Should you requested the typical investor to call probably the most iron rule of investing, they’d doubtless say: “Shares outperform bonds.” And sure, over the lengthy haul, that’s been true.

Since 1900 US shares have returned 9.9% and 10-year US authorities bonds about 4.4%, a mile-wide hole.

However the important thing query most people by no means ask is… how lengthy is lengthy sufficient?

Most individuals would doubtless say a couple of years. True believers would say a whole decade.

The issue is that historical past is a brutal trainer, and he or she doesn’t care about your expectations.

Most individuals may solely final a brief period of time underperforming earlier than giving up. The right reply to “What’s the longest stretch of shares underperformance vs. bonds?”

68 years.

Let that sink in. You might theoretically go a whole lifetime with out seeing any fairness danger premium.

Now, this 68-year stretch occurred over 100 years in the past, so that you is perhaps tempted to dismiss it.

In fashionable instances, there have been a number of intervals throughout which shares have underperformed for many years. (And that is simply within the US…different nations have suffered far, far worse…) Given the outcomes of my Twitter ballot, it means many respondents would doubtless bail on shares a lot sooner.

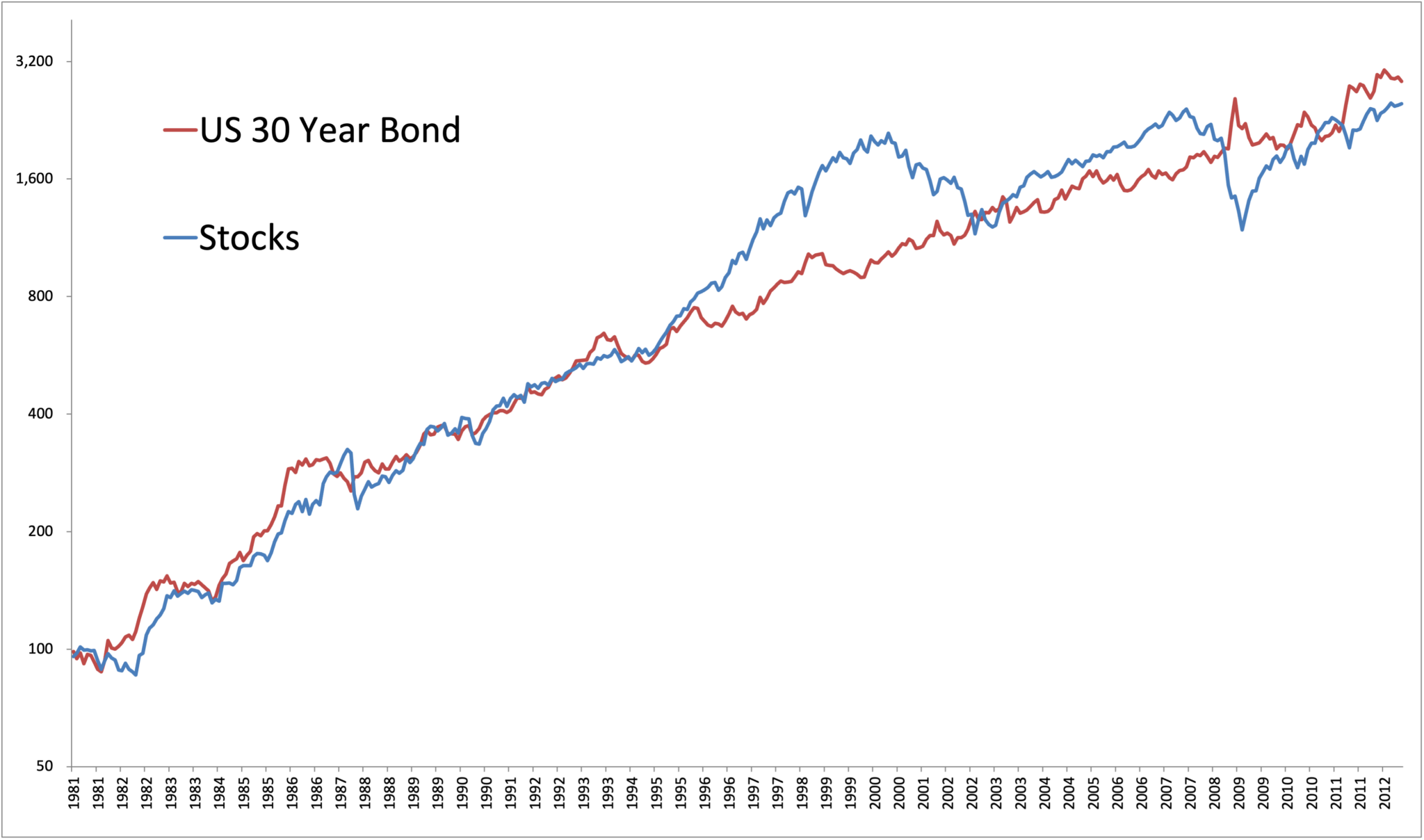

Let’s zoom in on this century. Should you plowed cash into U.S. shares initially of the century, you bought whacked with two huge drawdowns—the dot-com bust and the GFC. And regardless of a heroic restoration post-2009, shares nonetheless couldn’t outrun a primary bond portfolio over the complete stretch.

Two. Many years.

Take into consideration that. A whole investing era—new grads, younger households, retirees—may have spent their complete working life watching the “protected” stuff quietly outperform the market darling. And let’s be clear: we’re not speaking fancy hedge funds or tactical alphas. It is a plain-vanilla, middle-of-the-road bond portfolio.

Should you used the 30-year bond you can take it again to 1980…or three, maybe 4 a long time of no materials fairness premium.

Why does this matter? As a result of it flies within the face of one of the crucial ingrained assumptions in finance. And since most traders—retail and professional alike—chronically underestimate the size and depth of underperformance that may occur in markets. We’ve simply skilled huge inventory outperformance over bonds over the previous 15 years. Will that proceed without end?

We’re taught to consider bonds as ballast. Revenue-generating sleep aids. However there are occasions after they’re the higher guess—not in hindsight, however in actual time, should you’re listening to valuation and danger premiums.

What’s the takeaway?

- Shares don’t at all times win.

- Timeframes matter. Loads.

Diversification isn’t only a good thought—it’s survival. And in case your allocation is anchored in dogma (“shares for the long term!”), you is perhaps in for a impolite awakening when “long term” turns into “not in your lifetime.”