Printed on December 2nd, 2025 by Bob Ciura

Month-to-month dividend shares have immediate attraction for a lot of earnings traders. Shares that pay their dividends every month provide extra frequent payouts than conventional quarterly or semi-annual dividend payers.

For that reason, we created a full checklist of 83 month-to-month dividend shares.

You possibly can obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink beneath:

Buyers within the US shouldn’t overlook Canadian shares, a lot of which have greater dividend yields than their U.S.-based counterparts.

Notice: Canada imposes a 15% dividend withholding tax on U.S. traders. In lots of instances, investing in Canadian shares by way of a U.S. retirement account waives the dividend withholding tax from Canada, however verify along with your tax preparer or accountant for extra on this subject.

With the typical S&P 500 yield hovering round 1.3%, traders can generate far more earnings with high-yield shares.

Screening for month-to-month dividend shares that even have excessive dividend yields makes for an interesting mixture.

This text will checklist the ten highest-yielding Canadian month-to-month dividend shares.

Desk Of Contents

The next 10 Canadian month-to-month dividend shares have excessive dividend yields above 5%. Shares are listed by their dividend yields, from lowest to highest.

The checklist excludes oil and gasoline royalty belief, which have excessive fluctuations of their dividend payouts from one quarter to the subsequent as a result of underlying volatility of commodity costs. It additionally excludes REITs, BDCs, and MLPs, to focus solely on widespread shares.

You possibly can immediately leap to a person part of the article by using the hyperlinks beneath:

Excessive-Yield Canadian Month-to-month Dividend Inventory #10: Surge Power (ZPTAF)

Surge Power is a Calgary‑based mostly unbiased oil and gasoline exploration, growth and manufacturing firm working primarily in Alberta, Saskatchewan and Manitoba.

Surge holds a centered and operated portfolio of sunshine and medium gravity crude oil property, together with giant oil‑in‑place reservoirs with low restoration components.

The corporate maintains a big stock of low-risk growth drilling places, together with advancing water‑flood enhanced restoration tasks, whereas retaining operator management and excessive working pursuits throughout its key performs.

On November fifth, 2025, Surge Power reported its Q3 monetary outcomes for the interval ending September thirtieth, 2025. Complete income earlier than hedging was roughly $101.7 million, based mostly on common each day manufacturing of 23,622 boe/d, with crude oil representing about 88% of the combo.

Surge Power generated about $49.7 million in adjusted funds circulation, or $0.50 per share fundamental and $0.49 per share diluted, in contrast with about $51.6 million and $0.51 per share fundamental in the identical quarter final 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on ZPTAF (preview of web page 1 of three proven beneath):

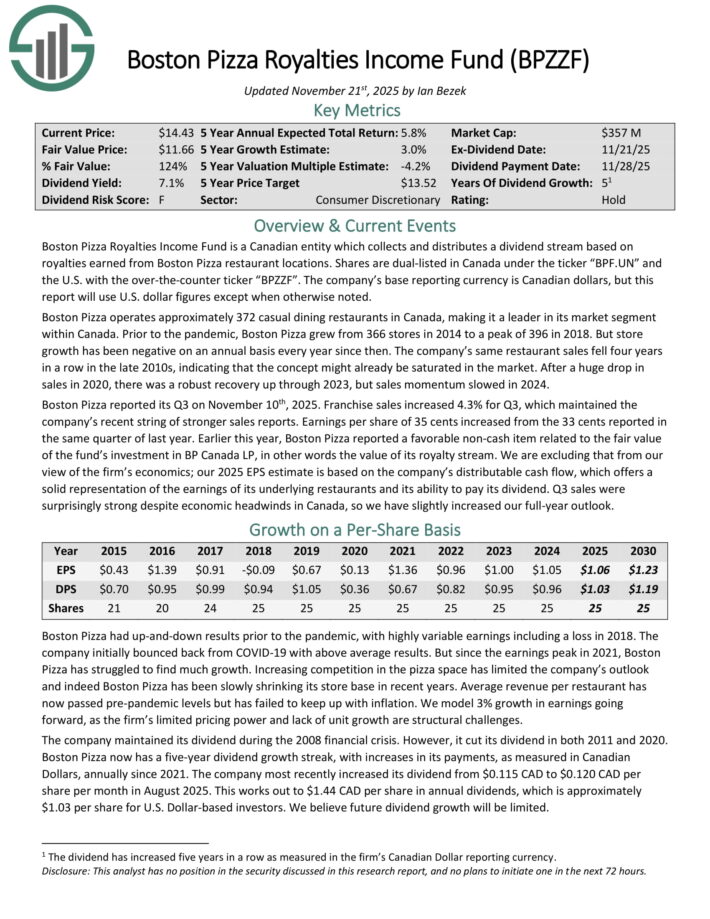

Excessive-Yield Canadian Month-to-month Dividend Inventory #9: Boston Pizza Royalties Revenue Fund (BPZZF)

Boston Pizza Royalties Revenue Fund is a Canadian entity which collects and distributes a dividend stream based mostly on royalties earned from Boston Pizza restaurant places.

Boston Pizza operates roughly 372 informal eating eating places in Canada, making it a pacesetter in its market section inside Canada. Previous to the pandemic, Boston Pizza grew from 366 shops in 2014 to a peak of 396 in 2018.

However retailer progress has been unfavorable on an annual foundation yearly since then. The corporate’s identical restaurant gross sales fell 4 years in a row within the late 2010s, indicating that the idea may already be saturated out there.

After an enormous drop in gross sales in 2020, there was a strong restoration up by way of 2023, however gross sales momentum slowed in 2024.

Boston Pizza reported its Q3 on November tenth, 2025. Franchise gross sales elevated 4.3% for Q3, which maintained the corporate’s current string of stronger gross sales stories.

Earnings per share of 35 cents elevated from the 33 cents reported in the identical quarter of final 12 months.

Earlier this 12 months, Boston Pizza reported a positive non-cash merchandise associated to the truthful worth of the fund’s funding in BP Canada LP, in different phrases the worth of its royalty stream.

Click on right here to obtain our most up-to-date Certain Evaluation report on BPZZF (preview of web page 1 of three proven beneath):

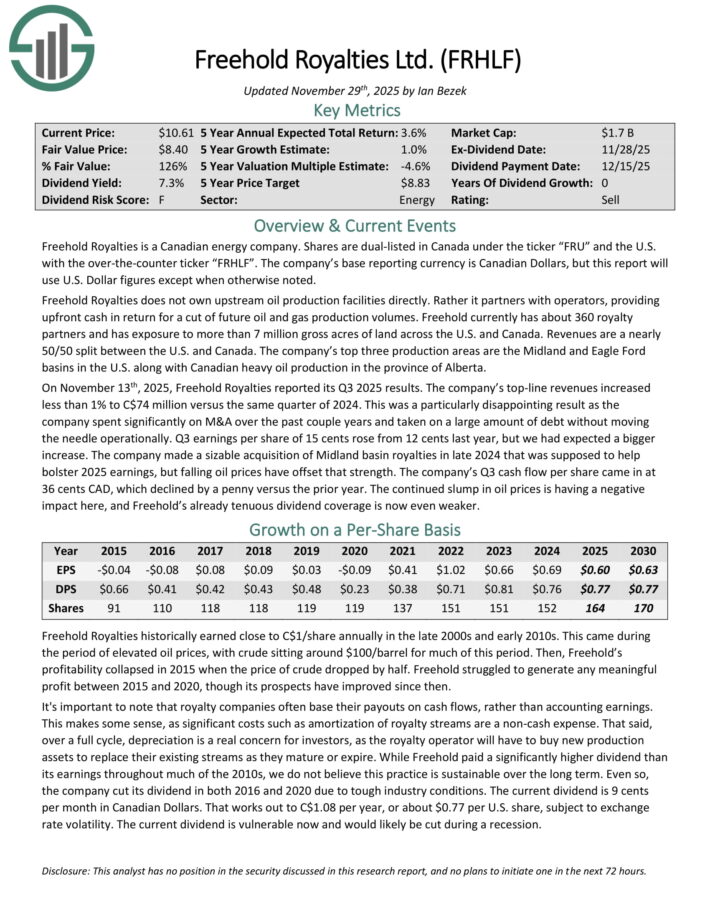

Excessive-Yield Canadian Month-to-month Dividend Inventory #8: Freehold Royalties (FRHLF)

Freehold Royalties is a Canadian power firm. It doesn’t personal upstream oil manufacturing services instantly. Quite it companions with operators, offering upfront money in return for a reduce of future oil and gasoline manufacturing volumes.

Freehold at the moment has about 360 royalty companions and has publicity to greater than 7 million gross acres of land throughout the U.S. and Canada. Revenues are a virtually 50/50 cut up between the U.S. and Canada.

The corporate’s prime three manufacturing areas are the Midland and Eagle Ford basins within the U.S. together with Canadian heavy oil manufacturing within the province of Alberta.

On November thirteenth, 2025, Freehold Royalties reported its Q3 2025 outcomes. The corporate’s top-line revenues elevated lower than 1% to C$74 million versus the identical quarter of 2024.

This was a very disappointing outcome as the corporate spent considerably on M&A over the previous couple years and brought on a considerable amount of debt with out transferring the needle operationally. Earnings per share of 15 cents rose from 12 cents final 12 months, however we had anticipated an even bigger improve.

The corporate made a large acquisition of Midland basin royalties in late 2024 that was supposed to assist bolster 2025 earnings, however falling oil costs have offset that power.

Money circulation per share got here in at 36 cents CAD, which declined by a penny versus the prior 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on FRHLF (preview of web page 1 of three proven beneath):

Excessive-Yield Canadian Month-to-month Dividend Inventory #7: Diversified Royalties Corp. (BEVFF)

Cardinal Power is a Canadian oil and gasoline producer working primarily in Alberta and Saskatchewan, with a robust give attention to standard mild and medium oil.

Its operations are centered on mature, low-decline fields the place enhanced oil restoration strategies, like waterflooding and CO₂ injection, are actively used to take care of steady manufacturing.

The corporate manages a big stock of vertical and horizontal wells tied into company-owned infrastructure, which helps environment friendly subject operations and value management.

With over 90% of manufacturing weighted to grease and NGLs, Cardinal’s day-to-day operations are closely oil-driven, with ongoing upkeep, recompletions, and focused infill drilling forming the spine of its growth exercise.

On July thirtieth, 2025, Cardinal Power reported its Q2 outcomes for the interval ending June thirtieth, 2025. Complete income for the quarter was about $94.0 million, down 25% from the identical interval in 2024, primarily because of decrease commodity costs.

Manufacturing averaged 21,184 boe/d, down 5% year-over-year, with oil and NGLs persevering with to make up over 90% of the combo.

Working earnings got here in at $36.07 million, reflecting weaker pricing however partially offset by decrease working bills. Diluted EPS was $0.073, down from $0.183 within the prior 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on CRLFF (preview of web page 1 of three proven beneath):

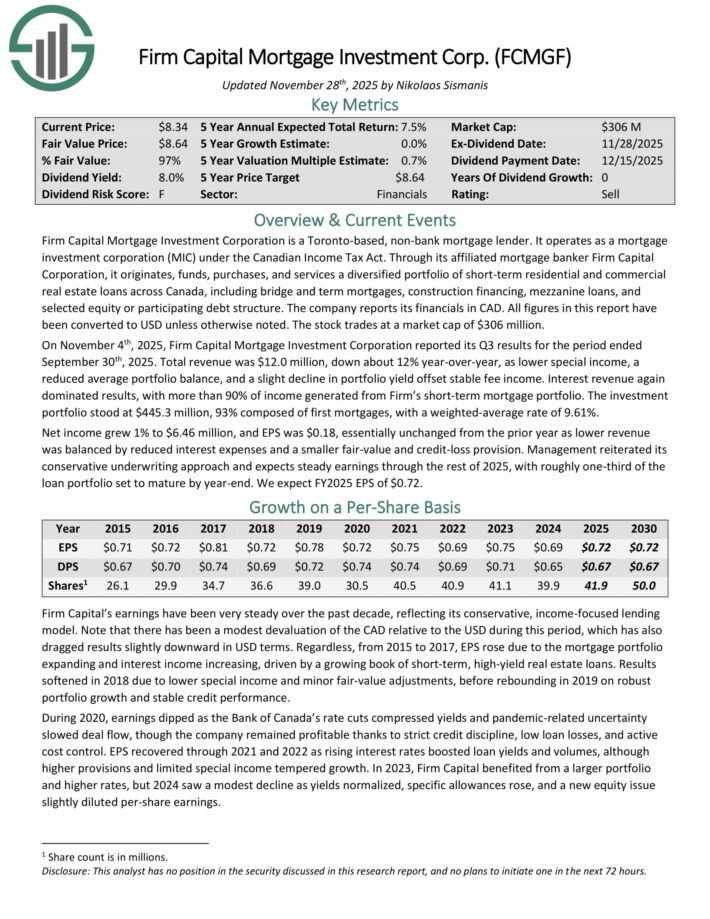

Excessive-Yield Canadian Month-to-month Dividend Inventory #6: Agency Capital Mortgage Funding (FCMGF)

Agency Capital Mortgage Funding Company is a Toronto-based, non-bank mortgage lender. It operates as a mortgage funding company (MIC) beneath the Canadian Revenue Tax Act.

By means of its affiliated mortgage banker Agency Capital Company, it originates, funds, purchases, and companies a diversified portfolio of short-term residential and business actual property loans throughout Canada, together with bridge and time period mortgages, building financing, mezzanine loans, and chosen fairness or taking part debt construction.

On November 4th, 2025, Agency Capital Mortgage Funding Company reported its Q3 outcomes. Complete income was $12.0 million, down about 12% year-over-year, as decrease particular earnings, a decreased common portfolio steadiness, and a slight decline in portfolio yield offset steady charge earnings.

Curiosity income once more dominated outcomes, with greater than 90% of earnings generated from Agency’s short-term mortgage portfolio. The funding portfolio stood at $445.3 million, 93% composed of first mortgages, with a weighted-average fee of 9.61%.

Web earnings grew 1% to $6.46 million, and EPS was $0.18, primarily unchanged from the prior 12 months as decrease income was balanced by decreased curiosity bills and a smaller fair-value and credit-loss provision.

Administration reiterated its conservative underwriting strategy and expects regular earnings by way of the remainder of 2025, with roughly one-third of the mortgage portfolio set to mature by year-end.

Click on right here to obtain our most up-to-date Certain Evaluation report on FCMGF (preview of web page 1 of three proven beneath):

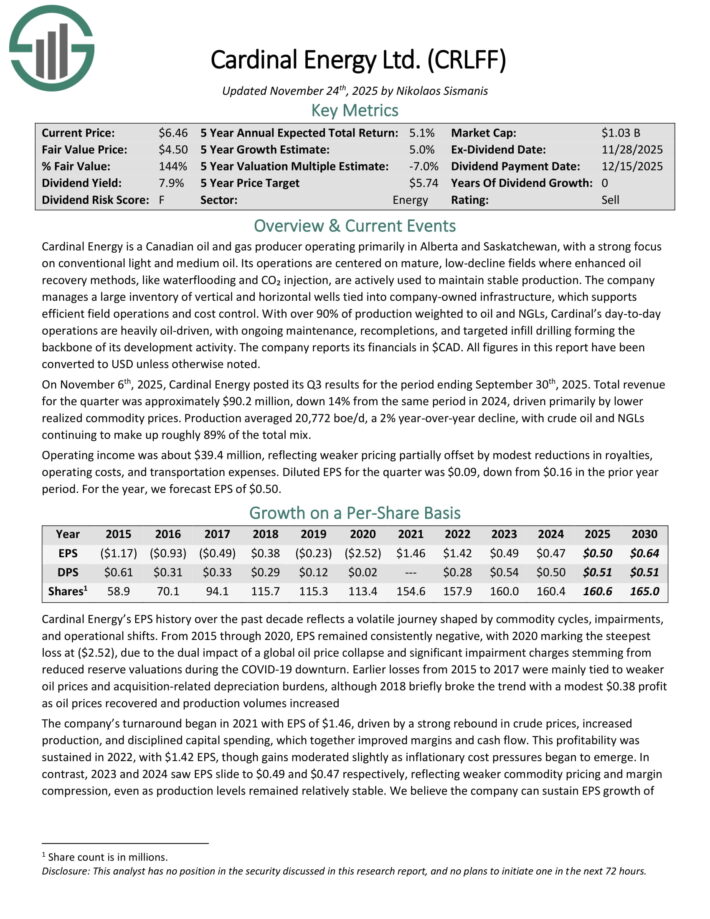

Excessive-Yield Canadian Month-to-month Dividend Inventory #5: Cardinal Power Ltd. (CRLFF)

Cardinal Power is a Canadian oil and gasoline producer working primarily in Alberta and Saskatchewan, with a robust give attention to standard mild and medium oil.

Its operations are centered on mature, low-decline fields the place enhanced oil restoration strategies, like waterflooding and CO₂ injection, are actively used to take care of steady manufacturing.

The corporate manages a big stock of vertical and horizontal wells tied into company-owned infrastructure, which helps environment friendly subject operations and value management.

With over 90% of manufacturing weighted to grease and NGLs, Cardinal’s day-to-day operations are closely oil-driven, with ongoing upkeep, recompletions, and focused infill drilling forming the spine of its growth exercise.

On November sixth, 2025, Cardinal Power posted its Q3 outcomes. Complete income for the quarter was roughly $90.2 million, down 14% from the identical interval in 2024, pushed primarily by decrease realized commodity costs.

Manufacturing averaged 20,772 boe/d, a 2% year-over-year decline, with crude oil and NGLs persevering with to make up roughly 89% of the overall combine.

Working earnings was about $39.4 million, reflecting weaker pricing partially offset by modest reductions in royalties, working prices, and transportation bills. Diluted EPS for the quarter was $0.09, down from $0.16 within the prior 12 months interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on CRLFF (preview of web page 1 of three proven beneath):

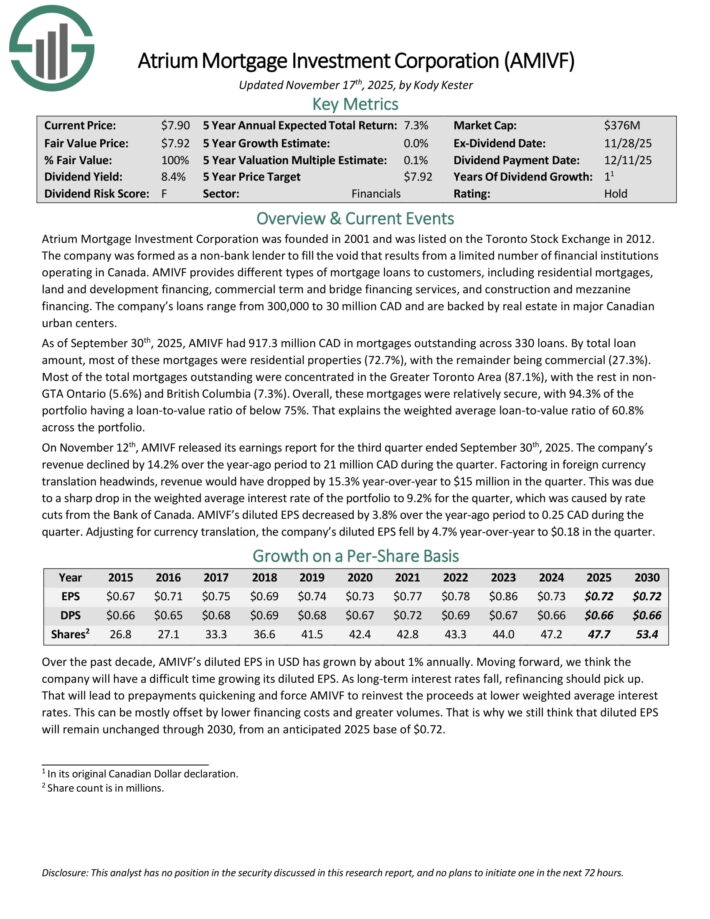

Excessive-Yield Canadian Month-to-month Dividend Inventory #4: Atrium Mortgage Funding Corp. (AMIVF)

Atrium Mortgage Funding Company was based in 2001 and was listed on the Toronto Inventory Trade in 2012. AMIVF supplies several types of mortgage loans to clients, together with residential mortgages, land and growth financing, business time period and bridge financing companies, and building and mezzanine financing.

The corporate’s loans vary from 300,000 to 30 million CAD and are backed by actual property in main Canadian city facilities.

As of September thirtieth, 2025, AMIVF had 917.3 million CAD in mortgages excellent throughout 330 loans. By complete mortgage quantity, most of those mortgages had been residential properties (72.7%), with the rest being business (27.3%).

A lot of the complete mortgages excellent had been concentrated within the Better Toronto Space (87.1%), with the remaining in non-GTA Ontario (5.6%) and British Columbia (7.3%).

General, these mortgages had been comparatively safe, with 94.3% of the portfolio having a loan-to-value ratio of beneath 75%. That explains the weighted common loan-to-value ratio of 60.8% throughout the portfolio.

On November twelfth, AMIVF launched its earnings report for the third quarter ended September thirtieth, 2025. The corporate’s income declined by 14.2% over the year-ago interval to 21 million CAD throughout the quarter.

Factoring in international foreign money translation headwinds, income would have dropped by 15.3% year-over-year to $15 million within the quarter. This was because of a pointy drop within the weighted common rate of interest of the portfolio to 9.2% for the quarter, which was brought on by fee cuts from the Financial institution of Canada.

AMIVF’s diluted EPS decreased by 3.8% over the year-ago interval to 0.25 CAD throughout the quarter. Adjusting for foreign money translation, the corporate’s diluted EPS fell by 4.7% year-over-year to $0.18 within the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on AMIVF (preview of web page 1 of three proven beneath):

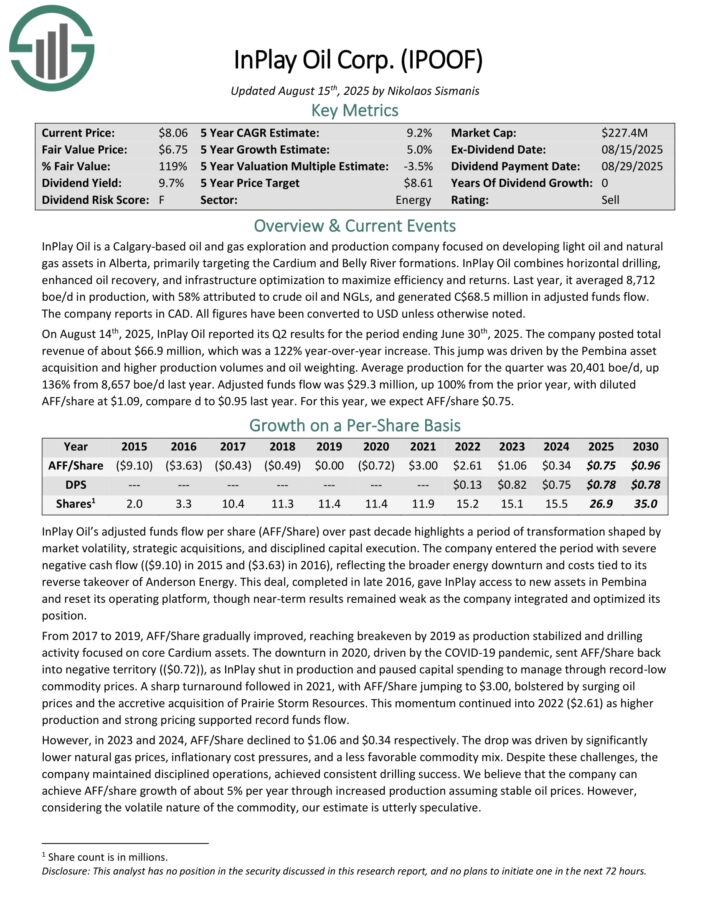

Excessive-Yield Canadian Month-to-month Dividend Inventory #3: InPlay Oil Corp. (IPOOF)

InPlay Oil is a Calgary-based oil and gasoline exploration and manufacturing firm centered on creating mild oil and pure gasoline property in Alberta, primarily focusing on the Cardium and Stomach River formations. InPlay Oil combines horizontal drilling, enhanced oil restoration, and infrastructure optimization to maximise effectivity and returns.

Final 12 months, it averaged 8,712 boe/d in manufacturing, with 58% attributed to crude oil and NGLs, and generated C$68.5 million in adjusted funds circulation.

InPlay Oil is a Calgary-based oil and gasoline exploration and manufacturing firm centered on creating mild oil and pure gasoline property in Alberta, primarily focusing on the Cardium and Stomach River formations.

InPlay Oil combines horizontal drilling, enhanced oil restoration, and infrastructure optimization to maximise effectivity and returns. Final 12 months, it averaged 8,712 boe/d in manufacturing, with 58% attributed to crude oil and NGLs, and generated C$68.5 million in adjusted funds circulation.

On August 14th, 2025, InPlay Oil reported its Q2 outcomes for the interval ending June thirtieth, 2025. The corporate posted complete income of about $66.9 million, which was a 122% year-over-year improve. This leap was pushed by the Pembina asset acquisition and better manufacturing volumes and oil weighting.

Common manufacturing for the quarter was 20,401 boe/d, up 136% from 8,657 boe/d final 12 months. Adjusted funds circulation was $29.3 million, up 100% from the prior 12 months, with diluted AFF/share at $1.09, evaluate d to $0.95 final 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on IPOOF (preview of web page 1 of three proven beneath):

Excessive-Yield Canadian Month-to-month Dividend Inventory #2: SIR Royalty Revenue Fund (SIRZF)

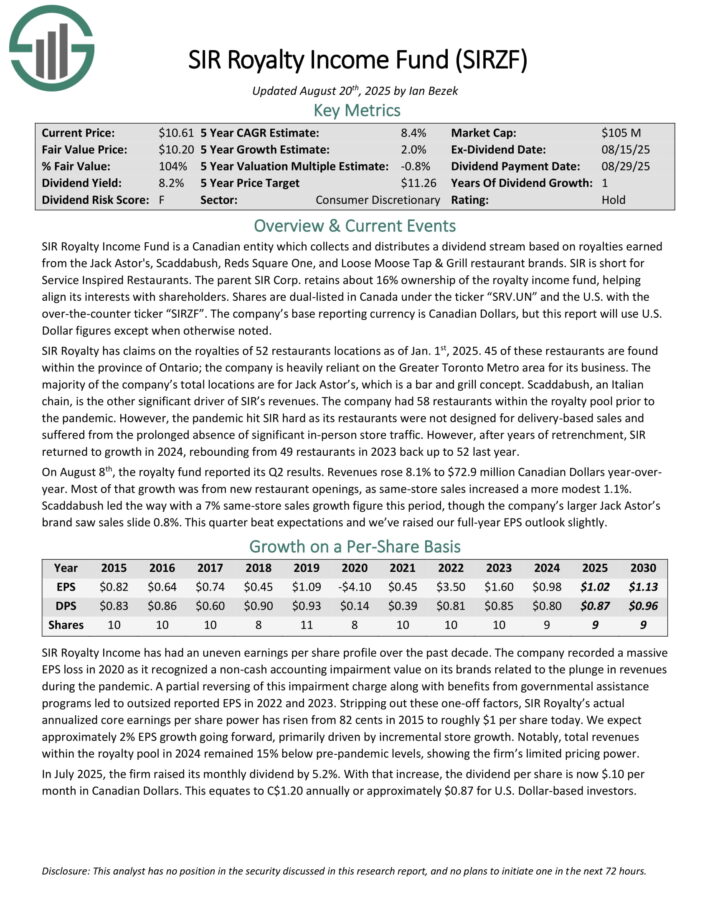

SIR Royalty Revenue Fund is a Canadian entity which collects and distributes a dividend stream based mostly on royalties earned from the Jack Astor’s, Scaddabush, Reds Sq. One, and Unfastened Moose Faucet & Grill restaurant manufacturers.

The dad or mum SIR Corp. retains about 16% possession of the royalty earnings fund, serving to align its pursuits with shareholders.

SIR Royalty has claims on the royalties of 52 eating places places as of Jan. 1st, 2025. 45 of those eating places are discovered inside the province of Ontario; the corporate is closely reliant on the Better Toronto Metro space for its enterprise.

The vast majority of the corporate’s complete places are for Jack Astor’s, which is a bar and grill idea. Scaddabush, an Italian chain, is the opposite important driver of SIR’s revenues.

On August eighth, the royalty fund reported its Q2 outcomes. Revenues rose 8.1% to $72.9 million Canadian {Dollars} year-over-year. Most of that progress was from new restaurant openings, as same-store gross sales elevated a extra modest 1.1%.

Scaddabush led the way in which with a 7% same-store gross sales progress determine this era, although the corporate’s bigger Jack Astor’s model noticed gross sales slide 0.8%.

Click on right here to obtain our most up-to-date Certain Evaluation report on SIRZF (preview of web page 1 of three proven beneath):

Excessive-Yield Canadian Month-to-month Dividend Inventory #1: Timbercreek Monetary Corp. (TBCRF)

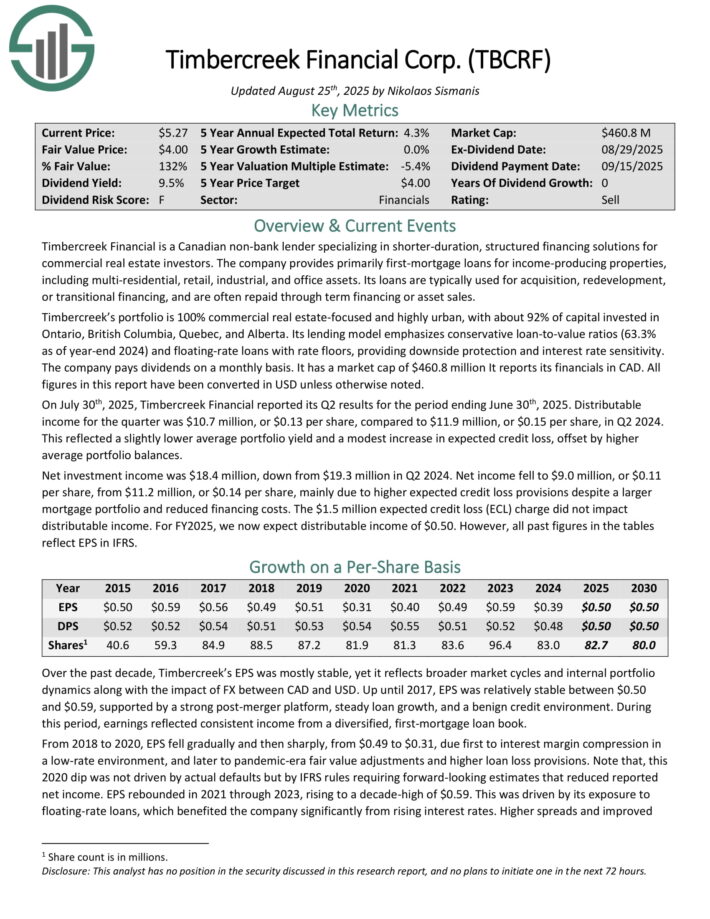

Timbercreek Monetary is a Canadian non-bank lender specializing in shorter-duration, structured financing options for business actual property traders.

The corporate supplies primarily first-mortgage loans for income-producing properties, together with multi-residential, retail, industrial, and workplace property. Its loans are usually used for acquisition, redevelopment, or transitional financing, and are sometimes repaid by way of time period financing or asset gross sales.

Timbercreek’s portfolio is 100% business actual estate-focused and extremely city, with about 92% of capital invested in Ontario, British Columbia, Quebec, and Alberta.

On July thirtieth, 2025, Timbercreek Monetary reported its Q2 outcomes. Distributable earnings for the quarter was $10.7 million, or $0.13 per share, in comparison with $11.9 million, or $0.15 per share, in Q2 2024.

This mirrored a barely decrease common portfolio yield and a modest improve in anticipated credit score loss, offset by greater common portfolio balances.

Web funding earnings was $18.4 million, down from $19.3 million in Q2 2024. Web earnings fell to $9.0 million, or $0.11 per share, from $11.2 million, or $0.14 per share, primarily because of greater anticipated credit score loss provisions regardless of a bigger mortgage portfolio and decreased financing prices.

Click on right here to obtain our most up-to-date Certain Evaluation report on TBCRF (preview of web page 1 of three proven beneath):

Last Ideas

Month-to-month dividend shares may very well be extra interesting to earnings traders than quarterly or semi-annual dividend shares. It is because month-to-month dividend shares make 12 dividend funds per 12 months, as a substitute of the standard 4 or 2.

Moreover, month-to-month dividend shares with excessive yields above 5% are much more enticing for earnings traders.

The ten shares on this checklist haven’t been vetted for dividend security, that means every investor ought to perceive the distinctive danger components of every firm.

That stated, these 10 Canadian dividend shares make month-to-month funds to shareholders, and all have excessive dividend yields.

Additional Studying

In case you are involved in discovering high-yield Canadian shares and/or month-to-month dividend shares, the next Certain Dividend assets might be helpful:

Month-to-month Dividend Inventory Particular person Safety Analysis

Different Canadian Dividend Shares Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].