AT&T (NYSE:) recently completed the much-awaited WarnerMedia spin-off. The media group officially with Discovery, creating a new entity, Warner Bros Discovery (NASDAQ:), which started trading on Apr. 11.

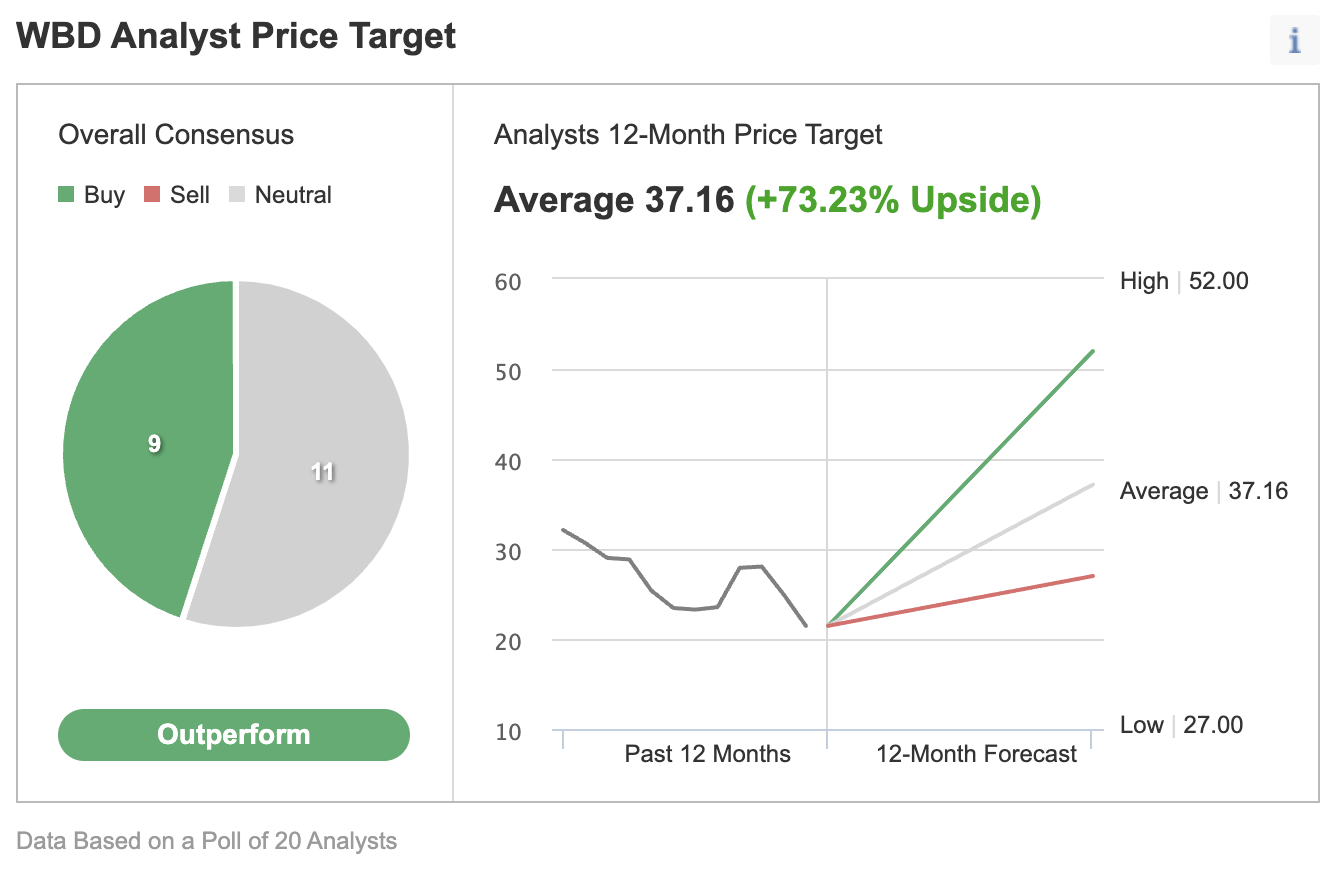

Several analysts have already upgraded the stock. As we write, WBD shares are hovering at $21.45.

Meanwhile, Investing.com analysts’ 12-month price target stands at $37.16, implying a 73.2% upside potential.

Source: Investing.com

A recent study projects the global video streaming market will grow at a compound annual rate (CAGR) of 21% from 2021 to 2028.

Wall Street agrees that WBD, with its unique content portfolio, is ready to compete with forerunners Netflix (NASDAQ:) and Walt Disney’s (NYSE:) Disney+ in the streaming battle.

WBD’s streaming services (HBO Max and Discovery+) had 96 million worldwide subscribers at the end of 2021. By comparison, Netflix ended 2021 with 221.8 million subscribers, and Disney with 129.8 million.

However, on Apr.19, Netflix released that raised eyebrows as management said that revenue growth had slowed considerably.

Netflix also announced that it for the first time in a decade. As a result, streaming stocks, including WBD, have come under significant pressure. However, for WBD bulls, this decline means an excellent opportunity to buy into the share price.

Meanwhile, following the highly anticipated WarnerMedia spin-off, analysts are keen on AT&T stock, which is now a pure-play in the telecommunications sector. For starters, the cash from the transaction will help T to deleverage and clean up its balance sheet.

The leaner organization will also be able to devote resources to 5G, which pleases many investors. About three years after its launch stateside, 5G is in over 60 countries. IDATE DigiWorld states:

“5G connections will increase significantly by 2026 and reach over 2 billion subscriptions at year-end.”

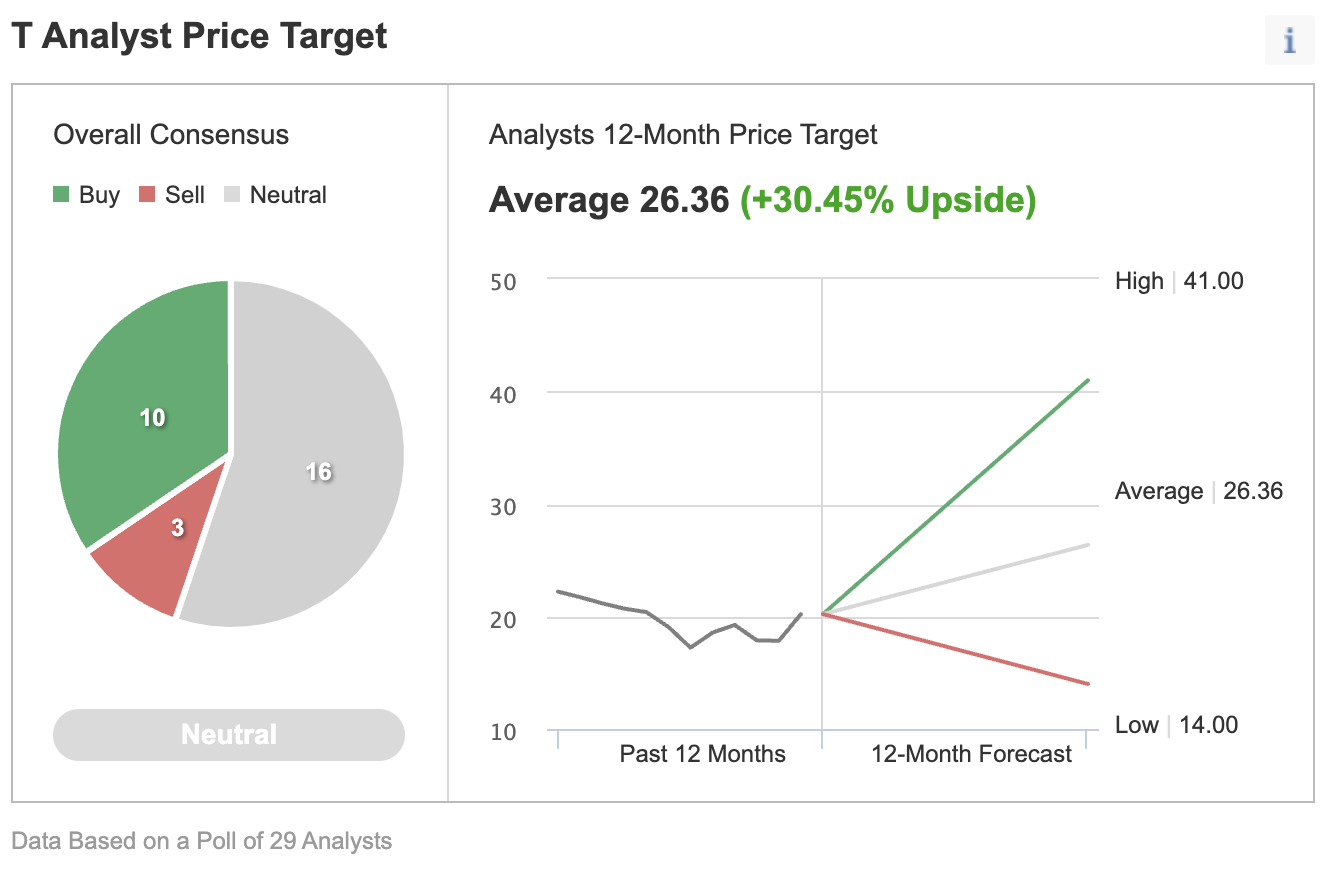

T stock currently trades at $20.21. Investing.com has a 12-month target price of $26.36, implying an increase of over 30%.

Source: Investing.com

Today’s article discusses two exchange-traded funds (ETFs), which may appeal to readers interested in the Warner Bros. Discovery merger.

1. Defiance 5G Next Gen Connectivity ETF

- Current Price: $35.86

- 52-week range: $34.34 – $42.49

- Dividend Yield: 1.46%

- Expense ratio: 0.30% per year

The Defiance 5G Next Gen Connectivity ETF (NYSE:) gives access to companies at the center of the deployment of 5G networks. The fund started trading in March 2019.

FIVG, which tracks BlueStar 5G Communications Index, has 85 holdings. With regards to sub-sectors, we see radio access network tech (30.28%), cloud core (17.22%), and Mobile Network Operator (MNO) (17.03%), network virtualization (11.58%), cell tower & data center REIT (9.67%), among others.

Over 80% of the companies come from the US. Next in line are those from the Netherlands, Canada, France, Sweden, and Israel. The top 10 stocks in the portfolio account for close to 41% of $1.1 billion in net assets.

Advanced Micro Devices (NASDAQ:), Analog Devices (NASDAQ:), Qualcomm (NASDAQ:), AT&T, Verizon Communications (NYSE:), Akamai (NASDAQ:), and American Tower (NYSE:) are among those names.

FIVG hit a record high in December 2021. But the ETF is down nearly 14% year-to-date and about flat in the past 12 months. Interested readers could find value in FIVG around these levels. We like the diversity of this fund that provides exposure to companies in the 5G space.

2. iShares Evolved US Media and Entertainment ETF

- Current Price: $29.72

- 52-week range: $29.72 – $38.90

- Dividend yield: 1.21%

- Expense ratio: 0.18% per year

The iShares Evolved US Media and Entertainment ETF (NYSE:) invests in the US media and entertainment segment. The fund was first launched in March 2018.

IEME, has 91 holdings. Media & entertainment companies lead the names on the roster at 84.94%. They come from consumer services, consumer durables, telecommunications, commercial & professional services, real estate, retailing, software & services, and tech hardware & equipment.

Over 40% of the portfolio is in the leading 10 stocks. They include Fox (NASDAQ:), Comcast (NASDAQ:), Paramount Global (NASDAQ:), Walt Disney, Activision Blizzard (NASDAQ:), and Warner Bros Discovery.

IEME saw an all-time high in July 2021. However, it has been on a downtrend ever since. The ETF has lost 10.8% since January, hitting a 52-week low yesterday. Trailing P/E and P/B ratios are 11.96x and 2.15x, respectively. Buy-and-hold investors could consider buying the dip in IEME.