Revealed on June eleventh, 2025 by Bob Ciura

Utility shares have nice attraction for earnings traders. They sometimes generate regular earnings 12 months after 12 months, and plenty of utility shares have recession-proof dividend payouts.

In any case, folks will all the time want water, warmth, and electrical energy, even during times of steep financial downturns.

Consequently, utility shares are likely to have excessive dividend yields, with constant dividend development over time.

You possibly can obtain the checklist of excessive dividend shares (together with vital monetary ratios reminiscent of dividend yields and payout ratios) by clicking on the hyperlink beneath:

So why do these companies make for enticing investments?

Utilities often conduct enterprise in extremely regulated markets, complying with guidelines set by federal, state, and municipal governments.

Whereas this sounds extremely unattractive on the floor, what it means in apply is that utilities are principally authorized monopolies.

The strict regulatory setting that utility companies function in creates a robust and sturdy aggressive benefit for current trade contributors.

For that reason, utilities are among the many hottest shares for long-term dividend development traders — particularly as a result of they have a tendency to supply above-average dividend yields.

Certainly, the regulatory-based aggressive benefits out there to utility shares give them the consistency to lift their dividends frequently.

Merely put, utility shares are a few of the most reliable dividend shares round.

This text will checklist the 15 highest-yielding utility shares within the Positive Evaluation Analysis Database.

Desk Of Contents

The next desk of contents supplies for straightforward navigation:

Highest-Yielding Utility Inventory #15: New Jersey Assets (NJR)

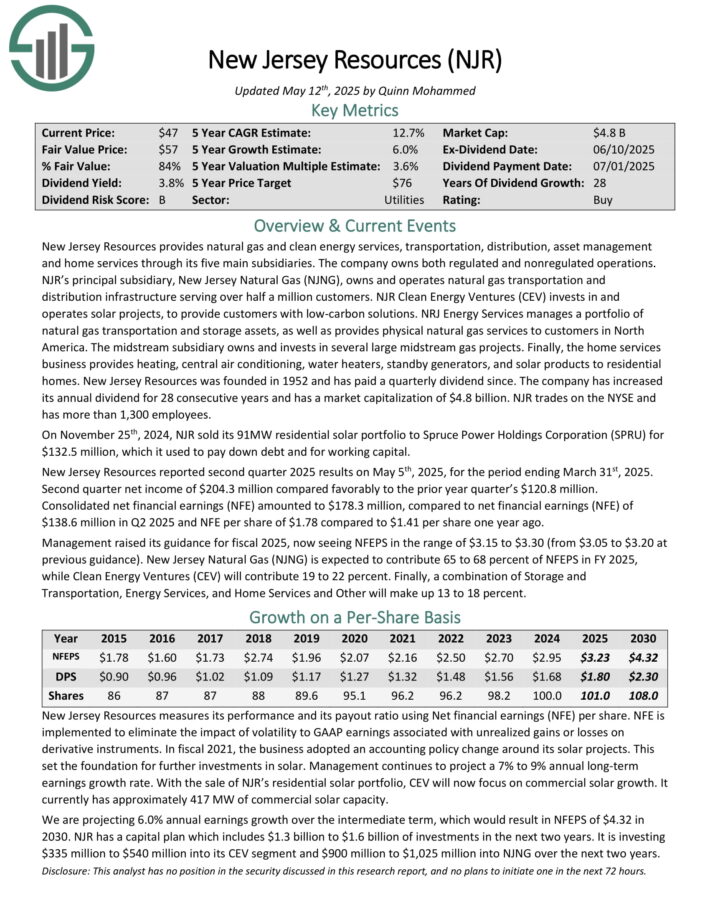

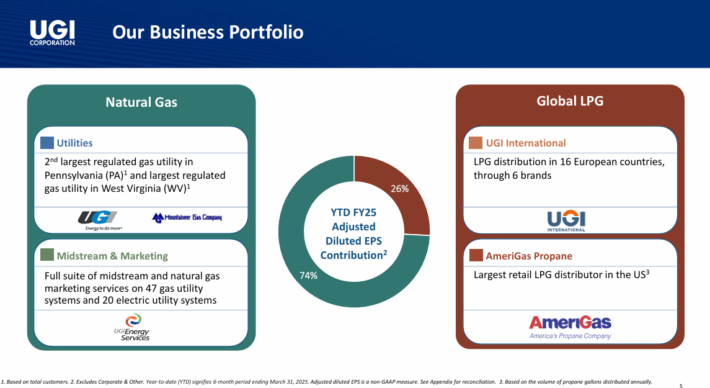

New Jersey Assets supplies pure gasoline and clear power providers, transportation, distribution, asset administration and residential providers via its 5 foremost subsidiaries. The corporate owns each regulated and non-regulated operations.

NJR’s principal subsidiary, New Jersey Pure Fuel (NJNG), owns and operates pure gasoline transportation and distribution infrastructure serving over half 1,000,000 clients. NJR Clear Vitality Ventures (CEV) invests in and operates photo voltaic tasks, to supply clients with low-carbon options.

NRJ Vitality Companies manages a portfolio of pure gasoline transportation and storage belongings, in addition to supplies bodily pure gasoline providers to clients in North America.

The midstream subsidiary owns and invests in a number of giant midstream gasoline tasks. Lastly, the house providers enterprise supplies heating, central air-con, water heaters, standby turbines, and photo voltaic merchandise to residential properties.

New Jersey Assets reported second quarter 2025 outcomes on Could fifth, 2025, for the interval ending March thirty first, 2025.

Supply: Investor Presentation

Second quarter web earnings of $204.3 million in contrast favorably to the prior 12 months quarter’s $120.8 million.

Consolidated web monetary earnings (NFE) amounted to $178.3 million, in comparison with web monetary earnings (NFE) of $138.6 million in Q2 2025 and NFE per share of $1.78 in comparison with $1.41 per share one 12 months in the past.

Administration raised its steering for fiscal 2025, now seeing NFEPS within the vary of $3.15 to $3.30 (from $3.05 to $3.20 at earlier steering).

Click on right here to obtain our most up-to-date Positive Evaluation report on NJR (preview of web page 1 of three proven beneath):

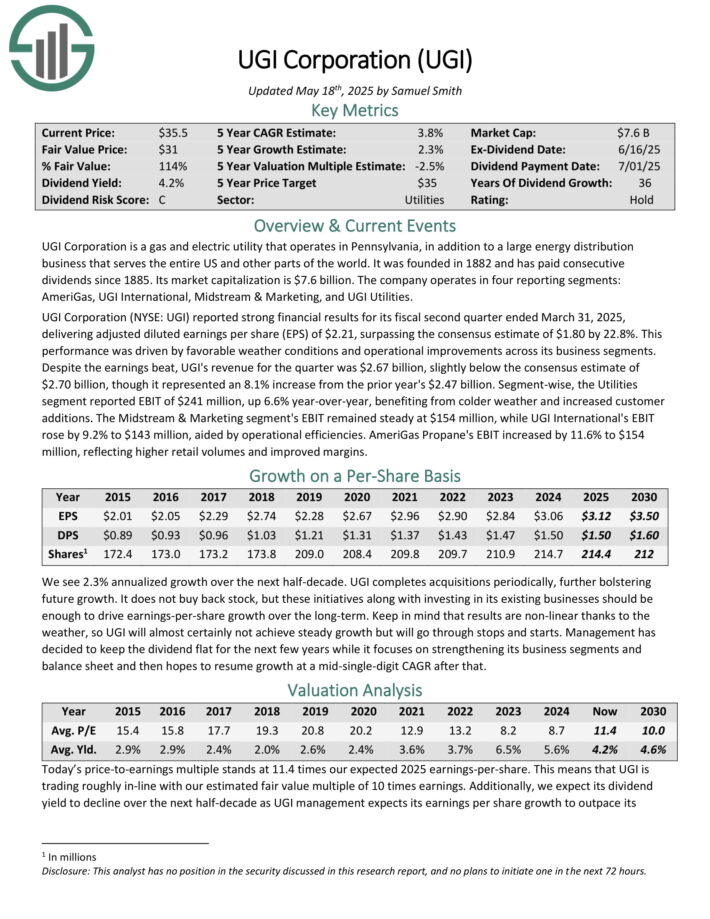

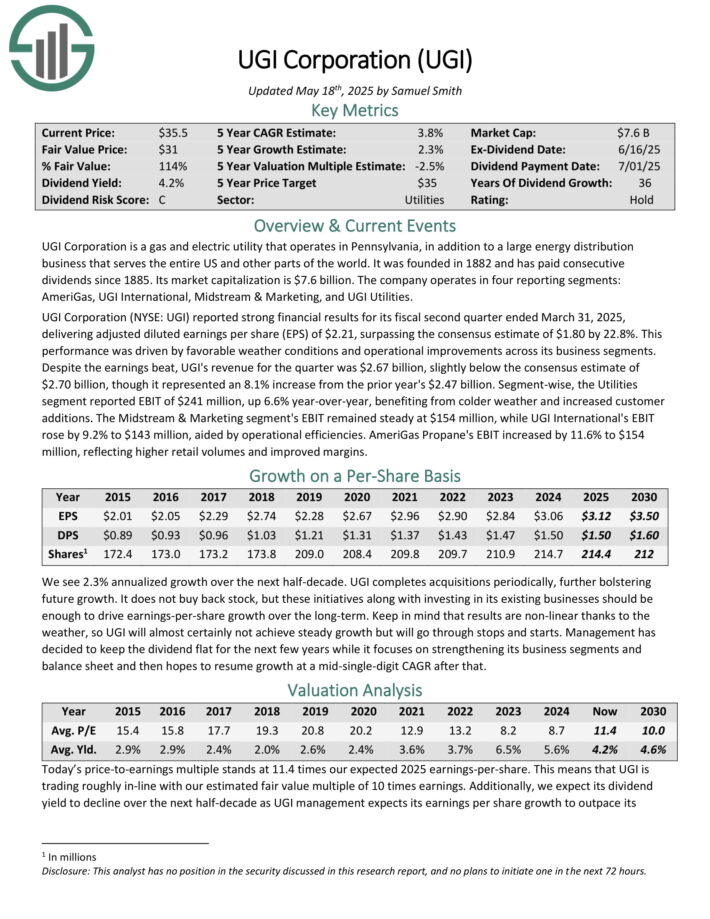

Highest-Yielding Utility Inventory #14: UGI Corp. (UGI)

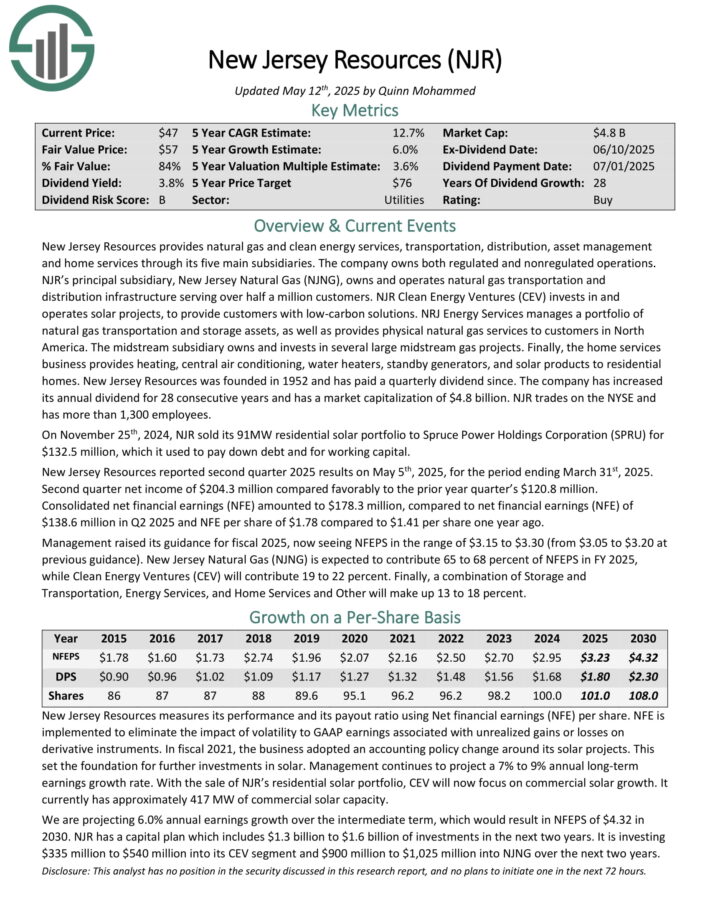

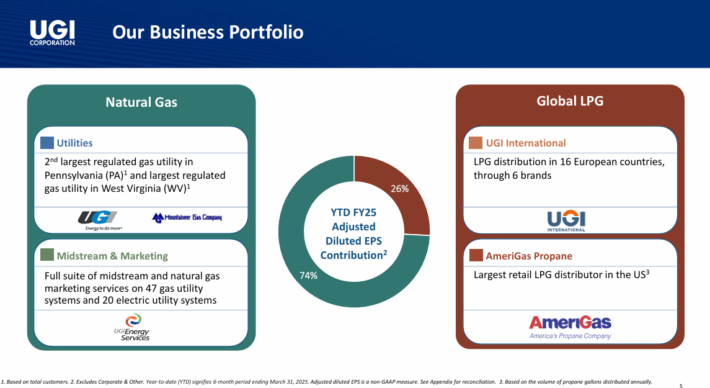

UGI Company is a gasoline and electrical utility that operates in Pennsylvania, along with a big power distribution enterprise that serves all the US and different components of the world. It was based in 1882 and has paid consecutive dividends since 1885.

The corporate operates in 4 reporting segments: AmeriGas, UGI Worldwide, Midstream & Advertising, and UGI Utilities.

Supply: Investor Presentation

UGI reported robust monetary outcomes for its fiscal second quarter ended March 31, 2025, delivering adjusted diluted earnings per share (EPS) of $2.21, surpassing the consensus estimate of $1.80 by 22.8%. This efficiency was pushed by favorable climate situations and operational enhancements throughout its enterprise segments.

Regardless of the earnings beat, UGI’s income for the quarter was $2.67 billion, barely beneath the consensus estimate of $2.70 billion, although it represented an 8.1% improve from the prior 12 months’s $2.47 billion. Section-wise, the Utilities phase reported EBIT of $241 million, up 6.6% year-over-year, benefiting from colder climate and elevated buyer additions.

The Midstream & Advertising phase’s EBIT remained regular at $154 million, whereas UGI Worldwide’s EBIT rose by 9.2% to $143 million, aided by operational efficiencies. AmeriGas Propane’s EBIT elevated by 11.6% to $154 million, reflecting increased retail volumes and improved margins.

Click on right here to obtain our most up-to-date Positive Evaluation report on UGI (preview of web page 1 of three proven beneath):

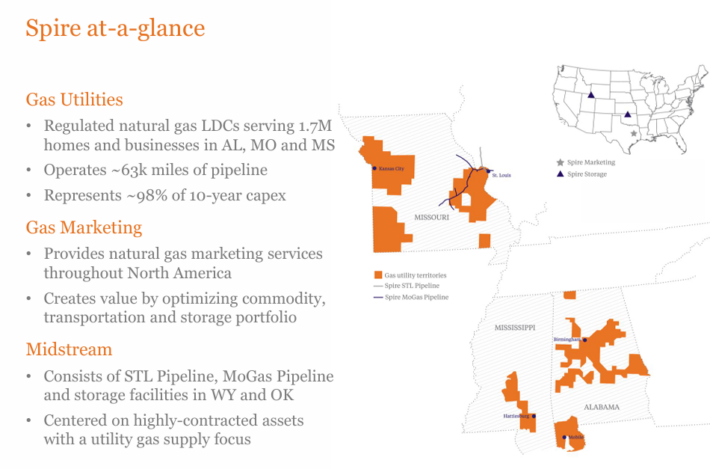

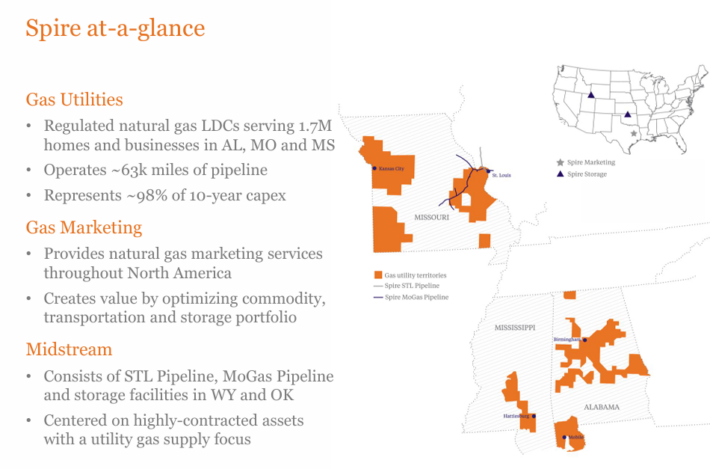

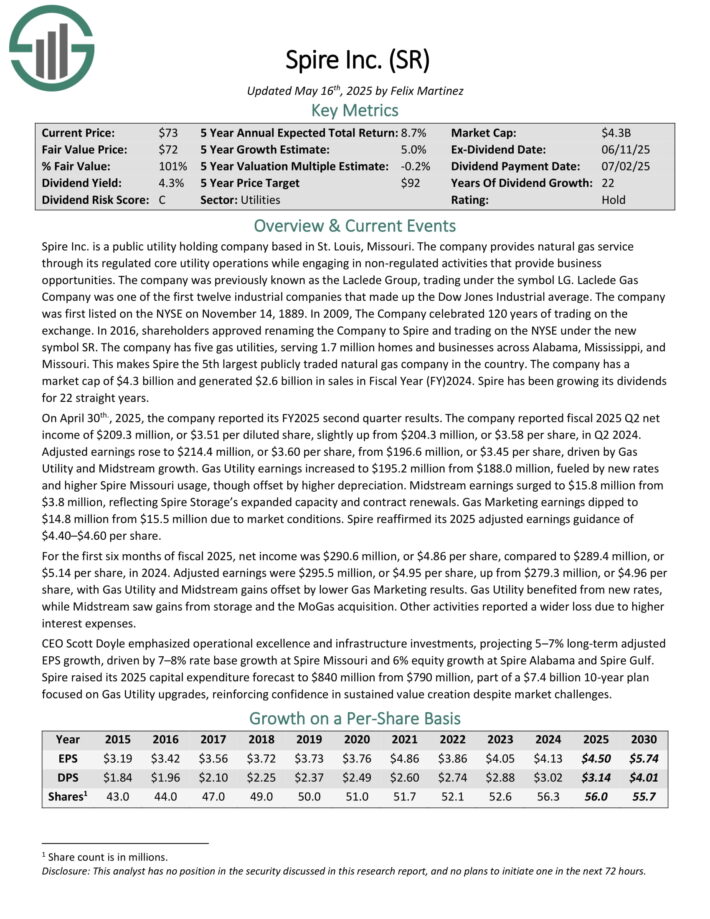

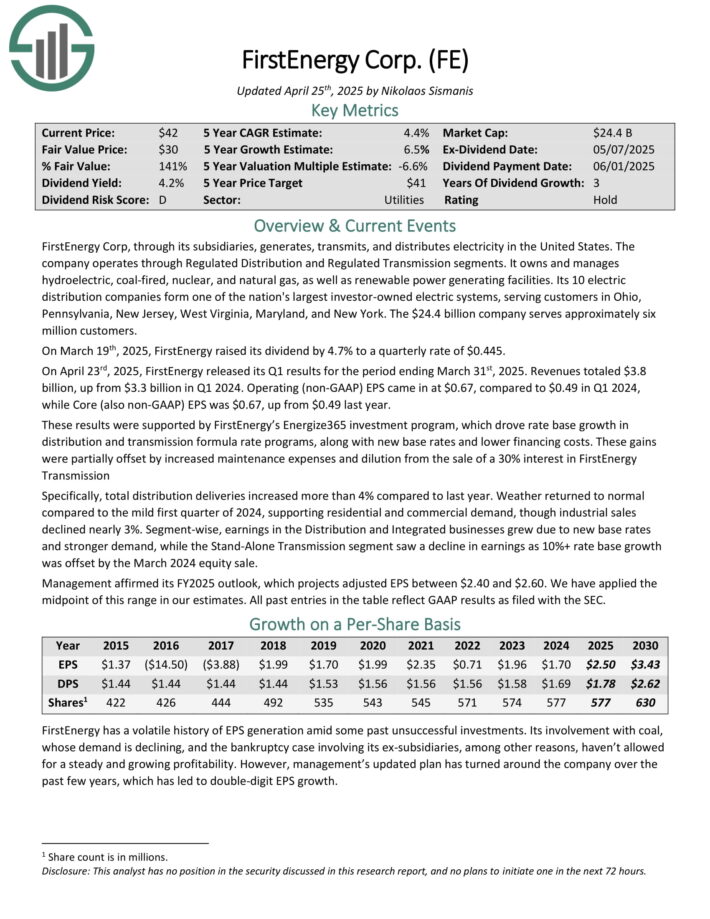

Highest-Yielding Utility Inventory #13: Spire Inc. (SR)

Spire Inc. is a public utility holding firm based mostly in St. Louis, Missouri. The corporate supplies pure gasoline service via its regulated core utility operations whereas partaking in non-regulated actions that present enterprise alternatives.

The corporate has 5 gasoline utilities, serving 1.7 million properties and companies throughout Alabama, Mississippi, and Missouri. This makes Spire the fifth largest publicly traded pure gasoline firm within the nation.

Supply: Investor Presentation

It generated $2.6 billion in gross sales in Fiscal 12 months (FY) 2024. Spire has been rising its dividends for 22 straight years.

On April thirtieth 2025, the corporate reported its FY2025 second quarter outcomes. It reported fiscal 2025 Q2 web earnings of $209.3 million, or $3.51 per diluted share, barely up from $204.3 million, or $3.58 per share, in Q2 2024.

Adjusted earnings rose to $214.4 million, or $3.60 per share, from $196.6 million, or $3.45 per share, pushed by Fuel Utility and Midstream development. Fuel Utility earnings elevated to $195.2 million from $188.0 million, fueled by new charges and better Spire Missouri utilization, although offset by increased depreciation.

Midstream earnings surged to $15.8 million from $3.8 million, reflecting Spire Storage’s expanded capability and contract renewals. Fuel Advertising earnings dipped to $14.8 million from $15.5 million as a result of market situations.

Spire reaffirmed its 2025 adjusted earnings steering of $4.40–$4.60 per share.

Click on right here to obtain our most up-to-date Positive Evaluation report on SR (preview of web page 1 of three proven beneath):

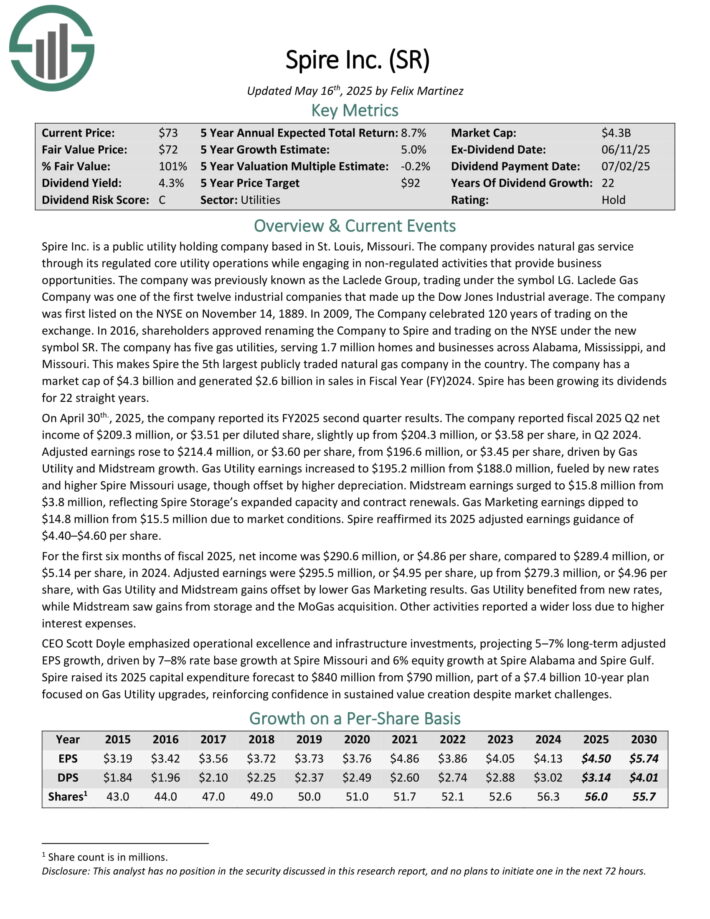

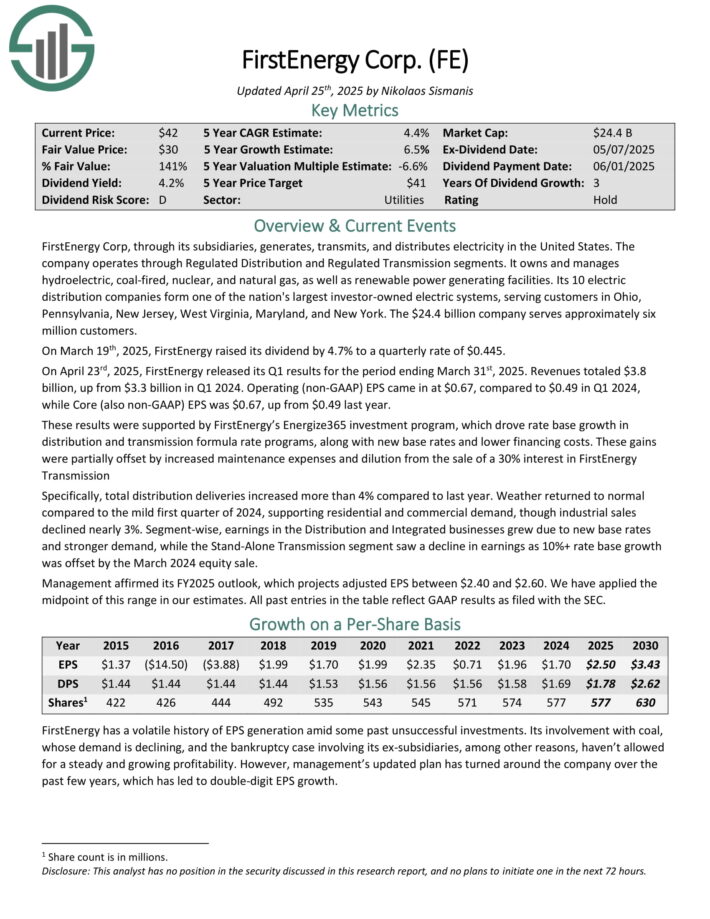

Highest-Yielding Utility Inventory #12: Firstenergy Corp. (FE)

FirstEnergy Corp, via its subsidiaries, generates, transmits, and distributes electrical energy in the US. The corporate operates via Regulated Distribution and Regulated Transmission segments. It owns and manages hydroelectric, coal-fired, nuclear, and pure gasoline, in addition to renewable energy producing amenities.

Its 10 electrical distribution firms kind one of many nation’s largest investor-owned electrical techniques, serving clients in Ohio, Pennsylvania, New Jersey, West Virginia, Maryland, and New York. The corporate serves roughly six million clients.

On March nineteenth, 2025, FirstEnergy raised its dividend by 4.7% to a quarterly charge of $0.445.

On April twenty third, 2025, FirstEnergy launched its Q1 outcomes for the interval ending March thirty first, 2025. Revenues totaled $3.8 billion, up from $3.3 billion in Q1 2024. Working (non-GAAP) EPS got here in at $0.67, in comparison with $0.49 in Q1 2024, whereas Core (additionally non-GAAP) EPS was $0.67, up from $0.49 final 12 months.

These outcomes have been supported by FirstEnergy’s Energize365 funding program, which drove charge base development in distribution and transmission system charge packages, together with new base charges and decrease financing prices.

Administration affirmed its FY2025 outlook, which tasks adjusted EPS between $2.40 and $2.60.

Click on right here to obtain our most up-to-date Positive Evaluation report on FE (preview of web page 1 of three proven beneath):

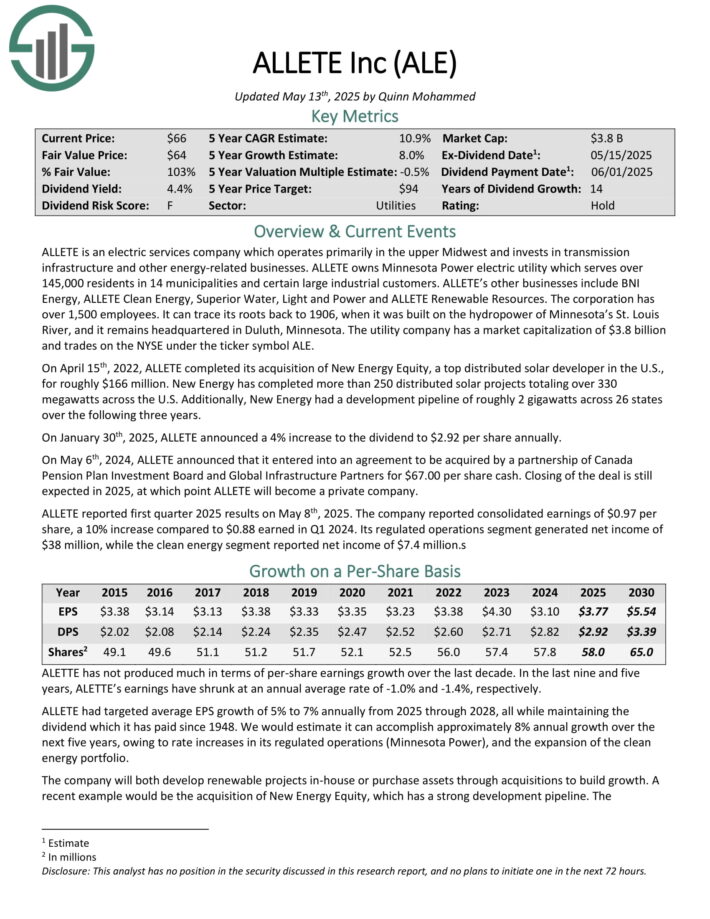

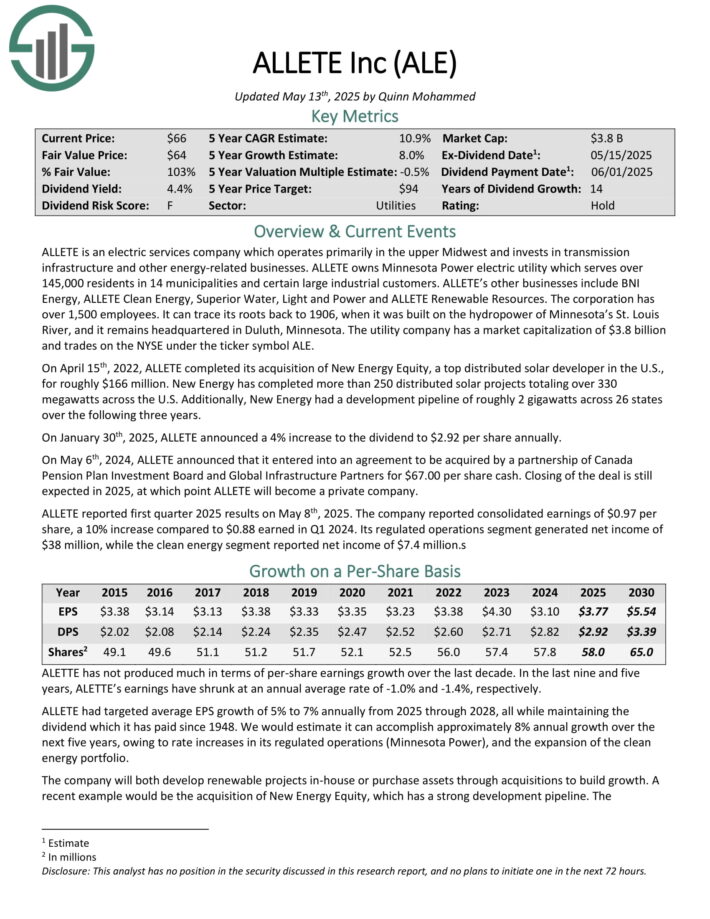

Highest-Yielding Utility Inventory #11: Allete, Inc. (ALE)

ALLETE is an electrical providers firm which operates primarily within the higher Midwest and invests in transmission infrastructure and different energy-related companies. ALLETE owns Minnesota Energy electrical utility which serves over 145,000 residents in 14 municipalities and sure giant industrial clients.

ALLETE’s different companies embrace BNI Vitality, ALLETE Clear Vitality, Superior Water, Gentle and Energy and ALLETE Renewable Assets. The company has over 1,500 staff.

On January thirtieth, 2025, ALLETE introduced a 4% improve to the dividend to $2.92 per share yearly.

On Could sixth, 2024, ALLETE introduced that it entered into an settlement to be acquired by a partnership of Canada Pension Plan Funding Board and International Infrastructure Companions for $67.00 per share money. Closing of the deal remains to be anticipated in 2025, at which level ALLETE will turn out to be a non-public firm.

ALLETE reported first quarter 2025 outcomes on Could eighth, 2025. The corporate reported consolidated earnings of $0.97 per share, a ten% improve in comparison with $0.88 earned in Q1 2024. Its regulated operations phase generated web earnings of $38 million, whereas the clear power phase reported web earnings of $7.4 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on ALE (preview of web page 1 of three proven beneath):

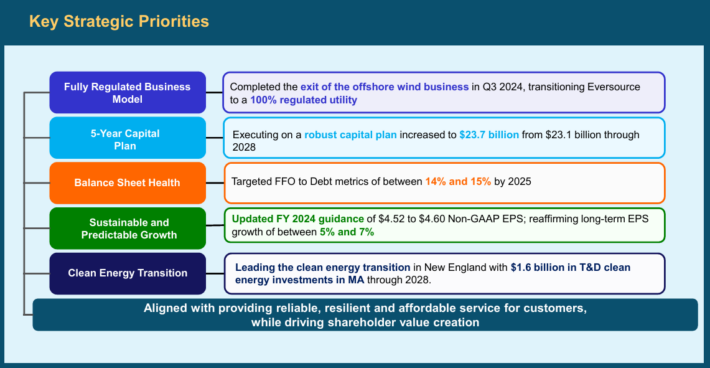

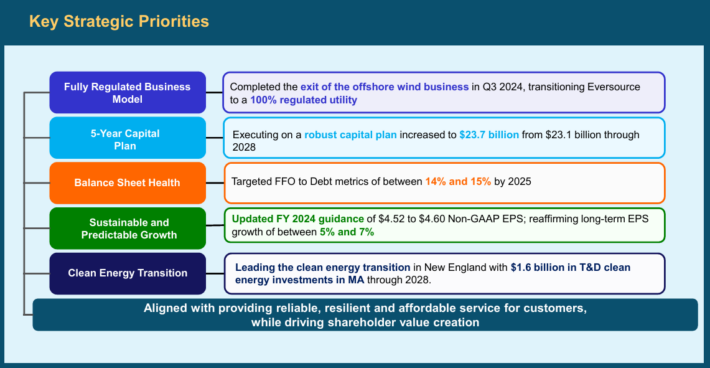

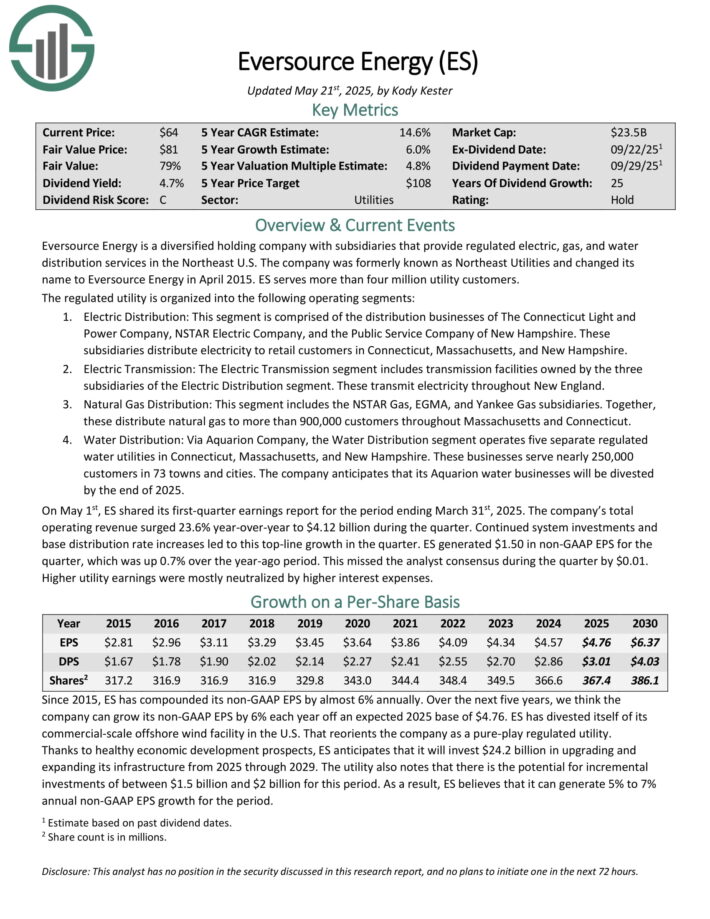

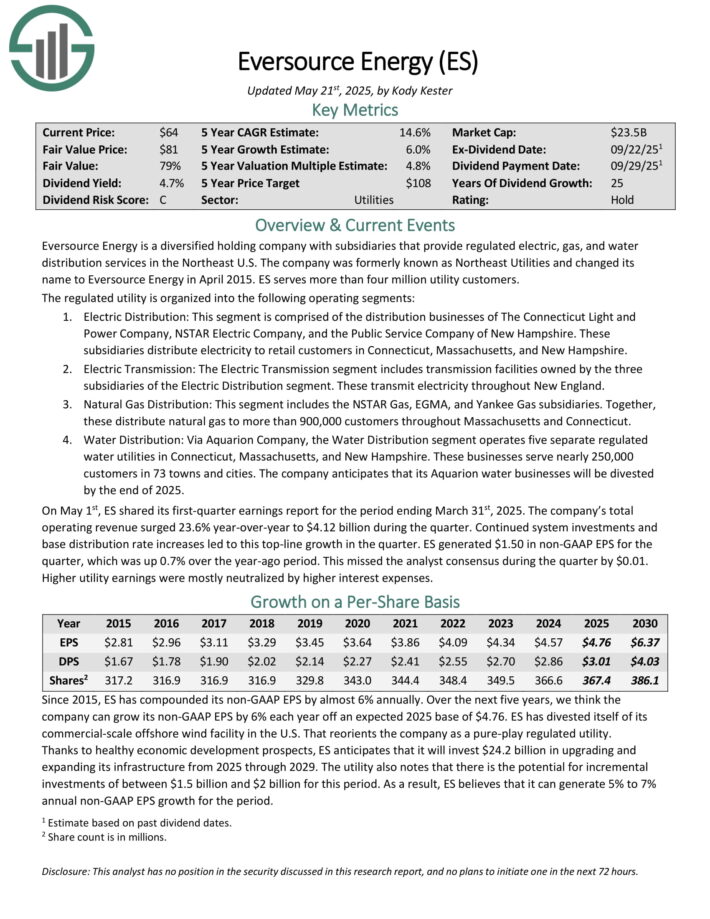

Highest-Yielding Utility Inventory #10: Eversource Vitality (ES)

Eversource Vitality is a diversified holding firm with subsidiaries that present regulated electrical, gasoline, and water distribution service within the Northeast U.S.

FactSet, Erie Indemnity, and Eversource Vitality are the three new Dividend Aristocrats for 2025.

The corporate’s utilities serve greater than 4 million clients. Eversource has delivered regular development to shareholders for a few years.

Supply: Investor Presentation

On February eleventh, 2025, Eversource Vitality launched its fourth-quarter and full-year 2024 outcomes. For the quarter, the corporate reported web earnings of $72.5 million, a major enchancment from a web lack of $(1,288.5) million in the identical quarter of final 12 months, which mirrored the influence of the corporate’s exit from offshore wind investments.

On Could 1st, ES shared its first-quarter earnings report for the interval ending March thirty first, 2025. The corporate’s whole working income surged 23.6% year-over-year to $4.12 billion in the course of the quarter.

Continued system investments and base distribution charge will increase led to this top-line development within the quarter. ES generated $1.50 in non-GAAP EPS for the quarter, which was up 0.7% over the year-ago interval.

Click on right here to obtain our most up-to-date Positive Evaluation report on ES (preview of web page 1 of three proven beneath):

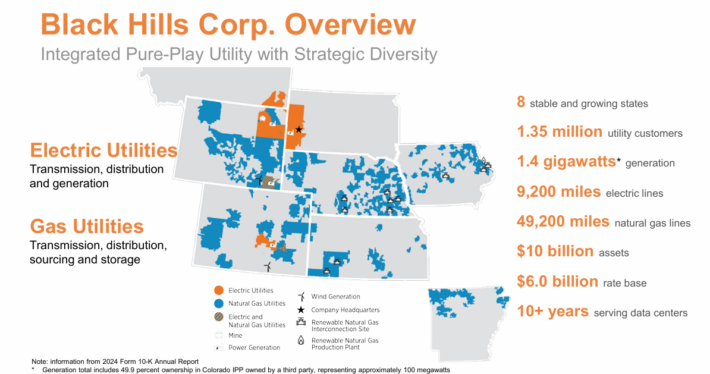

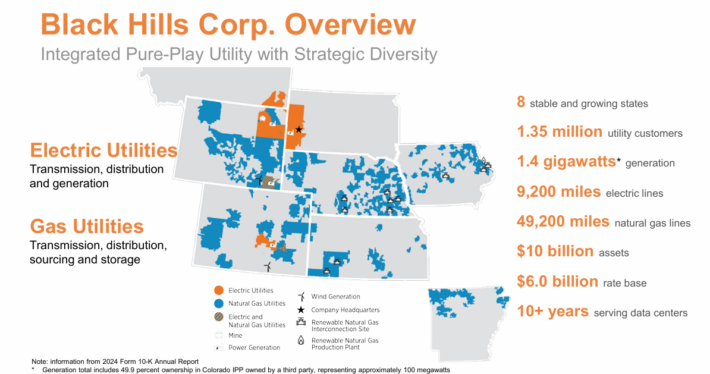

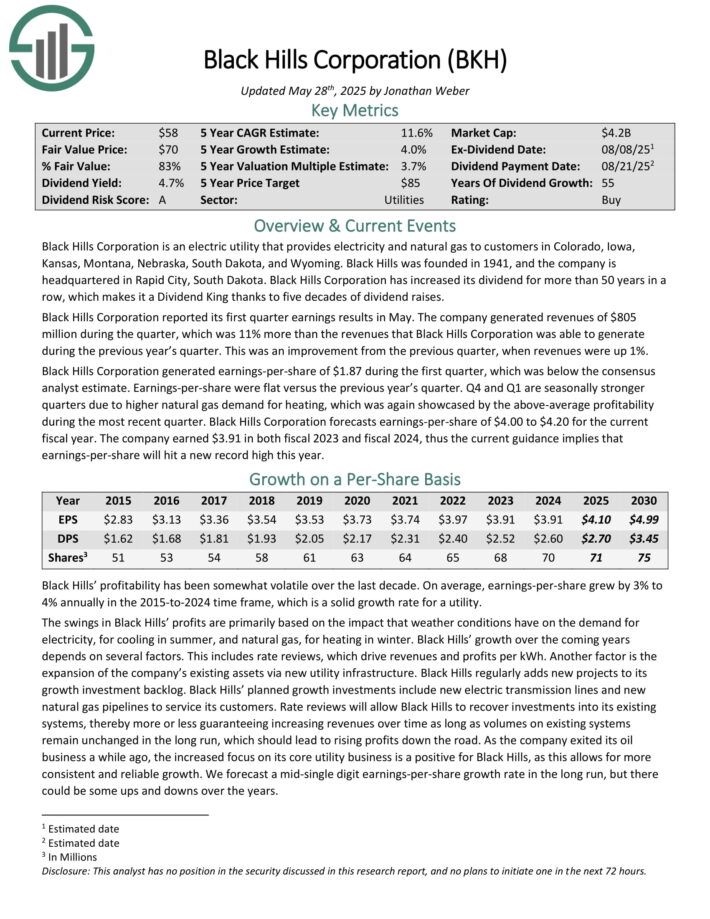

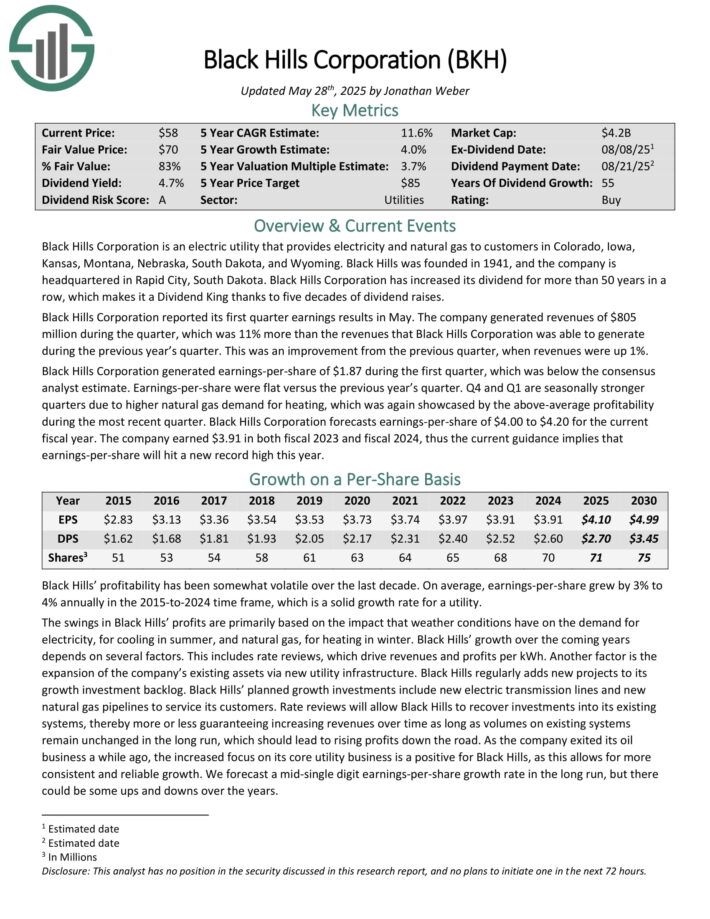

Highest-Yielding Utility Inventory #9: Black Hills Corp. (BKH)

Black Hills Company is an electrical utility that gives electrical energy and pure gasoline to clients in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The corporate has 1.35 million utility clients in eight states. Its pure gasoline belongings embrace 49,200 miles of pure gasoline strains. Individually, it has ~9,200 miles of electrical strains and 1.4 gigawatts of electrical era capability.

Supply: Investor Presentation

Black Hills Company reported its first quarter earnings leads to Could. The corporate generated revenues of $805 million in the course of the quarter, which was 11% year-over-year development.

Black Hills Company generated earnings-per-share of $1.87 in the course of the first quarter, which was beneath the consensus analyst estimate. Earnings-per-share have been flat versus the earlier 12 months’s quarter.

This fall and Q1 are seasonally stronger quarters as a result of increased pure gasoline demand for heating, which was once more showcased by the above-average profitability throughout the latest quarter.

Black Hills Company forecasts earnings-per-share of $4.00 to $4.20 for the present fiscal 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on BKH (preview of web page 1 of three proven beneath):

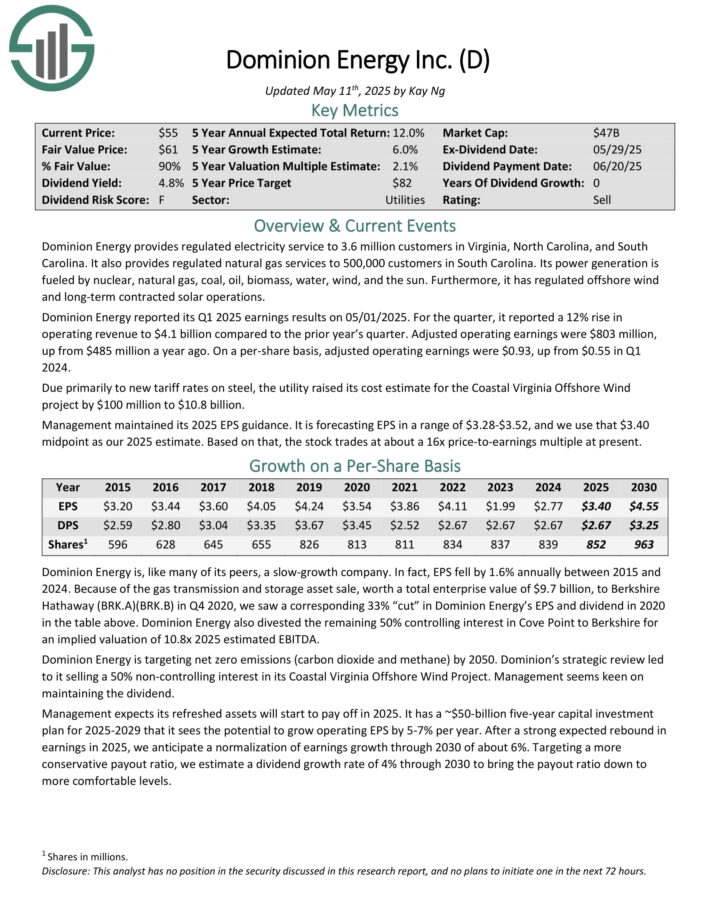

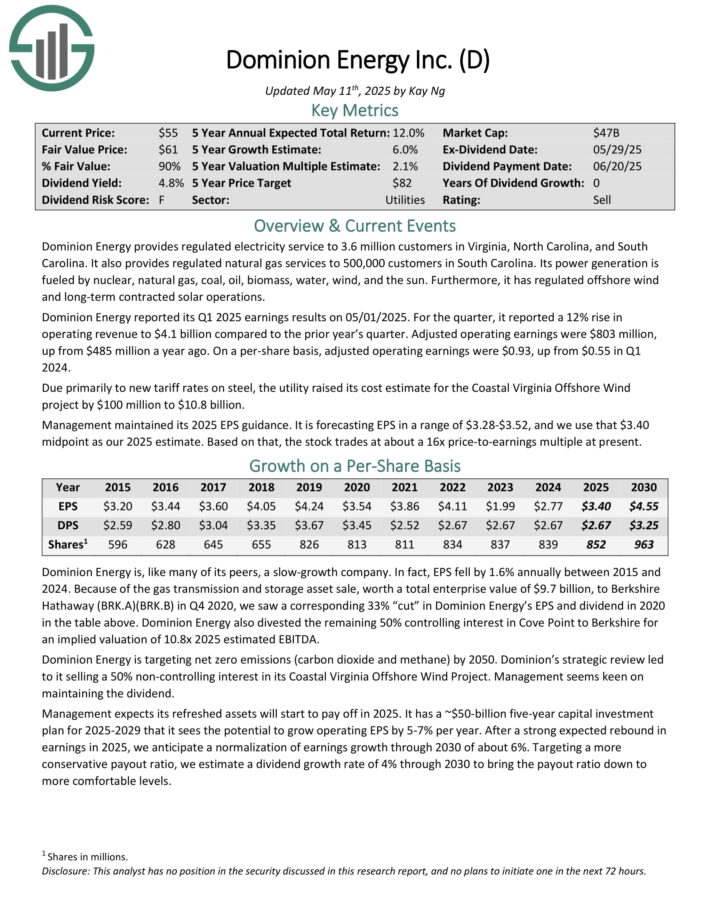

Highest-Yielding Utility Inventory #8: Dominion Vitality (D)

Dominion Vitality supplies regulated electrical energy service to three.6 million clients in Virginia, North Carolina, and South Carolina. It additionally supplies regulated pure gasoline providers to 500,000 clients in South Carolina.

Its energy era is fueled by nuclear, pure gasoline, coal, oil, biomass, water, wind, and the solar. Moreover, it has regulated offshore wind and long-term contracted photo voltaic operations.

Dominion Vitality reported its Q1 2025 earnings outcomes on 05/01/2025. For the quarter, it reported a 12% rise in working income to $4.1 billion in comparison with the prior 12 months’s quarter.

Adjusted working earnings have been $803 million, up from $485 million a 12 months in the past. On a per-share foundation, adjusted working earnings have been $0.93, up from $0.55 in Q1 2024.

Due primarily to new tariff charges on metal, the utility raised its value estimate for the Coastal Virginia Offshore Wind venture by $100 million to $10.8 billion.

Administration maintained its 2025 EPS steering. It’s forecasting EPS in a spread of $3.28-$3.52.

Administration expects its refreshed belongings will begin to repay in 2025. It has a ~$50-billion five-year capital funding plan for 2025-2029 that it sees the potential to develop working EPS by 5-7% per 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on D (preview of web page 1 of three proven beneath):

Highest-Yielding Utility Inventory #7: Northwest Pure Holding (NWN)

NW Pure was based in 1859 and has grown from a small utility to a big publicly traded utility at this time. The utility’s mission is to ship pure gasoline to its clients within the Pacific Northwest.

Supply: Investor Presentation

On Could 6, 2025, Northwest Pure Holding Firm reported its monetary outcomes for the primary quarter ended March 31, 2025. The corporate achieved web earnings of $87.9 million, or $2.18 per diluted share, in comparison with $63.8 million, or $1.69 per share, in the identical interval of the earlier 12 months.

Adjusted web earnings, which excludes $3.9 million in after-tax transaction prices associated to the SiEnergy acquisition, was $91.8 million, or $2.28 per share, surpassing analyst expectations of $2.01 per share. Whole working revenues elevated by 14% year-over-year to $494.3 million, pushed by robust efficiency throughout all enterprise segments.

The NWN Fuel Utility phase reported web earnings of $87.2 million, up from $65.7 million, primarily as a result of new charges in Oregon and elevated margins. SiEnergy, acquired in January 2025, contributed $5.5 million in web earnings and added roughly 73,000 meters, reflecting sturdy buyer development in Texas.

The NWN Water Utility phase posted web earnings of $1.7 million, reversing a lack of $0.7 million within the prior 12 months, aided by new charges in Arizona and the Puttman acquisition.

NW Pure Holdings reaffirmed its adjusted 2025 EPS steering of $2.75 to $2.95.

Click on right here to obtain our most up-to-date Positive Evaluation report on NWN (preview of web page 1 of three proven beneath):

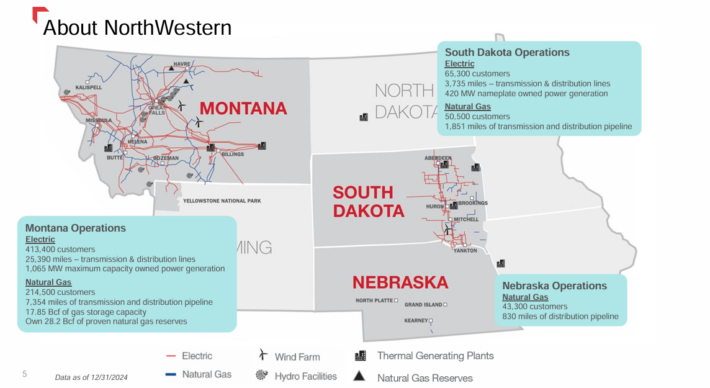

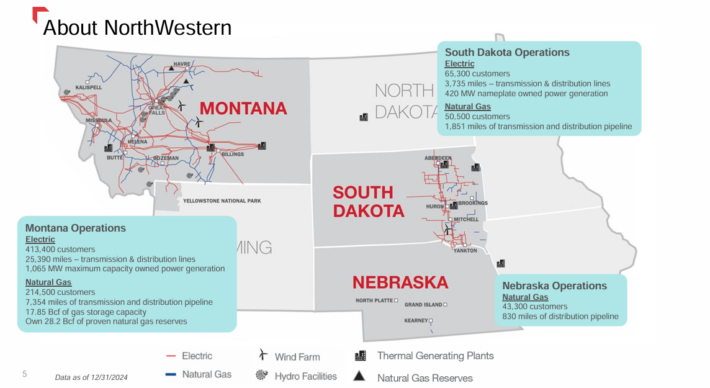

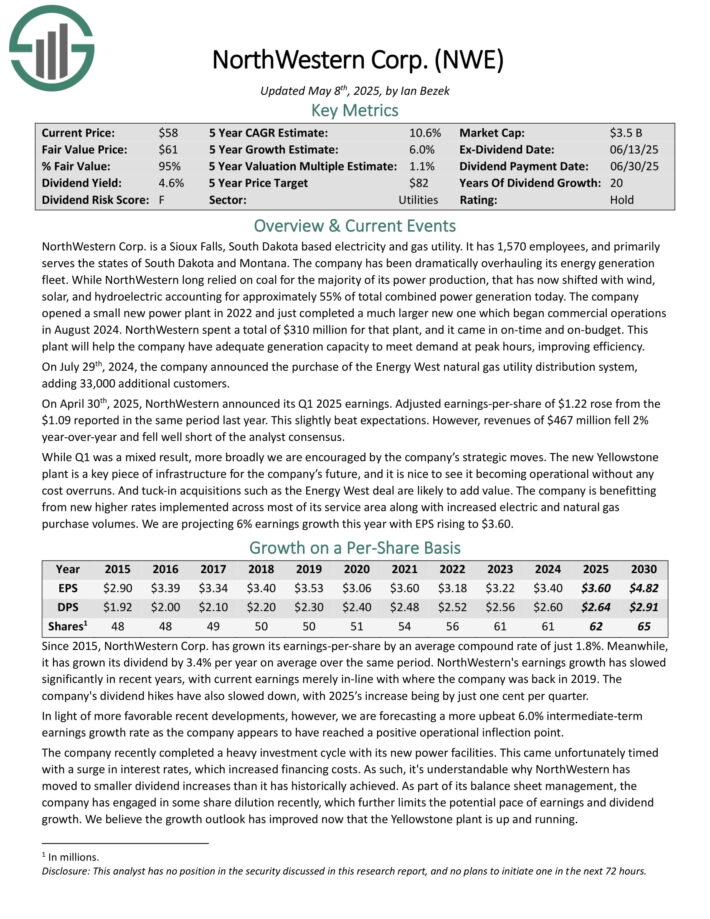

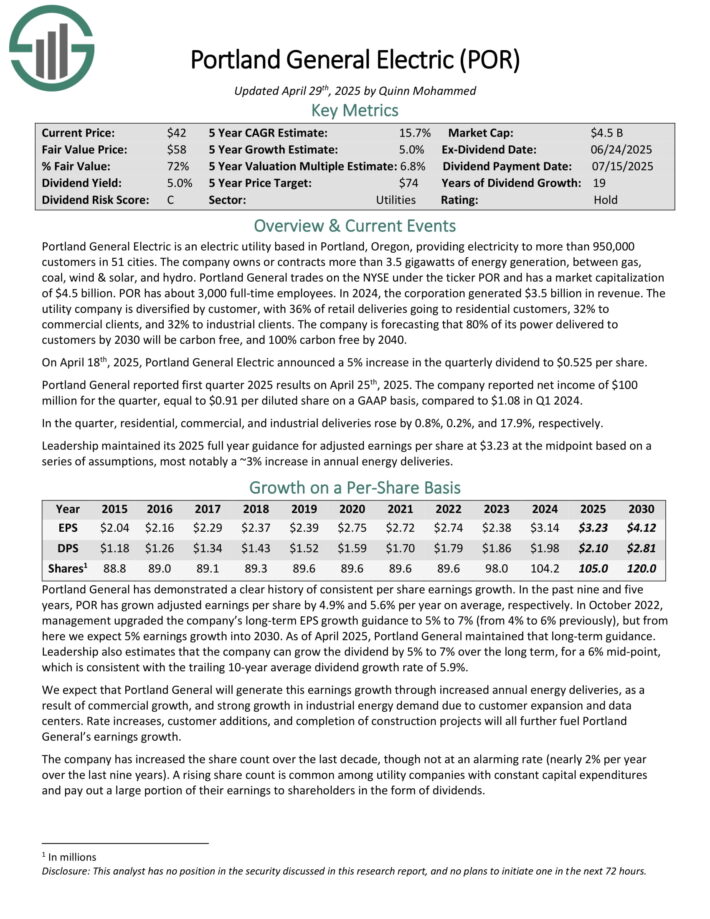

Highest-Yielding Utility Inventory #6: NorthWestern Vitality Group (NWE)

NorthWestern Corp. is a Sioux Falls, South Dakota based mostly electrical energy and gasoline utility. It has ~1,570 staff, and primarily serves the states of South Dakota and Montana.

The corporate has been dramatically overhauling its power era fleet. Whereas NorthWestern lengthy relied on coal for almost all of its energy manufacturing, that has now shifted with wind, photo voltaic, and hydroelectric accounting for roughly 55% of whole mixed energy era at this time.

Supply: Investor Presentation

On April thirtieth, 2025, NorthWestern introduced its Q1 2025 earnings. Adjusted earnings-per-share of $1.22 rose from the $1.09 reported in the identical interval final 12 months. This barely beat expectations. Nevertheless, revenues of $467 million fell 2% year-over-year and fell properly wanting the analyst consensus.

Whereas Q1 was a blended outcome, extra broadly we’re inspired by the corporate’s strategic strikes. The brand new Yellowstone plant is a key piece of infrastructure for the corporate’s future, and it’s good to see it changing into operational with none value overruns. And tuck-in acquisitions such because the Vitality West deal are probably so as to add worth.

NWE is benefiting from new increased charges carried out throughout most of its service space together with elevated electrical and pure gasoline buy volumes.

Click on right here to obtain our most up-to-date Positive Evaluation report on NWE (preview of web page 1 of three proven beneath):

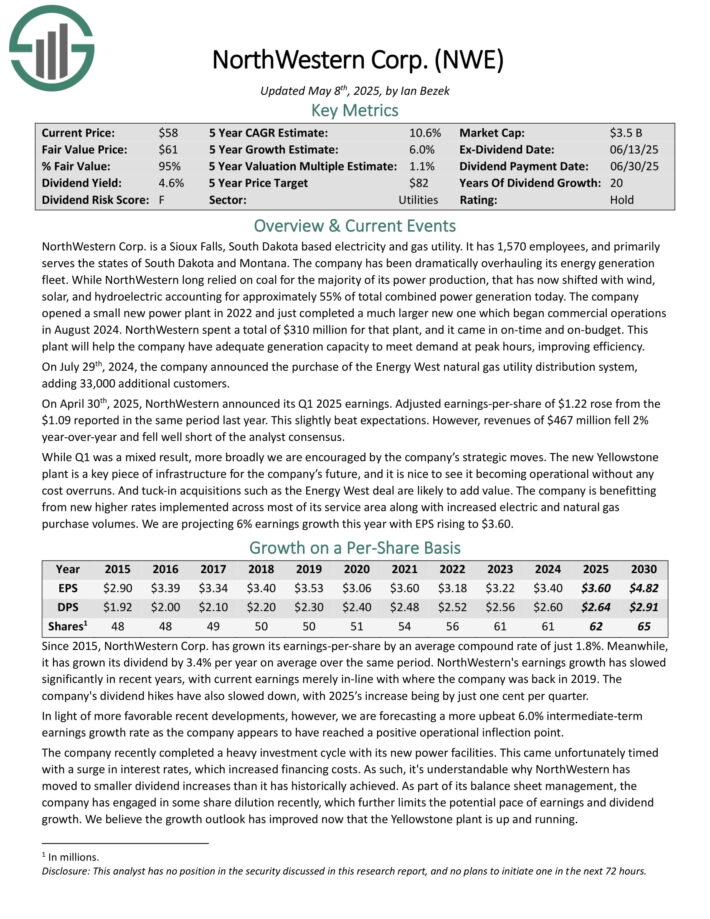

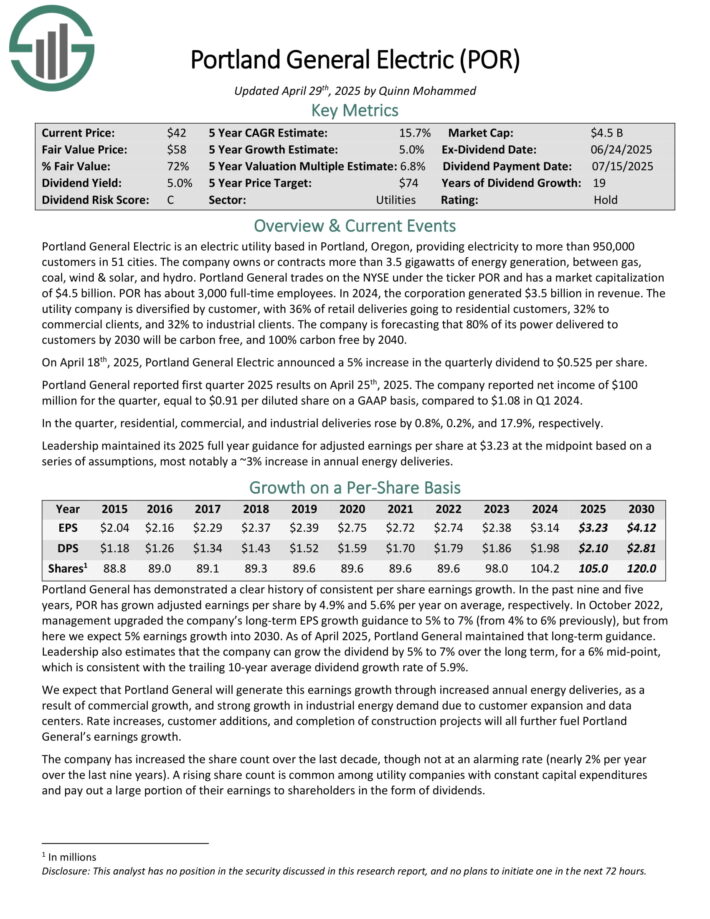

Highest-Yielding Utility Inventory #5: Portland Basic Electrical (POR)

Portland Basic Electrical is an electrical utility based mostly in Portland, Oregon, offering electrical energy to greater than 950,000 clients in 51 cities. The corporate owns or contracts greater than 3.5 gigawatts of power era, between gasoline, coal, wind & photo voltaic, and hydro.

In 2024, the company generated $3.5 billion in income. The utility firm is diversified by buyer, with 36% of retail deliveries going to residential clients, 32% to industrial shoppers, and 32% to industrial shoppers. The corporate is forecasting that 80% of its energy delivered to clients by 2030 can be carbon free, and 100% carbon free by 2040.

On April 18th, 2025, Portland Basic Electrical introduced a 5% improve within the quarterly dividend to $0.525 per share.

Portland Basic reported first quarter 2025 outcomes on April twenty fifth, 2025. The corporate reported web earnings of $100 million for the quarter, equal to $0.91 per diluted share on a GAAP foundation, in comparison with $1.08 in Q1 2024.

Within the quarter, residential, industrial, and industrial deliveries rose by 0.8%, 0.2%, and 17.9%, respectively. Management maintained its 2025 full 12 months steering for adjusted earnings per share at $3.23 on the midpoint.

Click on right here to obtain our most up-to-date Positive Evaluation report on POR (preview of web page 1 of three proven beneath):

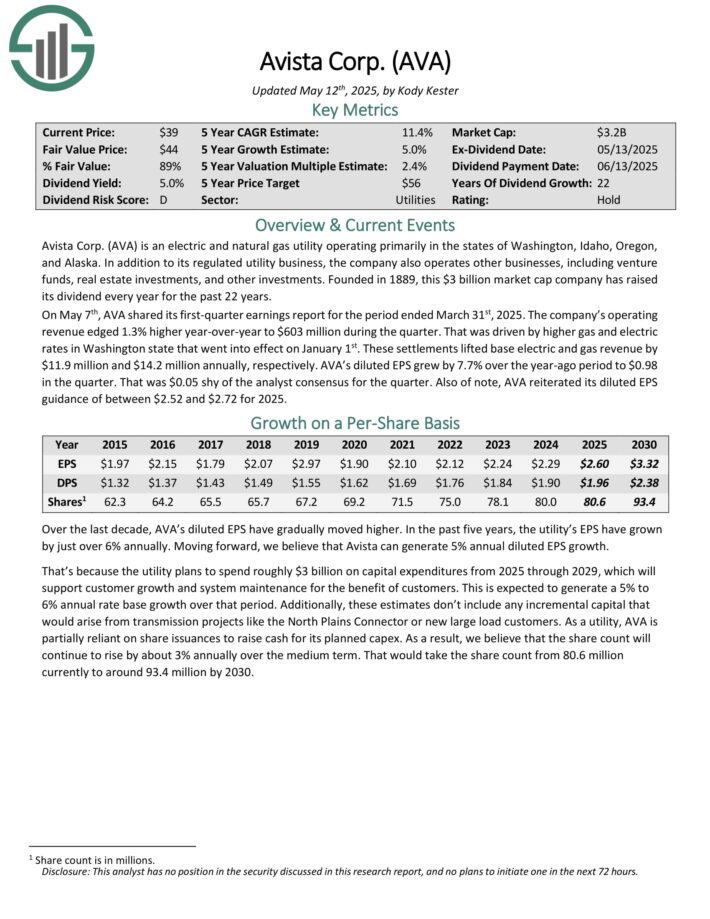

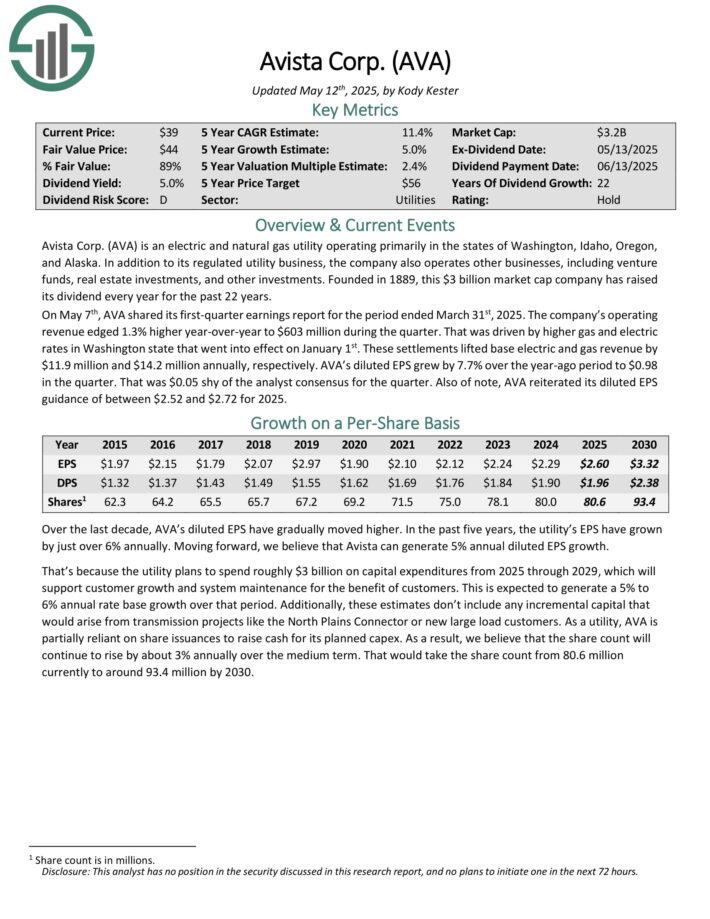

Highest-Yielding Utility Inventory #4: Avista Corp. (AVA)

Avista is an electrical and pure gasoline utility working primarily within the states of Washington, Idaho, Oregon, and Alaska. Along with its regulated utility enterprise, the corporate additionally operates different companies, together with enterprise funds, actual property investments, and different investments.

Based in 1889, the corporate has raised its dividend yearly for the previous 22 years.

On Could seventh, AVA shared its first-quarter earnings report for the interval ended March thirty first, 2025. The corporate’s working income edged 1.3% increased year-over-year to $603 million in the course of the quarter.

That was pushed by increased gasoline and electrical charges in Washington state that went into impact on January 1st. These settlements lifted base electrical and gasoline income by $11.9 million and $14.2 million yearly, respectively.

AVA’s diluted EPS grew by 7.7% over the year-ago interval to $0.98 within the quarter. That was $0.05 shy of the analyst consensus for the quarter. Additionally of notice, AVA reiterated its diluted EPS steering of between $2.52 and $2.72 for 2025.

It plans to spend roughly $3 billion on capital expenditures from 2025 via 2029, which is able to assist buyer development and system upkeep for the good thing about clients. That is anticipated to generate a 5% to six% annual charge base development over that interval.

Click on right here to obtain our most up-to-date Positive Evaluation report on AVA (preview of web page 1 of three proven beneath):

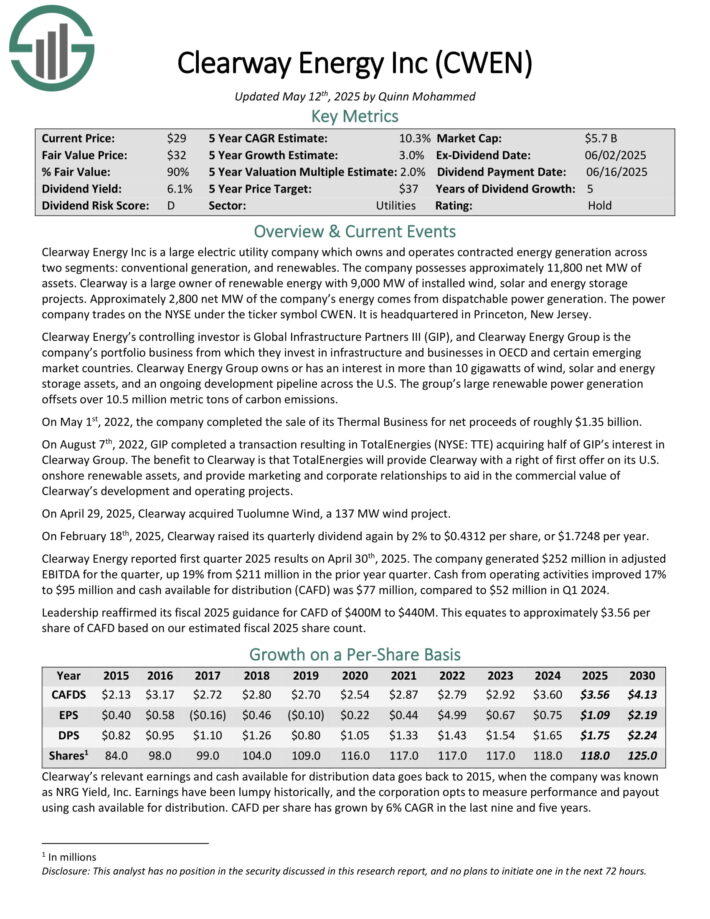

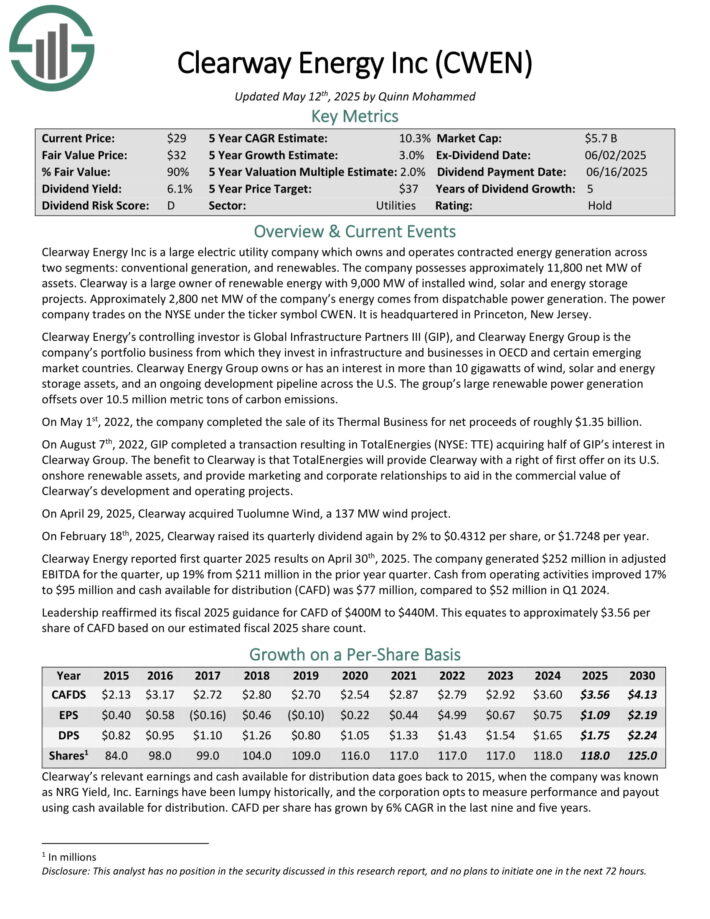

Highest-Yielding Utility Inventory #3: Clearway Vitality Inc. (CWEN)

Clearway Vitality Inc is a big electrical utility firm which owns and operates contracted power era throughout two segments: standard era, and renewables. The corporate possesses roughly 11,800 web MW of belongings.

Clearway is a big proprietor of renewable power with 9,000 MW of put in wind, photo voltaic and power storage tasks. Roughly 2,800 web MW of the corporate’s power comes from dispatchable energy era.

Clearway Vitality Group owns or has an curiosity in additional than 10 gigawatts of wind, photo voltaic and power storage belongings, and an ongoing growth pipeline throughout the U.S. The group’s giant renewable energy era offsets over 10.5 million metric tons of carbon emissions.

On February 18th, 2025, Clearway raised its quarterly dividend once more by 2% to $0.4312 per share, or $1.7248 per 12 months. Clearway Vitality reported first quarter 2025 outcomes on April thirtieth, 2025. The corporate generated $252 million in adjusted EBITDA for the quarter, up 19% from $211 million within the prior 12 months quarter.

Money from working actions improved 17% to $95 million and money out there for distribution (CAFD) was $77 million, in comparison with $52 million in Q1 2024.

Management reaffirmed its fiscal 2025 steering for CAFD of $400M to $440M. This equates to roughly $3.56 per share of CAFD based mostly on our estimated fiscal 2025 share rely.

Click on right here to obtain our most up-to-date Positive Evaluation report on CWEN (preview of web page 1 of three proven beneath):

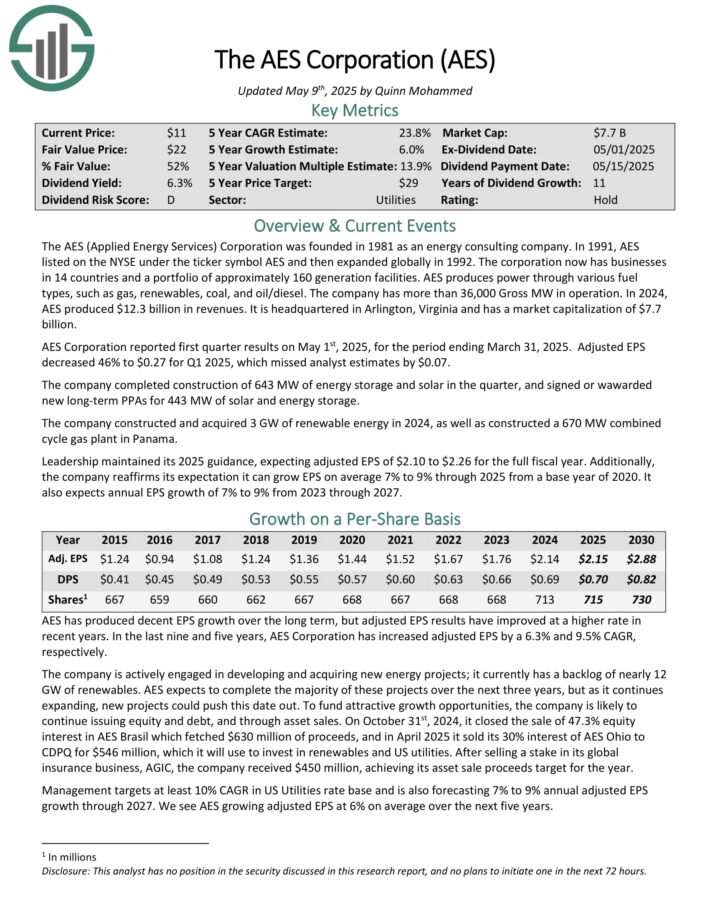

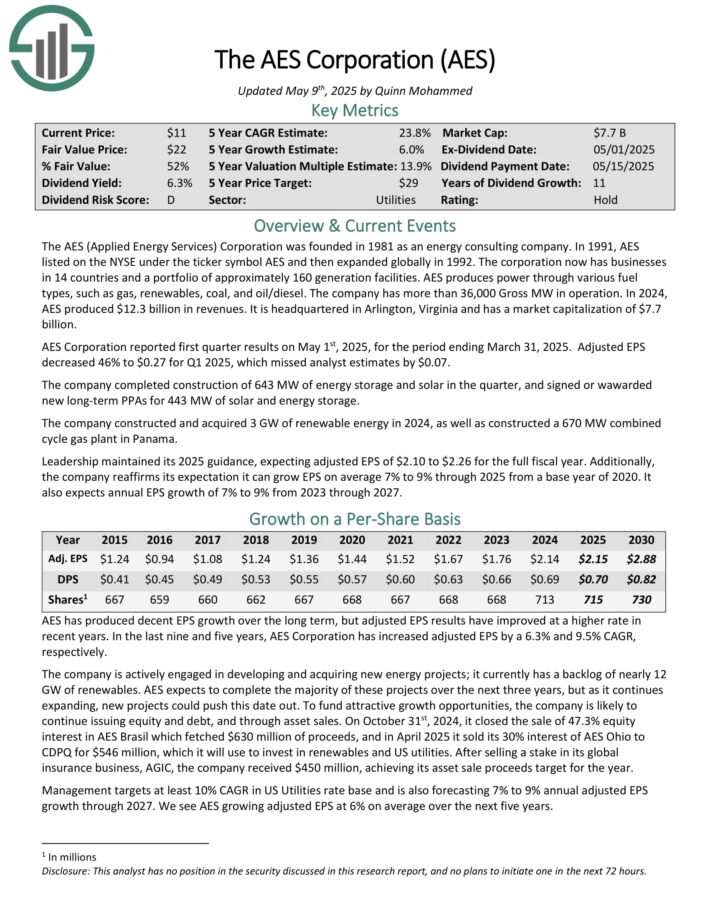

Highest-Yielding Utility Inventory #2: AES Corp. (AES)

The AES (Utilized Vitality Companies) Company has companies in 14 nations and a portfolio of roughly 160 era amenities. AES produces energy via numerous gasoline varieties, reminiscent of gasoline, renewables, coal, and oil/diesel.

The corporate has greater than 36,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Company reported first quarter outcomes on Could 1st, 2025, for the interval ending March 31, 2025. Adjusted EPS decreased 46% to $0.27 for Q1 2025, which missed analyst estimates by $0.07.

The corporate accomplished development of 643 MW of power storage and photo voltaic within the quarter, and signed or wawarded new long-term PPAs for 443 MW of photo voltaic and power storage.

The corporate constructed and bought 3 GW of renewable power in 2024, in addition to constructed a 670 MW mixed cycle gasoline plant in Panama. Management maintained its 2025 steering, anticipating adjusted EPS of $2.10 to $2.26 for the total fiscal 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on AES (preview of web page 1 of three proven beneath):

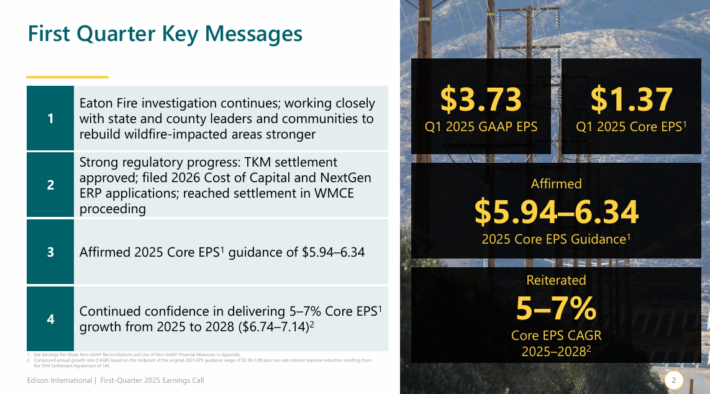

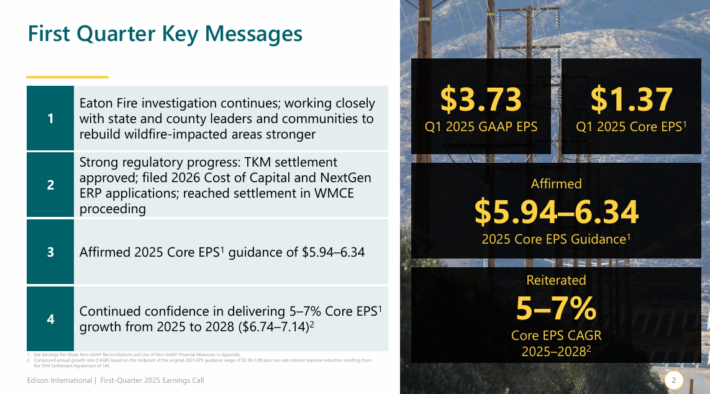

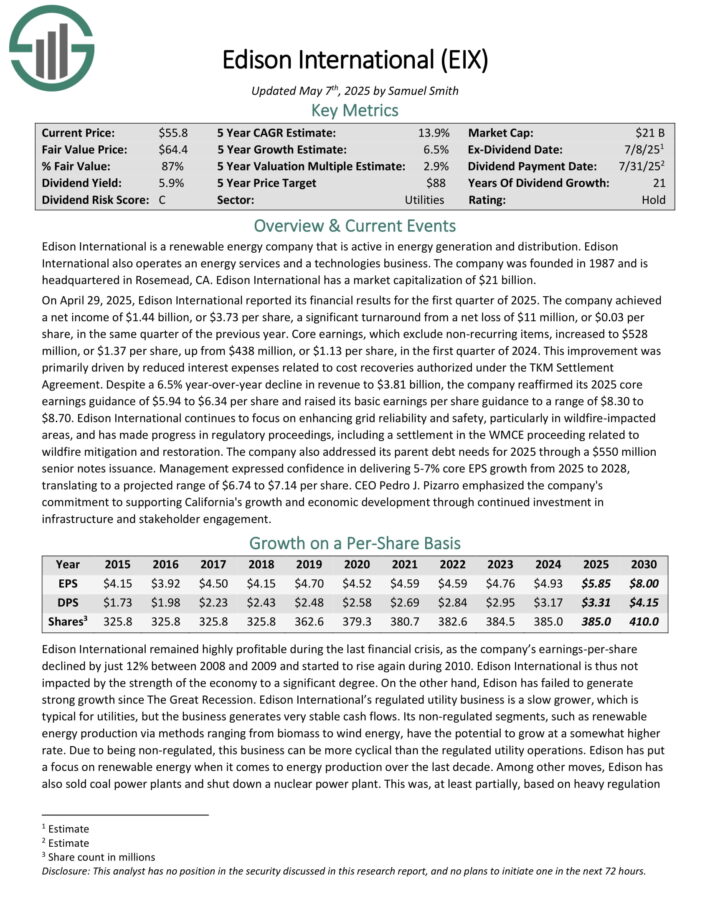

Highest-Yielding Utility Inventory #1: Edison Worldwide (EIX)

Edison Worldwide is a renewable power firm that’s lively in power era and distribution. Edison Worldwide additionally operates an power providers and a applied sciences enterprise. The corporate was based in 1987 and is headquartered in Rosemead, CA.

On April 29, 2025, Edison Worldwide reported its monetary outcomes for the primary quarter of 2025. The corporate achieved a web earnings of $1.44 billion, or $3.73 per share, a major turnaround from a web lack of $11 million, or $0.03 per share, in the identical quarter of the earlier 12 months.

Supply: Investor Presentation

Core earnings, which exclude non-recurring objects, elevated to $528 million, or $1.37 per share, up from $438 million, or $1.13 per share, within the first quarter of 2024.

This enchancment was primarily pushed by lowered curiosity bills associated to value recoveries licensed beneath the TKM Settlement Settlement. Regardless of a 6.5% year-over-year decline in income to $3.81 billion, the corporate reaffirmed its 2025 core earnings steering of $5.94 to $6.34 per share.

Click on right here to obtain our most up-to-date Positive Evaluation report on EIX (preview of web page 1 of three proven beneath):

Ultimate Ideas

If you’re fascinated about discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Positive Dividend sources can be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].