chaofann

Co-produced by Austin Rogers

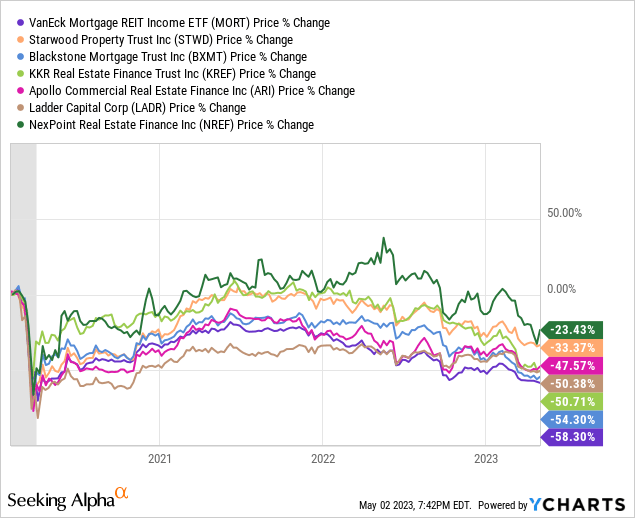

Business mortgage REITs, or REITs whose major belongings are loans secured by industrial actual property properties, have been completely crushed over the past yr. Frankly, they have not had fun over the past three years:

YCHARTS

On a worth foundation alone, the index (MORT), which incorporates residential mREITs, is down over 50%, whereas a number of industrial mREITs are likewise down over 50% from their pre-COVID ranges.

A point of selloff is warranted, as a result of the essential enterprise mannequin of mREITs is to borrow at a less expensive charge than they lend. They aren’t depositary establishments or banks that take deposits and pay very low rates of interest on these deposits. They should use debt, and the lenders on the opposite facet of their debt count on a excessive sufficient rate of interest to generate a return.

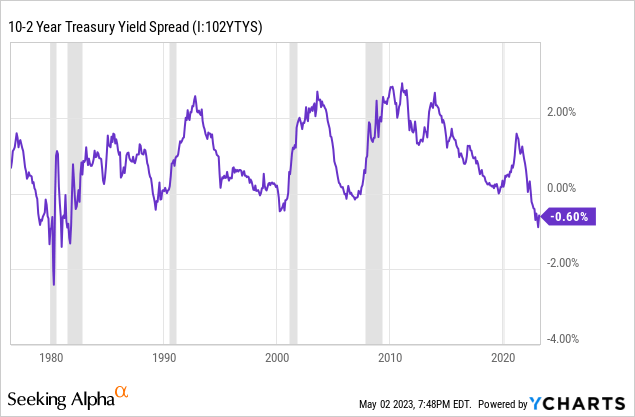

Proper now’s a very troublesome setting to make this mannequin work, as a result of mREITs typically lend long-term and borrow short-term, however the yield curve is deeply inverted, and short-term rates of interest are larger than long-term rates of interest!

YCHARTS

Furthermore, industrial mREITs are promoting off as traders worry the implications of the chaos taking part in out in workplace actual property proper now. Workplace landlords are defaulting left and proper and easily handing the keys again to the lender, who then has to promote the property at what might be a reduction to the worth they assumed once they prolonged the mortgage.

So, for industrial mortgage REITs with workplace publicity, the worry is that:

- Debtors will not have the revenue to maintain servicing their debt, and thus the mREIT’s distributable EPS will take successful, doubtlessly necessitating a dividend minimize.

- The mREIT must take possession of sure actual property that has misplaced vital worth from its underwriting assumptions, or else be compelled to just accept a exercise by which it takes a loss or a decrease yield.

That stated, the diploma to which mREITs have bought off could also be overdone.

Might there be worth amid the rubble?

To seek out out, we check out six key industrial mREITs to see if we are able to discover enticing worth and comparatively protected dividend yields.

Evaluating 6 Business mREITs

If you would like to look by the latest investor shows for every firm, right here they’re:

To be clear, these six mortgage REITs usually are not cookie-cutter copies of one another. There are distinctive elements to every of them.

STWD additionally engages in infrastructure lending, and about 9% of its mortgage portfolio is in infrastructure (primarily midstream vitality and renewable pure gasoline) loans.

BXMT has the advantage of being managed by Blackstone (BX), the most important actual estate-focused non-public fairness / different asset administration agency on the planet.

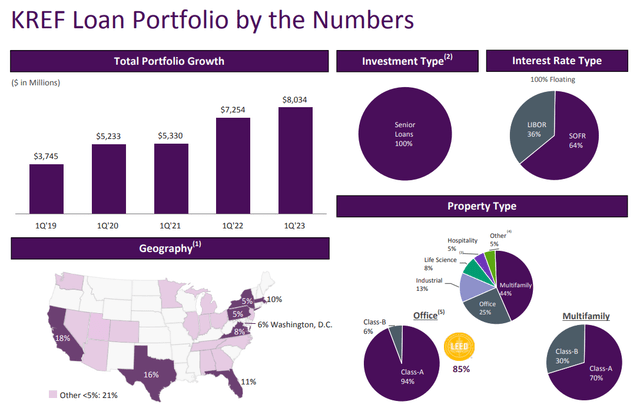

KREF is managed by KKR & Co. (KKR), one other main different asset supervisor, and it is helpful to notice that 94% of KREF’s workplace loans are backed by Class A workplace buildings.

ARI is managed by Apollo World Administration (APO), one other different asset supervisor, has a large publicity to European actual property (together with much less dangerous European workplace properties), and the loan-to-value ratio for its workplace portfolio sits at a remarkably low 50% as of Q1 2023.

LADR is internally managed (uncommon within the mREIT area) with over 10% insider possession, and the corporate additionally has a ~$700 million portfolio of straight owned CRE, most of which is internet lease.

Lastly, NREF is managed by NexPoint Advisors and boasts a extremely defensive portfolio of multifamily and single-family residential loans backed by properties positioned overwhelmingly in Sunbelt states like Georgia, Florida, and Texas.

There are myriad different small variations between these six firms, however what all have in widespread is that their major belongings are loans secured by industrial actual property. They earn a revenue by issuing fairness and (largely) debt and investing in belongings at a ramification over their price of capital.

Actual Property Sector Publicity

For the core mortgage portfolios, listed here are the actual property sector exposures of every mREIT:

| SECTOR EXPOSURE | Residential | Workplace | Retail | Industrial | Resort |

| Starwood Property (STWD) | 33% | 23% | 2% | 6% | 16% |

| Blackstone Mortgage (BXMT) | 27% | 34% | 4% | 9% | 19% |

| KKR RE Finance (KREF) | 44% | 25% | 0% | 13% | 5% |

| Apollo CRE Finance (ARI) | 19% | 18% | 16% | 3% | 23% |

| Ladder Capital (LADR) | 37% | 24% | 6% | 7% | 4% |

| NexPoint RE Finance (NREF) | 95% | 0% |

0% |

0% | 0% |

As beforehand acknowledged, NREF’s loans are about 95% multifamily and single-family, with the remaining in life science and self-storage.

Of the remaining, BXMT has the very best publicity to workplace area at a little bit over 1/third of the mortgage portfolio. Amongst that workplace publicity, 36% is positioned outdoors the US (Europe and Australia). Additionally, 25% of its US workplace publicity is backed by workplace buildings within the Sunbelt, which typically has larger workplace utilization.

STWD has the aforementioned ~10% of its mortgage portfolio in infrastructure belongings, however of the CRE loans, just below 1/4th is in workplace, and about 1/third is in residential property loans.

KREF’s portfolio, apparently, includes a 57% focus in residential and industrial property loans, which seems defensive within the present setting. In the meantime, one quarter of its portfolio is in workplace, however as beforehand acknowledged, 94% of that workplace portfolio is backed by Class A buildings.

What’s putting about ARI’s mortgage portfolio is its diversification throughout its 4 important sectors of hospitality, residential, workplace, and retail.

With regards to the kind of loans every mREIT makes, it must be unsurprising to seek out putting similarities between the six:

| PORTFOLIO METRICS | % Floating Price | % Senior Secured |

| STWD | 99% | 92% |

| BXMT | 100% | 100% |

| KREF | 100% | 100% |

| ARI | 99% | 93% |

| LADR | 88% | 99% |

| NREF | N/A | 41% |

Of observe right here, NREF doesn’t report the floating charge share of its portfolio, however we are able to surmise that it’s round 50% or larger. In the meantime, its share of senior secured debt (the very best precedence within the capital stack and thus technically the most secure) is the bottom at 41%. Different types of funding are CMBS, mezzanine, and most well-liked fairness.

Steadiness Sheet Energy

Turning to some debt metrics (for each the funding loans and the mREITs’ personal steadiness sheets):

| DEBT METRICS | Portfolio LTV | Debt-To-Fairness |

| STWD | 60% | 3.8x |

| BXMT | 64% | 4.5x |

| KREF | 66% | 4.2x |

| ARI | 58% | 3.0x |

| LADR | 68% | 2.7x |

| NREF | 69% | 2.7x |

The “portfolio LTV” is the loan-to-value of every mREIT’s respective mortgage portfolio. ARI has the bottom portfolio LTV at 58%, whereas NREF has the very best at 69%.

In the meantime, utilizing a easy debt-to-equity measurement (taking complete debt on the 10-Q and dividing it by the shareholder fairness on the 10-Q), we discover that BXMT is highest levered mREIT within the listing, whereas LADR and NREF are tied for the bottom.

I’d caveat this, nonetheless, by noting that NREF has a excessive quantity of “bonds payable” on its steadiness sheet. If these are added again into the whole debt combine, NREF’s debt-to-equity to surge to 20x.

So, we are able to summarily state that LADR has the bottom debt-to-equity on this listing, maybe on account of administration’s conservatism.

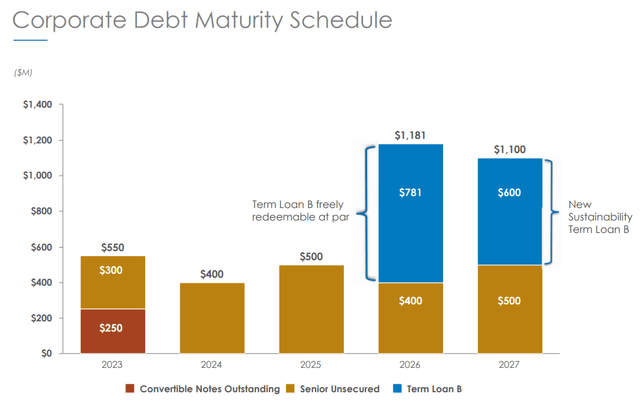

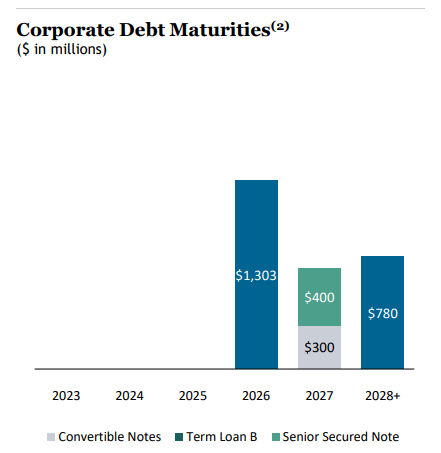

However this is just one means to take a look at mREITs’ steadiness sheet energy. One other means is by analyzing the debt maturity schedule. Proper now, lenders are probably lower than passionate about extending credit score to mREITs with workplace publicity, so having fewer debt maturities within the close to future can be a energy.

Let’s check out every mREIT’s debt maturity schedule one after the other:

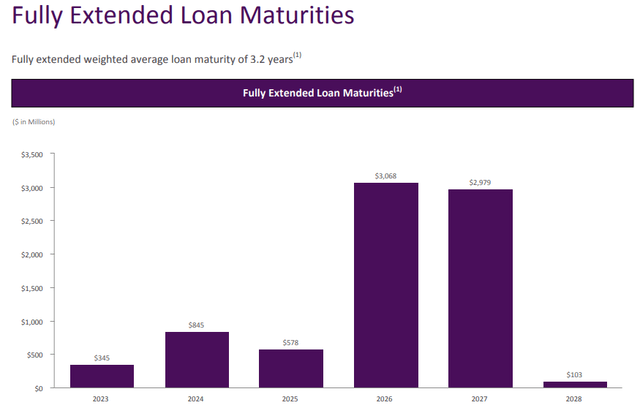

Starwood Property Belief:

Starwood Property Belief

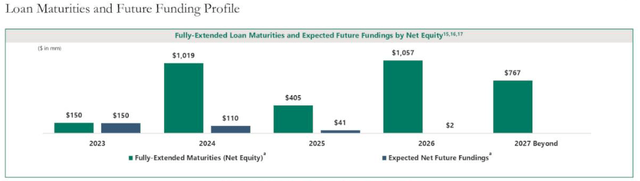

Blackstone Mortgage Belief:

Blackstone Mortgage Belief

KKR RE Finance:

KKR RE Finance

Apollo CRE Finance:

Apollo CRE Finance

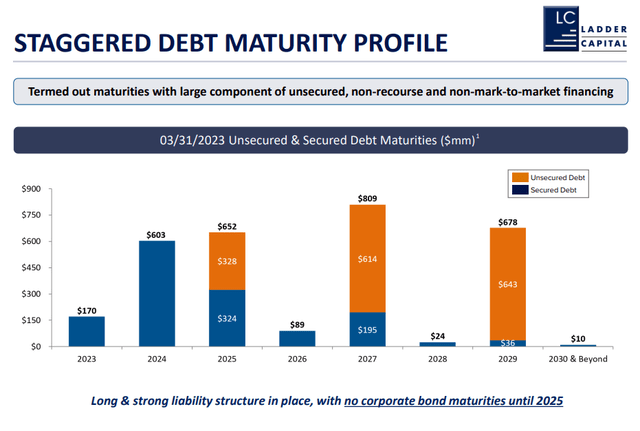

Ladder Capital:

Ladder Capital

NREF doesn’t embrace a slide just like the above exhibiting its debt maturity schedule, however its 10-Q reveals a weighted common debt time period to maturity of 5.1 years and no debt maturing in 2023 or 2024, making its debt maturity schedule look fairly robust.

The strongest debt maturity on this listing, although, must be BXMT, which has no maturities till 2026.

The second strongest can be NREF, and the third strongest would in all probability be KREF, as a manageable quantity of debt matures annually till the subsequent massive hurdle of 2026.

Dividend Protection

What concerning the security of the dividend? All six have double-digit dividend yields, however how a lot protection do these dividends have from distributable earnings?

| DIVIDEND METRICS | Protection | Yield |

| STWD | 104% | 11.2% |

| BXMT | 127% | 14.1% |

| KREF | 112% | 16.5% |

| ARI | 146% | 14.6% |

| LADR | 165% | 10.1% |

| NREF | 110% | 13.9% |

Of this listing, we are able to see that LADR provides the very best dividend protection at 165%, whereas STWD has the bottom protection at a mere 104%.

Administration groups are nonetheless projecting confidence in quarterly convention calls concerning the sustainability of their dividends, however for such extremely leveraged autos as mREITs, the potential of a handful of dangerous loans necessitating a dividend minimize can by no means be discounted.

That is very true amid the fallout of workplace actual property, a few of which is struggling large declines in market worth as loans come due and pressure fireplace gross sales.

We expect that the risk-to-reward is comparatively enticing for all of those mREITs assuming that you’ve got a protracted funding horizon and a excessive threat tolerance.

However right here is our favourite possibility of all:

Our Favourite Possibility: KREF’s Most well-liked Inventory

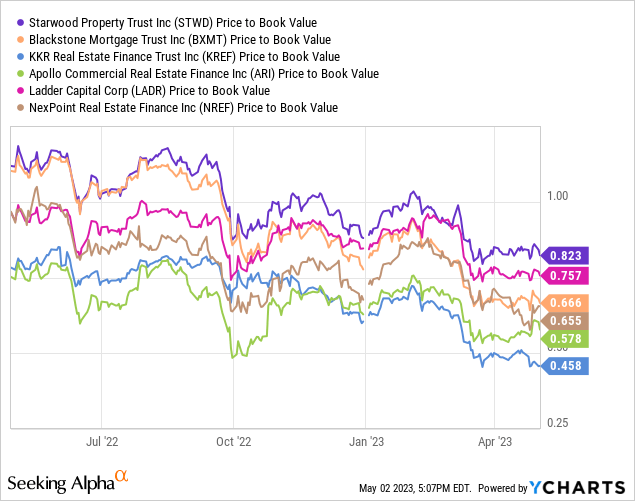

Whereas the six mREITs talked about above do look enticing primarily based on their worth to guide values (all buying and selling below 1x)…

YCHARTS

…we’d urge warning round these names due to the danger simply talked about. If you function with this a lot leverage (85%+ debt to belongings) and this excessive of dividend payout ratios (80-95%), it solely takes a number of dangerous apples to trigger your distributable earnings to sink nicely beneath your dividend, necessitating a minimize.

However there may be an alternate that we discover extra enticing than any of those mREIT widespread shares, and that’s the KKR Actual Property Finance Belief 6.5% Sequence A Most well-liked Inventory (KREF.PA).

The pref inventory has bought off together with the widespread shares of economic mortgage REITs although its dividend is considerably safer than these of the widespread shares.

As of this writing, KREF.PA trades at a dividend yield of proper at 9-10%. Listed here are some primary particulars about KREF.PA:

| Name Date | April 2026 (No required maturity date) |

| Complete Capitalization | $326 Million |

| Pref Capitalization To KREF Complete Capitalization | 4.5% |

| Annual Most well-liked Dividends | $21.2 Million |

| Quarterly Most well-liked Dividends | $5.3 Million |

| KREF Q1 2023 Distributable Earnings | $33.1 Million |

| KREF Q1 2023 Distributable Earnings Earlier than Pref Dividends | $38.4 Million |

| Q1 2023 Most well-liked Dividend Protection | 725% |

| Q1 2023 Most well-liked Dividend Payout Ratio | 13.8% |

Furthermore, understand that KREF.PA’s dividend is cumulative, which signifies that the total quarterly quantity is required to be paid up by its eventual redemption. If any dividends go unpaid, they accrue and should ultimately be paid to most well-liked shareholders. Additionally, KREF can’t pay a standard dividend till and until KREF.PA’s cumulative dividends have been paid in full.

Issues must go actually fallacious for KREF.PA’s dividends to be completely in peril.

Likewise, take into account the standard of KREF’s 100% senior secured, 100% floating charge mortgage portfolio:

KKR Actual Property Finance Belief

Sure, 25% of loans are backed by workplace buildings, however understand that 94% of these workplace buildings are Class A. Though all workplace buildings are affected by detrimental sentiment and occupancy declines proper now, there is a robust case to be made that Class A places of work will survive the present disaster as tenants make a “flight to high quality” within the years to come back.

What’s extra, the rest of KREF’s mortgage portfolio in multifamily, industrial, life science, and inns appears to be like well-positioned. These property varieties are typically not struggling a lot, if in any respect, proper now. Most of them proceed to thrive with rising rents and increasing debt service protection ratios.

For that reason, we’re right this moment initiating a small place for Retirement Portfolio with the acquisition of 200 shares.

We consider that the risk-to-reward is compelling with the shares buying and selling at a 35% low cost to par and providing a ten% dividend yield. Alternatively,

Backside Line

Whereas industrial mREITs look low cost on a price-to-book worth foundation, it’s troublesome to evaluate the harm they might incur from the fallout of the workplace actual property disaster ongoing proper now. Occupancies are dropping, and the market values of workplace properties are dropping as nicely. This might translate into massive losses for the mREITs who’ve prolonged loans to workplace landlords.

However with KREF.PA, you get a ~10% yield that’s far safer than the dividend yields of any mREIT widespread inventory. Plus, it’s backed by a powerful portfolio of CRE loans managed by one of many prime different asset administration companies on the planet.