Revealed on June 18th, 2025 by Bob Ciura

The purpose of rational traders is to maximize complete return.

Complete return is the entire return of an funding over a given time interval. It consists of all capital features and any dividends or curiosity paid.

The three features of complete return for shares are:

- Dividends

- Change in earnings-per-share

- Change within the price-to-earnings a number of

The free excessive dividend shares listing spreadsheet beneath has our full listing of particular person securities (shares, REITs, MLPs, and so on.) with with 5%+ dividend yields.

We calculate anticipated complete returns utilizing the three features of complete return for greater than 600 securities in The Positive Evaluation Analysis Database.

Whereas we at the moment price lots of the shares we cowl as buys, resulting from anticipated annual returns above 10%, many are rated as holds resulting from mediocre returns.

Moreover, there are additionally loads of shares we at the moment price as sells.

Sometimes, low (or damaging) projected complete return is because of overvaluation. Put merely, lots of the shares we price as sells are overvalued, resulting from their excessive present valuations.

Shopping for overvalued shares can lead to low, or damaging, future returns, even with a excessive dividend yield.

With that in thoughts, this text will cowl 10 excessive dividend shares we at the moment price as sells in keeping with their low projected complete returns.

The listing is sorted by annual anticipated returns over the following 5 years, from lowest to highest.

Desk of Contents

You possibly can immediately leap to any particular part of the article by utilizing the hyperlinks beneath:

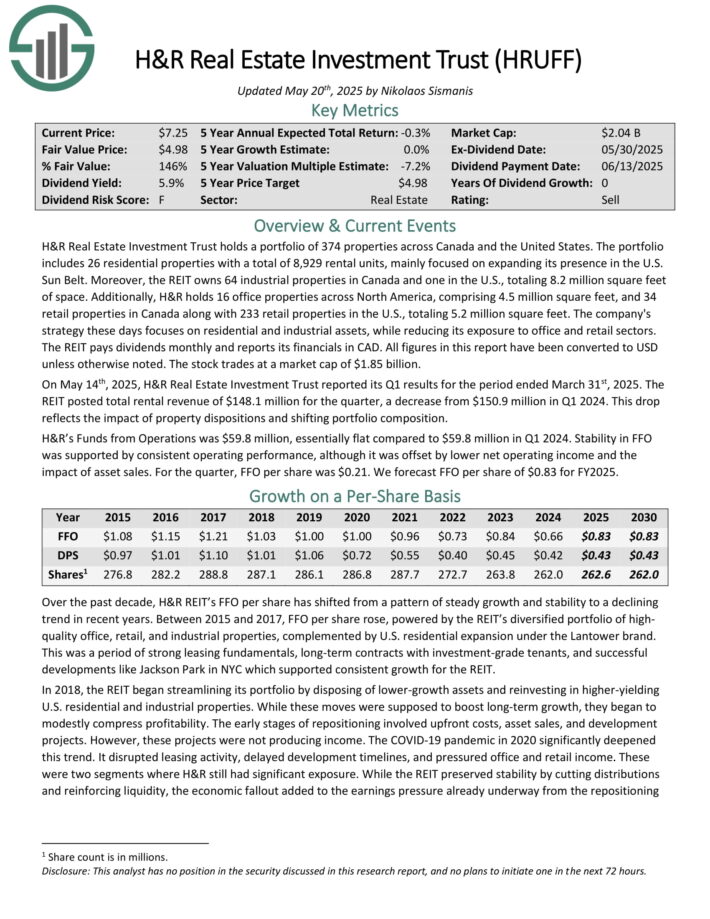

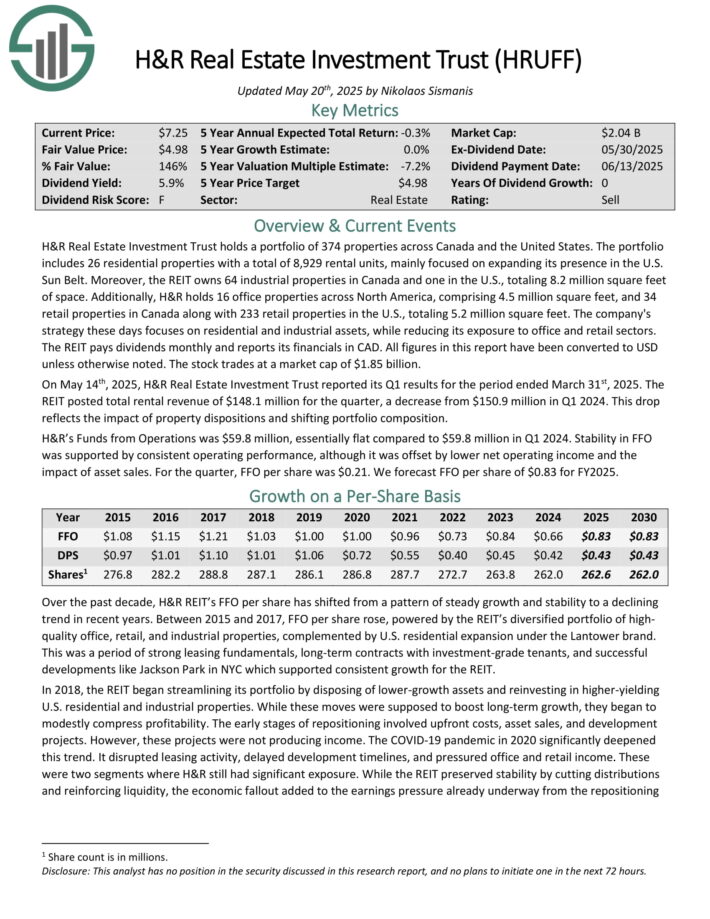

Excessive Dividend Inventory To Promote #10: H&R Actual Property Funding Belief (HRUFF)

- Annual Anticipated Return: -2.1%

H&R Actual Property Funding Belief holds a portfolio of 374 properties throughout Canada and america. The portfolio consists of 26 residential properties with a complete of 8,929 rental models, primarily centered on increasing its presence within the U.S. Solar Belt.

Furthermore, the REIT owns 64 industrial properties in Canada and one within the U.S., totaling 8.2 million sq. ft of area. Moreover, H&R holds 16 workplace properties throughout North America, comprising 4.5 million sq. ft, and 34 retail properties in Canada together with 233 retail properties within the U.S., totaling 5.2 million sq. ft.

The corporate’s technique lately focuses on residential and industrial belongings, whereas decreasing its publicity to workplace and retail sectors.

The REIT pays dividends month-to-month and studies its financials in CAD. All figures on this report have been transformed to USD except in any other case famous.

On Could 14th, 2025, H&R Actual Property Funding Belief reported its Q1 outcomes. The REIT posted complete rental income of $148.1 million for the quarter, a lower from $150.9 million in Q1 2024.

This drop displays the impression of property tendencies and shifting portfolio composition. H&R’s Funds from Operations was $59.8 million, primarily flat in comparison with $59.8 million in Q1 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on HRUFF (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory To Promote #9: Sabine Royalty Belief (SBR)

- Annual Anticipated Return: -0.5%

Sabine Royalty Belief is an oil and fuel belief arrange in 1983 by Sabine Company. At initiation, the belief initially had an anticipated reserve lifetime of 9 to 10 years however it has surpassed expectations by a powerful margin.

The belief consists of royalty and mineral pursuits in producing properties and proved oil and fuel properties in Florida, Louisiana, Mississippi, New Mexico, Oklahoma, and Texas. It’s roughly 2/3 oil and 1/3 fuel by way of revenues.

The belief’s belongings are static in that no additional properties may be added. The belief has no operations however is merely a pass-through automobile for royalties. SBR had royalty revenue of $82.6 million in 2024.

In early Could, SBR reported (5/9/25) monetary outcomes for the primary quarter of fiscal 2025. Manufacturing of oil grew 22% however manufacturing of fuel dipped -1% over the prior yr’s quarter. As well as, the common realized costs of oil and fuel decreased -26% and -7%, respectively. Consequently, distributable money movement per unit declined -6%, from $1.27 to $1.19.

The outlook for this yr is damaging, as OPEC has begun to unwind its manufacturing cuts and intends to spice up its output by 2.0 million barrels per day till the tip of 2026.

Click on right here to obtain our most up-to-date Positive Evaluation report on SBR (preview of web page 1 of three proven beneath):

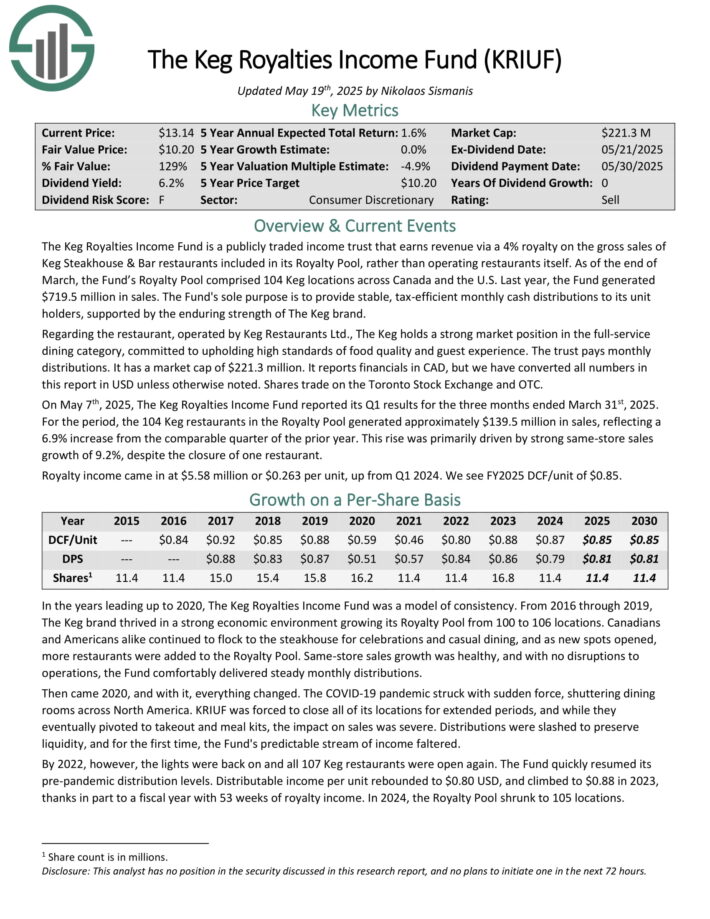

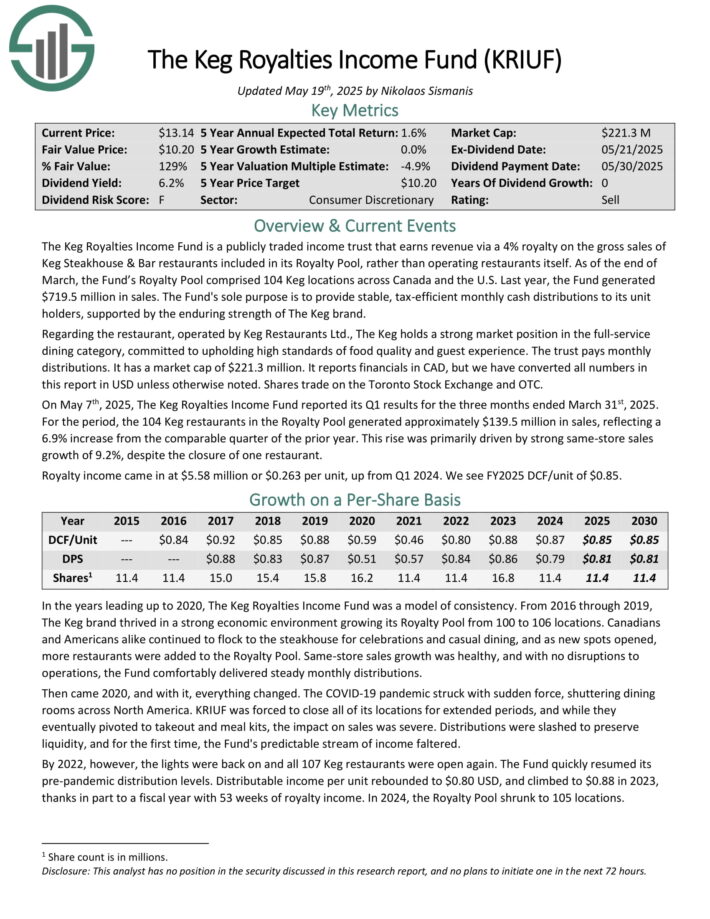

Excessive Dividend Inventory To Promote #8: The Keg Royalties Revenue Fund (KRIUF)

- Annual Anticipated Return: 1.2%

The Keg Royalties Revenue Fund is a publicly traded revenue belief that earns income by way of a 4% royalty on the product sales of Keg Steakhouse & Bar eating places included in its Royalty Pool, somewhat than working eating places itself.

As of the tip of March, the Fund’s Royalty Pool comprised 104 Keg places throughout Canada and the U.S. Final yr, the Fund generated $719.5 million in gross sales.

The Keg holds a robust market place within the full-service eating class, dedicated to upholding excessive requirements of meals high quality and visitor expertise.

It studies financials in CAD, however we’ve transformed all numbers on this report in USD except in any other case famous. Shares commerce on the Toronto Inventory Alternate and OTC.

On Could seventh, 2025, The Keg Royalties Revenue Fund reported its Q1 outcomes for the three months ended March thirty first, 2025. For the interval, the 104 Keg eating places within the Royalty Pool generated roughly $139.5 million in gross sales, reflecting a 6.9% improve from the comparable quarter of the prior yr.

This rise was primarily pushed by sturdy same-store gross sales development of 9.2%, regardless of the closure of 1 restaurant.

Click on right here to obtain our most up-to-date Positive Evaluation report on KRIUF (preview of web page 1 of three proven beneath):

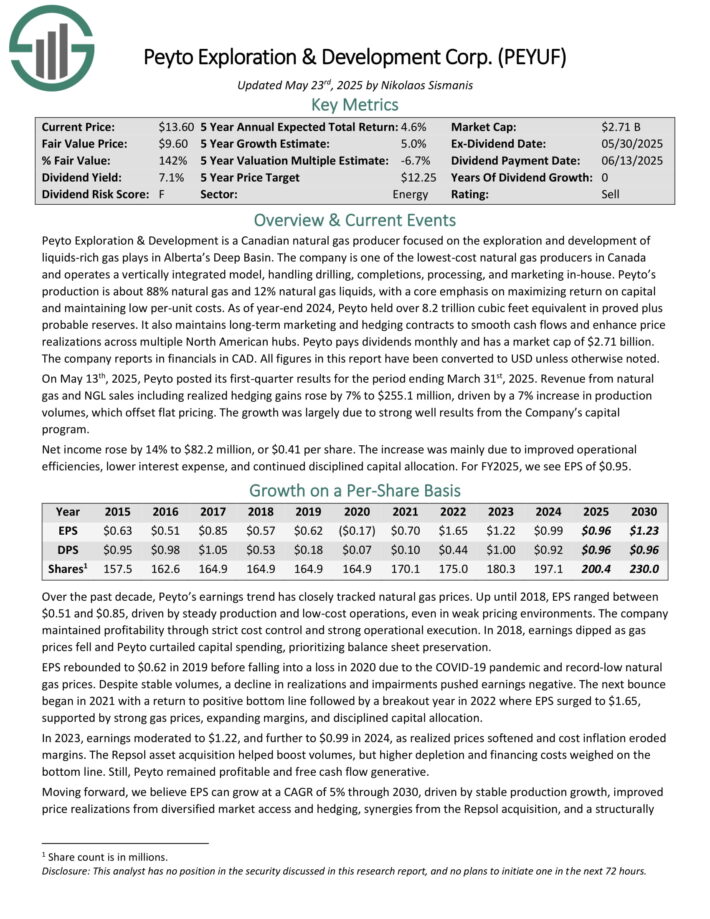

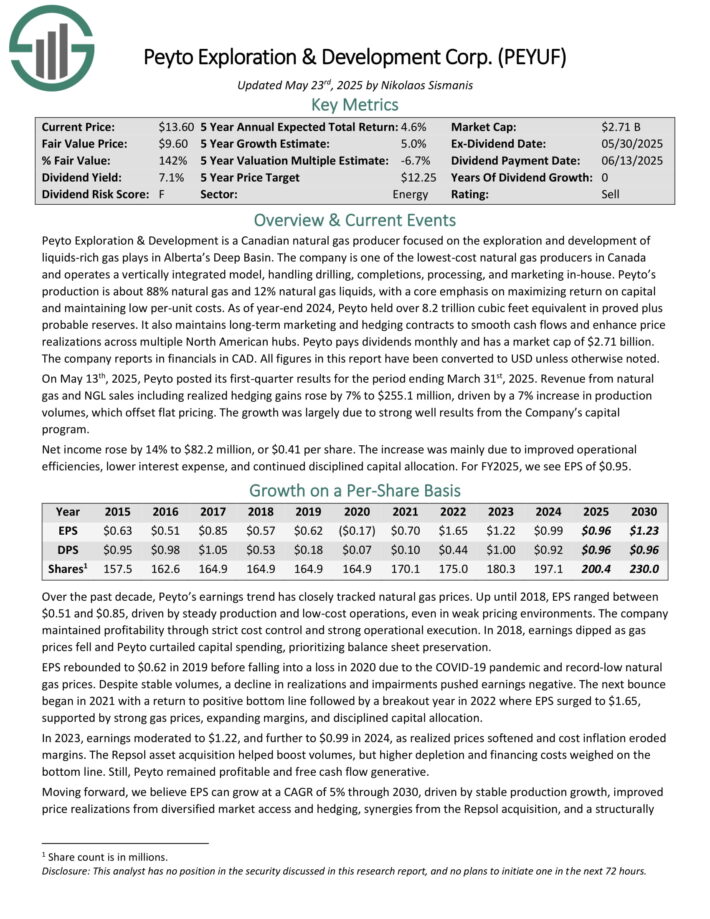

Excessive Dividend Inventory To Promote #7: Peyto Exploration & Growth (PEYUF)

- Annual Anticipated Return: 2.4%

Peyto Exploration & Growth is a Canadian pure fuel producer centered on the exploration and growth of liquids-rich fuel performs in Alberta’s Deep Basin.

The corporate is without doubt one of the lowest-cost pure fuel producers in Canada and operates a vertically built-in mannequin, dealing with drilling, completions, processing, and advertising and marketing in-house.

Peyto’s manufacturing is about 88% pure fuel and 12% pure fuel liquids, with a core emphasis on maximizing return on capital and sustaining low per-unit prices.

As of year-end 2024, Peyto held over 8.2 trillion cubic ft equal in proved plus possible reserves. It additionally maintains long-term advertising and marketing and hedging contracts to easy money flows and improve value realizations throughout a number of North American hubs.

The corporate studies in financials in CAD. All figures on this report have been transformed to USD except in any other case famous.

On Could thirteenth, 2025, Peyto posted its first-quarter outcomes for the interval ending March thirty first, 2025. Income from pure fuel and NGL gross sales together with realized hedging features rose by 7% to $255.1 million, pushed by a 7% improve in manufacturing volumes, which offset flat pricing. The expansion was largely resulting from sturdy nicely outcomes from the Firm’s capital program.

Click on right here to obtain our most up-to-date Positive Evaluation report on PEYUF (preview of web page 1 of three proven beneath):

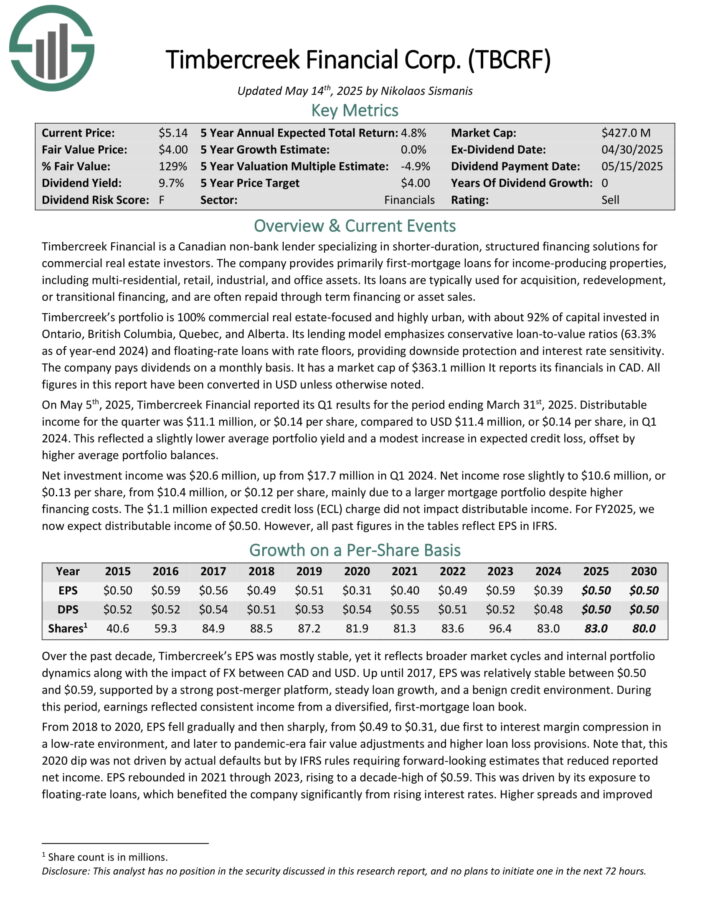

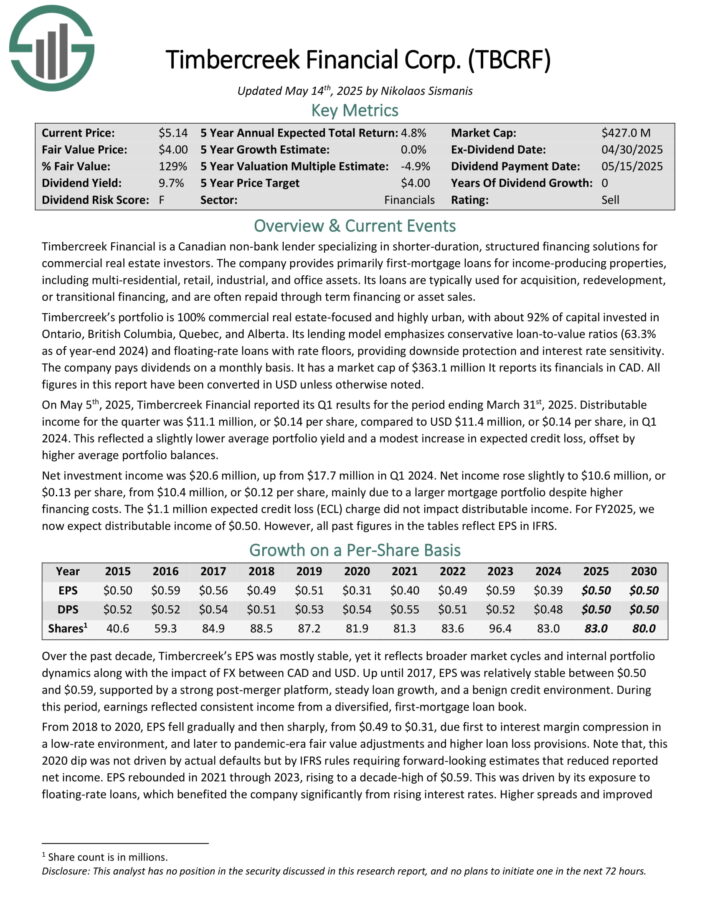

Excessive Dividend Inventory To Promote #6: Timbercreek Monetary Corp. (TBCRF)

- Annual Anticipated Return: 3.1%

Timbercreek Monetary is a Canadian non-bank lender specializing in shorter-duration, structured financing options for industrial actual property traders.

The corporate gives primarily first-mortgage loans for income-producing properties, together with multi-residential, retail, industrial, and workplace belongings.

Its loans are sometimes used for acquisition, redevelopment, or transitional financing, and are sometimes repaid via time period financing or asset gross sales.

Timbercreek’s portfolio is 100% industrial actual estate-focused and extremely city, with about 92% of capital invested in Ontario, British Columbia, Quebec, and Alberta. Its lending mannequin emphasizes conservative loan-to-value ratios (63.3% as of year-end 2024) and floating-rate loans with price flooring, offering draw back safety and rate of interest sensitivity.

All figures on this report have been transformed in USD except in any other case famous.

On Could fifth, 2025, Timbercreek Monetary reported its Q1 outcomes for the interval ending March thirty first, 2025. Distributable revenue for the quarter was $11.1 million, or $0.14 per share, in comparison with USD $11.4 million, or $0.14 per share, in Q1 2024.

This mirrored a barely decrease common portfolio yield and a modest improve in anticipated credit score loss, offset by greater common portfolio balances.

Click on right here to obtain our most up-to-date Positive Evaluation report on TBCRF (preview of web page 1 of three proven beneath):

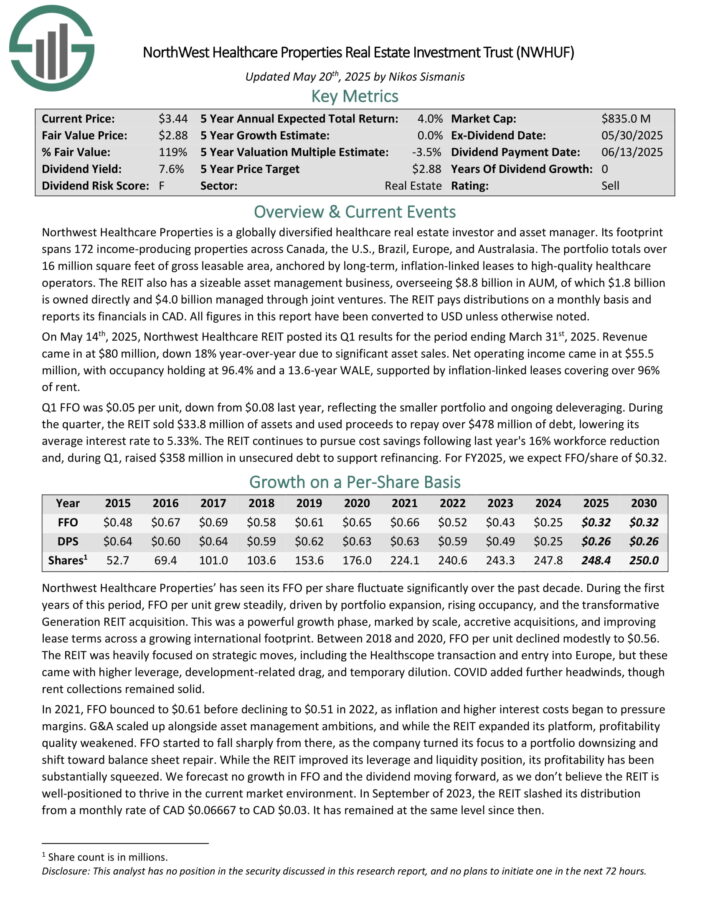

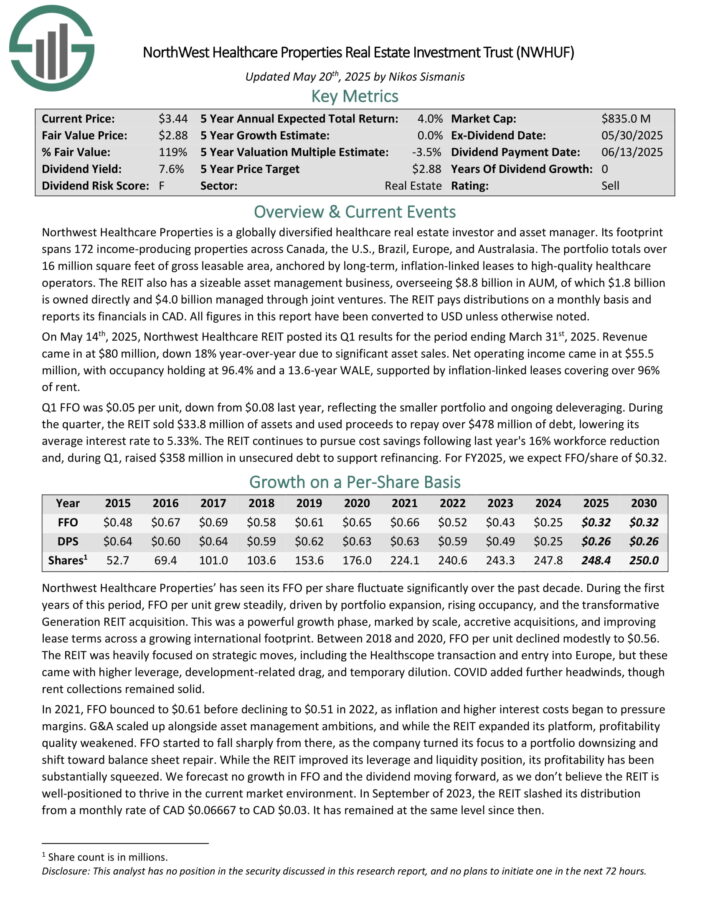

Excessive Dividend Inventory To Promote #5: NorthWest Healthcare Properties (NWHUF)

- Annual Anticipated Return: 3.7%

Northwest Healthcare Properties is a globally diversified healthcare actual property investor and asset supervisor. Its footprint spans 172 income-producing properties throughout Canada, the U.S., Brazil, Europe, and Australasia.

The portfolio totals over 16 million sq. ft of gross leasable space, anchored by long-term, inflation-linked leases to high-quality healthcare operators.

The REIT additionally has a sizeable asset administration enterprise, overseeing $8.8 billion in AUM, of which $1.8 billion is owned straight and $4.0 billion managed via joint ventures. The REIT pays distributions on a month-to-month foundation and studies its financials in CAD. All figures on this report have been transformed to USD except in any other case famous.

On Could 14th, 2025, Northwest Healthcare REIT posted its Q1 outcomes for the interval ending March thirty first, 2025. Income got here in at $80 million, down 18% year-over-year resulting from vital asset gross sales.

Web working revenue got here in at $55.5 million, with occupancy holding at 96.4% and a 13.6-year WALE, supported by inflation-linked leases masking over 96% of lease.

Q1 FFO was $0.05 per unit, down from $0.08 final yr, reflecting the smaller portfolio and ongoing deleveraging. Through the quarter, the REIT bought $33.8 million of belongings and used proceeds to repay over $478 million of debt, reducing its common rate of interest to five.33%.

Click on right here to obtain our most up-to-date Positive Evaluation report on NWHUF (preview of web page 1 of three proven beneath):

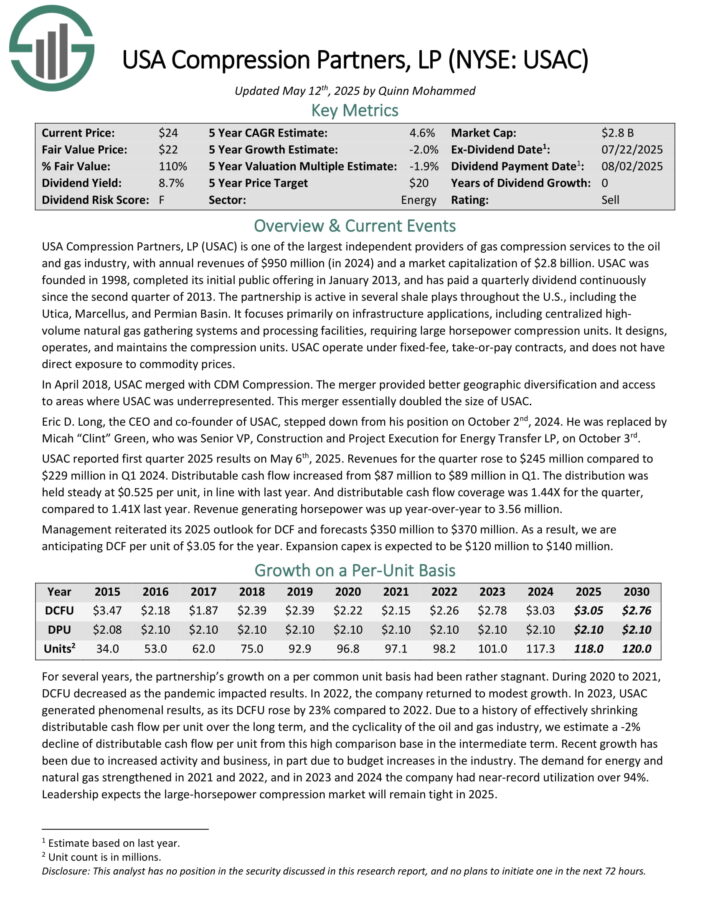

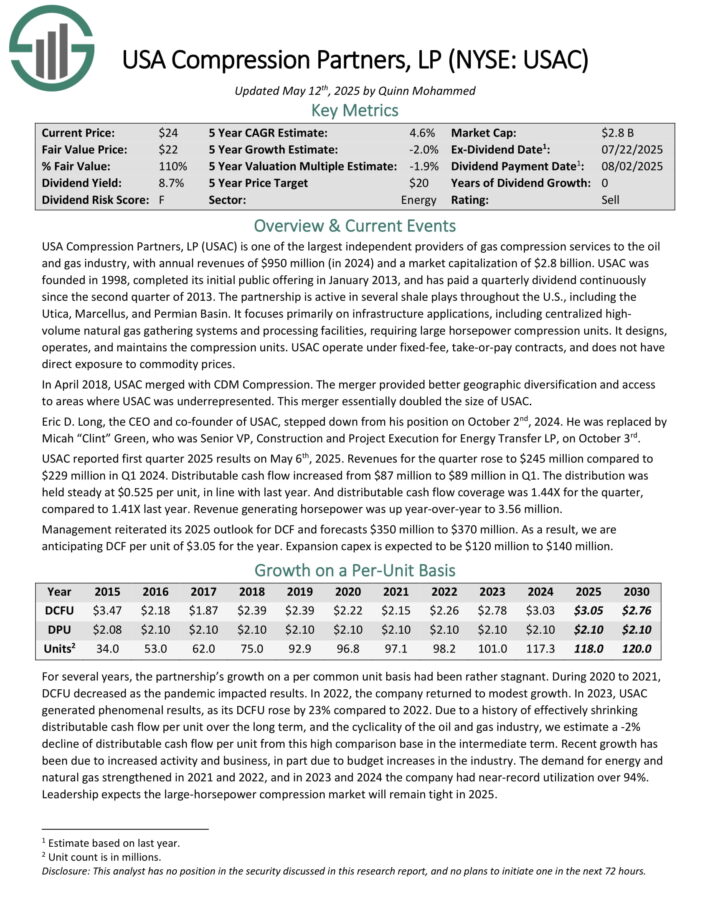

Excessive Dividend Inventory To Promote #4: USA Compression Companions LP (USAC)

- Annual Anticipated Return: 4.0%

USA Compression Companions, LP is without doubt one of the largest unbiased suppliers of fuel compression companies to the oil and fuel trade, with annual revenues of $950 million in 2024.

The partnership is lively in a number of shale performs all through the U.S., together with the Utica, Marcellus, and Permian Basin. It focuses totally on infrastructure functions, together with centralized high-volume pure fuel gathering techniques and processing amenities, requiring massive horsepower compression models.

It designs, operates, and maintains the compression models. USAC function below fixed-fee, take-or-pay contracts, and doesn’t have direct publicity to commodity costs.

USAC reported first quarter 2025 outcomes on Could sixth, 2025. Revenues for the quarter rose to $245 million in comparison with $229 million in Q1 2024. Distributable money movement elevated from $87 million to $89 million in Q1. The distribution was held regular at $0.525 per unit, in step with final yr.

Distributable money movement protection was 1.44X for the quarter, in comparison with 1.41X final yr. Income producing horsepower was up year-over-year to three.56 million. Administration reiterated its 2025 outlook for DCF and forecasts $350 million to $370 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on USAC (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory To Promote #3: Pizza Pizza Royalty Corp. (PZRIF)

- Annual Anticipated Return: 4.0%

Pizza Pizza Royalty Corp. is a Canadian entity which collects and distributes a dividend stream based mostly on royalties earned from the Pizza Pizza and Pizza 73 restaurant chains.

The corporate’s base reporting foreign money is Canadian {Dollars}, however this report will use U.S. Greenback figures besides when in any other case famous.

Pizza Pizza Royalty Corp. receives revenue from 797 mixed complete restaurant places throughout Canada below its two manufacturers. Greater than 150 of those are non-traditional places sited in public locations corresponding to universities and hospitals.

Pizza Pizza has outsized publicity to the province of Alberta due to its possession of Pizza 73 which is centered in that province.

Pizza Pizza reported its Q1 2025 outcomes on Could seventh, 2025. Identical retailer gross sales grew 1.2% in Q1 versus the prior yr. Whereas nothing extraordinary, this was a sequential enchancment as Pizza Pizza had reported damaging identical retailer gross sales all through 2024.

Whereas revenues ticked up, so did bills, resulting in flattish outcomes. EPS of 17 cents fell by 1% from the identical interval of the prior yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on PZRIF (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory To Promote #2: Northland Energy (NPIFF)

- Annual Anticipated Return: 4.1%

Northland Energy develops, builds, owns, and operates energy technology belongings, together with offshore and onshore wind, photo voltaic, pure fuel, and battery vitality storage techniques.

It additionally provides vitality via a regulated utility in Colombia. Northland manages 3.2 GW of gross working capability and has 2.4 GW in lively building throughout three tasks: Hai Lengthy (Taiwan), Baltic Energy (Poland), and Oneida (Canada), with a broader growth pipeline totaling about 10 GW.

Northland studies in CAD. All figures have been transformed to USD except in any other case famous. On Could thirteenth, 2025, Northland Energy reported its Q1 outcomes for the interval ending March thirty first, 2025. Income declined 14% year-over-year to about $467 million, primarily resulting from exceptionally low wind circumstances in Europe and a robust wind quarter the yr prior, partially offset by greater contributions from North American onshore wind and pure fuel belongings.

Adjusted EBITDA fell 20% to roughly $260 million, reflecting weaker offshore wind manufacturing regardless of continued operational self-discipline. Web revenue fell to $80 million from $107 million a yr earlier, pushed by the identical headwinds in offshore technology and spinoff honest worth modifications.

Click on right here to obtain our most up-to-date Positive Evaluation report on NPIFF (preview of web page 1 of three proven beneath):

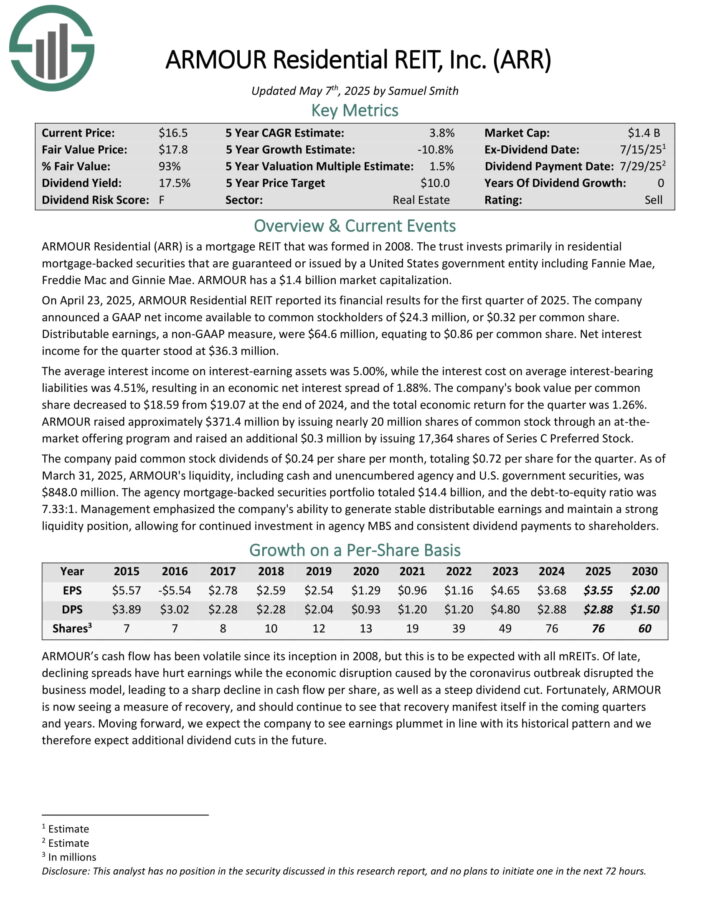

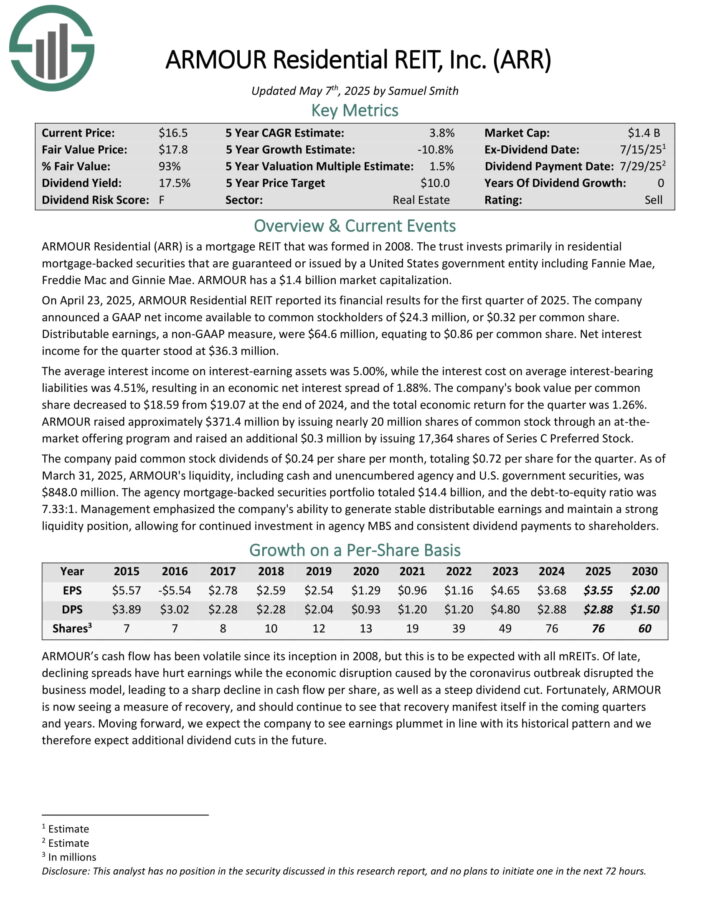

Excessive Dividend Inventory To Promote #1: ARMOUR Residential REIT (ARR)

- Annual Anticipated Return: 4.3%

ARMOUR Residential invests in residential mortgage-backed securities that embody U.S. Authorities-sponsored entities (GSE) corresponding to Fannie Mae and Freddie Mac.

It additionally consists of Ginnie Mae, the Authorities Nationwide Mortgage Administration’s issued or assured securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate dwelling loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, cash market devices, and non-GSE or authorities agency-backed securities are examples of different sorts of investments.

On April 23, 2025, ARMOUR Residential REIT reported its monetary outcomes for the primary quarter of 2025. The corporate introduced a GAAP internet revenue accessible to frequent stockholders of $24.3 million, or $0.32 per frequent share.

Distributable earnings, a non-GAAP measure, had been $64.6 million, equating to $0.86 per frequent share. Web curiosity revenue for the quarter stood at $36.3 million.

The typical curiosity revenue on interest-earning belongings was 5.00%, whereas the curiosity value on common interest-bearing liabilities was 4.51%, leading to an financial internet curiosity unfold of 1.88%. The corporate’s ebook worth per frequent share decreased to $18.59 from $19.07 on the finish of 2024, and the full financial return for the quarter was 1.26%.

Click on right here to obtain our most up-to-date Positive Evaluation report on ARMOUR Residential REIT Inc (ARR) (preview of web page 1 of three proven beneath):

Last Ideas & Extra Studying

Excessive dividend shares are naturally interesting on the floor, resulting from their excessive dividend yields.

However revenue traders want to ensure they don’t fall right into a dividend ‘lure’, that means buying an overvalued inventory solely resulting from its excessive yield.

There are different vital components when shopping for shares, particularly the full return potential. Shares with damaging or low future returns must be bought, even after they provide a excessive dividend yield.

If you’re concerned about discovering different high-yield securities and revenue securities, the next Positive Dividend sources shall be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].