Printed on February eleventh, 2026 by Bob Ciura

Blue-chip shares are established, financially robust, and constantly worthwhile publicly traded firms.

Their energy makes them interesting investments for comparatively secure, dependable dividends and capital appreciation versus much less established shares.

We outline blue chip shares as having raised their dividends for a minimum of 10 consecutive years.

This analysis report has the next sources that can assist you put money into blue chip shares:

There are presently greater than 500 securities in our blue chip shares checklist.

In the meantime, dividend progress shares might be even greater bargains, when buying and selling at all-time low costs.

The next 10 blue-chip dividend shares have yields above 5%, and are buying and selling inside 10% of their 52-week lows.

The checklist is sorted by anticipated annual returns over the subsequent 5 years, in ascending order.

Desk of Contents

The desk of contents under permits for straightforward navigation.

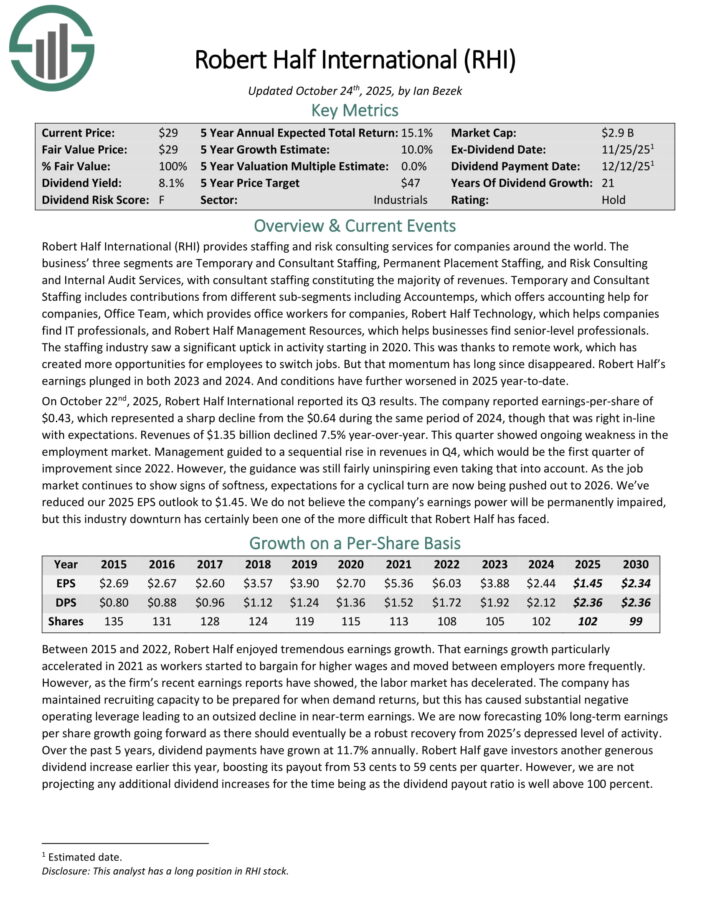

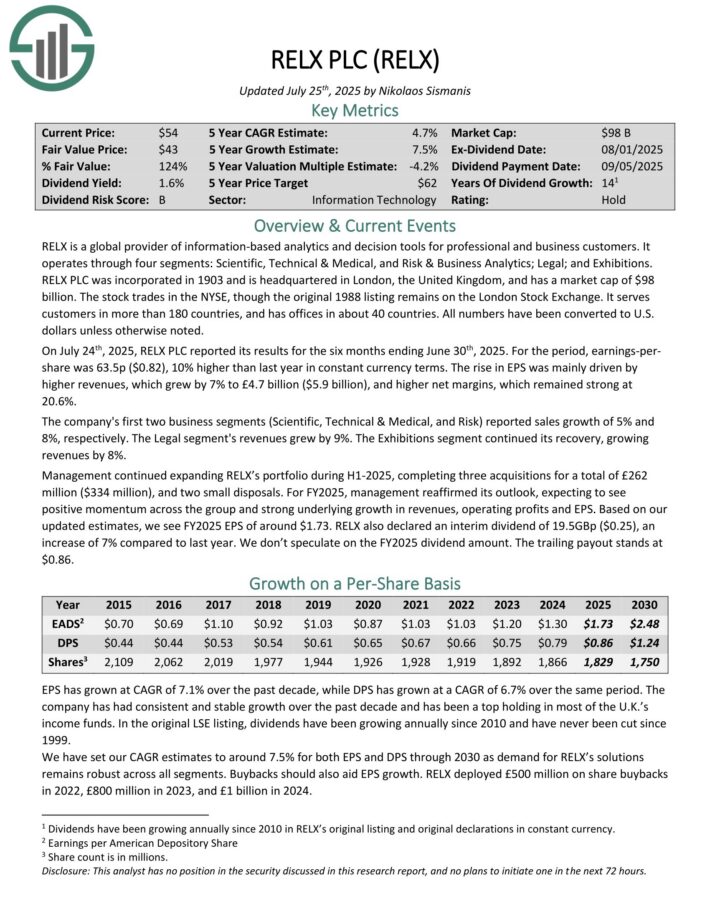

Dividend Inventory Buying and selling At Lows: Robert Half Inc. (RHI)

- Anticipated Whole Return: 17.2%

Robert Half Worldwide gives staffing and threat consulting providers for firms all over the world.

Its three segments are Short-term and Marketing consultant Staffing, Everlasting Placement Staffing, and Danger Consulting and Inner Audit Companies, with marketing consultant staffing constituting nearly all of revenues.

Short-term and Marketing consultant Staffing contains contributions from totally different sub-segments together with Accountemps, which affords accounting assist for firms, Workplace Crew, which gives workplace employees for firms, Robert Half Expertise, which helps firms discover IT professionals, and Robert Half Administration Assets, which helps companies discover senior-level professionals.

Robert Half’s earnings plunged in each 2023 and 2024, and situations additional worsened in 2025.

On October twenty second, 2025, Robert Half Worldwide reported its Q3 outcomes. The corporate reported earnings-per-share of $0.43, which represented a pointy decline from the $0.64 throughout the identical interval of 2024.

Income of $1.35 billion declined 7.5% year-over-year. This quarter confirmed ongoing weak point within the employment market. Administration guided to a sequential rise in revenues in This autumn, which might be the primary quarter of enchancment since 2022.

Nevertheless, the steerage was nonetheless pretty uninspiring even taking that into consideration. Because the job market continues to indicate indicators of softness, expectations for a cyclical flip are actually being pushed out to 2026.

Click on right here to obtain our most up-to-date Certain Evaluation report on RHI (preview of web page 1 of three proven under):

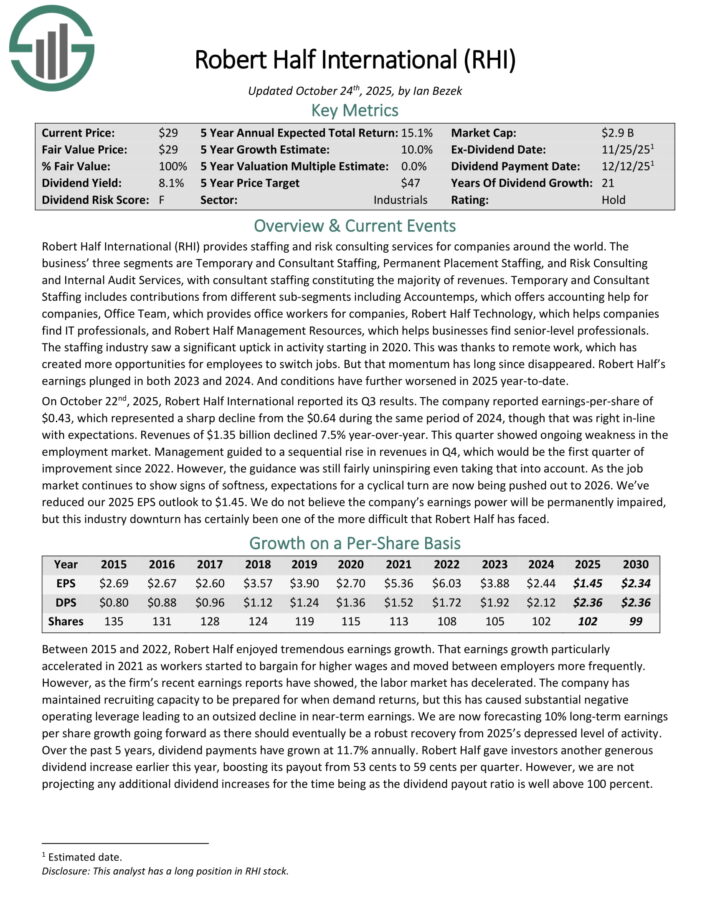

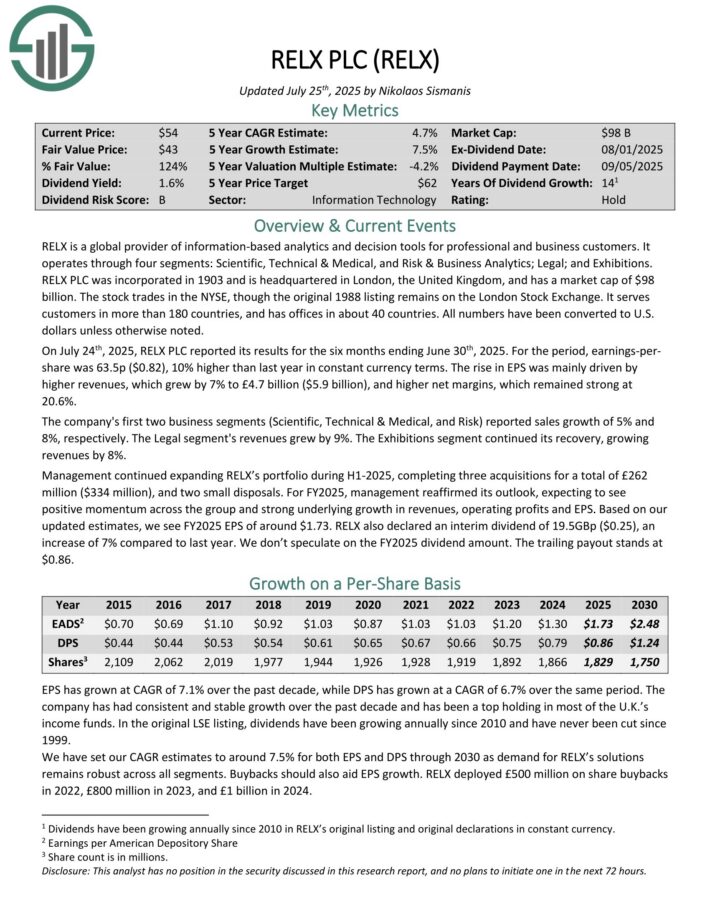

Dividend Inventory Buying and selling At Lows: RELX plc ADR (RELX)

- Anticipated Whole Return: 18.0%

RELX is a worldwide supplier of information-based analytics and resolution instruments for skilled and enterprise prospects.

It operates by way of 4 segments: Scientific, Technical & Medical, and Danger & Enterprise Analytics; Authorized; and Exhibitions.

RELX PLC was included in 1903 and is headquartered in London, the UK. It serves prospects in additional than 180 nations, and has workplaces in about 40 nations.

On July twenty fourth, 2025, RELX PLC reported its outcomes for the six months ending June thirtieth, 2025. For the interval, earnings-per-share was 63.5p ($0.82), 10% larger than final 12 months in fixed forex phrases.

The rise in EPS was primarily pushed by larger revenues, which grew by 7% to £4.7 billion ($5.9 billion), and better web margins, which remained robust at 20.6%.

The corporate’s first two enterprise segments (Scientific, Technical & Medical, and Danger) reported gross sales progress of 5% and eight%, respectively. The Authorized phase’s revenues grew by 9%. The Exhibitions phase continued its restoration, rising revenues by 8%.

Administration continued increasing RELX’s portfolio throughout H1-2025, finishing three acquisitions for a complete of £262 million ($334 million), and two small disposals.

For FY 2025, administration reaffirmed its outlook, anticipating to see constructive momentum throughout the group and robust underlying progress in revenues, working earnings and EPS.

Based mostly on our up to date estimates, we see FY2025 EPS of round $1.73. RELX additionally declared an interim dividend of 19.5GBp ($0.25), a rise of seven% in comparison with final 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on RELX (preview of web page 1 of three proven under):

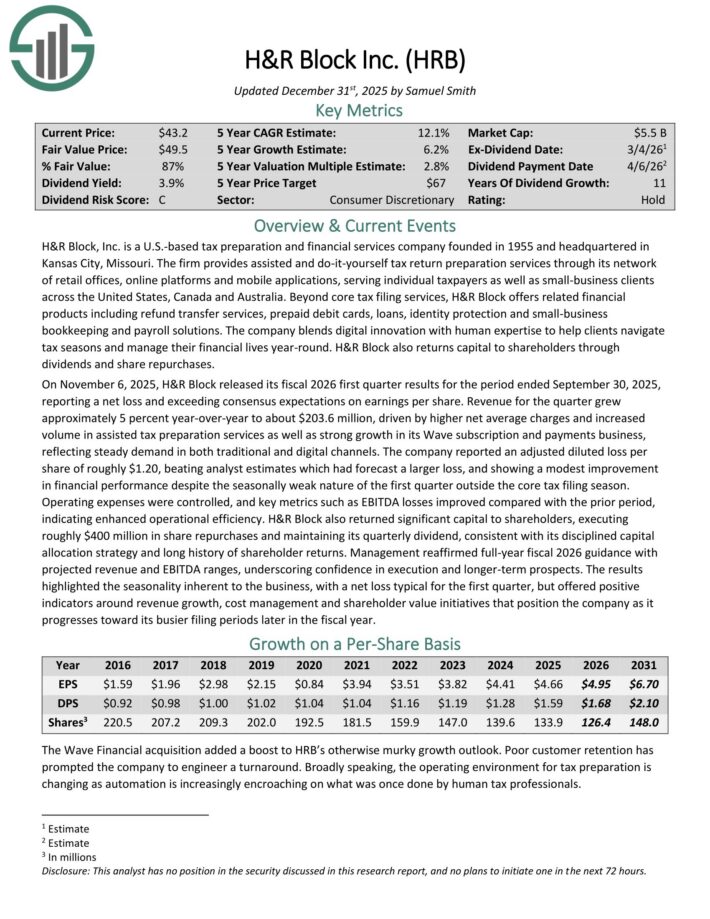

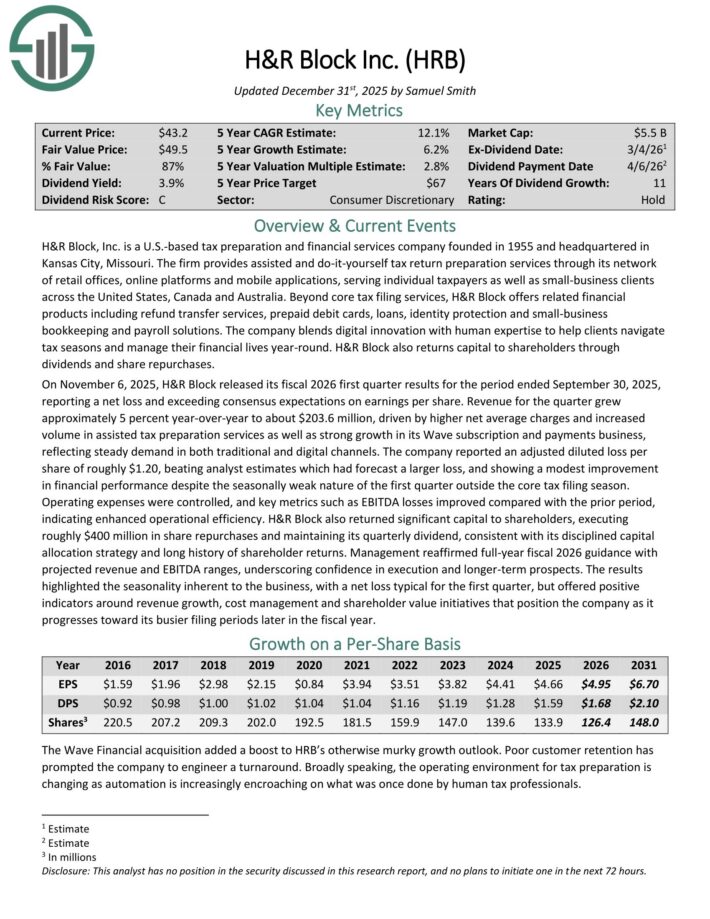

Dividend Inventory Buying and selling At Lows: H&R Block Inc. (HRB)

- Anticipated Whole Return: 18.6%

H&R Block, Inc. is a U.S.-based tax preparation that gives assisted and do-it-yourself tax return preparation providers by way of its community of retail workplaces, on-line platforms and cell functions.

Past core tax submitting providers, H&R Block affords associated monetary merchandise together with refund switch providers, pay as you go debit playing cards, loans, identification safety and small-business bookkeeping and payroll options.

On November 6, 2025, H&R Block launched its fiscal 2026 first quarter outcomes. Income for the quarter grew roughly 5% year-over-year to about $203.6 million.

Progress was pushed by larger web common prices and elevated quantity in assisted tax preparation providers in addition to robust progress in its Wave subscription and funds enterprise, reflecting regular demand in each conventional and digital channels.

The corporate reported an adjusted diluted loss per share of roughly $1.20, beating analyst estimates which had forecast a bigger loss, and exhibiting a modest enchancment in monetary efficiency regardless of the seasonally weak nature of the primary quarter outdoors the core tax submitting season.

Working bills have been managed, and key metrics reminiscent of EBITDA losses improved in contrast with the prior interval, indicating enhanced operational effectivity.

H&R Block additionally returned vital capital to shareholders, executing roughly $400 million in share repurchases and maintained its quarterly dividend.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRB (preview of web page 1 of three proven under):

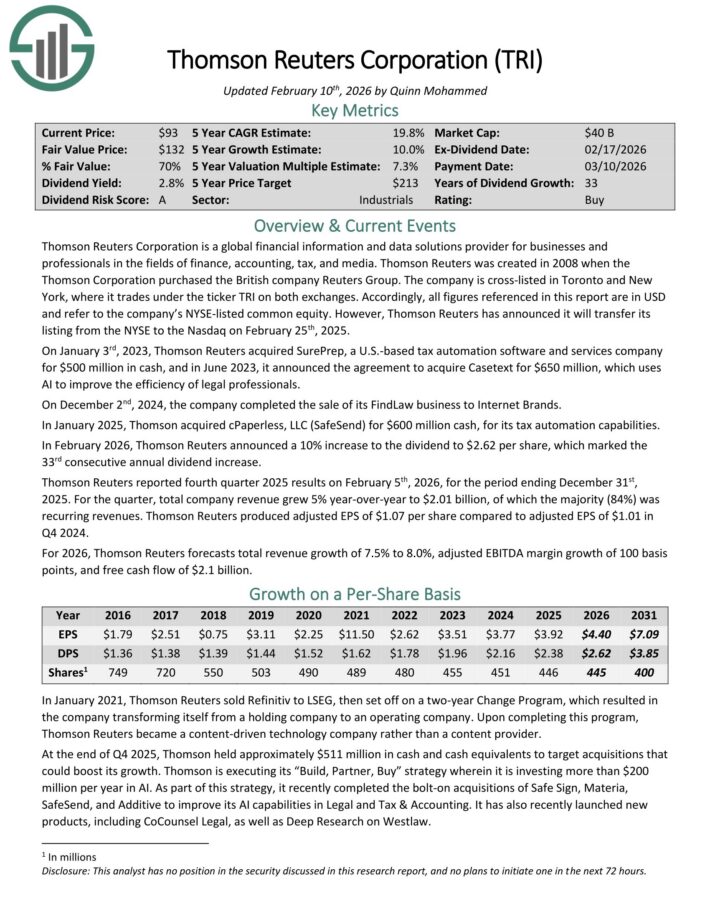

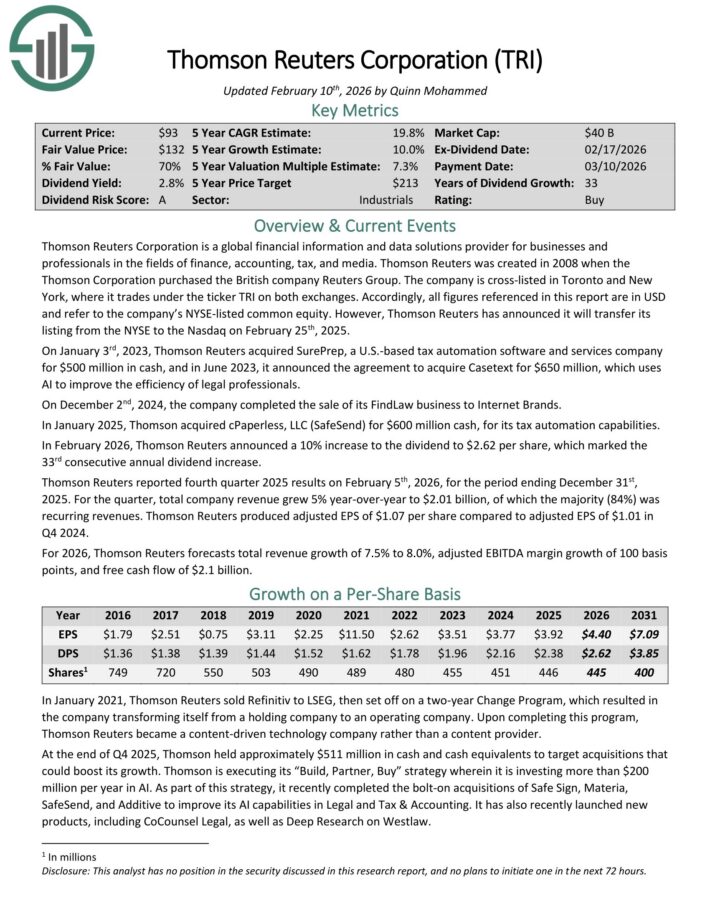

Dividend Inventory Buying and selling At Lows: Thomson-Reuters Corp. (TRI)

- Anticipated Whole Return: 19.6%

Thomson Reuters Company is a worldwide monetary data and information options supplier for companies and professionals within the fields of finance, accounting, tax, and media.

In January 2025, Thomson acquired cPaperless, LLC (SafeSend) for $600 million money, for its tax automation capabilities.

In February 2026, Thomson Reuters introduced a ten% improve to the dividend to $2.62 per share, which marked the thirty third consecutive annual dividend improve.

Thomson Reuters reported fourth quarter 2025 outcomes on February fifth, 2026. For the quarter, whole firm income grew 5% year-over-year to $2.01 billion, of which the bulk (84%) was recurring revenues. Thomson Reuters produced adjusted EPS of $1.07 per share in comparison with adjusted EPS of $1.01 in This autumn 2024.

For 2026, Thomson Reuters forecasts whole income progress of seven.5% to eight.0%, adjusted EBITDA margin progress of 100 foundation factors, and free money movement of $2.1 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on TRI (preview of web page 1 of three proven under):

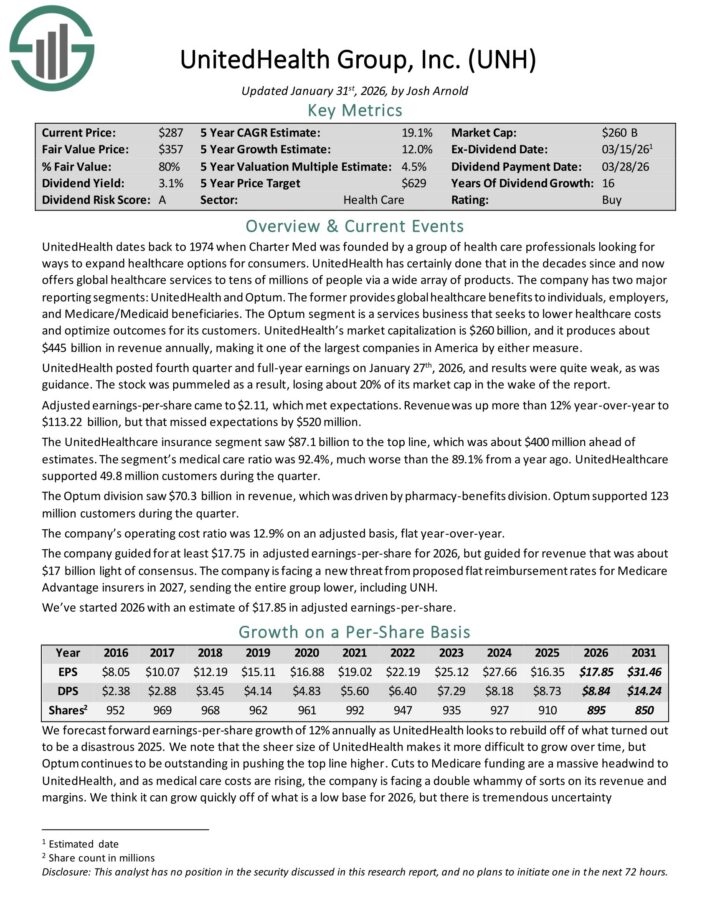

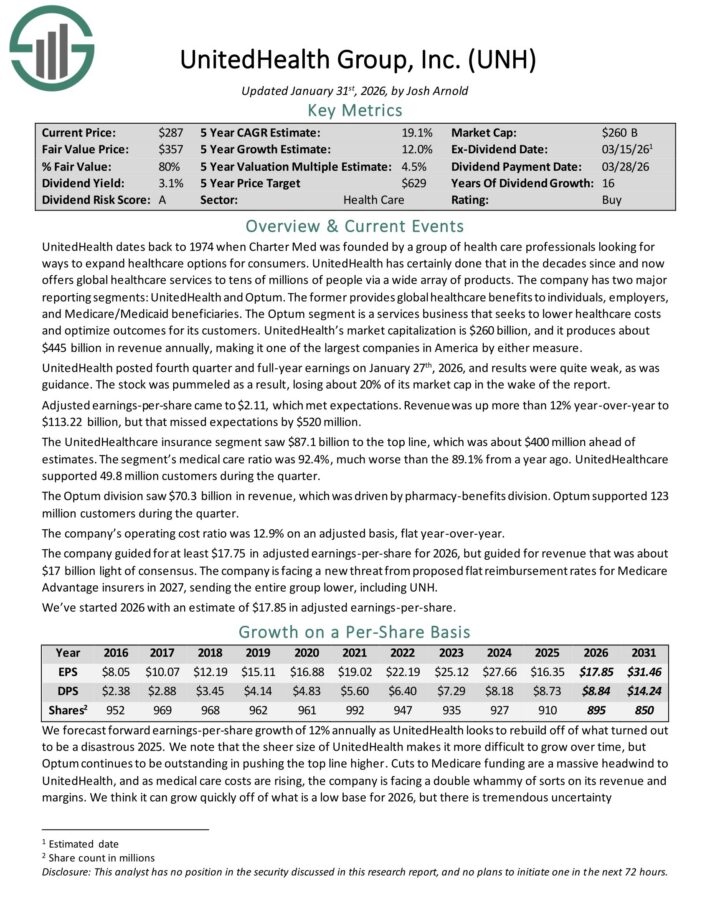

Dividend Inventory Buying and selling At Lows: UnitedHealth Group (UNH)

- Anticipated Whole Return: 20.3%

UnitedHealth affords world healthcare providers to tens of hundreds of thousands of individuals through a wide selection of merchandise. The corporate has two main reporting segments: UnitedHealth and Optum.

It gives world healthcare advantages to people, employers, and Medicare/Medicaid beneficiaries. The Optum phase is a providers enterprise that seeks to decrease healthcare prices and optimize outcomes for its prospects.

UnitedHealth posted fourth quarter and full-year earnings on January twenty seventh, 2026. Adjusted earnings-per-share got here to $2.11, which met expectations. Income was up greater than 12% year-over-year to $113.22 billion, however that missed expectations by $520 million.

The UnitedHealthcare insurance coverage phase noticed $87.1 billion to the highest line, which was about $400 million forward of estimates.

The phase’s medical care ratio was 92.4%, a lot worse than the 89.1% from a 12 months in the past. UnitedHealthcare supported 49.8 million prospects through the quarter.

The Optum division noticed $70.3 billion in income, which was pushed by pharmacy-benefits division. Optum supported 123 million prospects through the quarter. The corporate’s working price ratio was 12.9% on an adjusted foundation, flat year-over-year.

The corporate guided for a minimum of $17.75 in adjusted earnings-per-share for 2026, however guided for income that was about $17 billion gentle of consensus.

Click on right here to obtain our most up-to-date Certain Evaluation report on UNH (preview of web page 1 of three proven under):

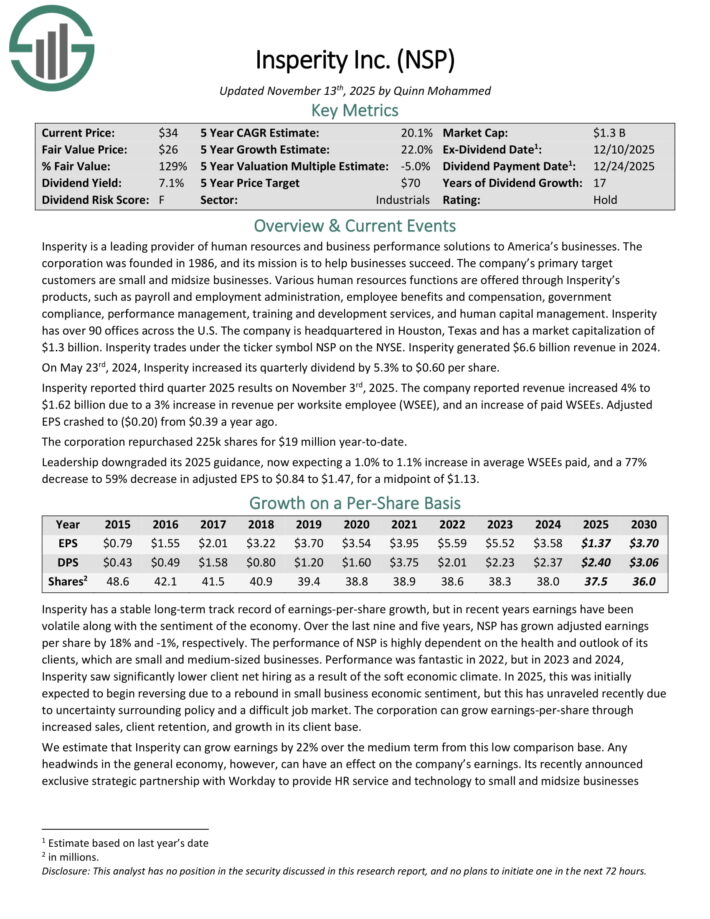

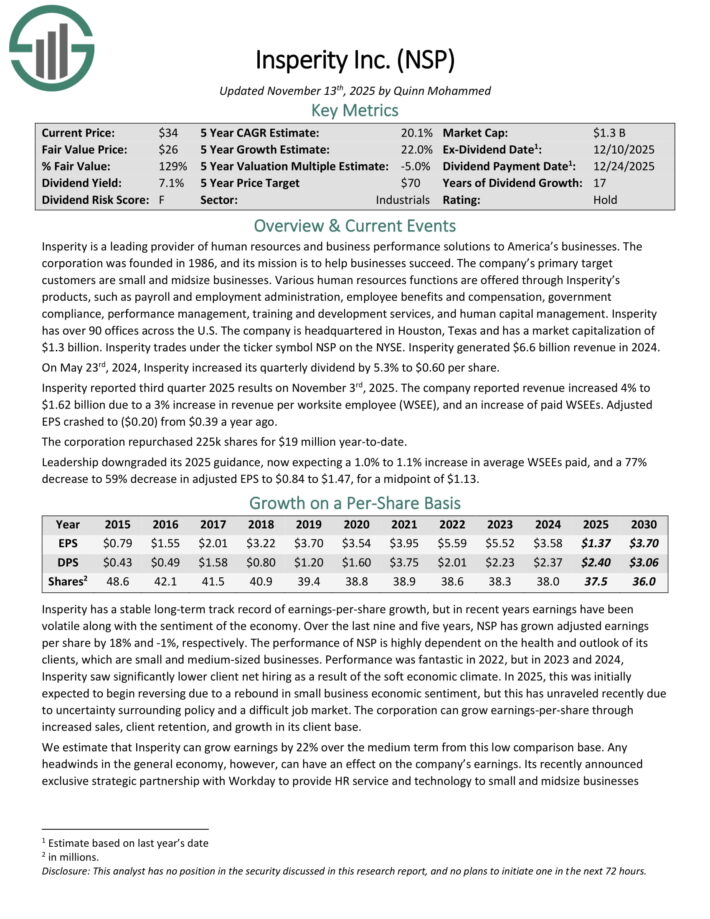

Dividend Inventory Buying and selling At Lows: Insperity Inc. (NSP)

- Anticipated Whole Return: 21.1%

Insperity is a number one supplier of human sources and enterprise efficiency options to companies. The corporate’s main goal prospects are small and midsize companies.

Numerous human sources features are supplied by way of Insperity’s merchandise, reminiscent of payroll and employment administration, worker advantages and compensation, authorities compliance, efficiency administration, coaching and growth providers, and human capital administration.

Insperity has over 90 workplaces throughout the U.S. and generated $6.6 billion income in 2024.

Insperity reported third quarter 2025 outcomes on November third, 2025. The corporate reported income elevated 4% to $1.62 billion as a consequence of a 3% improve in income per worksite worker (WSEE), and a rise of paid WSEEs. Adjusted EPS crashed to ($0.20) from $0.39 a 12 months in the past.

The company repurchased 225k shares for $19 million year-to-date.

Management downgraded its 2025 steerage, now anticipating a 1.0% to 1.1% improve in common WSEEs paid, and a 77% lower to 59% lower in adjusted EPS to $0.84 to $1.47, for a midpoint of $1.13.

NSP’s payout ratio is elevated at 175% of forecast earnings. The corporate has by no means minimize its dividend, however this 12 months it’s not more likely to earn sufficient to cowl it.

Click on right here to obtain our most up-to-date Certain Evaluation report on NSP (preview of web page 1 of three proven under):

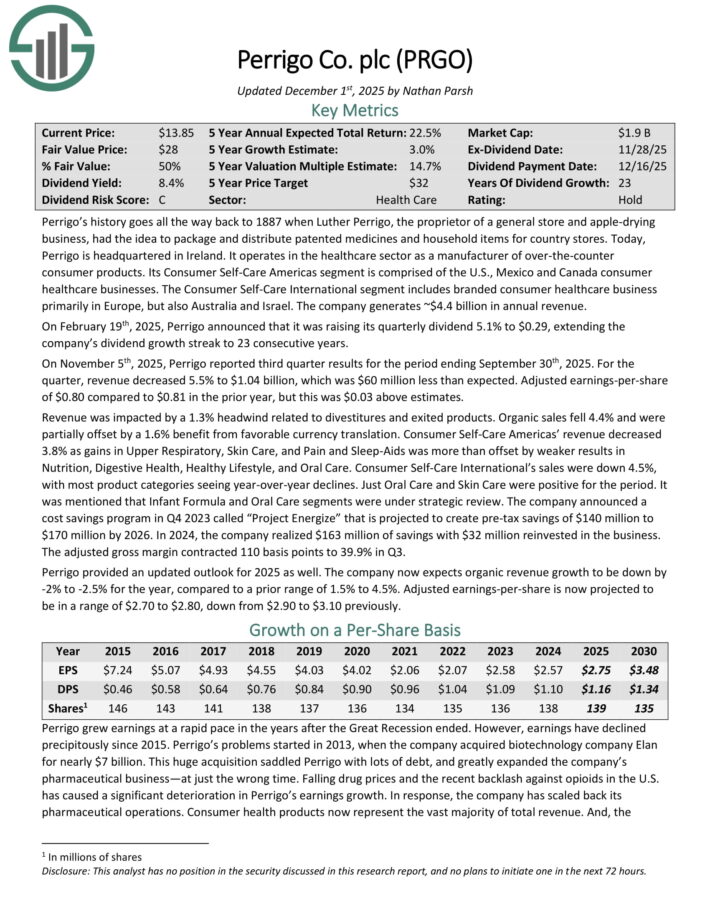

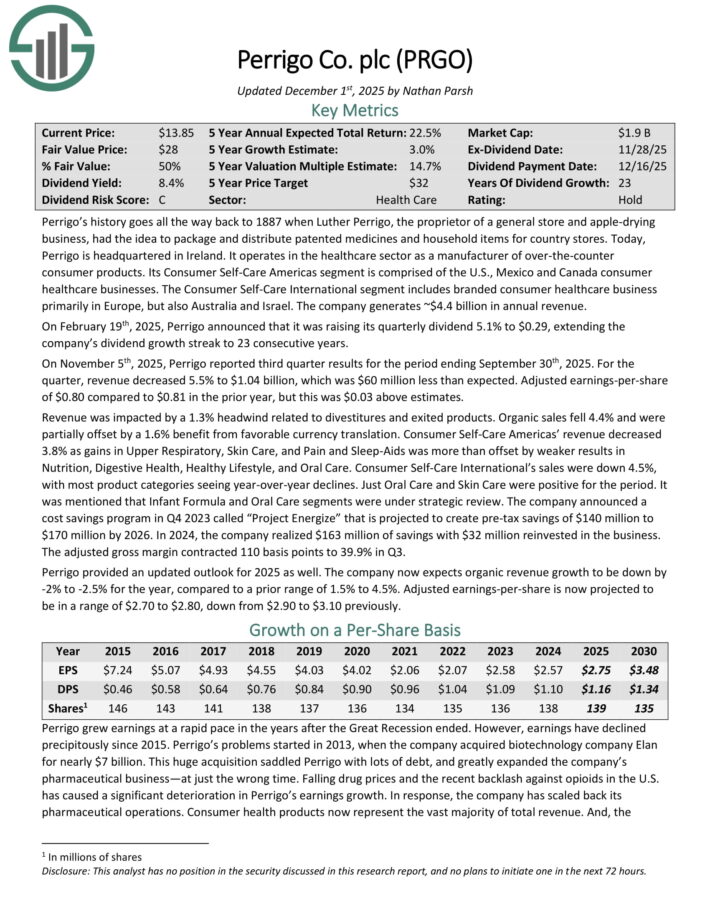

Dividend Inventory Buying and selling At Lows: Perrigo Firm plc (PRGO)

- Anticipated Whole Return: 22.2%

Perrigo is headquartered in Eire. It operates within the healthcare sector as a producer of over-the-counter client merchandise.

Its Client Self-Care Americas phase is comprised of the U.S., Mexico and Canada client healthcare companies.

The Client Self-Care Worldwide phase contains branded client healthcare enterprise primarily in Europe, but additionally Australia and Israel.

On February nineteenth, 2025, Perrigo introduced that it was elevating its quarterly dividend 5.1% to $0.29, extending the corporate’s dividend progress streak to 23 consecutive years.

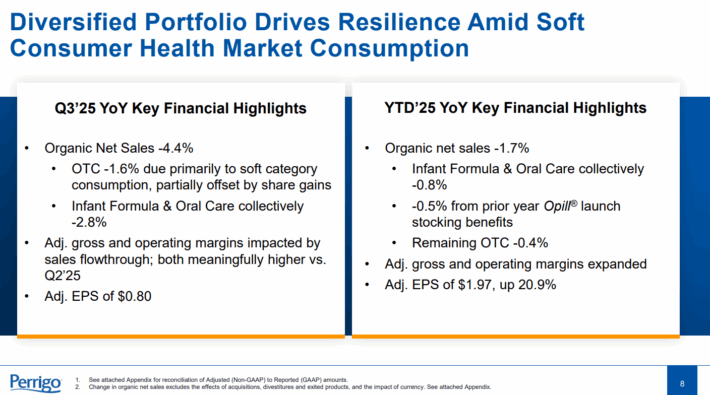

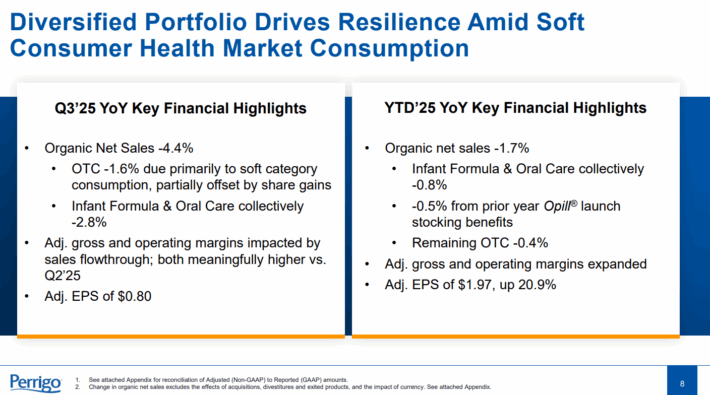

On November fifth, 2025, Perrigo reported third quarter outcomes for the interval ending September thirtieth, 2025. For the quarter, income decreased 5.5% to $1.04 billion, which was $60 million lower than anticipated.

Adjusted earnings-per-share of $0.80 in comparison with $0.81 within the prior 12 months, however this was $0.03 above estimates.

Supply: Investor Presentation

Income was impacted by a 1.3% headwind associated to divestitures and exited merchandise. Natural gross sales fell 4.4% and have been partially offset by a 1.6% profit from favorable forex translation.

Client Self-Care Americas’ income decreased 3.8% as positive aspects in Higher Respiratory, Pores and skin Care, and Ache and Sleep-Aids was greater than offset by weaker ends in Diet, Digestive Well being, Wholesome Way of life, and Oral Care.

Client Self-Care Worldwide’s gross sales have been down 4.5%, with most product classes seeing year-over-year declines. Simply Oral Care and Pores and skin Care have been constructive for the interval. Toddler Formulation and Oral Care segments are below strategic evaluation.

Click on right here to obtain our most up-to-date Certain Evaluation report on PRGO (preview of web page 1 of three proven under):

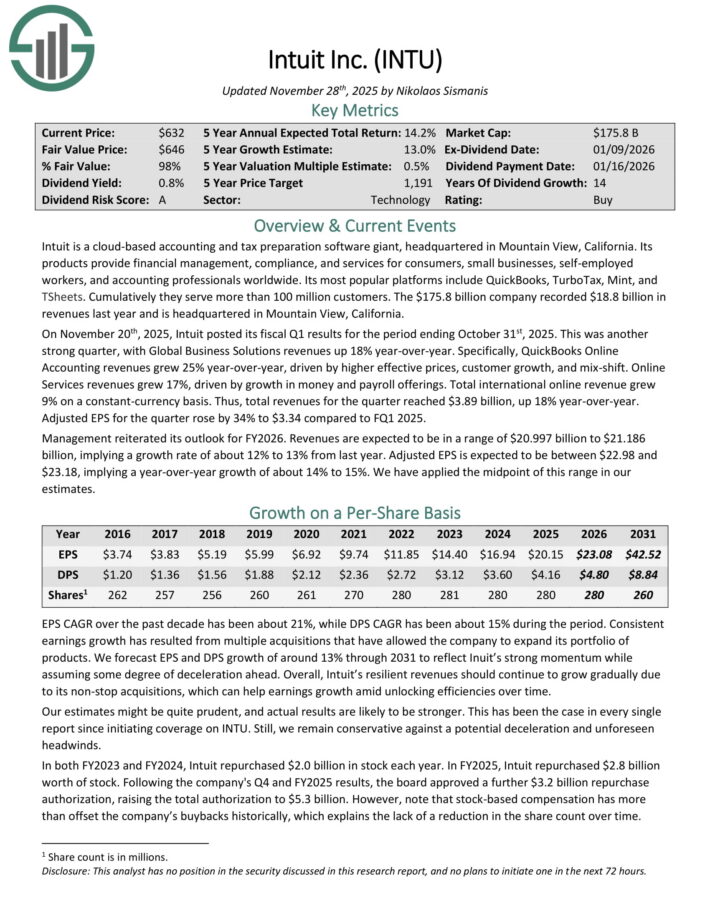

Dividend Inventory Buying and selling At Lows: Intuit Inc. (INTU)

- Anticipated Whole Return: 23.7%

Intuit is a cloud-based accounting and tax preparation software program big. Its merchandise present monetary administration, compliance, and providers for shoppers, small companies, self-employed employees, and accounting professionals worldwide.

Its hottest platforms embody QuickBooks, TurboTax, Mint, and TSheets. Cumulatively they serve greater than 100 million prospects. The corporate recorded $18.8 billion in revenues final 12 months and is headquartered in Mountain View, California.

On November twentieth, 2025, Intuit posted its fiscal Q1 outcomes for the interval ending October thirty first, 2025. This was one other robust quarter, with International Enterprise Options revenues up 18% year-over-year.

QuickBooks On-line Accounting revenues grew 25% year-over-year, pushed by larger efficient costs, buyer progress, and mix-shift.

On-line Companies revenues grew 17%, pushed by progress in cash and payroll choices. Whole worldwide on-line income grew 9% on a constant-currency foundation. Thus, whole revenues for the quarter reached $3.89 billion, up 18% year-over-year.

Adjusted EPS for the quarter rose by 34% to $3.34 in comparison with FQ1 2025.

Administration reiterated its outlook for FY2026. Revenues are anticipated to be in a spread of $20.997 billion to $21.186 billion, implying a progress charge of about 12% to 13% from final 12 months.

Adjusted EPS is predicted to be between $22.98 and $23.18, implying a year-over-year progress of about 14% to fifteen%.

Click on right here to obtain our most up-to-date Certain Evaluation report on INTU (preview of web page 1 of three proven under):

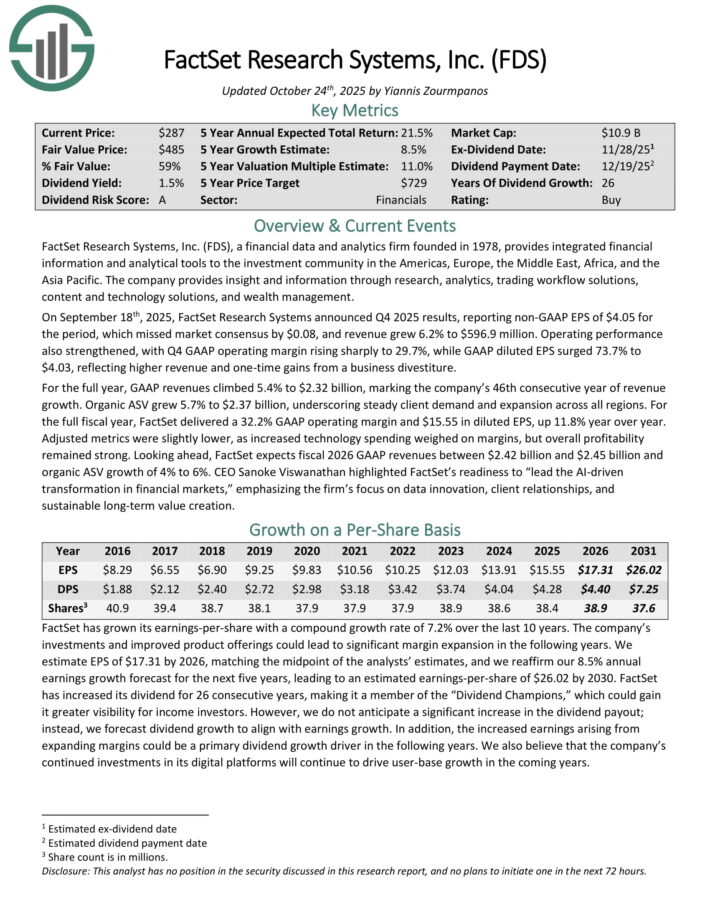

Dividend Inventory Buying and selling At Lows: Factset Analysis Programs (FDS)

- Anticipated Whole Return: 30.4%

FactSet Analysis Programs, a monetary information and analytics agency based in 1978, gives built-in monetary data and analytical instruments to the funding group within the Americas, Europe, the Center East, Africa, and Asia-Pacific.

The corporate gives perception and knowledge by way of analysis, analytics, buying and selling workflow options, content material and expertise options, and wealth administration.

On September 18th, 2025, FactSet Analysis Programs introduced This autumn 2025 outcomes, reporting non-GAAP EPS of $4.05 for the interval, which missed market consensus by $0.08, and income grew 6.2% to $596.9 million. Working efficiency additionally strengthened, with This autumn GAAP working margin rising sharply to 29.7%.

GAAP diluted EPS surged 73.7% to $4.03, reflecting larger income and one-time positive aspects from a enterprise divestiture. For the total 12 months, GAAP revenues climbed 5.4% to $2.32 billion, marking the corporate’s forty sixth consecutive 12 months of income progress.

Natural ASV grew 5.7% to $2.37 billion, underscoring regular shopper demand and enlargement throughout all areas. For the total fiscal 12 months, FactSet delivered a 32.2% GAAP working margin and $15.55 in diluted EPS, up 11.8% 12 months over 12 months.

Adjusted metrics have been barely decrease, as elevated expertise spending weighed on margins, however general profitability remained robust. Trying forward, FactSet expects fiscal 2026 GAAP revenues between $2.42 billion and $2.45 billion and natural ASV progress of 4% to six%.

Click on right here to obtain our most up-to-date Certain Evaluation report on FDS (preview of web page 1 of three proven under):

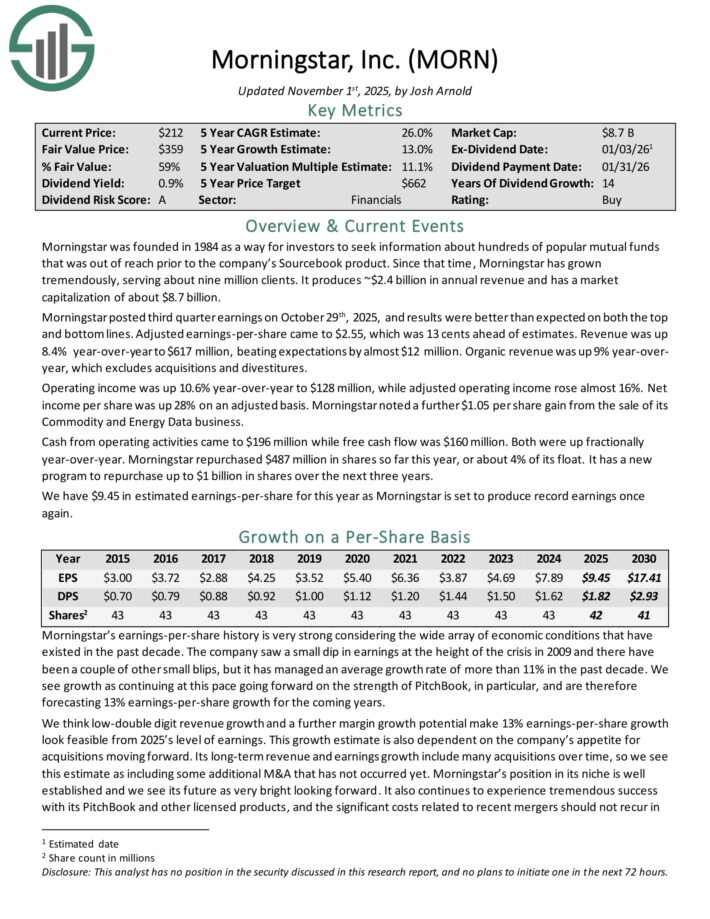

Dividend Inventory Buying and selling At Lows: Morningstar Inc. (MORN)

- Anticipated Whole Return: 33.2%

Morningstar was based in 1984 as a manner for traders to hunt details about lots of of common mutual funds that was out of attain previous to the corporate’s Sourcebook product.

Since that point, Morningstar has grown tremendously, serving about 9 million purchasers. It produces ~$2.4 billion in annual income.

Morningstar posted third quarter earnings on October twenty ninth, 2025, and outcomes have been higher than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to $2.55, which was 13 cents forward of estimates.

Income was up 8.4% year-over-year to $617 million, beating expectations by nearly $12 million. Natural income was up 9% year-over-year, which excludes acquisitions and divestitures.

Working earnings was up 10.6% year-over-year to $128 million, whereas adjusted working earnings rose nearly 16%. Web earnings per share was up 28% on an adjusted foundation.

Morningstar famous an extra $1.05 per share achieve from the sale of its Commodity and Power Knowledge enterprise.

Money from working actions got here to $196 million whereas free money movement was $160 million. Each have been up fractionally year-over-year.

Morningstar repurchased $487 million in shares to this point this 12 months, or about 4% of its float. It has a brand new program to repurchase as much as $1 billion in shares over the subsequent three years.

Click on right here to obtain our most up-to-date Certain Evaluation report on MORN (preview of web page 1 of three proven under):

Different Blue Chip Inventory Assets

Blue chip shares may make glorious investments for the long-run. Their energy and reliability make them compelling investments for traders of all expertise ranges, from inexperienced persons to consultants.

The sources under will provide you with a greater understanding of dividend progress investing:

Dividend Progress Investing

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].