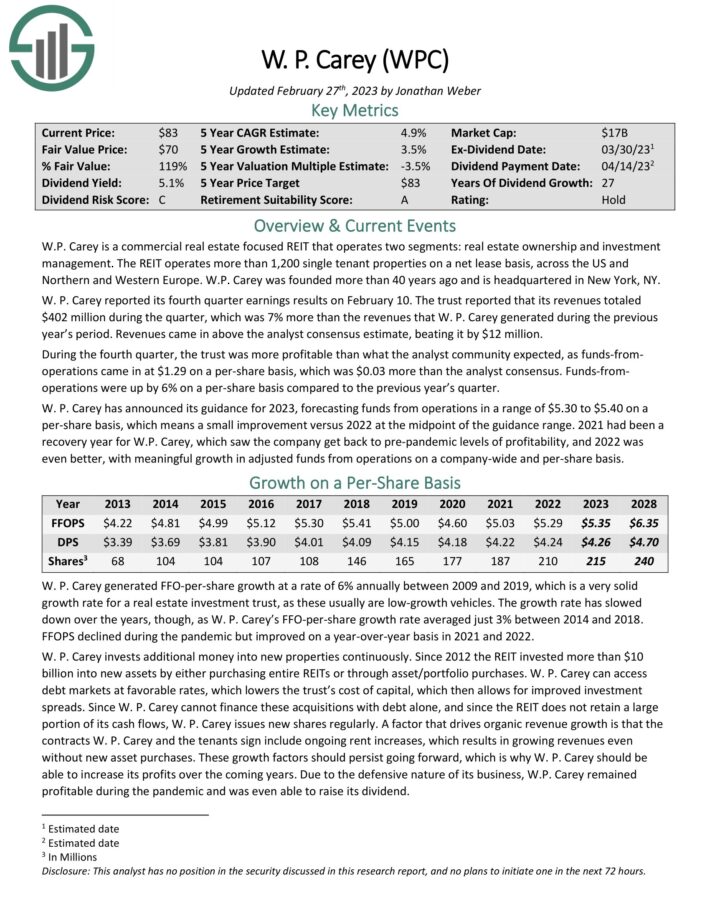

Blue-Chip Inventory #2: W.P. Carey (WPC)

- Dividend Historical past: 28 years of consecutive will increase

- Dividend Yield: 5.5%

- 5-year Annualized Commonplace Deviation: 24.48%

W.P. Carey is a Actual Property Funding Belief (or REIT) with two segments: actual property possession and funding administration. The previous is the a lot bigger of the enterprise, with greater than 1,200 single-tenant properties throughout the U.S. and Northern and Western Europe.

W. P. Carey reported its fourth quarter earnings outcomes on February 10. The belief reported that its revenues totaled $402 million through the quarter, which was 7% greater than the revenues that W. P. Carey generated through the earlier 12 months’s interval. Revenues got here in above the analyst consensus estimate by $12 million.

Throughout the fourth quarter, funds-from operations got here in at $1.29 on a per-share foundation, which was $0.03 greater than the analyst consensus. Funds-from operations had been up by 6% on a per-share foundation in comparison with the earlier 12 months’s quarter.

W. P. Carey has introduced its steering for 2023, forecasting funds from operations in a variety of $5.30 to $5.40 on a per-share foundation, which implies a small enchancment versus 2022 on the midpoint of the steering vary.

The belief has spent greater than $10 billion during the last decade buying properties to develop its portfolio. A lot of this acquisition spree has been by means of the usage of share issuance, because the share depend has practically tripled since 2012. That being the case, development has been very regular for W.P. Carey even because the float has gotten bigger.

W.P. Carey raises its dividend barely each quarter, although the five-year CAGR is below 1%. Even so, the inventory has a 5.3% yield and a dividend development streak of 28 years. The forecasted payout ratio is 80%, an inexpensive charge for a REIT.

Click on right here to obtain our most up-to-date Positive Evaluation report on W. P. Carey (WPC) (preview of web page 1 of three proven beneath):

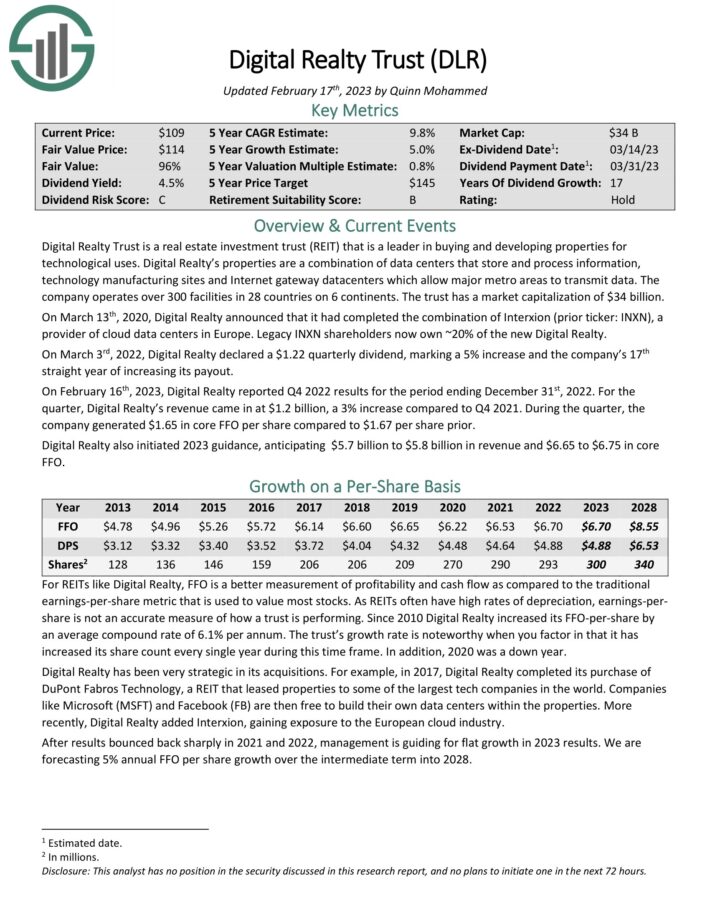

Blue-Chip Inventory #3: 3M Firm (MMM)

- Dividend Historical past: 65 years of consecutive will increase

- Dividend Yield: 5.8%

- 5-year Annualized Commonplace Deviation: 24.78%

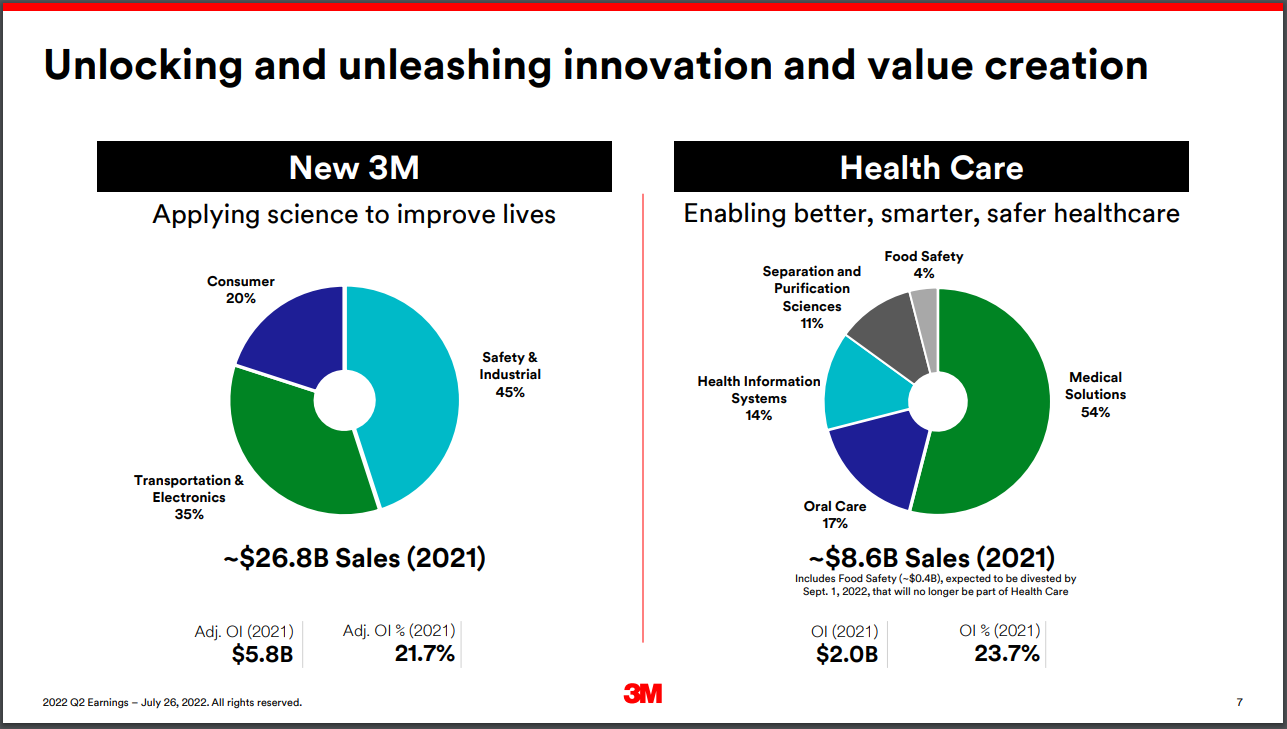

3M sells greater than 60,000 merchandise which can be used day by day in properties, hospitals, workplace buildings and colleges across the world. It has about 95,000 staff and serves clients in additional than 200 nations.

The corporate individually introduced that it’ll spinoff its healthcare phase. It is a main announcement, because the healthcare enterprise itself generates over $8 billion in annual gross sales.

Supply: Investor Presentation

The transaction is anticipated to shut by the top of 2023.

On January twenty fourth, 2023, 3M reported introduced earnings outcomes for the fourth quarter and full 12 months for the interval ending December thirty first, 2022. For the quarter, income declined 5.9% to $8.1 billion, however was $10 million greater than anticipated. Adjusted earnings-per-share of $2.28 in comparison with $2.31 within the prior 12 months and was $0.11 lower than projected.

For 2022, income decreased 3% to $34.2 billion. Adjusted earnings-per-share for the interval totaled $10.10, which in contrast unfavorably to $10.12 within the earlier 12 months and was on the low finish of the corporate’s steering.

Natural development for the quarter was 1.2%. Well being Care, Transportation & Electronics, and Security & Industrial grew 1.9%, 1.4%, and 1.3%, respectively. Client fell 5.7%. The corporate will reduce 2,500 manufacturing jobs. 3M supplied an outlook for 2023, with the corporate anticipating adjusted earnings-per-share in a variety of $8.50 to $9.00.

Click on right here to obtain our most up-to-date Positive Evaluation report on 3M (preview of web page 1 of three proven beneath):

Blue-Chip Inventory #4: Altria Group (MO)

- Dividend Historical past: 53 years of consecutive will increase

- Dividend Yield: 8.4%

- 5-year Annualized Commonplace Deviation: 25.56%

Altria is a client staples big, with a historical past of 175 years. The corporate is the producer of the top-selling cigarette model on the earth, specifically Marlboro, in addition to some non-smokeable merchandise.

The tobacco big has maintained a market share of about 40%-43% for a number of years in a row.

Supply: Investor Presentation

Altria additionally has giant stakes in international beer big Anheuser Busch InBev (BUD) and Cronos Group (CRON), a hashish firm.

Altria has a rock-solid enterprise mannequin in place. Due to the inelastic demand for its merchandise, the corporate has been elevating its costs 12 months after 12 months. In consequence, it has greater than offset the impact of the steadily declining consumption per capita of cigarettes on its earnings.

As a consequence of its sturdy pricing energy, Altria has grown its earnings per share each single 12 months during the last decade, at an 8.8% common annual charge. The constant development report of Altria is a testomony to the energy of its enterprise mannequin.

Click on right here to obtain our most up-to-date Positive Evaluation report on Altria (MO) (preview of web page 1 of three proven beneath):

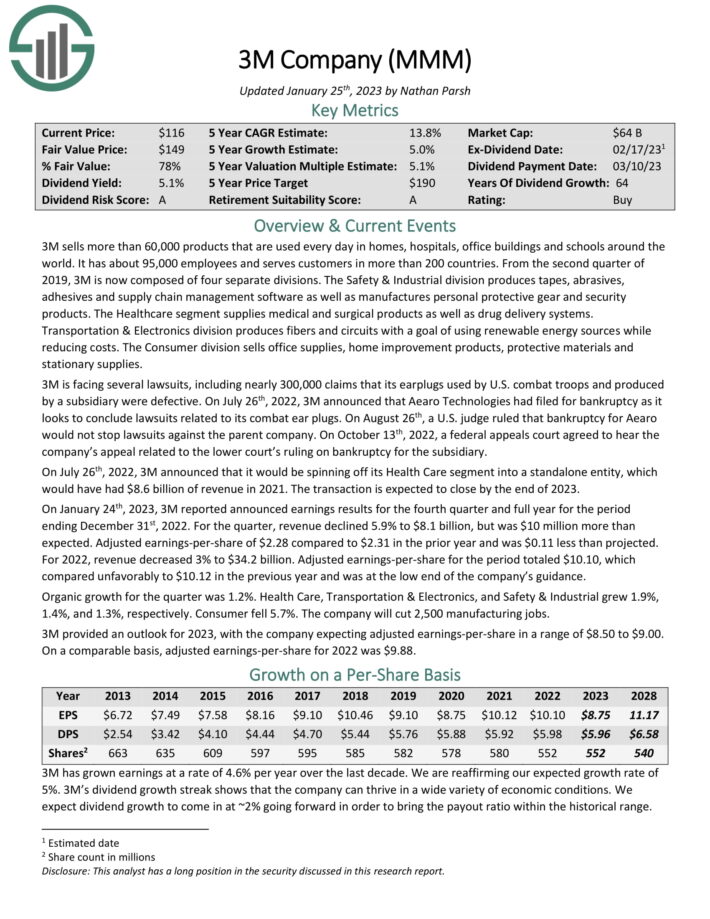

Blue-Chip Inventory #5: Digital Realty (DLR)

- Dividend Historical past: 17 years of consecutive will increase

- Dividend Yield: 5.2%

- 5-year Annualized Commonplace Deviation: 25.77%

Digital Realty Belief is a REIT that may be a chief in shopping for and creating properties for technological makes use of. Digital Realty’s properties are a mixture of knowledge facilities that retailer and course of info, expertise manufacturing websites and Web gateway information facilities which permit main metro areas to transmit information. The corporate operates over 300 amenities in 28 nations on 6 continents.

On March third, 2022, Digital Realty declared a $1.22 quarterly dividend, marking a 5% improve and the corporate’s seventeenth straight 12 months of accelerating its payout. On February sixteenth, 2023, Digital Realty reported This autumn 2022 outcomes for the interval ending December thirty first, 2022.

For the quarter, Digital Realty’s income got here in at $1.2 billion, a 3% improve in comparison with This autumn 2021. Throughout the quarter, the corporate generated $1.65 in core FFO per share in comparison with $1.67 per share prior. Digital Realty additionally initiated 2023 steering, anticipating $5.7 billion to $5.8 billion in income and $6.65 to $6.75 in core FFO.

Click on right here to obtain our most up-to-date Positive Evaluation report on Digital Realty (preview of web page 1 of three proven beneath):

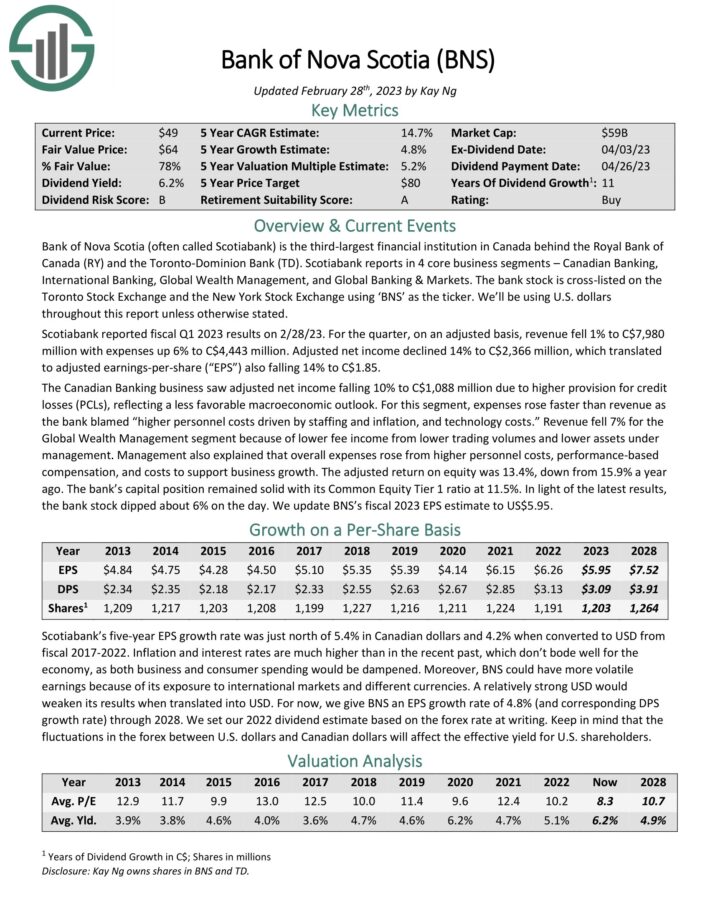

Blue-Chip Inventory #6: First of Lengthy Island Corp. (FLIC)

- Dividend Historical past: 45 years of consecutive will increase

- Dividend Yield: 6.3%

- 5-year Annualized Commonplace Deviation: 25.96%

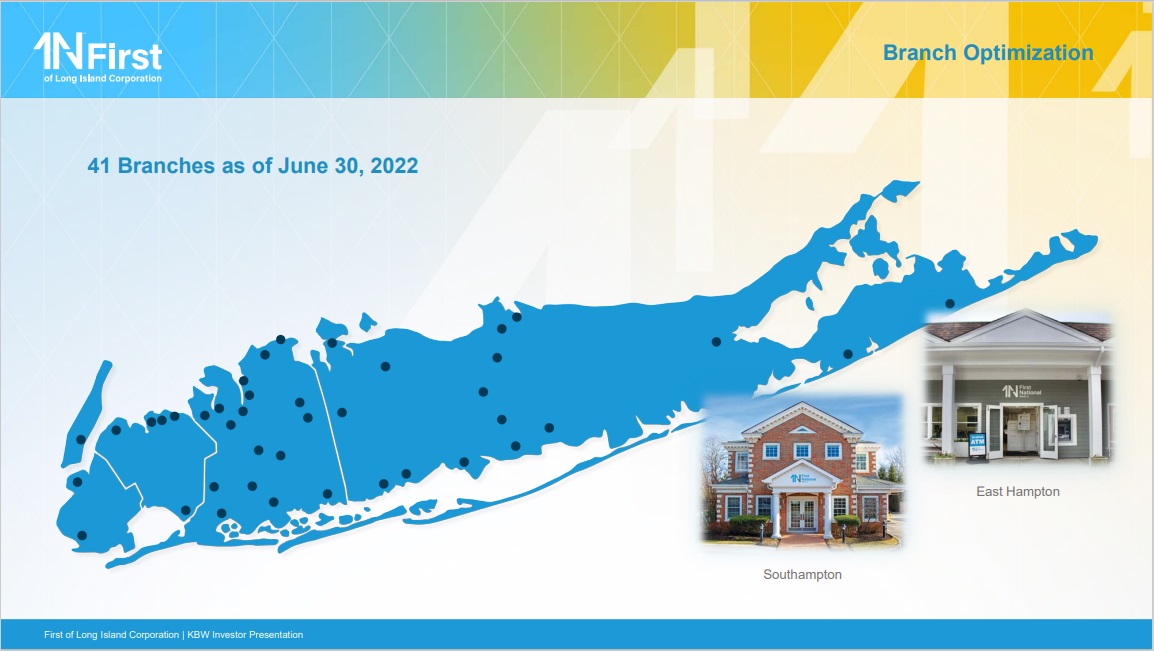

The First of Lengthy Island Company is the holding firm for The First Nationwide Financial institution of Lengthy Island. This small-sized financial institution supplies a variety of monetary companies to customers and small to medium-sized companies. Its choices embrace enterprise loans, client loans, mortgages, financial savings accounts, and many others.

FLIC operates over 40 branches in two Lengthy Island counties and several other NYC burrows, together with Queens, Brooklyn, and Manhattan.

Supply: Investor Presentation

FLIC reported its most up-to-date quarterly outcomes on January 26. The corporate reported revenues of $31 million for the third quarter, which was 0.2% lower than the revenues that the corporate generated through the earlier 12 months’s interval. FLIC’s revenues missed what analysts had forecasted for the quarter by 5%. The income lower might be defined by the truth that the financial institution’s web curiosity margin declined 12 months over 12 months, from 2.86% through the earlier 12 months’s quarter to 2.74%. This made FLIC’s web curiosity revenue decline barely.

FLIC’s earnings-per-share totaled $0.44 through the fourth quarter, which was up 16% 12 months over 12 months. This strong earnings-per-share efficiency was principally pushed margin growth, though buybacks additionally resulted in development tailwinds. Throughout 2021, FLIC generated earnings-per-share of $1.81, which was a brand new report end result for the corporate, and the end result was the identical for 2022.

Click on right here to obtain our most up-to-date Positive Evaluation report on FLIC (preview of web page 1 of three proven beneath):

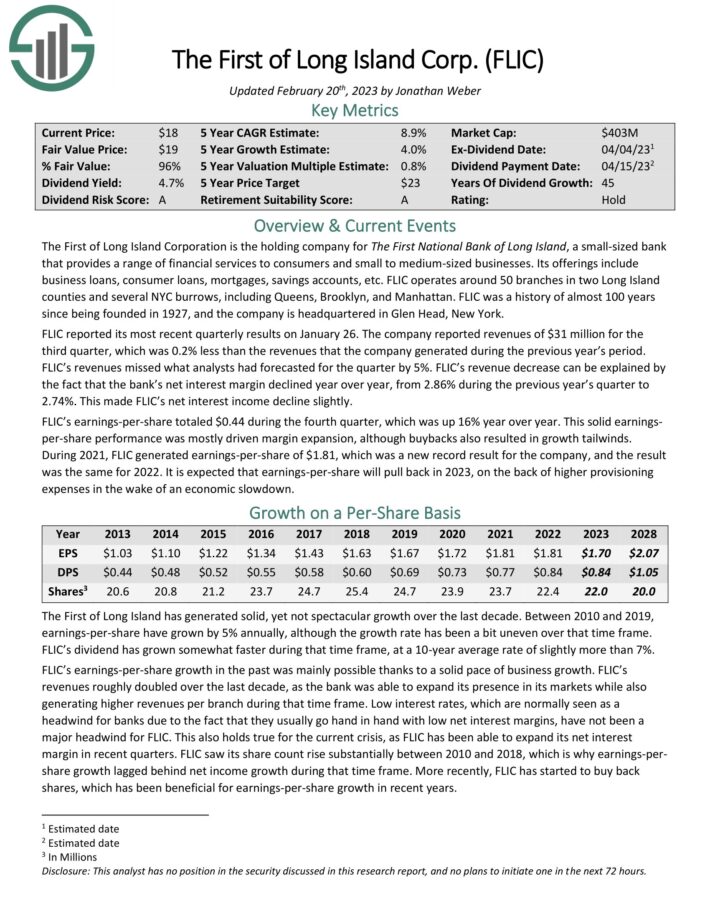

Blue-Chip Inventory #7: Financial institution of Nova Scotia (BNS)

- Dividend Historical past: 11 years of consecutive will increase

- Dividend Yield: 6.2%

- 5-year Annualized Commonplace Deviation: 25.97%

Financial institution of Nova Scotia (usually referred to as Scotiabank) is the fourth-largest monetary establishment in Canada behind the Royal Financial institution of Canada, the Toronto-Dominion Financial institution and Financial institution of Montreal. Scotiabank studies in 4 core enterprise segments – Canadian Banking, Worldwide Banking, World Wealth Administration, and World Banking & Markets.

Scotiabank reported fiscal This autumn 2022 outcomes on November twenty ninth, 2022. For the quarter, adjusted web revenue decreased 4%, whereas adjusted EPS decreased 2% 12 months over 12 months. The adjusted return on fairness (ROE) was 15.0%, down from 15.6% a 12 months in the past.

We anticipate annual returns of 16.7% for BNS inventory, making it No. 1 amongst Canadian financial institution shares proper now.

Click on right here to obtain our most up-to-date Positive Evaluation report on BNS (preview of web page 1 of three proven beneath):

Blue-Chip Inventory #8: Enbridge Inc. (ENB)

- Dividend Historical past: 27 years of consecutive will increase

- Dividend Yield: 6.9%

- 5-year Annualized Commonplace Deviation: 26.30%

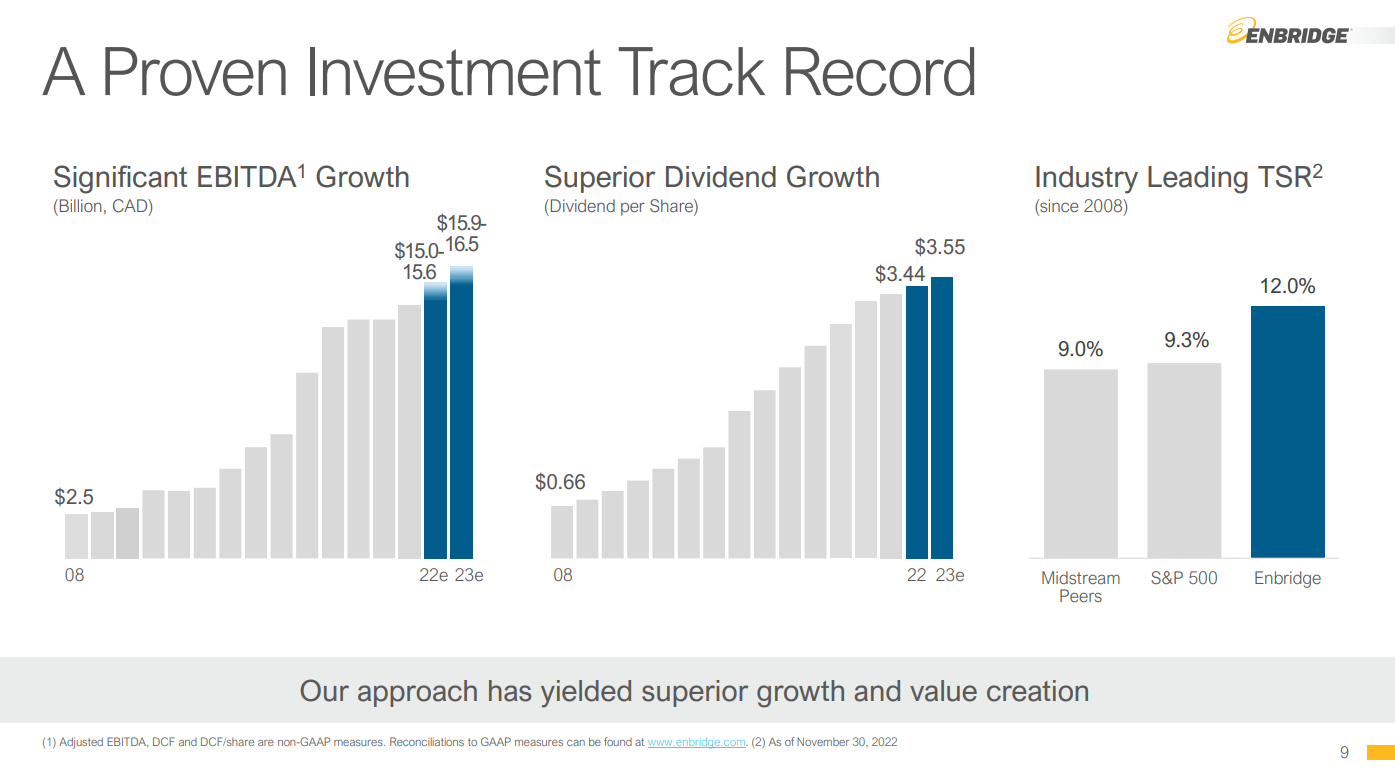

Enbridge is an oil & gasoline firm that operates the next segments: Liquids Pipelines, Fuel Distributions, Vitality Providers, Fuel Transmission & Midstream, and Inexperienced Energy & Transmission. Enbridge purchased Spectra Vitality for $28 billion in 2016 and has grow to be one of many largest midstream firms in North America.

Boasting 27 years of consecutive dividend will increase, Enbridge has undoubtedly established its operational resilience capabilities. As essential power infrastructure belongings have grow to be extra important than ever in as we speak’s financial system, Enbridge’s efficiency will probably stay sturdy within the coming years and in the long run.

Supply: Investor Presentation

Enbridge reported its fourth quarter earnings outcomes on February tenth. The corporate generated greater revenues through the quarter, however since commodity costs are principally a pass-through value for the corporate, greater revenues don’t essentially translate into greater earnings.

Throughout the quarter, Enbridge nonetheless managed to develop its adjusted EBITDA by 6% 12 months over 12 months, to CAD$3.9 billion, up from CAD$3.7 billion through the earlier 12 months’s quarter. This was doable because of stronger contributions from the liquids pipelines phase primarily.

Enbridge was in a position to generate distributable money flows of CAD$2.7 billion, which equates to US$2.0 billion, or US$0.99 on a per-share foundation, which was up by a strong 7% 12 months over 12 months in CAD. Enbridge is forecasting distributable money flows in a variety of CAD$5.25-5.65 per share for the present 12 months.

With its payout ratio standing at a wholesome 68% and its huge asset footprint serving as an incredible aggressive benefit, we imagine Enbridge ought to proceed serving income-oriented traders adequately for many years.

Click on right here to obtain our most up-to-date Positive Evaluation report on Enbridge Inc. (preview of web page 1 of three proven beneath):

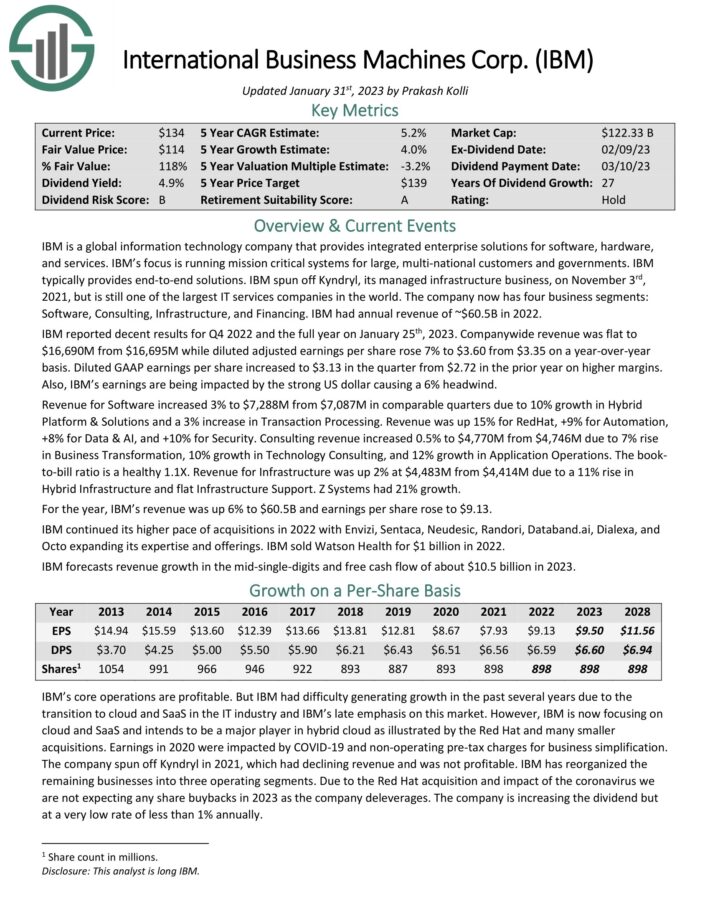

Blue-Chip Inventory #9: Worldwide Enterprise Machines (IBM)

- Dividend Historical past: 27 years of consecutive will increase

- Dividend Yield: 5.1%

- 5-year Annualized Commonplace Deviation: 26.67%

IBM is a world informationrmation expertise firm that supplies built-in enterprise options for software program, {hardware}, and companies. IBM’s focus is operating mission essential methods for giant, multi-nationwide clients and governments. IBM usually supplies end-to-end options.

IBM reported outcomes for This autumn 2022 and the total 12 months on January twenty fifth, 2023. Firm-wide income was flat whereas diluted adjusted earnings per share rose 7% to $3.60 from $3.35 on a year-over-year foundation. Diluted GAAP earnings per share elevated to $3.13 within the quarter from $2.72 within the prior 12 months on greater margins. Additionally, IBM’s earnings are being impacted by the sturdy US greenback inflicting a 6% headwind.

Income for Software program elevated 3% to $7,288M from $7,087M in comparable quarters as a consequence of 10% development in Hybrid Platform & Options and a 3% improve in Transaction Processing. Income was up 15% for RedHat, +9% for Automation, +8% for Information & AI, and +10% for Safety. Consulting income elevated 0.5% as a consequence of a 7% rise in Enterprise Transformation, 10% development in Expertise Consulting, and 12% development in Utility Operations.

The book-to-bill ratio is a wholesome 1.1X. Income for Infrastructure was up 2% at $4,483M from $4,414M as a consequence of a 11% rise in Hybrid Infrastructure and flat Infrastructure Help. Z Techniques had 21% development. For the 12 months, IBM’s income was up 6% to $60.5B and earnings per share rose to $9.13.

Click on right here to obtain our most up-to-date Positive Evaluation report on IBM (preview of web page 1 of three proven beneath):

Blue-Chip Inventory #10: Philip Morris Worldwide (PM)

- Dividend Historical past: 15 years of consecutive will increase

- Dividend Yield: 5.3%

- 5-year Annualized Commonplace Deviation: 27.00%

Philip Morris was shaped when its mother or father firm Altria spun off its worldwide operations. Philip Morris sells cigarettes below the Marlboro model and others manufacturers in worldwide markets.

Philip Morris has one of the crucial beneficial cigarette manufacturers on the earth, Marlboro, and is a frontrunner within the reduced-risk product class with iQOS.

Supply: Investor Presentation

Due to its sturdy enterprise place, it’s a low-risk enterprise. The one materials threat comes from potential restrictions from regulatory authorities however Philip Morris is safer than many different tobacco firms on this regard because of its broad geographic diversification.

Philip Morris has grown its dividend for 15 consecutive years and is at the moment providing a virtually 10-year excessive dividend yield of 5.6%. Its payout ratio is just too excessive, at 83%, however the firm is probably going to have the ability to defend its dividend now that its previous investments have begun to bear fruit and capital necessities have decreased sharply. However, it’s prudent for traders to be ready for modest dividend development going ahead.

However, because of the sturdy enterprise momentum of its various tobacco merchandise, Philip Morris expects to develop its currency-neutral earnings per share by about 6% this 12 months, from $5.81 to an all-time excessive of $6.09-$6.21.

Click on right here to obtain our most up-to-date Positive Evaluation report on Philip Morris (PM) (preview of web page 1 of three proven beneath):

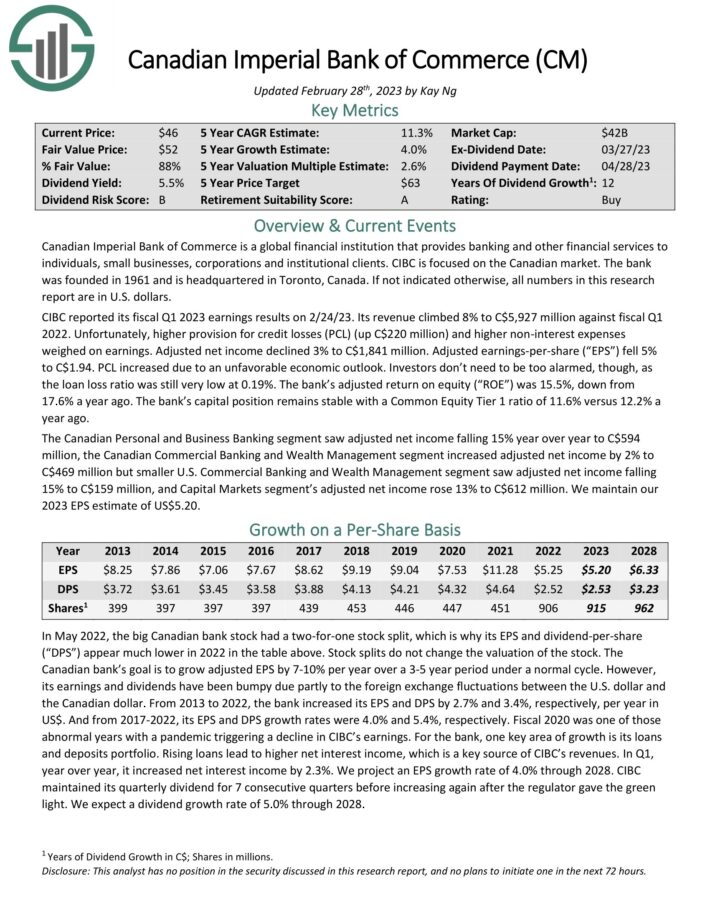

Blue-Chip Inventory #11: Canadian Imperial Financial institution of Commerce (CM)

- Dividend Historical past: 12 years of consecutive will increase

- Dividend Yield: 6.0%

- 5-year Annualized Commonplace Deviation: 27.68%

Canadian Imperial Financial institution of Commerce is a world monetary establishment that gives banking and different monetary companies to people, small companies, companies, and institutional purchasers. CIBC was based in 1961 and is headquartered in Toronto, Canada.

On December 1st, 2022, CIBC reported its fiscal This autumn 2022 earnings outcomes. For the quarter, income elevated 6% whereas adjusted EPS decreased 17% year-over-year. This autumn adjusted return on fairness was 11.2% (down from 14.7% a 12 months in the past).

Greater provision for credit score losses (PCL) (up C$220 million) and better non-interest bills weighed on earnings. Adjusted web revenue declined 3% to C$1,841 million. Adjusted earnings-per-share (“EPS”) fell 5% to C$1.94. PCL elevated as a consequence of an unfavorable financial outlook. The mortgage loss ratio was nonetheless very low at 0.19%.

The financial institution’s adjusted return on fairness (“ROE”) was 15.5%, down from 17.6% a 12 months in the past. The financial institution’s capital place stays secure with a Frequent Fairness Tier 1 ratio of 11.6% versus 12.2% a 12 months in the past.

Click on right here to obtain our most up-to-date Positive Evaluation report on CM (preview of web page 1 of three proven beneath):

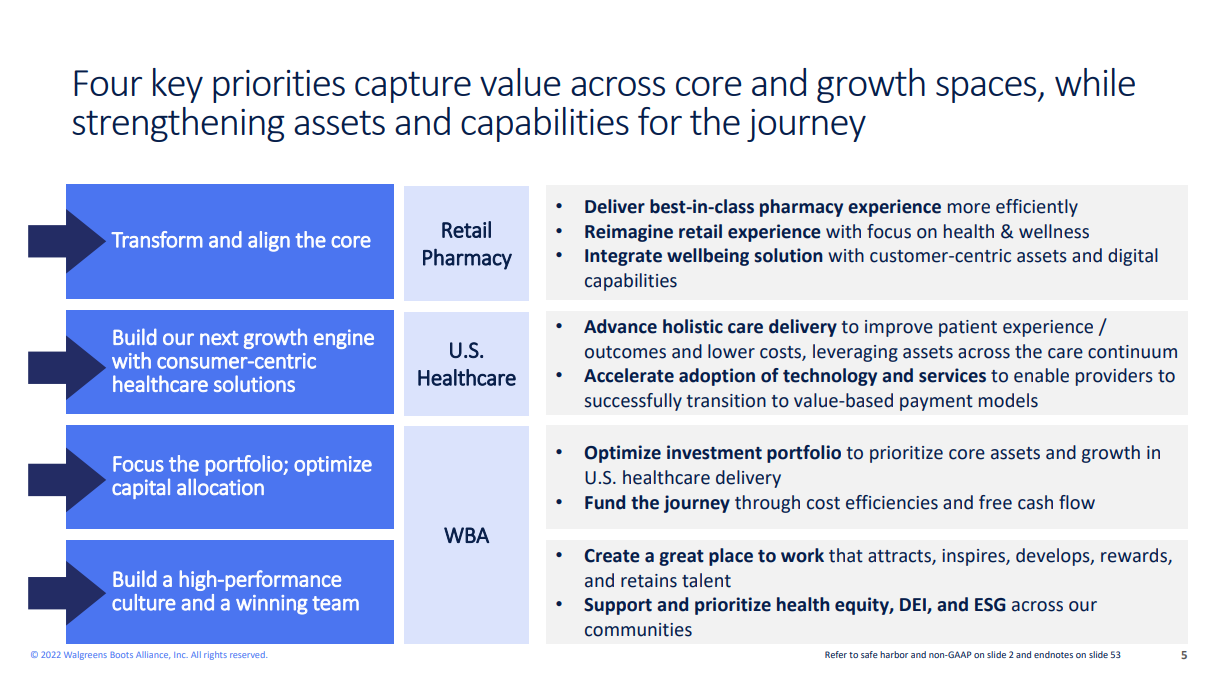

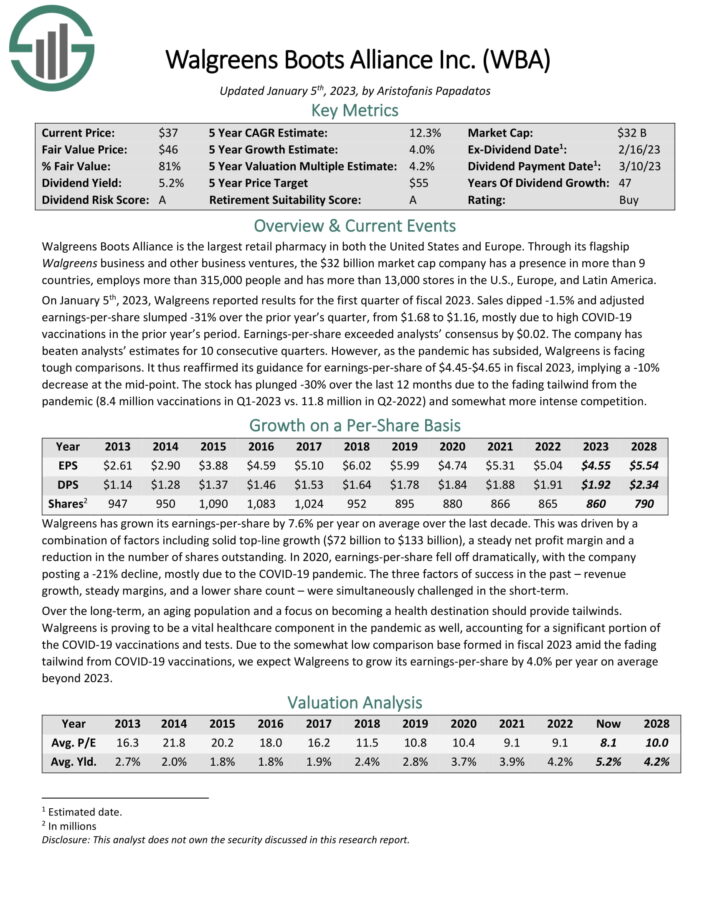

Blue-Chip Inventory #12: Walgreens Boots Alliance (WBA)

- Dividend Historical past: 47 years of consecutive will increase

- Dividend Yield: 5.5%

- 5-year Annualized Commonplace Deviation: 28.76%

Walgreens Boots Alliance is the most important retail pharmacy in each america and Europe. By way of its flagship Walgreens enterprise and different business ventures, the firm employs extra than 325,000 folks and has greater than 13,000 shops.

Walgreens Boots Alliance is the most important retail pharmacy in each america and Europe. By way of its flagship Walgreens enterprise and different business ventures, the firm employs extra than 325,000 folks and has greater than 13,000 shops.

Supply: Investor Presentation

On January fifth, 2023, Walgreens reported outcomes for the primary quarter of fiscal 2023. Gross sales dipped -1.5% and adjusted earnings-per-share slumped -31% over the prior 12 months’s quarter, from $1.68 to $1.16, principally as a consequence of excessive COVID-19 vaccinations within the prior 12 months’s interval. Earnings-per-share exceeded analysts’ consensus by $0.02.

The corporate has crushed analysts’ estimates for 10 consecutive quarters. Nevertheless, because the pandemic has subsided, Walgreens is dealing with robust comparisons. It thus reaffirmed its steering for earnings-per-share of $4.45-$4.65 in fiscal 2023, implying a -10% lower on the mid-point.

Click on right here to obtain our most up-to-date Positive Evaluation report on Walgreens Boots Alliance (preview of web page 1 of three proven beneath):

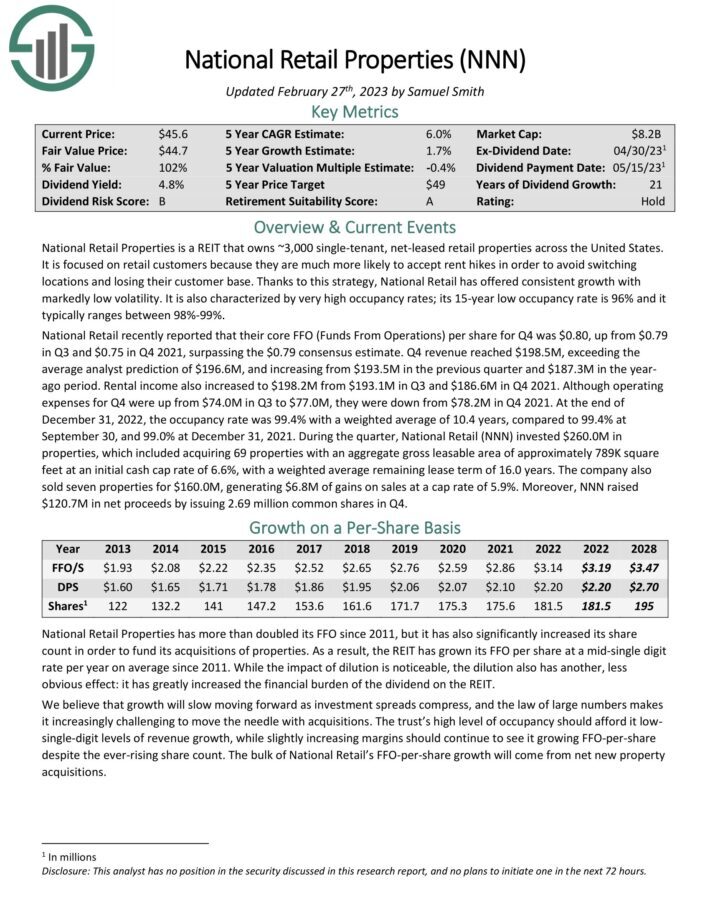

Blue-Chip Inventory #13: Nationwide Retail Properties (NNN)

- Dividend Historical past: 21 years of consecutive will increase

- Dividend Yield: 5.1%

- 5-year Annualized Commonplace Deviation: 30.03%

Lincoln Nationwide Company affords life insurance coverage, annuities, retirement plan companies and group safety. The company was based in 1905 as The Lincoln Nationwide Life Insurance coverage Firm. Permission from Abraham Lincoln’s son to make use of the previous president’s title was granted. In 1912, the corporate entered the reinsurance enterprise. In 1969, Lincoln Nationwide Corp begins buying and selling on the New York Inventory Trade and the Midwest Inventory Trade.

Lincoln Nationwide reported fourth quarter and full 12 months 2022 outcomes on February eighth, 2023, for the interval ending December thirty first, 2022. The corporate had web revenue of 1 penny per share within the fourth quarter, which in contrast unfavorably to $1.20 within the fourth quarter of 2021. Adjusted web revenue equaled $0.97 per share in comparison with $1.56 in the identical prior 12 months interval. Moreover, annuities common account values shrunk by 16% to $144 billion and group safety insurance coverage premiums grew 9% to $1.2 billion.

For the total 12 months, Lincoln suffered an adjusted lack of $(5.22) per share in comparison with adjusted web revenue of $8.20 in

2021. These outcomes included $12.21 of web unfavorable gadgets due largely to the corporate’s annual evaluate of DAC and reserve assumptions.

The corporate repurchased 8.7 million shares of inventory for $550 million within the trailing twelve months, decreasing the share depend by 7%. E-book worth per share (together with adjusted revenue from operations (AOCI)) decreased 84% in comparison with the prior 12 months to $18.41. E-book worth per share (excluding AOCI) decreased 18% to $63.73.

Click on right here to obtain our most up-to-date Positive Evaluation report on NNN (preview of web page 1 of three proven beneath):

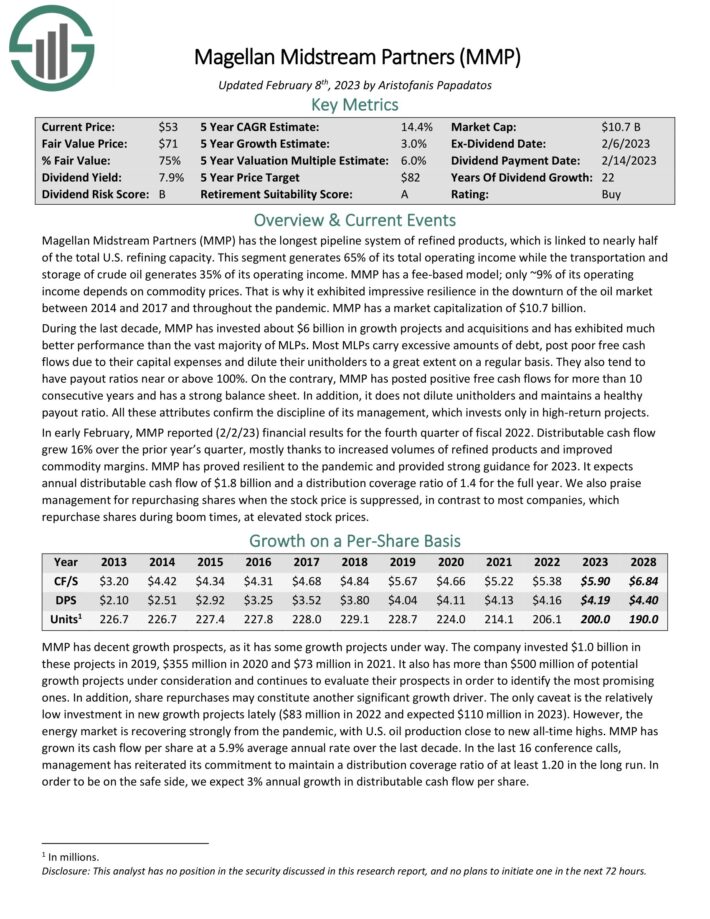

Blue-Chip Inventory #14: Magellan Midstream Companions LP (MMP)

- Dividend Historical past: 22 years of consecutive will increase

- Dividend Yield: 7.7%

- 5-year Annualized Commonplace Deviation: 30.74%

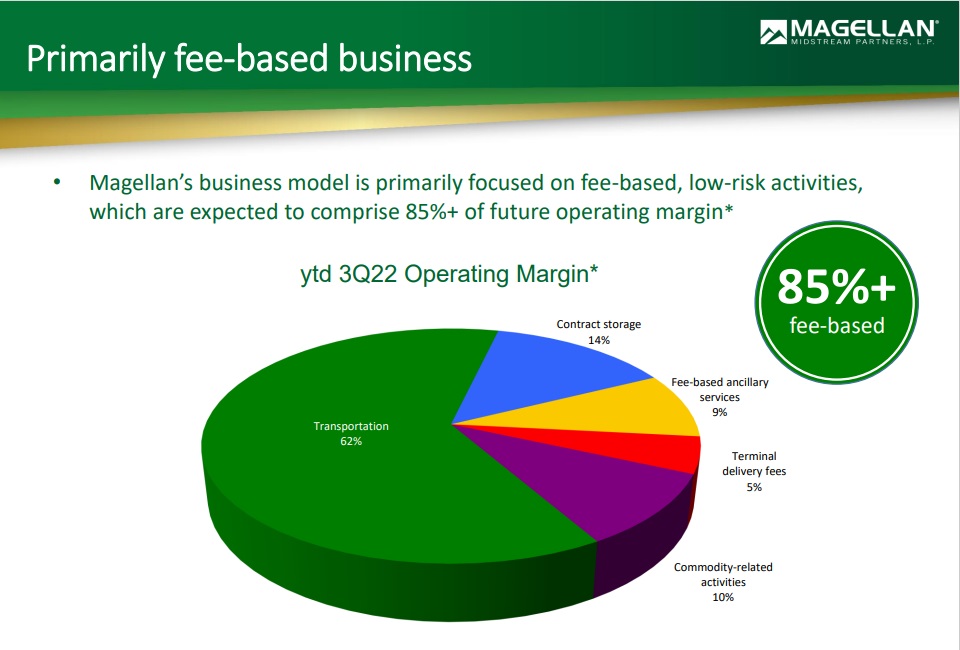

Magellan has the longest pipeline system of refined merchandise, which is linked to just about half of the overall U.S. refining capability.

Transportation generates over 60% of its complete working revenue. MMP has a fee-based mannequin; solely ~10% of its working revenue is determined by commodity costs.

Supply: Investor Presentation

In early February, MMP reported (2/2/23) monetary outcomes for the fourth quarter of fiscal 2022. Distributable money movement grew 16% over the prior 12 months’s quarter, principally because of elevated volumes of refined merchandise and improved commodity margins.

MMP has proved resilient to the pandemic and supplied sturdy steering for 2023. It expects annual distributable money movement of $1.8 billion and a distribution protection ratio of 1.4 for the total 12 months.

The corporate has greater than $500 million of potential development initiatives into consideration and continues to judge their prospects with a view to determine essentially the most promising ones. As well as, share repurchases could represent one other important development driver.

Click on right here to obtain our most up-to-date Positive Evaluation report on MMP (preview of web page 1 of three proven beneath):

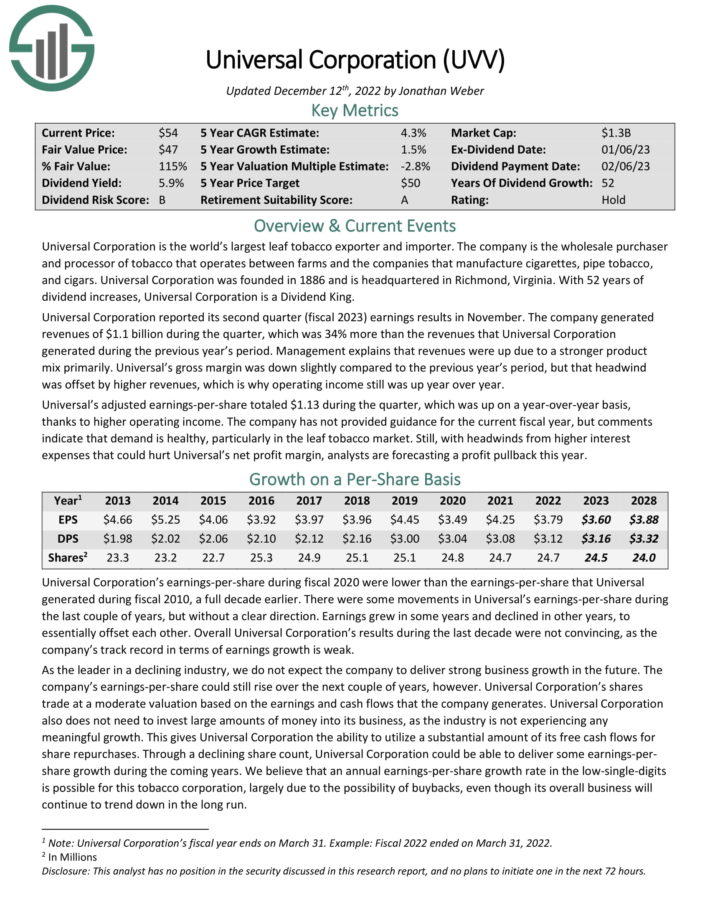

Blue-Chip Inventory #15: Common Corp. (UVV)

- Dividend Historical past: 52 years of consecutive will increase

- Dividend Yield: 6.0%

- 5-year Annualized Commonplace Deviation: 31.58%

Common Company is a tobacco inventory. It’s the world’s largest leaf tobacco exporter and importer. The corporate is the wholesale purchaser and processor of tobacco that operates as an middleman between tobacco farms and the businesses that manufacture cigarettes, pipe tobacco, and cigars. Common additionally has an substances enterprise that’s separate from the core leaf phase.

Common Company reported its second quarter (fiscal 2023) earnings ends in November. The corporate generated revenues of $1.1 billion through the quarter, which was 34% greater than the revenues that Common Company generated through the earlier 12 months’s interval. Administration explains that revenues had been up as a consequence of a stronger product combine primarily.

Common’s gross margin was down barely in comparison with the earlier 12 months’s interval, however that headwind was offset by greater revenues, which is why working revenue nonetheless was up 12 months over 12 months. Common’s adjusted earnings-per-share totaled $1.13 through the quarter, which was up on a year-over-year foundation, because of greater working revenue.

Because the chief in a declining business, we don’t anticipate the corporate to ship sturdy development sooner or later. The corporate’s earnings-per-share may nonetheless rise over the subsequent couple of years, nevertheless. Common’s shares commerce at a average valuation based mostly on the earnings and money flows that the corporate generates.

Common additionally doesn’t want to take a position giant quantities of cash into its enterprise, which provides it the flexibility to make the most of a considerable quantity of its free money flows for share repurchases and dividends.

With a dividend payout of ~79% for the present fiscal 12 months, we view Common’s dividend as reasonably protected, with the caveat that the corporate faces headwinds because of the regular decline of the tobacco business.

Click on right here to obtain our most up-to-date Positive Evaluation report on Common (preview of web page 1 of three proven beneath):

Blue-Chip Inventory #16: Enterprise Merchandise Companions LP (EPD)

- Dividend Historical past: 25 years of consecutive will increase

- Dividend Yield: 7.6%

- 5-year Annualized Commonplace Deviation: 31.62%

Enterprise Merchandise Companions was based in 1968 and operates as an oil and gasoline storage and transportation firm.

Enterprise Merchandise has a wonderful asset base which consists of practically 50,000 miles of pure gasoline, pure gasoline liquids, crude oil, and refined merchandise pipelines. It additionally has a storage capability of greater than 250 million barrels.

These belongings acquire charges based mostly on supplies transported and saved.

Continued development is probably going over the subsequent a number of years. The corporate has $5.8 billion of main capital initiatives below building.

Supply: Investor Presentation

Click on right here to obtain our most up-to-date Positive Evaluation report on Enterprise Merchandise Companions (preview of web page 1 of three proven beneath):

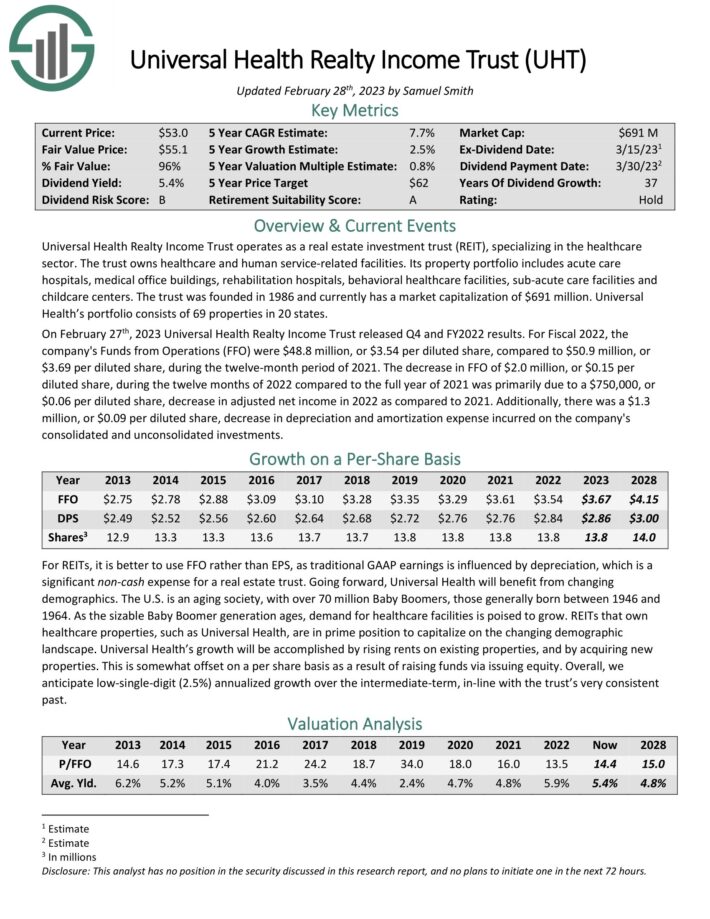

Blue-Chip Inventory #17: Common Well being Realty Earnings Belief (UHT)

- Dividend Historical past: 37 years of consecutive will increase

- Dividend Yield: 6.0%

- 5-year Annualized Commonplace Deviation: 35.11%

Common Well being Realty Earnings Belief operates as a REIT, specializing within the healthcare sector. The belief owns healthcare and human service-related amenities. Its property portfolio contains acute care hospitals, medical workplace buildings, rehabilitation hospitals, behavioral healthcare amenities, sub-acute care amenities and childcare facilities. The belief was based in 1986 and at the moment has a market capitalization of $691 million. Common Well being’s portfolio consists of 69 properties in 20 states.

On February twenty seventh, 2023 Common Well being Realty Earnings Belief launched This autumn and FY2022 outcomes. For Fiscal 2022, the corporate’s Funds from Operations (FFO) had been $48.8 million, or $3.54 per diluted share, in comparison with $50.9 million, or $3.69 per diluted share, through the twelve-month interval of 2021.

Going ahead, Common Well being will profit from altering demographics. The U.S. is an getting older society, with over 70 million Child Boomers, these usually born between 1946 and 1964. Because the sizable Child Boomer era ages, demand for healthcare amenities is poised to develop.

REITs that personal healthcare properties, resembling Common Well being, are in prime place to capitalize on the altering demographic panorama. Common Well being’s development shall be completed by rising rents on current properties, and by buying new properties.

Click on right here to obtain our most up-to-date Positive Evaluation report on UHT (preview of web page 1 of three proven beneath):

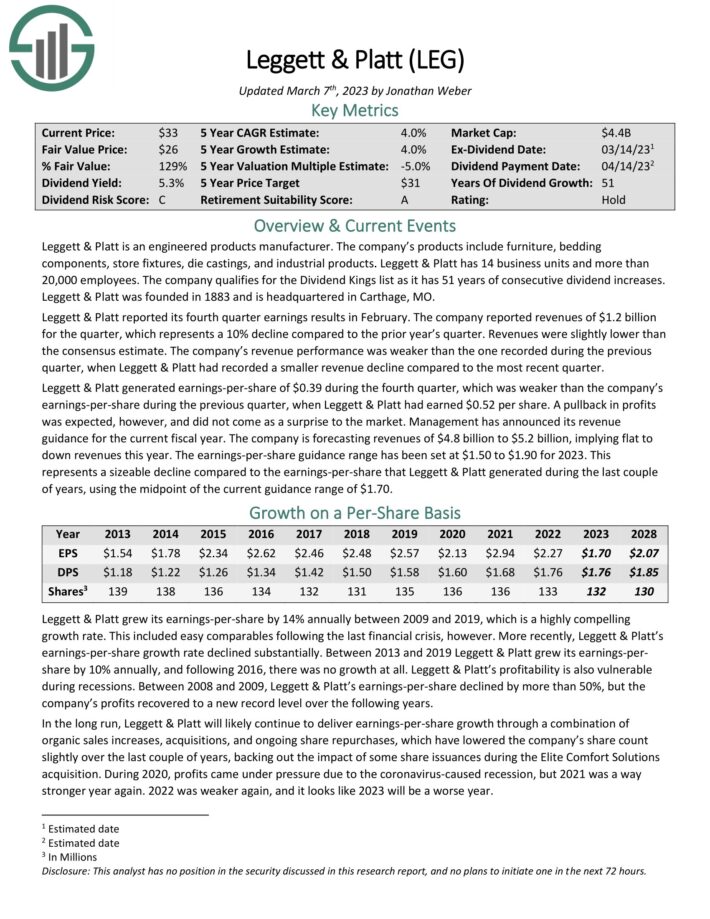

Blue-Chip Inventory #18: Leggett & Platt (LEG)

- Dividend Historical past: 51 years of consecutive will increase

- Dividend Yield: 5.7%

- 5-year Annualized Commonplace Deviation: 35.41%

Leggett & Platt is an engineered merchandise producer. The corporate’s merchandise embrace furnishings, bedding elements, retailer fixtures, die castings, and industrial merchandise. Leggett & Platt has 14 enterprise items and greater than 20,000 staff.

Leggett & Platt reported its fourth quarter earnings ends in February. The corporate reported revenues of $1.2 billion for the quarter, which represents a ten% decline in comparison with the prior 12 months’s quarter. Revenues had been barely decrease than the consensus estimate.

The corporate’s income efficiency was weaker than the one recorded through the earlier quarter, when Leggett & Platt had recorded a smaller income decline in comparison with the newest quarter.

Leggett & Platt generated earnings-per-share of $0.39 through the fourth quarter, which was weaker than the corporate’s earnings-per-share through the earlier quarter, when Leggett & Platt had earned $0.52 per share. A pullback in earnings was anticipated, nevertheless, and didn’t come as a shock to the market.

Administration has introduced its income steering for the present fiscal 12 months. The corporate is forecasting revenues of $4.8 billion to $5.2 billion, implying flat to down revenues this 12 months. The earnings-per-share steering vary has been set at $1.50 to $1.90 for 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on Leggett & Platt (preview of web page 1 of three proven beneath):

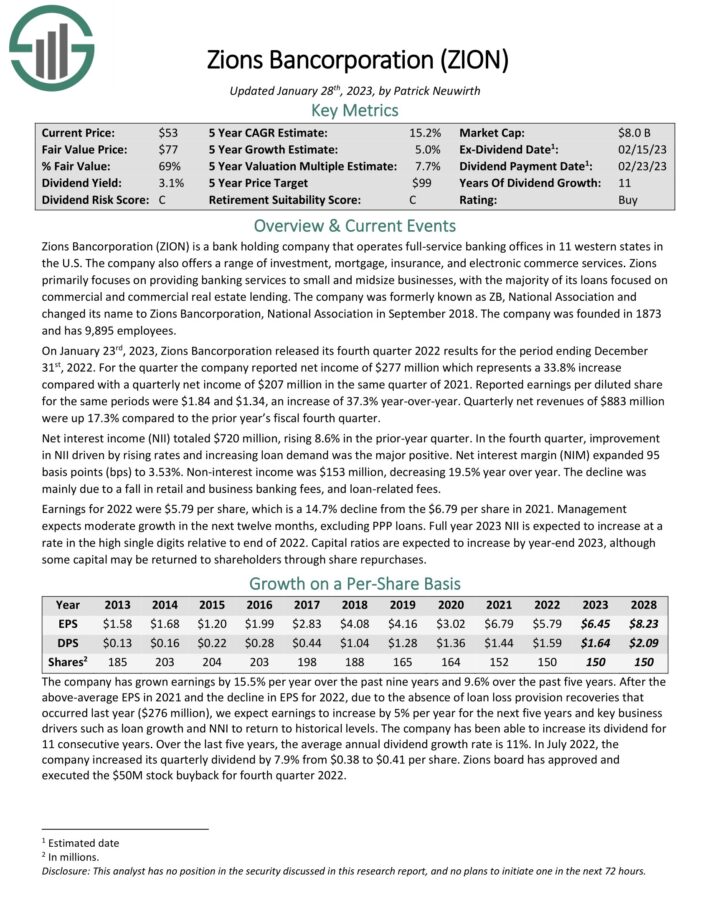

Blue-Chip Inventory #19: Zions Bancorporation (ZION)

- Dividend Historical past: 11 years of consecutive will increase

- Dividend Yield: 5.4%

- 5-year Annualized Commonplace Deviation: 36.68%

Zions Bancorporation is a financial institution holding firm that operates full-service banking places of work in 11 western states within the U.S. The corporate additionally affords a variety of funding, mortgage, insurance coverage, and digital commerce companies. Zions primarily focuses on offering banking companies to small and midsize companies, with the vast majority of its loans centered on industrial and industrial actual property lending.

Supply: Investor Presentation

On January twenty third, 2023, Zions Bancorporation launched its fourth quarter 2022 outcomes. For the quarter the corporate reported web revenue of $277 million which represents a 33.8% improve in contrast with a quarterly web revenue of $207 million in the identical quarter of 2021. Reported earnings per diluted share for a similar durations had been $1.84 and $1.34, a rise of 37.3% year-over-year. Quarterly web revenues of $883 million had been up 17.3% in comparison with the prior 12 months’s fiscal fourth quarter.

Internet curiosity revenue (NII) totaled $720 million, rising 8.6% within the prior-year quarter. Within the fourth quarter, enchancment in NII pushed by rising charges and rising mortgage demand was the main optimistic. Internet curiosity margin (NIM) expanded 95 foundation factors (bps) to three.53%. Non-interest revenue was $153 million, reducing 19.5% 12 months over 12 months. The decline was primarily as a consequence of a fall in retail and enterprise banking charges, and loan-related charges.

Earnings for 2022 had been $5.79 per share, which is a 14.7% decline from the $6.79 per share in 2021. Administration expects average development within the subsequent twelve months, excluding PPP loans. Full 12 months 2023 NII is anticipated to extend at a charge within the excessive single digits relative to finish of 2022. Capital ratios are anticipated to extend by year-end 2023, though some capital could also be returned to shareholders by means of share repurchases.

Click on right here to obtain our most up-to-date Positive Evaluation report on ZION (preview of web page 1 of three proven beneath):

Blue-Chip Inventory #20: Fifth Third Bancorp (FITB)

- Dividend Historical past: 12 years of consecutive will increase

- Dividend Yield: 5.0%

- 5-year Annualized Commonplace Deviation: 37.25%

Fifth Third Bancorp owns and operates banks in 12 midwestern and southern U.S. states, together with Georgia, Florida, Michigan and Ohio. The corporate has practically 1,100 places of work.

On January nineteenth, 2023, Fifth Third Bancorp reported fourth quarter and full 12 months earnings outcomes for the interval ending December thirty first, 2022. For the quarter, income grew 14.3% to $2.32 billion, which was $20 million lower than anticipated. Earnings-per-share of $1.01 in contrast favorably to $0.91 within the prior 12 months and was $0.01 above estimates.

For 2022, income grew 4.8% to $8.32 billion whereas earnings-per-share of $3.41 in comparison with $3.77 within the earlier 12 months. Common portfolio loans and leases improved 10.9% year-over-year to $121.4 billion. Provisions for credit score losses was $180 million within the third quarter, in comparison with a good thing about $47 million within the prior 12 months. The non-performing asset ratio of 0.44% was a 2 foundation level enchancment from the third quarter of the 2022 and a 3 foundation factors beneath the identical interval a 12 months in the past.

Common deposits declined 3.9% from the identical interval a 12 months in the past. Internet curiosity revenue grew 5.3% sequentially and 32% year-over-year. Internet-interest-margin of three.35% was greater by 13 foundation factors quarter-over-quarter and was up 80 foundation factors year-over-year.

Click on right here to obtain our most up-to-date Positive Evaluation report on FITB (preview of web page 1 of three proven beneath):

Further Sources

The Blue Chips checklist isn’t the one method to rapidly display for shares that recurrently pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].