Revealed on July nineteenth, 2023 by Bob Ciura

The Dividend Kings are the best-of-the-best in dividend longevity.

What’s a Dividend King? A inventory with 50 or extra consecutive years of dividend will increase.

The downloadable Dividend Kings Spreadsheet Checklist under accommodates the next for every inventory within the index amongst different vital investing metrics:

- Payout ratio

- Dividend yield

- Value-to-earnings ratio

You’ll be able to see the complete downloadable spreadsheet of all 50 Dividend Kings (together with vital monetary metrics comparable to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink under:

The one requirement to be a Dividend King, is 50+ years of rising dividends.

However not all Dividend Kings make equally good investments right now. Some Dividend Kings are higher than others, primarily based on the sustainability of their dividends.

With this in thoughts, we have now analyzed the ten most secure Dividend Kings from our Certain Evaluation Analysis Database with the most secure dividends primarily based on our Dividend Threat Rating score system.

The next 10 Dividend Kings have Dividend Threat Scores of A (our prime score), and the bottom payout ratios. Consequently, they’re the most secure Dividend Kings for 2023.

Desk of Contents

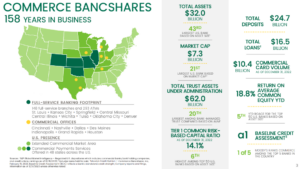

Most secure Dividend Kings #10: Commerce Bancshares (CBSH)

Commerce Bancshares is a financial institution holding for Commerce Financial institution. It affords common banking companies to its prospects. Its companies embrace retail and company banking, in addition to asset administration, funding banking, and different choices.

The corporate was based in 1865 and operates branches in Colorado, Kansas, Missouri, Illinois, and Oklahoma.

Supply: Investor Presentation

Commerce Bancshares reported its first quarter earnings outcomes on April 18. Revenues of $390 million rose 14% from the earlier yr’s quarter. Throughout the quarter, Commerce Bancshares’ mortgage portfolio averaged $15.9 billion, up 1.5% sequentially. Provisions for mortgage losses had been considerably greater than in the course of the earlier quarter, rising by one-third.

Commerce Bancshares generated earnings-per-share of $0.95 in the course of the first quarter, which was up 3% in comparison with the earlier yr’s quarter, with greater revenues greater than offsetting the headwind from greater provisions for credit score losses.

Click on right here to obtain our most up-to-date Certain Evaluation report on Commerce Bancshares (preview of web page 1 of three proven under):

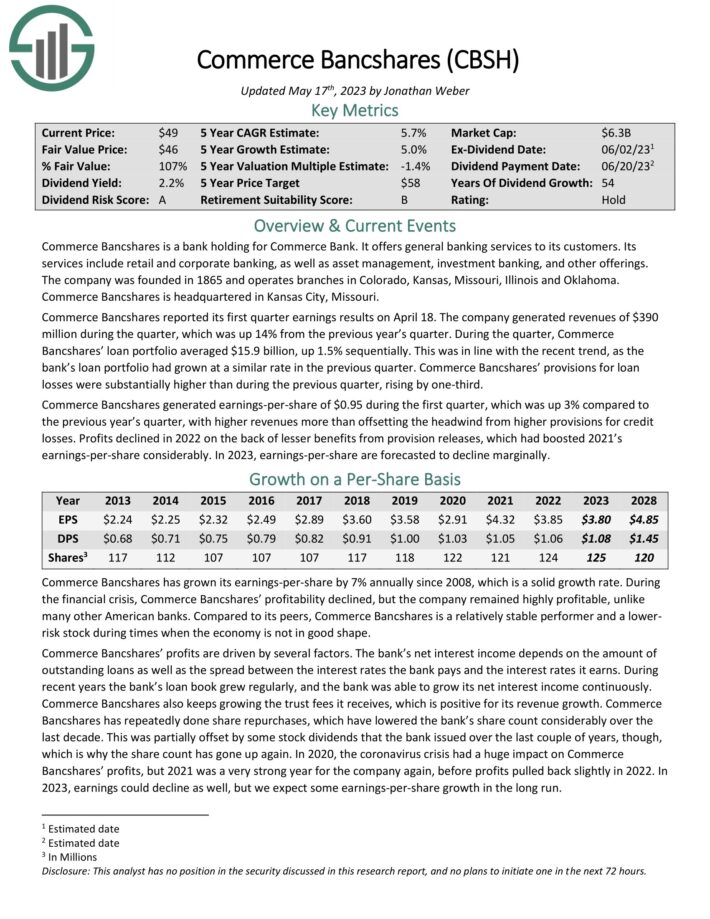

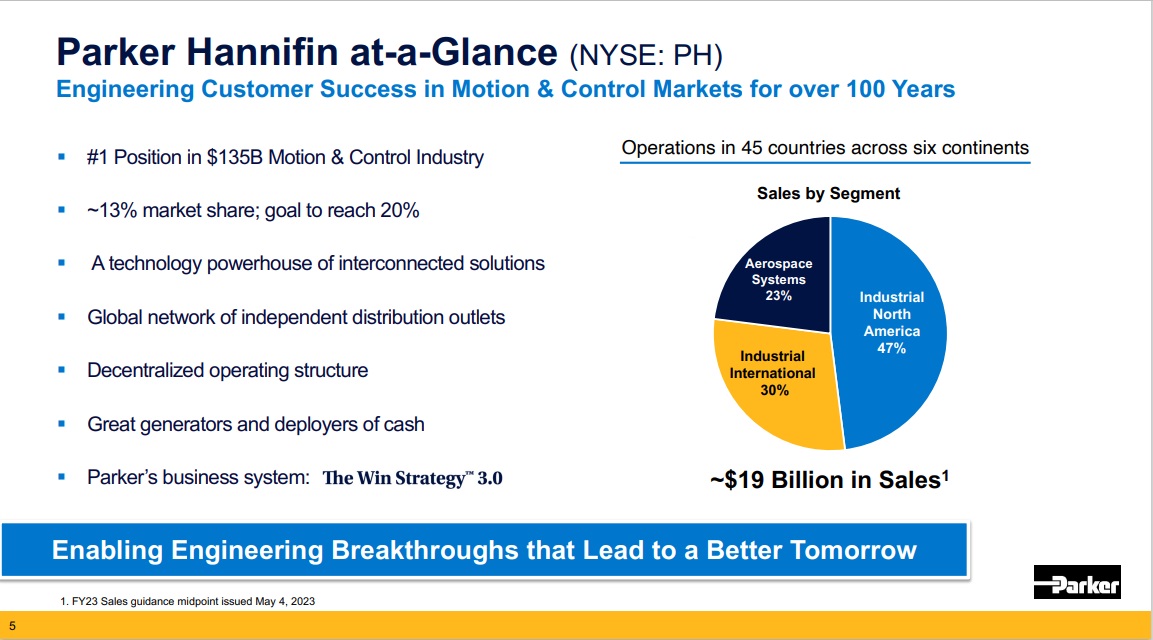

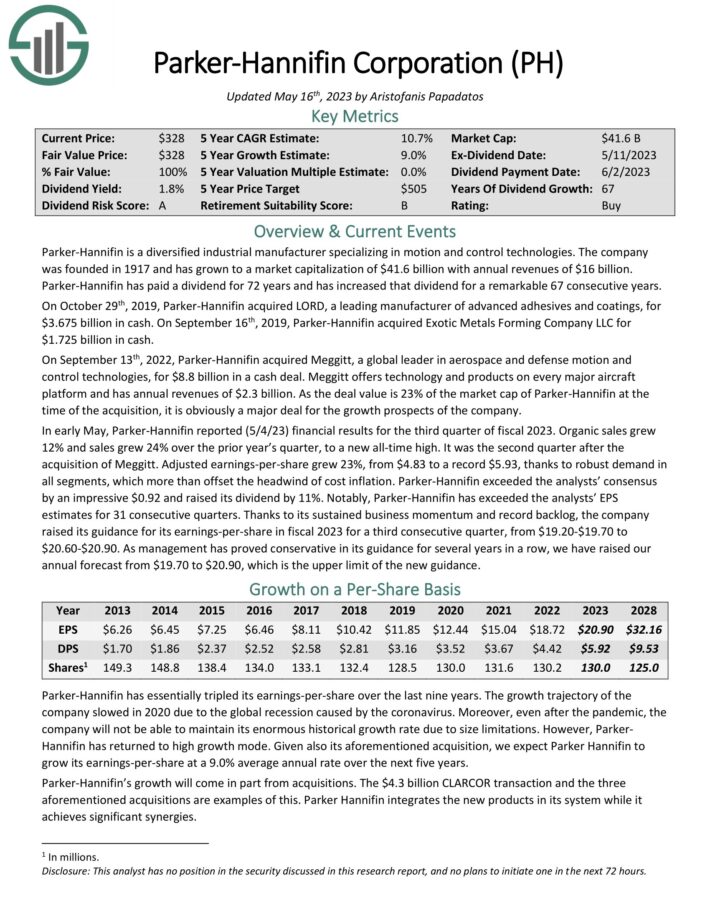

Most secure Dividend Kings #9: Parker-Hannifin (PH)

Parker-Hannifin is a diversified industrial producer specializing in movement and management applied sciences. The corporate generates annual revenues of $16 billion. Parker-Hannifin has paid a dividend for 72 years and has elevated the dividend for 67 consecutive years.

Supply: Investor Presentation

In early Could, Parker-Hannifin reported (5/4/23) monetary outcomes for the third quarter of fiscal 2023. Natural gross sales grew 12% and gross sales grew 24% over the prior yr’s quarter, to a brand new all-time excessive. Adjusted earnings-per-share grew 23%, from $4.83 to a file $5.93, due to sturdy demand in all segments, which greater than offset the headwind of price inflation.

Parker-Hannifin exceeded the analysts’ consensus by a formidable $0.92 and raised its dividend by 11%. Notably, Parker-Hannifin has exceeded the analysts’ EPS estimates for 31 consecutive quarters.

Click on right here to obtain our most up-to-date Certain Evaluation report on Parker-Hannifin (preview of web page 1 of three proven under):

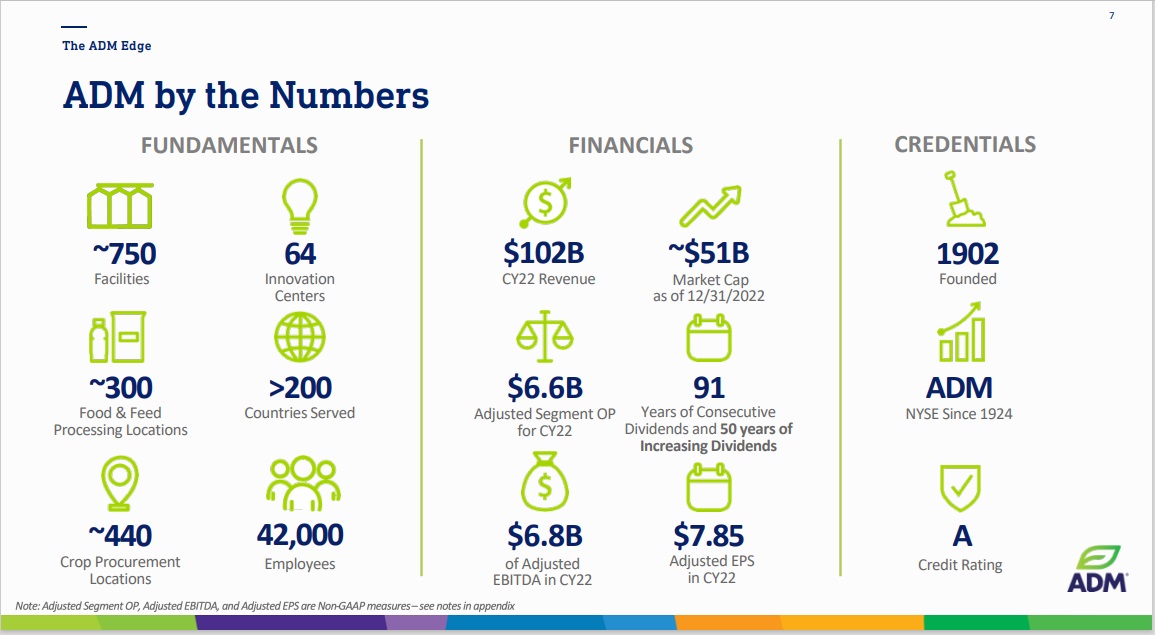

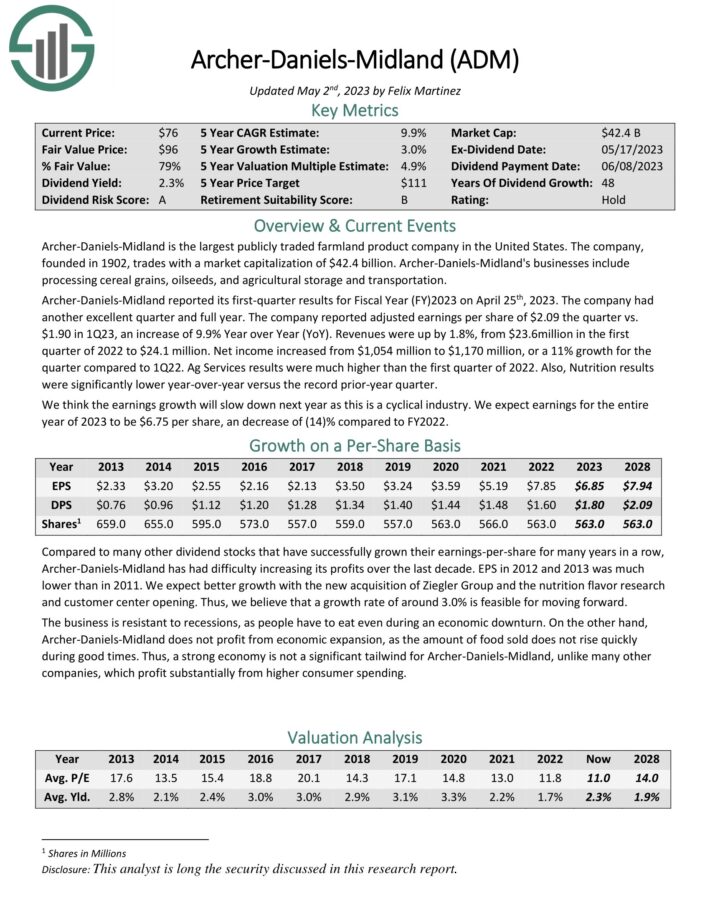

Most secure Dividend Kings #8: Archer-Daniels Midland (ADM)

Archer-Daniels-Midland is likely one of the prime agriculture shares. ADM is the most important publicly traded farmland product firm in the US. Its companies embrace processing cereal grains, oil seeds, and agricultural storage and transportation.

Supply: Investor Presentation

Archer-Daniels-Midland reported its first-quarter outcomes on April twenty fifth, 2023. The corporate had one other glorious quarter. The corporate reported adjusted earnings per share of $2.09 the quarter versus $1.90 in 1Q23, a rise of 9.9% year-over-year.

Revenues had been up by 1.8%, from $23.6million within the first quarter of 2022 to $24.1 million. Web earnings elevated from $1,054 million to $1,170 million, or a 11% development for the quarter in comparison with the primary quarter of 2022.

Click on right here to obtain our most up-to-date Certain Evaluation report on ADM (preview of web page 1 of three proven under):

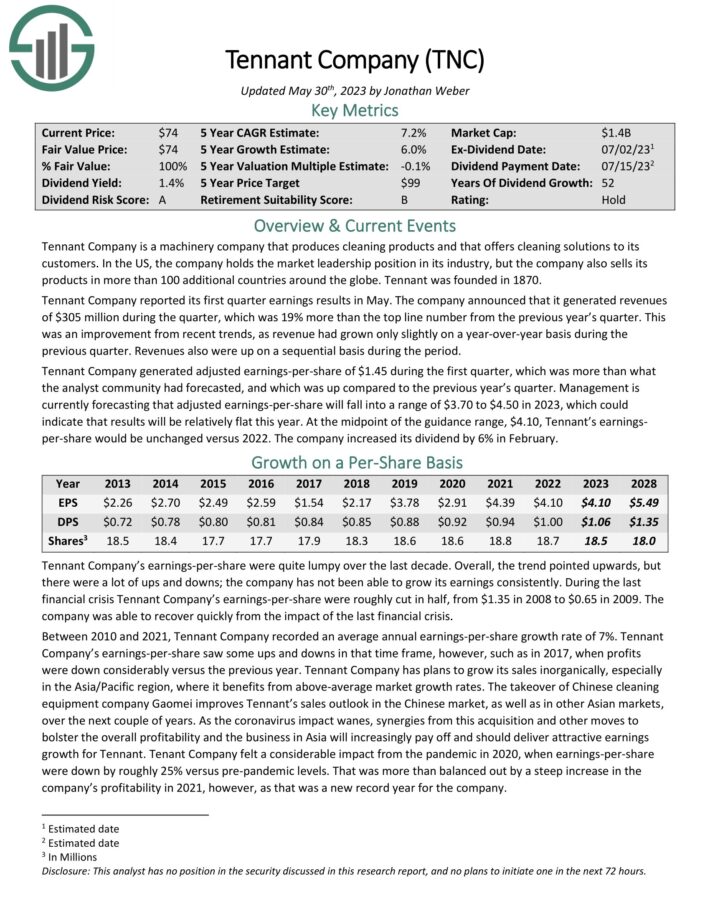

Most secure Dividend Kings #7: Tennant Co. (TNC)

Tennant Firm is a equipment firm that produces cleansing merchandise and affords cleansing options to its prospects. Within the US, the corporate holds the market management place in its trade, however it additionally sells its merchandise in additional than 100 extra international locations across the globe.

Supply: Investor Presentation

Tennant Firm reported its first quarter earnings ends in Could. It generated revenues of $305 million in the course of the quarter, which was 19% greater than the earlier yr’s quarter. This was an enchancment from latest tendencies, as income had grown solely barely on a year-over-year foundation in the course of the earlier quarter.

Tennant Firm generated adjusted earnings-per-share of $1.45 in the course of the first quarter, which was greater than what the analyst neighborhood had forecasted, and which was up in comparison with the earlier yr’s quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on Tennant Firm (preview of web page 1 of three proven under):

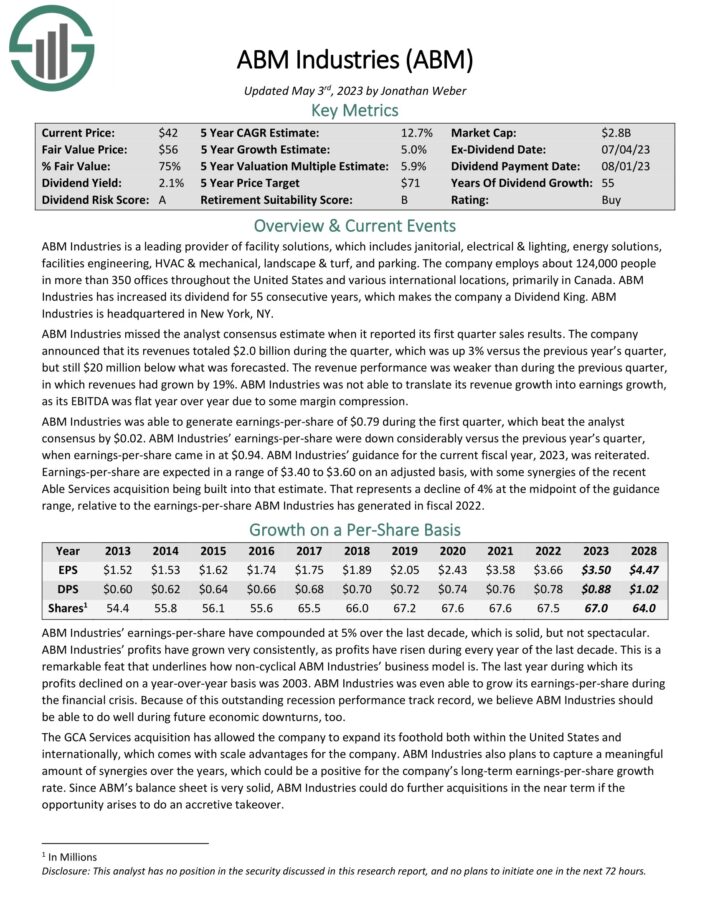

Most secure Dividend Kings #6: ABM Industries (ABM)

ABM Industries is a number one supplier of facility options, which incorporates janitorial, electrical & lighting, power options, amenities engineering, HVAC & mechanical, panorama & turf, and parking. ABM Industries has elevated its dividend for 55 consecutive years.

First-quarter revenues totaled $2.0 billion, which was up 3% versus the earlier yr’s quarter, however nonetheless $20 million under forecasts. EBITDA was flat yr over yr resulting from some margin compression. ABM Industries was in a position to generate earnings-per-share of $0.79 in the course of the first quarter, which beat the analyst consensus by $0.02.

ABM Industries’ earnings-per-share had been down significantly versus the earlier yr’s quarter, when earnings-per-share got here in at $0.94. ABM Industries’ steering for the present fiscal yr, 2023, was reiterated. Earnings-per-share are anticipated in a variety of $3.40 to $3.60 on an adjusted foundation.

Click on right here to obtain our most up-to-date Certain Evaluation report on ABM (preview of web page 1 of three proven under):

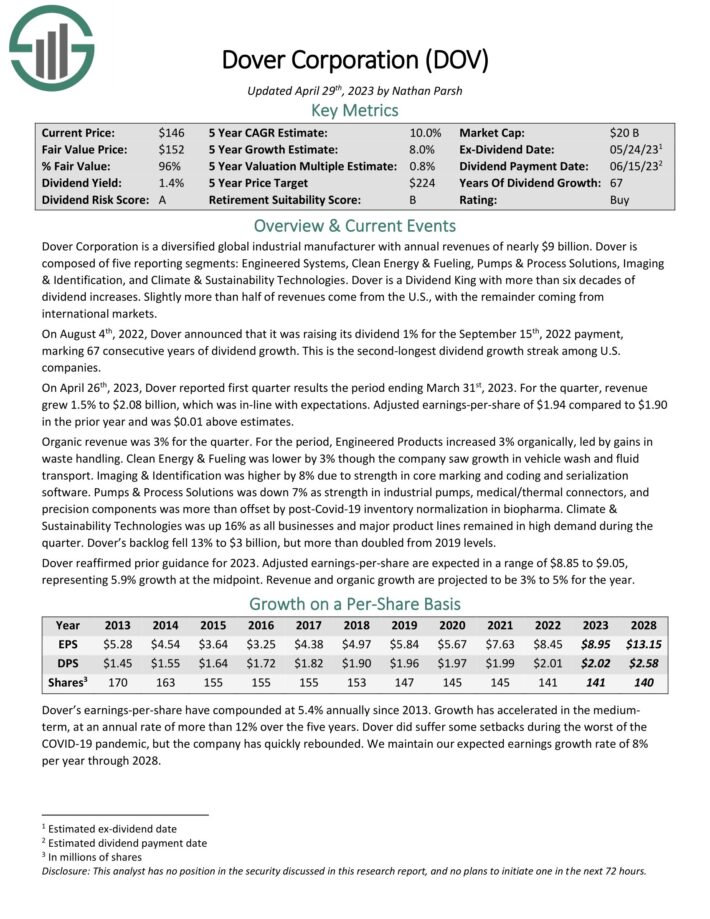

Most secure Dividend Kings #5: Dover Company (DOV)

Dover Company is a diversified world industrial producer with annual revenues of practically $9 billion. Dover consists of 5 reporting segments: Engineered Methods, Clear Power & Fueling, Pumps & Course of Options, Imaging & Identification, and Local weather & Sustainability Applied sciences. Barely greater than half of revenues come from the U.S., with the rest coming from worldwide markets.

On April twenty sixth, 2023, Dover reported first quarter outcomes the interval ending March thirty first, 2023. For the quarter, income grew 1.5% to $2.08 billion, which was in-line with expectations. Adjusted earnings-per-share of $1.94 in comparison with $1.90 within the prior yr and was $0.01 above estimates.

Click on right here to obtain our most up-to-date Certain Evaluation report on DOV (preview of web page 1 of three proven under):

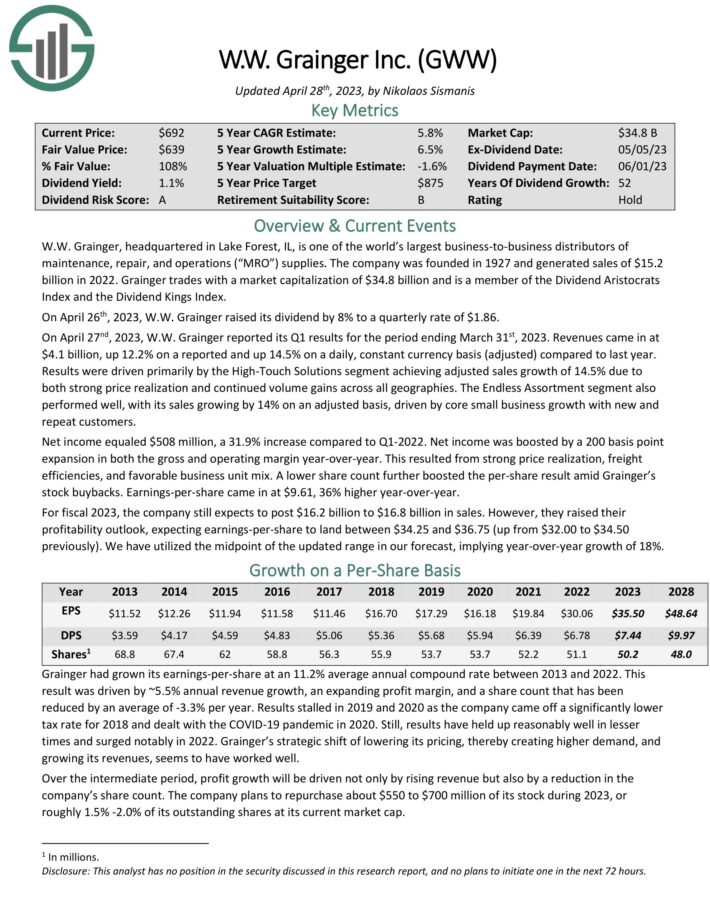

Most secure Dividend Kings #4: W.W. Grainger (GWW)

W.W. Grainger, headquartered in Lake Forest, IL, is likely one of the world’s largest business-to-business distributors of upkeep, restore, and operations (“MRO”) provides.

On April 27nd, 2023, W.W. Grainger reported its Q1 outcomes for the interval ending March thirty first, 2023. Revenues got here in at $4.1 billion, up 12.2% on a reported and up 14.5% on a every day, fixed forex foundation (adjusted) in comparison with final yr. Outcomes had been pushed primarily by the Excessive-Contact Options phase reaching adjusted gross sales development of 14.5% resulting from each sturdy worth realization and continued quantity positive factors throughout all geographies.

Click on right here to obtain our most up-to-date Certain Evaluation report on GWW (preview of web page 1 of three proven under):

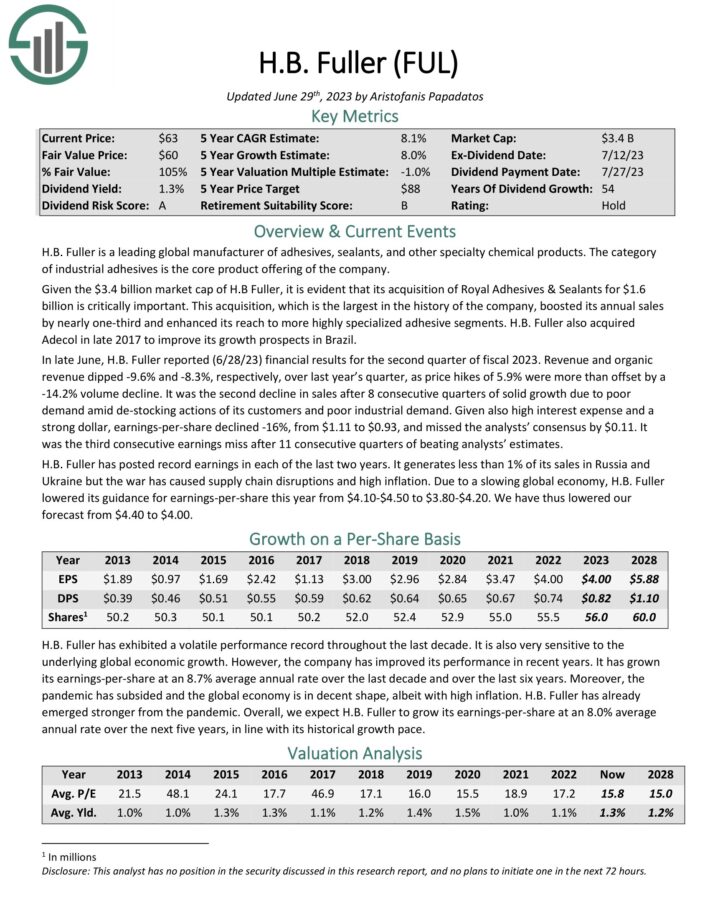

Most secure Dividend Kings #3: H.B. Fuller (FUL)

H.B. Fuller is a number one world producer of adhesives, sealants, and different specialty chemical merchandise. The class of business adhesives is the core product providing of the corporate.

In late June, H.B. Fuller reported (6/28/23) monetary outcomes for the second quarter of fiscal 2023. Income and natural income declined by 9.6% and eight.3%, respectively, over final yr’s quarter, as worth hikes of 5.9% had been greater than offset by a 14.2% quantity decline.

Given additionally excessive curiosity expense and a robust greenback, earnings-per-share declined -16%, from $1.11 to $0.93, and missed the analysts’ consensus by $0.11. It was the third consecutive earnings miss after 11 consecutive quarters of beating analysts’ estimates.

As a result of a slowing world financial system, H.B. Fuller lowered its steering for earnings-per-share this yr from $4.10-$4.50 to $3.80-$4.20.

Click on right here to obtain our most up-to-date Certain Evaluation report on H.B. Fuller (preview of web page 1 of three proven under):

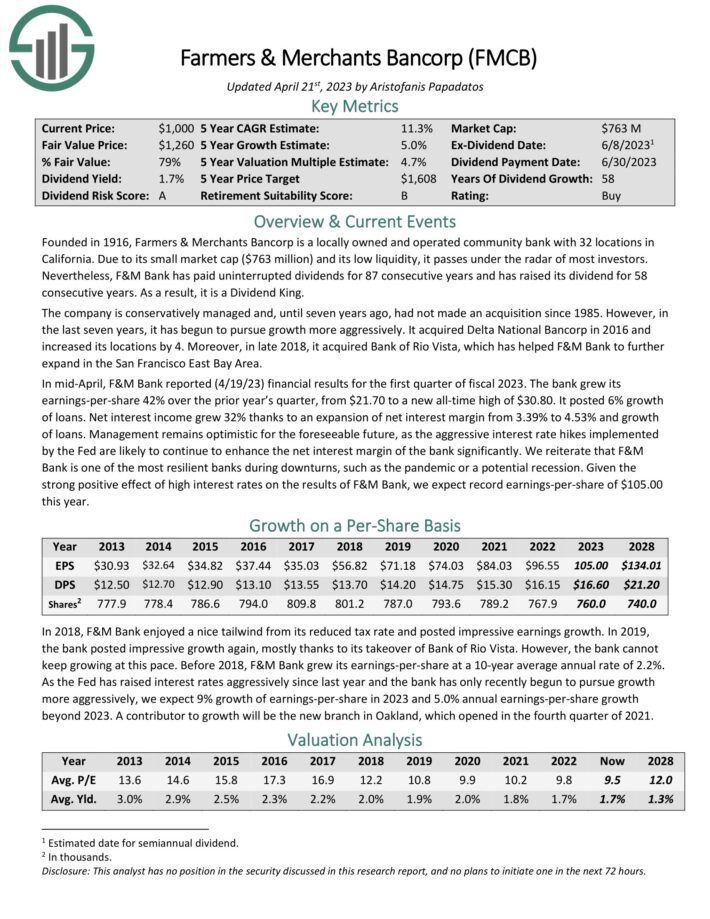

Most secure Dividend Kings #2: Farmers & Retailers Bancorp (FMCB)

Farmers & Retailers Bancorp is a domestically owned and operated neighborhood financial institution with 32 places in California. F&M Financial institution has paid uninterrupted dividends for 87 consecutive years and has raised its dividend for 58 consecutive years.

In mid-April, F&M Financial institution reported (4/19/23) monetary outcomes for the primary quarter of fiscal 2023. The financial institution grew its earnings-per-share 42% over the prior yr’s quarter, from $21.70 to a brand new all-time excessive of $30.80. It posted 6% development of loans. Web curiosity earnings grew 32% due to an enlargement of web curiosity margin from 3.39% to 4.53% and development of loans.

Click on right here to obtain our most up-to-date Certain Evaluation report on FMCB (preview of web page 1 of three proven under):

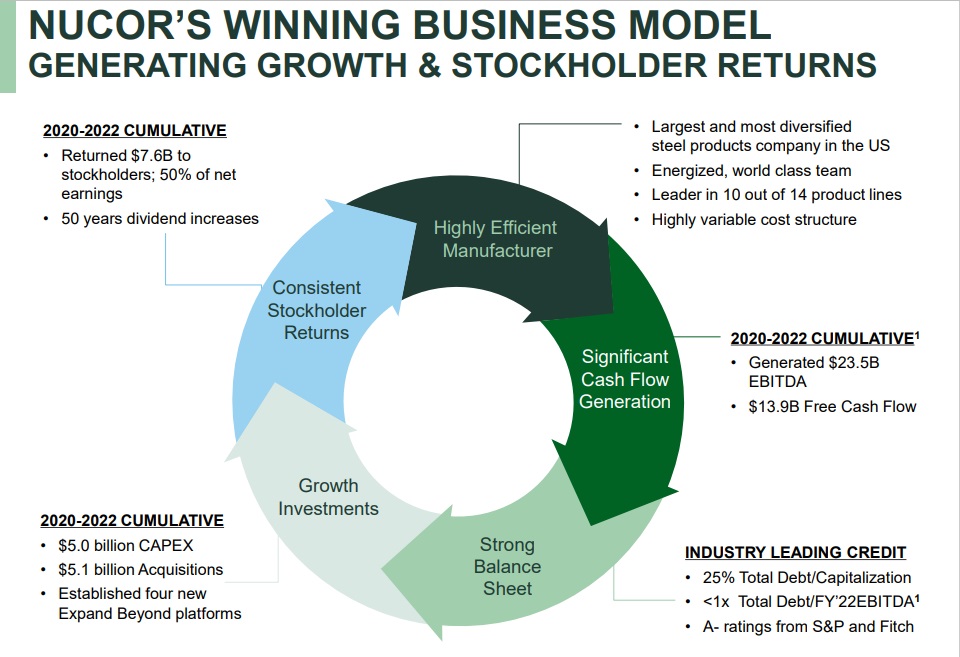

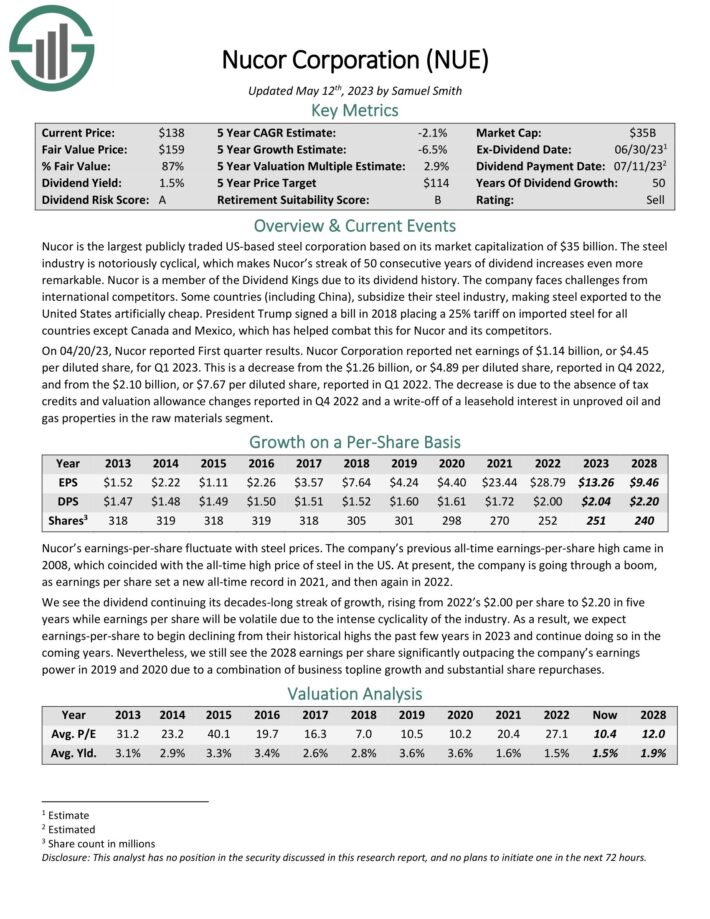

Most secure Dividend Kings #1: Nucor Corp. (NUE)

Nucor is the most important publicly traded US-based metal company. The metal trade is notoriously cyclical, which makes Nucor’s streak of fifty consecutive years of dividend will increase much more exceptional.

Supply: Investor Presentation

On 04/20/23, Nucor reported First quarter outcomes. Nucor Company reported web earnings of $1.14 billion, or $4.45 per diluted share, for Q1 2023. It is a lower from the $1.26 billion, or $4.89 per diluted share, reported in This autumn 2022, and from the $2.10 billion, or $7.67 per diluted share, reported in Q1 2022.

The lower is because of the absence of tax credit and valuation allowance adjustments reported in This autumn 2022 and a write-off of a leasehold curiosity in unproved oil and fuel properties within the uncooked supplies phase.

Click on right here to obtain our most up-to-date Certain Evaluation report on NUE (preview of web page 1 of three proven under):

Remaining Ideas

The Dividend Kings are a gaggle of high-quality companies with shareholder-friendly administration groups which have sturdy aggressive benefits.

Buying companies with these traits at truthful or higher costs and holding them for lengthy durations of time will seemingly end in sturdy long-term funding efficiency.

The ten shares introduced on this article have the best Dividend Threat scores in our database, in addition to the bottom dividend payout ratios. Consequently, they’re the most secure Dividend Kings.

Screening to seek out the most secure Dividend Kings is just not the one technique to discover high-quality dividend development inventory concepts.

Certain Dividend maintains comparable databases on the next helpful universes of shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].