- Within the dynamic panorama of progress shares, figuring out firms with the potential to multiply in worth requires analyzing each present enterprise momentum and long-term market alternatives.

- Robinhood and Roblox signify two of probably the most thrilling progress tales out there at present.

- Each firms have pathways to achieve the $100/share milestone and past, making them compelling additions to any growth-oriented portfolio.

- On the lookout for extra actionable commerce concepts? Subscribe now to unlock entry to InvestingPro’s AI-selected inventory winners for 45% off.

Because the inventory market continues to evolve in 2025 amid tariff uncertainty, two firms stand out as prime candidates to interrupt the $100 per share barrier and probably climb larger: Robinhood Markets (NASDAQ:) and Roblox (NYSE:). Each firms have demonstrated outstanding progress pushed by modern enterprise fashions, increasing consumer bases, and strategic initiatives that place them for long-term success.

Right here’s a more in-depth have a look at the elements driving their progress and why buyers are optimistic about their future trajectories.

1. Robinhood: The Way forward for Retail Investing

Robinhood has reworked from a controversial buying and selling app right into a diversified monetary providers platform with a number of progress vectors that would propel its inventory towards the $100 mark and past.

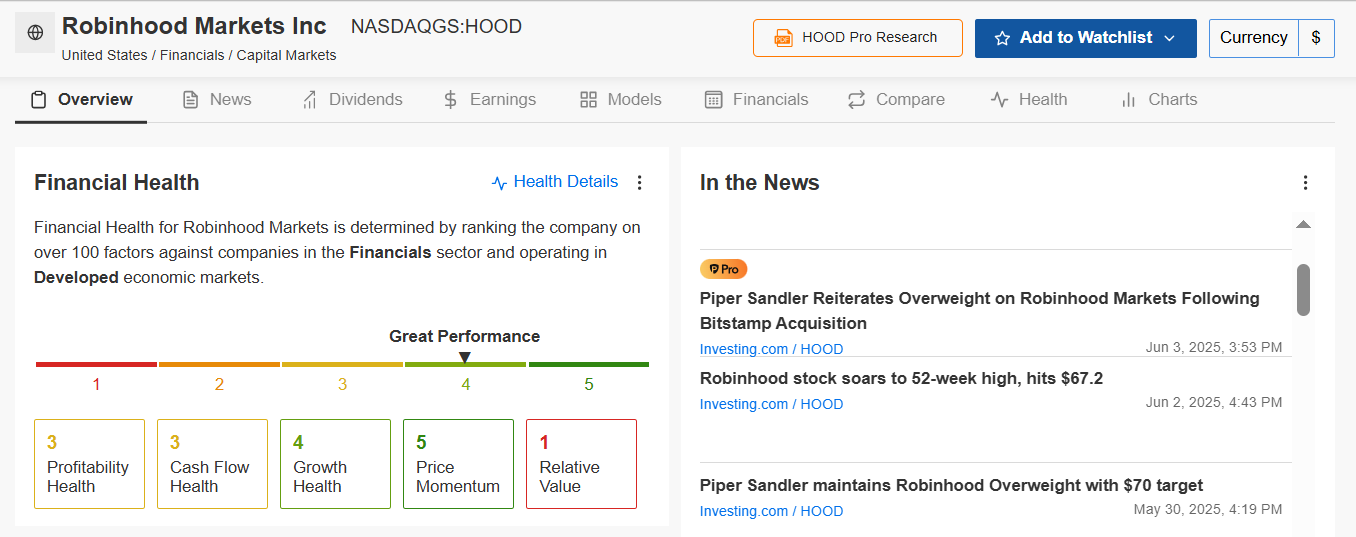

Supply: Investing.com

Presently buying and selling at round $72 per share, HOOD has staged a jaw-dropping 228.4% one-year rally, leaving skeptics within the mud. Its momentum isn’t any accident: the app’s 25.9 million funded accounts, aggressive growth into banking and advisory, and a crypto enterprise that’s browsing the wave have all moved the needle.

The corporate’s monetary well being is rated ‘GREAT’ (rating: 3.18), as per InvestingPro, with income exploding 58.2% final 12 months and forecast to leap one other 22.0%.

Analysts are tripping over one another to lift targets. Piper Sandler simply reaffirmed a $70 goal, Needham is at $71, and the excessive estimate for HOOD is a skyscraping $105.00. The imply sits at $62.08—however with the value already above that, the market’s betting on extra fireworks.

Supply: InvestingPro

Newest strikes—like buying Toronto-based cryptocurrency agency WonderFi and launching ’Robinhood Legend’ within the UK—present an organization intent on international domination, not simply U.S. disruption. The most important danger? Regulatory curveballs and breakneck volatility. However with a consumer base that skews younger and tech-savvy, Robinhood is positioned to seize market share from conventional brokerages like Charles Schwab (NYSE:) and Constancy.

Why $100+ is Achievable:

Robinhood’s distinctive place within the retail investing house, mixed with its rising consumer base and increasing product suite, makes it a powerful candidate to achieve $100 and past. Because the platform continues to innovate and entice new customers, its inventory value is more likely to replicate its long-term potential.

2. Roblox: Constructing and Monetizing the Metaverse

Roblox has established itself as a singular leisure platform that blends gaming, social interplay, and creator economics. Its potential to achieve the $100 per share threshold and properly past is supported by a number of compelling progress drivers, and Wall Road is lastly catching on.

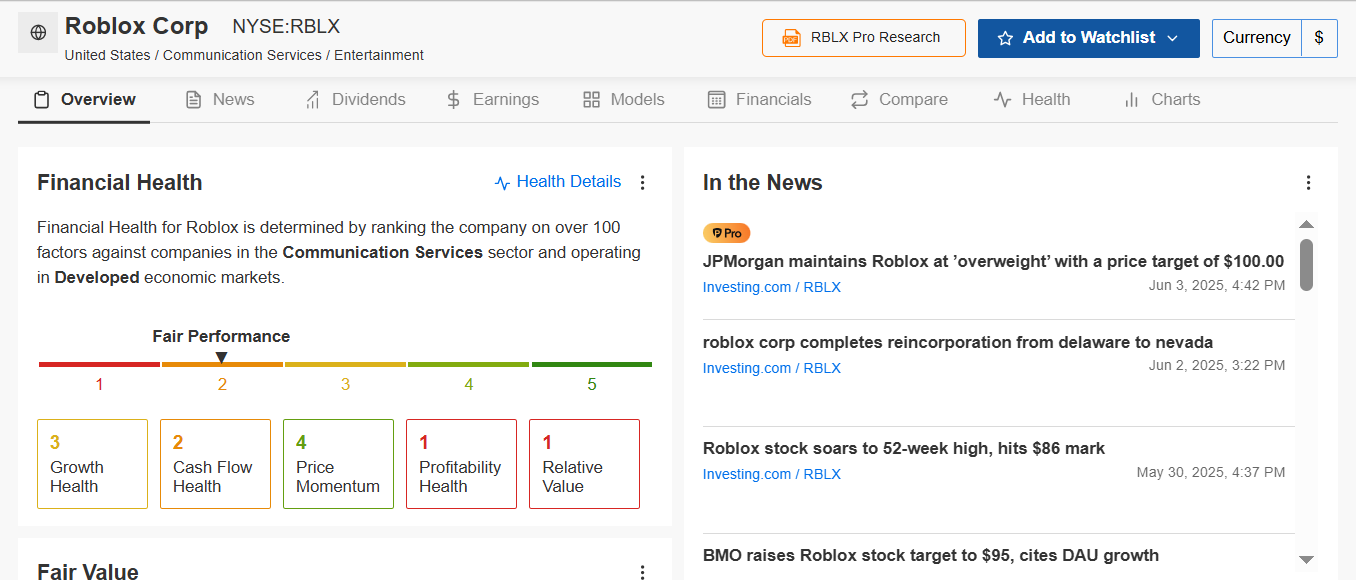

Supply: Investing.com

Presently at about $90/share, RBLX inventory’s 171.3% one-year surge is powered by a string of earnings beats, livid platform growth, and the rollout of latest income streams from promoting to e-commerce.

InvestingPro charges Roblox’s monetary well being as ‘FAIR’ (rating: 2.36), with income progress at 28.7% final 12 months and a forecast to speed up to 48.8%. With every day energetic customers (DAUs) approaching 100 million and vital progress in engagement hours, Roblox’s modern monetization methods make it a compelling progress story.

Analysts are overwhelmingly bullish, with 21 Purchase scores and a median value goal of $75.88, although latest upgrades from JPMorgan and Citi raised targets to $100, reflecting confidence within the firm’s long-term outlook. With adjusted EPS nonetheless damaging, Roblox is a traditional “develop now, revenue later” story—like Amazon (NASDAQ:) in its early days, however for the metaverse.

Supply: InvestingPro

Roblox’s secret sauce: relentless consumer progress (+26% every day actives), ever-expanding platform partnerships, and AI-fueled content material creation that retains engagement (and spending) rising. Dangers? It’s nonetheless unprofitable and faces fierce competitors, however the market is betting on scale, not stasis.

Why $100+ is Achievable:

Roblox’s management within the metaverse, mixed with its sturdy consumer engagement and rising monetization efforts, positions it properly to interrupt the $100 barrier, with room for additional appreciation. Because the metaverse positive factors traction and Roblox continues to innovate, its inventory value has vital upside potential.

Conclusion: $100 Is a Milestone, Not a Ceiling

Robinhood and Roblox are already flirting with the century mark —and with each firms driving secular progress waves (crypto, creator economic system, digital finance), $100 feels much less like a end line and extra like a pit cease.

For buyers seeking to capitalize on long-term tendencies like retail investing and digital worlds, HOOD and RBLX supply compelling alternatives.

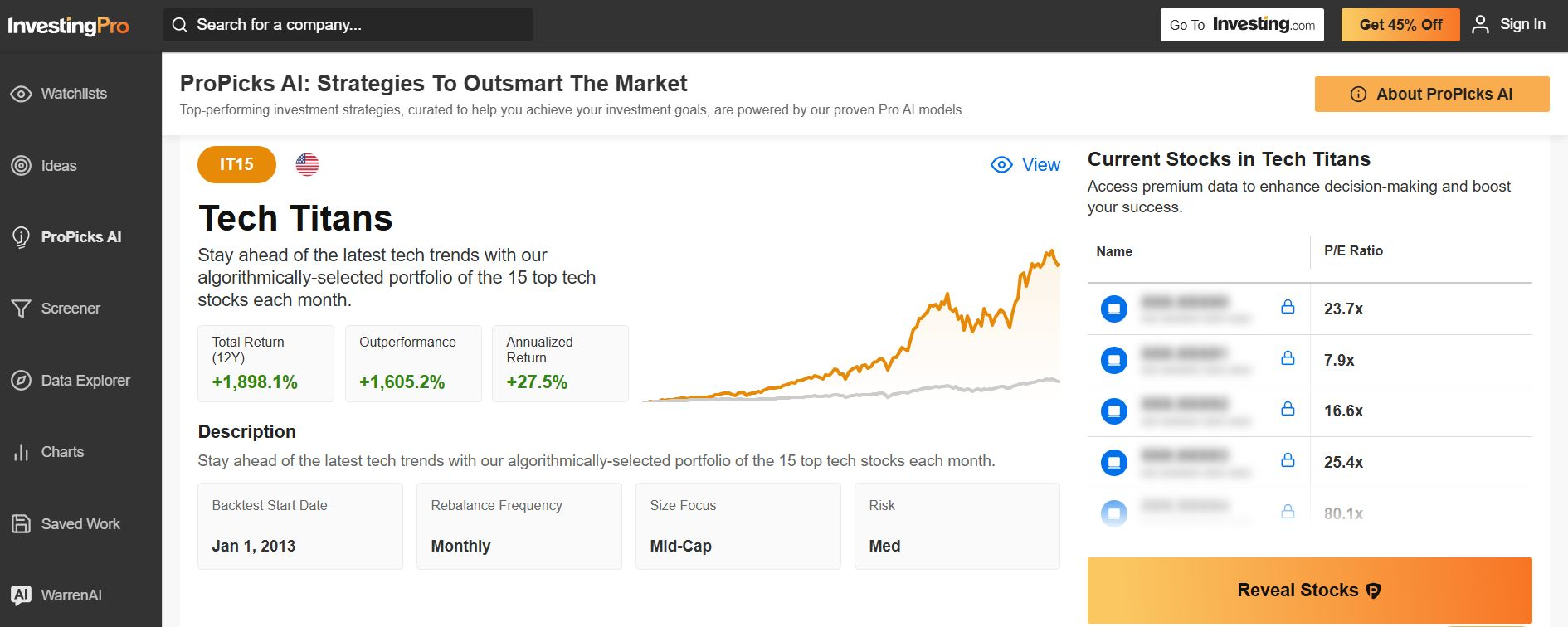

Make sure to take a look at InvestingPro to remain in sync with the market pattern and what it means on your buying and selling. Whether or not you’re a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now for 45% off and immediately unlock entry to a number of market-beating options, together with:

- ProPicks AI: AI-selected inventory winners with confirmed observe file.

- InvestingPro Honest Worth: Immediately discover out if a inventory is underpriced or overvalued.

- Superior Inventory Screener: Seek for the perfect shares primarily based on a whole lot of chosen filters, and standards.

- Prime Concepts: See what shares billionaire buyers resembling Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the Nasdaq 100 through the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco Prime QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I usually rebalance my portfolio of particular person shares and ETFs primarily based on ongoing danger evaluation of each the macroeconomic setting and firms’ financials.

The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

Comply with Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.