Printed on February seventh, 2025 by Bob Ciura

The typical dividend yield within the S&P 500 Index stays low at simply 1.3%. Consequently, earnings buyers ought to deal with higher-yielding securities, if they need further earnings from their inventory portfolios.

Even higher, buyers should purchase excessive dividend shares when they’re additionally undervalued, which might result in excessive whole returns within the coming years.

In any case, the aim of rational buyers is to maximize whole return underneath a given set of constraints. Excessive dividend shares can contribute a good portion of a inventory’s whole return.

With this in thoughts, we compiled an inventory of excessive dividend shares with dividend yields above 5%. You’ll be able to obtain your free copy of the excessive dividend shares listing by clicking on the hyperlink beneath:

Observe: The spreadsheet makes use of the Wilshire 5000 because the universe of securities from which to pick, plus just a few further securities we display for with 5%+ dividend yields.

The free excessive dividend shares listing spreadsheet has our full listing of ~170 particular person securities (shares, REITs, MLPs, and many others.) with 5%+ dividend yields.

Curiously, all returns come from solely three sources:

- Dividends (or distributions, curiosity, and many others.)

- Progress on a per share foundation (sometimes measured as earnings-per-share)

- Valuation a number of adjustments (sometimes measured as a change within the price-to-earnings ratio)

Mixed, these three sources make up whole return.

Historic whole return, whereas fascinating, shouldn’t be what issues in investing. It’s anticipated future returns that we care about.

And since whole returns can solely come from the three sources talked about above, you need to use the anticipated whole return framework to make clear your considering on the place you count on whole returns to return from.

The next listing represents the ten most undervalued shares within the Positive Evaluation Analysis Database that even have yields above 5%.

The listing excludes MLPs, BDCs, and REITs, and likewise excludes worldwide shares. The ten undervalued hidden gems beneath are sorted by anticipated return from valuation adjustments, from lowest to highest.

Desk of Contents

You’ll be able to immediately soar to any particular part of the article through the use of the hyperlinks beneath:

Undervalued Hidden Gem #10: Verizon Communications (VZ)

- Annual Valuation Return: 5.0%

- Dividend Yield: 6.8%

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is without doubt one of the largest wi-fi carriers within the nation.

Wi-fi contributes three-quarters of all revenues, and broadband and cable providers account for a few quarter of gross sales. The corporate’s community covers ~300 million individuals and 98% of the U.S.

On January twenty fourth, 2025, Verizon introduced fourth quarter and full 12 months outcomes. For the quarter, income grew 1.7% to $35.7 billion, which beat estimates by $360 million.

Supply: Investor Presentation

Adjusted earnings-per-share of $1.10 in contrast favorably to $1.08 within the prior 12 months and was in-line with expectations. For the 12 months, grew 0.6% to $134.8 billion whereas adjusted earnings-per-share $4.59 in comparison with $4.71 in 2023.

For the quarter, Verizon had postpaid telephone internet additions of 568K, which was higher than the 449K internet additions the corporate had in the identical interval final 12 months. Retail postpaid internet additions totaled 426K.

Wi-fi retail postpaid telephone churn fee stays low at 0.89%. Wi-fi income grew 3.1% to $20.0 billion whereas the Client section elevated 2.2% to $27.6 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on VZ (preview of web page 1 of three proven beneath):

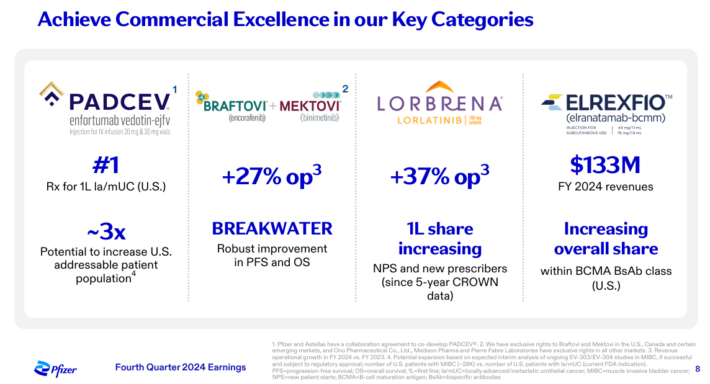

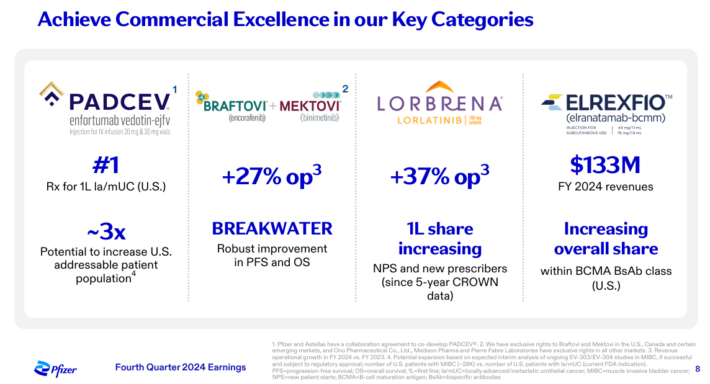

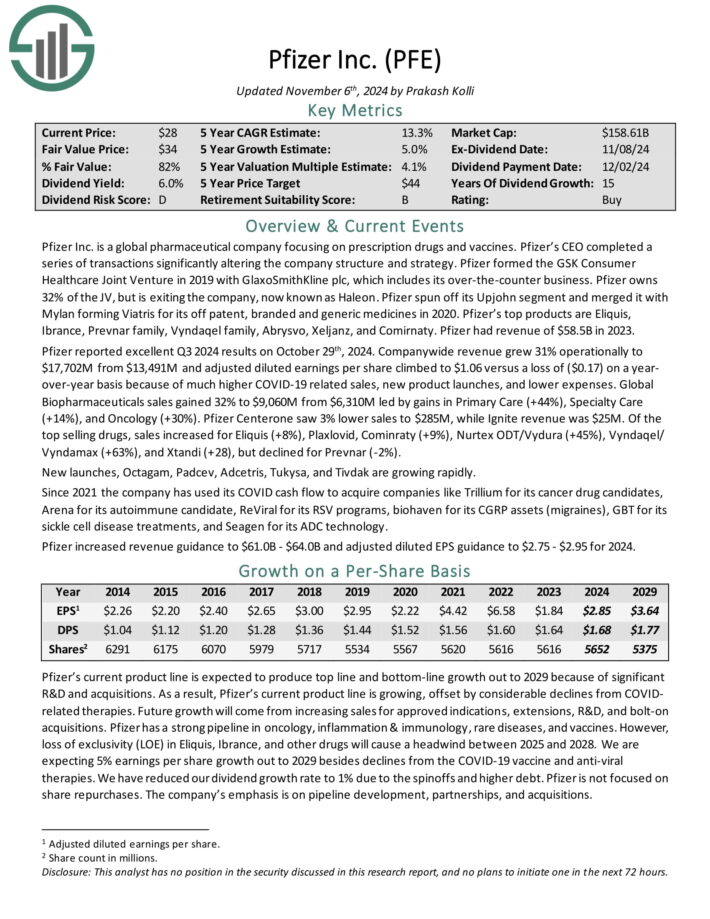

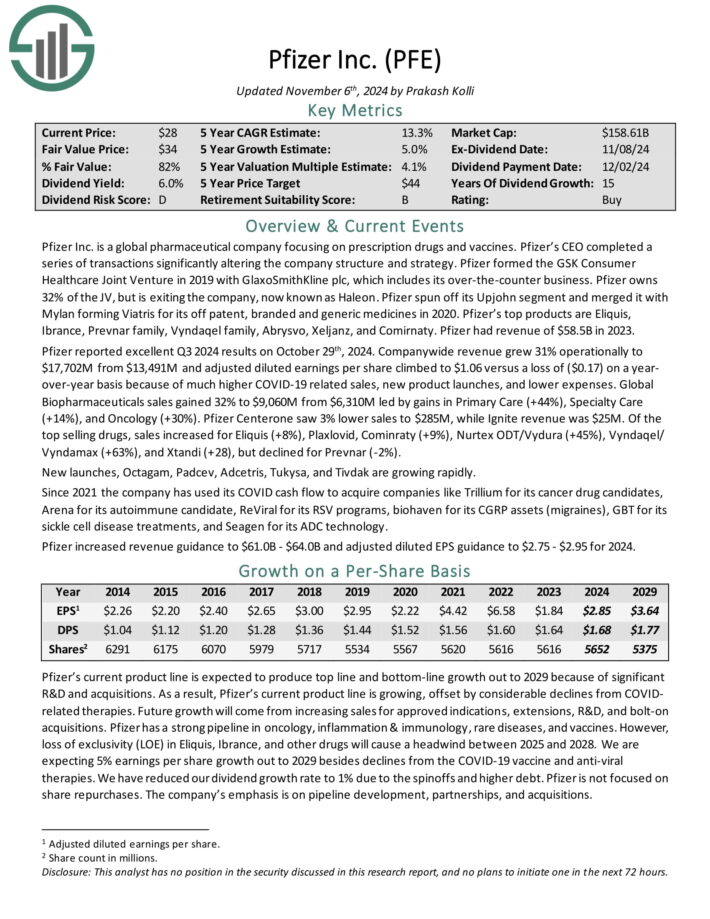

Undervalued Hidden Gem #9: Pfizer Inc. (PFE)

- Annual Valuation Return: 5.7%

- Dividend Yield: 6.7%

Pfizer Inc. is a worldwide pharmaceutical firm specializing in prescribed drugs and vaccines. Pfizer shaped the GSK Client Healthcare Joint Enterprise in 2019 with GlaxoSmithKline plc, which incorporates its over-the-counter enterprise.

Pfizer owns 32% of the JV, however is exiting the corporate, now often called Haleon. Pfizer spun off its Upjohn section and merged it with Mylan forming Viatris for its off patent, branded and generic medicines in 2020.

Pfizer’s prime merchandise are Eliquis, Ibrance, Prevnar household, Vyndaqel household, Abrysvo, Xeljanz, and Comirnaty.

Supply: Investor Presentation

Pfizer’s present product line is anticipated to provide prime line and bottom-line progress due to important R&D and acquisitions.

Consequently, Pfizer’s present product line is rising, offset by appreciable declines from COVID-related therapies. Future progress will come from growing gross sales for permitted indications, extensions, R&D, and bolt-on acquisitions.

Pfizer is without doubt one of the largest pharmaceutical corporations on this planet. As such, it has scale in R&D, manufacturing, regulatory affairs, distribution, and advertising around the globe.

This provides Pfizer the flexibility to convey new therapies to market, companion with smaller corporations, or purchase total corporations outright. The present pipeline is strong, and a few will doubtless be blockbuster medication even after attrition.

Click on right here to obtain our most up-to-date Positive Evaluation report on PFE (preview of web page 1 of three proven beneath):

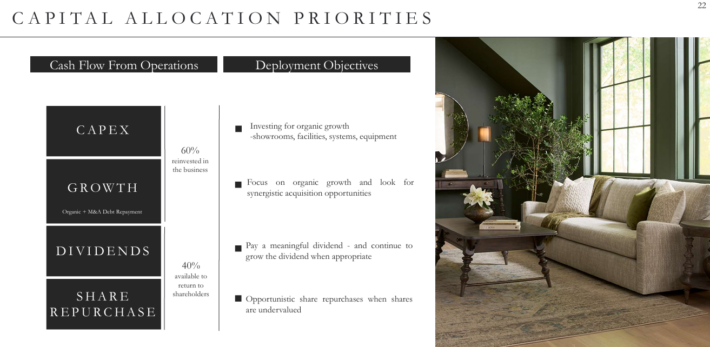

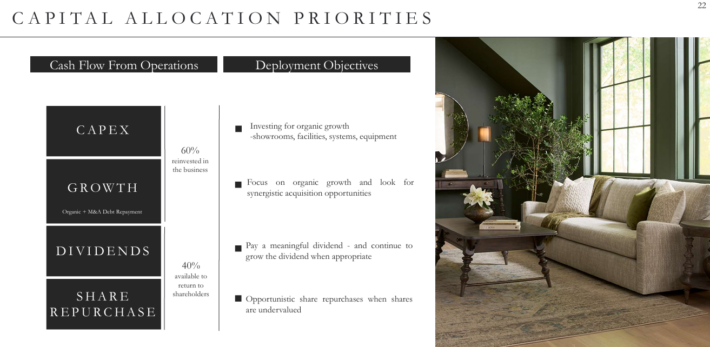

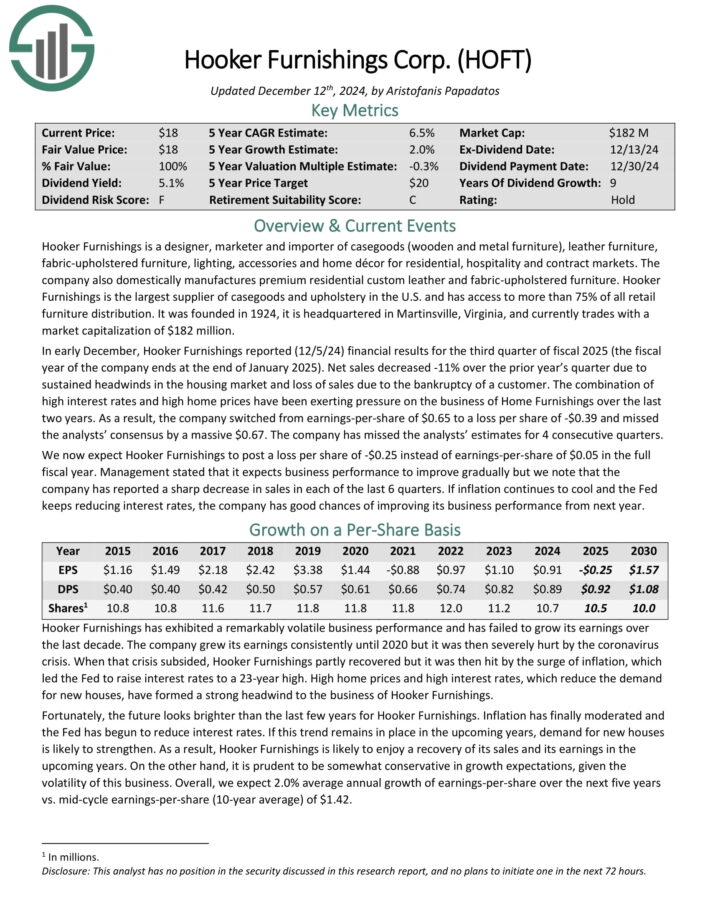

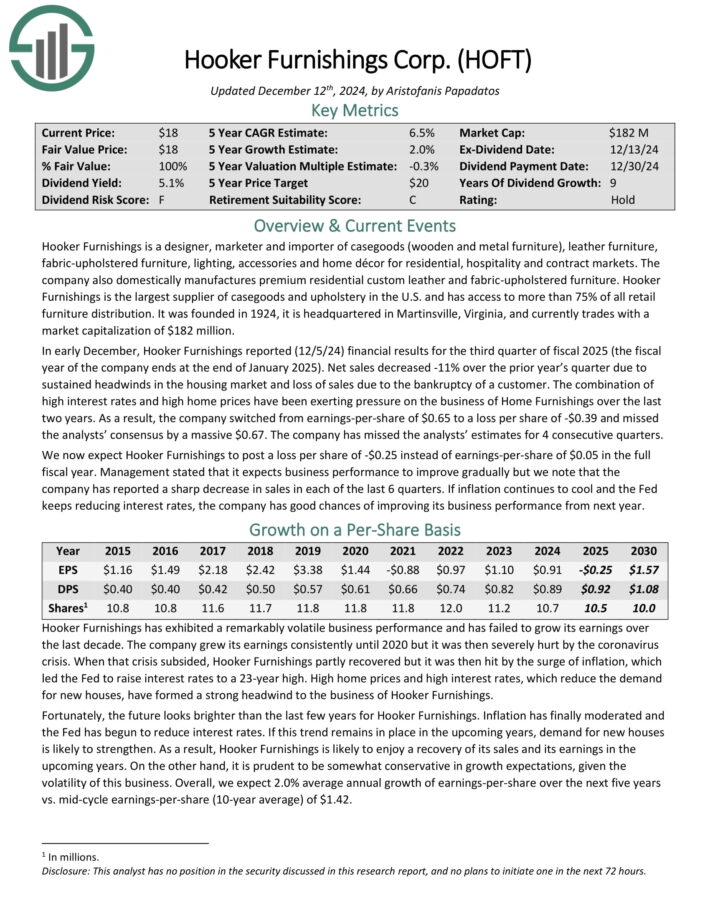

Undervalued Hidden Gem #8: Hooker Furnishings Firm (HOFT)

- Annual Valuation Return: 6.6%

- Dividend Yield: 7.0%

Hooker Furnishings is a designer, marketer and importer of casegoods (wood and steel furnishings), leather-based furnishings, fabric-upholstered furnishings, lighting, equipment and residential décor for residential, hospitality and contract markets.

The corporate additionally domestically manufactures premium residential customized leather-based and fabric-upholstered furnishings.

Hooker Furnishings is the biggest provider of casegoods and fabric within the U.S. and has entry to greater than 75% of all retail furnishings distribution.

Supply: Investor Presentation

In early December, Hooker Furnishings reported (12/5/24) monetary outcomes for the third quarter of fiscal 2025. Internet gross sales decreased -11% over the prior 12 months’s quarter because of sustained headwinds within the housing market and lack of gross sales because of the chapter of a buyer.

The mix of excessive rates of interest and excessive dwelling costs have been exerting stress on the enterprise of Dwelling Furnishings during the last two years.

Consequently, the corporate switched from earnings-per-share of $0.65 to a loss per share of -$0.39 and missed the analysts’ consensus by a large $0.67.

Click on right here to obtain our most up-to-date Positive Evaluation report on HOFT (preview of web page 1 of three proven beneath):

Undervalued Hidden Gem #7: Kraft Heinz Co. (KHC)

- Annual Valuation Return: 6.6%

- Dividend Yield: 7.0%

Kraft-Heinz is a processed meals and drinks firm which owns a product portfolio that features meals merchandise reminiscent of condiments, sauces, cheese & dairy, frozen & chilled meals, and toddler weight-reduction plan & diet.

The corporate was created in 2015 in a merger between Kraft Meals Group and H. J. Heinz Firm, orchestrated by Warren Buffett’s Berkshire Hathaway and 3G Capital.

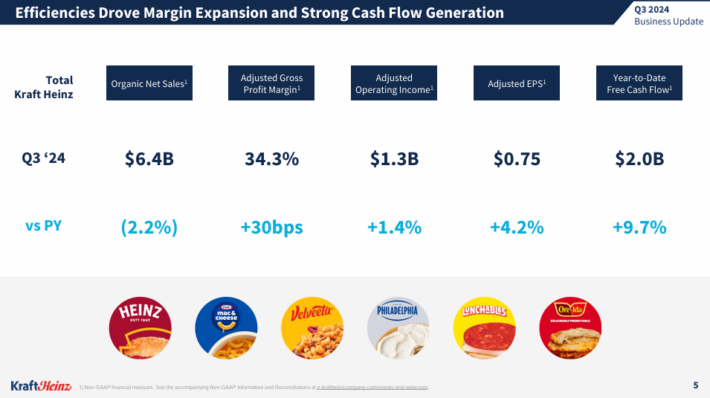

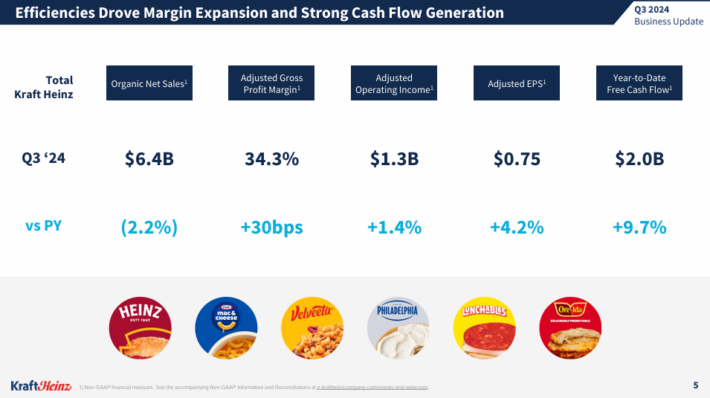

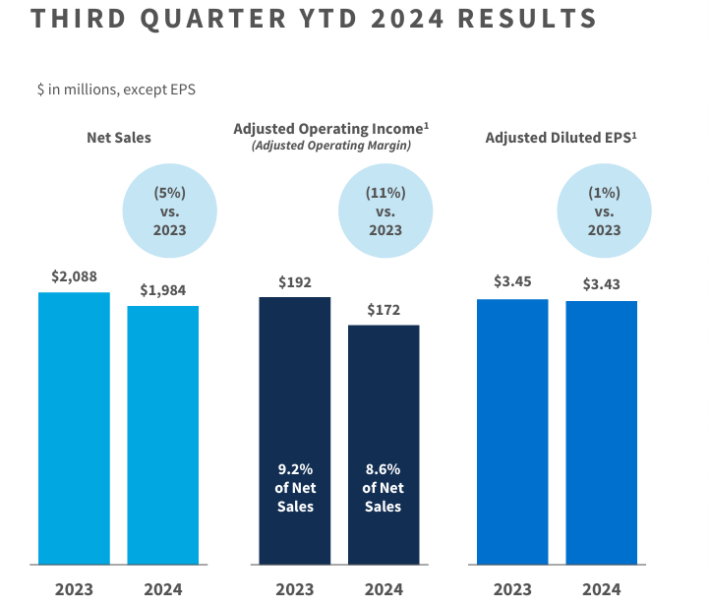

The Kraft-Heinz Firm reported its third quarter earnings outcomes on October 30. The corporate reported that its revenues totaled $6.38 billion throughout the quarter, which was down 2.9% year-over-year.

Supply: Investor Presentation

Natural gross sales have been down by 2.2%. This was a weaker efficiency in comparison with the earlier quarter, when natural gross sales had declined by simply 0.5%.

Kraft-Heinz generated earnings-per-share of $0.75 throughout the third quarter, which was above the consensus estimate. Earnings-per-share have been up 4% versus the earlier 12 months’s quarter.

Administration acknowledged that they see natural internet gross sales declining by round 2% in 2024, whereas administration is forecasting earnings-per-share to return in between $3.01 and $3.07 for the present 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on KHC (preview of web page 1 of three proven beneath):

Undervalued Hidden Gem #6: FMC Corp. (FMC)

- Annual Valuation Return: 6.6%

- Dividend Yield: 7.0%

FMC Company is an agricultural sciences firm that gives crop safety, plant well being, {and professional} pest and turf administration merchandise. By way of acquisitions, FMC is now one of many 5 largest patented crop chemical corporations.

The corporate markets its merchandise by its personal gross sales group and thru alliance companions, impartial distributors, and gross sales representatives. It operates in North America, Latin America, Europe, the Center East, Africa, and Asia.

The corporate stays properly positioned in its markets and was in a position to improve costs in all areas. We count on rising demand from agricultural markets that may drive robust gross sales of fertilizer within the years forward. Progress from rising markets also needs to be robust.

Pricing good points together with robust quantity progress of higher-margin merchandise have supported FMC’s revenues and earnings. The corporate’s strong analysis and growth pipeline will help secure progress within the years to return.

Click on right here to obtain our most up-to-date Positive Evaluation report on FMC (preview of web page 1 of three proven beneath):

Undervalued Hidden Gem #5: Western Union Firm (WU)

- Annual Valuation Return: 6.6%

- Dividend Yield: 7.0%

The Western Union Firm is the world chief within the enterprise of home and worldwide cash transfers. The corporate has a community of roughly 550,000 brokers globally and operates in additional than 200 nations.

About 90% of brokers are outdoors of the US. Western Union operates two enterprise segments, Client-to-Client (C2C) and Different (invoice funds within the US and Argentina).

Western Union reported Q3 2024 outcomes on October twenty third, 2024. Firm-wide income decreased 6% and diluted GAAP earnings per share elevated 70% to $0.78 within the quarter in comparison with $0.46 within the prior 12 months.

Supply: Investor Presentation

Income fell on challenges in Iraq regardless of larger retail, branded digital transactions, and Client Companies volumes. Volumes are usually larger, however income is flat to declining in most geographies.

CMT income fell 9% on a year-over-year foundation even with 3% larger transaction volumes. Branded Digital Cash Switch CMT revenues elevated 9% as volumes rose 15%.

Click on right here to obtain our most up-to-date Positive Evaluation report on WU (preview of web page 1 of three proven beneath):

Undervalued Hidden Gem #4: Wendy’s Co. (WEN)

- Annual Valuation Return: 9.1%

- Dividend Yield: 5.1%

Wendy’s is the second largest hamburger quick-service restaurant chain within the U.S. (up from #3 previous to 2020), with over 7,000 restaurant areas globally. The corporate was based in 1969 in Columbus, Ohio. Greater than 90% of the corporate’s areas are in america.

On October thirty first, 2024, Wendy’s reported third quarter 2024 outcomes for the interval ending September twenty ninth, 2024. The corporate’s world system-wide gross sales progress equaled 1.8% in comparison with progress of 4.8% in third quarter 2023.

World same-restaurant gross sales progress of 0.2% in contrast unfavorably to 2.8% in the identical prior 12 months interval. System-wide gross sales of $3.64 billion in comparison with $3.58 billion earned in Q3 2023.

Out of the 64 whole new restaurant openings within the third quarter, the corporate had 31 internet new eating places, which compares unfavorably to final 12 months’s 51 internet new eating places on 72 whole new eating places.

The U.S. noticed 2 internet new eating places closed, whereas 33 internet new eating places openings have been worldwide. The worldwide re-imaging of Wendy’s was reported to be 89% full as of 3Q 2024 in comparison with 83% one 12 months in the past.

Click on right here to obtain our most up-to-date Positive Evaluation report on WEN (preview of web page 1 of three proven beneath):

Undervalued Hidden Gem #3: Eversource Power (ES)

- Annual Valuation Return: 6.6%

- Dividend Yield: 7.0%

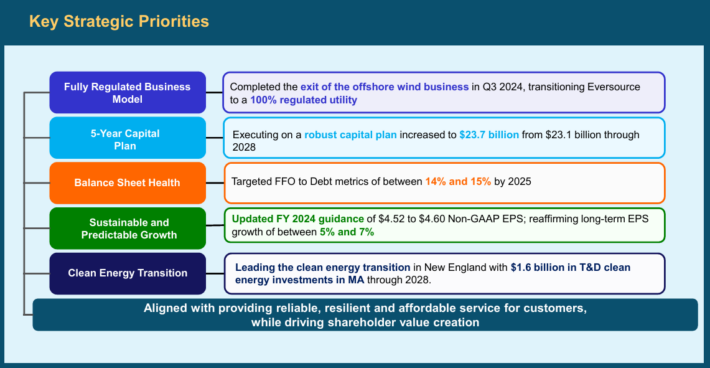

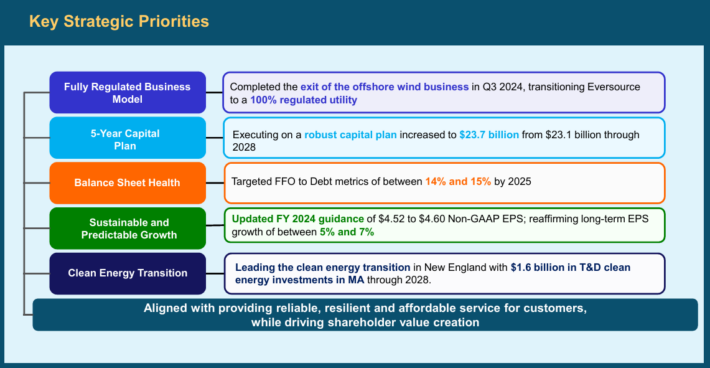

Eversource Power is a diversified holding firm with subsidiaries that present regulated electrical, gasoline, and water distribution service within the Northeast U.S.

The corporate’s utilities serve greater than 4 million prospects after buying NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gasoline in 2020.

Eversource has delivered regular progress to shareholders for a few years.

Supply: Investor Presentation

On November 4th, 2024, Eversource Power launched its third-quarter 2024 outcomes for the interval ending September thirtieth, 2024.

For the quarter, the corporate reported a internet lack of $(118.1) million, a pointy decline from earnings of $339.7 million in the identical quarter of final 12 months, which displays the affect of the corporate’s exit from offshore wind investments.

The corporate reported a loss per share of $(0.33), in contrast with earnings-per-share of $0.97 within the prior 12 months. Earnings from the Electrical Transmission section elevated to $174.9 million, up from $160.3 million within the prior 12 months, primarily because of a better degree of funding in Eversource’s electrical transmission system.

Click on right here to obtain our most up-to-date Positive Evaluation report on ES (preview of web page 1 of three proven beneath):

Undervalued Hidden Gem #2: Carters Inc. (CRI)

- Annual Valuation Return: 9.1%

- Dividend Yield: 6.3%

Carter’s, Inc. is the biggest branded retailer of attire completely for infants and younger kids in North America. It was based in 1865 by William Carter. The corporate owns the Carter’s and OshKosh B’gosh manufacturers, two of essentially the most recognized manufacturers within the kids’s attire area.

Carter’s acquired competitor OshKosh B’gosh for $312 million in 2005. Now, these manufacturers are offered in main department shops, nationwide chains, and specialty retailers domestically and internationally.

On October twenty sixth, 2024, the corporate reported third-quarter outcomes for Fiscal Yr (FY)2024. The corporate reported a decline in third-quarter fiscal 2024 outcomes, with internet gross sales down 4.2% to $758 million in comparison with the earlier 12 months’s $792 million.

Supply: Investor Presentation

The corporate’s working margin decreased to 10.2% from 11.8%, attributed to larger investments in pricing and advertising, regardless of a decrease value of products.

Earnings per diluted share (EPS) dropped to $1.62 from $1.78, reflecting softer demand in key segments.

Click on right here to obtain our most up-to-date Positive Evaluation report on CRI (preview of web page 1 of three proven beneath):

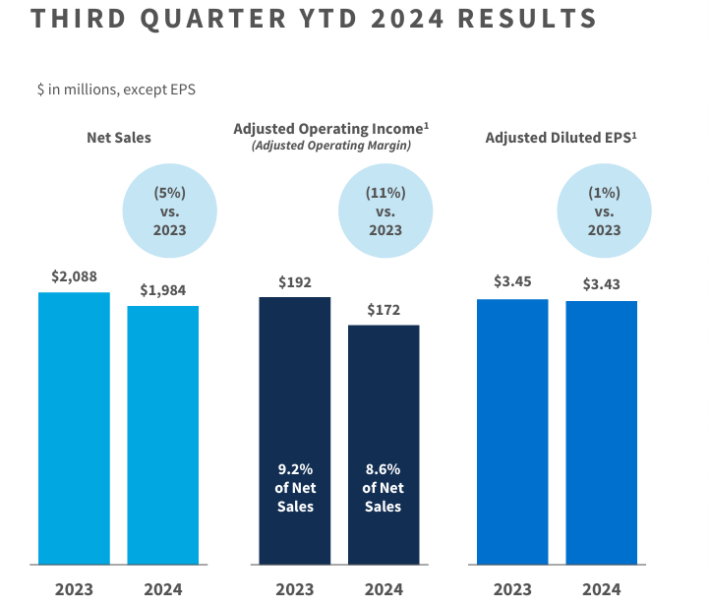

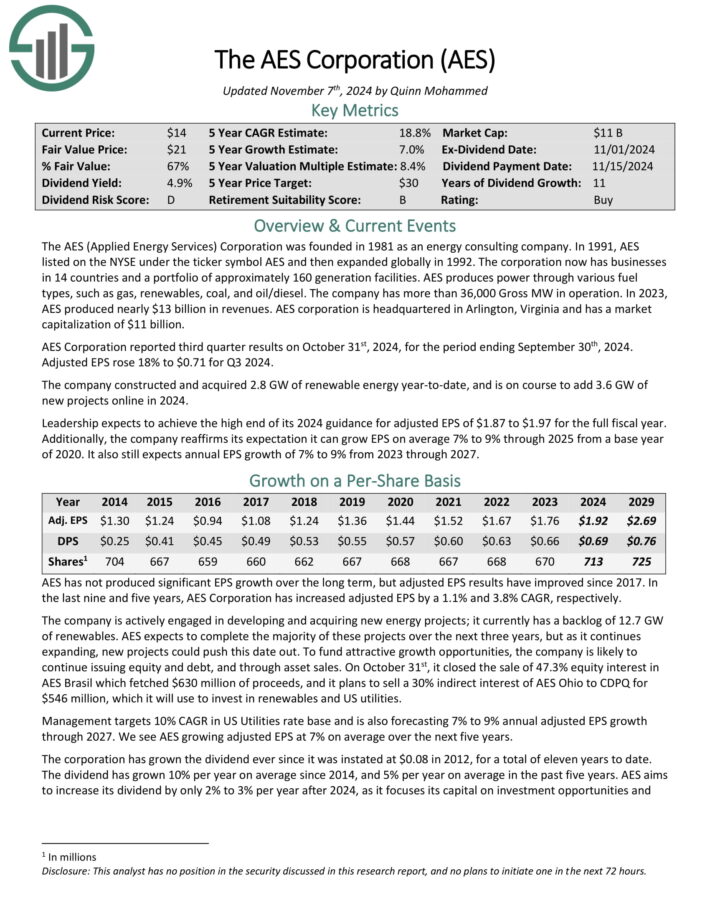

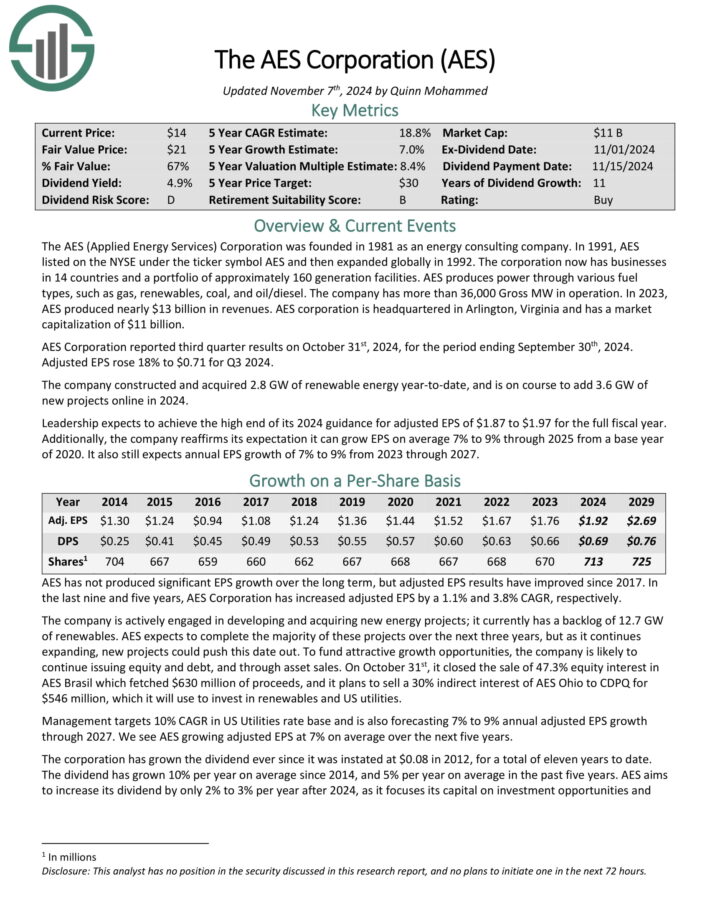

Undervalued Hidden Gem #1: AES Corp. (AES)

- Annual Valuation Return: 14.2%

- Dividend Yield: 6.5%

The AES (Utilized Power Companies) Company was based in 1981 as an vitality consulting firm. It now has companies in 14 nations and a portfolio of roughly 160 era services.

AES produces energy by numerous gasoline varieties, reminiscent of gasoline, renewables, coal, and oil/diesel. The corporate has greater than 36,000 Gross MW in operation.

AES Company reported third quarter outcomes on October thirty first, 2024, for the interval ending September thirtieth, 2024. Adjusted EPS rose 18% to $0.71 for Q3 2024.

The corporate constructed and bought 2.8 GW of renewable vitality year-to-date, and is heading in the right direction so as to add 3.6 GW of latest initiatives on-line in 2024.

Supply: Investor Presentation

Management expects to attain the excessive finish of its 2024 steering for adjusted EPS of $1.87 to $1.97 for the complete fiscal 12 months. Moreover, the corporate reaffirms it additionally nonetheless expects annual EPS progress of seven% to 9% from 2023 by 2027.

The corporate is actively engaged in creating and buying new vitality initiatives.

It at present has a backlog of 12.7 GW of renewables. AES expects to finish the vast majority of these initiatives by 2027.

Click on right here to obtain our most up-to-date Positive Evaluation report on AES (preview of web page 1 of three proven beneath):

Closing Ideas & Extra Studying

In case you are keen on discovering high-quality dividend progress shares and/or different high-yield securities and earnings securities, the next Positive Dividend sources will probably be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].