Revealed on August eleventh, 2025 by Bob Ciura

Spreadsheet knowledge up to date every day

Actual property funding trusts – or REITs – give buyers the chance to earn earnings from actual property, with none of the day-to-day hassles related to being a conventional landlord.

REITs are standard for earnings buyers, as they broadly pay larger dividend yields than the common inventory.

Whereas the S&P 500 Index on common yields simply 1.3% proper now, it’s comparatively straightforward to seek out REITs with dividend yields of 5% or larger.

You possibly can obtain your free 200+ REIT listing (together with vital monetary metrics like dividend yields and payout ratios) by clicking on the hyperlink beneath:

The fantastic thing about incomes passive earnings is that it permits buyers to generate earnings for doing nearly nothing.

With this in thoughts, the next 10 REITs have excessive dividend yields and secure dividend payouts, permitting buyers to earn passive earnings from actual property.

Desk Of Contents

The desk of contents beneath permits for simple navigation. The ten REITs are sorted by dividend yield, in ascending order.

Excessive Yield REIT For Passive Earnings: Fairness Way of life Properties (ELS)

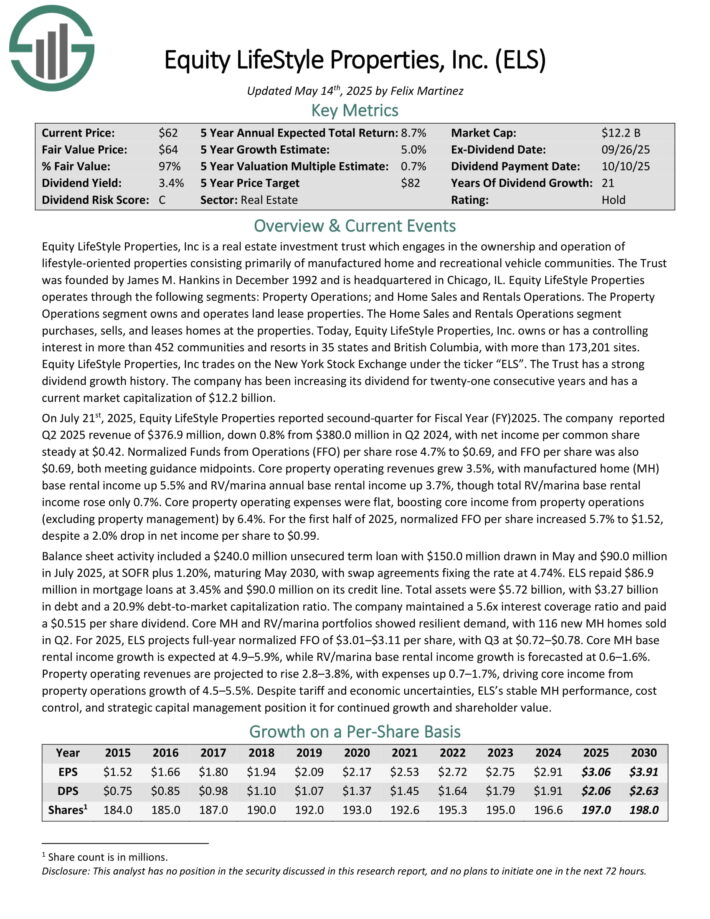

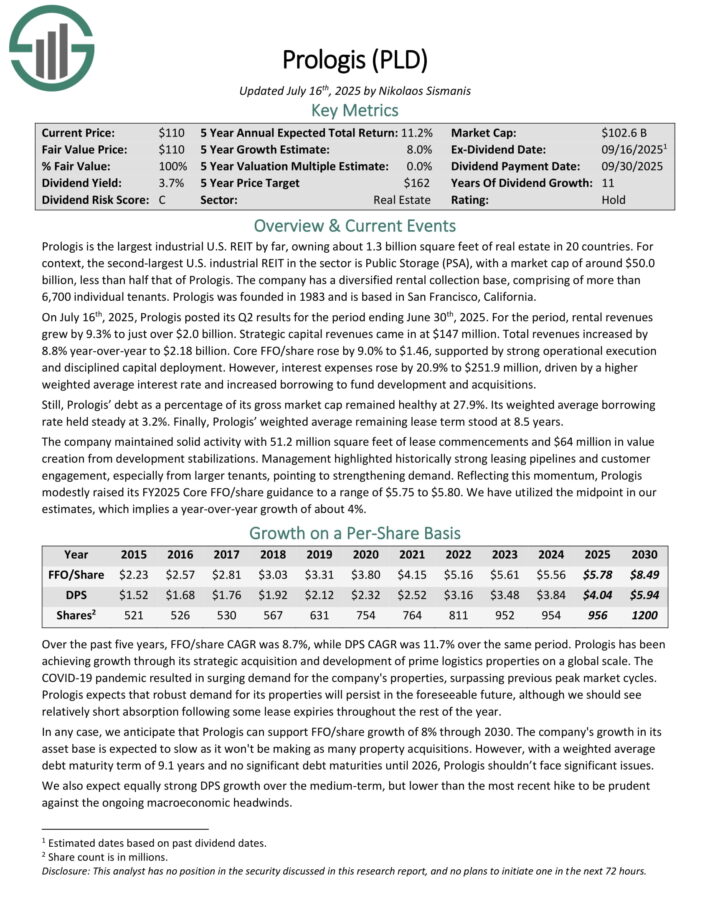

Fairness LifeStyle Properties, Inc is an actual property funding belief which engages within the possession and operation of lifestyle-oriented properties consisting primarily of manufactured residence and leisure automobile communities.

Fairness LifeStyle Properties operates by the next segments: Property Operations; and Dwelling Gross sales and Leases Operations. The Property Operations phase owns and operates land lease properties. The Dwelling Gross sales and Leases Operations phase purchases, sells, and leases properties on the properties.

Fairness LifeStyle Properties owns or has a controlling curiosity in additional than 452 communities and resorts in 35 states and British Columbia, with greater than 173,201 websites.

On July twenty first, 2025, Fairness LifeStyle Properties reported second-quarter. The corporate reported Q2 2025 income of $376.9 million, down 0.8% from $380.0 million in Q2 2024, with internet earnings per widespread share regular at $0.42.

Normalized Funds from Operations (FFO) per share rose 4.7% to $0.69, and FFO per share was additionally $0.69, each assembly steering midpoints. Core property working revenues grew 3.5%, with manufactured residence (MH) base rental earnings up 5.5% and RV/marina annual base rental earnings up 3.7%.

Core property working bills have been flat, boosting core earnings from property operations (excluding property administration) by 6.4%.

Click on right here to obtain our most up-to-date Certain Evaluation report on ELS (preview of web page 1 of three proven beneath):

Excessive Yield REIT For Passive Earnings: Prologis Inc. (PLD)

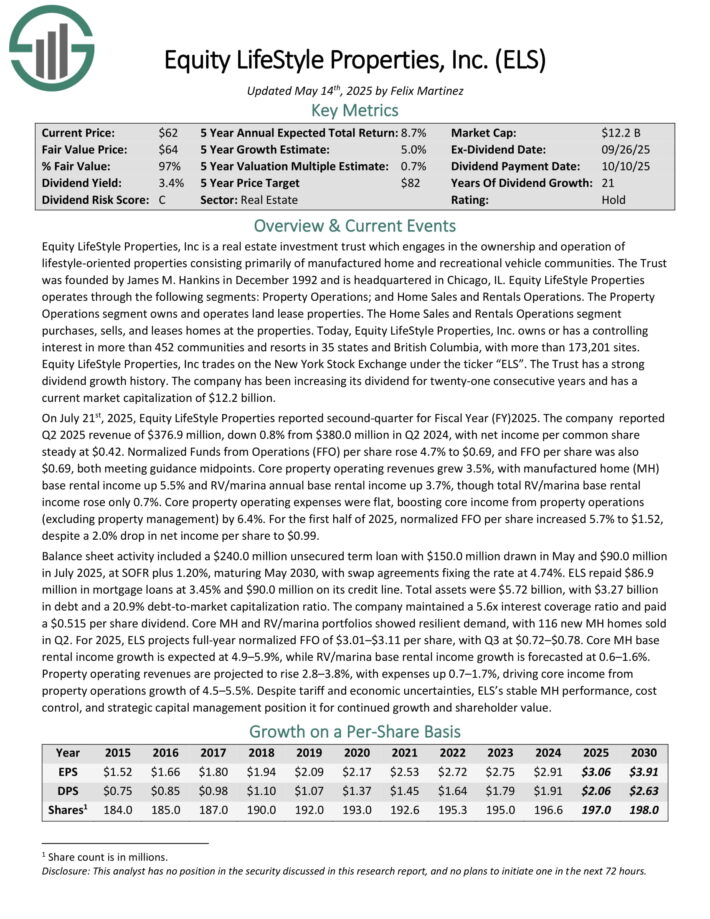

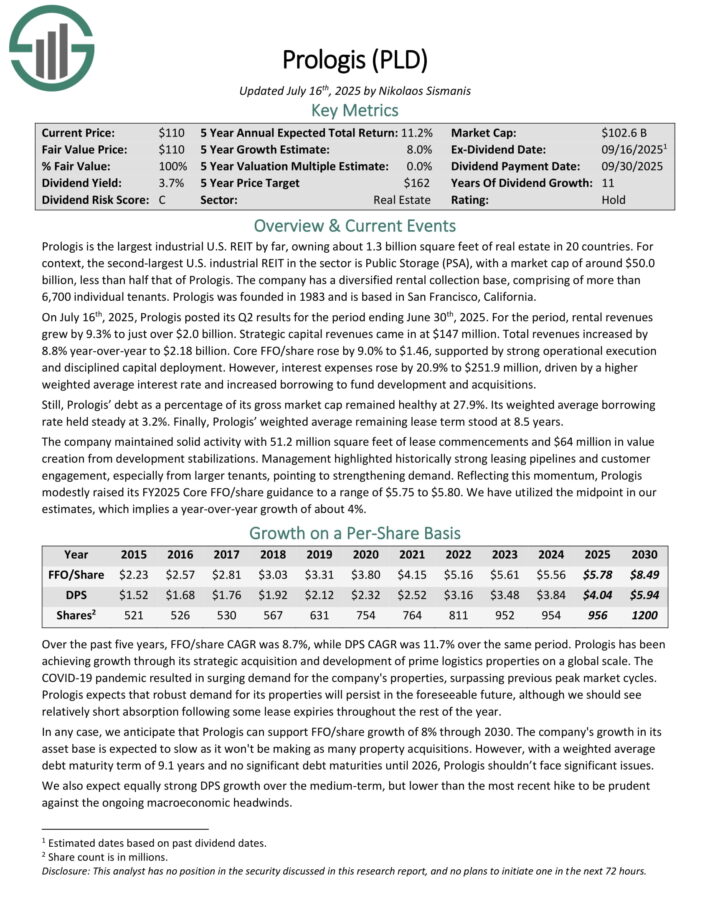

Prologis is the most important industrial U.S. REIT, proudly owning about 1.3 billion sq. toes of actual property in 20 international locations. It has a diversified rental assortment base, comprising of greater than 6,700 particular person tenants.

On July sixteenth, 2025, Prologis posted its Q2 outcomes for the interval ending June thirtieth, 2025. For the interval, rental income grew by 9.3% to only over $2.0 billion. Strategic capital revenues got here in at $147 million. Whole income elevated by 8.8% year-over-year to $2.18 billion.

Core FFO/share rose by 9.0% to $1.46, supported by sturdy operational execution and disciplined capital deployment. Prologis’ debt as a proportion of its gross market cap remained wholesome at 27.9%.

Its weighted common borrowing price held regular at 3.2%. Lastly, Prologis’ weighted common remaining lease time period stood at 8.5 years.

The corporate maintained strong exercise with 51.2 million sq. toes of lease commencements and $64 million in worth creation from growth stabilizations.

Administration highlighted traditionally sturdy leasing pipelines and buyer engagement, particularly from bigger tenants, pointing to strengthening demand.

Click on right here to obtain our most up-to-date Certain Evaluation report on PLD (preview of web page 1 of three proven beneath):

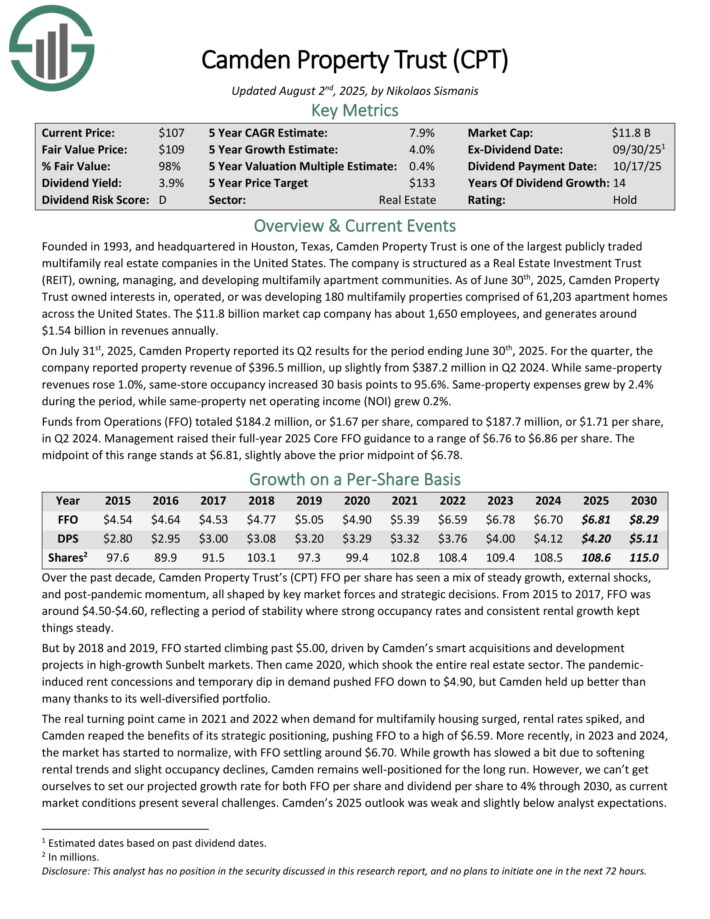

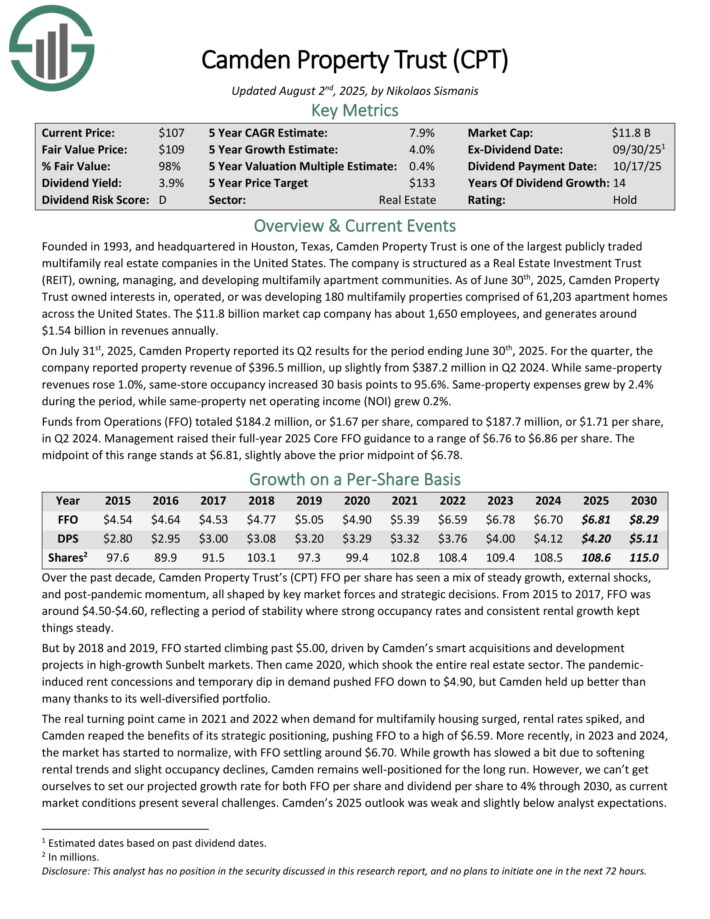

Excessive Yield REIT For Passive Earnings: Camden Property Belief (CPT)

Based in 1993 and headquartered in Houston, Texas, Camden Property Belief is likely one of the largest publicly traded multifamily actual property corporations within the U.S.

The REIT owns, manages and develops multifamily house communities. It at the moment owns 172 properties that include over 58,000 flats.

On July thirty first, 2025, Camden Property reported its Q2 outcomes. For the quarter, the corporate reported property income of $396.5 million, up barely from $387.2 million in Q2 2024.

Whereas same-property revenues rose 1.0%, same-store occupancy elevated 30 foundation factors to 95.6%. Identical-property bills grew by 2.4% in the course of the interval, whereas same-property internet working earnings (NOI) grew 0.2%.

Funds from Operations (FFO) totaled $184.2 million, or $1.67 per share, in comparison with $187.7 million, or $1.71 per share, in Q2 2024.

Camden has a aggressive benefit in its place as one of many largest multifamily REITs within the U.S. Its scale and experience permit it to leverage its expertise throughout a large portfolio of properties and actively pursue developments.

The corporate’s FFO payout ratio has hovered within the 60% to 70% vary for the final decade. CPT has elevated its dividend for 14 consecutive years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Camden Property Belief (CPT) (preview of web page 1 of three proven beneath):

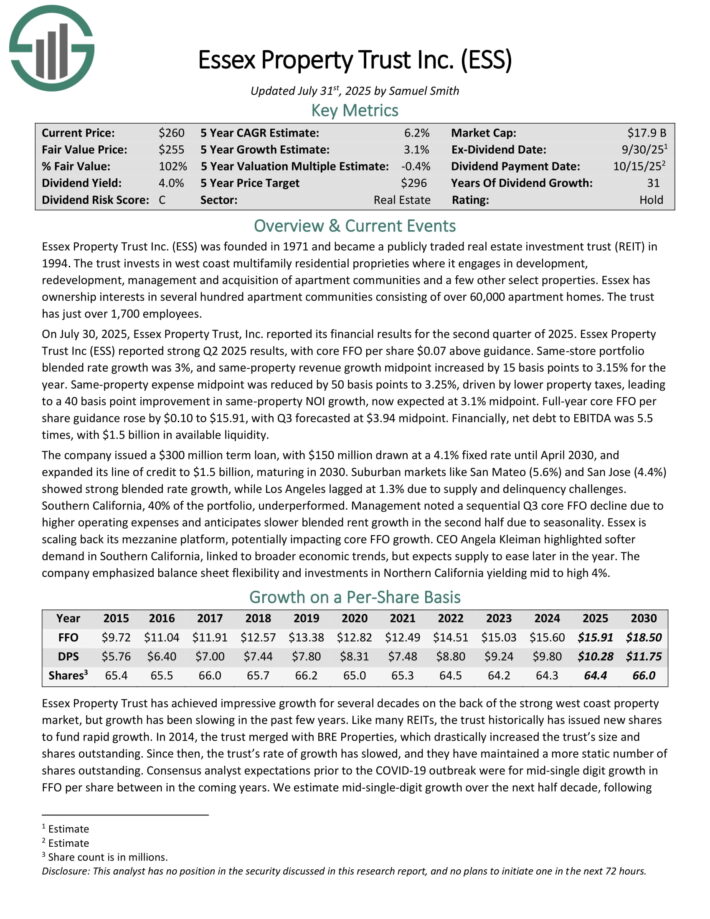

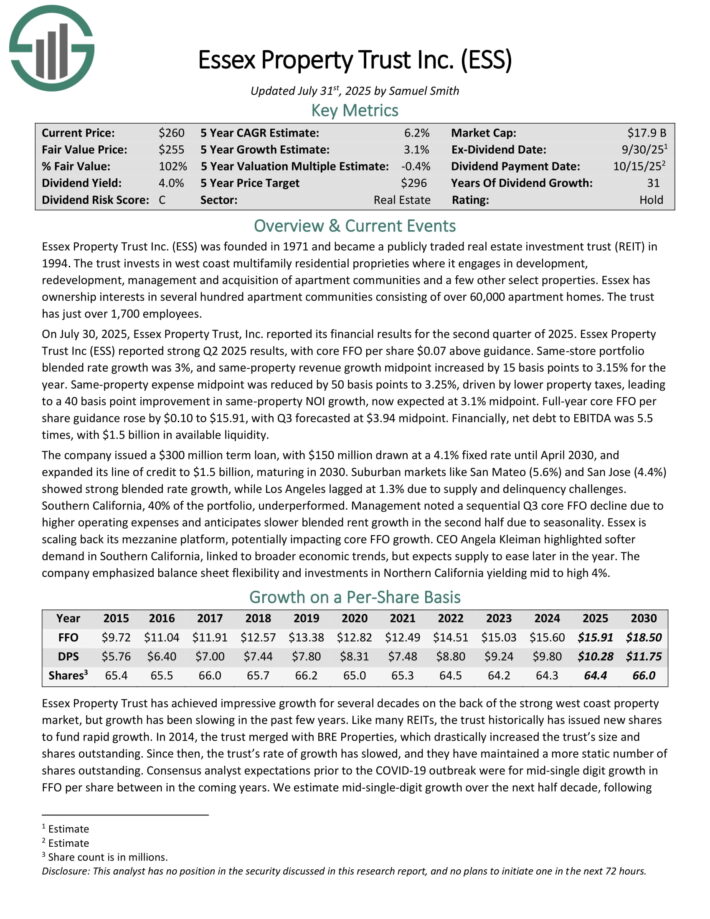

Excessive Yield REIT For Passive Earnings: Essex Property Belief (ESS)

Essex Property Belief was based in 1971. The belief invests in West Coast multi-family residential proprieties the place it engages in growth, redevelopment, administration and acquisition of house communities and some different choose properties.

Essex has possession pursuits in a number of hundred house communities consisting of over 60,000 house properties. The belief has about 1,800 staff and produces roughly $1.6 billion in annual income.

Essex is targeting the West Coast of the U.S., together with cities like Seattle and San Francisco.

On July 30, 2025, Essex Property Belief, Inc. reported its monetary outcomes for the second quarter of 2025. Essex Property Belief Inc (ESS) reported sturdy Q2 2025 outcomes, with core FFO per share $0.07 above steering.

Identical-store portfolio blended price progress was 3%, and same-property income progress midpoint elevated by 15 foundation factors to three.15% for the yr.

Identical-property expense midpoint was decreased by 50 foundation factors to three.25%, pushed by decrease property taxes, resulting in a 40 foundation level enchancment in same-property NOI progress, now anticipated at 3.1% midpoint. Full-year core FFO per share steering rose by $0.10 to $15.91, with Q3 forecasted at $3.94 midpoint.

Financially, internet debt to EBITDA was 5.5 instances, with $1.5 billion in obtainable liquidity.

Click on right here to obtain our most up-to-date Certain Evaluation report on ESS (preview of web page 1 of three proven beneath):

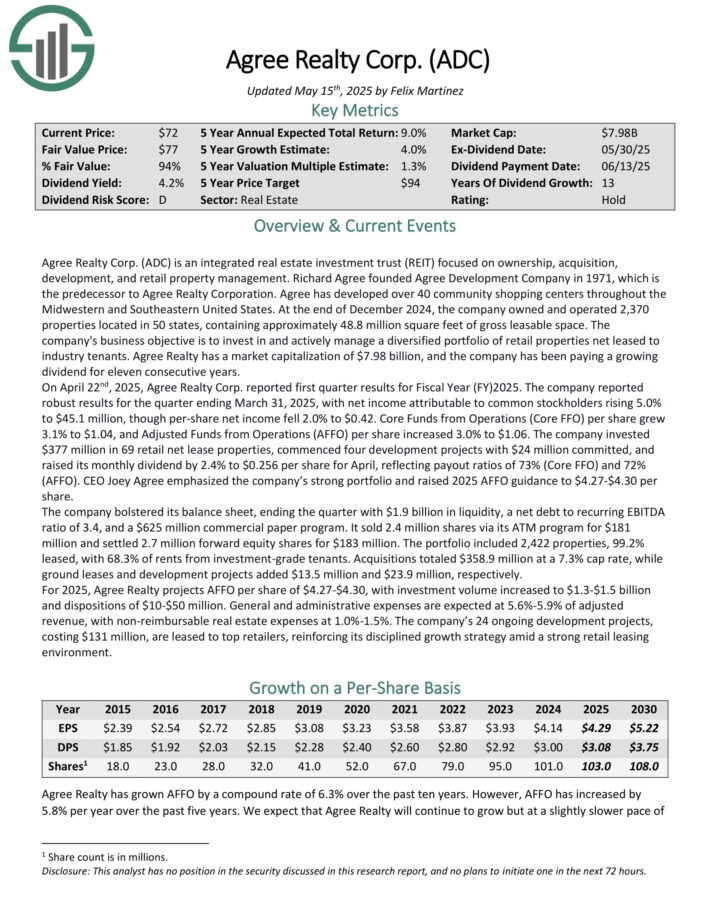

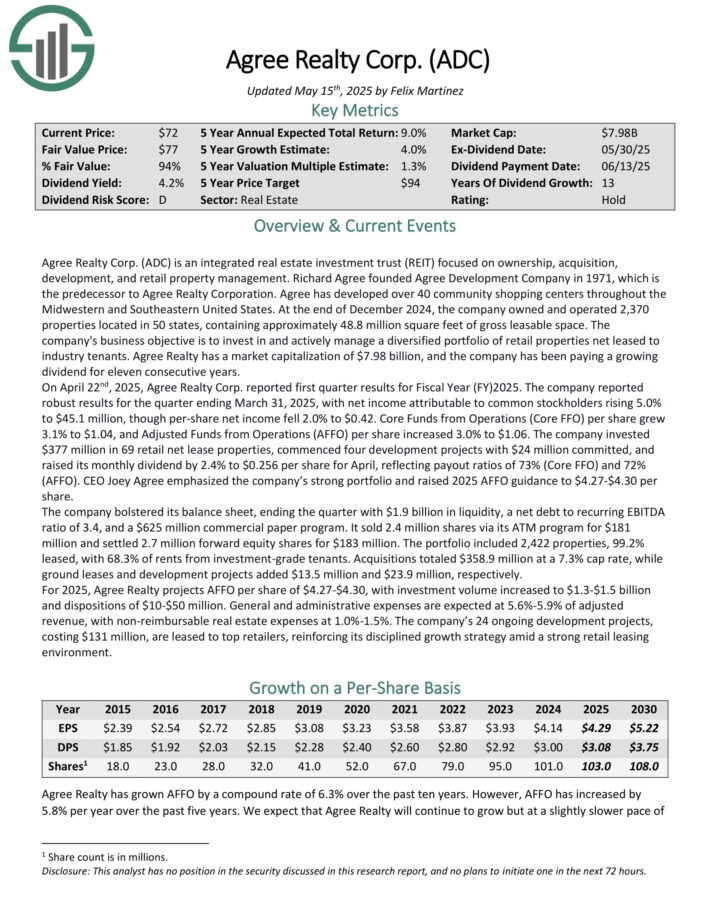

Prime REIT #6: Agree Realty (ADC)

Agree Realty is an built-in actual property funding belief (REIT) targeted on possession, acquisition, growth, and retail property administration.

Agree has developed over 40 neighborhood procuring facilities all through the Midwestern and Southeastern United States.

On April twenty second, 2025, Agree Realty Corp. reported first quarter outcomes for Fiscal Yr (FY)2025. The corporate reported sturdy outcomes for the quarter ending March 31, 2025, with internet earnings attributable to widespread stockholders rising 5.0% to $45.1 million, although per-share internet earnings fell 2.0% to $0.42.

Core Funds from Operations (Core FFO) per share grew 3.1% to $1.04, and Adjusted Funds from Operations (AFFO) per share elevated 3.0% to $1.06.

The corporate invested $377 million in 69 retail internet lease properties, commenced 4 growth initiatives with $24 million dedicated, and raised its month-to-month dividend by 2.4% to $0.256 per share for April, reflecting payout ratios of 73% (Core FFO) and 72% (AFFO).

The corporate bolstered its stability sheet, ending the quarter with $1.9 billion in liquidity, a internet debt to recurring EBITDA ratio of three.4, and a $625 million industrial paper program.

The portfolio included 2,422 properties, 99.2% leased, with 68.3% of rents from investment-grade tenants. Acquisitions totaled $358.9 million at a 7.3% cap price, whereas floor leases and growth initiatives added $13.5 million and $23.9 million, respectively.

For 2025, Agree Realty initiatives AFFO per share of $4.27-$4.30, with funding quantity elevated to $1.3-$1.5 billion and inclinations of $10-$50 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on ADC (preview of web page 1 of three proven beneath):

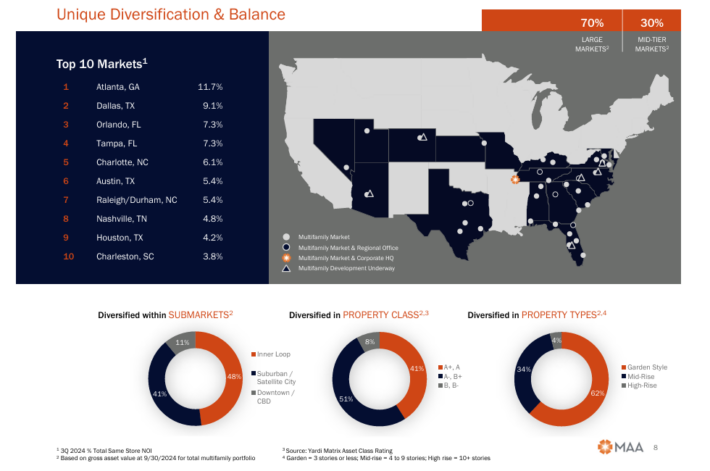

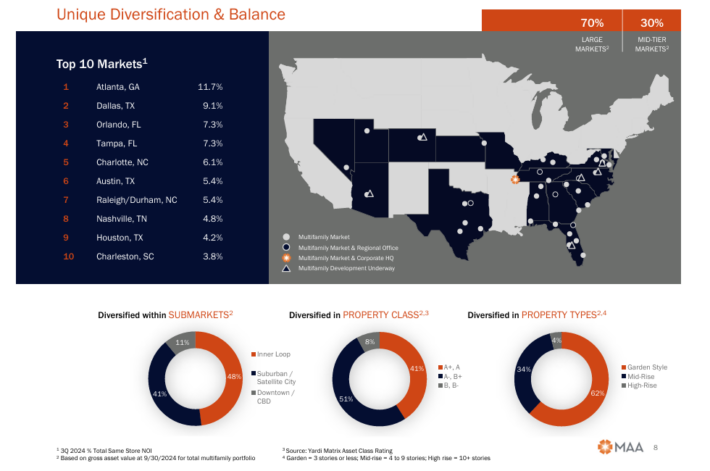

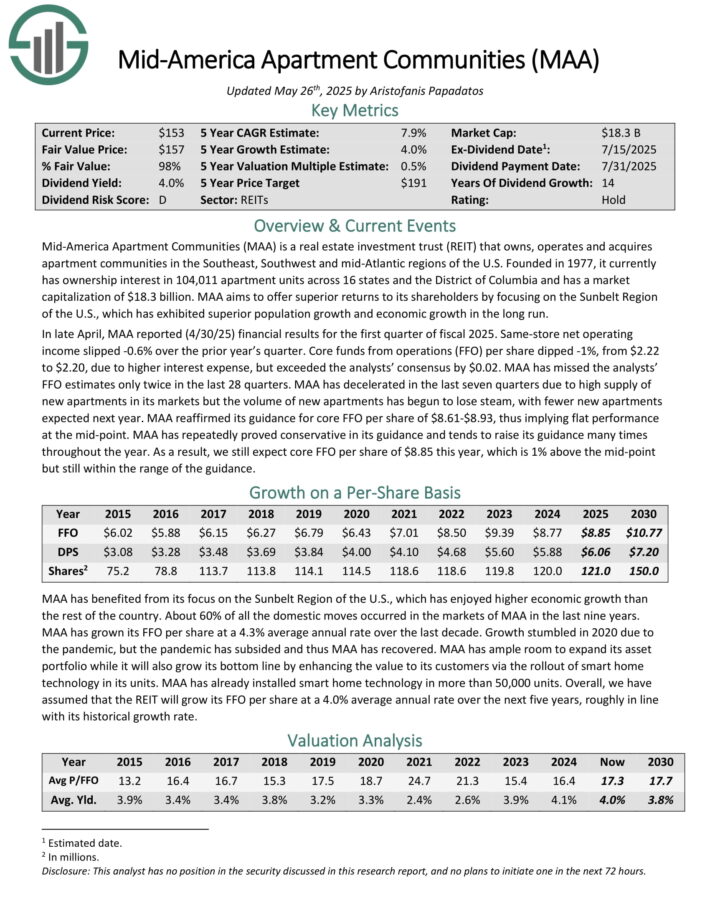

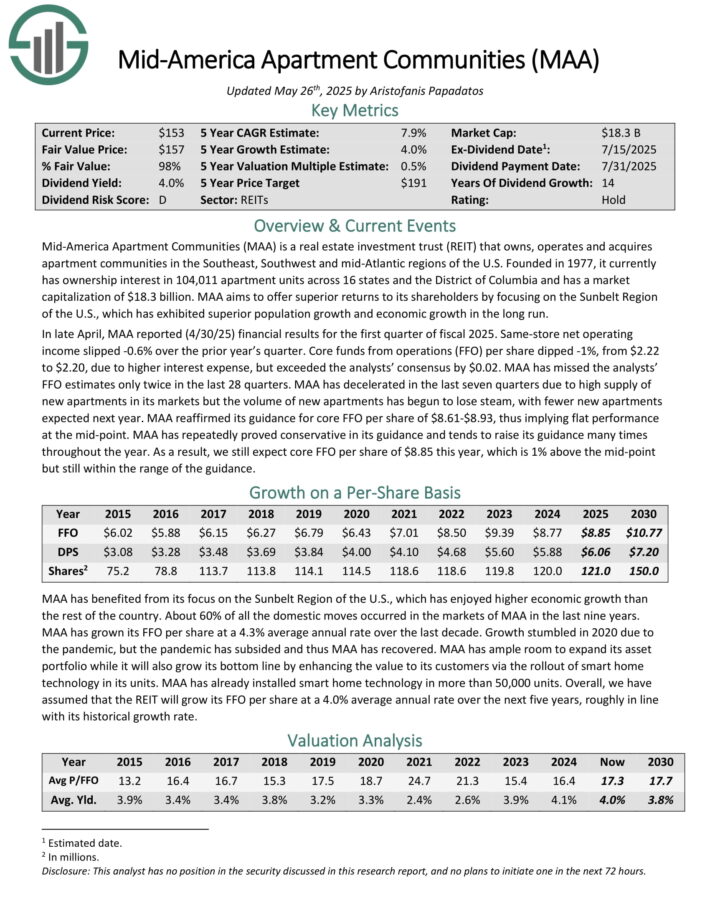

Prime REIT #5: Mid-America Condominium Communities (MAA)

Mid-America Condominium Communities is a REIT that owns, operates and acquires house communities within the Southeast, Southwest and mid-Atlantic areas of the U.S.

It at the moment has possession curiosity in ~102,000 house models throughout 16 states and the District of Columbia.

MAA is targeted on the Sunbelt Area of the U.S., which has exhibited superior inhabitants progress and financial progress in the long term.

Supply: Investor Presentation

In late April, MAA reported (4/30/25) monetary outcomes for the primary quarter of fiscal 2025. Identical-store internet working earnings slipped -0.6% over the prior yr’s quarter. Core funds from operations (FFO) per share dipped -1%, from $2.22 to $2.20, resulting from larger curiosity expense, however exceeded the analysts’ consensus by $0.02.

MAA has missed the analysts’ FFO estimates solely twice within the final 28 quarters. MAA has decelerated within the final seven quarters resulting from excessive provide of recent flats in its markets however the quantity of recent flats has begun to lose steam, with fewer new flats anticipated subsequent yr.

MAA reaffirmed its steering for core FFO per share of $8.61-$8.93.

Click on right here to obtain our most up-to-date Certain Evaluation report on Mid-America Condominium Communities (MAA) (preview of web page 1 of three proven beneath):

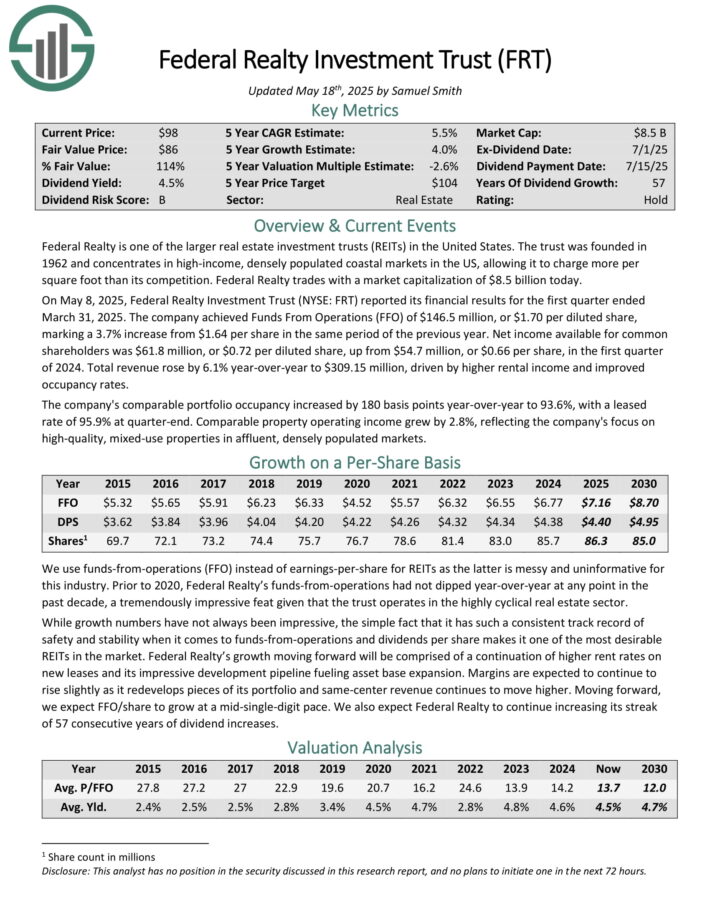

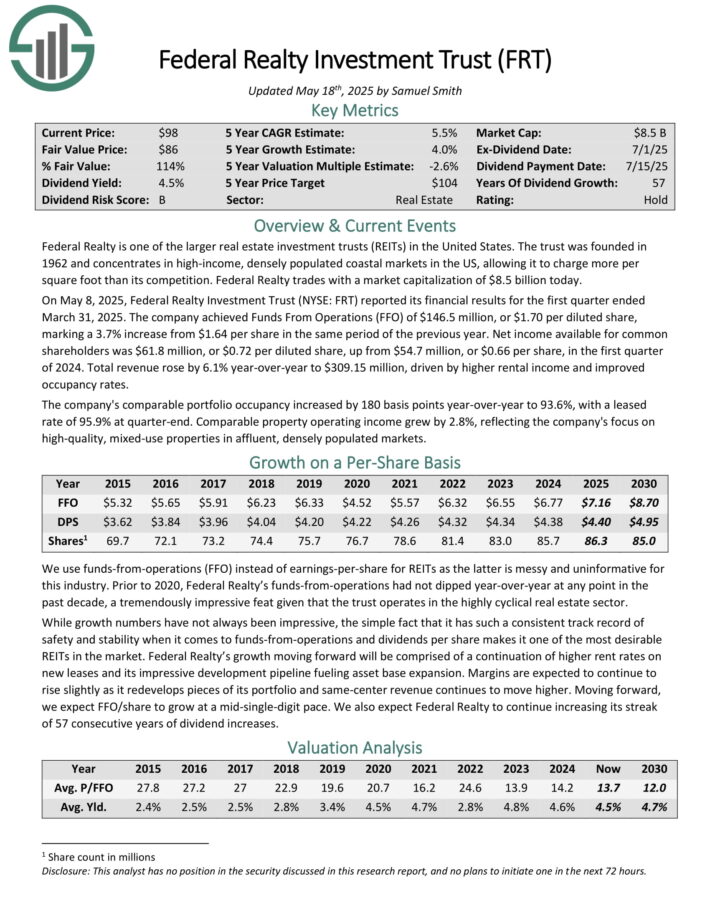

Prime REIT #4: Federal Realty Funding Belief (FRT)

Federal Realty was based in 1962. It concentrates in high-income, densely populated coastal markets within the US, permitting it to cost extra per sq. foot than its competitors.

On Might 8, 2025, Federal Realty Funding Belief reported its monetary outcomes for the primary quarter. The corporate achieved Funds From Operations (FFO) of $146.5 million, or $1.70 per diluted share, marking a 3.7% improve from $1.64 per share in the identical interval of the earlier yr.

Internet earnings obtainable for widespread shareholders was $61.8 million, or $0.72 per diluted share, up from $54.7 million, or $0.66 per share, within the first quarter of 2024. Whole income rose by 6.1% year-over-year to $309.15 million, pushed by larger rental earnings and improved occupancy charges.

The corporate’s comparable portfolio occupancy elevated by 180 foundation factors year-over-year to 93.6%, with a leased price of 95.9% at quarter-end.

Click on right here to obtain our most up-to-date Certain Evaluation report on Federal Realty (preview of web page 1 of three proven beneath):

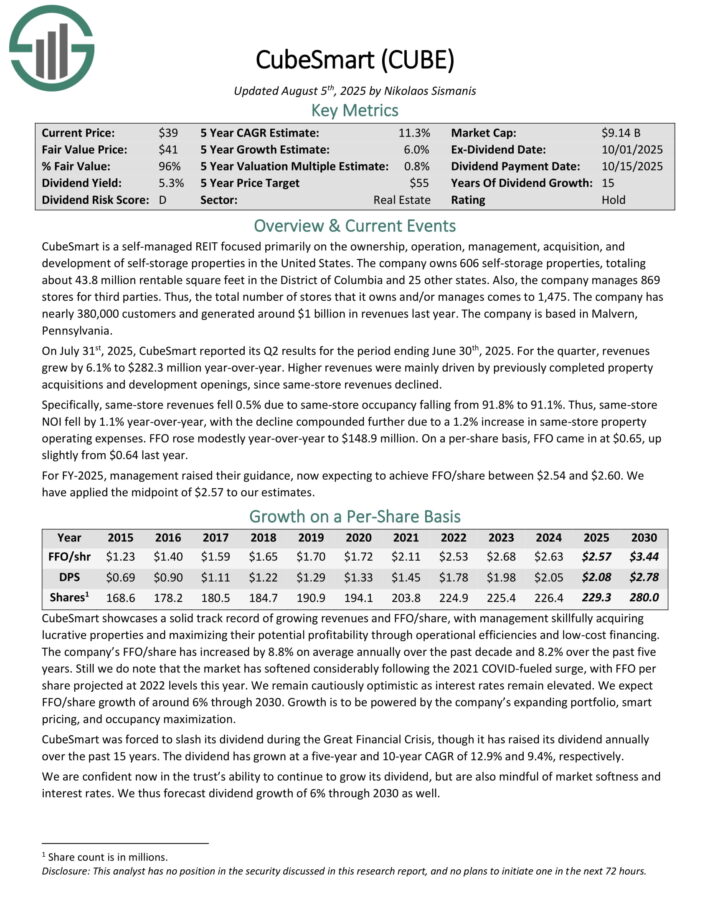

Prime REIT #3: CubeSmart (CUBE)

CubeSmart is a self-managed REIT targeted totally on the possession, operation, administration, acquisition, and growth of self-storage properties in the US.

It owns 606 self-storage properties, totaling about 43.8 million rentable sq. toes within the District of Columbia and 25 different states. Additionally, the corporate manages 869 shops for third events. Thus, the overall variety of shops that it owns and/or manages involves 1,475.

The corporate has practically 380,000 prospects and generated round $1 billion in income final yr.

On July thirty first, 2025, CubeSmart reported its Q2 outcomes for the interval ending June thirtieth, 2025. For the quarter, revenues grew by 6.1% to $282.3 million year-over-year.

Increased revenues have been primarily pushed by beforehand accomplished property acquisitions and growth openings, since same-store revenues declined.

Particularly, same-store revenues fell 0.5% resulting from same-store occupancy falling from 91.8% to 91.1%. Thus, same-store NOI fell by 1.1% year-over-year, with the decline compounded additional resulting from a 1.2% improve in same-store property working bills.

FFO rose modestly year-over-year to $148.9 million. On a per-share foundation, FFO got here in at $0.65, up barely from $0.64 final yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on CUBE (preview of web page 1 of three proven beneath):

Prime REIT #2: Realty Earnings Corp. (O)

Realty Earnings is a retail actual property targeted REIT that owns retail properties that aren’t a part of a wider retail growth (comparable to a mall), however as an alternative are standalone properties.

Which means that the properties are viable for a lot of totally different tenants, together with authorities companies, healthcare companies, and leisure.

Realty Earnings’s diversified portfolio includes 15,627 industrial properties throughout eight international locations, with 79.9% in retail, 14.4% in industrial, 3.2% in gaming, and a couple of.5% in different sectors.

Geographically, 84.6% of annualized base lease originates from the US, 12.6% from the UK, and a couple of.8% from continental Europe.

On Might 5, 2025, Realty Earnings Company reported its monetary outcomes for the primary quarter ended March 31, 2025. The corporate achieved whole income of $1.38 billion, surpassing analyst expectations of $1.27 billion.

Internet earnings obtainable to widespread stockholders was $249.8 million, or $0.28 per diluted share, in comparison with $129.7 million, or $0.16 per share, in the identical interval of the earlier yr.

Funds from Operations (FFO) per share elevated to $1.05 from $0.94, whereas Adjusted Funds from Operations (AFFO) per share rose to $1.06 from $1.03, reflecting a 2.9% year-over-year progress.

Click on right here to obtain our most up-to-date Certain Evaluation report on Realty Earnings (preview of web page 1 of three proven beneath):

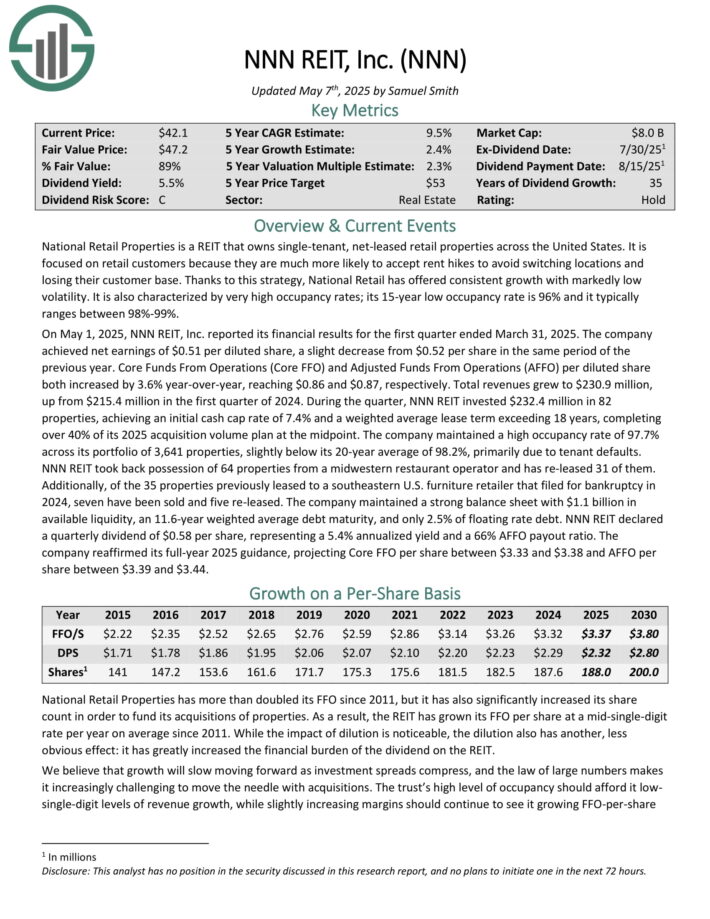

Prime REIT #1: NNN REIT Inc. (NNN)

Nationwide Retail Properties is a REIT that owns single-tenant, net-leased retail properties throughout the US. It’s targeted on retail prospects as a result of they’re much extra more likely to settle for lease hikes to keep away from switching areas and dropping their buyer base.

On Might 1, 2025, NNN REIT, Inc. reported its monetary outcomes for the primary quarter ended March 31, 2025. The corporate achieved internet earnings of $0.51 per diluted share, a slight lower from $0.52 per share in the identical interval of the earlier yr.

Core Funds From Operations (Core FFO) and Adjusted Funds From Operations (AFFO) per diluted share each elevated by 3.6% year-over-year, reaching $0.86 and $0.87, respectively. Whole revenues grew to $230.9 million, up from $215.4 million within the first quarter of 2024.

Through the quarter, NNN REIT invested $232.4 million in 82 properties, attaining an preliminary money cap price of seven.4% and a weighted common lease time period exceeding 18 years, finishing over 40% of its 2025 acquisition quantity plan on the midpoint.

The corporate maintained a excessive occupancy price of 97.7% throughout its portfolio of three,641 properties, barely beneath its 20-year common of 98.2%, primarily resulting from tenant defaults.

Click on right here to obtain our most up-to-date Certain Evaluation report on NNN (preview of web page 1 of three proven beneath):

Further Studying

You possibly can see extra high-quality dividend shares within the following Certain Dividend databases, every primarily based on lengthy streaks of steadily rising dividend funds:

You may additionally be trying to create a extremely custom-made dividend earnings stream to pay for all times’s bills.

The next lists present helpful data on excessive dividend shares and shares that pay month-to-month dividends:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].