A few years in the past, funds orchestration was a international time period to many giant firms Juan Pablo Ortega would converse to. In the present day, the Yuno co-founder and CEO doesn’t must do as a lot explaining.

“The notion has modified dramatically,” Ortega advised TechCrunch. “Many giant firms at the moment are properly conscious of what cost orchestration is, and really a number of of them are beginning to do requests for proposals only for orchestration.”

These multinational firms usually use half a dozen cost suppliers, acquirers and banks to cowl their wants worldwide, however Yuno says they solely want one world funds orchestration supplier. Funds orchestration is a solution to combine all of these cost suppliers and monetary establishments right into a single layer to exchange the person providers tech world firms already use to facilitate every cost conversion. The corporate launched its product in October 2022 to supply a big selection of cost strategies — over 300 truly — with fraud detection capabilities, one-click checkout and superior sensible routing know-how.

TechCrunch coated the Colombian funds startup when it was newly fashioned and raised $10 million from some heavy-hitter buyers, together with Andreessen Horowitz. In the present day, Yuno has facilitated transactions in over 40 nations worldwide and is working with enterprise purchasers like McDonald’s, Rappi, Avianca and inDrive.

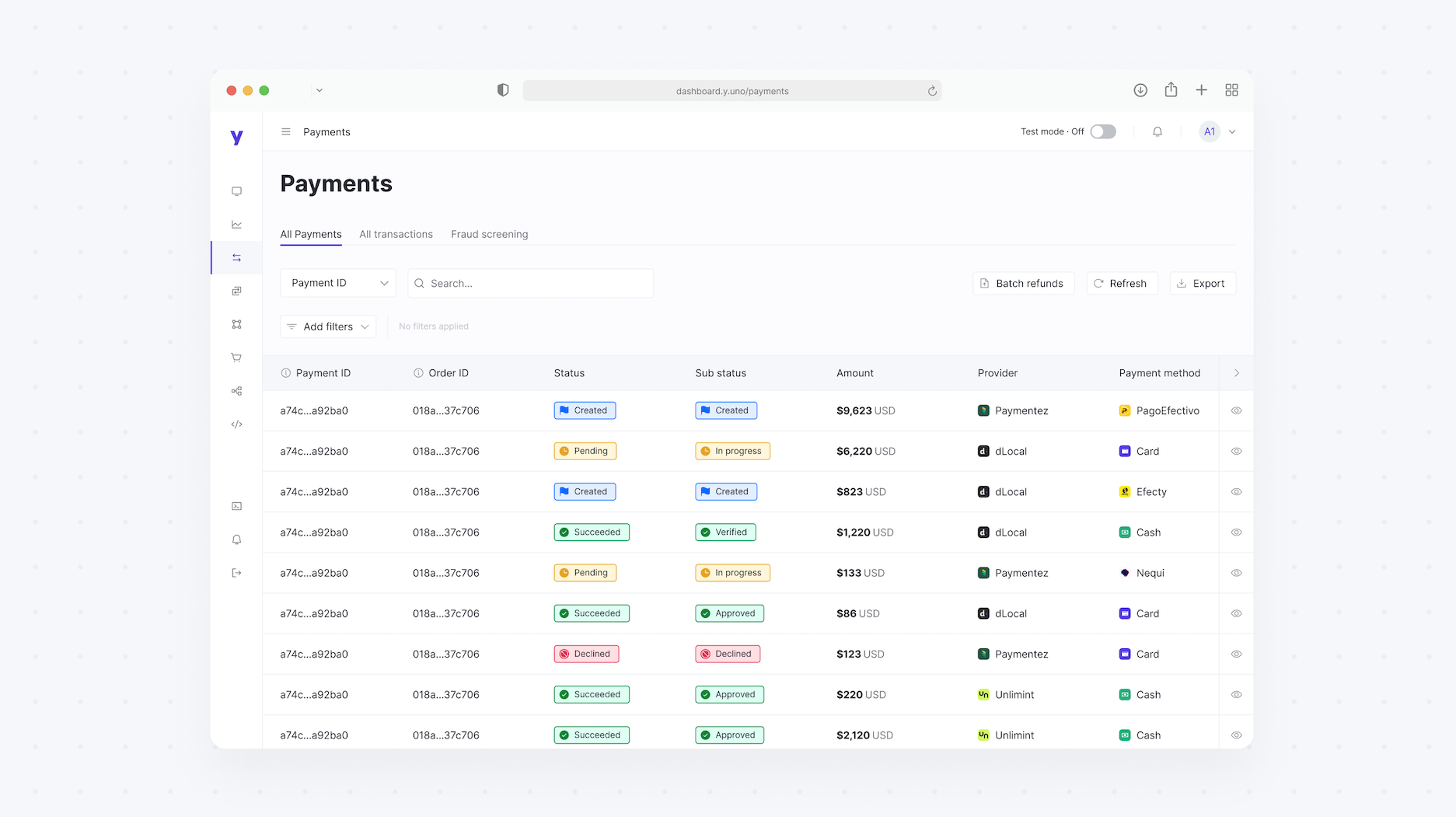

Yuno’s funds dashboard. (Picture credit score: Yuno)

The worldwide funds orchestration market is forecasted to achieve practically $7 billion in worth by 2032. In Latin America, particularly, retailers making an attempt to cater to prospects in different nations have to determine tips on how to accumulate completely different currencies and from prospects that don’t have bank cards.

The potential alternative has attracted firms everywhere in the world which hope to seize a bit of that pie, like Gr4vy, Plug and Revio. Just like Yuno grabbing capital from prime buyers, Simetrik, additionally primarily based in Colombia, is creating a funds infrastructure and is now backed by Goldman Sachs.

A lot of Yuno’s rivals give attention to fixing cost orchestration for small and medium companies, and never many had been constructing the infrastructure for giant enterprises, Ortega says.

“We’re one of many few orchestrators that really have integrations all over the world,” Ortega mentioned. “In the present day we’ve greater than 150 integrations that allow firms to entry cost strategies that require cost processors in all of the completely different continents.”

Up to now 12 months, Yuno caught the attention of main funding firm DST World Companions, which put collectively a current $25 million Collection A injection into the corporate. DST was joined by Andreessen Horowitz, Tiger World, Kaszek Ventures and Monashees. That new spherical of capital provides Yuno a valuation of $150 million, Ortega mentioned.

The funding will likely be used to solidify Yuno’s presence in Asia, Europe and Africa and in addition to maintain investing in constructing its cost infrastructure orchestration platform.

“We’re going to hold constructing our gross sales, product and know-how groups by means of a lot of the primary quarter,” Ortega mentioned. “Along with Latin America, we even have places of work in New York and Singapore, so having extra presence in these markets will likely be key for this 12 months.”