Revealed by Josh Arnold on November tenth, 2022

Inventory markets, and certainly any monetary markets, undergo durations of rotation. That is the place cash flows from one sector or asset class to a different, as establishments imagine one space will begin to outperform one other. We see this when recessions strike, as an example, when cash flows to shopper staples shares and away from know-how.

There are various examples like this, and a technique that we will reap the benefits of these cycles as buyers is to purchase names which might be out of favor. Which means their valuations shall be decrease than truthful worth; over time, that undervaluation can flip into outsized returns for buyers.

There are various blue chip shares buying and selling for affordable valuations. You’ll be able to obtain the whole listing of all 350+ blue-chip shares (plus necessary monetary metrics equivalent to dividend yield, P/E ratios, and payout ratios) by clicking under:

We worth shares by inspecting their historic valuations over a interval of years and figuring out if the components that drove that historic valuation have modified. As an illustration, if a inventory was valued fairly extremely on account of exemplary development, however that development profile has deteriorated, we might probably assign a decrease truthful worth than historic. The other is true, after all, however the level is that historical past is our information.

As well as, we are likely to err on the facet of warning relating to assigning truthful worth, that means that once we see a inventory that’s undervalued based on our mannequin, it tends to be fairly undervalued. This will increase the chances of success and reduces the probabilities of being unsuitable. Shopping for overvalued shares, in contrast, means the chances of a draw-down are a lot larger, lowering potential complete returns.

With this in thoughts, we’ll check out 10 shares under that display nicely for these standards. Their names, we predict, are out of favor as we speak and, subsequently, undervalued and provide nice complete return potential to patrons.

Qualcomm, Inc. (QCOM)

Our first inventory is Qualcomm, a know-how firm that designs and manufactures know-how options, primarily for the cell phone {industry}. Qualcomm has pursuits in 5G wi-fi service, synthetic intelligence, automotive chip and software program manufacturing, and quite a lot of associated mental properties.

The corporate was based in 1985, generates about $40 billion in annual income, and trades as we speak with a market cap of $123 billion.

Supply: Investor presentation

The corporate simply completed up its fiscal 2022, and as we will see above, development was excellent. We predict that is indicative of Qualcomm’s valuation being far too low as we speak.

We see Qualcomm buying and selling at simply 56% of truthful worth as we speak, given it’s valued at nearly 9 instances earnings for this yr. Semiconductor shares, and know-how shares usually, have been out of favor for all of 2022, and Qualcomm’s valuation has declined enormously.

The excellent news is that it might drive a 12%+ tailwind to complete annual returns from the valuation, as we see the case for reflation as fairly sturdy.

The inventory additionally yields 2.7% and has raised its payout for a formidable 20 consecutive years. Lastly, we see 7% annual earnings-per-share development as Qualcomm’s industry-leading place stays intact. All informed, we anticipate Qualcomm’s very low valuation to assist energy complete annual returns of practically 22% going ahead.

Click on right here to obtain our most up-to-date Certain Evaluation report on Qualcomm (preview of web page 1 of three proven under):

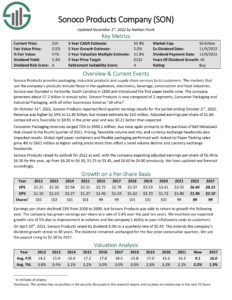

Sonoco Merchandise Co. (SON)

Our subsequent inventory is Sonoco, a maker of shopper packaging merchandise globally. The corporate makes a big selection of paper, textile, meals, chemical, cable, and packaging merchandise.

Sonoco was based in 1899, produces about $7.3 billion in annual income, and trades with a market cap of $5.7 billion.

Sonoco trades for 9 instances earnings, which we assess at simply 56% of truthful worth. Like Qualcomm, we see this as driving the potential for 12%+ annual returns to shareholders because the valuation reflates over time.

The inventory additionally sports activities a dividend that’s double that of the S&P 500 at 3.4%. Not solely that, however Sonoco has a 40-year streak of dividend will increase, placing it in a uncommon firm on that measure as nicely.

We see development at 5% yearly, so we imagine the inventory can produce ~20% complete returns within the years to return from its enticing mix of valuation, yield, and development.

Click on right here to obtain our most up-to-date Certain Evaluation report on Sonoco Merchandise Co. (preview of web page 1 of three proven under):

Williams-Sonoma, Inc. (WSM)

Our subsequent inventory is Williams-Sonoma, the upscale residence items retailer that owns manufacturers equivalent to Williams-Sonoma, Pottery Barn, West Elm, Mark and Graham, and extra. It operates greater than 500 shops, was based in 1956, and generates about $8.8 billion in annual income. The inventory has had a tough 2022, and has a present market cap of $8.2 billion.

The inventory trades at simply over 8 instances earnings, which we imagine is about 40% undervalued. That might drive a tailwind of ~11% to complete returns within the years to return.

The yield can be as much as 2.6%, which is nicely forward of the inventory’s historic yields, owed to the low valuation. The corporate has a 16-year streak of annual dividend will increase, which is kind of good for a cyclical retailer.

We see 4% development forward for Williams-Sonoma, so once we add this to the valuation tailwind and yield, we imagine shareholders can see 17% complete annual returns within the years to return.

Click on right here to obtain our most up-to-date Certain Evaluation report on Williams-Sonoma, Inc. (preview of web page 1 of three proven under):

V.F. Corp. (VFC)

Subsequent up is V.F. Company, a worldwide designer, producer, and distributor of varied attire, footwear, and accent manufacturers for males, ladies, and kids. The corporate owns profitable manufacturers equivalent to Vans, Supreme, Timberland, and the North Face, amongst others.

V.F. was based in 1899, generates $11.7 billion in annual gross sales, and trades with a market cap of $11 billion.

Shares commerce for about 12 instances earnings, which we imagine is sort of 40% undervalued. That has the potential to drive a tailwind of 10% within the years forward.

V.F. isn’t solely undervalued, however is an impressive dividend inventory. The corporate is a Dividend King, that means it has raised its payout for 50 consecutive years. It additionally yields a staggering 7.1% as we speak. When mixed with 7% anticipated development, we predict V.F. patrons as we speak have the potential to earn 21%+ complete annual returns within the years to return.

Click on right here to obtain our most up-to-date Certain Evaluation report on V.F. Corp. (preview of web page 1 of three proven under):

Hanesbrands Inc (HBI)

Hanesbrands is our subsequent inventory, one other shopper items firm that designs, manufactures, and distributes a spread of low-cost attire for males, ladies, and kids. Hanesbrands sells necessities which might be accessible for each funds, so it thrives on excessive volumes.

Hanesbrands was based in 1901, generates about $6.4 billion in annual income, and trades with a market cap of $2.5 billion.

Shares commerce for lower than six instances this yr’s earnings estimate, that means we predict it’s not less than 40% undervalued as we speak. That provides the potential for a tailwind of greater than 11% yearly within the years to return.

Hanesbrands doesn’t have a dividend improve streak, but it surely does have an enormous present yield of 8.5%. That places the inventory in extraordinarily uncommon firm on a pure earnings foundation.

We see 8% development yearly from a low base of earnings for this yr, so in complete, we predict patrons of the inventory as we speak might take pleasure in complete returns of 24% yearly within the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Hanesbrands Inc. (preview of web page 1 of three proven under):

Equitable Holdings Inc (EQH)

Our subsequent inventory is Equitable Holdings, a worldwide monetary companies firm. The corporate affords retirement merchandise and funding and insurance coverage companies, primarily. Equitable was based in 1859, generates practically $14 billion in annual income, and trades with a market cap of $11.3 billion.

Equitable trades for an nearly unbelievable 4.6 instances this yr’s earnings, which is half of our projected truthful worth a number of. That suggests 14%+ yearly from the valuation reflating simply to get again to historic ranges.

The corporate’s dividend development streak is simply 4 years, but it surely has a good 2.7% present yield. As well as, the inventory has solely traded by itself since 2018, so it has successfully raised its dividend yearly as a publicly-traded firm.

We predict the corporate can ship 6% annual development, so combining all of those components means we forecast complete annual returns of practically 23% within the years to return.

Click on right here to obtain our most up-to-date Certain Evaluation report on Equitable Holdings Inc. (preview of web page 1 of three proven under):

Lincoln Nationwide Corp. (LNC)

Our subsequent inventory is Lincoln Nationwide, an insurance coverage and retirement merchandise enterprise within the US. The corporate affords all kinds of ordinary retirement and insurance coverage strains to shoppers, establishments, governments, and the like.

Lincoln was based in 1905, produces $18.5 billion in yearly income, and trades with a market cap of $5.6 billion.

Lincoln has one of many lowest valuations in our total protection universe of greater than 800 shares at 4.1 instances this yr’s earnings. Which means the inventory is undervalued by half towards our pretty conservative estimate of truthful worth. That might end in a tailwind of 14.5% ought to the valuation transfer in direction of truthful worth over time.

That has additionally pushed the yield as much as 5.2% as we speak, which is greater than triple that of the S&P 500. We see a development of three% shifting ahead.

Combining these components provides us estimates of greater than 21% of complete annual returns within the years to return, primarily from the valuation.

Click on right here to obtain our most up-to-date Certain Evaluation report on Lincoln Nationwide Corp. (preview of web page 1 of three proven under):

Open Textual content Corp (OTEX)

Subsequent up is Open Textual content, a know-how firm that designs, develops, and markets info administration software program and options. The corporate has quite a lot of API, analytics, and cyber merchandise, amongst others.

Open Textual content was based in 1991, produces about $3.6 billion in annual income, and trades with a market cap of $7.3 billion.

The inventory is buying and selling for simply over 8 instances earnings as we speak, which is a reduction of greater than 40% to truthful worth. That might drive a tailwind of 11% yearly within the years to return, ought to the inventory reflate to its truthful worth.

Open Textual content can be distinctive within the know-how area in that it sports activities a 3.6% dividend yield. That’s nicely forward of double the S&P 500’s common yield, and it has 9 consecutive years of dividend will increase.

Supply: Investor presentation

We anticipate 8% annual earnings-per-share development over the medium time period, which might be considerably conservative in comparison with this steering for the corporate’s 2023 development. Nonetheless, 8% would add properly to complete returns within the coming 5 years.

Altogether, we see 22%+ complete annual returns for Open Textual content, derived from 8% earnings development, the three.6% yield, and a double-digit tailwind from the low valuation.

Click on right here to obtain our most up-to-date Certain Evaluation report on Open Textual content Corp. (preview of web page 1 of three proven under):

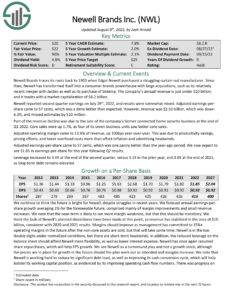

Newell Manufacturers Inc (NWL)

Subsequent to final is Newell Manufacturers, a shopper items firm that designs, manufactures, and distributes an enormous number of kitchen, residence items, cleansing merchandise, group techniques, and extra. It owns manufacturers equivalent to Rubbermaid, Mr. Espresso, Calphalon, Yankee Candle, and different well-known manufacturers.

The corporate was based in 1903, produces $9.4 billion in annual income, and has a present market cap of $5.4 billion.

Newell trades for 7 instances this yr’s earnings, a 40%+ low cost to the place we assess truthful worth. Which means the potential for a tailwind of 11%+ from a reflation of the valuation within the years to return.

As well as, Newell has an incredible yield that’s higher than 7%, placing it in a really uncommon firm on a pure earnings foundation, even towards REITs and different conventional sources of earnings.

Supply: Investor presentation

We see development potential as modest at simply 2% yearly, and we will see why above with Q3 and year-to-date outcomes. The corporate is struggling to develop gross sales however has been at work on margin enchancment efforts for a number of quarters whereas repurchasing inventory. We predict the mixture of those will drive low ranges of development going ahead.

Even so, complete annual returns might attain practically 18% within the years to return when contemplating the 11% valuation tailwind and seven% yield.

Click on right here to obtain our most up-to-date Certain Evaluation report on Newell Manufacturers Inc. (preview of web page 1 of three proven under):

Clipper Realty Inc (CLPR)

Our last inventory is Clipper Realty, a self-administered actual property funding belief, or REIT, that operates in New York Metropolis. The place most REITs try diversification, Clipper’s technique is anti-diversification, specializing in one single market.

The REIT was based in 2015, produces about $130 million in annual income, and trades with a market cap of $288 million.

Clipper trades for 13.5 instances FFO, which is an earnings equal for the REIT sector. That additionally means it’s about 45% undervalued, in our view, with the potential for a 13% tailwind to complete returns because of this.

The yield is kind of good at 5.9%, though some shares on this listing have stronger yields. Clipper lacks a dividend development streak at current as nicely.

We see simply over 5% annual development within the years forward, and when mixed with the large tailwind from the valuation and robust 5.9% yield, we see ~22% complete annual returns for Clipper over the medium time period.

Click on right here to obtain our most up-to-date Certain Evaluation report on Clipper Realty Inc. (preview of web page 1 of three proven under):

Last Ideas

Whereas shopping for shares which might be out of favor might be robust emotionally, that’s typically one of the simplest ways to yield sturdy returns over the long run. When shares are out of favor, significantly sturdy dividend shares like the ten above, they provide higher capital return potential and stronger dividend yields.

We like the ten shares above as all provide sturdy capital appreciation potential, and all have some mixture of earnings potential and dividend longevity.

The next articles comprise shares with very lengthy dividend or company histories, ripe for choice for dividend development buyers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].