Printed on January twenty first, 2025 by Bob Ciura

Rock stable dividend shares could be held for the long-run.

At Certain Dividend, we concentrate on dividend paying securities to create a long time of rising dividend earnings.

On the subject of rock stable dividend shares, there aren’t any higher shares than the Dividend Kings. The Dividend Kings are the best-of-the-best in dividend longevity.

What’s a Dividend King? A inventory with 50 or extra consecutive years of dividend will increase.

You’ll be able to see the complete downloadable spreadsheet of all 54 Dividend Kings (together with essential monetary metrics comparable to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink under:

This text will record the ten Dividend Kings with the very best 5-year dividend development fee, from lowest to highest.

With their outsized dividend development potential, these 10 Dividend Kings are rock stable dividend shares to purchase and maintain for the long term.

Desk of Contents

You’ll be able to immediately bounce to any particular part of the article by clicking on the hyperlinks under:

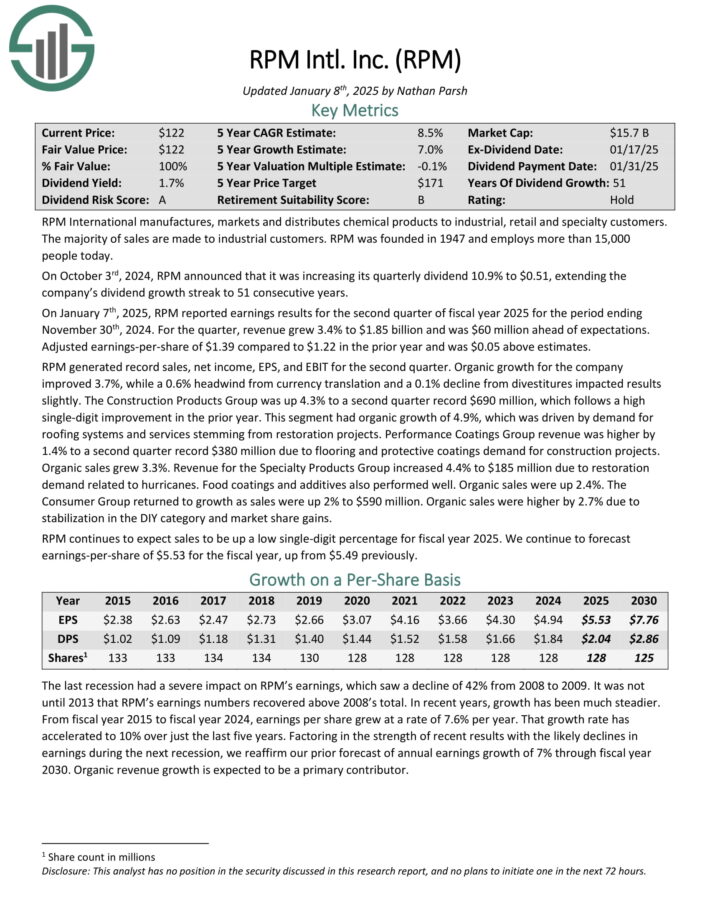

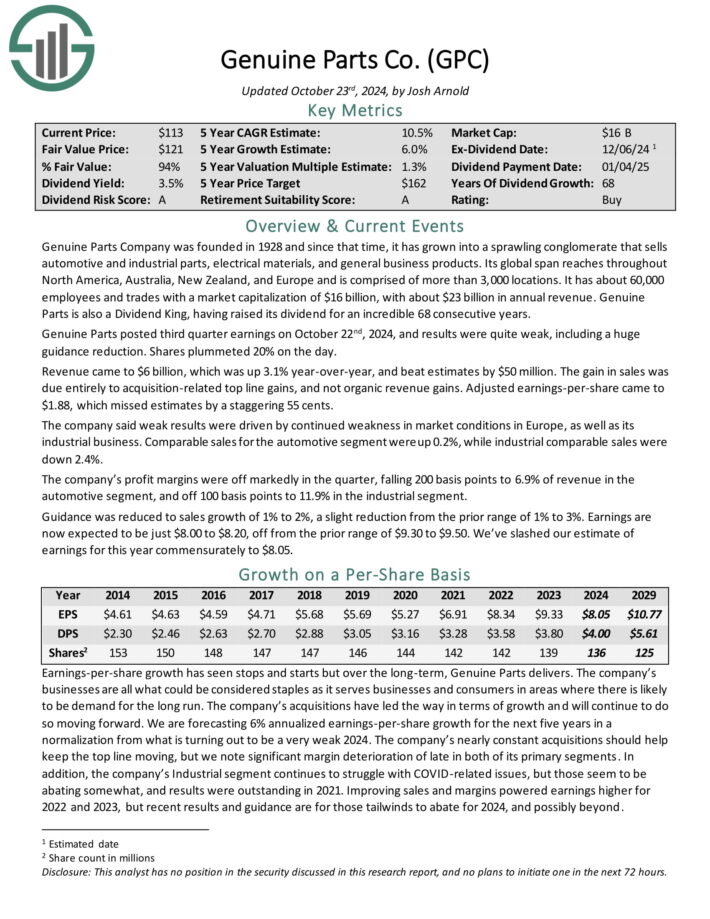

Rock Strong Dividend Inventory: RPM Worldwide (RPM)

- 5-year dividend development: 7.0%

RPM Worldwide manufactures, markets and distributes chemical merchandise to industrial, retail and specialty clients. The vast majority of gross sales are made to industrial clients.

On October third, 2024, RPM introduced that it was rising its quarterly dividend 10.9% to $0.51, extending the corporate’s dividend development streak to 51 consecutive years.

On January seventh, 2025, RPM reported earnings outcomes for the second quarter of fiscal yr 2025. For the quarter, income grew 3.4% to $1.85 billion and was $60 million forward of expectations. Adjusted earnings-per-share of $1.39 in comparison with $1.22 within the prior yr and was $0.05 above estimates.

RPM generated report gross sales, internet earnings, EPS, and EBIT for the second quarter. Natural development for the corporate improved 3.7%, whereas a 0.6% headwind from forex translation and a 0.1% decline from divestitures impacted outcomes barely.

The Development Merchandise Group was up 4.3% to a second quarter report $690 million, which follows a excessive single-digit enchancment within the prior yr. This phase had natural development of 4.9%, which was pushed by demand for roofing methods and providers stemming from restoration tasks.

Efficiency Coatings Group income was larger by 1.4% to a second quarter report $380 million as a consequence of flooring and protecting coatings demand for building tasks. Natural gross sales grew 3.3%.

Click on right here to obtain our most up-to-date Certain Evaluation report on RPM (preview of web page 1 of three proven under):

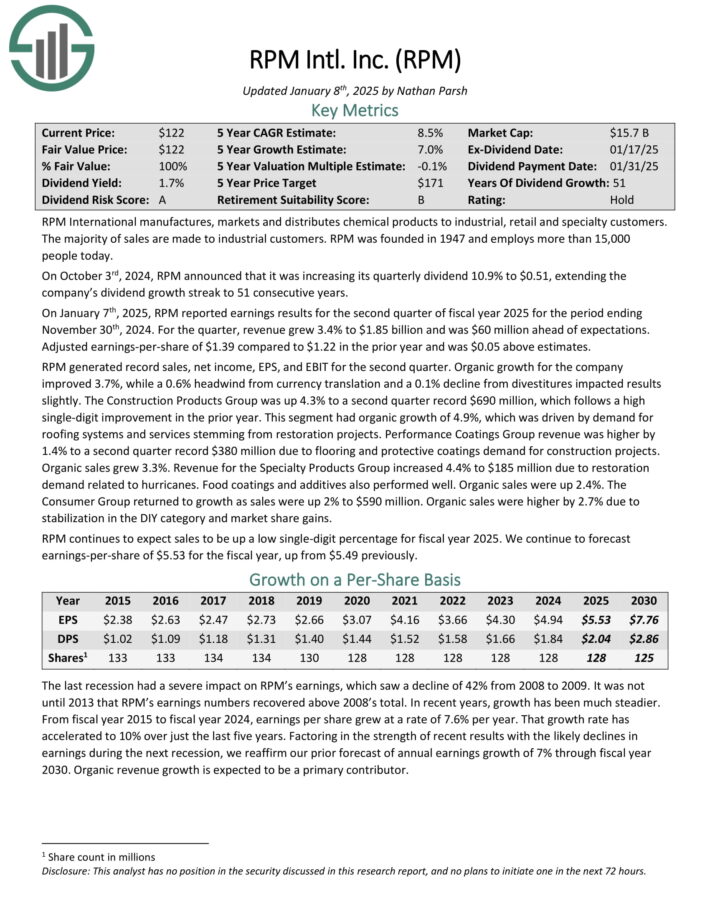

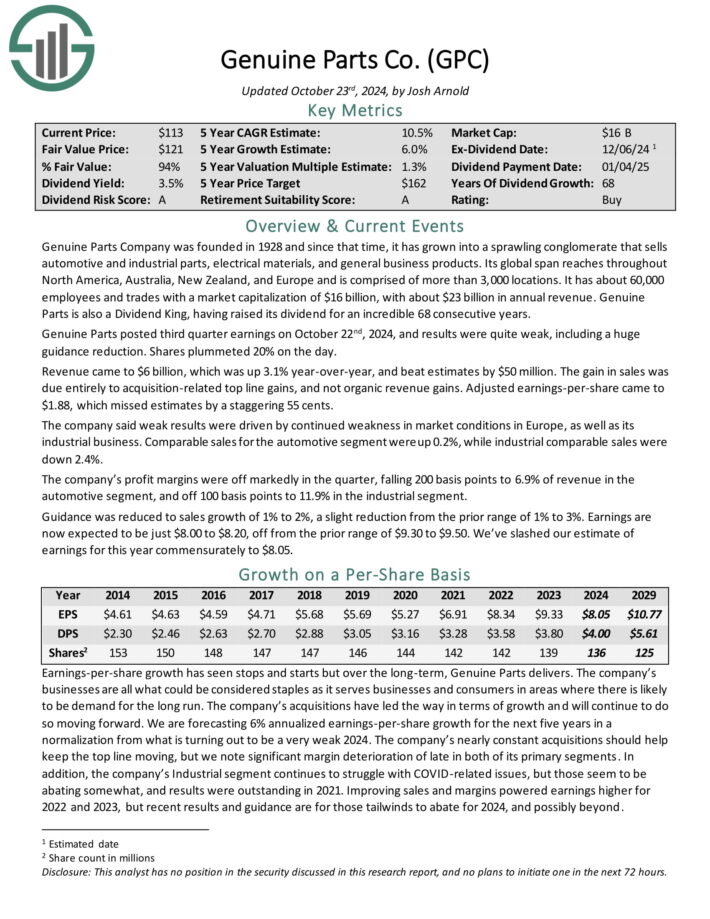

Rock Strong Dividend Inventory: Real Elements Firm (GPC))

- 5-year dividend development: 7.0%

Real Elements has the world’s largest world auto components community, with greater than 10,800 areas worldwide. As a significant distributor of automotive and industrial components, Real Elements generates annual income of almost $23 billion.

Supply: Investor Presentation

It operates two segments, that are automotive (contains the NAPA model) and the economic components group which sells industrial substitute components to MRO (upkeep, restore, and operations) and OEM (unique gear producer) clients.

Clients are derived from a variety of segments, together with meals and beverage, metals and mining, oil and gasoline, and well being care.

The corporate reported its third-quarter 2024 outcomes, with gross sales reaching $6.0 billion, a 2.5% enhance from the earlier yr.

Internet earnings fell to $227 million, or $1.62 per diluted share, down from $351 million in Q3 2023. Adjusted diluted earnings per share (EPS) additionally decreased to $1.88 in comparison with $2.49 final yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on GPC (preview of web page 1 of three proven under):

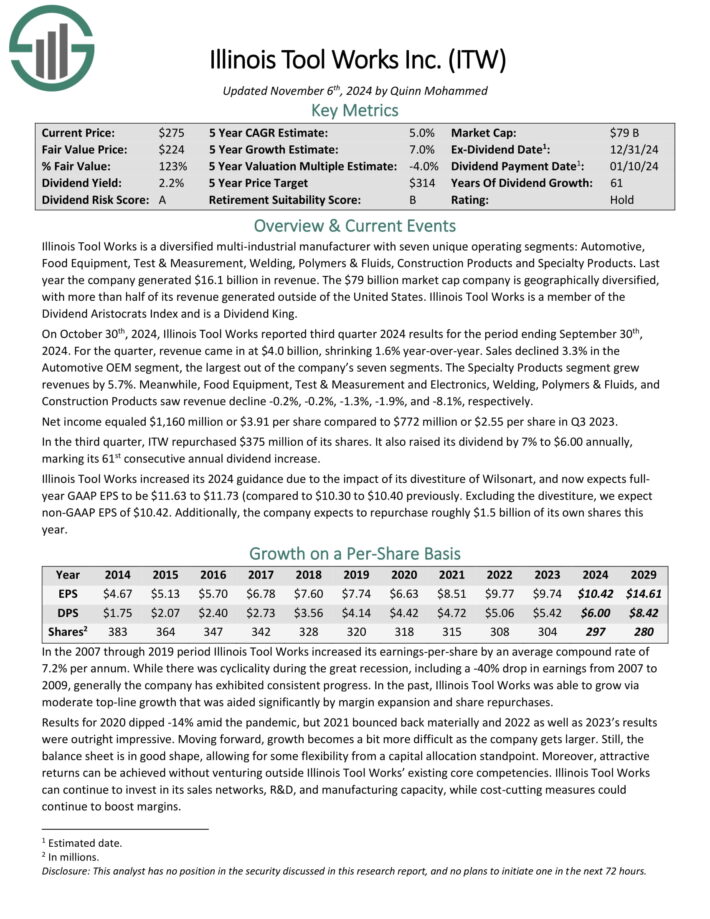

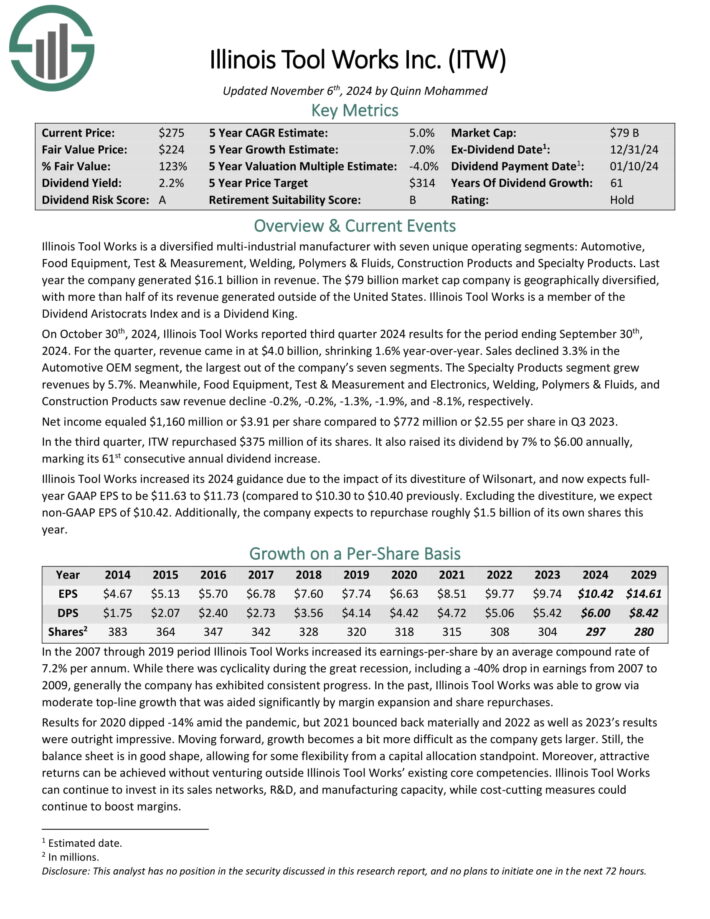

Rock Strong Dividend Inventory: Illinois Device Works (ITW)

- 5-year dividend development: 7.0%

Illinois Device Works is a diversified multi-industrial producer with seven distinctive working segments: Automotive, Meals Tools, Check & Measurement, Welding, Polymers & Fluids, Development Merchandise and Specialty Merchandise.

Final yr the corporate generated $16.1 billion in income.

On October thirtieth, 2024, Illinois Device Works reported third quarter 2024 outcomes for the interval ending September thirtieth, 2024. For the quarter, income got here in at $4.0 billion, shrinking 1.6% year-over-year.

Gross sales declined 3.3% within the Automotive OEM phase, the most important out of the corporate’s seven segments.

The Specialty Merchandise phase grew revenues by 5.7%. In the meantime, Meals Tools, Check & Measurement and Electronics, Welding, Polymers & Fluids and Development Merchandise noticed income decline -0.2%, -0.2%, -1.3%, -1.9%, and -8.1%, respectively.

Internet earnings equaled $1,160 million or $3.91 per share in comparison with $772 million or $2.55 per share in Q3 2023. Within the third quarter, ITW repurchased $375 million of its shares.

It additionally raised its dividend by 7% to $6.00 yearly, marking its 61st consecutive annual dividend enhance.

Click on right here to obtain our most up-to-date Certain Evaluation report on ITW (preview of web page 1 of three proven under):

Rock Strong Dividend Inventory: Stepan Co. (SCL)

- 5-year dividend development: 8.0%

Stepan manufactures fundamental and intermediate chemical compounds, together with surfactants, specialty merchandise, germicidal and cloth softening quaternaries, phthalic anhydride, polyurethane polyols and particular substances for the meals, complement, and pharmaceutical markets.

It’s organized into three distinct enterprise strains: surfactants, polymers, and specialty merchandise. These companies serve all kinds of finish markets, that means that Stepan shouldn’t be beholden to only a handful of industries.

Supply: Investor presentation

The surfactants enterprise is Stepan’s largest by income, accounting for ~68% of whole gross sales in the newest quarter. A surfactant is an natural compound that incorporates each water-soluble and water-insoluble parts.

Stepan posted third quarter earnings on October thirtieth, 2024, and outcomes have been combined. Adjusted earnings-per-share got here in effectively forward of expectations at $1.03, which was 38 cents higher than anticipated.

Income fell nearly 3% year-over-year to $547 million, and missed estimates by over $30 million.

World gross sales quantity fell 1% year-over-year, as double-digit development in a number of of the corporate’s Surfactant finish markets have been totally offset by demand weak spot in Polymers.

Click on right here to obtain our most up-to-date Certain Evaluation report on SCL (preview of web page 1 of three proven under):

Rock Strong Dividend Inventory: W.W. Grainger (GWW)

- 5-year dividend development: 8.0%

W.W. Grainger, headquartered in Lake Forest, IL, is among the world’s largest business-to-business distributors of upkeep, restore, and operations (“MRO”) provides.

Grainger has greater than 4.5 million lively clients, with greater than 30 million merchandise provided globally.

Supply: Investor Presentation

On October thirty first, 2024, W.W. Grainger reported its Q3 outcomes for the interval ending September thirtieth, 2024. Gross sales have been $4.39 billion, up 4.3% on a reported foundation and up 4.0% on a every day, fixed forex foundation (adjusted) in comparison with final yr.

Outcomes have been pushed by stable efficiency throughout the board. The Excessive-Contact Options phase achieved gross sales development of three.3% as a consequence of stable quantity development in all geographies. Within the Limitless Assortment phase, gross sales have been up 8.1%.

Income development for the phase was pushed by core B2B clients at Zoro and powerful efficiency throughout MonotaRO, most notably with Enterprise clients.

Internet earnings equaled $486 million, up simply 2.8% in comparison with Q3-2022. Earnings-per-share got here in at $9.87, 4.7% larger year-over-year.

Click on right here to obtain our most up-to-date Certain Evaluation report on GWW (preview of web page 1 of three proven under):

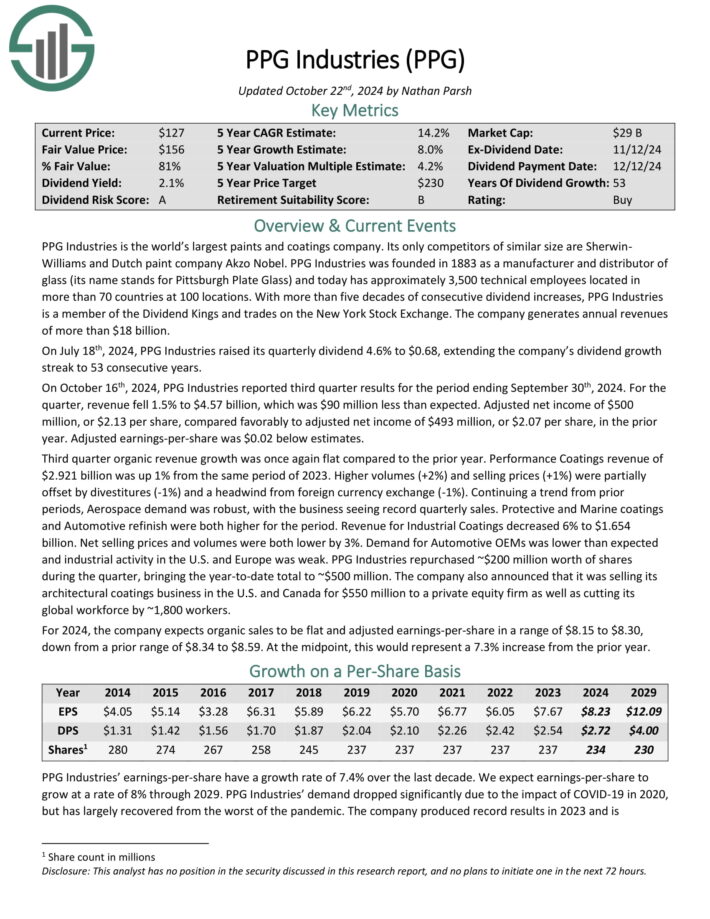

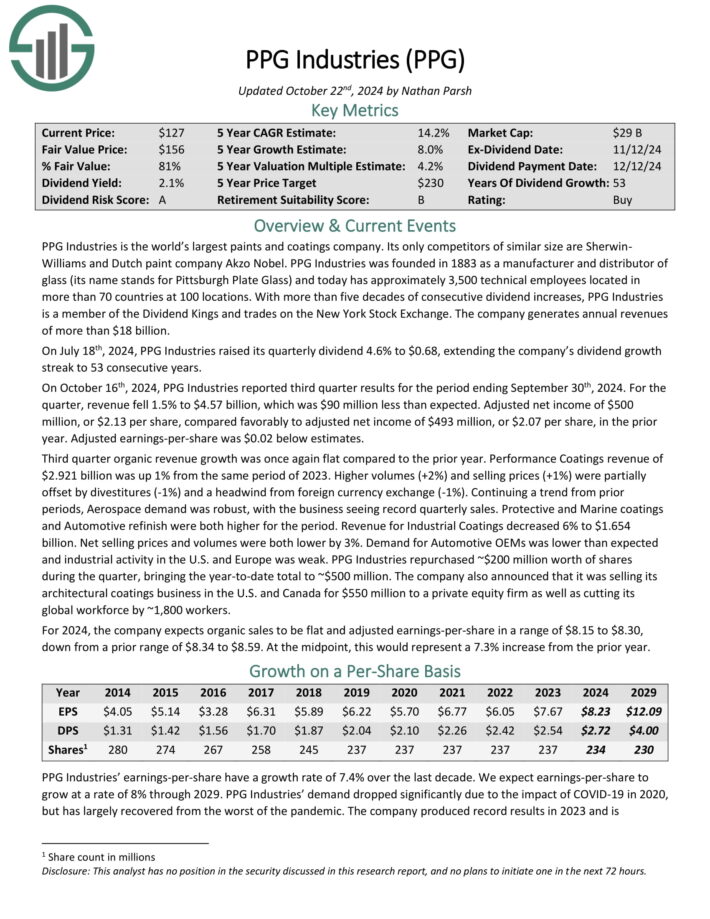

Rock Strong Dividend Inventory: PPG Industries (PPG)

- 5-year dividend development: 8.0%

PPG Industries is the world’s largest paints and coatings firm. Its solely opponents of comparable dimension are Sherwin-Williams and Dutch paint firm Akzo Nobel.

On October sixteenth, 2024, PPG Industries reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income fell 1.5% to $4.57 billion, which was $90 million lower than anticipated.

The corporate generates annual income of about $18.2 billion.

Supply: Investor Presentation

Adjusted internet earnings of $500 million, or $2.13 per share, in contrast favorably to adjusted internet earnings of $493 million, or $2.07 per share, within the prior yr. Adjusted earnings-per-share was $0.02 under estimates.

Third quarter natural income development was as soon as once more flat in comparison with the prior yr. Efficiency Coatings income of $2.921 billion was up 1% from the identical interval of 2023.

Increased volumes (+2%) and promoting costs (+1%) have been partially offset by divestitures (-1%) and a headwind from overseas forex alternate (-1%).

Click on right here to obtain our most up-to-date Certain Evaluation report on PPG (preview of web page 1 of three proven under):

Rock Strong Dividend Inventory: Lowe’s Firms (LOW)

- 5-year dividend development: 9.0%

Lowe’s Firms is the second-largest dwelling enchancment retailer within the US (after House Depot). It operates or providers greater than 1,700 dwelling enchancment and {hardware} shops within the U.S.

Lowe’s reported third quarter 2024 outcomes on November nineteenth, 2024. Whole gross sales got here in at $20.2 billion in comparison with $20.5 billion in the identical quarter a yr in the past.

Comparable gross sales decreased by 1.1%, whereas internet earnings-per-share of $2.99 in comparison with $3.06 in third quarter 2023.

Adjusted EPS was even decrease at $2.89. The corporate continues to be negatively impacted from a discount in DIY discretionary spending.

The corporate repurchased 2.9 million shares within the quarter for $758 million. Moreover, it paid out $654 million in dividends.

The corporate narrowed its fiscal 2024 outlook and now expects to earn adjusted diluted EPS of $11.80 to $11.90 (from $11.70 to $11.90 beforehand) on whole gross sales of $83.0 to $83.5 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on LOW (preview of web page 1 of three proven under):

Rock Strong Dividend Inventory: Nordson Company (NDSN)

- 5-year dividend development: 10.0%

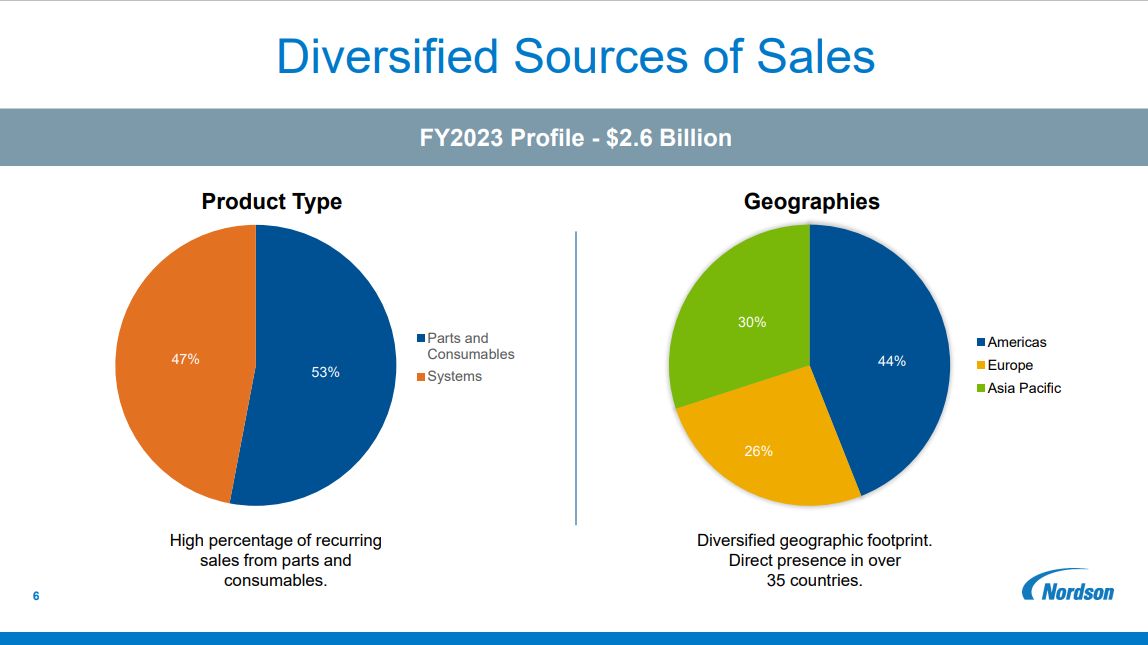

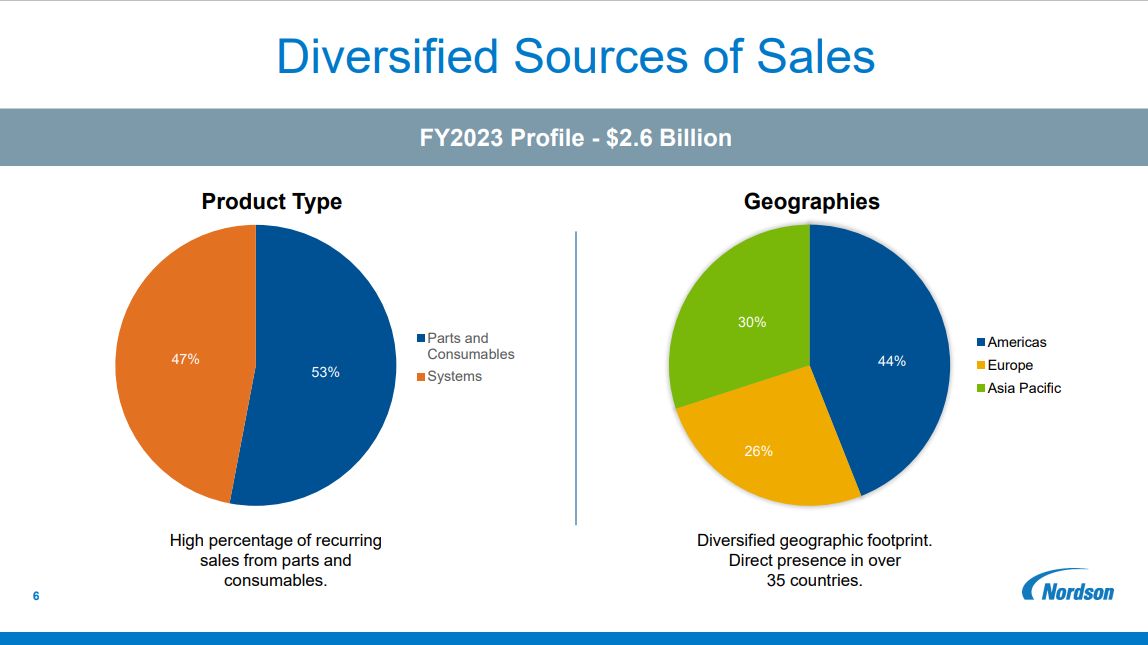

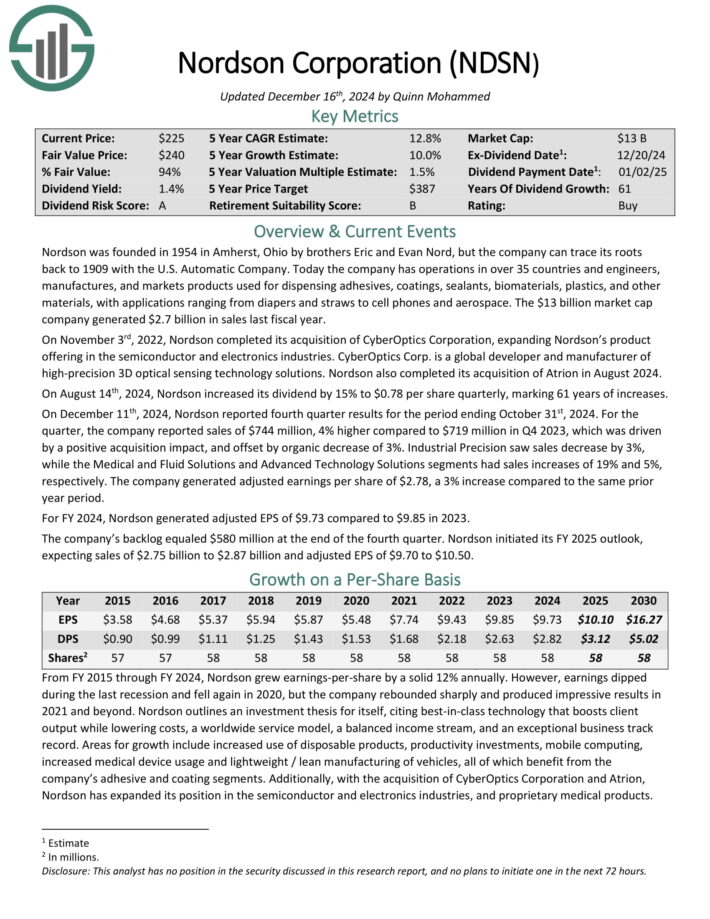

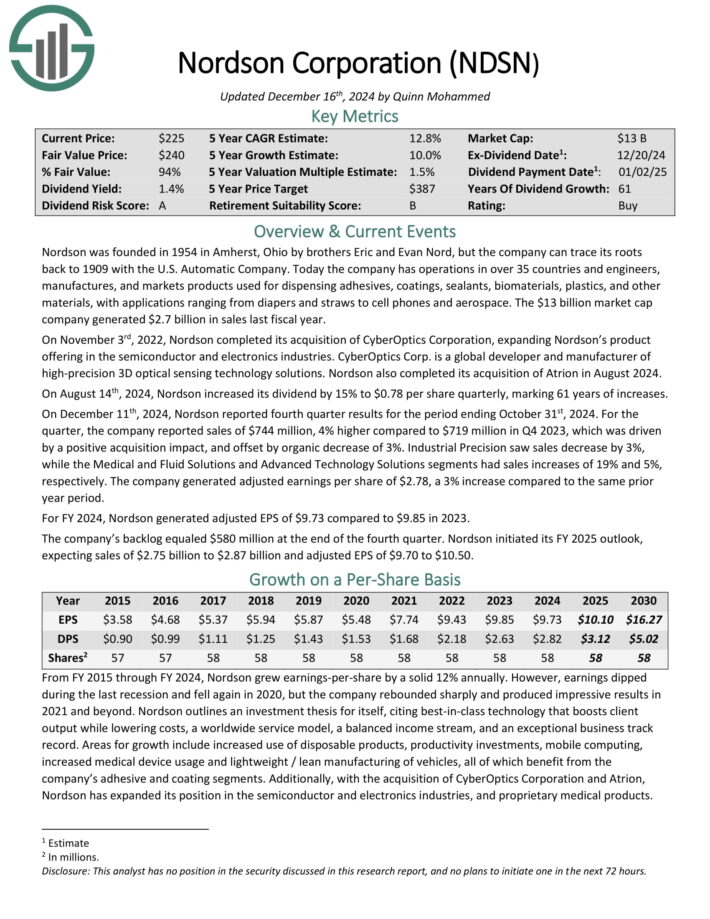

Nordson was based in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, however the firm can hint its roots again to 1909 with the U.S. Computerized Firm.

At the moment the corporate has operations in over 35 international locations and engineers, manufactures, and markets merchandise used for dishing out adhesives, coatings, sealants, biomaterials, plastics, and different supplies.

Supply: Investor Presentation

On August 14th, 2024, Nordson elevated its dividend by 15% to $0.78 per share quarterly, marking 61 years of will increase.

On December eleventh, 2024, Nordson reported fourth quarter outcomes for the interval ending October thirty first, 2024. For the quarter, the corporate reported gross sales of $744 million, 4% larger in comparison with $719 million in This fall 2023, which was pushed by a optimistic acquisition impression, and offset by natural lower of three%.

Industrial Precision noticed gross sales lower by 3%, whereas the Medical and Fluid Options and Superior Expertise Options segments had gross sales will increase of 19% and 5%, respectively.

The corporate generated adjusted earnings per share of $2.78, a 3% enhance in comparison with the identical quarter final yr. For FY 2024, Nordson generated adjusted EPS of $9.73 in comparison with $9.85 in 2023.

Click on right here to obtain our most up-to-date Certain Evaluation report on NDSN (preview of web page 1 of three proven under):

Rock Strong Dividend Inventory: Parker-Hannifin (PH)

- 5-year dividend development: 10.0%

Parker-Hannifin is a diversified industrial producer specializing in movement and management applied sciences. The corporate generates annual revenues of $16 billion.

Parker-Hannifin has paid a dividend for 72 years and has elevated the dividend for 67 consecutive years.

Supply: Investor Presentation

In late October, Parker-Hannifin reported (10/31/24) outcomes for the primary quarter of 2025. Gross sales grew 1% over final yr’s quarter, to a brand new all-time excessive.

Adjusted earnings-per-share grew 4%, from $5.96 to $6.20, primarily due to sturdy demand in aerospace.

Parker-Hannifin exceeded the analysts’ consensus by $0.06. Notably, Parker-Hannifin has exceeded the analysts’ EPS estimates for 37 consecutive quarters.

Click on right here to obtain our most up-to-date Certain Evaluation report on Parker-Hannifin (preview of web page 1 of three proven under):

Rock Strong Dividend Inventory: S&P World (SPGI)

- 5-year dividend development: 12.0%

S&P World is a worldwide supplier of monetary providers and enterprise data and income of over $13 billion.

By way of its varied segments, it offers credit score rankings, benchmarks and indices, analytics, and different information to commodity market members, capital markets, and automotive markets.

S&P World has paid dividends constantly since 1937 and has elevated its payout for 51 consecutive years.

S&P World posted third quarter earnings on October twenty fourth, 2024, and outcomes have been fairly sturdy as soon as once more. Adjusted earnings-per-share got here to $3.89, which was 25 cents forward of estimates. Earnings have been down from $4.04 in Q2, however a lot larger than $3.21 within the year-ago interval.

Income soared 16% larger year-on-year to $3.58 billion, which additionally beat estimates by $150 million. Development within the Scores and Indices phase led the highest line larger in Q3, though energy was broad.

With dividend development above 10%, SPGI is among the rock stable dividend shares.

Click on right here to obtain our most up-to-date Certain Evaluation report on SPGI (preview of web page 1 of three proven under):

Extra Studying

Screening to search out the most effective Dividend Kings shouldn’t be the one approach to discover rock stable dividend shares. There are lots of different teams of shares for long-term dividend development.

Certain Dividend maintains comparable databases on the next universes of rock stable dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].