Up to date on October twenty fifth, 2023

On the earth of investing, there are particular sectors that are inclined to lend themselves extra to development, worth, or nice dividend traits. Relying upon one’s targets, allocating most appropriately to those traits could make a giant distinction to complete returns over the investor’s lifetime.

One kind of inventory that tends to see a excessive price of dividend payers is so-called “sin shares.” These are shares which can be usually outlined as these promoting tobacco or alcohol, however not too long ago expanded to these promoting hashish or different associated merchandise which have age restrictions.

You’ll be able to see the complete downloadable spreadsheet of all 51 Dividend Kings (together with essential monetary metrics corresponding to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink under:

Sin shares are inclined to see pretty steady earnings throughout every kind of financial situations, which is why the group lends itself to dividend buyers as a good selection for earnings.

On this article, we’ll check out 10 sin shares we like at this time for complete returns and earnings prospects.

Common Corp. (UVV)

Our first sin inventory is Common Company, which is a provider of tobacco leaf and plant-based meals components worldwide. The corporate has a spotty historical past of development given it’s beholden to international demand for cigarettes and cigars, which has been waning for a few years. The speed of decline is gradual, nevertheless, so we consider Common has the flexibility to pay its ample dividend for a few years to come back.

Common additionally has an components enterprise that’s separate from the core leaf section.

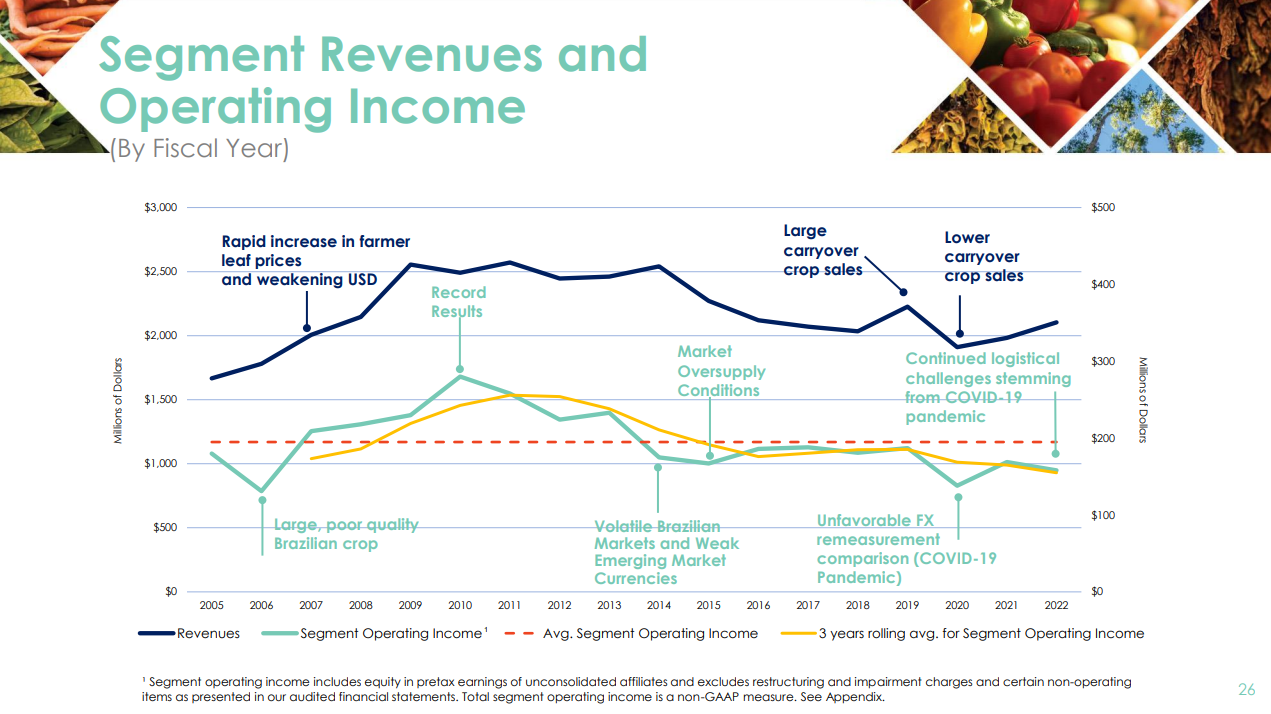

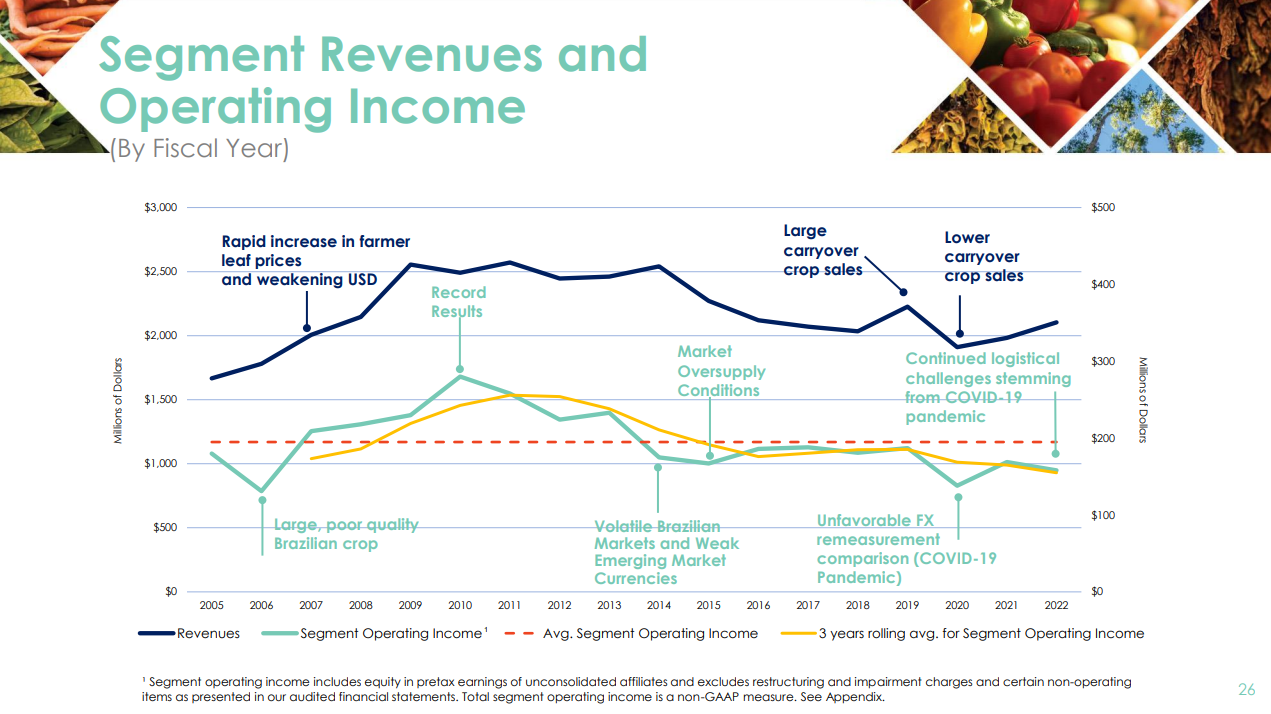

Supply: Investor Presentation, web page 26

We see 1.5% development shifting ahead, as pricing will increase ought to assist offset declines in total demand. The inventory is buying and selling for barely greater than our estimate of honest worth, so shareholder returns could possibly be partially offset by a reversion to honest worth at 13 instances earnings.

Common, nevertheless, has an excellent dividend enhance streak of 51 years, making it a Dividend King. This longevity, in addition to the 6.5% dividend yield, make Common a dividend inventory purchase.

Click on right here to obtain our most up-to-date Positive Evaluation report on UVV (preview of web page 1 of three proven under):

Imperial Manufacturers PLC (IMBBY)

Our subsequent sin inventory is Imperial Manufacturers, which is a maker of varied tobacco merchandise, together with cigars and cigarettes, in addition to vaping, oral nicotine, and heated tobacco merchandise that operates globally. Imperial was based in 1901 and is predicated in the UK.

Imperial Manufacturers reported outcomes for the primary half of fiscal 12 months 2023 on Might sixteenth, 2023. For the primary half 12 months, internet income grew 0.6% in fixed forex and excluding Russia. Excluding Russia, tobacco pricing improved 9.3%, however was partially offset by a 2.5% headwind from combine.

Adjusted earnings-per-share declined 1.2%, aided by a small tailwind from forex change. Whole tobacco market share improved 20 foundation factors throughout the corporate’s high 5 markets, led by a 95 foundation factors enhance within the U.S. and a 15 foundation level enchancment in Spain, whereas Germany and the U.Ok. fell 80 foundation factors and 75 foundation factors, respectively.

Imperial Manufacturers reaffirmed steering, with income nonetheless anticipated develop by a low single-digit fixed forex determine whereas adjusted earnings-per-share must be barely forward of this price for fiscal 12 months 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on IMBBY (preview of web page 1 of three proven under):

Philip Morris Worldwide Inc. (PM)

Subsequent up is Philip Morris, one of many largest tobacco corporations on this planet by market cap. Philip Morris makes and distributes a wide range of cigarettes and associated merchandise outdoors the U.S.

Nonetheless, it’s on a long-term journey to ultimately transfer people who smoke off of its tobacco merchandise and into smoke-free merchandise. Over time, Philip Morris plans to stop being a tobacco firm, however that’s nonetheless a few years away. For now, it’s firmly within the class of sin shares, and a relatively good one.

Development in earnings has been difficult in recent times as the corporate is topic to international change fluctuations, in addition to waning demand for cigarettes particularly. We expect Philip Morris can add 3% yearly to earnings, on common, pushed by pricing will increase and share repurchases.

The corporate has a 15-year streak of dividend will increase, which started when it was spun from former guardian Altria, which we’ll have a look at under. We expect Philip Morris has a strong dividend story behind it, but in addition trying ahead.

The inventory is yielding 5.7% at this time, making it one other high-yield sin inventory at virtually 4 instances that of the S&P 500. Philip Morris trades proper at honest worth, so we don’t see any influence going ahead on returns from the valuation.

Click on right here to obtain our most up-to-date Positive Evaluation report on PM (preview of web page 1 of three proven under):

Molson Coors Beverage Firm (TAP)

Molson Coors is a producer and distributor of beer and malt drinks that operates globally. The corporate owns ubiquitous manufacturers corresponding to Coors, Molson, and Blue Moon, and has an enviable international distribution community.

Development has been exhausting to come back by in recent times after a fast ascension out of the Nice Recession. Since peak earnings had been hit in 2018, Molson Coors has struggled considerably to supply earnings development. We see 2% development going ahead as the corporate has recognizable manufacturers with pricing energy, and because the firm is aggressively slicing prices.

Molson Coors reduce its dividend through the COVID recession, so its enhance streak stands at simply two years. The dividend is almost again to pre-COVID ranges, nevertheless, and the yield is at almost 3% at this time, which is almost double that of the S&P 500.

Shares additionally commerce about 10% under honest worth, so we see a pleasant tailwind to returns from the valuation within the years to come back. Mixed with the yield and projected development, we predict Molson Coors can produce ~9% complete returns within the coming years.

Click on right here to obtain our most up-to-date Positive Evaluation report on TAP (preview of web page 1 of three proven under):

Anheuser-Busch InBev SA/NV (BUD)

Our subsequent inventory is Anheuser-Busch InBev, which is the mixture of the previously separate Anheuser-Busch and InBev companies that merged in 2008. That merger created the biggest alcoholic beverage firm on this planet, and one which owns 500 completely different beer manufacturers. These embrace Budweiser, Corona, Stella Artois, Michelob Extremely, Modelo, and extra of a few of the world’s hottest beers.

General, AB-InBev has 17 particular person beers that every generate a minimum of $1 billion in annual gross sales.

Supply: Investor Presentation

AB InBev has a spotty historical past with earnings development, because it sees peaks and troughs over time. This historical past of uneven development meant that the dividend was unsustainable in 2016 and 2017, and was reduce sharply. The corporate now pays a a lot decrease, variable dividend annually.

That dividend is sweet for a present yield round 1% at this time, that means the inventory is likely one of the lowest-yielding sin shares available in the market at this time.

Click on right here to obtain our most up-to-date Positive Evaluation report on BUD (preview of web page 1 of three proven under):

British American Tobacco PLC (BTI)

Our subsequent inventory is British American Tobacco, an organization that makes and distributes all kinds of cigarettes, snuff, heated tobacco, and oral nicotine merchandise globally. The corporate owns some extremely profitable manufacturers, together with Camel, Fortunate Strike, and Newport, amongst others.

British American Tobacco managed to spice up earnings up to now decade, though progress has seen some begins and stops. Nonetheless, we predict 3% development trying ahead is affordable given the corporate’s concentrate on share repurchases, in addition to its pricing energy with its sturdy suite of manufacturers.

The corporate pays a variable dividend annually, so its streak of dividend will increase stops relatively incessantly. As well as, dividends are declared in British kilos, so there’s a measure of forex translation danger for U.S. buyers. Even so, the inventory yields greater than 7% at this time, making it a really sturdy earnings inventory on that measure.

Shares commerce barely under honest worth, so we see a modest tailwind to complete returns from the valuation within the coming years. Mixed with the massive yield and 1% annual EPS development, that must be adequate for the inventory to supply ~11% complete annual returns over the following 5 years.

Click on right here to obtain our most up-to-date Positive Evaluation report on BTI (preview of web page 1 of three proven under):

Diageo PLC (DEO)

Diageo producers a few of the hottest spirits and beer manufacturers on this planet, corresponding to Johnnie Walker, Smirnoff, Captain Morgan, Baileys, Tanqueray, Guinness, Crown Royal, Ketel One, and lots of extra. In all, Diageo has 20 of the world’s high 100 spirits manufacturers.

Supply: Investor Presentation

Diageo raised its dividend for 9 consecutive years, and we anticipate that streak to get for much longer over time. Diageo’s payout ratio is beneath half of earnings, and its fast earnings development price ought to afford it the flexibility to proceed to extend the dividend indefinitely. The present yield is 2.4%, so whereas it’s not a pure earnings inventory, it’s nonetheless about 1.5 instances that of the S&P 500. As well as, shareholders get sturdy development potential from the dividend with Diageo.

The inventory is buying and selling just below honest worth, so we see a modest tailwind to returns from that. All advised, we anticipate to see ~11% complete annual returns within the years to come back, largely from earnings development.

Click on right here to obtain our most up-to-date Positive Evaluation report on DEO (preview of web page 1 of three proven under):

Ambev SA (ABEV)

Ambev is our subsequent sin inventory, an organization that makes and distributes a wide range of drinks, most of that are alcoholic. The corporate sells beer, draft beer, carbonated mushy drinks, malt, and meals merchandise all through a lot of the Western Hemisphere. The corporate doesn’t compete in america.

Ambev has struggled considerably with profitability through the years, owed to fluctuating income totals from 12 months to 12 months. Trying forward, we predict the corporate can common 3% development in earnings from barely larger income, and robust margins. We notice that international change is a giant line merchandise for Ambev given the wide range of geographies the place it competes, so outcomes can fluctuate from 12 months to 12 months for that purpose.

Ambev pays a variable dividend, so like a few of the others on this checklist, it sees cuts infrequently. The present payout is sweet for a 5% dividend yield, which is kind of engaging. It’s equal to about two-thirds of internet earnings, so we don’t essentially see an enormous runway for development within the payout, however the present yield is sweet.

Shares commerce at a few 20% low cost to honest worth, so we predict the valuation might produce a roughly 5% tailwind to complete returns annually for the foreseeable future.

Click on right here to obtain our most up-to-date Positive Evaluation report on ABEV (preview of web page 1 of three proven under):

Altria Group Inc. (MO)

Altria Group was based by Philip Morris in 1847. Immediately, it’s a shopper staples big. It sells the Marlboro cigarette model within the U.S. and quite a few different non-smokeable manufacturers, together with Skoal and Copenhagen.

Altria has elevated its dividend for over 50 years, putting it on the unique Dividend Kings checklist. It is a uncommon enterprise longevity achievement that speaks to the endurance of the corporate’s manufacturers, even with the gradual decline in smoking within the U.S.

Supply: Investor Presentation

On August 1st, 2023, Altria reported second-quarter outcomes. Its adjusted diluted earnings per share got here in at $1.31, up 4% year-over-year, whereas its internet revenues declined by 0.5% year-over-year.

Administration reaffirmed its 2023 full 12 months steering vary of adjusted diluted earnings per share of between $4.89 and $5.03, reflecting a possible development vary of 1-4% year-over-year.

Click on right here to obtain our most up-to-date Positive Evaluation report on Altria (preview of web page 1 of three proven under):

Vector Group Ltd. (VGR)

Our last inventory is Vector Group, a conglomerate that makes and sells cigarettes within the U.S, in addition to an actual property enterprise that invests in properties. Vector’s main enterprise is promoting cigarettes, a portfolio that features about 100 manufacturers, largely within the decrease finish of the market that competes on worth.

Development has been fairly good for Vector, together with 2021 that noticed a close to doubling of earnings-per-share. We see sturdy earnings once more this 12 months, adopted by 3% development within the years to come back.

Vector beforehand had an unsustainable dividend, nevertheless it was reduce in 2020 and has been flat ever since. Even so, the inventory yields over 7%, which is able to drive sturdy complete returns within the years to come back.

Click on right here to obtain our most up-to-date Positive Evaluation report on VGR (preview of web page 1 of three proven under):

Last Ideas

Whereas sin shares usually don’t supply an enormous quantity of development to buyers, they usually sport very excessive dividend yields, and commerce for affordable earnings multiples. This checklist contains some high-yield names, good worth shares, and a few larger development names. All pay dividends, and all supply good complete return prospects for the years to come back.

The next articles include shares with very lengthy dividend or company histories, ripe for choice for dividend development buyers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.