Bedrin-Alexander

Welcome to the ultimate version of my month-to-month collection of 10 Dividend Progress Shares for 2022!

On this collection, I rank a collection of Dividend Radar shares and current the ten top-ranked shares for additional analysis and potential funding. Dividend Radar is a weekly routinely generated spreadsheet of dividend development [DG] shares with dividend enhance streaks of 5 or extra years.

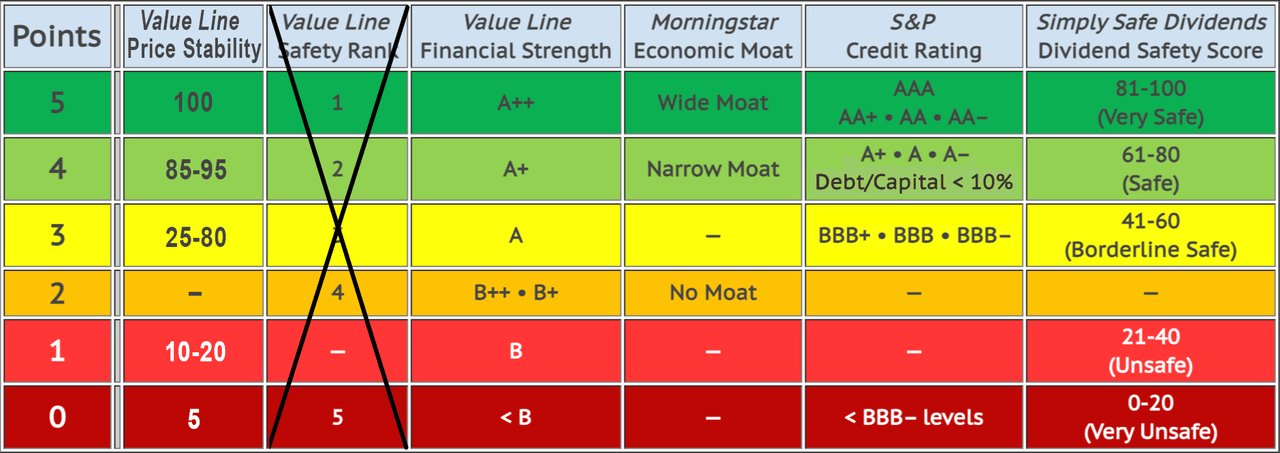

To rank shares, I take advantage of the scoring system of DVK High quality Snapshots, a chic strategy to assess the standard of DG shares. Developed by David Van Knapp, DVK High quality Snapshots employs 5 extensively used high quality indicators from impartial sources and assigns as much as 5 factors per high quality indicator for a most high quality rating of 25 factors. This month, I used a variation of DVK High quality Snapshots wherein I changed Worth Line’s Security Rank with Worth Line’s Worth Stability Index.

I apply completely different screens each month to spotlight completely different features of dividend development investing. This month, I used a brand new Dividend High quality Grade developed by Portfolio Perception as the first display screen. Particularly, I screened for Dividend Contenders with A+ Dividend High quality Grades. Dividend Contenders are DG shares with dividend enhance streaks of 10-24 years.

I additionally screened for DG shares buying and selling at discounted valuations. Solely shares buying and selling beneath my honest worth estimates and risk-adjusted Purchase Beneath costs and whose dividend yield is increased than its 5-year common dividend yield certified. With these screens, this month’s picks provide nice worth!

Dividend High quality Grade

I have been working with Portfolio Perception to develop a Dividend High quality Grade for dividend shares. The system evaluates all dividend-paying shares and assesses the chance of a dividend enhance within the subsequent 12-month interval. It additionally identifies shares most prone to freezing or chopping the dividend. In backtesting the system, we discovered it precisely predicted a failure to proceed dividend will increase in additional than 98% of instances.

The Dividend High quality Grade is routinely decided from broker-grade knowledge utilizing the identical know-how platform that delivers Dividend Radar to the funding neighborhood each week. Our method is totally data-driven and eliminates assumptions or subjective biases about any of the underlying metrics.

The system analyzes 20 completely different metrics over a 10-year timeframe and establishes a top quality vary for every metric utilizing knowledge from DG shares with dividend enhance streaks of no less than ten years (i.e. the Dividend Champions and Dividend Contenders). The evaluation is completed per GICS sector, and every inventory then receives a rating per metric primarily based on the place it falls within the corresponding high quality vary.

Particular person metric scores are mixed into element scores as follows:

- EPS Efficiency & Outlook

- Dividend Efficiency and Outlook

- Income Efficiency & Outlook

- Monetary Efficiency

- Profitability Efficiency

The element scores are rolled into an general rating per ticker, then ranked primarily based on the place they fall by percentile. These rankings decide a inventory’s Dividend High quality Grade from A+ to F.

For this text, I used a pre-release model of Dividend High quality Grades to extract Dividend Contenders with A+ (Distinctive) Dividend High quality Grades.

Screening and Rating

The newest Dividend Radar (dated December 23, 2022) incorporates 722 shares. Of those, 350 are Dividend Contenders with dividend enhance streaks of 10-24 years. Solely 48 Dividend Contenders have A+ Dividend High quality Grades, and solely twelve of those shares are buying and selling at discounted valuations.

Listed here are this month’s screens:

- Dividend Contenders (Dividend Radar shares with dividend enhance streaks of 10-24 years)

- Shares with Distinctive Dividend High quality Grades (A+ solely)

- Shares buying and selling beneath my honest worth estimates

- Shares buying and selling beneath my risk-adjusted Purchase Beneath costs

- Shares whose dividend yield is increased than its 5-year common dividend yield.

See beneath for an outline of my honest worth estimates and risk-adjusted Purchase Beneath costs.

I ranked the twelve candidates that cross all my screens utilizing a variation of DVK High quality Snapshots wherein I substituted Worth Line’s Worth Stability for Worth Line’s Security Rank:

Created by the creator

Worth Line’s Worth Stability relies on a rating of the usual deviation (a measure of volatility) of weekly p.c modifications within the worth of an organization’s inventory during the last 5 years. It’s reported on a scale of 100 (highest) to five (lowest) in increments of 5.

Typically, DVK High quality Snapshots assigns 5 factors to the best ranks and greatest rankings in order that the best high quality shares would get 5 factors per high quality indicator for a most rating of 25 factors.

I assigned scores for Worth Stability to considerably match the distribution of scores for Security Rank, however I elected to penalize the bottom ranks by shifting them down one row within the scoring desk.

The ten Dividend Progress Shares for December

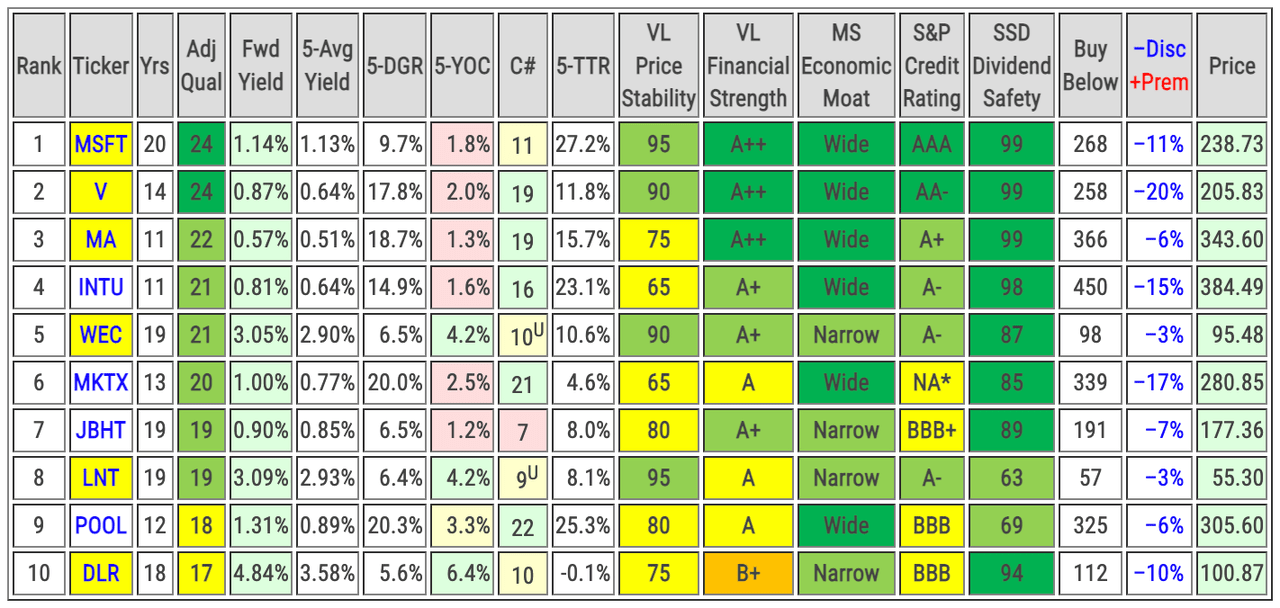

Listed here are this month’s ten top-ranked DG shares in rank order:

The six shares I personal in my DivGro portfolio are highlighted.

| Rank | Firm (Ticker) | Sector | Supersector |

| 1 | Microsoft (MSFT) | Info Expertise | Delicate |

| 2 | Visa (V) | Info Expertise | Delicate |

| 3 | Mastercard (MA) | Info Expertise | Delicate |

| 4 | Intuit (INTU) | Info Expertise | Delicate |

| 5 | WEC Vitality (WEC) | Utilities | Defensive |

| 6 | MarketAxess (MKTX) | Financials | Cyclical |

| 7 | J.B. Hunt Transport Companies (JBHT) | Industrials | Delicate |

| 8 | Alliant Vitality (LNT) | Utilities | Defensive |

| 9 | Pool (POOL) | Shopper Discretionary | Cyclical |

| 10 | Digital Realty (DLR) | Actual Property | Cyclical |

The next firm descriptions are my abstract of firm descriptions sourced from Finviz.

1. Microsoft

Based in 1975 and primarily based in Redmond, Washington, MSFT is a know-how firm with worldwide operations. The corporate’s merchandise embody working programs, cross-device productiveness purposes, server purposes, productiveness and enterprise options purposes, software program growth instruments, video video games, and internet advertising. MSFT additionally designs, manufactures, and sells a number of {hardware} gadgets.

2. Visa

Headquartered in San Francisco, California, V operates as a funds know-how firm worldwide. The corporate facilitates commerce by transferring worth and data amongst customers, retailers, monetary establishments, companies, strategic companions, and authorities entities. V gives its providers below the Visa, Visa Electron, Interlink, V PAY, and PLUS manufacturers.

3. Mastercard

MA, a know-how firm, gives transaction processing and different payment-related services in the US and internationally. The corporate affords fee options and providers below the MasterCard, Maestro, and Cirrus manufacturers. MA was based in 1966 and is headquartered in Buy, New York.

4. Intuit

INTU gives monetary administration and compliance services for customers, small companies, self-employed, and accounting professionals in the US, Canada, and internationally. The corporate operates in three segments: Small Enterprise & Self-Employed, Shopper, and Strategic Accomplice. INTU was based in 1983 and is headquartered in Mountain View, California.

5. WEC Vitality

Based in 1981 and primarily based in Milwaukee, Wisconsin, WEC gives regulated pure fuel and electrical energy; and renewable and nonregulated renewable power providers in the US. The corporate operates in six segments: Wisconsin, Illinois, Different States, Electrical Transmission, Non-Utility Vitality Infrastructure, and Company and Different. WEC generates and distributes electrical energy from coal, pure fuel, oil, hydroelectric, wind, photo voltaic, and biomass sources.

6. MarketAxess

MKTX, along with its subsidiaries, operates an digital buying and selling platform that allows fixed-income market individuals to commerce company bonds and different sorts of fixed-income devices, providing institutional investor and broker-dealer companies entry to world liquidity. MKTX was based in 2000 and is headquartered in New York, New York.

7. J.B. Hunt Transport Companies

JBHT, along with its subsidiaries, gives floor transportation and supply providers within the continental United States, Canada, and Mexico. It operates via 4 segments: Intermodal, Devoted Contract Companies, Built-in Capability Options, and Truckload. The corporate additionally transports or arranges for the transportation of freight. JBHT was based in 1961 and is headquartered in Lowell, Arkansas.

8. Alliant Vitality

LNT operates as a regulated investor-owned public utility holding firm. LNT gives electrical energy and pure fuel providers to clients within the U.S. Midwest via two subsidiaries, Interstate Energy and Mild Firm and Wisconsin Energy and Mild Firm. LNT was based in 1917 and is headquartered in Madison, Wisconsin.

9. Pool

Based in 1993 and headquartered in Covington, Louisiana, POOL distributes swimming pool provides, gear, and associated leisure merchandise in North America and internationally. POOL affords upkeep merchandise, restore and alternative components for pool gear, packaged pool kits, pool gear and elements for brand new pool development and the reworking of present swimming pools, and irrigation and panorama merchandise.

10. Digital Realty

DLR is an actual property funding belief that owns, acquires, develops, and operates knowledge facilities. The corporate gives knowledge middle and colocations options to home and worldwide tenants, together with firms offering monetary and data know-how providers. The corporate was based in 2004 and is headquartered in San Francisco.

Please be aware that the highest ten DG shares are candidates for additional evaluation, not suggestions.

Key Metrics and Truthful Worth Estimates

Beneath, I current key metrics of curiosity to dividend development traders, together with high quality indicators and honest worth estimates:

|

|

Colour-coding

|

Created by the creator from a private spreadsheet

I take advantage of a survey method to estimate honest worth [FV], gathering honest worth estimates and worth targets from a number of on-line sources comparable to Morningstar, Finbox, and Portfolio Perception. Moreover, I estimate honest worth utilizing every inventory’s five-year common dividend yield. With as much as 11 estimates and targets out there, I ignore the outliers (the bottom and highest values) and use the common of the median and imply of the remaining values as my FV estimate.

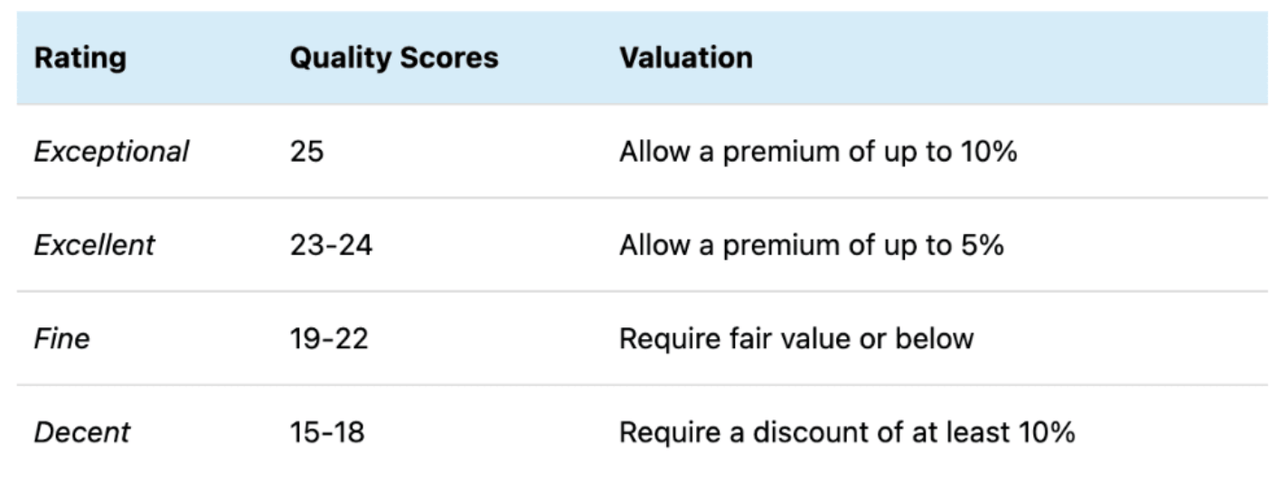

My risk-adjusted Purchase Beneath costs enable premium valuations for the highest-quality shares however require discounted valuations for lower-quality shares:

Created by the creator

My Purchase Beneath costs acknowledge that the highest-quality shares not often commerce at discounted valuations. As a dividend development investor with a long-term funding horizon, I am extra inquisitive about proudly owning high quality shares than getting a discount on lower-quality shares.

Commentary

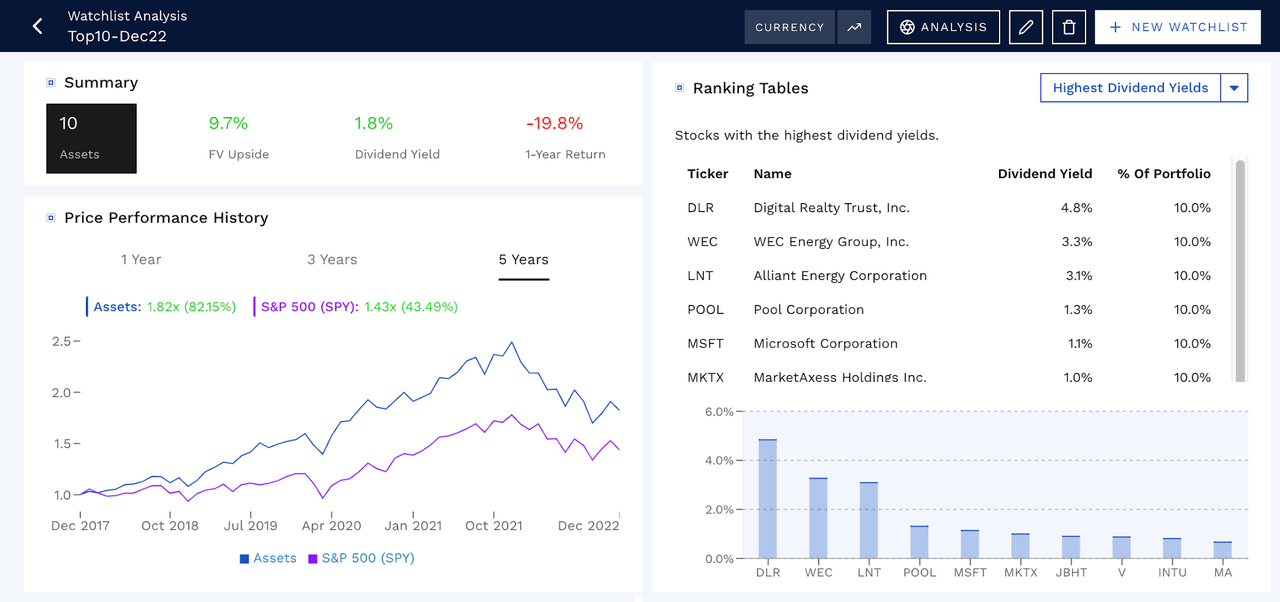

This is a comparative evaluation of an equal-weighted portfolio of this month’s prime ten DG shares, courtesy of Finbox.com:

Finbox.com

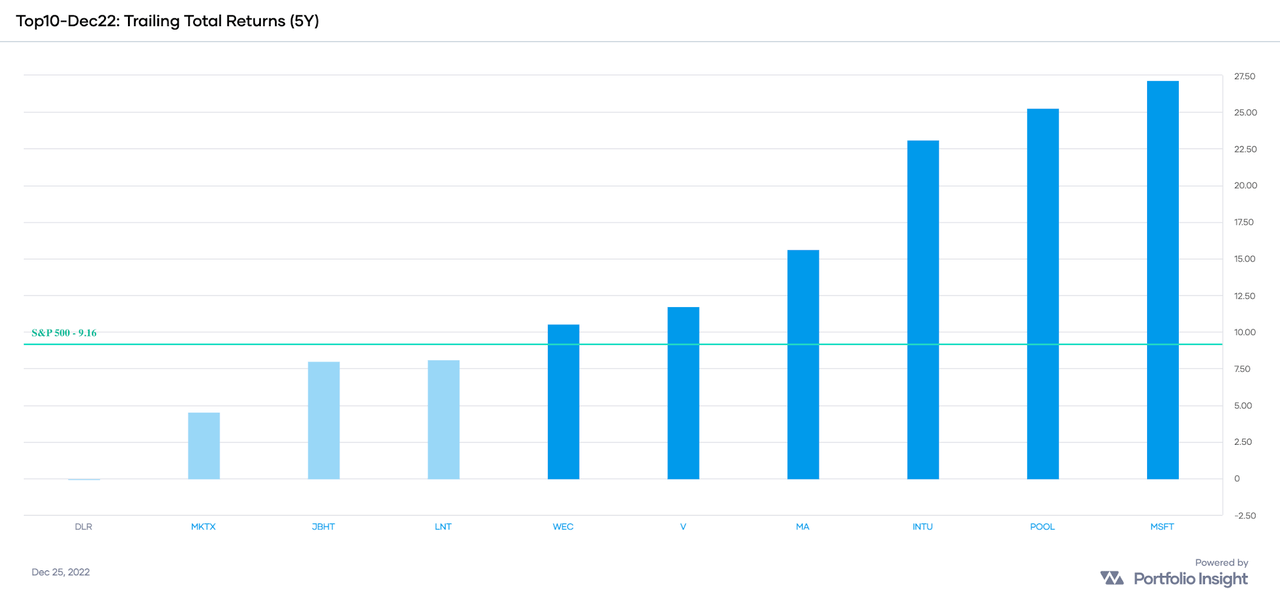

From a price-performance perspective, the portfolio would have outperformed the S&P 500 (as represented by the SPDR S&P 500 Belief ETF (SPY)) during the last 5 years, returning 82% versus SPY’s 43%.

The shares provide all kinds of yields, with DLR the best at 4.84% to MA the bottom at 0.57%.

DLR, WEC, and LNT are appropriate for income-oriented traders.

POOL (20.3%) and MKTX (20.0%) have the best 5-year dividend development charges and are sturdy candidates for growth-oriented traders. Different candidates with double-digit 5-DGRs are MA, V, and INTU.

MSFT, POOL, and INTU have the best 5-year TTRs and, together with MA, V, and WEC, are the shares on this month’s checklist which have outperformed SPY over the trailing 5-year interval:

Portfolio Perception

As for valuations, V (-20%) and MKTX (-17%) are discounted most relative to my Purchase Beneath costs and are sturdy candidates for worth traders.

Not one of the shares I do not personal curiosity me, primarily as a result of they’ve low yields. For youthful traders with a very long time horizon, INTU and POOL may very well be fascinating candidates, although I might think about MSFT first as a consequence of its superior high quality rating.

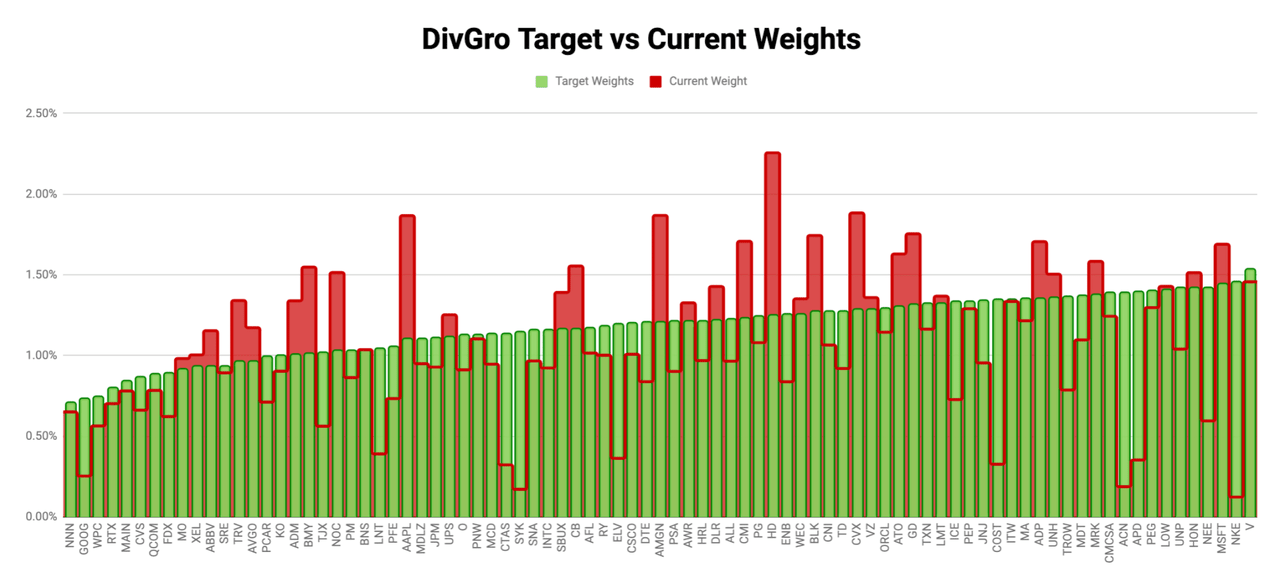

I take advantage of a dynamic and versatile system to find out goal weights for my DivGro portfolio. Here’s a chart exhibiting the present and goal weights of dividend-paying shares in DivGro:

Created by the Writer

Of this month’s candidate shares in my portfolio, solely LNT (just lately added) is effectively beneath my goal weight. Based mostly on the present worth, I might want so as to add 165 shares to match my goal weight. V and MA are barely underweight, and I might want to purchase 5 shares of every inventory to match my goal weights.

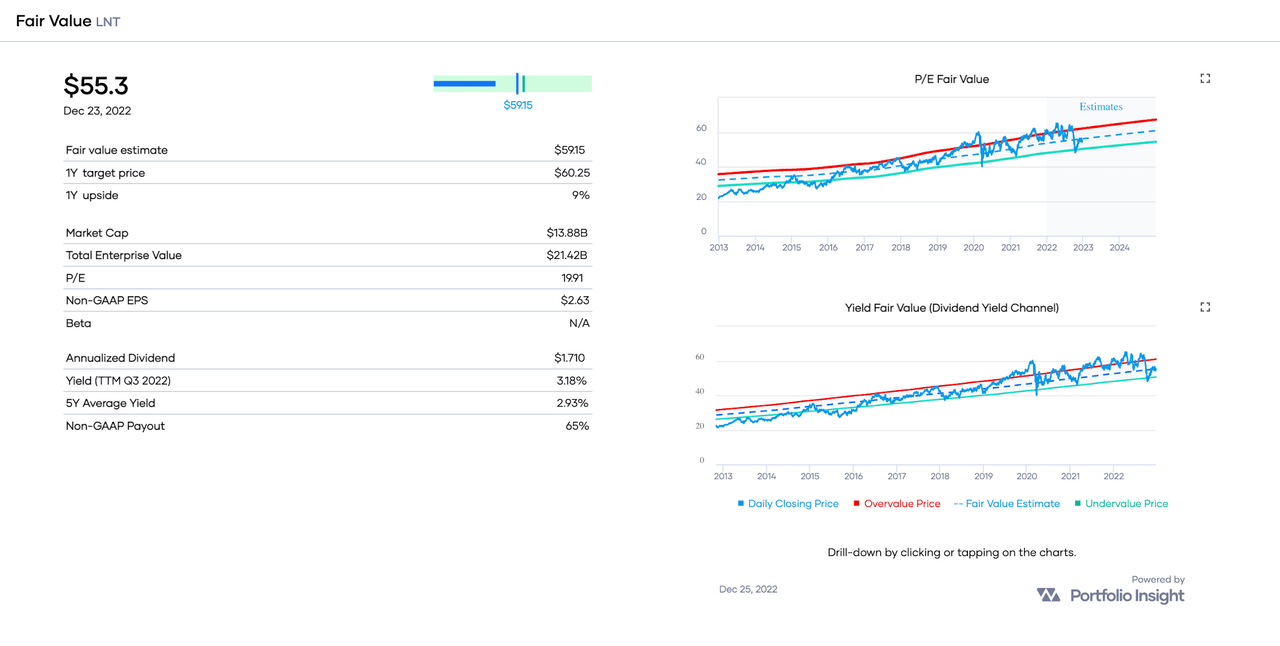

Portfolio Perception

In accordance with Portfolio Perception, LNT has a 1-year upside of 9%.

With a Non-GAAP payout ratio of 65%, which is low for Utilities, LNT has loads of room to proceed paying and elevating its dividend. LNT’s dividend is deemed Protected with a Dividend Security Rating of 63, in keeping with Merely Protected Dividends.

Bonus Part

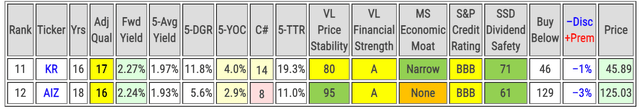

I discussed that solely twelve shares handed all my screens this month. Listed here are the 2 shares that ranked lowest primarily based on their high quality scores:

Created by the creator from a private spreadsheet

| Rank | Firm (Ticker) | Sector | Supersector |

| 11 | Kroger (KR) | Shopper Staples | Defensive |

| 12 | Assurant (AIZ) | Financials | Cyclical |

Concluding Remarks

On this article, I ranked a collection of Dividend Radar shares utilizing a variation of DVK High quality Snapshots. This month, I used Worth Line’s Worth Stability as an alternative of Worth Line’s Security Rank. I launched Portfolio Perception’s Dividend High quality Grade and screened the Dividend Contenders for shares with Distinctive (A+) Dividend High quality Grades. I used extra screens to search out DG shares buying and selling at discounted valuations.

As at all times, I encourage readers to do their due diligence earlier than shopping for any shares I cowl.

Thanks for studying, and I want all my readers a festive vacation season and a really glad and affluent new yr!