Printed on February 4th, 2026 by Bob Ciura

For buyers searching for high quality dividend shares to purchase, it isn’t overly tough discovering appropriate candidates. All one has to do is go searching their residence.

Lots of the inventory market’s finest dividend shares promote issues that hundreds of thousands of individuals have of their properties proper now. Such merchandise embody meals, drinks, family cleaners, and the like.

Collectively, some of these firms are included within the client staples sector.

The buyer staples sector is residence to a number of the most well-known dividend progress shares on this planet.

With that in thoughts, we’ve compiled a database of greater than 60 client staples shares, which you’ll be able to obtain beneath:

Shopper staples shares are an interesting funding class for a variety of causes.

Initially, client staples shares are very recession-resistant by definition. Shopper staples firms make merchandise or ship providers which might be thought of to be ‘staples’ – in different phrases, shoppers can’t do with out them.

Because of this client staples shares have a tendency to carry up very effectively in periods of financial turmoil. This may be seen by learning the sector’s efficiency throughout the 2007-2009 monetary disaster.

This text will rank 10 prime client staples shares which have market-beating yields of at the least 2%.

In addition they have secure dividends, with our highest Dividend Threat Scores of ‘A’ or ‘B’. And, every has elevated its dividend for at the least 10 consecutive years.

These 10 client staples shares have sturdy dividend progress histories, and will be capable of elevate their dividends for years to come back.

Desk of Contents

The ten shares are ranked by 5-year anticipated returns, from lowest to highest.

The hyperlinks beneath permits for simple navigation:

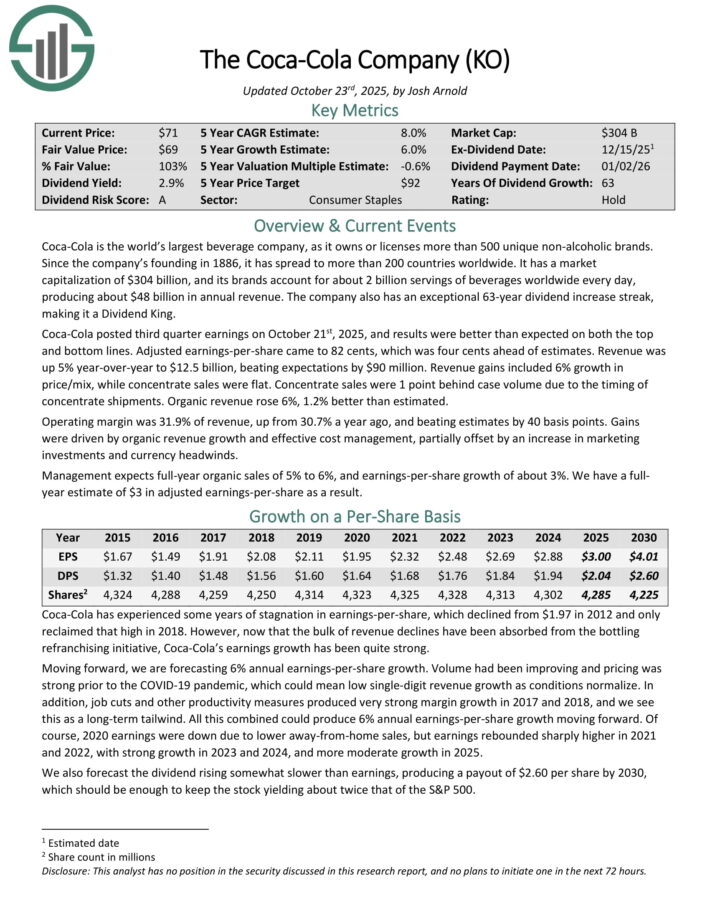

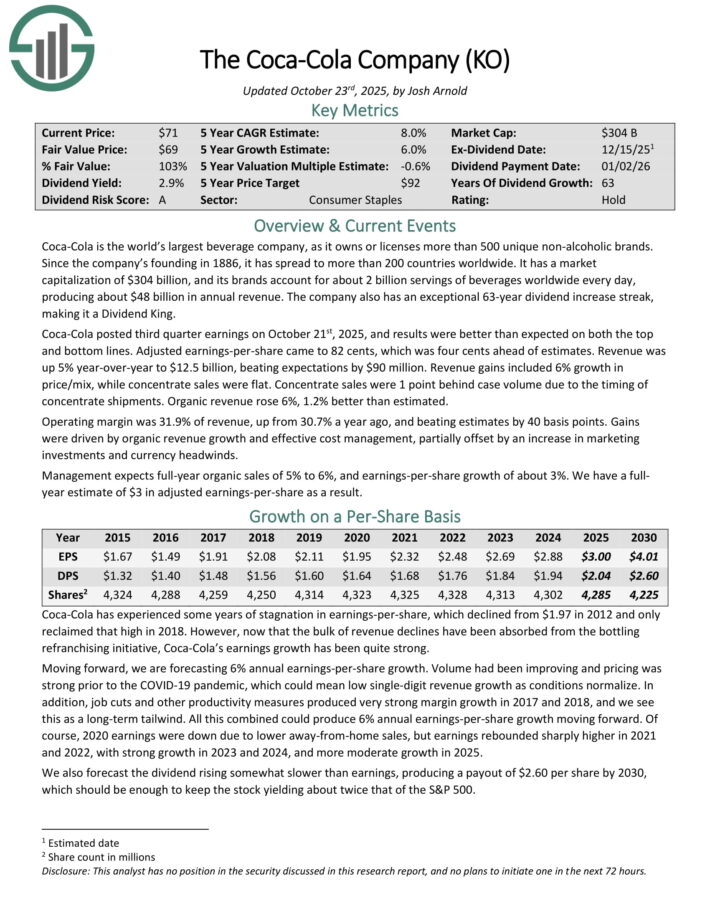

Family Merchandise Inventory #10: Coca-Cola Co. (KO)

- Anticipated Annual Returns: 6.3%

Coca-Cola is likely one of the largest beverage firms on this planet, because it owns or licenses greater than 500 distinctive non-alcoholic manufacturers.

The corporate has operations in additional than 200 international locations worldwide. Its merchandise are served about 2 billion instances every day, producing annual income of near $48 billion.

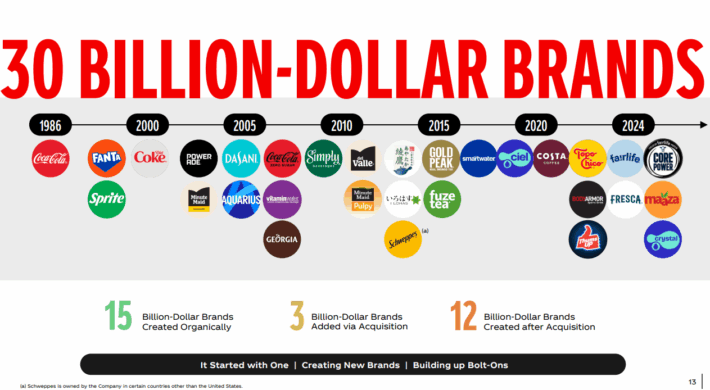

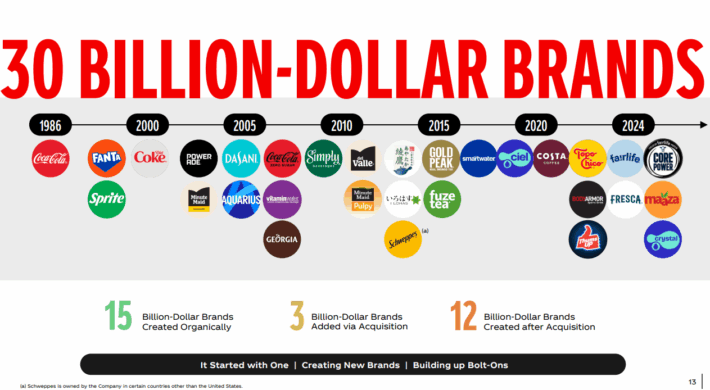

Coca-Cola’s portfolio consists of 30 manufacturers that generate at the least $1 billion in annual income.

Supply: Investor Presentation

Coca-Cola launched third-quarter earnings outcomes on October 21st, 2025, with outcomes that had been above estimates on each the highest and backside strains.

Adjusted earnings-per-share of $0.82 was $0.04 higher than anticipated whereas income of $12.5 billion was $90 million greater than anticipated.

Income good points had been supported by a 6% enchancment in worth/combine whereas focus gross sales had been unchanged. Focus gross sales had been 1 level behind case quantity because of the timing of focus shipments. Natural income grew 6%, which was 1.2% higher than anticipated.

The working margin expanded 120 foundation factors to 31.9%, which was 40 foundation factors greater than projected. Beneficial properties had been pushed by natural income progress and efficient value administration, partially offset by a rise in marking funding and forex headwinds.

Click on right here to obtain our most up-to-date Certain Evaluation report on KO (preview of web page 1 of three proven beneath):

Family Merchandise Inventory #9: Goal Corp. (TGT)

- Anticipated Annual Returns: 6.9%

Goal is a significant retailer with operations solely within the U.S. market. Its enterprise consists of about 1,850 large field shops, which provide normal merchandise and meals, in addition to serving as distribution factors for the corporate’s burgeoning e-commerce enterprise.

Goal ought to produce greater than $100 billion in complete income this yr. The corporate additionally sports activities a particularly spectacular dividend improve streak of 57 years.

Goal posted third quarter earnings on November nineteenth, 2025, and outcomes had been barely higher than anticipated. Adjusted earnings-per-share got here to $1.78, which was seven cents forward of estimates.

Income was $25.3 billion, assembly expectations, however declining simply over 1% year-over-year. Gross sales had been off 1.5% year-over-year, reflecting merchandise gross sales declines of 1.9%, partially offset by a 17.7% improve in non-merchandise gross sales.

Comparable gross sales had been off 2.7%, lacking estimates for a 2.1% decline. Bodily retailer gross sales fell 3.8% on a comparable foundation, partially offset by digital comparable gross sales progress of two.4%.

Working earnings was $1.1 billion on an adjusted foundation, with gross margin off 10 foundation factors to twenty-eight.2% of income. This mirrored merchandising strain from elevated markdowns.

Share repurchases had been $152 million throughout the quarter at a mean worth of $91.59. The corporate has about $8.3 billion in remaining repurchase capability below the 2021 authorization that’s nonetheless incomplete.

Click on right here to obtain our most up-to-date Certain Evaluation report on TGT (preview of web page 1 of three proven beneath):

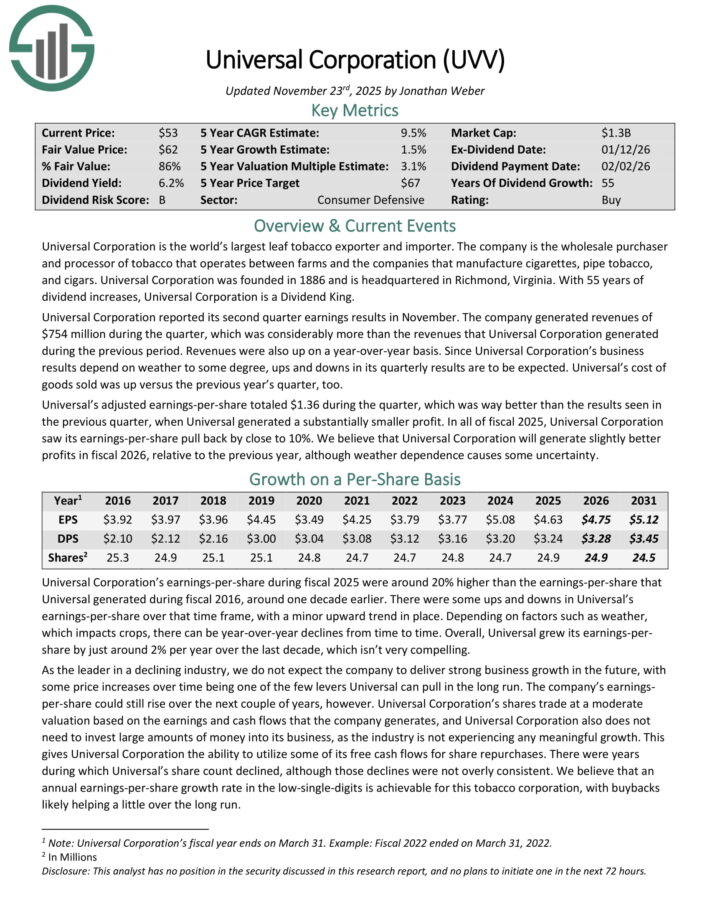

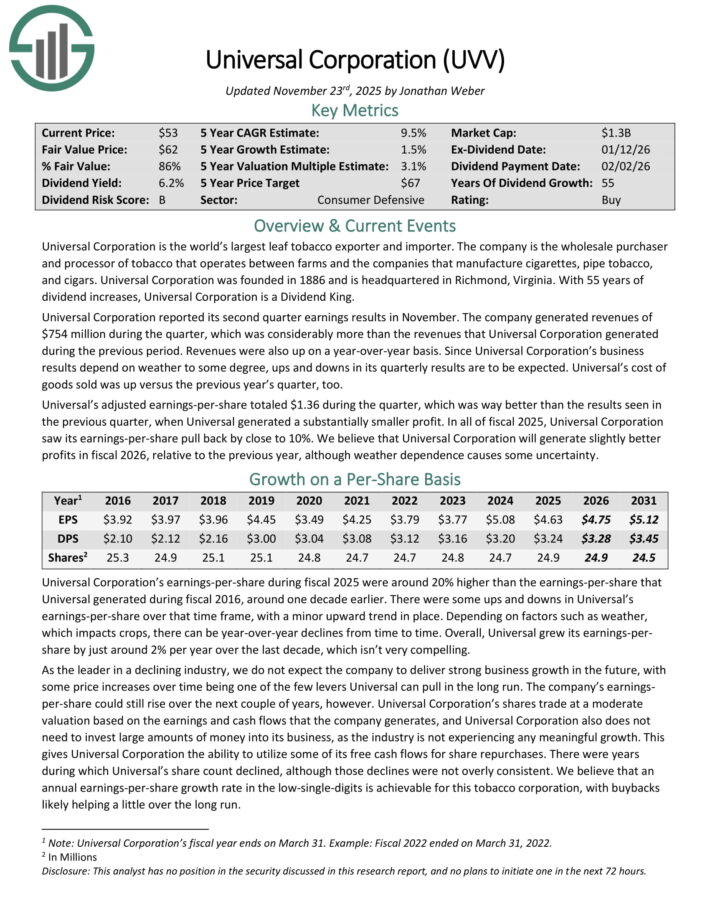

Family Merchandise Inventory #8: Common Corp. (UVV)

- Anticipated Annual Returns: 7.5%

Common Company is the world’s largest leaf tobacco exporter and importer. The corporate is the wholesale purchaser and processor of tobacco that operates between farms and the businesses that manufacture cigarettes, pipe tobacco, and cigars.

Common Company was based in 1886 and is headquartered in Richmond, Virginia. With 55 years of dividend will increase, Common Company is a Dividend King.

Common Company reported its second quarter earnings ends in November. The corporate generated income of $754 million throughout the quarter, which was significantly greater than the revenues that Common Company generated throughout the earlier interval.

Revenues had been additionally up on a year-over-year foundation. Since Common Company’s enterprise outcomes rely on climate to a point, ups and downs in its quarterly outcomes are to be anticipated. Common’s value of products offered was up versus the earlier yr’s quarter.

Common’s adjusted earnings-per-share totaled $1.36 throughout the quarter. In fiscal 2025, Common Company noticed its earnings-per-share pull again by near 10%.

Click on right here to obtain our most up-to-date Certain Evaluation report on UVV (preview of web page 1 of three proven beneath):

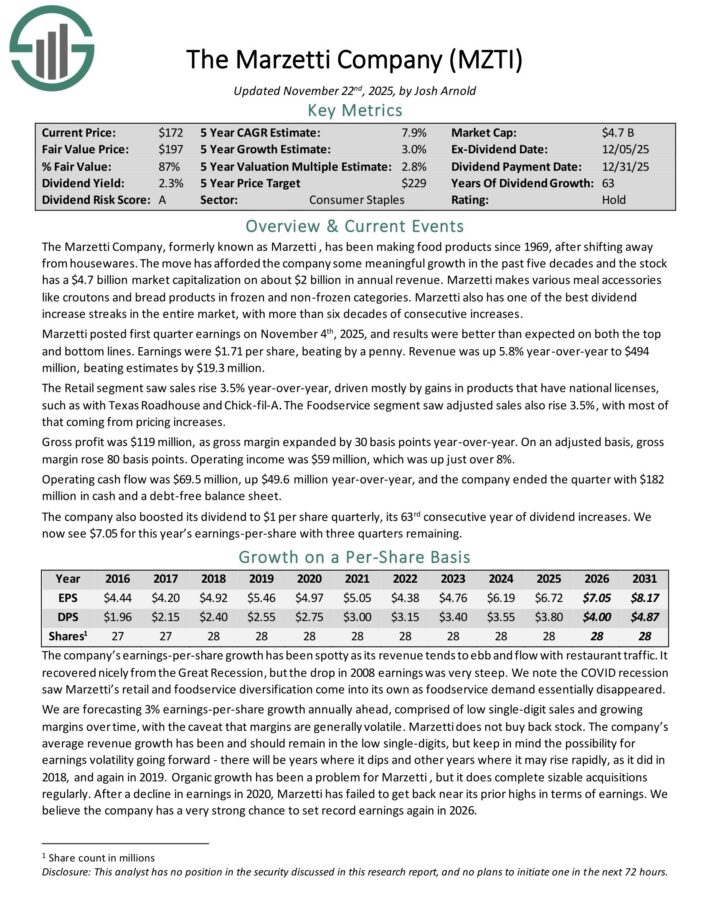

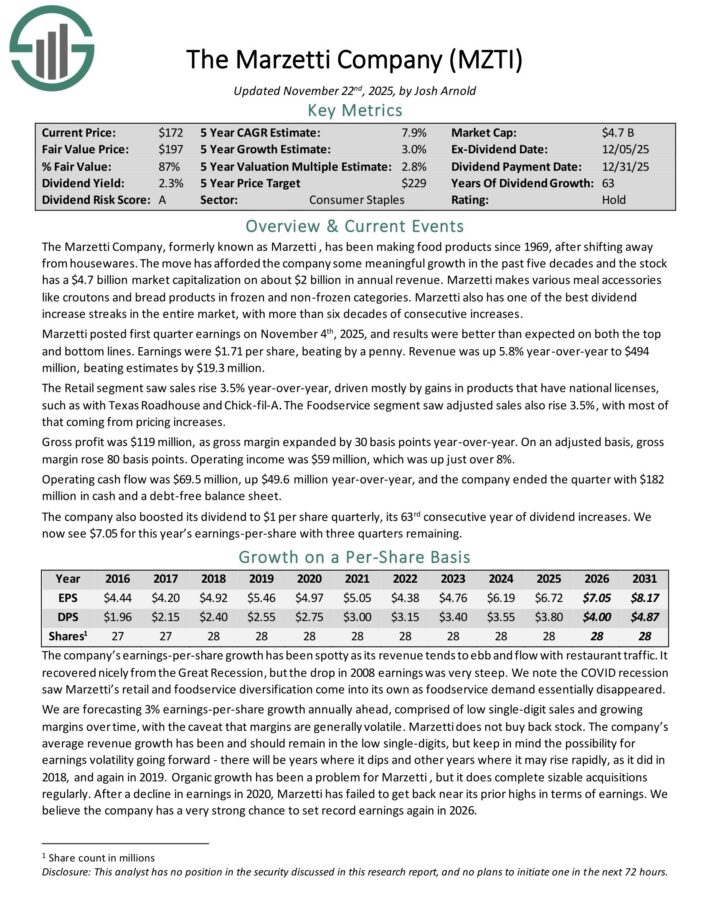

Family Merchandise Inventory #7: The Marzetti Firm (MZTI)

- Anticipated Annual Returns: 9.3%

The Marzetti Firm has been making meals merchandise since 1969, after shifting away from housewares. Marzetti makes varied meal equipment like croutons and bread merchandise in frozen and non-frozen classes.

It additionally has among the finest dividend improve streaks in your complete market, with greater than six many years of consecutive will increase.

Marzetti posted first quarter earnings on November 4th, 2025, and outcomes had been higher than anticipated on each the highest and backside strains.

Earnings had been $1.71 per share, beating by a penny. Income was up 5.8% year-over-year to $494 million, beating estimates by $19.3 million.

Retail section gross sales rose 3.5% year-over-year, pushed largely by good points in merchandise which have nationwide licenses, similar to with Texas Roadhouse and Chick-fil-A.

The Foodservice section noticed adjusted gross sales additionally rise 3.5%, with most of that coming from pricing will increase.

Gross revenue was $119 million, as gross margin expanded by 30 foundation factors year-over-year. On an adjusted foundation, gross margin rose 80 foundation factors. Working earnings was $59 million, which was up simply over 8%.

Working money movement was $69.5 million, up $49.6 million year-over-year, and the corporate ended the quarter with $182 million in money and a debt-free stability sheet.

The corporate additionally boosted its dividend to $1 per share quarterly, its 63rd consecutive yr of dividend will increase.

Click on right here to obtain our most up-to-date Certain Evaluation report on MZTI (preview of web page 1 of three proven beneath):

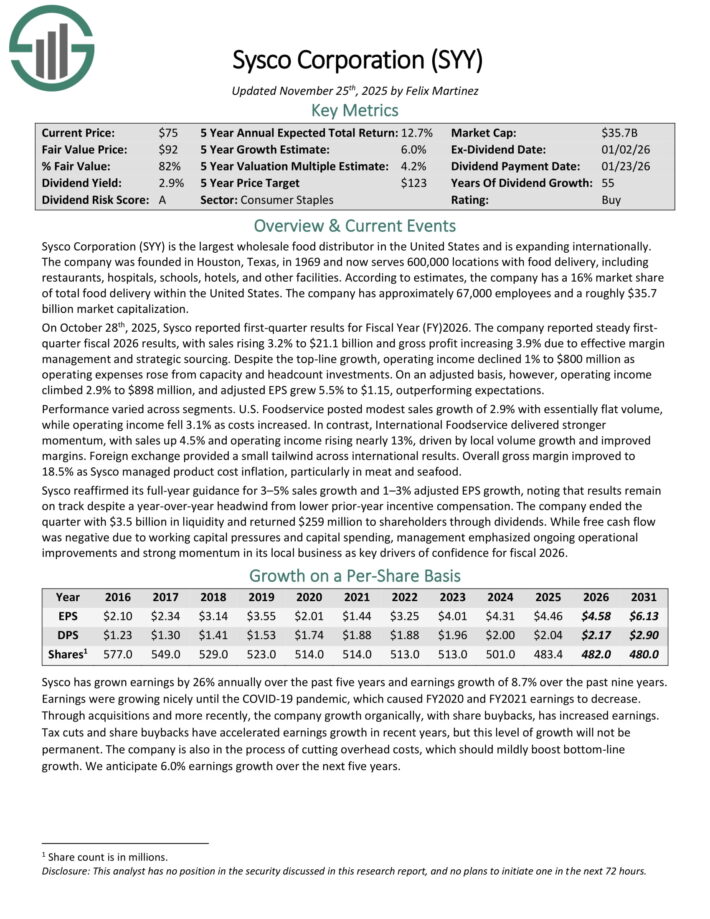

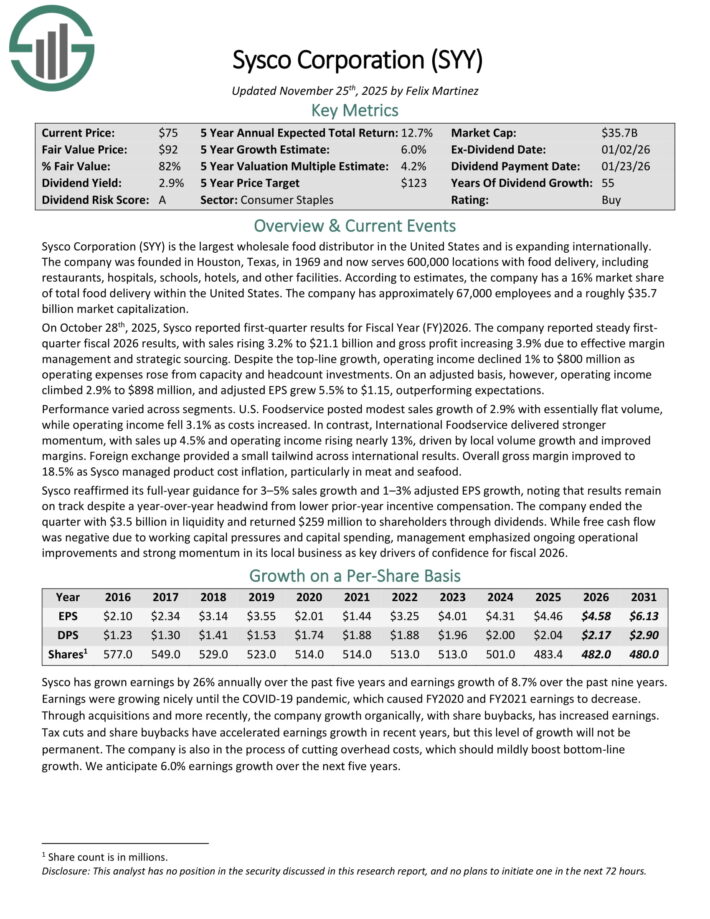

Family Merchandise Inventory #6: Sysco Corp. (SYY)

- Anticipated Annual Returns: 10.0%

Sysco Company is the biggest wholesale meals distributor in the USA and is increasing internationally. The corporate serves 600,000 places with meals supply, together with eating places, hospitals, faculties, inns, and different amenities.

Based on estimates, the corporate has a 16% market share of complete meals supply inside the USA. The corporate has roughly 67,000 staff.

On October twenty eighth, 2025, Sysco reported first-quarter outcomes for Fiscal Yr 2026. The corporate reported regular first-quarter fiscal 2026 outcomes, with gross sales rising 3.2% to $21.1 billion and gross revenue rising 3.9% attributable to efficient margin administration and strategic sourcing.

Regardless of the top-line progress, working earnings declined 1% to $800 million as working bills rose from capability and headcount investments. On an adjusted foundation, nonetheless, working earnings climbed 2.9% to $898 million, and adjusted EPS grew 5.5% to $1.15, outperforming expectations.

Sysco reaffirmed its full-year steering for 3–5% gross sales progress and 1–3% adjusted EPS progress, noting that outcomes stay on monitor regardless of a year-over-year headwind from decrease prior-year incentive compensation.

Click on right here to obtain our most up-to-date Certain Evaluation report on SYY (preview of web page 1 of three proven beneath):

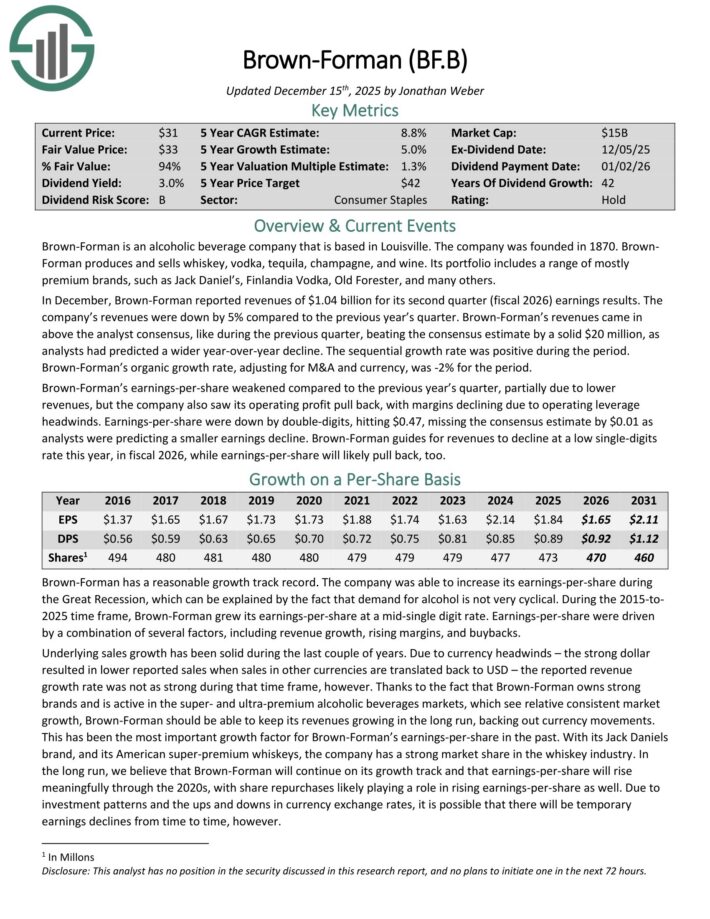

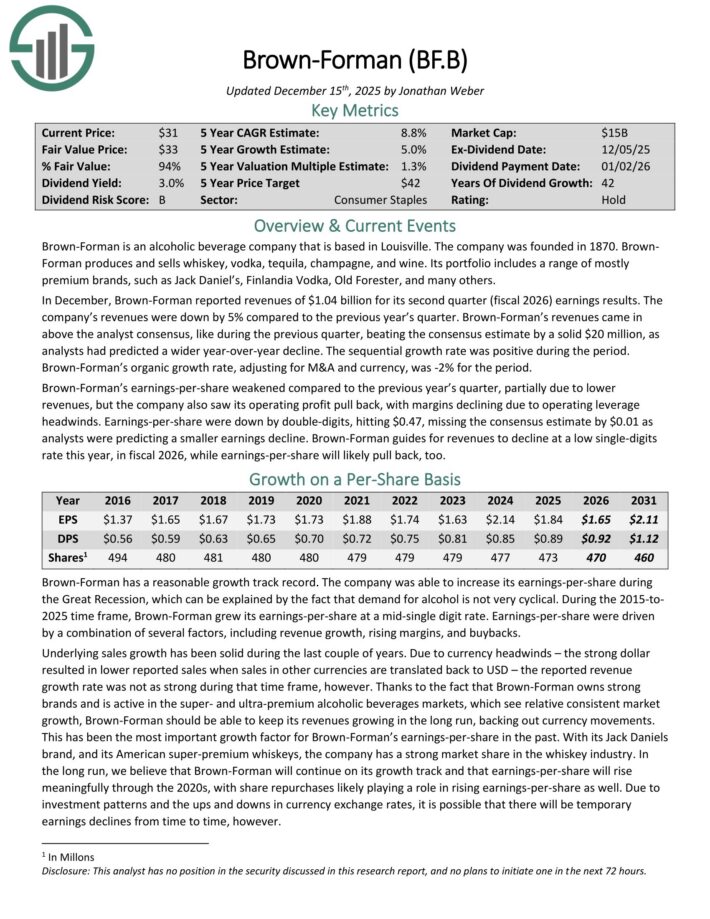

Family Merchandise Inventory #5: Brown-Forman Corp. (BF.B)

- Anticipated Annual Returns: 11.2%

Brown-Forman is an alcoholic beverage firm based mostly in Louisville. It produces and sells whiskey, vodka, tequila, champagne, and wine.

Its portfolio features a vary of largely premium manufacturers, similar to Jack Daniel’s, Finlandia Vodka, Outdated Forester, and plenty of others.

In December, Brown-Forman reported revenues of $1.04 billion for its second quarter (fiscal 2026) earnings outcomes. Income declined by 5% in comparison with the earlier yr’s quarter. Income got here in above the analyst consensus by $20 million.

Natural progress, adjusting for M&A and forex, was -2% for the interval. Earnings-per-share weakened in comparison with the earlier yr’s quarter, partially attributable to decrease revenues, however the firm additionally noticed its working revenue pull again, with margins declining attributable to working leverage headwinds.

Earnings-per-share had been down by double-digits at $0.47, lacking the consensus estimate by $0.01. Brown-Forman guides for revenues to say no at a low single-digit fee in fiscal 2026.

Brown-Forman has elevated its dividend for 42 consecutive years.

Click on right here to obtain our most up-to-date Certain Evaluation report on BF.B (preview of web page 1 of three proven beneath):

Family Merchandise Inventory #4: Hormel Meals Corp. (HRL)

- Anticipated Annual Returns: 11.4%

Hormel Meals was based in 1891 in Minnesota. Since that point, the corporate has grown right into a meals merchandise large with about $12 billion in annual income.

The corporate sells its merchandise in 80 international locations worldwide, and its manufacturers embody Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

As well as, Hormel is a member of the Dividend Kings, having elevated its dividend for 60 consecutive years.

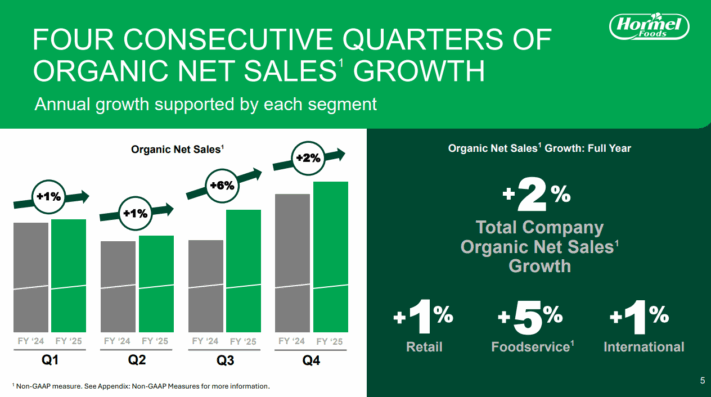

Hormel posted fourth quarter and full-year earnings on December 4th, 2025.

Supply: Investor Presentation

The corporate noticed 32 cents in adjusted earnings-per-share for the quarter, beating estimates by two cents. Income was up 1.6% year-over-year and missed estimates by $30 million, coming in at $3.19 billion.

Adjusted working margin was 7.7% of income, whereas money movement from operations was $323 million. Volumes within the fourth quarter had been flat within the retail section, down 5% in foodservice, and down 7% within the worldwide section.

Hormel raised its dividend for the sixtieth consecutive yr, this time including 0.9% to a brand new payout of $1.20 per share yearly. We begin 2026 with an estimate of $1.47 in adjusted earnings-per-share.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRL (preview of web page 1 of three proven beneath):

Family Merchandise Inventory #3: PepsiCo Inc. (PEP))

- Anticipated Annual Returns: 12.7%

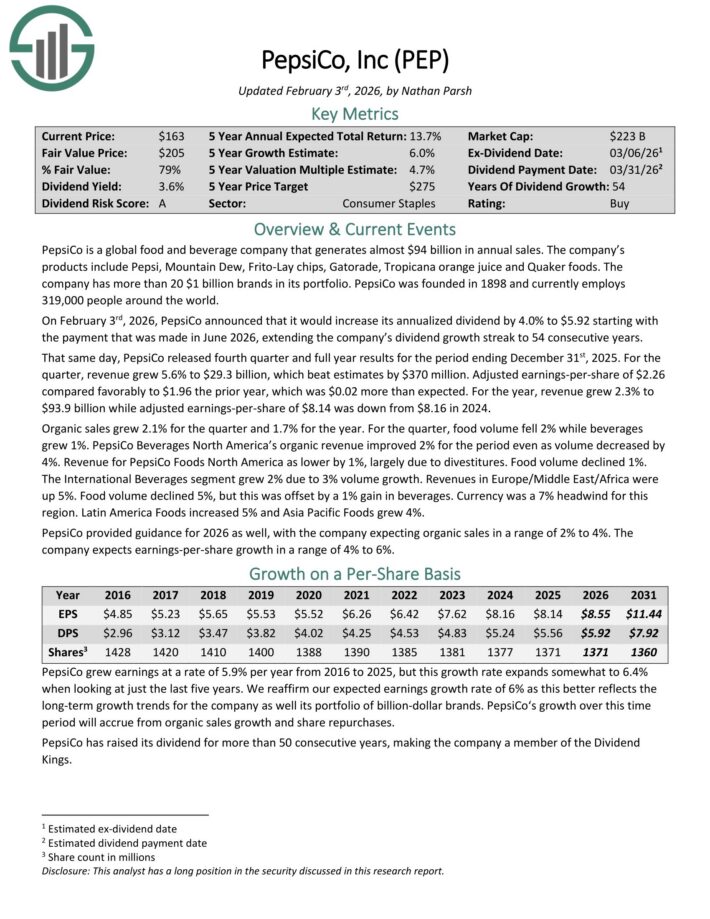

PepsiCo is a worldwide meals and beverage firm that generates virtually $94 billion in annual gross sales. The corporate’s merchandise embody Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

The corporate has greater than 20 $1 billion manufacturers in its portfolio.

On February third, 2026, PepsiCo introduced that it will improve its annualized dividend by 4.0% to $5.92 beginning with the fee that was made in June 2026, extending the corporate’s dividend progress streak to 54 consecutive years.

That very same day, PepsiCo launched fourth quarter and full yr outcomes for the interval ending December thirty first, 2025. For the quarter, income grew 5.6% to $29.3 billion, which beat estimates by $370 million.

Adjusted earnings-per-share of $2.26 in contrast favorably to $1.96 the prior yr, which was $0.02 greater than anticipated.

For the yr, income grew 2.3% to $93.9 billion whereas adjusted earnings-per-share of $8.14 was down from $8.16 in 2024. Natural gross sales grew 2.1% for the quarter and 1.7% for the yr.

For the quarter, meals quantity fell 2% whereas drinks grew 1%. PepsiCo Drinks North America’s natural income improved 2% for the interval whilst quantity decreased by 4%.

Income for PepsiCo Meals North America as decrease by 1%, largely attributable to divestitures. Meals quantity declined 1%.

The Worldwide Drinks section grew 2% attributable to 3% quantity progress. Revenues in Europe/Center East/Africa had been up 5%. Meals quantity declined 5%, however this was offset by a 1% acquire in drinks.

Foreign money was a 7% headwind for this area. Latin America Meals elevated 5% and Asia Pacific Meals grew 4%.

PepsiCo offered steering for 2026 as effectively, with the corporate anticipating natural gross sales in a spread of two% to 4%. The corporate expects earnings-per-share progress in a spread of 4% to six%.

Click on right here to obtain our most up-to-date Certain Evaluation report on PEP (preview of web page 1 of three proven beneath):

Family Merchandise Inventory #2: Kimberly-Clark Corp. (KMB)

- Anticipated Annual Returns: 13.0%

The Kimberly-Clark Company is a worldwide client merchandise firm that operates in 175 international locations and sells disposable client items, together with paper towels, diapers, and tissues.

It operates by two segments that every home many widespread manufacturers: Private Care Phase (Huggies, Pull-Ups, Kotex, Rely, Poise) and the Shopper Tissue section (Kleenex, Scott, Cottonelle, and Viva), producing about $20 billion in annual income.

Kimberly-Clark posted third quarter earnings on October thirtieth, 2025, and outcomes had been higher than anticipated on each the highest and backside strains.

Adjusted earnings-per-share got here to $1.82, which was seven cents forward of estimates. Income was flat year-over-year at $4.15 billion, however did finest estimates by $50 million.

Gross sales included detrimental impacts of about 2.2% from the exit of the non-public label diaper enterprise within the US. Natural gross sales had been up 2.5%, which was pushed by a 2.4% acquire in quantity, whereas portfolio combine and worth had been flat.

Gross margin was 36.8% of income on an adjusted foundation, off 170 foundation factors year-over-year. This mirrored sturdy productiveness good points that had been greater than offset by unfavorable pricing internet of value inflation.

Working revenue was $683 million on an adjusted foundation, pushed by decrease advertising and R&D prices, in addition to effectivity efforts. Internet curiosity expense was $59 million, up from $49 million a yr in the past.

We now see $7.50 in adjusted earnings-per-share for this yr, which might be the best since 2020, if achieved. Individually, Kimberly-Clark introduced its intention to purchase Kenvue (KVUE) for $48.7 billion in a money and inventory deal.

Click on right here to obtain our most up-to-date Certain Evaluation report on KMB (preview of web page 1 of three proven beneath):

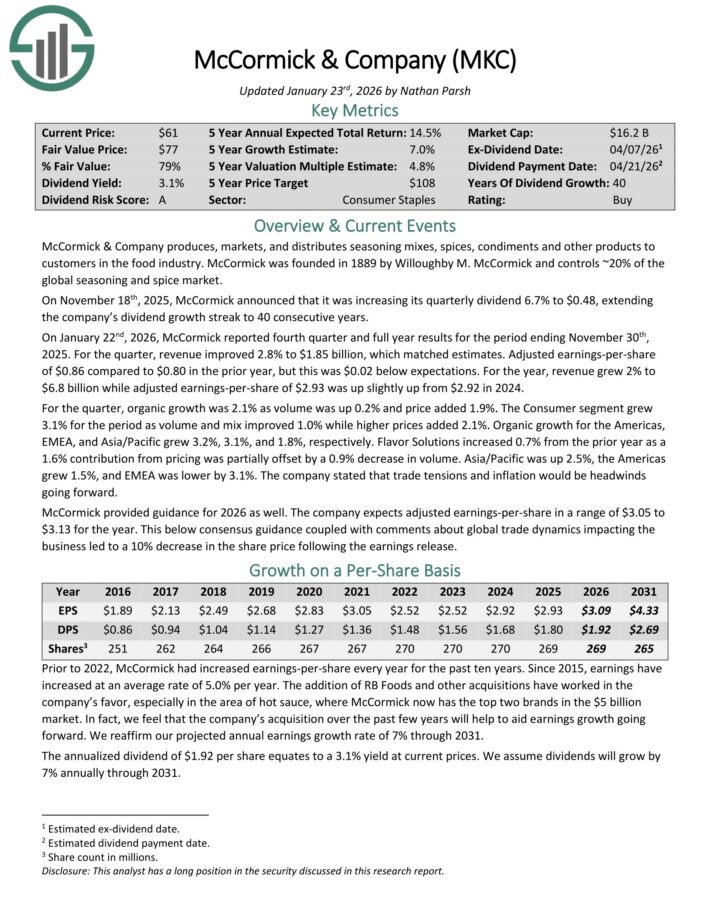

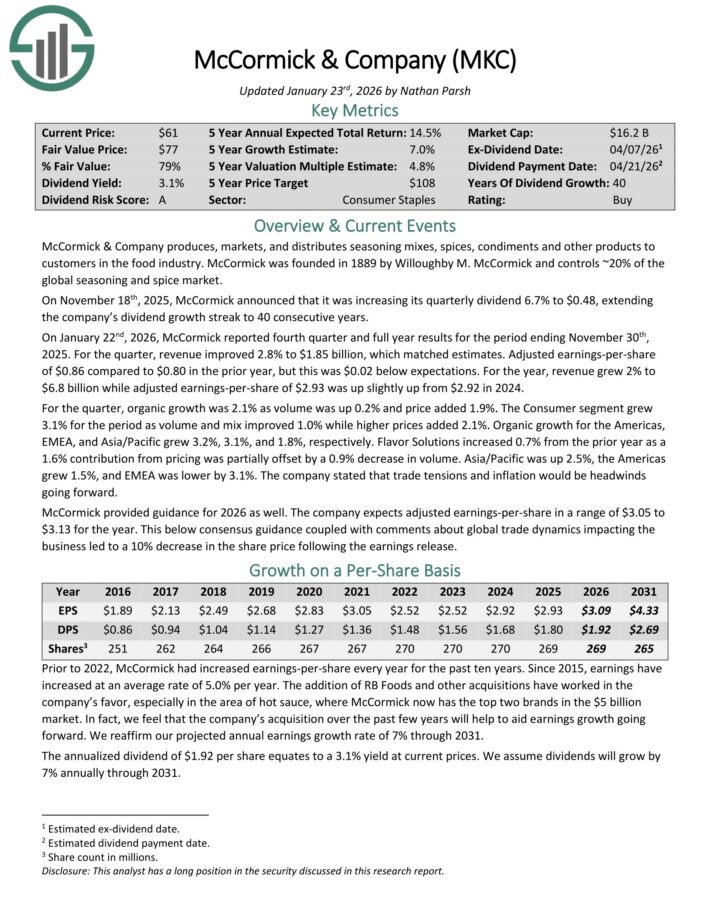

Family Merchandise Inventory #1: McCormick & Co. (MKC)

- Anticipated Annual Returns: 13.5%

McCormick & Firm produces, markets, and distributes seasoning mixes, spices, condiments and different merchandise to prospects within the meals trade. It controls ~20% of the worldwide seasoning and spice market.

On November 18th, 2025, McCormick introduced that it was rising its quarterly dividend 6.7% to $0.48, extending the corporate’s dividend progress streak to 40 consecutive years.

On January twenty second, 2026, McCormick reported fourth quarter and full yr outcomes for the interval ending November thirtieth, 2025. For the quarter, income improved 2.8% to $1.85 billion, which matched estimates.

Adjusted earnings-per-share of $0.86 in comparison with $0.80 within the prior yr, however this was $0.02 beneath expectations.

For the yr, income grew 2% to $6.8 billion whereas adjusted earnings-per-share of $2.93 was up barely up from $2.92 in 2024.

For the quarter, natural progress was 2.1% as quantity was up 0.2% and worth added 1.9%. The Shopper section grew 3.1% for the interval as quantity and blend improved 1.0% whereas greater costs added 2.1%.

Natural progress for the Americas, EMEA, and Asia/Pacific grew 3.2%, 3.1%, and 1.8%, respectively. Taste Options elevated 0.7% from the prior yr as a 1.6% contribution from pricing was partially offset by a 0.9% lower in quantity.

Asia/Pacific was up 2.5%, the Americas grew 1.5%, and EMEA was decrease by 3.1%. The corporate acknowledged that commerce tensions and inflation could be headwinds going ahead.

McCormick offered steering for 2026 as effectively. The corporate expects adjusted earnings-per-share in a spread of $3.05 to $3.13 for the yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on MKC (preview of web page 1 of three proven beneath):

Extra Sources

When you’re prepared to look outdoors of this sector whereas attempting to find funding alternatives, the next inventory databases are extremely helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].