Revealed on October sixth, 2025 by Bob Ciura

Spreadsheet knowledge up to date every day

Positive Dividend practices a long-term buy-and-hold technique constructed on consistency.

Meaning avoiding hypothesis, resisting fads, and never overloading on one inventory or sector – since even former Dividend Aristocrats like Walgreens (WBA) and V.F. Corp (VFC) can stumble.

Consistency additionally applies to investing habits. As an alternative of lump sums, regular contributions at common intervals assist you purchase by each bull markets and downturns.

And holding throughout recessions is difficult however vital, as historical past reveals markets rebound and reward affected person traders.

There are lots of high quality dividend shares which have supplied constant dividend will increase annually, even throughout recessions.

For instance, the Dividend Champions are a gaggle of shares which have raised their dividends annually for no less than 25 years in a row.

You may obtain your free copy of the Dividend Champions record, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink beneath:

Buyers are probably aware of the Dividend Aristocrats, a gaggle of 69 shares within the S&P 500 Index with 25+ consecutive years of dividend will increase.

In the meantime, traders must also familiarize themselves with the Dividend Champions, which have additionally raised their dividends for no less than 25 years in a row.

This text will present an in depth evaluation on 10 constant dividend progress shares on the record of Dividend Champions, which have recession-proof payouts.

These 5 Dividend Champions have the very best Dividend Danger Scores of ‘A’, with payout ratios beneath 70% and optimistic long-term progress potential.

The shares beneath are ranked in accordance with their dividend yield, from lowest to highest.

Desk of Contents

Constant Dividend Development Inventory #10: Coca-Cola Co. (KO)

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers. Because the firm’s founding in 1886, it has unfold to greater than 200 nations worldwide.

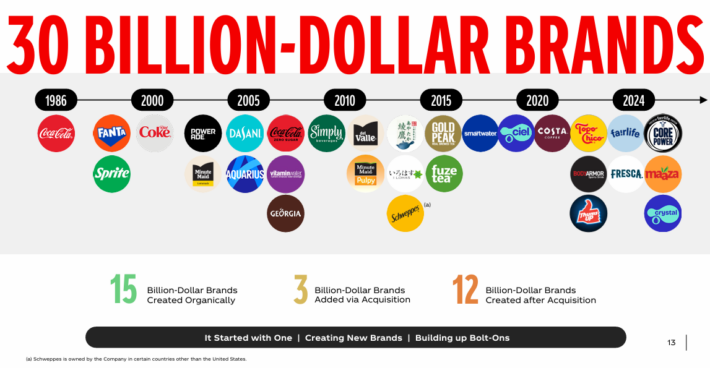

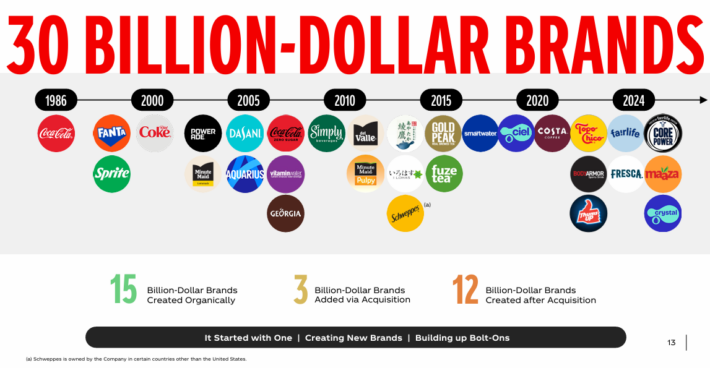

Coca-Cola now has 30 billion-dollar manufacturers in its portfolio, which every generate no less than $1 billion in annual gross sales.

Supply: Investor Presentation

Coca-Cola posted second quarter earnings on July twenty second, 2025, and outcomes have been considerably blended. Adjusted earnings-per-share got here to 87 cents, which was three cents forward of estimates. Income was up 0.8% year-over-year to $12.5 billion, lacking estimates by $80 million.

Natural income was up 5%, together with 6% progress in pricing and blend, partially offset by a 1% decline in volumes. The corporate nonetheless expects to ship 5% to six% progress in natural income this yr, unchanged from prior. Internet income is predicted to face a 1% to 2% headwind from foreign money impacts primarily based on present positioning.

Glowing gentle drinks quantity was off 1%, as Coca-Cola fell 1%. Coca-Cola Zero Sugar soared 14% because it grew in all geographic segments. Comparable working margin growth through the quarter was as much as 37.1% of income, pushed by natural progress, the timing of selling investments, and efficient value administration. Forex headwinds partially offset a few of that..

Click on right here to obtain our most up-to-date Positive Evaluation report on KO (preview of web page 1 of three proven beneath):

Constant Dividend Development Inventory #9: Stepan Co. (SCL)

Stepan manufactures primary and intermediate chemical substances, together with surfactants, specialty merchandise, germicidal and material softening quaternaries, phthalic anhydride, polyurethane polyols and particular substances for the meals, complement, and pharmaceutical markets.

It’s organized into three distinct enterprise traces: surfactants, polymers, and specialty merchandise. These companies serve all kinds of finish markets. The surfactants enterprise is Stepan’s largest by income.

Stepan posted second quarter earnings on July thirtieth, 2025, and outcomes have been a lot worse than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to 52 cents, which was nowhere near estimates for 90 cents. Income was up 7% year-over-year to $595 million, lacking estimates by $3.6 million.

Surfactant gross sales have been $412 million, with promoting costs hovering 11% on pass-through of uncooked materials prices, primarily. Gross sales volumes have been down 1%. Polymers web gross sales have been up 2% to $163 million. Volumes have been up 7% however promoting costs declined 7%. Specialty Product gross sales have been $20.5 million, up 22%, however margins worsened.

Adjusted EBITDA was $51.4 million, up 8% year-over-year. Adjusted web earnings was $12 million. Money from operations got here to $11.2 million, and free money stream was unfavourable $14.4 million on increased working capital necessities, in addition to uncooked materials builds.

Click on right here to obtain our most up-to-date Positive Evaluation report on SCL (preview of web page 1 of three proven beneath):

Constant Dividend Development Inventory #8: H2O America (HTO)

H2O America, previously generally known as SJW Group, is a water utility firm that produces, purchases, shops, purifies and distributes water to shoppers and companies within the Silicon Valley space of California, the world north of San Antonio, Texas, Connecticut, and Maine.

It additionally has a small actual property division that owns and develops properties for residential and warehouse clients in California and Tennessee. The corporate generates about $670 million in annual revenues.

On July eighth, 2025, H2O America introduced that it bought Quadvest for $540 million. This buy provides to the corporate’s place within the Houston space.

Quadvest has 50,500 energetic connections, virtually 91,000 connections beneath contract and pending growth, 50 water remedy vegetation, 27 wastewater remedy vegetation, and 89 elevate stations and underground belongings.

On July twenty eighth, 2025, H2O America introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income grew 12.5% to $198.3 million, which was $10.9 million greater than anticipated.

Earnings-per-share of $0.71 in contrast favorably to earnings-per-share of $0.66 within the prior yr and was $0.01 forward of estimates.

For the quarter, increased water charges general added $17.6 million to outcomes and better buyer utilization added $4.9 million. Working manufacturing bills totaled $154.4 million, which was a 14% enhance from the prior yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on HTO (preview of web page 1 of three proven beneath):

Constant Dividend Development Inventory #7: Tompkins Monetary (TMP)

Tompkins Monetary is a regional monetary companies holding firm headquartered in Ithaca, NY that may hint its roots again greater than 180 years. It has whole belongings of about $8 billion, which produce about $300 million in annual income.

The corporate provides a variety of companies, together with checking and deposit accounts, time deposits, loans, bank cards, insurance coverage companies, and wealth administration to its clients in New York and Pennsylvania.

Tompkins posted second quarter earnings on July twenty fifth, 2025. Earnings-per-share got here to $1.50, and income was virtually $83 million.

Internet curiosity margin was 3.08%, up 10 foundation factors from the prior quarter, and better by 35 foundation factors year-over-year. Whole common value of funds was 1.84%, unchanged from Q1, and decrease by 12 foundation factors year-over-year.

Whole loans have been $106 million increased than March, or 1.8%. From the year-ago interval, loans have been $411 million increased, or 7.1%.

Whole deposits have been $6.7 billion, in step with March, however virtually 7% increased year-on-year. The financial institution’s loan-to-deposit ratio was 91.9%, worse than 89.8% in March and roughly flat to 91.7% a yr in the past.

Click on right here to obtain our most up-to-date Positive Evaluation report on TMP (preview of web page 1 of three proven beneath):

Constant Dividend Development Inventory #6: Neighborhood Belief Bancorp (CTBI)

Neighborhood Belief Bancorp is a regional financial institution with 84 department places in 35 counties in Kentucky, Tennessee and West Virginia. It’s the second-largest financial institution holding firm in Kentucky and has a market cap of $962 million.

Neighborhood Belief Bancorp operates with a $6.4 billion steadiness sheet. It has raised its dividend for 45 consecutive years.

In mid-July, Neighborhood Belief Bancorp reported (7/16/25) monetary outcomes for the second quarter of fiscal 2025. Its web curiosity earnings grew 18% over the prior yr’s quarter, as web curiosity margin improved from 3.38% to three.64% and loans grew 10%.

Provisions for mortgage losses decreased from $3.0 million to $2.1 million. Non-interest earnings rose 3%, largely due to increased belief income. Total, earnings-per-share grew 27% due to robust web curiosity earnings, from $1.09 to $1.38, and exceeded the analyst’s consensus by $0.12. The financial institution raised its dividend by 13%.

Neighborhood Belief Bancorp is a conservatively managed financial institution, which has proved resilient to every kind of downturns. The financial institution has grown its deposits 10% within the final 12 months. It has additionally proved resilient to the downturn attributable to the affect of almost 23-year excessive rates of interest on the web curiosity margin of most banks by way of excessive deposit prices.

As we anticipate increased web curiosity earnings amid decrease rates of interest this yr, we anticipate virtually 11% progress of earnings-per-share, to a brand new all-time excessive.

Click on right here to obtain our most up-to-date Positive Evaluation report on CTBI (preview of web page 1 of three proven beneath):

Constant Dividend Development Inventory #5: PepsiCo Inc. (PEP)

PepsiCo is a world meals and beverage firm. Its merchandise embody Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

Its enterprise is break up roughly 60-40 when it comes to meals and beverage income. It’s also balanced geographically between the U.S. and the remainder of the world.

Supply: Investor Presentation

On July 18th, 2025, PepsiCo introduced second quarter earnings outcomes for the interval ending June thirtieth, 2025. For the quarter, income grew 1.0% to $22.7 billion, which topped estimates by $430 million.

Adjusted earnings-per-share of $2.12 in contrast unfavorably to $2.28 the prior yr, however this was $0.09 forward of expectations. Forex trade diminished income by 1.5% and adjusted earnings-per-share by 5%.

Natural gross sales grew 2.1% for the second quarter. For the interval, quantity for drinks was as soon as once more unchanged whereas meals fell 1.5%.

Click on right here to obtain our most up-to-date Positive Evaluation report on PEP (preview of web page 1 of three proven beneath):

Constant Dividend Development Inventory #4: Northwest Pure Holding (NWN)

NW Pure was based in 1859 and has grown from only a handful of shoppers to serving greater than 760,000 right this moment. The utility’s mission is to ship pure gasoline to its clients within the Pacific Northwest.

The corporate’s places served are proven within the picture beneath.

Supply: Investor Presentation

On August 7, 2025, Northwest Pure Holding Firm reported outcomes for the second quarter ended June 30, 2025, displaying regular progress in buyer base and fee restoration regardless of seasonal weak spot typical of hotter months.

The corporate recorded web earnings of $7.4 million, or $0.19 per diluted share, in contrast with $5.8 million, or $0.16 per share, in the identical quarter final yr. Working income totaled $219.6 million, barely down from $222.3 million within the prior yr, as decrease gasoline utilization from gentle climate offset the good thing about fee will increase and buyer progress.

Working earnings was $28.9 million, up from $25.7 million, reflecting disciplined value management and contributions from utility margin enchancment. The gasoline distribution phase added almost 11,000 new clients year-over-year, sustaining annual progress of about 1.4%, whereas infrastructure companies contributed modestly to earnings.

Click on right here to obtain our most up-to-date Positive Evaluation report on NWN (preview of web page 1 of three proven beneath):

Constant Dividend Development Inventory #3: Black Hills Company (BKH)

Black Hills Company is an electrical utility that gives electrical energy and pure gasoline to clients in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The corporate has 1.35 million utility clients in eight states. Its pure gasoline belongings embody 49,200 miles of pure gasoline traces. Individually, it has ~9,200 miles of electrical traces and 1.4 gigawatts of electrical technology capability.

Supply: Investor Presentation

Black Hills Company reported its second quarter earnings outcomes on July 30. The corporate generated revenues of $439 million through the quarter, up 9% year-over-year.

Black Hills Company generated earnings-per-share of $0.38 through the second quarter, which was forward of the consensus analyst estimate.

Earnings-per-share have been up $0.05 versus the earlier yr’s quarter. This fall and Q1 are seasonally stronger quarters on account of increased pure gasoline demand for heating.

Black Hills Company forecasts earnings-per-share of $4.00 to $4.20 for the present fiscal yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on BKH (preview of web page 1 of three proven beneath):

Constant Dividend Development Inventory #2: Sonoco Merchandise (SON)

Sonoco Merchandise gives packaging, industrial merchandise and provide chain companies to its clients. The markets that use the corporate’s merchandise embody these within the home equipment, electronics, beverage, development and meals industries.

The corporate generates over $5 billion in annual gross sales. Sonoco Merchandise is now composed of two main segments, Shopper Packaging, and Industrial Packaging, with all different companies listed as “All Different”.

On April sixteenth, 2025, Sonoco Merchandise raised its quarterly dividend 1.9% to $0.53, extending the corporate’s dividend progress streak to 49 consecutive years.

On July twenty third, 2025, Sonoco Merchandise introduced second quarter outcomes for the interval ending June twenty ninth, 2025. For the quarter, income grew 17.9% to $1.91 billion, which was in-line with estimates. Adjusted earnings-per-share of $1.37 in comparison with $1.28 within the prior yr, however was $0.08 lower than anticipated.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Shopper Packaging revenues surged 110% to $1.23 billion, largely on account of contributions from Eviosys.

Quantity progress was robust and favorable foreign money trade charges additionally aided outcomes. Industrial Paper Packing gross sales fell 2% to $588 million because of the affect of overseas foreign money trade charges and decrease quantity following two plant divestitures in China final yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on Sonoco (SON) (preview of web page 1 of three proven beneath):

Constant Dividend Development Inventory #1: Goal Corp. (TGT)

Goal was based in 1902 and now operates about 1,850 large field shops, which provide common merchandise and meals, in addition to serving as distribution factors for the corporate’s e-commerce enterprise.

Goal launched second quarter earnings on August twentieth, 2025, and outcomes have been higher than anticipated. Nevertheless, steerage and the CEO change underwhelmed traders, and the inventory fell as soon as once more.

Adjusted earnings-per-share got here to $2.05, which was a penny forward of estimates. Income was off fractionally year-on-year to $25.21 billion, however did beat estimates by $310 million. Gross sales have been decrease on merchandise gross sales declines of 1.2%, partially offset by a 14.2% enhance in non-merchandise gross sales.

Comparable gross sales have been down 1.9%, because the bodily shops fell 3.2% whereas digital gross sales grew 4.3%. Administration stated site visitors and gross sales traits improved “meaningfully” from the primary quarter.

The corporate is investing closely in its enterprise with a purpose to navigate by the altering panorama within the retail sector. The payout is now 62% of earnings for this yr, which is elevated from historic ranges, however the dividend stays well-covered.

Click on right here to obtain our most up-to-date Positive Evaluation report on TGT (preview of web page 1 of three proven beneath):

Further Studying

The next Positive Dividend databases include probably the most dependable dividend growers in our funding universe:

If you happen to’re searching for shares with distinctive dividend traits, take into account the next Positive Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.