Revealed on January twenty first, 2026 by Bob Ciura

Actual property funding trusts – or REITs – give traders the chance to earn revenue from actual property, with none of the day-to-day hassles related to being a standard landlord.

REITs are fashionable for revenue traders, as they broadly pay increased dividend yields than the typical inventory.

Even higher, many REITs pay month-to-month dividends.

Month-to-month dividends permit traders to obtain extra frequent funds than shares which pay quarterly or semi-annual dividend payouts.

There are over 80 month-to-month dividend shares that at the moment provide a month-to-month dividend fee.

You may obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter, like dividend yield and payout ratio) by clicking on the hyperlink under:

With this in thoughts, this text lists 10 REITs with month-to-month dividends, which might make them significantly interesting for revenue traders.

The shares are sorted by dividend yield, from lowest to highest.

Desk of Contents

Month-to-month Dividend REIT #10: STAG Industrial (STAG)

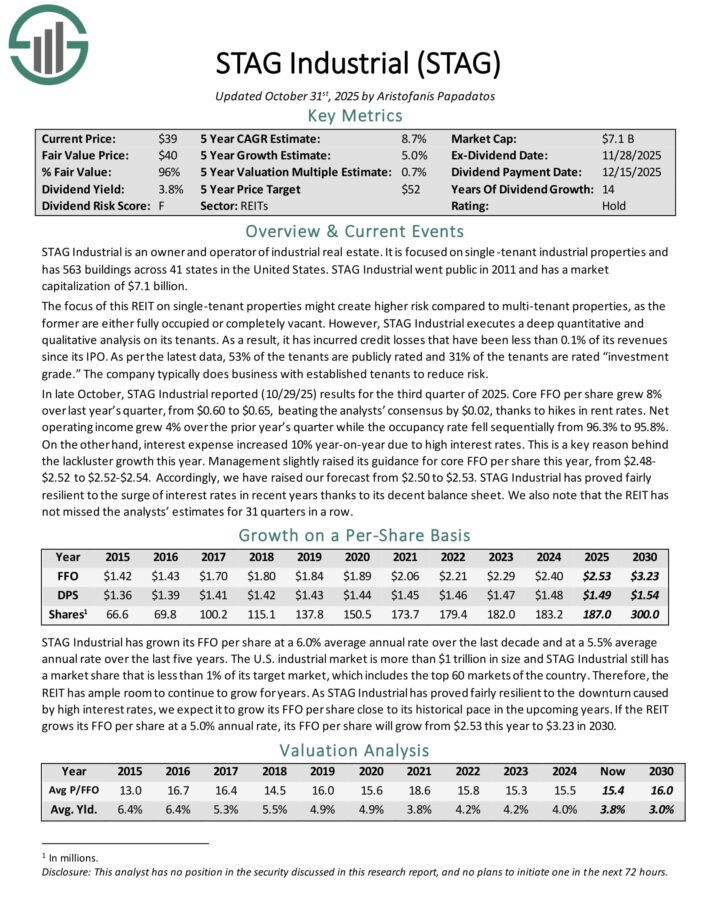

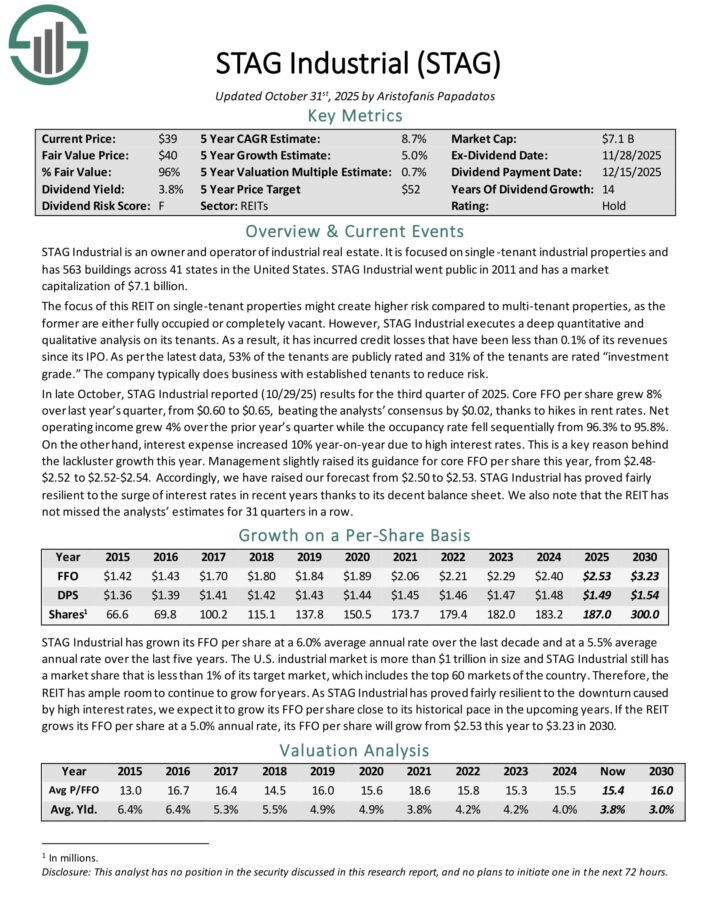

STAG Industrial is an proprietor and operator of business actual property. It’s targeted on single-tenant industrial properties and has 563 buildings throughout 41 states in the USA.

The main target of this REIT on single-tenant properties may create increased threat in comparison with multi-tenant properties, as the previous are both absolutely occupied or utterly vacant.

Nonetheless, STAG Industrial executes a deep quantitative and qualitative evaluation on its tenants. Consequently, it has incurred credit score losses which have been lower than 0.1% of its revenues since its IPO.

As per the newest knowledge, 53% of the tenants are publicly rated and 31% of the tenants are rated “funding grade.” The corporate sometimes does enterprise with established tenants to cut back threat.

In late October, STAG Industrial reported (10/29/25) outcomes for the third quarter of 2025. Core FFO per share grew 8% over final yr’s quarter, from $0.60 to $0.65, beating the analysts’ consensus by $0.02, due to hikes in lease charges.

Web working revenue grew 4% over the prior yr’s quarter whereas the occupancy fee fell sequentially from 96.3% to 95.8%.

Alternatively, curiosity expense elevated 10% year-on-year because of excessive rates of interest. This can be a key motive behind the lackluster progress this yr. Administration barely raised its steerage for core FFO per share this yr, from $2.48-$2.52 to $2.52-$2.54.

Click on right here to obtain our most up-to-date Certain Evaluation report on STAG (preview of web page 1 of three proven under):

Month-to-month Dividend REIT #9: Agree Realty (ADC)

Agree Realty is an built-in actual property funding belief (REIT) targeted on possession, acquisition, growth, and retail property administration.

Agree has developed over 40 group purchasing facilities all through the Midwestern and Southeastern United States. On the finish of December 2024, the corporate owned and operated 2,370 properties positioned in 50 states, containing roughly 48.8 million sq. toes of gross leasable house.

The corporate’s enterprise goal is to put money into and actively handle a diversified portfolio of retail properties web leased to trade tenants.

On October twenty first, 2025, Agree Realty Corp. reported third quarter outcomes for Fiscal Yr (FY)2025. The corporate reported sturdy third-quarter outcomes for 2025, with EPS of $0.47, beating estimates by $0.01, and income of $183.22 million, up 18.7% year-over-year.

Web revenue per share rose 7.9% to $0.45, whereas Core FFO and AFFO per share elevated 8.4% and seven.2% to $1.09 and $1.10, respectively.

The corporate declared a month-to-month dividend of $0.256 per share, representing a 2.4% enhance from the prior yr, and raised full-year 2025 AFFO steerage to $4.31–$4.33 per share.

ADC has elevated its dividend for 13 consecutive years.

Click on right here to obtain our most up-to-date Certain Evaluation report on ADC (preview of web page 1 of three proven under):

Month-to-month Dividend REIT #8: SmartStop Self Storage REIT (SMA)

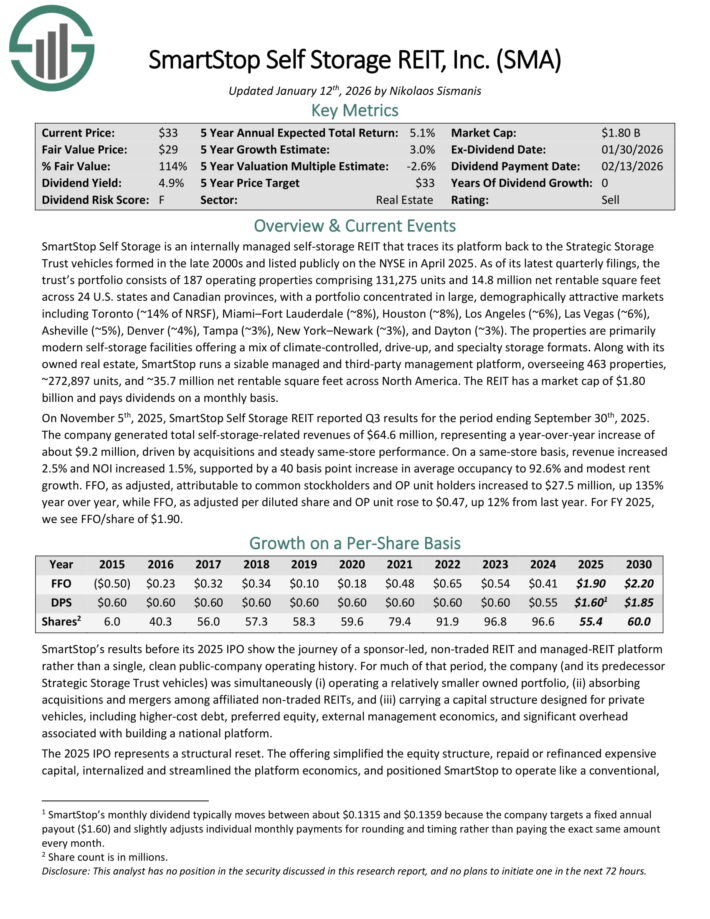

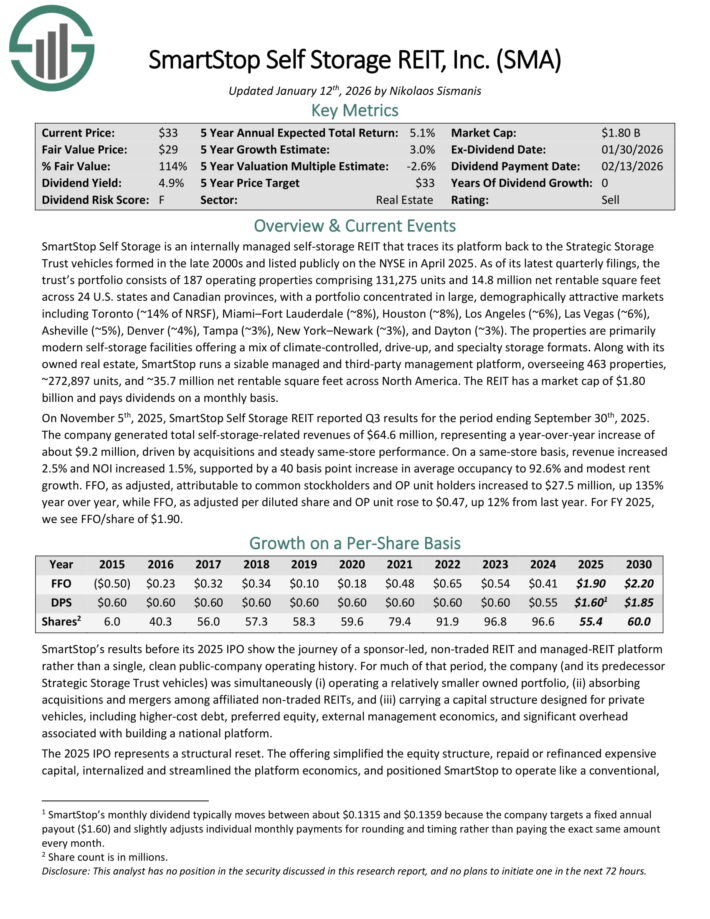

SmartStop Self Storage is an internally managed self-storage REIT that traces its platform again to the Strategic Storage Belief automobiles shaped within the late 2000s and listed publicly on the NYSE in April 2025.

As of its newest quarterly filings, the belief’s portfolio consists of 187 working properties comprising 131,275 items and 14.8 million web rentable sq. toes throughout 24 U.S. states and Canadian provinces.

The properties are primarily trendy self-storage amenities providing a mixture of climate-controlled, drive-up, and specialty storage codecs. Together with its owned actual property, SmartStop runs a large managed and third-party administration platform, overseeing 463 properties, ~272,897 items, and ~35.7 million web rentable sq. toes throughout North America.

On November fifth, 2025, SmartStop Self Storage REIT reported Q3 outcomes. The corporate generated complete self-storage-related revenues of $64.6 million, representing a year-over-year enhance of about $9.2 million, pushed by acquisitions and regular same-store efficiency.

On a same-store foundation, income elevated 2.5% and NOI elevated 1.5%, supported by a 40 foundation level enhance in common occupancy to 92.6% and modest lease progress.

FFO, as adjusted, attributable to widespread stockholders and OP unit holders elevated to $27.5 million, up 135% yr over yr, whereas FFO, as adjusted per diluted share and OP unit rose to $0.47, up 12% from final yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on SMA (preview of web page 1 of three proven under):

Month-to-month Dividend REIT #7: Realty Earnings (O)

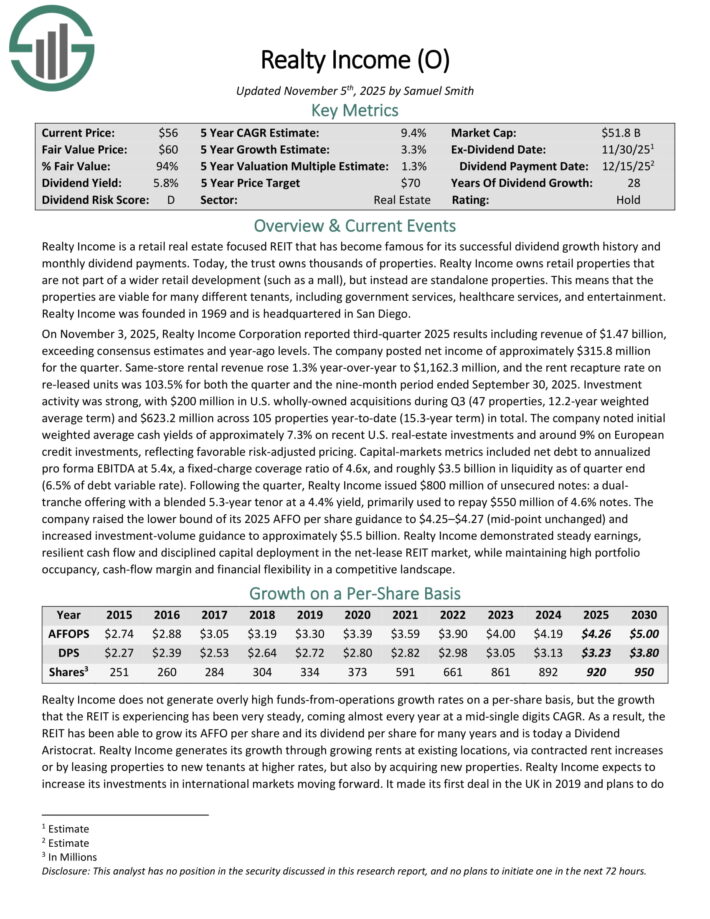

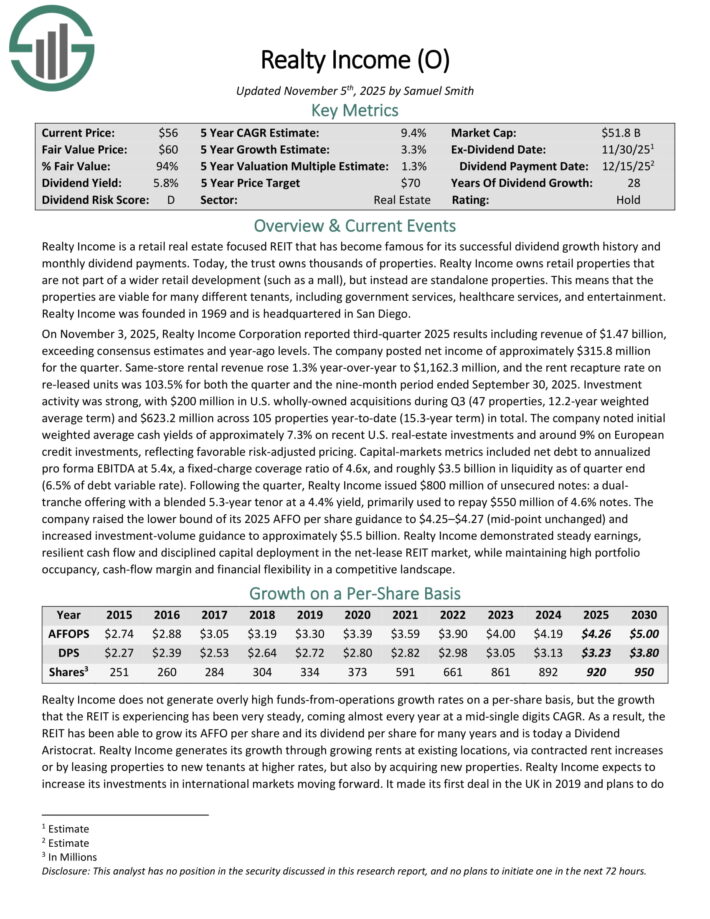

Realty Earnings is a retail actual property targeted REIT that has develop into well-known for its profitable dividend progress historical past and month-to-month dividend funds.

Realty Earnings owns retail properties that aren’t a part of a wider retail growth (equivalent to a mall), however as a substitute are standalone properties. Because of this the properties are viable for a lot of totally different tenants, together with authorities companies, healthcare companies, and leisure.

On November 3, 2025, Realty Earnings Company reported third-quarter 2025 outcomes together with income of $1.47 billion, exceeding consensus estimates and year-ago ranges.

The corporate posted web revenue of roughly $315.8 million for the quarter. Identical-store rental income rose 1.3% year-over-year to $1,162.3 million, and the lease recapture fee on re-leased items was 103.5% for each the quarter and the nine-month interval ended September 30, 2025.

Funding exercise was sturdy, with $200 million in U.S. wholly-owned acquisitions throughout Q3 (47 properties, 12.2-year weighted common time period) and $623.2 million throughout 105 properties year-to-date (15.3-year time period) in complete.

Realty Earnings’s most necessary aggressive benefit is its world-class administration staff that has efficiently guided the belief up to now.

It has elevated its dividend for 28 consecutive years, and is on the listing of Dividend Aristocrats.

Click on right here to obtain our most up-to-date Certain Evaluation report on Realty Earnings (preview of web page 1 of three proven under):

Month-to-month Dividend REIT #6: LTC Properties (LTC)

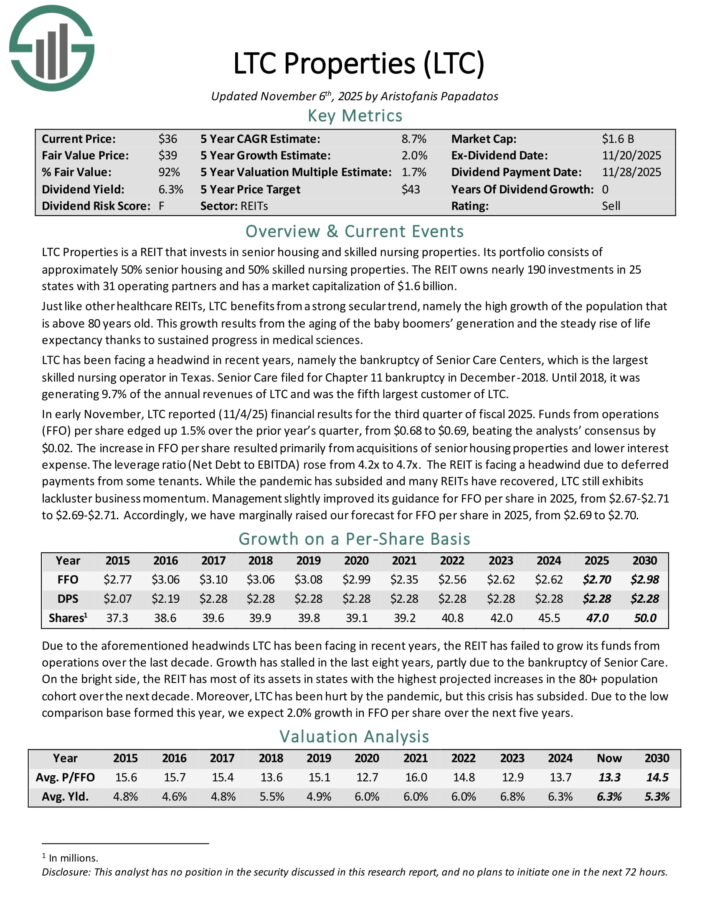

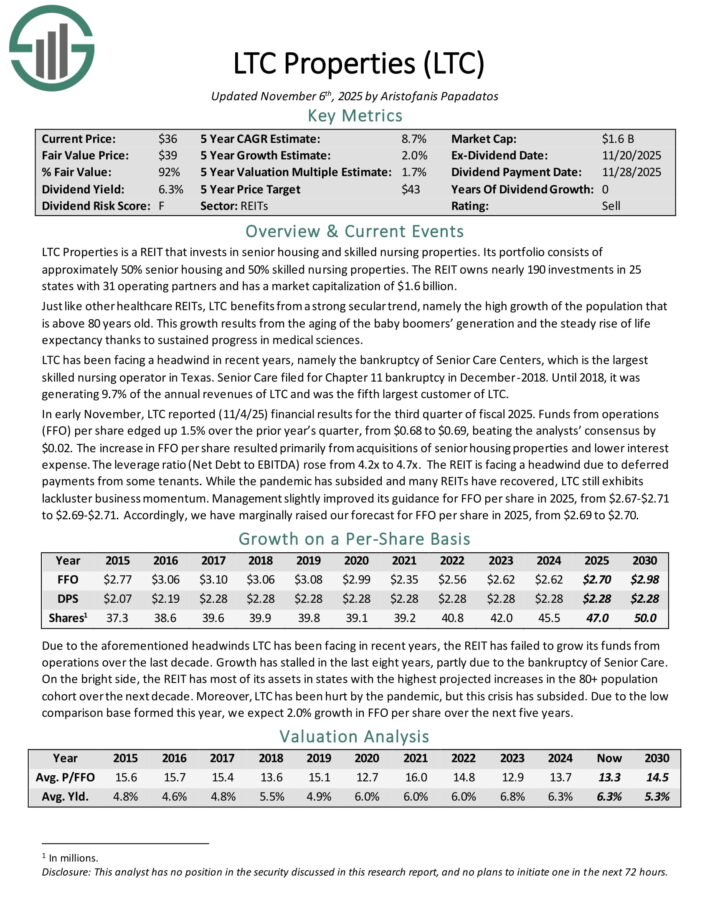

LTC Properties is a REIT that invests in senior housing and expert nursing properties. Its portfolio consists of roughly 50% senior housing and 50% expert nursing properties.

The REIT owns almost 190 investments in 25 states with 31 working companions. Similar to different healthcare REITs, LTC advantages from a robust secular pattern, specifically the excessive progress of the inhabitants that’s above 80 years outdated.

This progress outcomes from the getting old of the infant boomers’ technology and the regular rise of life expectancy due to sustained progress in medical sciences.

In early November, LTC reported (11/4/25) monetary outcomes for the third quarter of fiscal 2025. Funds from operations (FFO) per share edged up 1.5% over the prior yr’s quarter, from $0.68 to $0.69, beating the analysts’ consensus by $0.02.

The rise in FFO per share resulted primarily from acquisitions of senior housing properties and decrease curiosity expense.

The leverage ratio (Web Debt to EBITDA) rose from 4.2x to 4.7x. The REIT is going through a headwind because of deferred funds from some tenants.

Whereas the pandemic has subsided and plenty of REITs have recovered, LTC nonetheless reveals lackluster enterprise momentum. Administration barely improved its steerage for FFO per share in 2025, from $2.67-$2.71 to $2.69-$2.71.

Click on right here to obtain our most up-to-date Certain Evaluation report on LTC (preview of web page 1 of three proven under):

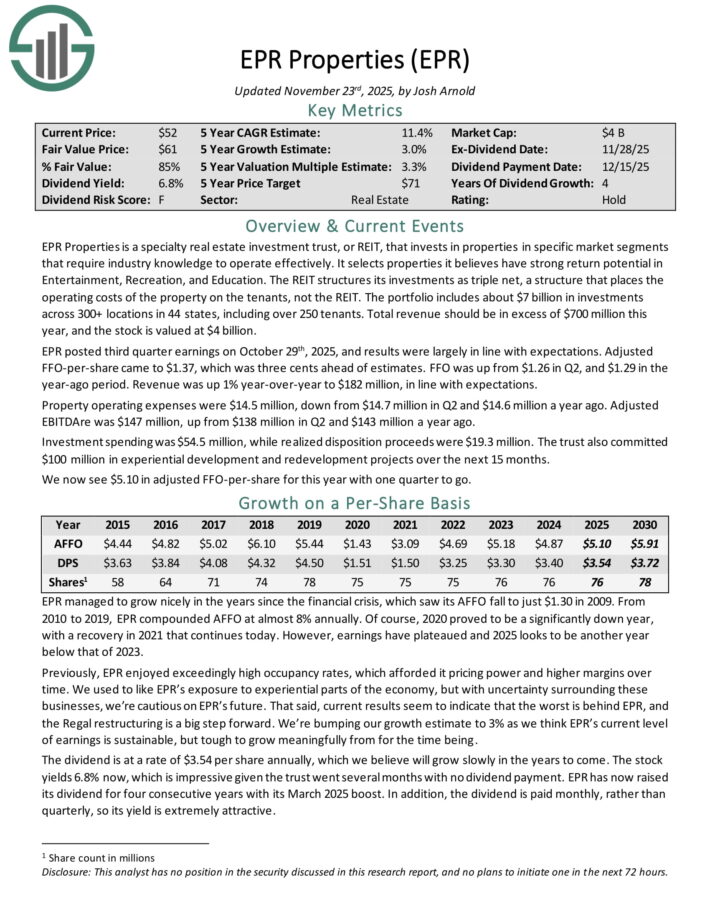

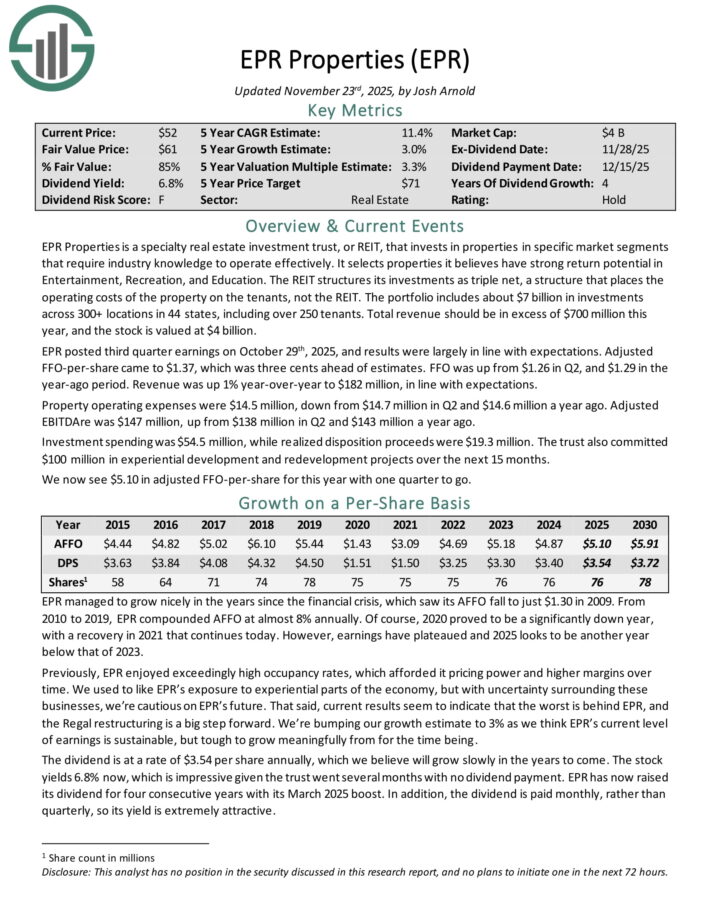

Month-to-month Dividend REIT #5: EPR Properties (EPR)

EPR Properties is a specialty actual property funding belief, or REIT, that invests in properties in particular market segments that require trade information to function successfully.

It selects properties it believes have sturdy return potential in Leisure, Recreation, and Training. The REIT constructions its investments as triple web, a construction that locations the working prices of the property on the tenants, not the REIT.

The portfolio consists of about $7 billion in investments throughout 300+ areas in 44 states, together with over 250 tenants. Whole income needs to be in extra of $700 million this yr.

EPR posted third quarter earnings on October twenty ninth, 2025, and outcomes have been largely in keeping with expectations. Adjusted FFO-per-share got here to $1.37, which was three cents forward of estimates.

FFO was up from $1.26 in Q2, and $1.29 within the year-ago interval. Income was up 1% year-over-year to $182 million, in keeping with expectations.

Property working bills have been $14.5 million, down from $14.7 million in Q2 and $14.6 million a yr in the past. Adjusted EBITDAre was $147 million, up from $138 million in Q2 and $143 million a yr in the past.

Funding spending was $54.5 million, whereas realized disposition proceeds have been $19.3 million. The belief additionally dedicated $100 million in experiential growth and redevelopment initiatives over the following 15 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on EPR (preview of web page 1 of three proven under):

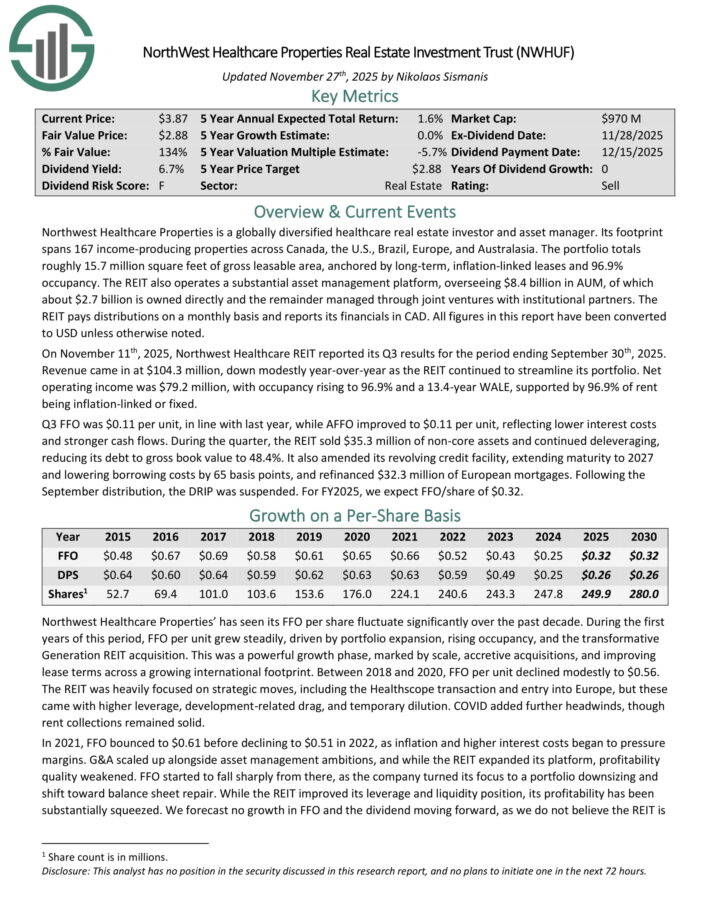

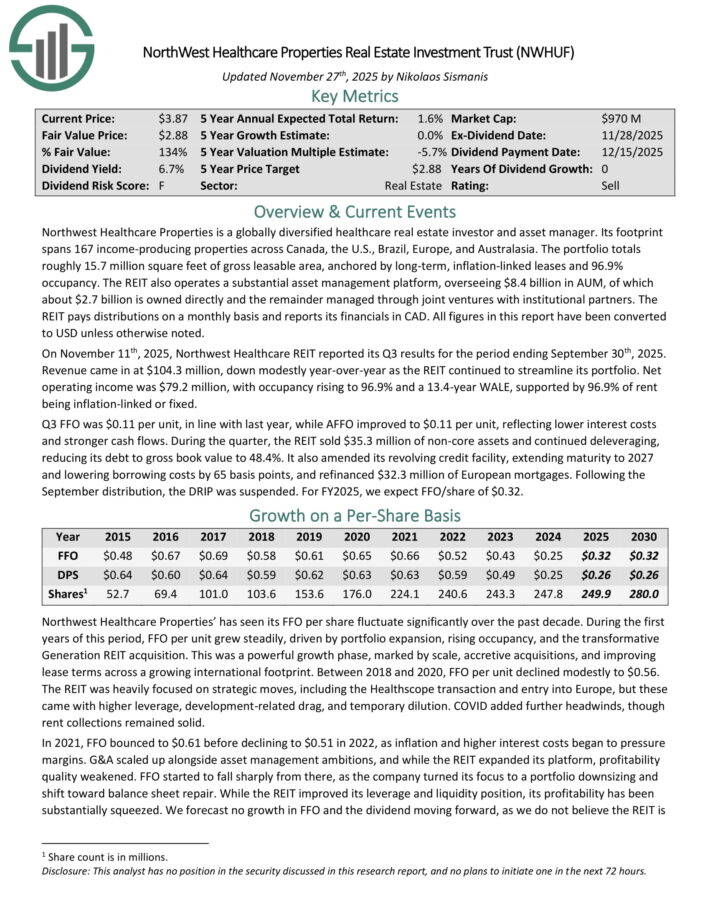

Month-to-month Dividend REIT #4: NorthWest Healthcare Properties (NWHUF)

Northwest Healthcare Properties is a globally diversified healthcare actual property investor and asset supervisor.

Its footprint spans 167 income-producing properties throughout Canada, the U.S., Brazil, Europe, and Australasia. The portfolio totals roughly 15.7 million sq. toes of gross leasable space, anchored by long-term, inflation-linked leases and 96.9% occupancy.

The REIT additionally operates a considerable asset administration platform, overseeing $8.4 billion in AUM, of which about $2.7 billion is owned immediately and the rest managed by means of joint ventures with institutional companions.

On November eleventh, 2025, Northwest Healthcare REIT reported its Q3 outcomes. Income got here in at $104.3 million, down modestly year-over-year because the REIT continued to streamline its portfolio.

Web working revenue was $79.2 million, with occupancy rising to 96.9% and a 13.4-year WALE, supported by 96.9% of lease being inflation-linked or fastened.

Q3 FFO was $0.11 per unit, in keeping with final yr, whereas AFFO improved to $0.11 per unit, reflecting decrease curiosity prices and stronger money flows.

Through the quarter, the REIT bought $35.3 million of non-core property and continued deleveraging, lowering its debt to gross ebook worth to 48.4%.

It additionally amended its revolving credit score facility, extending maturity to 2027 and decreasing borrowing prices by 65 foundation factors, and refinanced $32.3 million of European mortgages.

Click on right here to obtain our most up-to-date Certain Evaluation report on NWHUF (preview of web page 1 of three proven under):

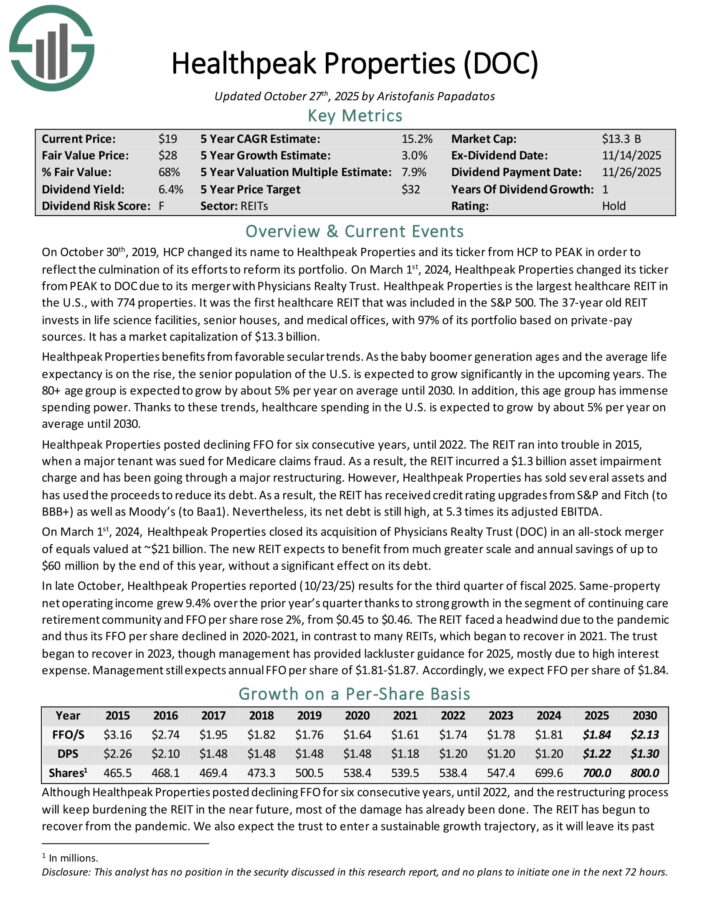

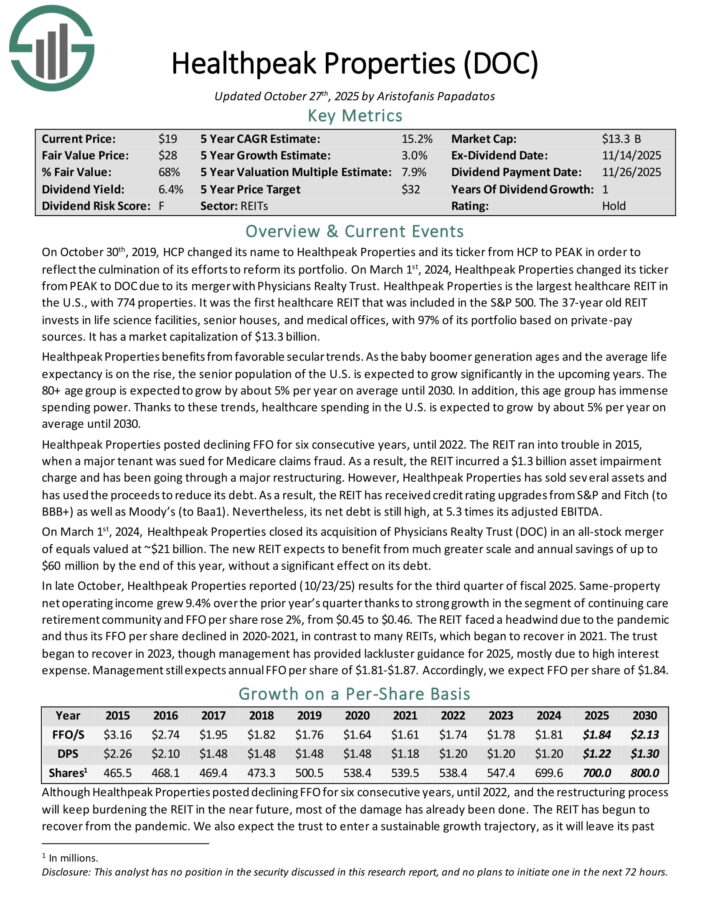

Month-to-month Dividend REIT #3: Healthpeak Properties (DOC)

Healthpeak Properties is the most important healthcare REIT within the U.S., with 774 properties. It was the primary healthcare REIT that was included within the S&P 500.

The REIT invests in life science amenities, senior homes, and medical places of work, with 97% of its portfolio primarily based on private-pay sources.

In late October, Healthpeak Properties reported (10/23/25) outcomes for the third quarter of fiscal 2025. Identical-property web working revenue grew 9.4% over the prior yr’s quarter due to sturdy progress within the section of constant care retirement group and FFO per share rose 2%, from $0.45 to $0.46.

Administration nonetheless expects annual FFO per share of $1.81-$1.87.

The payout ratio is standing at an almost 10-year low whereas the REIT didn’t have any debt maturities in 2025. The REIT has begun to get well from the pandemic. We additionally anticipate the belief to enter a sustainable progress trajectory.

Click on right here to obtain our most up-to-date Certain Evaluation report on DOC (preview of web page 1 of three proven under):

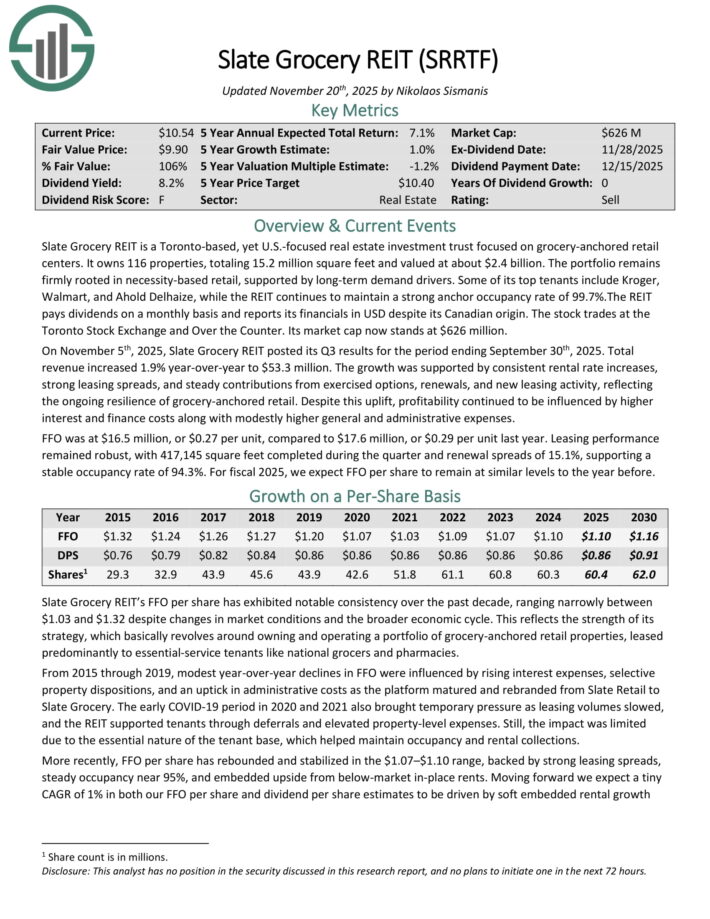

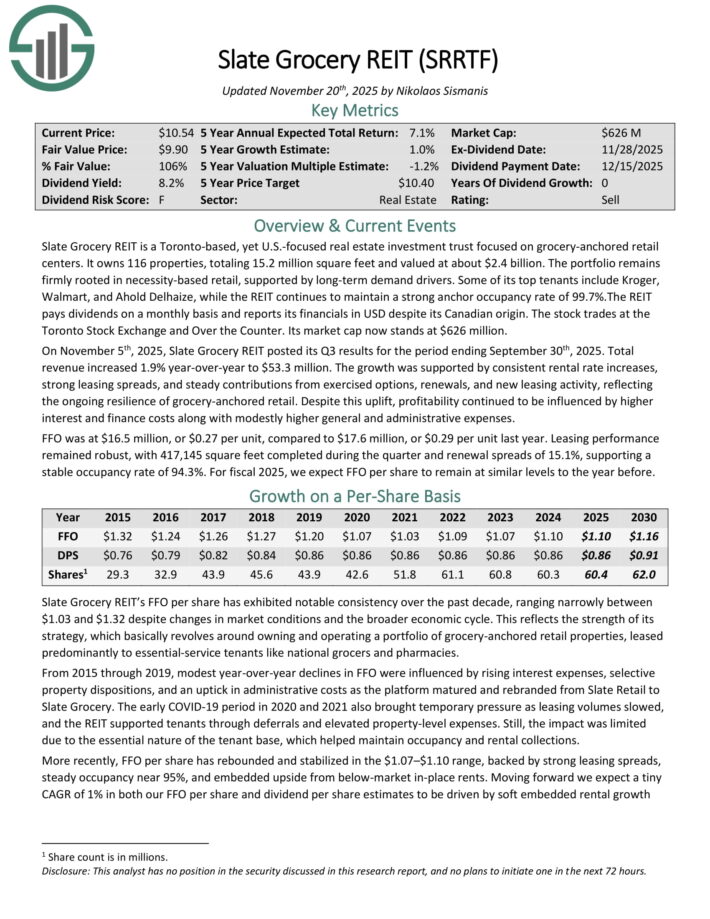

Month-to-month Dividend REIT #2: Slate Grocery REIT (SRRTF)

Slate Grocery REIT is a Toronto-based, but U.S.-focused actual property funding belief targeted on grocery-anchored retail facilities. It owns 116 properties, totaling 15.2 million sq. toes.

The portfolio stays firmly rooted in necessity-based retail, supported by long-term demand drivers. A few of its high tenants embrace Kroger, Walmart, and Ahold Delhaize, whereas the REIT continues to take care of a robust anchor occupancy fee of 99.7%.

On November fifth, 2025, Slate Grocery REIT posted its Q3 outcomes for the interval ending September thirtieth, 2025. Whole income elevated 1.9% year-over-year to $53.3 million.

The expansion was supported by constant rental fee will increase, sturdy leasing spreads, and regular contributions from exercised choices, renewals, and new leasing exercise, reflecting the continued resilience of grocery-anchored retail.

Regardless of this uplift, profitability continued to be influenced by increased curiosity and finance prices together with modestly increased normal and administrative bills. FFO was at $16.5 million, or $0.27 per unit, in comparison with $17.6 million, or $0.29 per unit final yr.

Leasing efficiency remained strong, with 417,145 sq. toes accomplished throughout the quarter and renewal spreads of 15.1%, supporting a secure occupancy fee of 94.3%.

Click on right here to obtain our most up-to-date Certain Evaluation report on SRRTF (preview of web page 1 of three proven under):

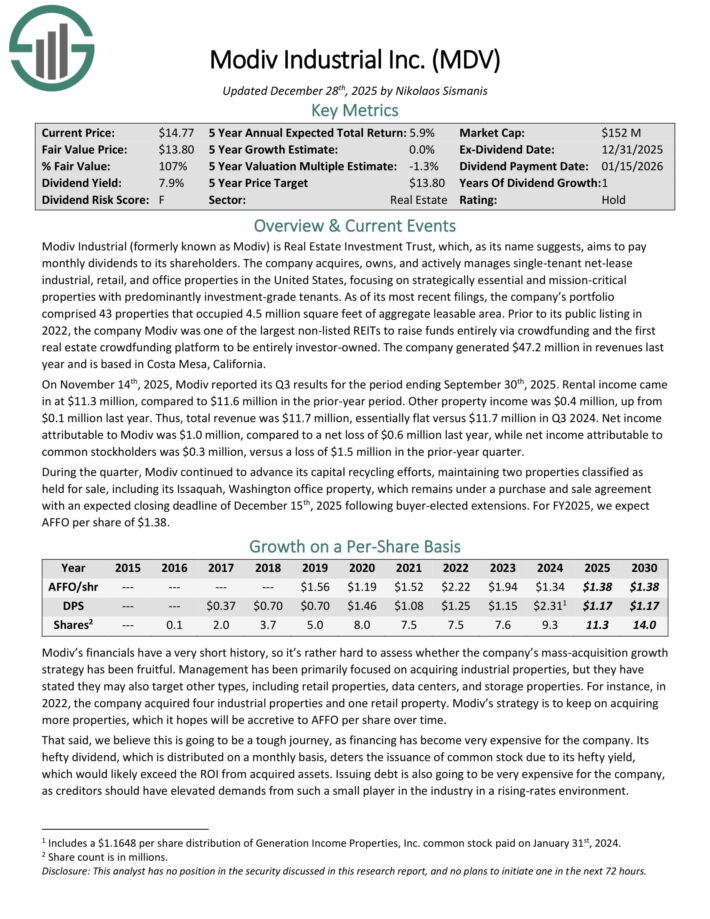

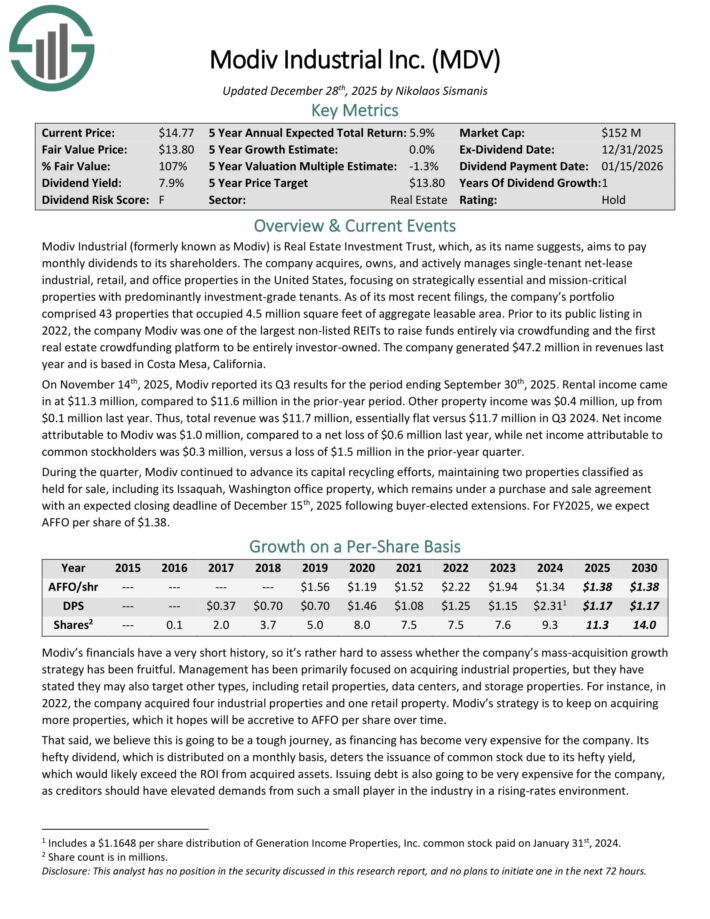

Month-to-month Dividend REIT #1: Modiv Industrial (MDV)

Modiv Industrial (previously often known as Modiv) is Actual Property Funding Belief, which, as its title suggests, goals to pay month-to-month dividends to its shareholders.

The corporate acquires, owns, and actively manages single-tenant net-lease industrial, retail, and workplace properties in the USA, specializing in strategically important and mission-critical properties with predominantly investment-grade tenants.

As of its most up-to-date filings, the corporate’s portfolio comprised 43 properties that occupied 4.5 million sq. toes of combination leasable space. The corporate generated $47.2 million in revenues final yr and relies in Costa Mesa, California.

On November 14th, 2025, Modiv reported its Q3 outcomes for the interval ending September thirtieth, 2025. Rental revenue got here in at $11.3 million, in comparison with $11.6 million within the prior-year interval.

Different property revenue was $0.4 million, up from $0.1 million final yr. Thus, complete income was $11.7 million, basically flat versus $11.7 million in Q3 2024.

Web revenue attributable to Modiv was $1.0 million, in comparison with a web lack of $0.6 million final yr, whereas web revenue attributable to widespread stockholders was $0.3 million, versus a lack of $1.5 million within the prior-year quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on MDV (preview of web page 1 of three proven under):

Extra Studying

Don’t miss the sources under for extra month-to-month dividend inventory investing analysis.

And see the sources under for extra compelling funding concepts for dividend progress shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].