Revealed on Might seventh, 2025 by Bob Ciura

Worth and revenue traders sometimes hunt down dividend shares which are buying and selling beneath their intrinsic values.

There are numerous high quality dividend shares buying and selling close to their 52-week lows which are engaging, as a result of their low valuation multiples and excessive dividend yields.

Nevertheless, dividend development traders mustn’t keep away from high quality dividend development shares simply because their share costs have risen over the previous yr.

Certainly, there may be good purpose for traders to let their blue-chip winners run.

Blue-chip shares are established, financially robust, and constantly worthwhile publicly traded corporations.

This analysis report has the next sources that will help you put money into blue chip shares:

Many blue-chip dividend shares are buying and selling inside close to their 52-week highs, and but, we count on them to proceed performing effectively.

This text discusses the ten finest dividend shares within the Certain Evaluation Analysis Database presently buying and selling inside 10% of their 52-week highs.

These 10 dividend development shares have carried out effectively up to now yr, and we imagine they nonetheless have room to run, as a result of a mix of anticipated earnings development, valuation modifications, and dividends.

The shares are organized by annual anticipated returns, in ascending order.

Desk of Contents

The desk of contents beneath permits for straightforward navigation.

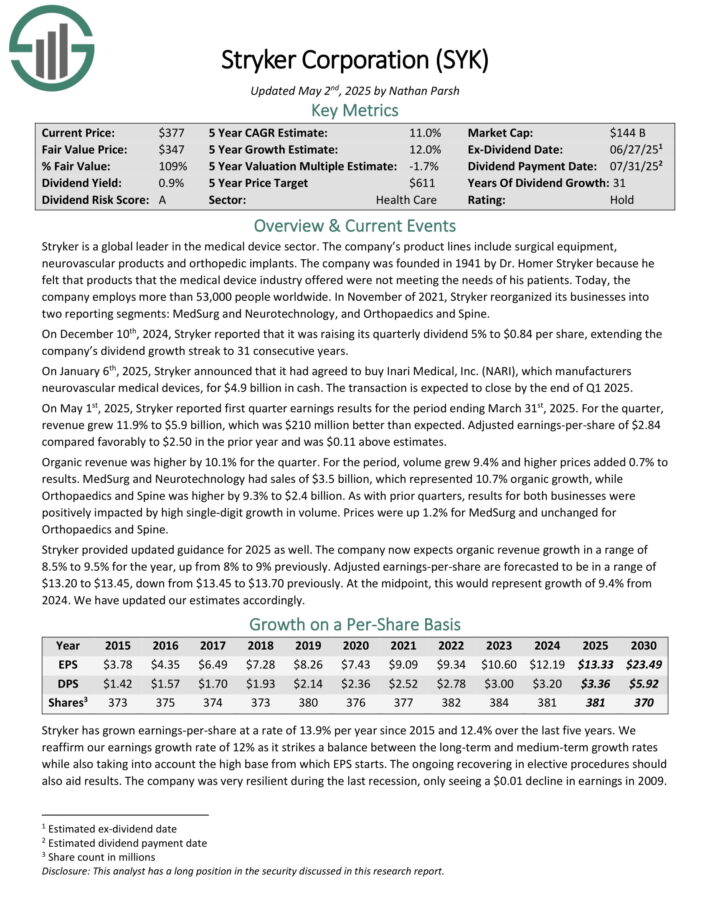

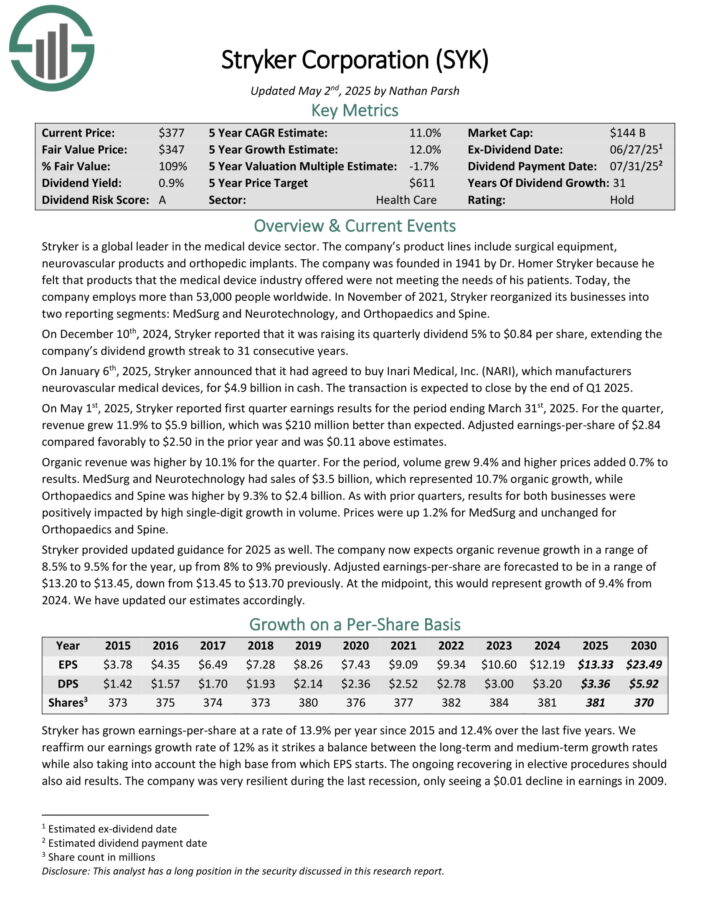

Dividend Inventory Close to 52-Week Excessive #10: Stryker Company (SYK)

- Anticipated Whole Return: 10.9%

Stryker is a worldwide chief within the medical system sector. The corporate’s product traces embrace surgical gear, neurovascular merchandise and orthopedic implants.

On December tenth, 2024, Stryker reported that it was elevating its quarterly dividend 5% to $0.84 per share, extending the corporate’s dividend development streak to 31 consecutive years.

On January sixth, 2025, Stryker introduced that it had agreed to purchase Inari Medical, Inc. (NARI), which producers

neurovascular medical gadgets, for $4.9 billion in money. The transaction is anticipated to shut by the tip of Q1 2025.

On Might 1st, 2025, Stryker reported first quarter earnings outcomes for the interval ending March thirty first, 2025. For the quarter, income grew 11.9% to $5.9 billion, which was $210 million higher than anticipated. Adjusted earnings-per-share of $2.84 in contrast favorably to $2.50 within the prior yr and was $0.11 above estimates.

Natural income was greater by 10.1% for the quarter. For the interval, quantity grew 9.4% and better costs added 0.7% to outcomes. MedSurg and Neurotechnology had gross sales of $3.5 billion, which represented 10.7% natural development, whereas Orthopaedics and Backbone was greater by 9.3% to $2.4 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on SYK (preview of web page 1 of three proven beneath):

Dividend Inventory Close to 52-Week Excessive #9: Allstate Company (ALL)

- Anticipated Whole Return: 10.9%

Allstate Company is an insurance coverage firm that gives property and casualty insurance coverage to its clients. The corporate additionally sells life, accident, and medical health insurance merchandise.

Its segments embrace Allstate Safety, Service Companies, Allstate Life, Allstate Advantages, Allstate Annuities, and so forth. Allstate’s insurance coverage manufacturers embrace Allstate, Embody, and Esurance.

Allstate Company reported fourth quarter 2024 outcomes on February fifth, 2025, for the interval ending December thirty first, 2024. The corporate reported consolidated revenues of $16.5 billion for the quarter, an 11.3% year-over-year improve, largely as a result of greater Property-Legal responsibility earned premium.

Property-Legal responsibility insurance coverage premiums earned totaled $13.9 billion, up 10.6% from $12.6 billion in the identical interval a yr in the past. Adjusted web revenue per share of $7.67 was a 32% enchancment from $5.82 a yr in the past.

Whole insurance policies in pressure elevated 7.2% year-over-year, from 194.4 million to 208.3 million. The trailing twelve months adjusted web revenue return on widespread shareholder’s fairness was 26.8%, 25.3 factors greater than final yr’s 1.5%. Ebook worth per share rose by 22% year-over-year to $72.35.

Click on right here to obtain our most up-to-date Certain Evaluation report on ALL (preview of web page 1 of three proven beneath):

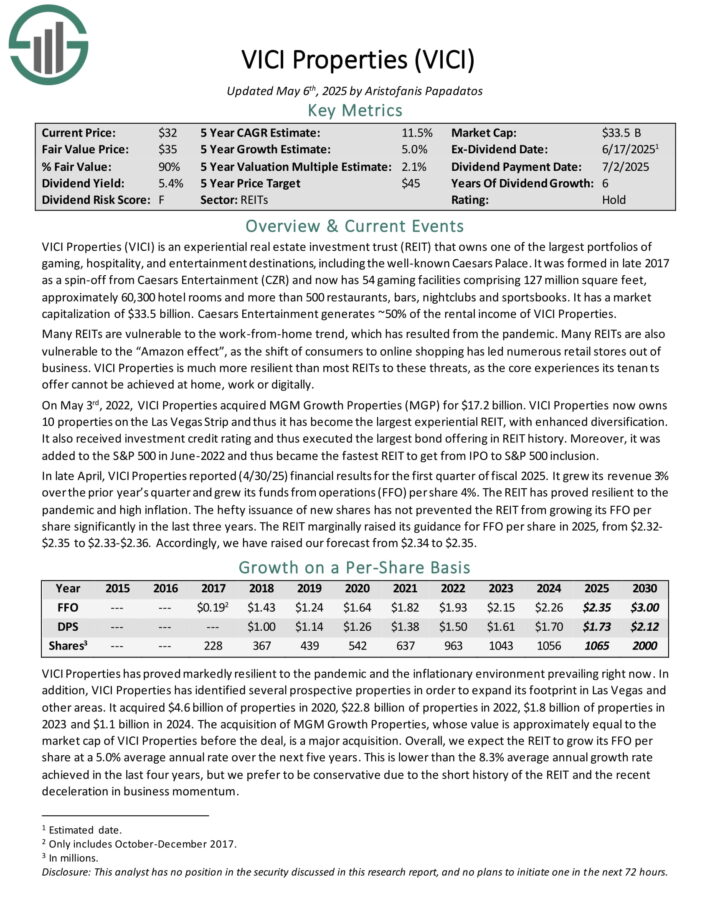

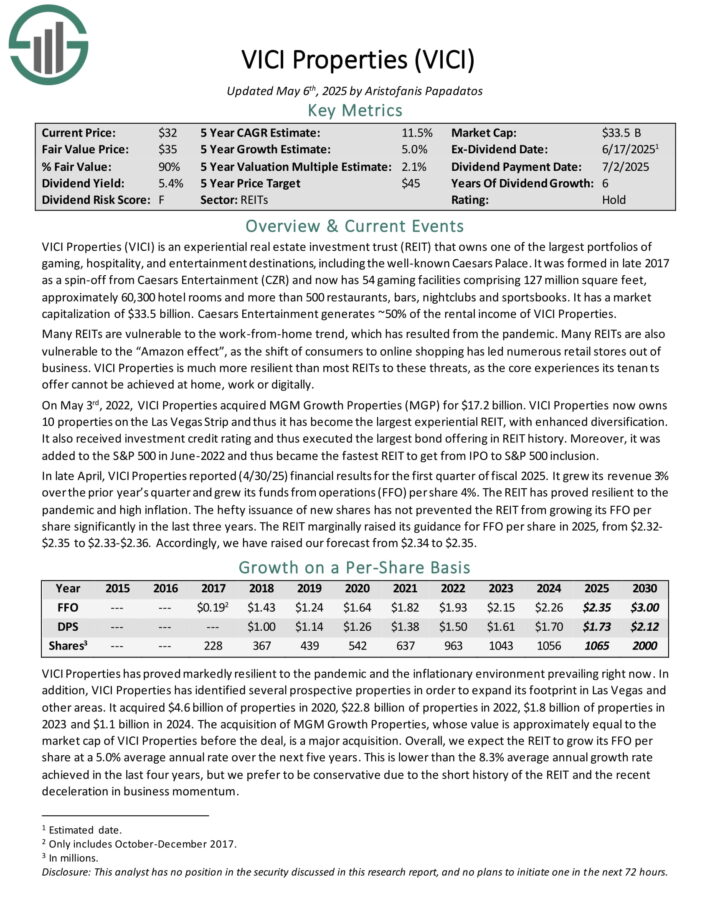

Dividend Inventory Close to 52-Week Excessive #8: VICI Properties (VICI)

- Anticipated Whole Return: 11.6%

VICI Properties (VICI) is an experiential actual property funding belief (REIT) that owns one of many largest portfolios of gaming, hospitality, and leisure locations, together with the well-known Caesars Palace.

It was fashioned in late 2017 as a spin-off from Caesars Leisure (CZR) and now has 54 gaming services comprising 127 million sq. ft, roughly 60,300 resort rooms and greater than 500 eating places, bars, nightclubs and sportsbooks.

In late April, VICI Properties reported (4/30/25) monetary outcomes for the primary quarter of fiscal 2025. It grew its income 3% over the prior yr’s quarter and grew its funds from operations (FFO) per share 4%. The REIT has proved resilient to the pandemic and excessive inflation.

The hefty issuance of recent shares has not prevented the REIT from rising its FFO per share considerably within the final three years. The REIT marginally raised its steerage for FFO per share in 2025, from $2.32-$2.35 to $2.33-$2.36.

Click on right here to obtain our most up-to-date Certain Evaluation report on VICI (preview of web page 1 of three proven beneath):

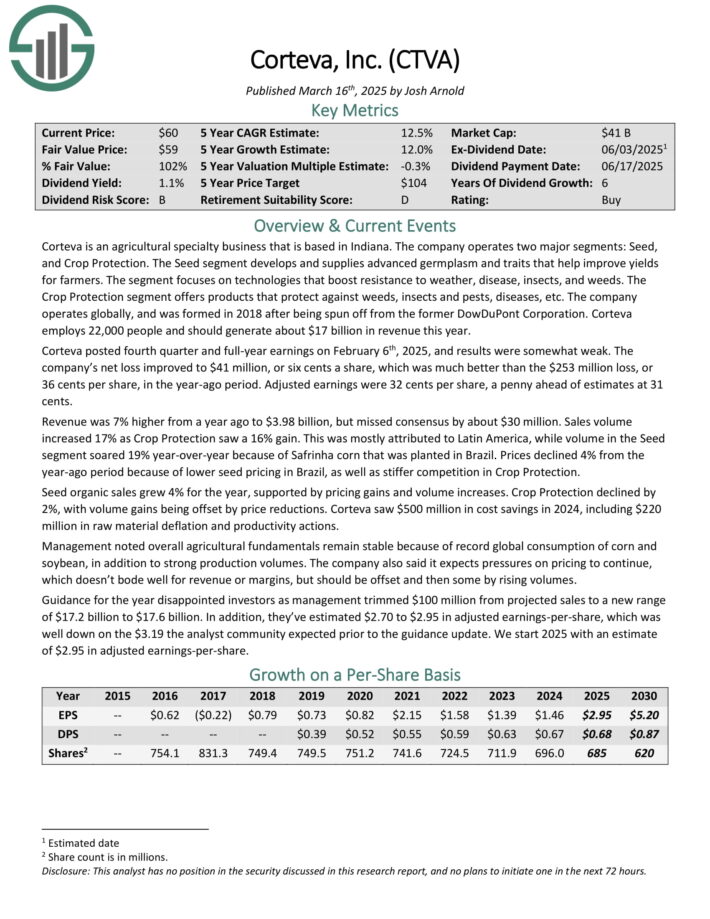

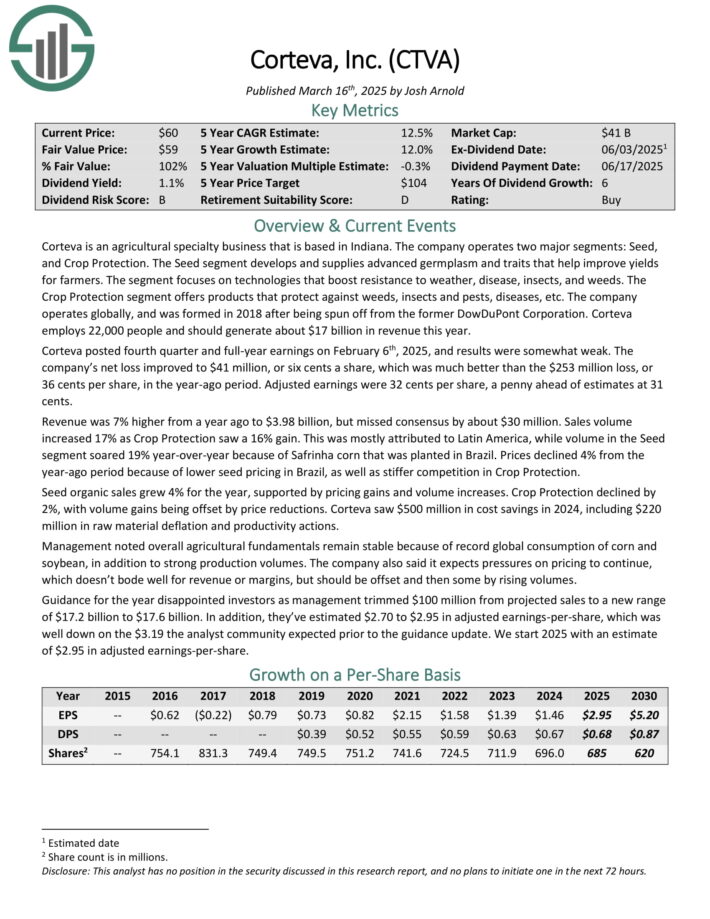

Dividend Inventory Close to 52-Week Excessive #7: Corteva, Inc. (CTVA)

- Anticipated Whole Return: 11.6%

Corteva is an agricultural specialty enterprise that’s based mostly in Indiana. The corporate operates two main segments: Seed, and Crop Safety.

The Seed section develops and provides superior germplasm and traits that assist enhance yields for farmers. The section focuses on applied sciences that increase resistance to climate, illness, bugs, and weeds.

The Crop Safety section provides merchandise that shield in opposition to weeds, bugs and pests, illnesses, and so forth.

Corteva posted fourth quarter and full-year earnings on February sixth, 2025, and outcomes had been considerably weak. The corporate’s web loss improved to $41 million, an enchancment from the $253 million loss within the year-ago interval.

Adjusted earnings had been 32 cents per share, a penny forward of estimates at 31 cents.

Income was 7% greater from a yr in the past to $3.98 billion, however missed consensus by about $30 million. Gross sales quantity elevated 17% as Crop Safety noticed a 16% achieve.

This was largely attributed to Latin America, whereas quantity within the Seed section soared 19% year-over-year due to Safrinha corn that was planted in Brazil.

Click on right here to obtain our most up-to-date Certain Evaluation report on CTVA (preview of web page 1 of three proven beneath):

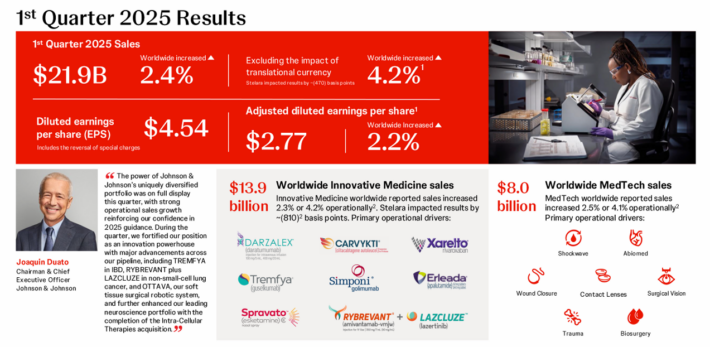

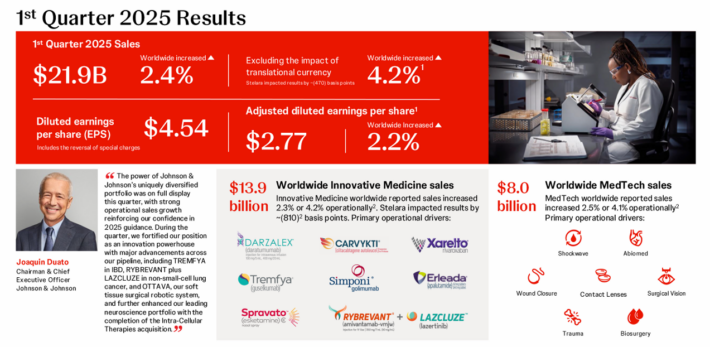

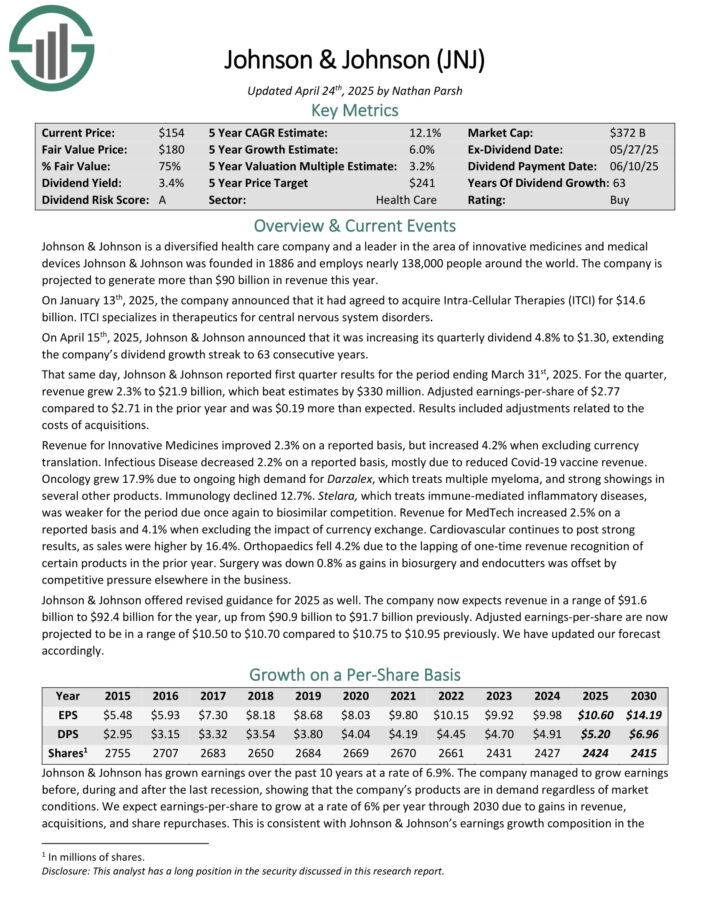

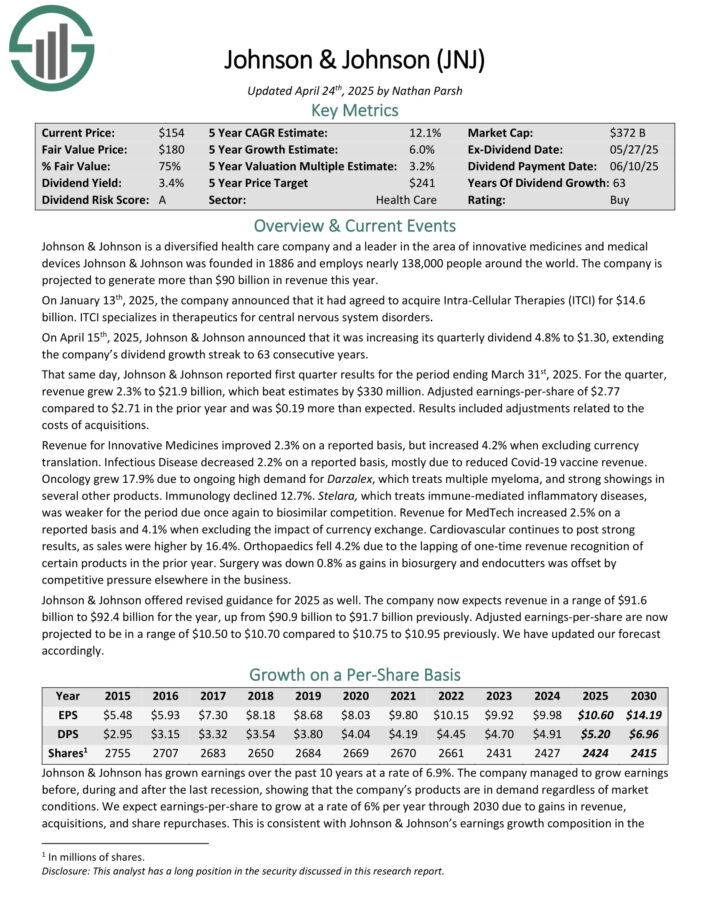

Dividend Inventory Close to 52-Week Excessive #6: Johnson & Johnson (JNJ)

- Anticipated Whole Return: 11.9%

Johnson & Johnson is a diversified well being care firm and a frontrunner within the space of revolutionary medicines and medical gadgets Johnson & Johnson was based in 1886.

On April fifteenth, 2025, Johnson & Johnson introduced that it was growing its quarterly dividend 4.8% to $1.30, extending the corporate’s dividend development streak to 63 consecutive years.

Supply: Investor Presentation

That very same day, Johnson & Johnson reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income grew 2.3% to $21.9 billion, which beat estimates by $330 million.

Adjusted earnings-per-share of $2.77 in comparison with $2.71 within the prior yr and was $0.19 greater than anticipated. Outcomes included changes associated to the prices of acquisitions.

Click on right here to obtain our most up-to-date Certain Evaluation report on JNJ (preview of web page 1 of three proven beneath):

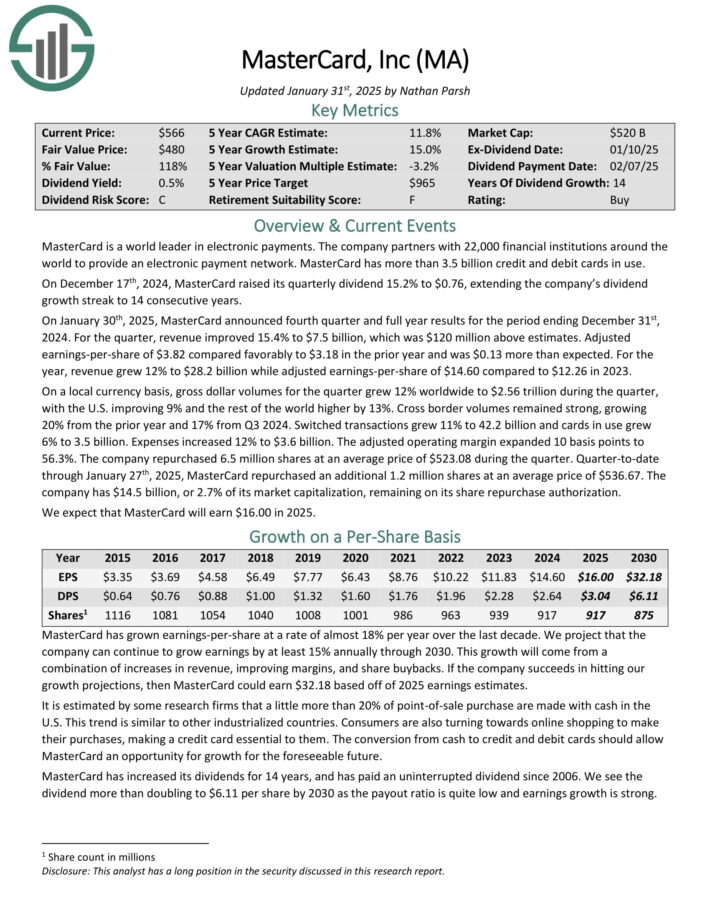

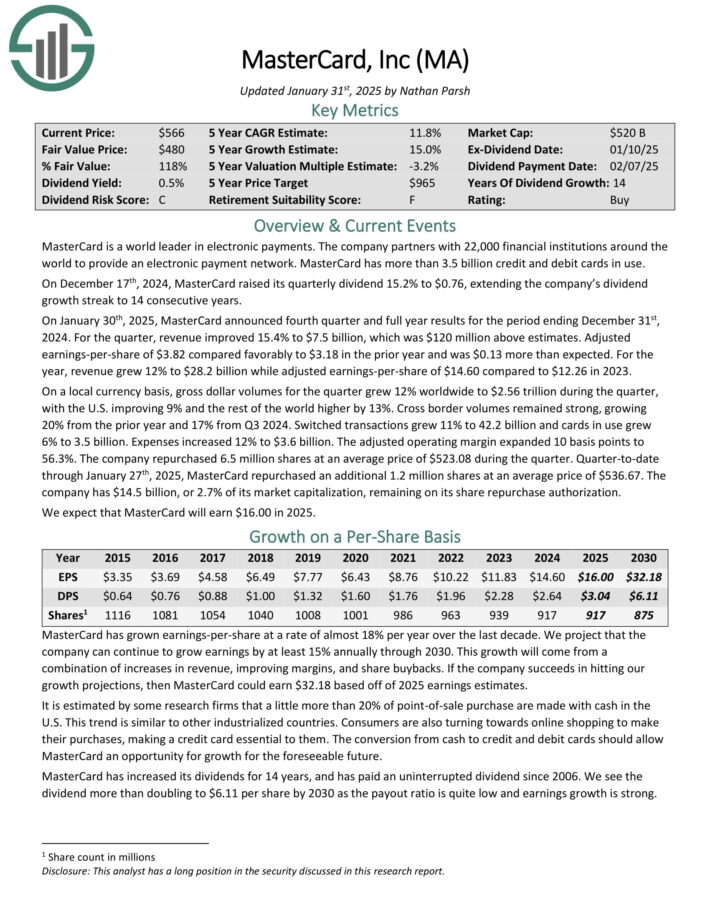

Dividend Inventory Close to 52-Week Excessive #5: Mastercard Inc. (MA)

- Anticipated Whole Return: 12.0%

MasterCard is a world chief in digital funds. The corporate companions with 25,000 monetary establishments around the globe to offer an digital cost community. MasterCard has greater than 3.1 billion credit score and debit playing cards in use.

On January thirtieth, 2025, MasterCard introduced fourth quarter and full yr outcomes for the interval ending December thirty first, 2024.

For the quarter, income improved 15.4% to $7.5 billion, which was $120 million above estimates. Adjusted earnings-per-share of $3.82 in contrast favorably to $3.18 within the prior yr and was $0.13 greater than anticipated.

For the yr, income grew 12% to $28.2 billion whereas adjusted earnings-per-share of $14.60 in comparison with $12.26 in 2023.

On a neighborhood forex foundation, gross greenback volumes for the quarter grew 12% worldwide to $2.56 trillion through the quarter, with the U.S. bettering 9% and the remainder of the world greater by 13%.

Cross border volumes remained robust, rising 20% from the prior yr and 17% from Q3 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on Mastercard (preview of web page 1 of three proven beneath):

Dividend Inventory Close to 52-Week Excessive #4: Financial institution of New York Mellon (BK)

- Anticipated Whole Return: 12.2%

Financial institution of New York Mellon is current in 35 international locations around the globe and acts as extra of an funding supervisor than a standard financial institution.

Certainly, BNY Mellon’s acknowledged aim is to assist its clients handle their belongings all through the funding lifecycle. As such, BNY Mellon’s income is generally derived from charges, not conventional curiosity revenue.

BNY Mellon posted first quarter earnings on April eleventh, 2025, and outcomes had been higher than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to $1.58, which was 9 cents forward of estimates. Income was up 5.7% year-over-year to $4.79 billion, beating estimates by $20 million.

Payment income was up 3%, primarily reflecting web new enterprise and better market values, which was partially offset by the combination of belongings beneath administration flows. Funding and different income primarily replicate an asset disposal achieve that was recorded.

Web curiosity revenue rose 11% year-over-year, primarily reflecting the reinvestment of maturing funding securities at greater yields, which was partially offset by modifications in deposit combine. Belongings beneath custody and administration rose 9%, reflecting inflows and better market values.

Click on right here to obtain our most up-to-date Certain Evaluation report on BK (preview of web page 1 of three proven beneath):

Dividend Inventory Close to 52-Week Excessive #3: S&P World (SPGI)

- Anticipated Whole Return: 12.5%

S&P World is a worldwide supplier of economic providers and enterprise info and income of over $13 billion.

Via its varied segments, it offers credit score rankings, benchmarks and indices, analytics, and different knowledge to commodity market members, capital markets, and automotive markets.

S&P World has paid dividends repeatedly since 1937 and has elevated its payout for 51 consecutive years.

S&P posted fourth quarter and full-year earnings on February eleventh, 2025, and outcomes had been significantly better than anticipated on each the highest and backside traces.

Adjusted earnings-per-share got here to $3.77, which was a staggering 30 cents forward of estimates. Earnings rose from $3.13 a yr in the past.

Income was up 14% year-over-year to $3.59 billion, beating estimates by $90 million. The corporate posted income development in all of its working segments, along with robust working margin growth.

Working bills rose barely from $2.26 billion to $2.33 billion year-over-year. That led to working revenue of $1.68 billion, sharply greater from $1.39 billion a yr in the past.

With dividend development above 10%, SPGI is among the rock stable dividend shares.

Click on right here to obtain our most up-to-date Certain Evaluation report on SPGI (preview of web page 1 of three proven beneath):

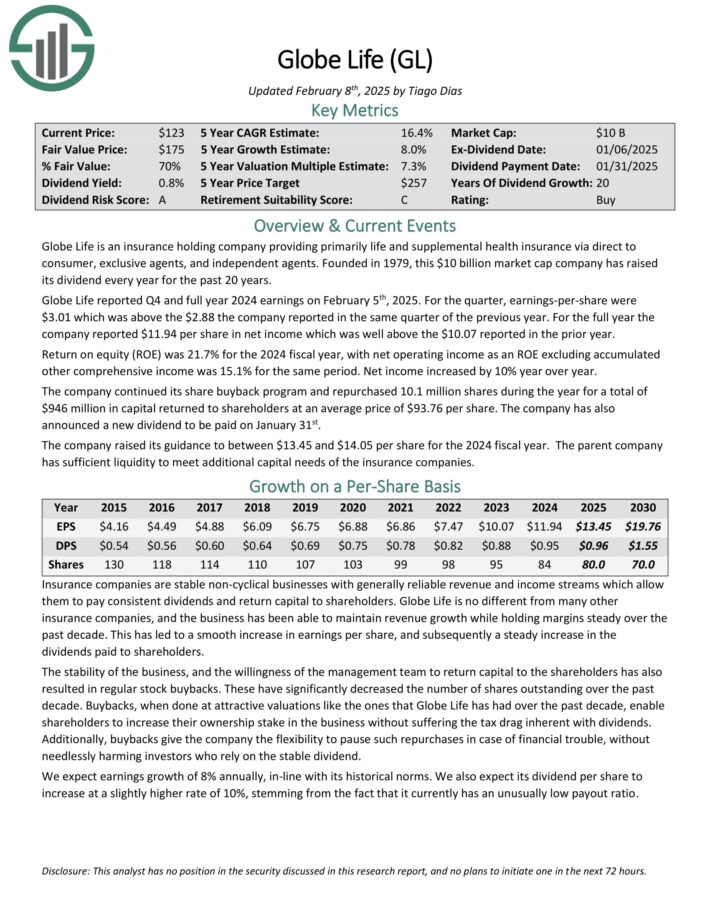

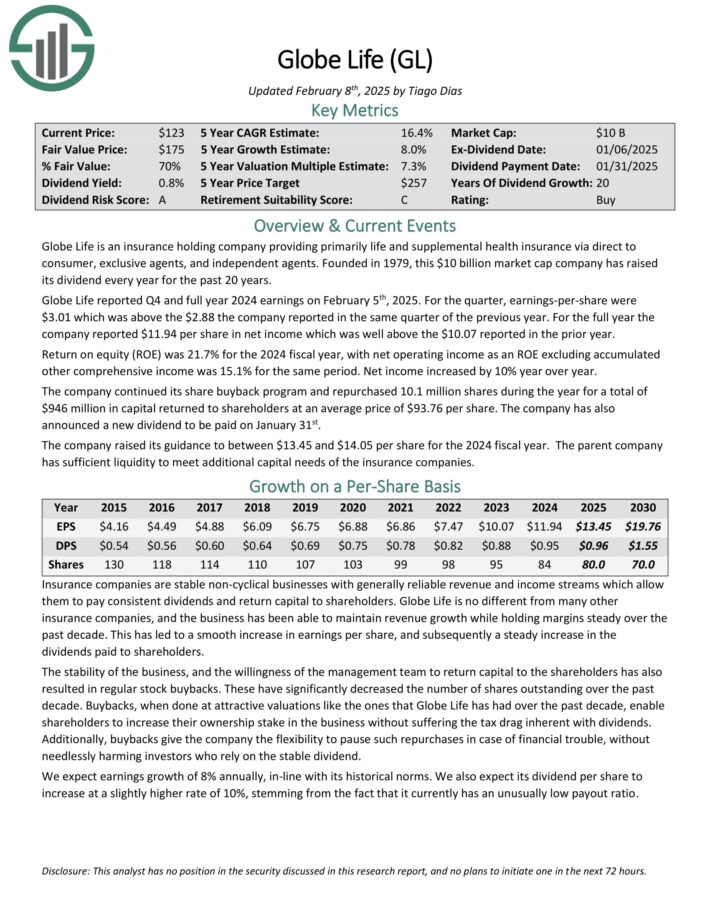

Dividend Inventory Close to 52-Week Excessive #2: Globe Life (GL)

- Anticipated Whole Return: 17.0%

Globe Life is an insurance coverage holding firm offering primarily life and supplemental medical health insurance by way of direct to client, unique brokers, and unbiased brokers.

Based in 1979, the corporate has raised its dividend yearly for the previous 20 years.

Globe Life reported This autumn and full yr 2024 earnings on February fifth, 2025. For the quarter, earnings-per-share had been $3.01 which was above the $2.88 the corporate reported in the identical quarter of the earlier yr. For the complete yr the corporate reported $11.94 per share in web revenue which was effectively above the $10.07 reported within the prior yr.

Return on fairness (ROE) was 21.7% for the 2024 fiscal yr, with web working revenue as an ROE excluding gathered different complete revenue was 15.1% for a similar interval. Web revenue elevated by 10% yr over yr.

The corporate continued its share buyback program and repurchased 10.1 million shares through the yr for a complete of $946 million in capital returned to shareholders at a median value of $93.76 per share.

Click on right here to obtain our most up-to-date Certain Evaluation report on GL (preview of web page 1 of three proven beneath):

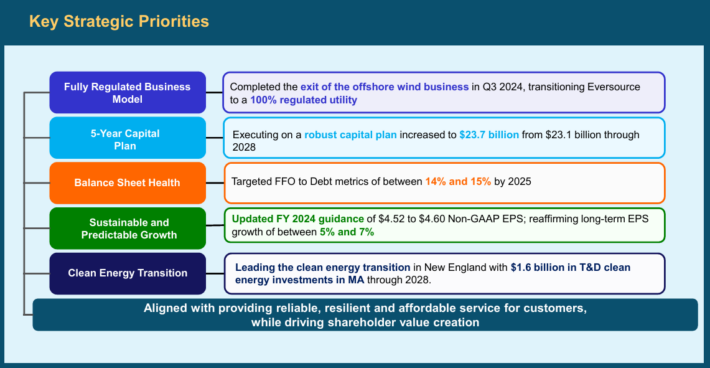

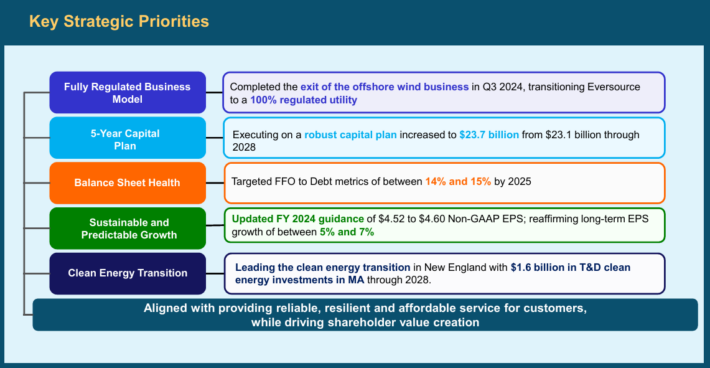

Dividend Inventory Close to 52-Week Excessive #1: Eversource Vitality (ES)

- Anticipated Whole Return: 19.6%

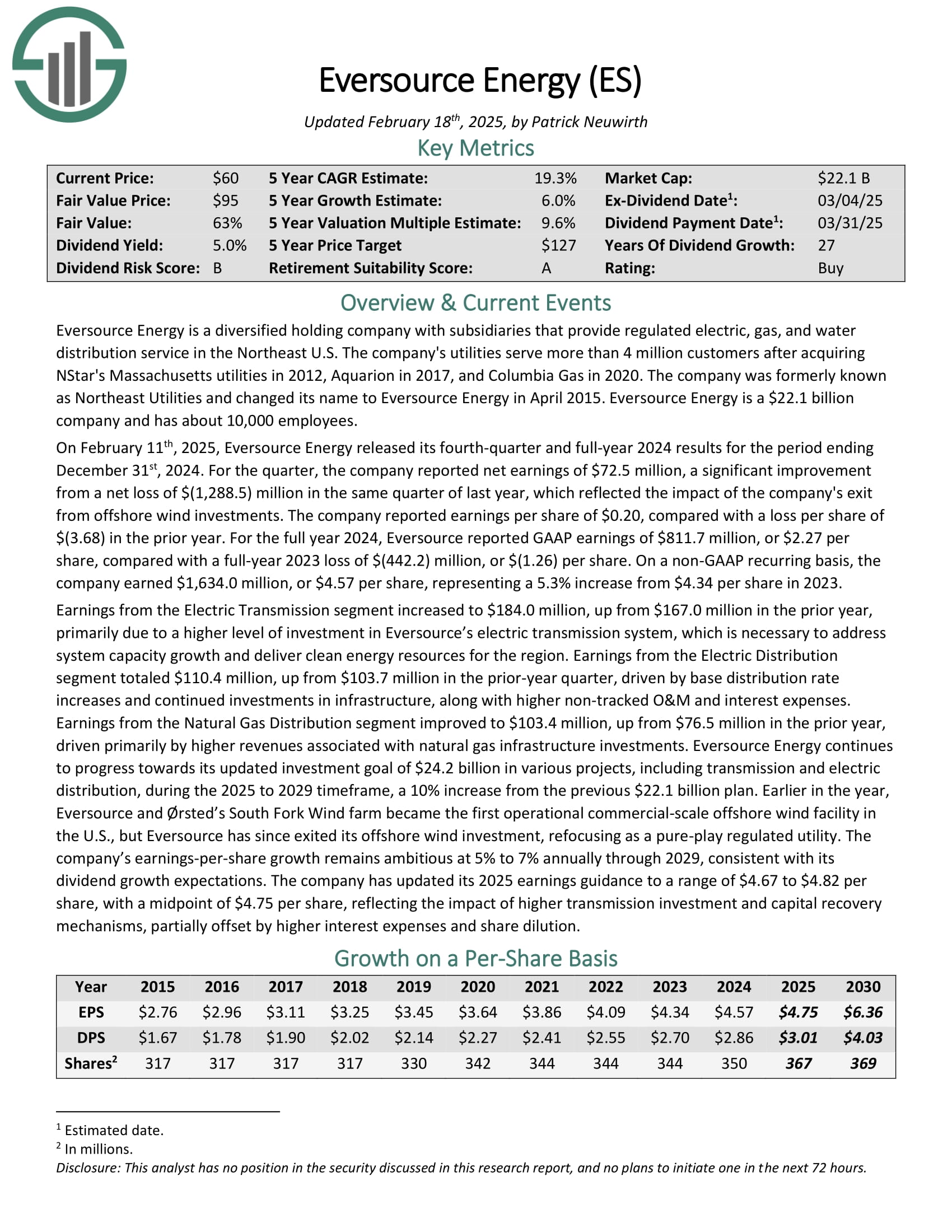

Eversource Vitality is a diversified holding firm with subsidiaries that present regulated electrical, gasoline, and water distribution service within the Northeast U.S.

FactSet, Erie Indemnity, and Eversource Vitality are the three new Dividend Aristocrats for 2025.

The corporate’s utilities serve greater than 4 million clients after buying NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Fuel in 2020.

Eversource has delivered regular development to shareholders for a few years.

Supply: Investor Presentation

On February eleventh, 2025, Eversource Vitality launched its fourth-quarter and full-year 2024 outcomes. For the quarter, the corporate reported web earnings of $72.5 million, a big enchancment from a web lack of $(1,288.5) million in the identical quarter of final yr, which mirrored the influence of the corporate’s exit from offshore wind investments.

The corporate reported earnings per share of $0.20, in contrast with a loss per share of $(3.68) within the prior yr. For the complete yr 2024, Eversource reported GAAP earnings of $811.7 million, or $2.27 per share, in contrast with a full-year 2023 lack of $(442.2) million, or $(1.26) per share.

On a non-GAAP recurring foundation, the corporate earned $1,634.0 million, or $4.57 per share, representing a 5.3% improve from 2023.

Click on right here to obtain our most up-to-date Certain Evaluation report on ES (preview of web page 1 of three proven beneath):

Different Blue Chip Inventory Assets

The sources beneath offers you a greater understanding of dividend development investing:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].