Revealed on January 14th, 2025 by Bob Ciura

A “one choice inventory” is a inventory that you just purchase (the purchase is the one choice) and maintain for the long term.

There are no different selections wanted, as a result of one choice shares have sturdy and powerful aggressive benefits coupled with shareholder pleasant managements. They reward traders extra the longer they maintain them.

“I don’t need loads of good investments; I would like a number of excellent ones. If the job has been accurately completed when a standard inventory is bought, the time to promote it’s virtually by no means.”

– Investing legend Philip Fisher

The thought behind one choice shares is to establish companies which are prone to reward shareholders with rising worth on a per share foundation over lengthy durations of time, and maintain onto these companies no matter market fluctuations.

The phrase was popularized with the “Nifty Fifty” shares of the late 1960’s and early 1970’s. Three of the “Nifty Fifty” shares which have compounded investor wealth over the past ~50 years are beneath:

- Coca-Cola (KO)

- McDonald’s (MCD)

- Johnson & Johnson (JNJ)

What do these shares have in frequent?

What the three shares above have in frequent is that they’re all Dividend Aristocrats, a gaggle of 66 shares within the S&P 500 Index, with 25+ consecutive years of dividend will increase.

There are presently 66 Dividend Aristocrats. You may obtain an Excel spreadsheet of the Dividend Aristocrats record (with metrics that matter comparable to dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

Disclaimer: Positive Dividend just isn’t affiliated with S&P World in any means. S&P World owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet relies on Positive Dividend’s personal assessment, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s based mostly. Not one of the data on this article or spreadsheet is official information from S&P World. Seek the advice of S&P World for official data.

There are a number of benefits to “one choice investing”.

The primary and most distinguished is that it places a higher emphasis in your purchase selections.

In case your anticipated holding interval is a month, the underlying high quality of the enterprise for the inventory you’re shopping for doesn’t matter a lot in any respect…

However if you’re shopping for and holding “perpetually”, then the standard of the enterprise is paramount.

The next 10 one choice shares have elevated their dividends for over 25 years, making them Dividend Aristocrats.

As well as, all 10 have Dividend Threat Scores of ‘A’ within the Positive Evaluation Analysis Database (our highest score), and dividend payout ratios beneath 50%, indicating sturdy dividend security.

Consequently, these one choice shares may be counted on for a few years of continued dividend will increase sooner or later.

The one choice shares beneath are ranked by dividend yield, from lowest to highest.

Desk of Contents

You may immediately leap to any particular part of the article by clicking on the hyperlinks beneath:

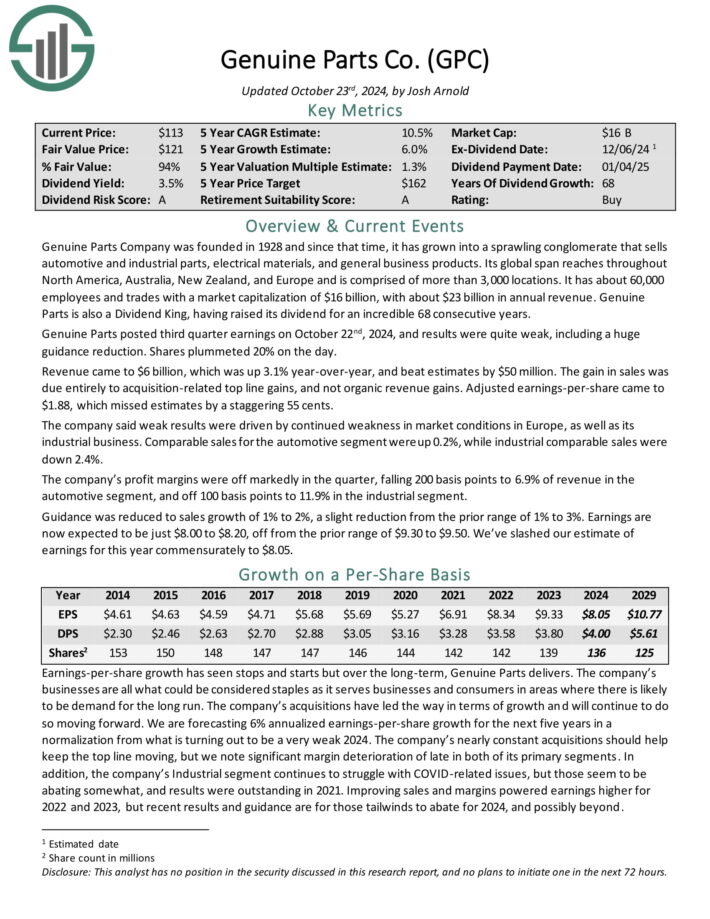

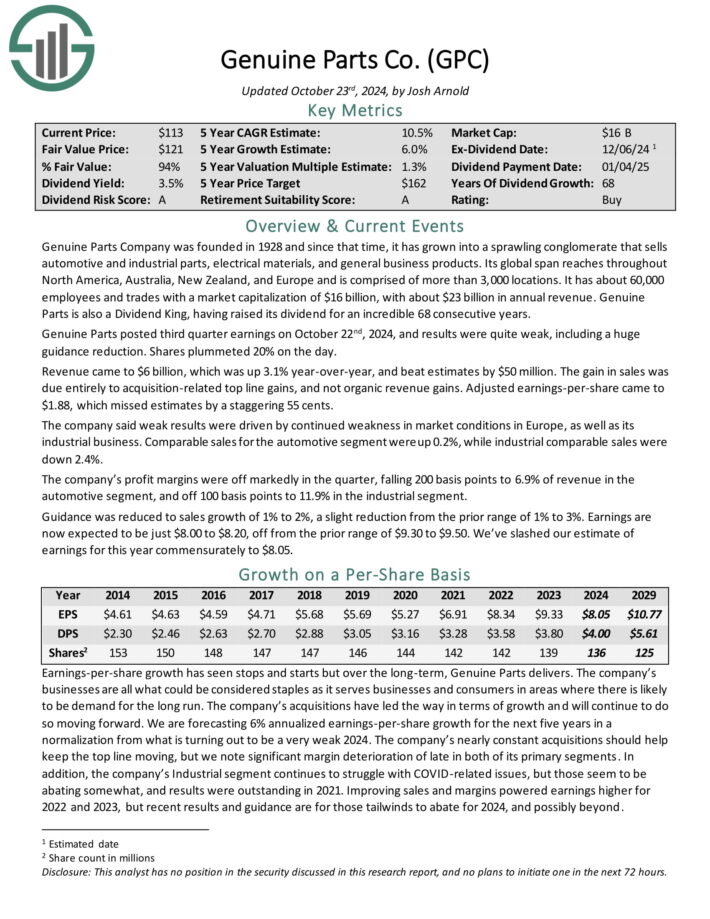

One Choice Inventory To Purchase Now: Real Elements Co. (GPC)

Real Elements has the world’s largest world auto components community, with greater than 10,800 areas worldwide. As a serious distributor of automotive and industrial components, Real Elements generates annual income of almost $23 billion.

Supply: Investor Presentation

It operates two segments, that are automotive (contains the NAPA model) and the economic components group which sells industrial alternative components to MRO (upkeep, restore, and operations) and OEM (authentic gear producer) prospects.

Prospects are derived from a variety of segments, together with meals and beverage, metals and mining, oil and gasoline, and well being care.

The corporate reported its third-quarter 2024 outcomes, with gross sales reaching $6.0 billion, a 2.5% enhance from the earlier 12 months.

Internet revenue fell to $227 million, or $1.62 per diluted share, down from $351 million in Q3 2023. Adjusted diluted earnings per share (EPS) additionally decreased to $1.88 in comparison with $2.49 final 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on GPC (preview of web page 1 of three proven beneath):

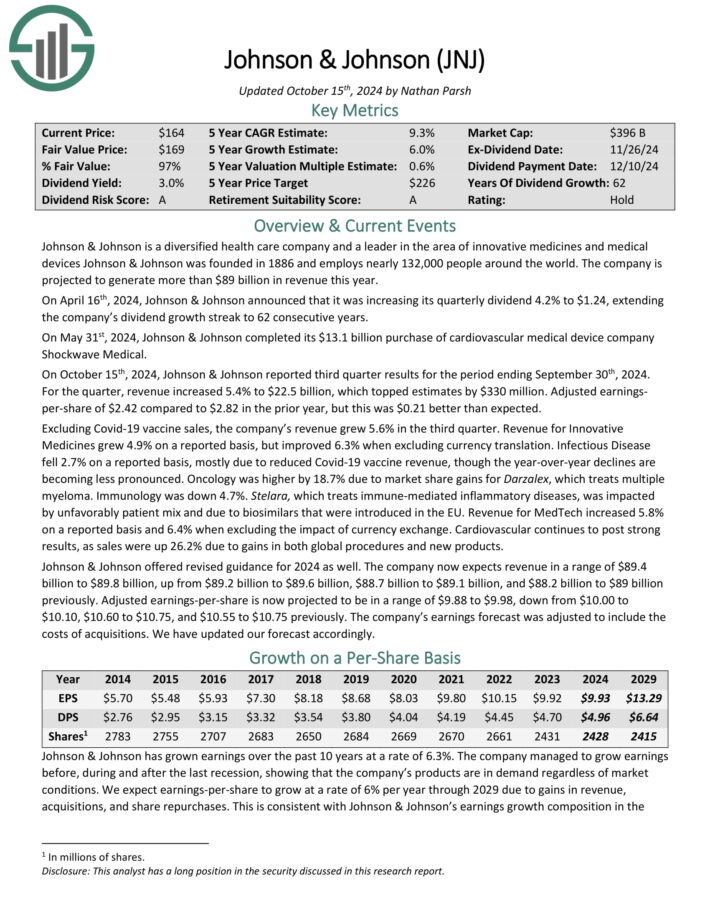

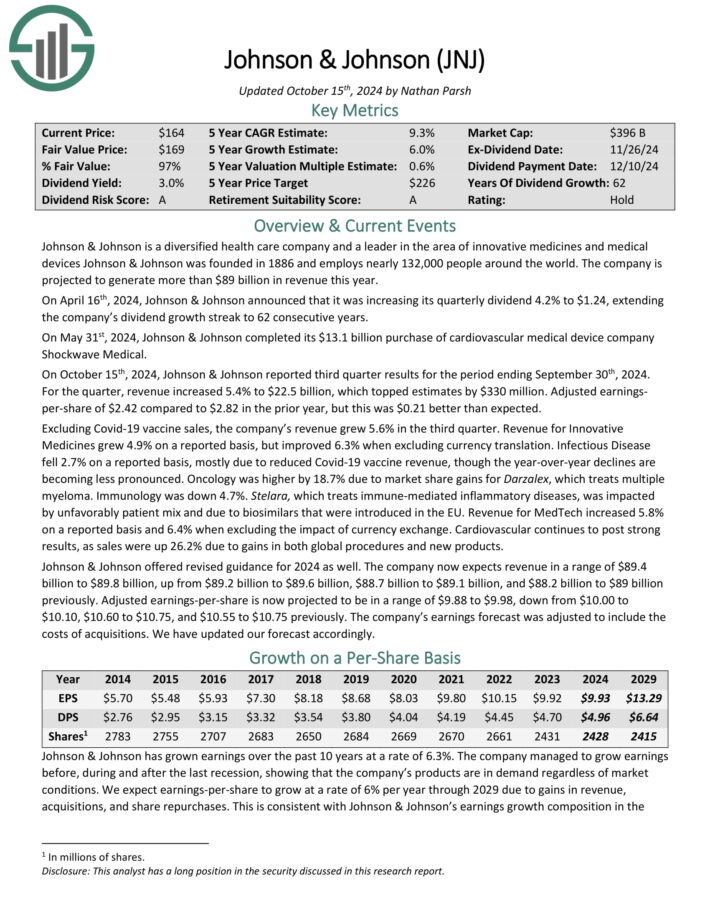

One Choice Inventory To Purchase Now: Johnson & Johnson (JNJ)

Johnson & Johnson was based in 1886 and has reworked into one of many largest firms on this planet. Johnson & Johnson is a mega-cap inventory. The corporate generates annual gross sales above $99 billion.

Johnson & Johnson operates a diversified enterprise mannequin, permitting it to enchantment to all kinds of shoppers inside the healthcare sector. J&J now operates two segments, prescription drugs and medical gadgets, after spinning off its client well being franchises.

Johnson & Johnson reported third-quarter 2024 gross sales development of 5.2%, reaching $22.5 billion, with operational development of 6.3%.

Supply: Investor Presentation

Nonetheless, earnings per share (EPS) decreased by 34.3%, largely attributable to a one-time particular cost and bought in-process analysis and growth (IPR&D).

Adjusted EPS fell 9.0% to $2.42, pushed by the identical IPR&D affect. The corporate made vital developments, together with approvals for therapies like TREMFYA and RYBREVANT, and the submission of a brand new basic surgical procedure robotic system, OTTAVA.

Click on right here to obtain our most up-to-date Positive Evaluation report on JNJ (preview of web page 1 of three proven beneath):

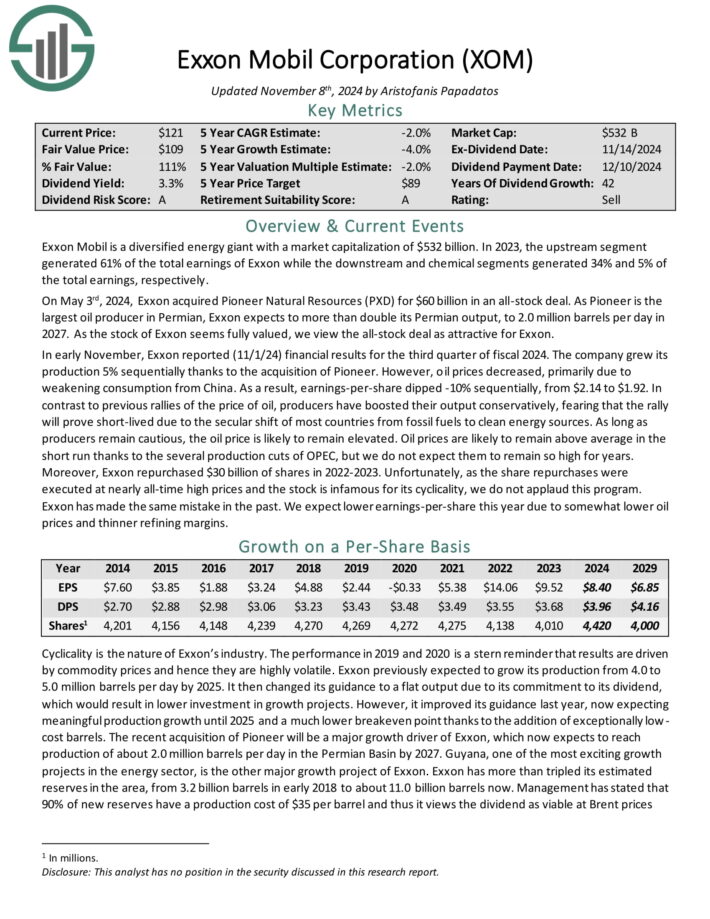

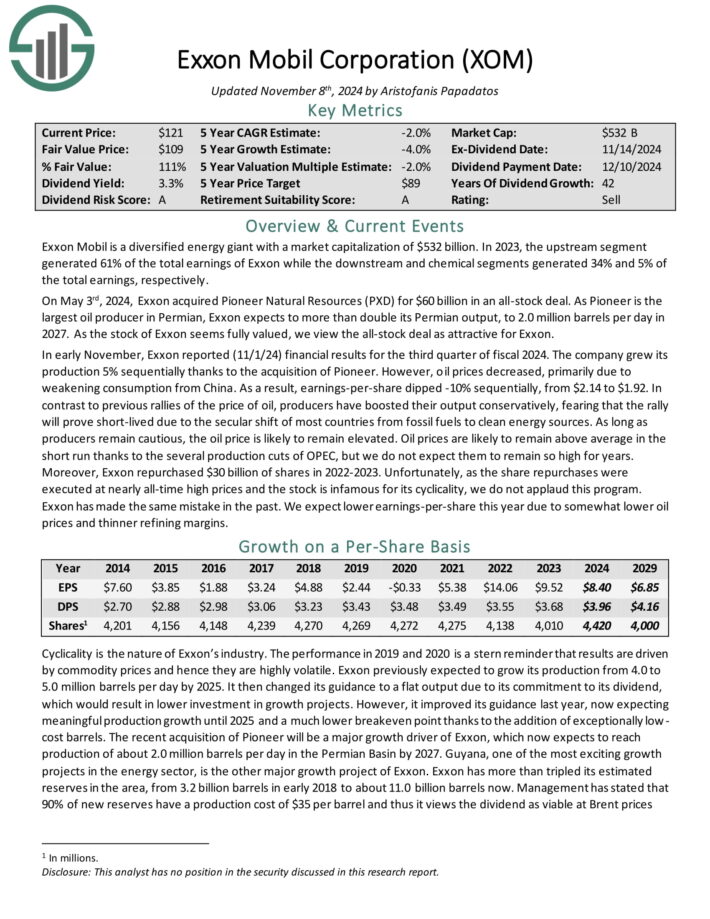

One Choice Inventory To Purchase Now: Exxon Mobil Corp. (XOM)

Exxon Mobil is a diversified vitality big with a market capitalization above $500 billion. In 2023, the upstream phase generated 61% of the overall earnings of Exxon whereas the downstream and chemical segments generated 34% and 5% of the overall earnings, respectively.

On Could third, 2024, Exxon acquired Pioneer Pure Sources (PXD) for $60 billion in an all-stock deal. As Pioneer is the biggest oil producer in Permian, Exxon expects to greater than double its Permian output, to 2.0 million barrels per day in 2027.

Supply: Investor Presentation

In early November, Exxon reported (11/1/24) monetary outcomes for the third quarter of fiscal 2024. The corporate grew its manufacturing 5% sequentially due to the acquisition of Pioneer.

Nonetheless, oil costs decreased, primarily attributable to weakening consumption from China. Consequently, earnings-per-share dipped -10% sequentially, from $2.14 to $1.92.

The latest acquisition of Pioneer might be a serious development driver of Exxon, which now expects to succeed in manufacturing of about 2.0 million barrels per day within the Permian Basin by 2027.

Guyana, probably the most thrilling development tasks within the vitality sector, is one other main development venture. Exxon has greater than tripled its estimated reserves within the space, from 3.2 billion barrels in early 2018 to about 11.0 billion barrels now.

Click on right here to obtain our most up-to-date Positive Evaluation report on XOM (preview of web page 1 of three proven beneath):

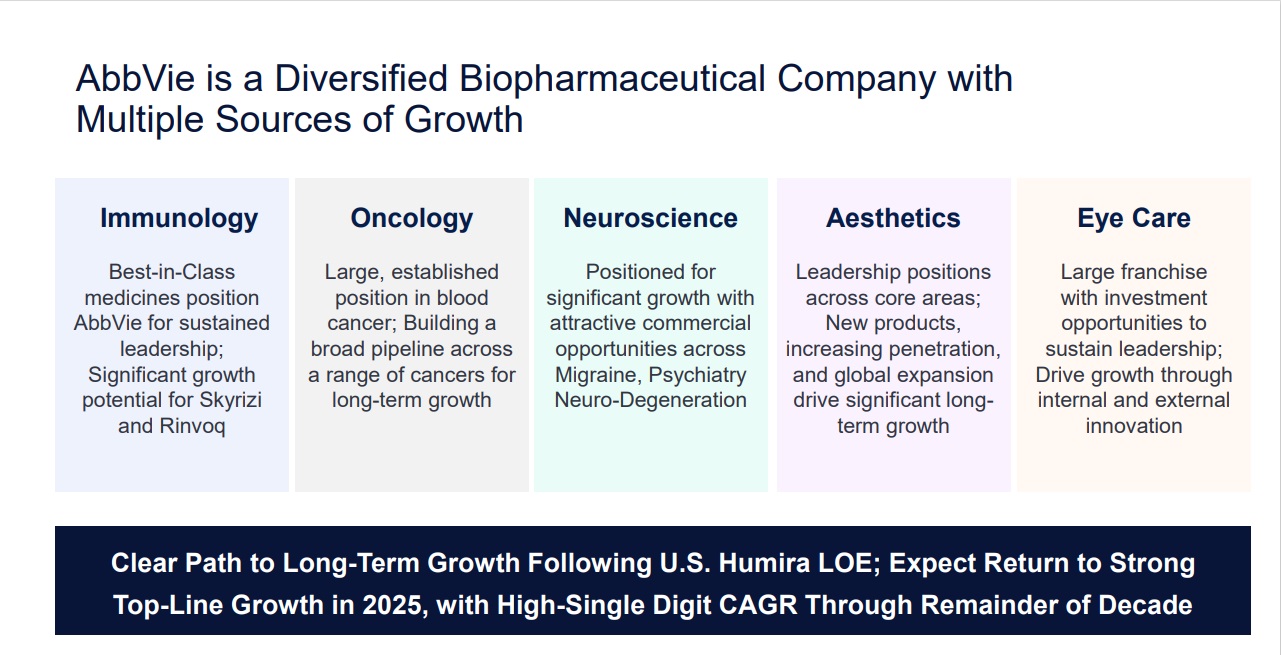

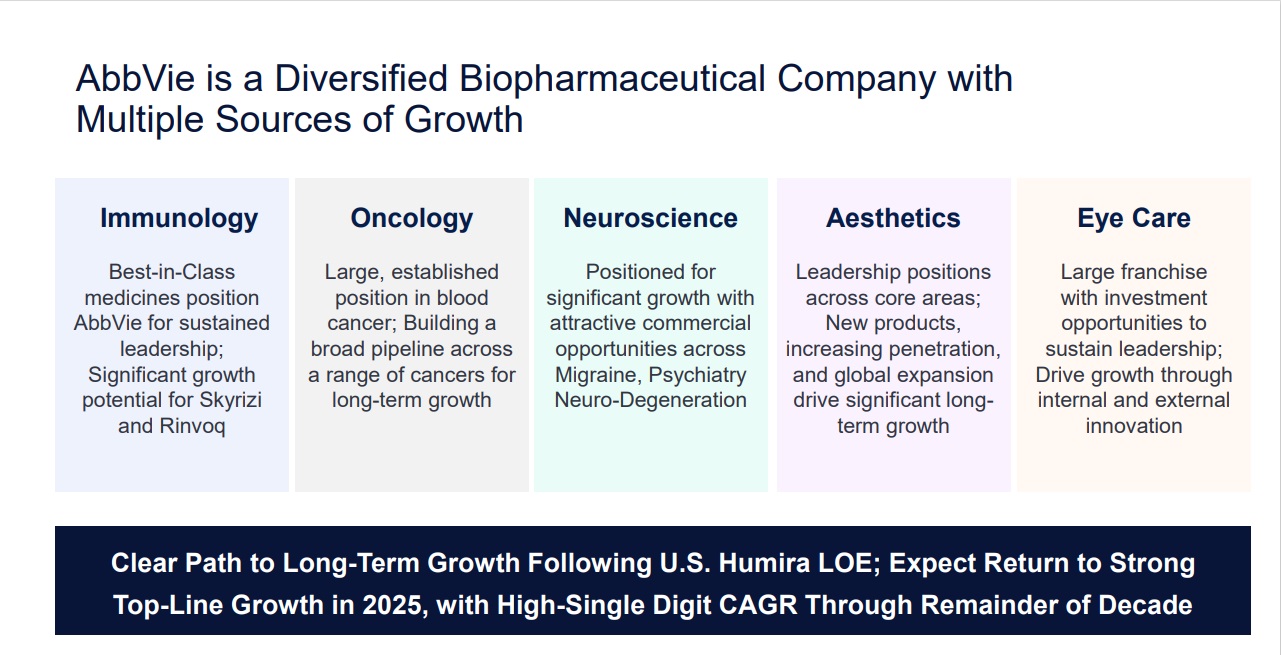

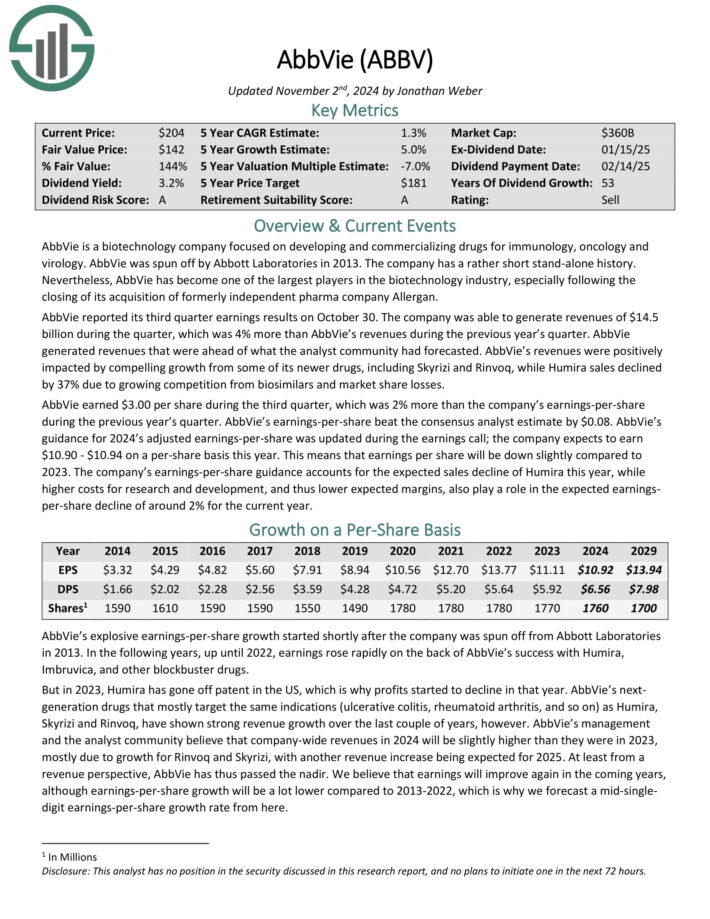

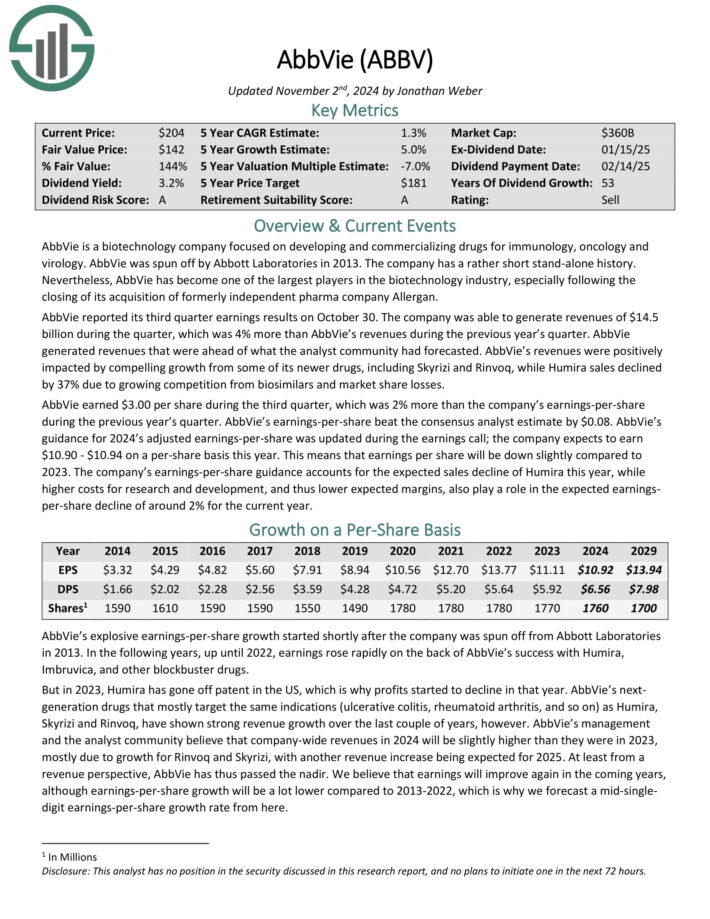

One Choice Inventory To Purchase Now: AbbVie Inc. (ABBV)

AbbVie is a pharmaceutical firm spun off by Abbott Laboratories (ABT) in 2013. Its most essential product is Humira, now going through biosimilar competitors in Europe and the U.S., which has had a noticeable affect on the corporate.

Even so, AbbVie stays an enormous within the healthcare sector, with a big and diversified product portfolio.

Supply: Investor Presentation

AbbVie reported its third quarter earnings outcomes on October 30. The corporate was capable of generate revenues of $14.5 billion in the course of the quarter, which was 4% greater than AbbVie’s revenues in the course of the earlier 12 months’s quarter.

Revenues had been positively impacted by compelling development from a few of its newer medication, together with Skyrizi and Rinvoq, whereas Humira gross sales declined by 37% attributable to rising competitors from biosimilars and market share losses.

AbbVie earned $3.00 per share in the course of the third quarter, which was 2% greater than the corporate’s earnings-per-share in the course of the earlier 12 months’s quarter. AbbVie’s earnings-per-share beat the consensus analyst estimate by $0.08.

AbbVie’s steering for 2024’s adjusted earnings-per-share was up to date in the course of the earnings name; the corporate expects to earn $10.90 – $10.94 on a per-share foundation this 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on AbbVie (preview of web page 1 of three proven beneath):

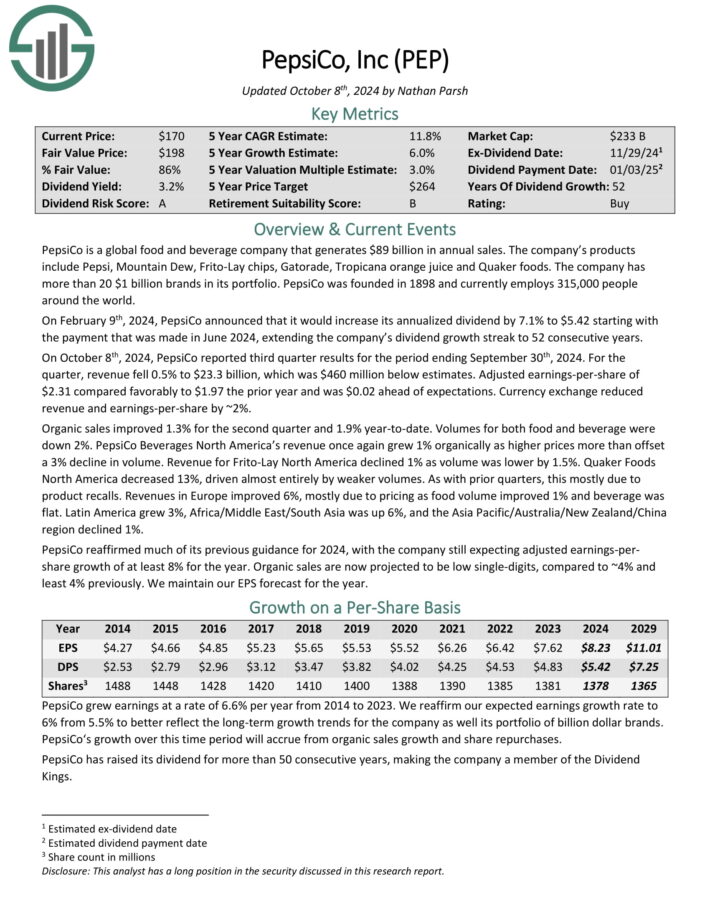

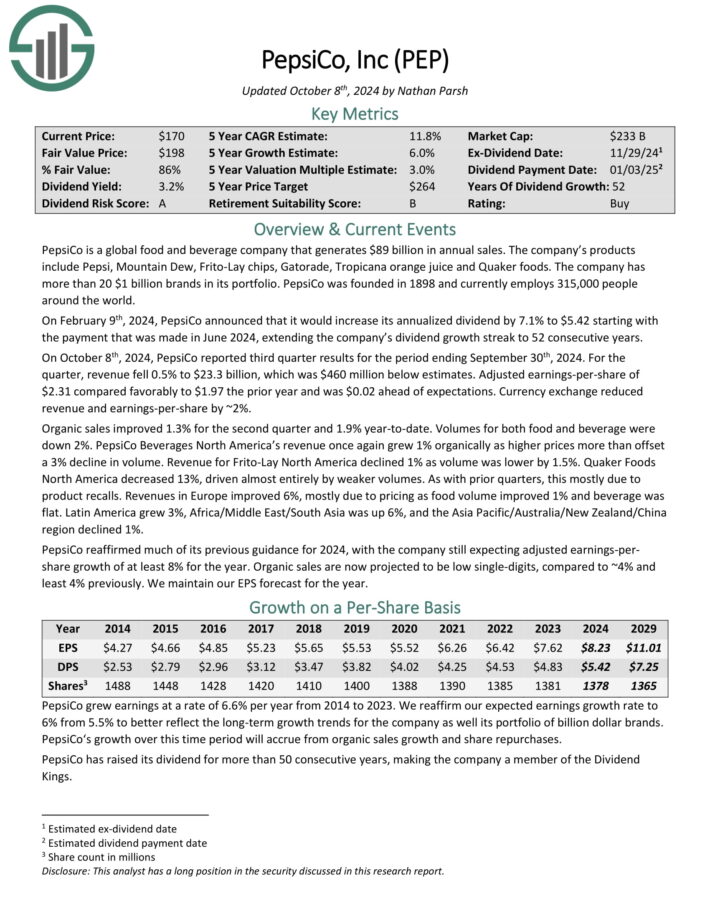

One Choice Inventory To Purchase Now: PepsiCo Inc. (PEP)

PepsiCo is a worldwide meals and beverage firm that generates $89 billion in annual gross sales. The corporate’s merchandise embrace Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

Its enterprise is cut up roughly 60-40 by way of meals and beverage income. Additionally it is balanced geographically between the U.S. and the remainder of the world.

Supply: Investor Presentation

On October eighth, 2024, PepsiCo reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income fell 0.5% to $23.3 billion, which was $460 million beneath estimates.

Adjusted earnings-per-share of $2.31 in contrast favorably to $1.97 the prior 12 months and was $0.02 forward of expectations. Foreign money change diminished income and earnings-per-share by ~2%.

Natural gross sales improved 1.3% for the second quarter and 1.9% year-to-date. Volumes for each meals and beverage had been down 2%.

PepsiCo Drinks North America’s income as soon as once more grew 1% organically as larger costs greater than offset a 3% decline in quantity.

Click on right here to obtain our most up-to-date Positive Evaluation report on PEP (preview of web page 1 of three proven beneath):

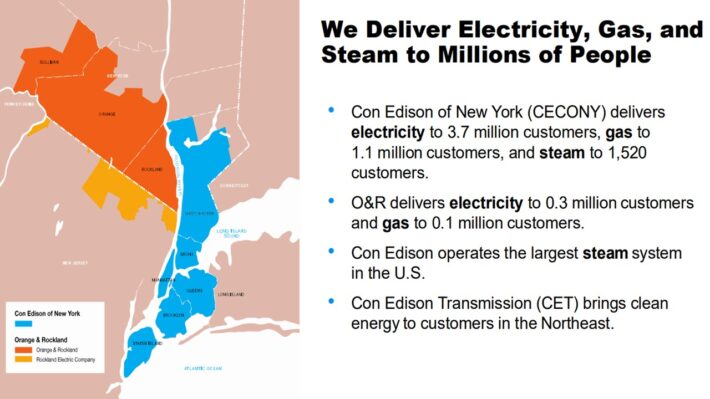

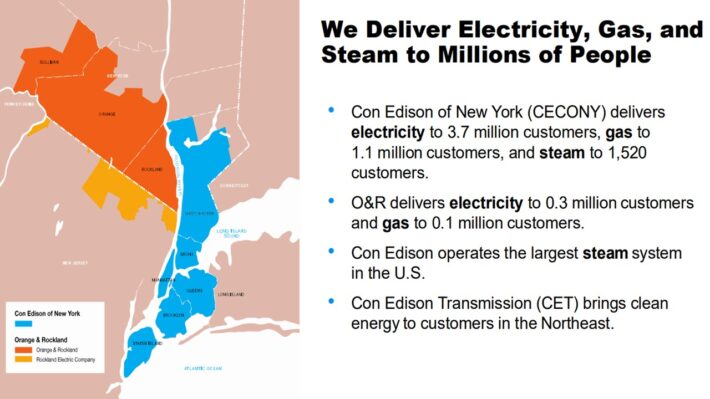

One Choice Inventory To Purchase Now: Consolidated Edison (ED)

Consolidated Edison is a large-cap utility inventory. The corporate generates almost $15 billion in annual income and has a market capitalization of roughly $36 billion.

The corporate serves 3.7 million electrical prospects, and one other 1.1 million gasoline prospects, in New York.

Supply: Investor Presentation

It operates electrical, gasoline, and steam transmission companies, with a steam system that’s the largest within the U.S.

On November seventh, 2024, Consolidated Edison reported third quarter outcomes. For the quarter, income improved 5.7% to $4.1 billion, which topped estimates by $26 million.

Adjusted earnings of $583 million, or $1.68 per share, in comparison with adjusted earnings of $561 million, or $1.62 per share, within the earlier 12 months. Adjusted earnings-per-share had been $0.10 greater than anticipated.

As with prior durations, larger fee bases for gasoline and electrical prospects had been the first contributors to leads to the CECONY enterprise, which accounts for the overwhelming majority of the corporate’s belongings.

Common fee base balances are nonetheless anticipated to develop by 6.4% yearly for the 2024 to 2028 interval.

Click on right here to obtain our most up-to-date Positive Evaluation report on Consolidated Edison (preview of web page 1 of three proven beneath):

One Choice Inventory To Purchase Now: Hormel Meals (HRL)

Hormel Meals is a juggernaut within the meals merchandise trade with almost $10 billion in annual income. It has a big portfolio of category-leading manufacturers. Only a few of its prime manufacturers embrace embrace Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

It has additionally pursued acquisitions to drive development. For instance, in 2021, Hormel acquired the Planters snack nuts enterprise from Kraft-Heinz (KHC) for $3.35 billion, which has boosted Hormel’s development.

Supply: Investor Presentation

Hormel posted fourth quarter and full-year earnings on December 4th, 2024, and outcomes had been in keeping with expectations. The corporate posted adjusted earnings-per-share of 42 cents, which met estimates. Income was off 2% year-on-year to $3.14 billion, additionally hitting estimates.

Working revenue was $308 million for the quarter on an adjusted foundation, or 9.8% of income. Working money stream was $409 million for This autumn. For the 12 months, gross sales had been $11.9 billion, and adjusted working revenue was $1.1 billion, or 9.6% of income. Adjusted earnings-per-share was $1.58. Working money stream hit a file of $1.3 billion.

Steering for 2025 was initiated at $11.9 billion to $12.2 billion in gross sales, with natural web gross sales development of 1% to three%.

Click on right here to obtain our most up-to-date Positive Evaluation report on HRL (preview of web page 1 of three proven beneath):

One Choice Inventory To Purchase Now: Archer Daniels Midland (ADM)

Archer-Daniels-Midland is the biggest publicly traded farmland product firm in the USA.

Archer-Daniels-Midland’s companies embrace processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its third-quarter outcomes for Fiscal 12 months (FY) 2024 on November 18th, 2024.

The corporate reported adjusted web earnings of $530 million and adjusted EPS of $1.09, each down from the prior 12 months attributable to a $461 million non-cash cost associated to its Wilmar fairness funding.

Consolidated money flows year-to-date reached $2.34 billion, reflecting sturdy operations regardless of market challenges.

Click on right here to obtain our most up-to-date Positive Evaluation report on ADM (preview of web page 1 of three proven beneath):

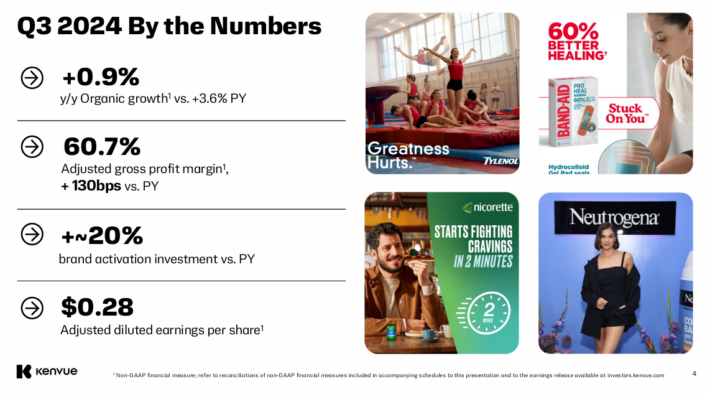

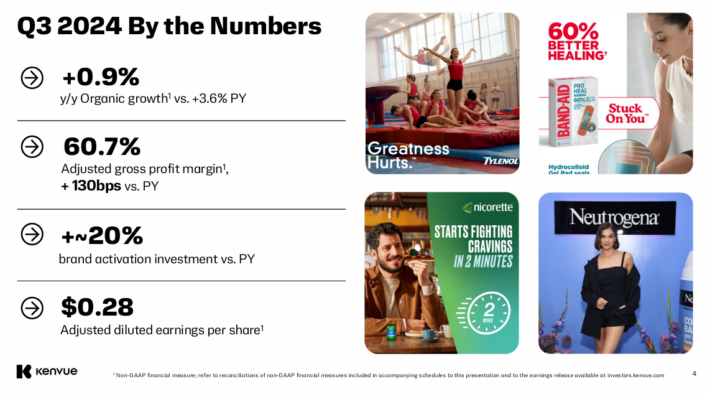

One Choice Inventory To Purchase Now: Kenvue Inc. (KVUE)

Kenvue is a client merchandise firm that was spun off from Johnson & Johnson. It has three segments, together with Self Care, Pores and skin Well being and Magnificence, and Important Well being.

The Self Care product portfolio contains cough, chilly, allergy, smoking cessation, and ache care merchandise amongst others. Pores and skin Well being and Magnificence holds merchandise comparable to face, physique, hair, and solar care. Important Well being accommodates merchandise for girls’s well being, wound care, oral care, and child care.

Nicely-known manufacturers in Kenvue’s product line up embrace Tylenol, Listerine, Band-Support, Neutrogena, Nicorette, and Zyrtec. These companies contributed roughly 17% of Johnson & Johnson’s annual income.

On November seventh, 2024, Kenvue reported third quarter earnings outcomes for the interval ending September thirtieth, 2024. Income decreased 0.5% to $3.9 billion, which was $20 million lower than anticipated.

Supply: Investor Presentation

Adjusted earnings-per-share of $0.28 in contrast unfavorably to $0.31 final 12 months, however this was $0.01 above estimates.

Natural gross sales had been up 0.9% for the quarter, which follows a 3.6% enchancment final 12 months. For the quarter, pricing and blend profit of two.5% was offset by a 1.6% decline in quantity.

As soon as once more, quantity development in Important Well being was offset by weak point in Pores and skin Well being and Magnificence and Self Care. Gross revenue margin expanded 100 foundation factors to 58.5%.

Click on right here to obtain our most up-to-date Positive Evaluation report on KVUE (preview of web page 1 of three proven beneath):

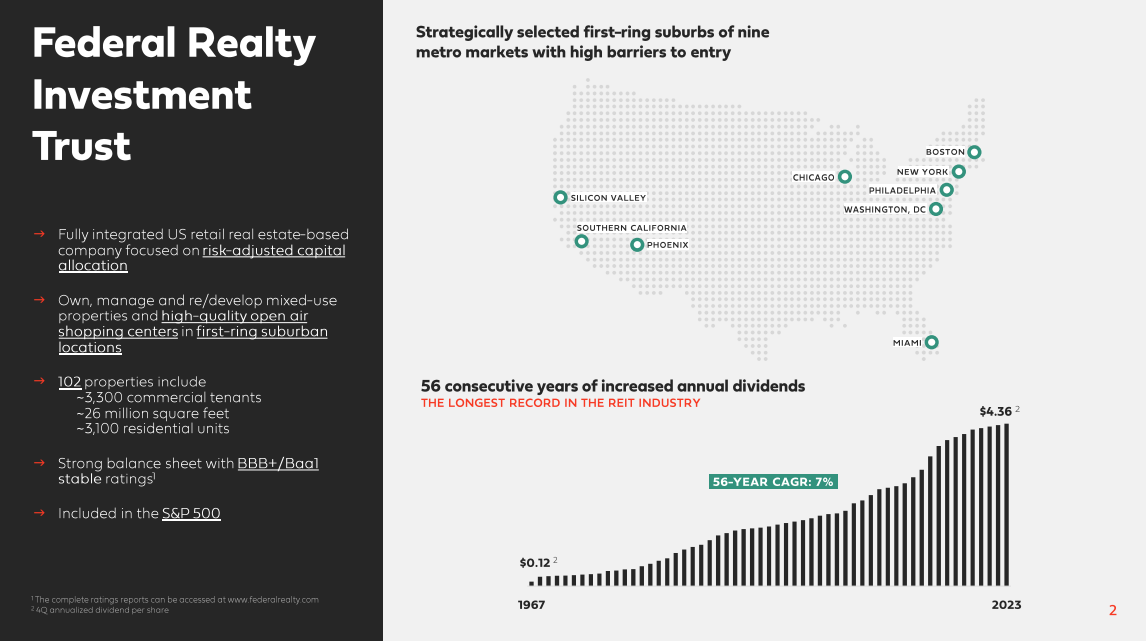

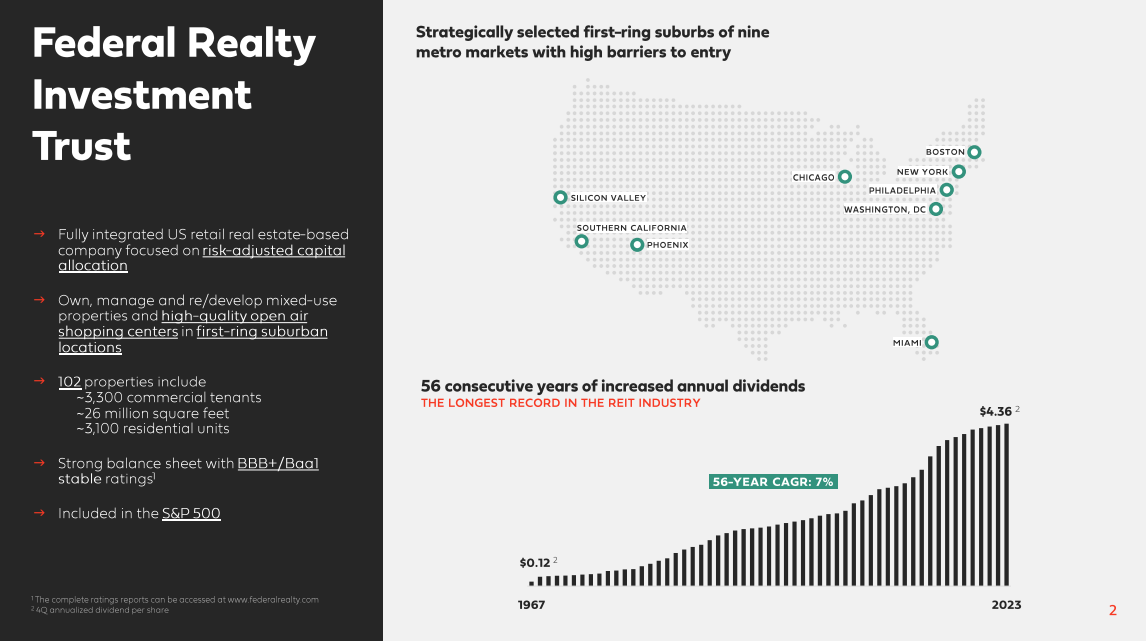

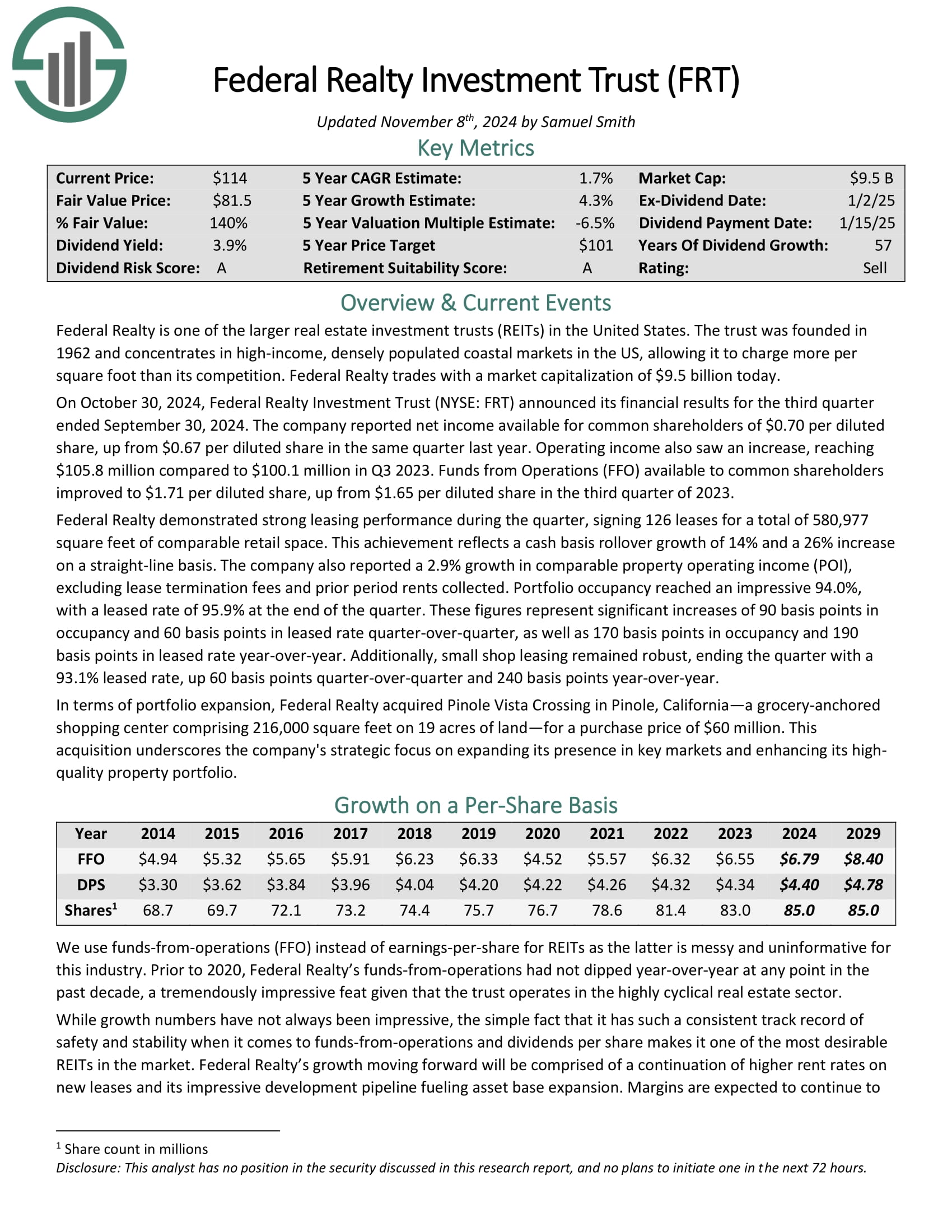

One Choice Inventory To Purchase Now: Federal Realty Funding Belief (FRT)

Federal Realty was based in 1962. As a Actual Property Funding Belief, Federal Realty’s enterprise mannequin is to personal and lease out actual property properties.

It makes use of a good portion of its rental revenue, in addition to exterior financing, to amass new properties.

Supply: Investor Presentation

On October 30, 2024, Federal Realty Funding Belief introduced its monetary outcomes for the third quarter ended September 30, 2024.

The corporate reported web revenue obtainable for frequent shareholders of $0.70 per diluted share, up from $0.67 per diluted share in the identical quarter final 12 months. Working revenue additionally noticed a rise, reaching $105.8 million in comparison with $100.1 million in Q3 2023.

Funds from Operations (FFO) obtainable to frequent shareholders improved to $1.71 per diluted share, up from $1.65 per diluted share within the third quarter of 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on Federal Realty (preview of web page 1 of three proven beneath):

Different Dividend Lists & Remaining Ideas

The Dividend Aristocrats record just isn’t the one technique to shortly display for shares that usually pay rising dividends.

- The Dividend Kings Listing is much more unique than the Dividend Aristocrats. It’s comprised of 54 shares with 50+ years of consecutive dividend will increase.

- The Blue Chip Shares Listing: shares that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The Excessive Dividend Shares Listing: shares that enchantment to traders within the highest yields of 5% or extra.

- The Month-to-month Dividend Shares Listing: shares that pay dividends each month, for 12 dividend funds per 12 months.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].