Printed on December fifteenth, 2025 by Bob Ciura

Low rates of interest and excessive valuations have made it tough to seek out high quality high-yield investments for retirement revenue.

Tough, however not not possible.

That’s the place the Dividend Kings may be helpful.

Certain Dividend helps buyers stay a extra snug and stress-free retirement (or early retirement) by discovering high quality, high-yield investments.

We consider the Dividend Kings are among the many greatest shares to purchase and maintain for the long term.

The Dividend Kings are a bunch of simply 56 shares which have all elevated their dividends for at the very least 50 consecutive years.

You’ll be able to obtain the total checklist, together with vital monetary metrics corresponding to dividend yields and price-to-earnings ratios, by clicking on the hyperlink under:

This text will talk about 10 high Dividend Kings that match the next standards:

- Present yields of at the very least 2.5% (double the typical yield of the S&P 500)

- Dividend Danger Scores of A or B

- Buying and selling under truthful worth

Learn on to find 10 high dividend shares to construct retirement revenue.

Desk of Contents

The desk of contents under permits for simple navigation. The shares are listed by anticipated complete returns over the following 5 years, in ascending order.

Dividend King To Construct Retirement Revenue #10: Consolidated Edison (ED)

- Anticipated annual returns: 9.6%

Consolidated Edison is a holding firm that delivers electrical energy, pure gasoline, and steam to its prospects in New York Metropolis and Westchester County. The corporate has annual revenues of greater than $16 billion.

On November sixth, 2025, Consolidated Edison reported third quarter outcomes for the interval ending September thirtieth, 2025. For the quarter, income elevated 10.7% to $4.5 billion, which was $310 million forward of estimates.

Adjusted earnings of $686 million, or $1.90 per share, in comparison with adjusted earnings of $583 million, or $1.68 per share, within the earlier 12 months. Adjusted earnings-per-share had been additionally $0.15 higher than anticipated.

Common fee base balances are nonetheless projected to develop by 8.2% yearly by way of 2029 based mostly off 2025 ranges. That is up from the corporate’s prior forecast of 6.4%. The corporate will replace its forecast by way of 2030 in February of subsequent 12 months.

Consolidated Edison nonetheless expects capital investments of $38 billion for the 2025 to 2029 interval, which was up from $28 billion beforehand. The corporate additionally expects capital investments of ~$72 billion over the following decade.

Consolidated Edison supplied up to date steering for 2025 as effectively, with the corporate now anticipating earnings-per-share in a spread of $5.60 to $5.70 for the 12 months, up from $5.50 to $5.70 beforehand.

The corporate expects 5% to 7% earnings development from 2025 ranges by way of 2029.

Click on right here to obtain our most up-to-date Certain Evaluation report on ED (preview of web page 1 of three proven under):

Dividend King To Construct Retirement Revenue #9: Goal Company (TGT)

- Anticipated annual returns: 9.8%

Goal is a serious retailer with operations solely within the U.S. market. Its enterprise consists of about 1,850 massive field shops, which provide normal merchandise and meals, in addition to serving as distribution factors for the corporate’s burgeoning e-commerce enterprise.

Goal ought to produce greater than $100 billion in complete income this 12 months. The corporate additionally sports activities an especially spectacular dividend enhance streak of 57 years.

Goal posted third quarter earnings on November nineteenth, 2025, and outcomes had been barely higher than anticipated. Adjusted earnings-per-share got here to $1.78, which was seven cents forward of estimates.

Income was $25.3 billion, assembly expectations, however declining simply over 1% year-over-year. Gross sales had been off 1.5% year-over-year, reflecting merchandise gross sales declines of 1.9%, partially offset by a 17.7% enhance in non-merchandise gross sales.

Comparable gross sales had been off 2.7%, lacking estimates for a 2.1% decline. Bodily retailer gross sales fell 3.8% on a comparable foundation, partially offset by digital comparable gross sales development of two.4%.

Working revenue was $1.1 billion on an adjusted foundation, with gross margin off 10 foundation factors to twenty-eight.2% of income. This mirrored merchandising stress from elevated markdowns.

Share repurchases had been $152 million through the quarter at a median worth of $91.59. The corporate has about $8.3 billion in remaining repurchase capability underneath the 2021 authorization that’s nonetheless incomplete.

Click on right here to obtain our most up-to-date Certain Evaluation report on TGT (preview of web page 1 of three proven under):

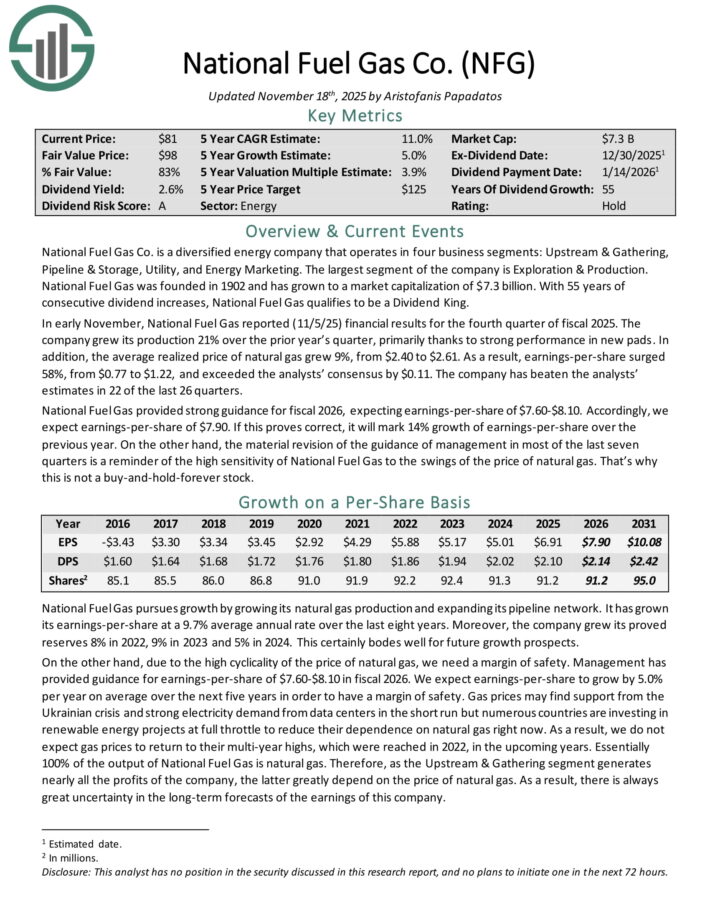

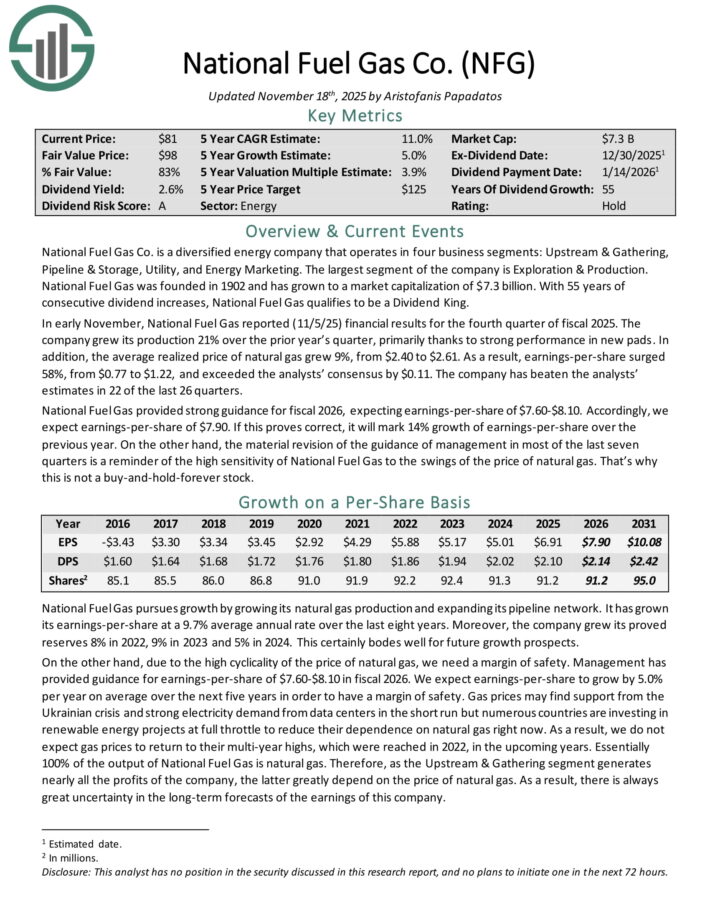

Dividend King To Construct Retirement Revenue #8: Nationwide Gas Gasoline (NFG)

- Anticipated annual returns: 10.7%

Nationwide Gas Gasoline Co. is a diversified power firm that operates in 4 enterprise segments: Upstream & Gathering, Pipeline & Storage, Utility, and Power Advertising and marketing.

The most important phase of the corporate is Exploration & Manufacturing. With 55 years of consecutive dividend will increase, Nationwide Gas Gasoline qualifies to be a Dividend King.

In early November, Nationwide Gas Gasoline reported (11/5/25) monetary outcomes for the fourth quarter of fiscal 2025. The corporate grew its manufacturing 21% over the prior 12 months’s quarter, primarily due to sturdy efficiency in new pads.

As well as, the typical realized worth of pure gasoline grew 9%, from $2.40 to $2.61. In consequence, earnings-per-share surged 58%, from $0.77 to $1.22, and exceeded the analysts’ consensus by $0.11.

The corporate has overwhelmed the analysts’ estimates in 22 of the final 26 quarters. Nationwide Gas Gasoline supplied sturdy steering for fiscal 2026, anticipating earnings-per-share of $7.60-$8.10.

Accordingly, we anticipate earnings-per-share of $7.90. If this proves right, it should mark 14% development of earnings-per-share over the earlier 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on NFG (preview of web page 1 of three proven under):

Dividend King To Construct Retirement Revenue #7: Hormel Meals (HRL)

- Anticipated annual returns: 12.2%

Hormel was based again in 1891 in Minnesota. Since that point, the corporate has grown right into a juggernaut within the meals merchandise business with almost $10 billion in annual income.

Hormel has saved with its core competency as a processor of meat merchandise for effectively over 100 years, however has additionally grown into different enterprise strains by way of acquisitions.

Hormel has a big portfolio of category-leading manufacturers. Just some of its high manufacturers embrace embrace Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

Hormel posted third quarter earnings on August twenty eighth, 2025, and outcomes had been very weak, together with disappointing steering for the fourth quarter.

Adjusted earnings-per-share got here to 35 cents, which was six cents mild of estimates. Income was up 4.5% year-over-year to $3.03 billion, beating estimates by $50 million. Natural internet gross sales had been up 6% year-over-year on quantity good points of 4%, with worth and blend comprising the opposite 2%.

The corporate additionally famous its value financial savings program is working and serving to save about $125 million yearly. Gross revenue was flat year-on-year, with inflationary headwinds offset by high line good points. The corporate famous 400 foundation factors of uncooked materials value inflation, a large headwind to margins.

Money movement from operations had been $157 million, whereas capex was $72 million, and dividends paid had been $159 million. Steerage for This fall was for internet gross sales of ~$3.2 billion, about $50 million mild of consensus. Earnings are anticipated at ~39 cents.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRL (preview of web page 1 of three proven under):

Dividend King To Construct Retirement Revenue #6: Kimberly-Clark Corp. (KMB)

- Anticipated annual returns: 12.4%

The Kimberly-Clark Company is a worldwide shopper merchandise firm that operates in 175 international locations and sells disposable shopper items, together with paper towels, diapers, and tissues.

It operates by way of two segments that every home many well-liked manufacturers: Private Care Section (Huggies, Pull-Ups, Kotex, Rely, Poise) and the Shopper Tissue phase (Kleenex, Scott, Cottonelle, and Viva), producing about $20 billion in annual income.

Kimberly-Clark posted third quarter earnings on October thirtieth, 2025, and outcomes had been higher than anticipated on each the highest and backside strains.

Adjusted earnings-per-share got here to $1.82, which was seven cents forward of estimates. Income was flat year-over-year at $4.15 billion, however did greatest estimates by $50 million.

Gross sales included damaging impacts of about 2.2% from the exit of the non-public label diaper enterprise within the US. Natural gross sales had been up 2.5%, which was pushed by a 2.4% acquire in quantity, whereas portfolio combine and worth had been flat.

Gross margin was 36.8% of income on an adjusted foundation, off 170 foundation factors year-over-year. This mirrored sturdy productiveness good points that had been greater than offset by unfavorable pricing internet of value inflation.

Working revenue was $683 million on an adjusted foundation, pushed by decrease advertising and R&D prices, in addition to effectivity efforts. Internet curiosity expense was $59 million, up from $49 million a 12 months in the past.

We now see $7.50 in adjusted earnings-per-share for this 12 months, which might be the best since 2020, if achieved. Individually, Kimberly-Clark introduced its intention to purchase Kenvue (KVUE) for $48.7 billion in a money and inventory deal.

Click on right here to obtain our most up-to-date Certain Evaluation report on KMB (preview of web page 1 of three proven under):

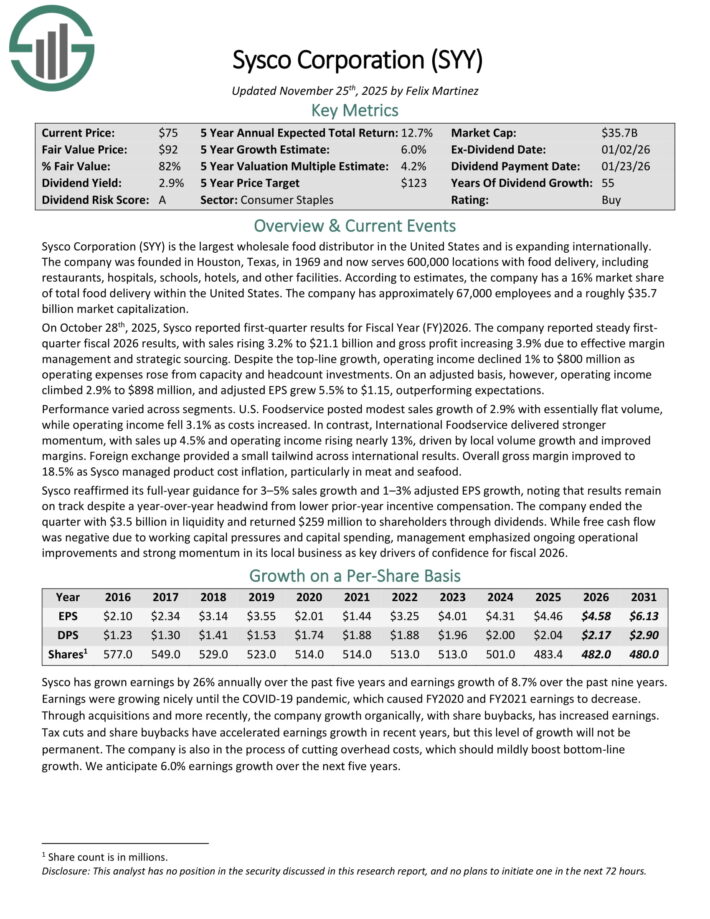

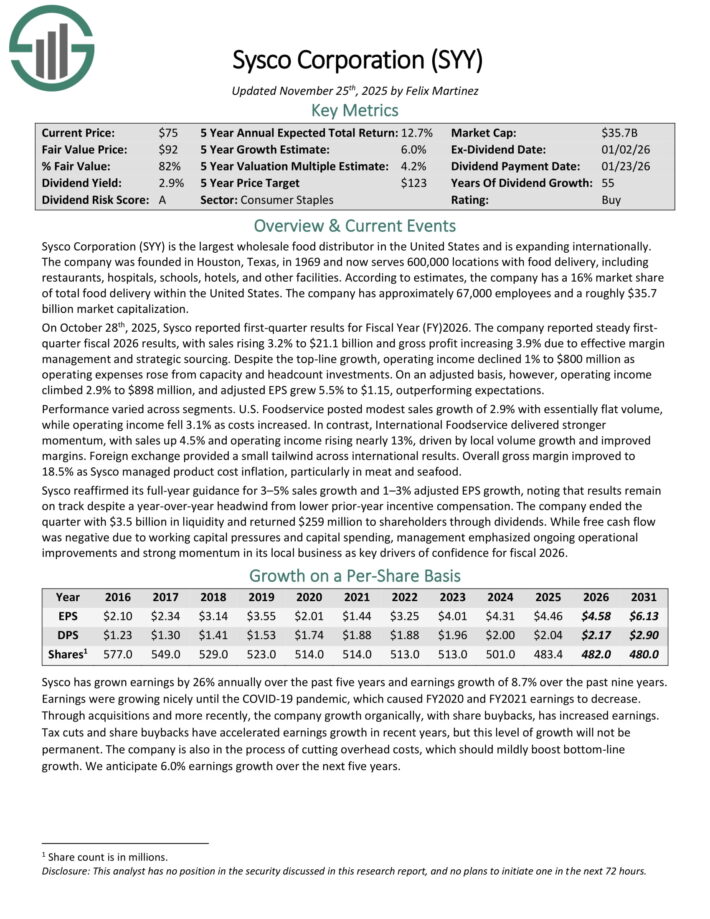

Dividend King To Construct Retirement Revenue #5: Sysco Corp. (SYY)

- Anticipated annual returns: 12.9%

Sysco Company is the most important wholesale meals distributor in america and is increasing internationally. The corporate serves 600,000 areas with meals supply, together with eating places, hospitals, faculties, resorts, and different services.

In keeping with estimates, the corporate has a 16% market share of complete meals supply inside america. The corporate has roughly 67,000 staff.

On October twenty eighth, 2025, Sysco reported first-quarter outcomes for Fiscal 12 months 2026. The corporate reported regular first-quarter fiscal 2026 outcomes, with gross sales rising 3.2% to $21.1 billion and gross revenue growing 3.9% because of efficient margin administration and strategic sourcing.

Regardless of the top-line development, working revenue declined 1% to $800 million as working bills rose from capability and headcount investments. On an adjusted foundation, nonetheless, working revenue climbed 2.9% to $898 million, and adjusted EPS grew 5.5% to $1.15, outperforming expectations.

Sysco reaffirmed its full-year steering for 3–5% gross sales development and 1–3% adjusted EPS development, noting that outcomes stay on monitor regardless of a year-over-year headwind from decrease prior-year incentive compensation.

Click on right here to obtain our most up-to-date Certain Evaluation report on SYY (preview of web page 1 of three proven under):

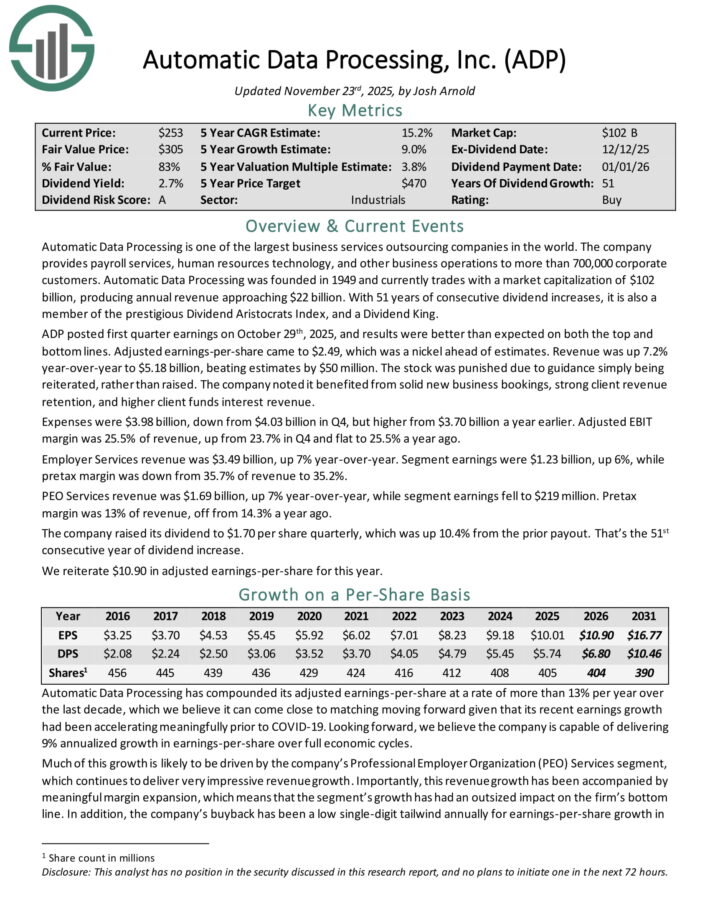

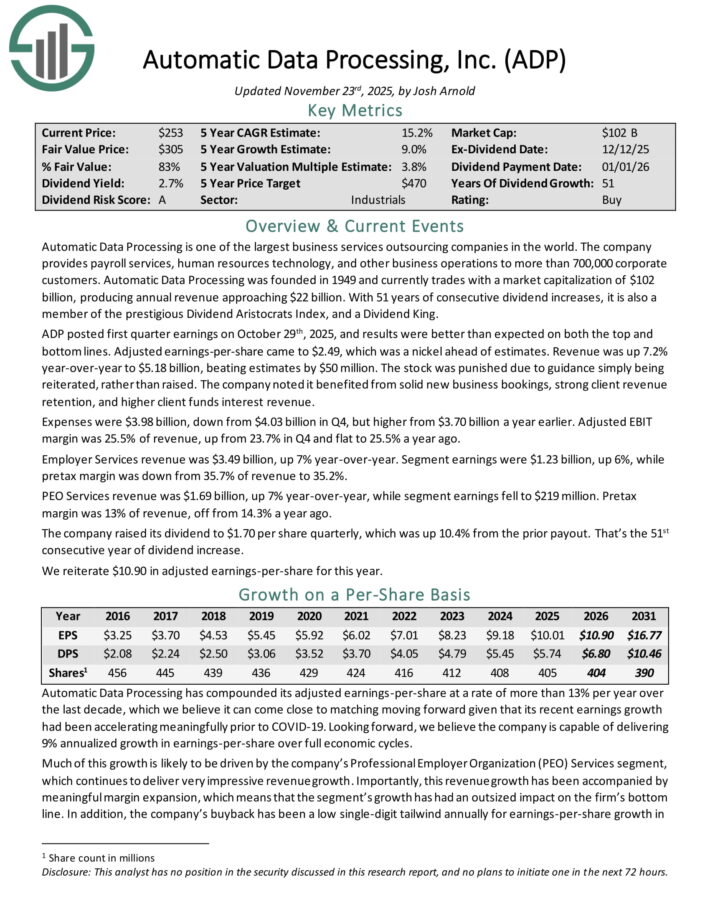

Dividend King To Construct Retirement Revenue #4: Automated Knowledge Processing (ADP)

- Anticipated annual returns: 14.0%

Automated Knowledge Processing is among the largest enterprise companies outsourcing firms on the earth. The corporate gives payroll companies, human sources expertise, and different enterprise operations to greater than 700,000 company prospects.

ADP posted first quarter earnings on October twenty ninth, 2025, and outcomes had been higher than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to $2.49, which was a nickel forward of estimates.

Income was up 7.2% year-over-year to $5.18 billion, beating estimates by $50 million. Bills had been $3.98 billion, down from $4.03 billion in This fall, however greater from $3.70 billion a 12 months earlier.

Adjusted EBIT margin was 25.5% of income, up from 23.7% in This fall and flat to 25.5% a 12 months in the past. Employer Providers income was $3.49 billion, up 7% year-over-year. Section earnings had been $1.23 billion, up 6%, whereas pretax margin was down from 35.7% of income to 35.2%.

PEO Providers income was $1.69 billion, up 7% year-over-year, whereas phase earnings fell to $219 million. Pretax margin was 13% of income, off from 14.3% a 12 months in the past.

The corporate raised its dividend to $1.70 per share quarterly, which was up 10.4% from the prior payout. That’s the 51st consecutive 12 months of dividend enhance.

Click on right here to obtain our most up-to-date Certain Evaluation report on ADP (preview of web page 1 of three proven under):

Dividend King To Construct Retirement Revenue #3: PepsiCo Inc. (PEP)

- Anticipated annual returns: 14.5%

PepsiCo is a worldwide meals and beverage firm that generates $89 billion in annual gross sales. The corporate’s merchandise embrace Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

The corporate has greater than 20 $1 billion manufacturers in its portfolio. On February 4th, 2025, PepsiCo elevated its annualized dividend by 5.0% to $5.69 beginning with the cost that was made in June 2025, extending the corporate’s dividend development streak to 53 consecutive years.

On October ninth, 2025, PepsiCo reported third quarter earnings outcomes for the interval ending September thirtieth, 2025. For the quarter, income grew 2.7% to $23.9 billion, which beat estimates by $90 million. Adjusted earnings-per-share of $2.29 in contrast unfavorably to $2.31 the prior 12 months, however this was $0.03 higher than anticipated.

Natural gross sales grew 1.3% for the third quarter. For the interval, volumes for each drinks and meals had been down 1%. PepsiCo Drinks North America’s natural income grew 2% for the interval at the same time as quantity declined by 3%.

Income for PepsiCo Meals North America decreased 3%, largely because of divestitures. Meals quantity decreased 4%. The Worldwide Drinks phase fell 1%, primarily because of decrease quantity. Revenues in Europe/Center East/Africa had been up 5.5%. Meals quantity declined 1%, however this was offset by a 1.5% acquire in drinks.

PepsiCo reaffirmed prior steering for 2025, with the corporate nonetheless anticipating natural gross sales within the low single-digit vary.

Click on right here to obtain our most up-to-date Certain Evaluation report on PEP (preview of web page 1 of three proven under):

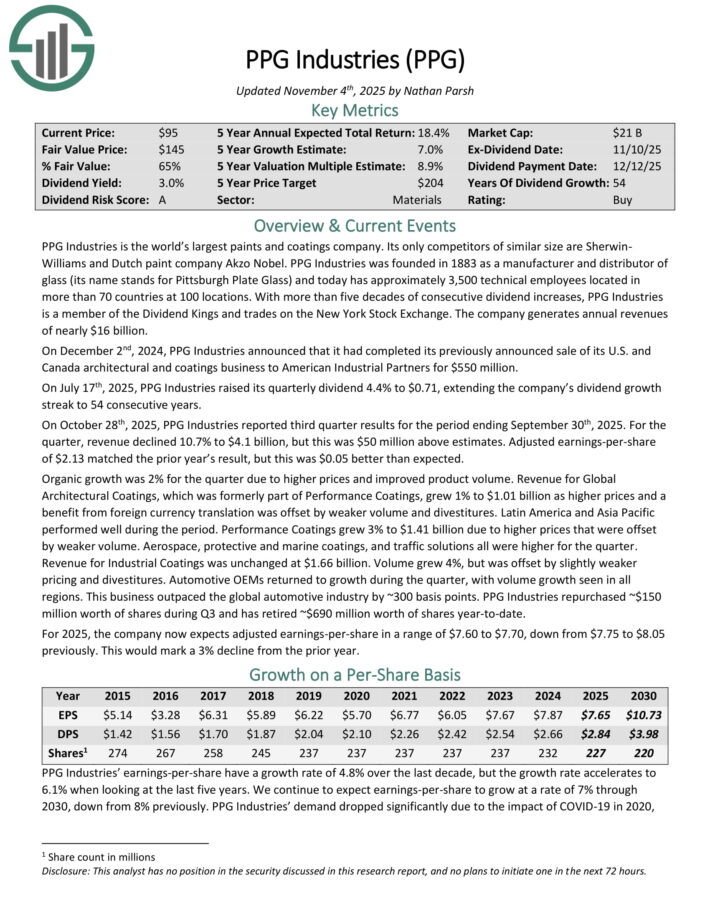

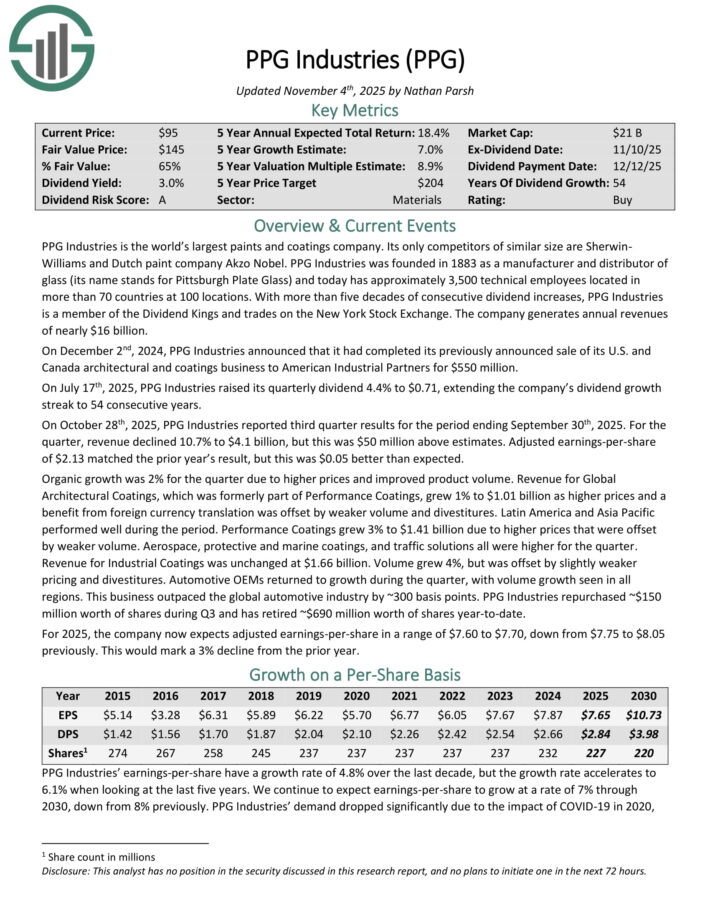

Dividend King To Construct Retirement Revenue #2: PPG Industries (PPG)

- Anticipated annual returns: 16.4%

PPG Industries is the world’s largest paints and coatings firm. Its solely rivals of comparable dimension are Sherwin-Williams and Dutch paint firm Akzo Nobel.

PPG Industries was based in 1883 as a producer and distributor of glass (its identify stands for Pittsburgh Plate Glass) and in the present day has roughly 3,500 technical staff positioned in additional than 70 international locations at 100 areas.

On July seventeenth, 2025, PPG Industries raised its quarterly dividend 4.4% to $0.71, extending the corporate’s dividend development streak to 54 consecutive years.

On October twenty eighth, 2025, PPG Industries reported third quarter outcomes for the interval ending September thirtieth, 2025. For the quarter, income declined 10.7% to $4.1 billion, however this was $50 million above estimates. Adjusted earnings-per-share of $2.13 matched the prior 12 months’s outcome, however this was $0.05 higher than anticipated.

Natural development was 2% for the quarter because of greater costs and improved product quantity. Income for International Architectural Coatings, which was previously a part of Efficiency Coatings, grew 1% to $1.01 billion as greater costs and a profit from overseas forex translation was offset by weaker quantity and divestitures.

Latin America and Asia Pacific carried out effectively through the interval. Efficiency Coatings grew 3% to $1.41 billion because of greater costs that had been offset by weaker quantity. Aerospace, protecting and marine coatings, and site visitors options all had been greater for the quarter.

Income for Industrial Coatings was unchanged at $1.66 billion. Quantity grew 4%, however was offset by barely weaker pricing and divestitures. Automotive OEMs returned to development through the quarter, with quantity development seen in all areas. This enterprise outpaced the worldwide automotive business by ~300 foundation factors.

PPG Industries repurchased ~$150 million price of shares throughout Q3 and has retired ~$690 million price of shares year-to-date.

For 2025, the corporate now expects adjusted earnings-per-share in a spread of $7.60 to $7.70.

Click on right here to obtain our most up-to-date Certain Evaluation report on PPG (preview of web page 1 of three proven under):

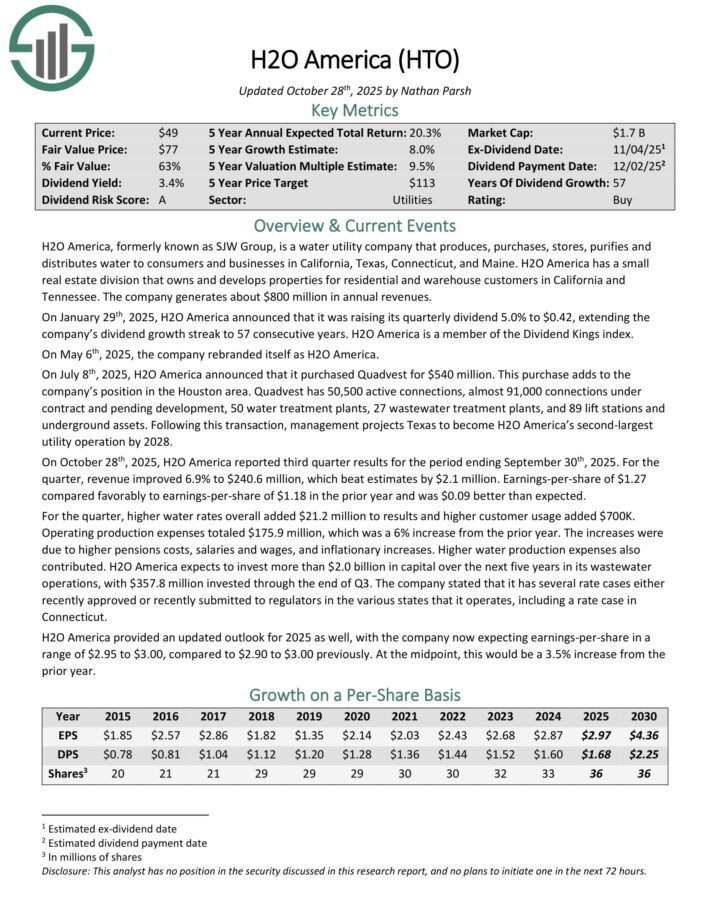

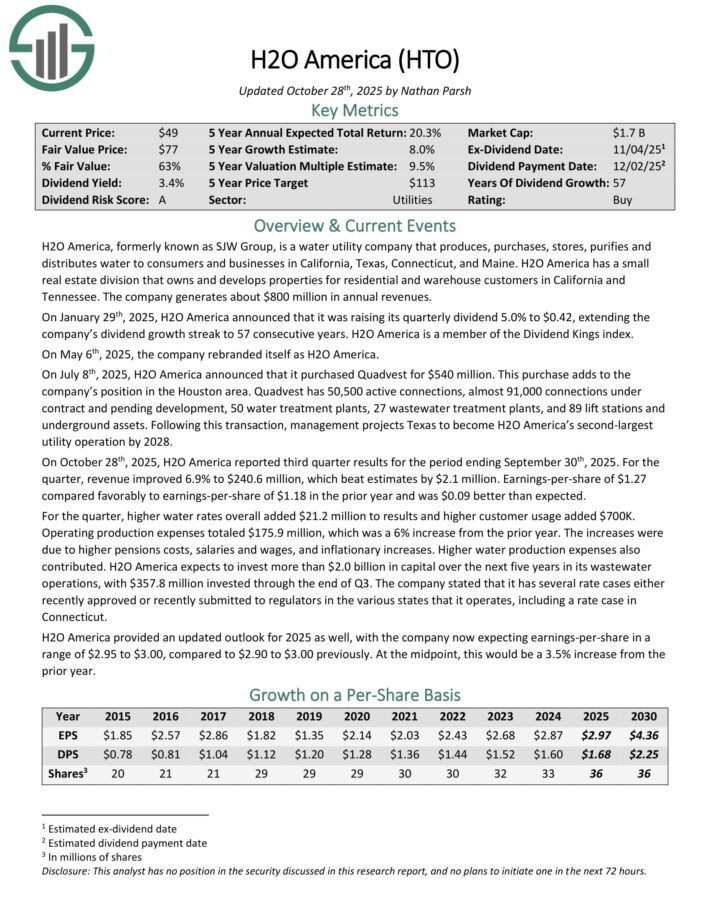

Dividend King To Construct Retirement Revenue #1: H2O America (HTO)

- Anticipated annual returns: 20.3%

H2O America, previously generally known as SJW Group, is a water utility firm that produces, purchases, shops, purifies and distributes water to shoppers and companies within the Silicon Valley space of California, the realm north of San Antonio, Texas, Connecticut, and Maine.

It additionally has a small actual property division that owns and develops properties for residential and warehouse prospects in California and Tennessee. The corporate generates about $670 million in annual revenues.

On July eighth, 2025, H2O America introduced that it bought Quadvest for $540 million. This buy provides to the corporate’s place within the Houston space.

Quadvest has 50,500 energetic connections, nearly 91,000 connections underneath contract and pending improvement, 50 water therapy vegetation, 27 wastewater therapy vegetation, and 89 carry stations and underground belongings.

On October twenty eighth, 2025, H2O America reported third quarter outcomes for the interval ending September thirtieth, 2025. For the quarter, income improved 6.9% to $240.6 million, which beat estimates by $2.1 million.

Earnings-per-share of $1.27 in contrast favorably to earnings-per-share of $1.18 within the prior 12 months and was $0.09 higher than anticipated.

For the quarter, greater water charges total added $21.2 million to outcomes and better buyer utilization added $700K. Working manufacturing bills totaled $175.9 million, which was a 6% enhance from the prior 12 months.

The will increase had been because of greater pensions prices, salaries and wages, and inflationary will increase.

Click on right here to obtain our most up-to-date Certain Evaluation report on HTO (preview of web page 1 of three proven under):

Further Studying

The next Certain Dividend databases include probably the most dependable dividend growers in our funding universe:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].