- Trump tariff information, U.S. inflation knowledge, retail gross sales, and the beginning of Q2 earnings season might be in focus this week.

- JPMorgan Chase stands out as a inventory to purchase, with its diversified enterprise mannequin and favorable market circumstances setting the stage for an earnings beat

- With slowing development, quantity declines, and margin pressures, PepsiCo is a inventory to promote this week.

- Searching for extra actionable commerce concepts? Subscribe now to unlock entry to InvestingPro’s AI-selected inventory winners and save as much as 50%!

Shares on Wall Avenue closed decrease on Friday, in per week marked by heightened commerce tensions after U.S. President Donald Trump issued new tariff bulletins for plenty of international locations, together with Canada, Japan, South Korea, and Brazil.

Supply: Investing.com

Friday’s losses pushed the most important averages into the purple for the week. The 30-stock misplaced about 1%, whereas the benchmark and tech-heavy notched respective losses of 0.3% and 0.1%.

Extra volatility might be in retailer within the week forward as traders assess the outlook for the financial system, inflation, rates of interest and company earnings amid escalating international commerce tensions.

President Trump mentioned Saturday that the U.S. will impose 30% tariffs on the European Union and Mexico beginning on August 1.

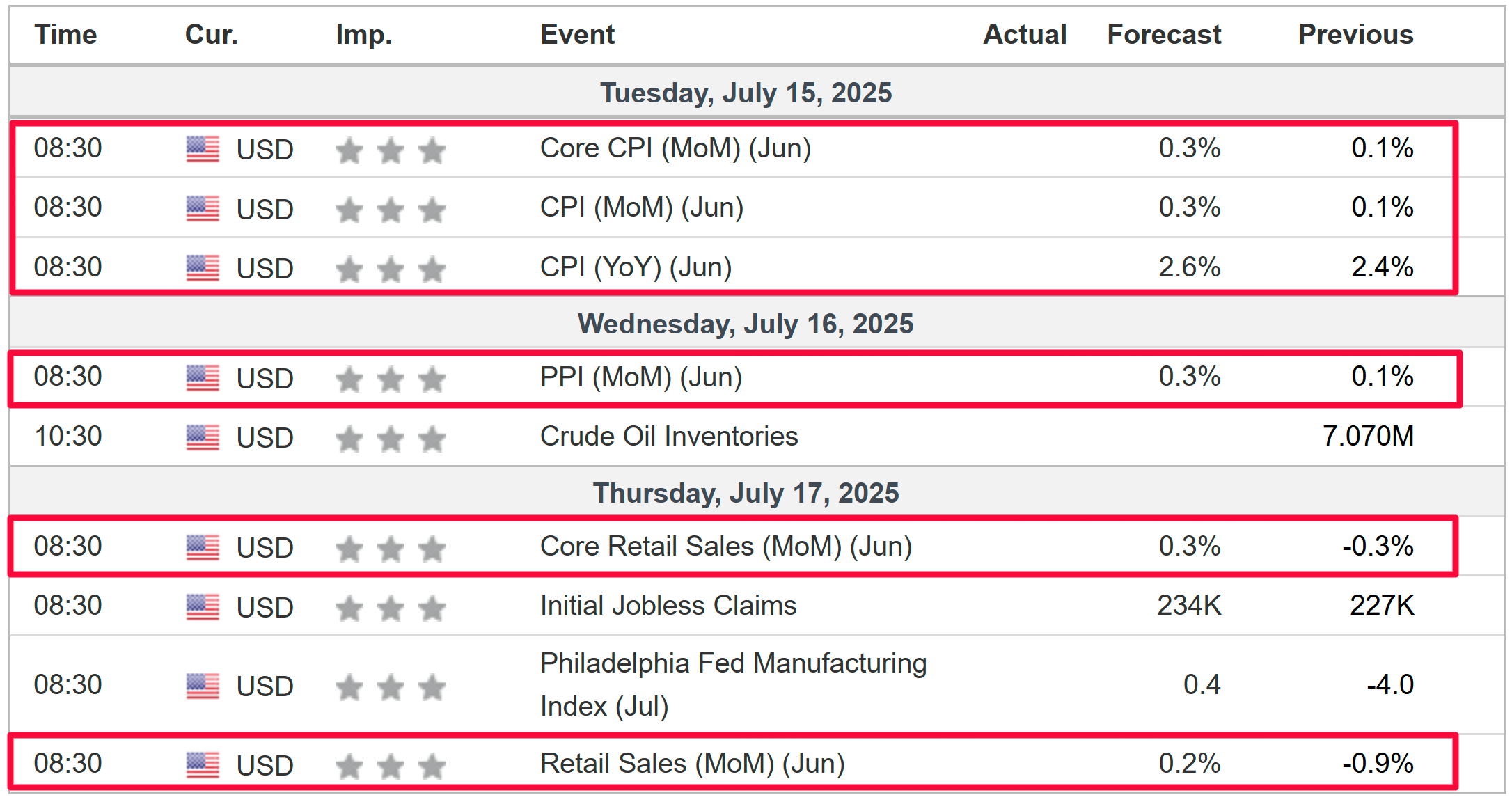

On the financial calendar, most necessary might be Tuesday’s U.S. client value inflation report, which may spark additional turmoil if it is available in larger than expectations. The CPI knowledge might be accompanied by the discharge of the newest figures on producer costs, which is able to assist fill out the inflation image. Retail gross sales and a number of other manufacturing-related experiences are also on faucet.

Supply: Investing.com

Elsewhere, a brand new earnings season is about to get underway, with JPMorgan Chase (NYSE:), Financial institution of America (NYSE:), Citigroup (NYSE:), Wells Fargo (NYSE:), Goldman Sachs (NYSE:), Morgan Stanley (NYSE:), BlackRock (NYSE:), Netflix (NASDAQ:), Taiwan Semiconductor (NYSE:), Johnson & Johnson (NYSE:), and PepsiCo (NASDAQ:), a number of the huge names resulting from report.

No matter which route the market goes, beneath I spotlight one inventory more likely to be in demand and one other which may see contemporary draw back. Bear in mind although, my timeframe is simply for the week forward, Monday, July 14 – Friday, July 18.

Inventory To Purchase: JPMorgan Chase

JPMorgan Chase stands out as a promising purchase this week, with a number of indicators suggesting it should beat earnings expectations. Analysts anticipate sturdy efficiency in key areas corresponding to funding banking and asset administration, pushed by elevated market exercise and a strong deal-making surroundings.

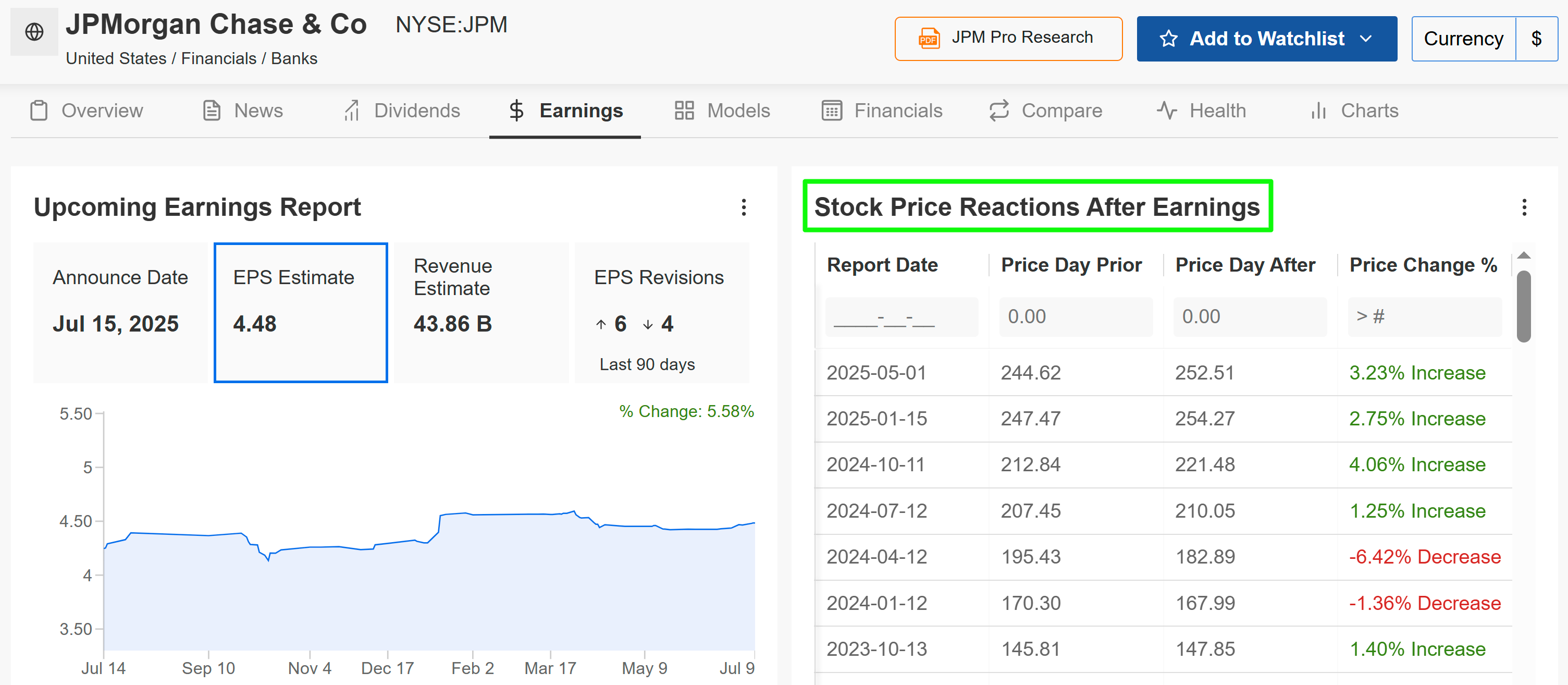

JPM is scheduled to ship its second quarter replace forward of the opening bell on Tuesday at 6:55AM EST, with each analysts and traders rising more and more bullish in regards to the Jamie Dimon-led megabank.

Market individuals anticipate a potential implied transfer of three.7% in both route in shares following the replace. The most important U.S. financial institution by market capitalization has a robust monitor report of beating earnings estimates.

Supply: InvestingPro

Consensus estimates name for JPMorgan Chase to submit Q2 earnings per share of $4.48 on income of $43.86 billion. A number of elements help JPMorgan’s probability of beating earnings expectations.

In a persistently larger rate of interest surroundings, banks like JPMorgan are direct beneficiaries. The widening unfold between what they earn on loans and what they pay on deposits interprets immediately into larger web curiosity revenue, a key driver of income.

Moreover, a rebound in funding banking exercise, together with mergers and acquisitions and debt underwriting, is predicted to spice up charges, whereas the financial institution’s wealth administration division continues to profit from a robust inventory market and elevated consumer inflows.

As such, Chief Government Officer Jamie Dimon is poised to supply upbeat steerage, buoyed by the banking large’s advantageous place amid the resurgence in international deal-making, merger exercise, and IPO underwriting.

Supply: Investing.com

JPM inventory ended Friday’s session at $286.86, just under the report excessive shut of $296 from July 3. At present ranges, JPMorgan Chase has a market cap of $797.2 billion, incomes the New York-based monetary companies agency the title of essentially the most precious financial institution on the planet.

InvestingPro factors out that JPMorgan Chase is in strong monetary well being situation, due to strong earnings and income development prospects, mixed with its enticing valuation and pristine steadiness sheet. Moreover, it needs to be famous that the megabank has maintained its dividend payout for 55 consecutive years.

Remember to try InvestingPro to remain in sync with the market development and what it means to your buying and selling. Subscribe now for 50% off and place your portfolio one step forward of everybody else!

Inventory to Promote: PepsiCo

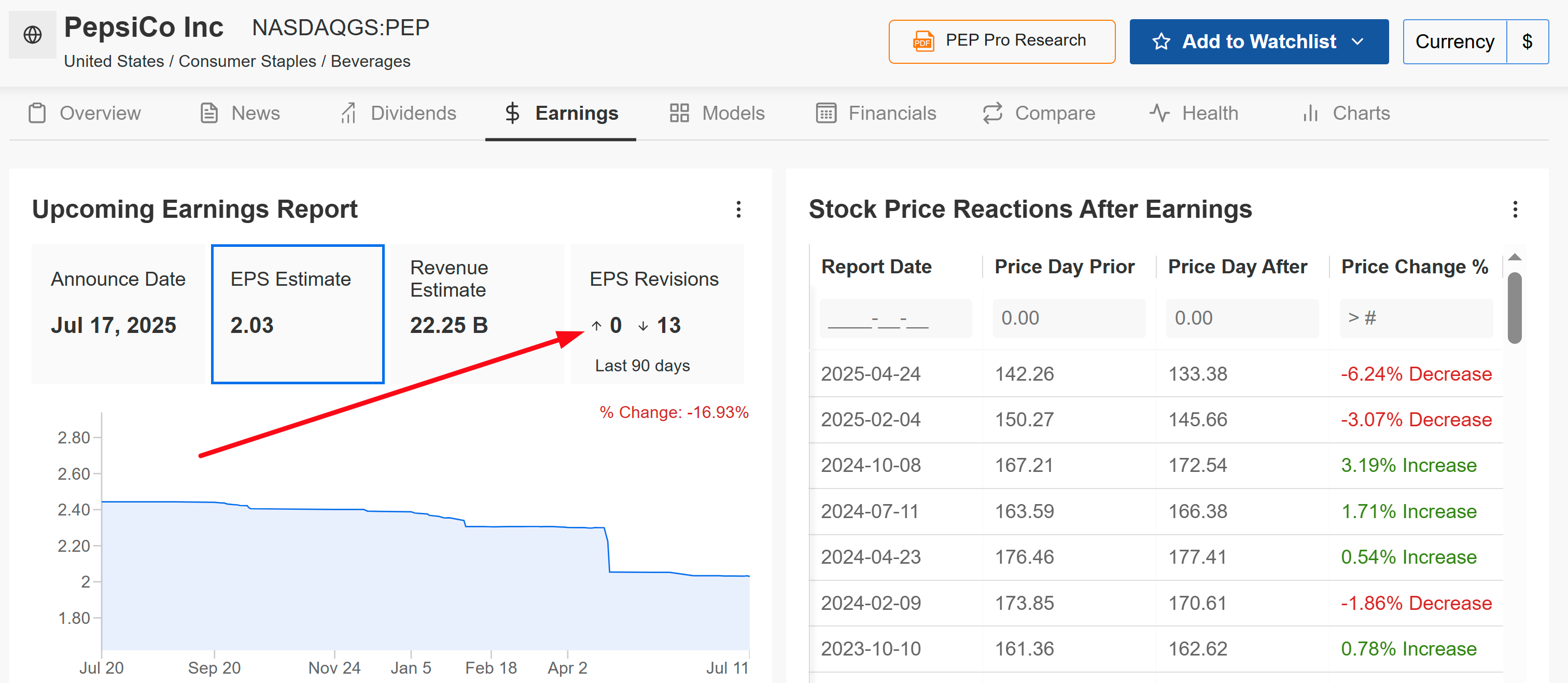

In distinction, PepsiCo faces a difficult week because it prepares to announce its quarterly revenue and gross sales figures. Analysts anticipate disappointing outcomes, with each revenue and income anticipated to fall wanting market expectations.

The beverage and snack large has been grappling with inflationary pressures, provide chain disruptions, and shifting client preferences towards more healthy choices, which have eroded margins and slowed development.

An InvestingPro survey of analyst earnings revisions reveals rising pessimism forward of the print, highlighting considerations about PepsiCo’s capability to navigate a troublesome macroeconomic surroundings. Merchants are bracing for post-earnings volatility, with choices markets pricing in a +/-4.1% implied transfer in both route.

Supply: InvestingPro

PepsiCo is seen incomes an adjusted $2.03 per share, declining 11% from EPS of $2.28 within the year-ago interval. In the meantime, income is forecast to inch down 1.1% year-over-year to $22.25 billion, reflecting ongoing challenges throughout its portfolio.

The corporate is fighting declining gross sales volumes in its beverage and snack segments, significantly in North America, as shoppers shift to more healthy options, difficult PepsiCo’s core manufacturers, corresponding to Pepsi and Lay’s.

Moreover, rising enter prices, significantly for sugar and packaging supplies, are squeezing margins and weighing on profitability. Provide chain disruptions and aggressive pressures within the beverage and snack classes additional cloud the outlook.

Given these challenges, PepsiCo is susceptible to an earnings miss and presumably a steerage lower, placing additional stress on the inventory.

Supply: Investing.com

PEP inventory closed at $135.26 on Friday, not removed from a latest 52-week low of $128.02 from June 25. Shifting averages reinforce the bearish case, with solely the very shortest timeframes providing any help.

Whereas its monetary well being is secure, as per InvestingPro, the shortage of value momentum and weak returns recommend restricted upside within the close to time period.

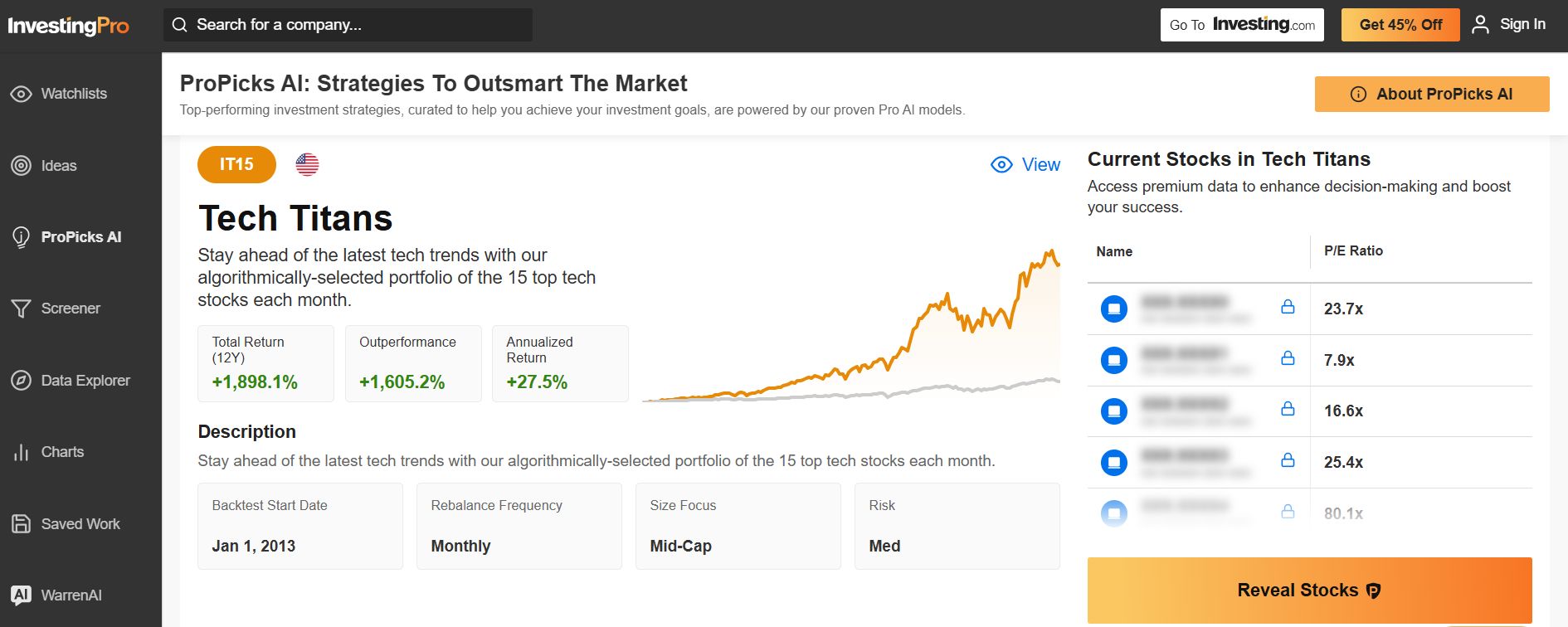

Whether or not you’re a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now for as much as 50% off and immediately unlock entry to a number of market-beating options, together with:

- ProPicks AI: AI-selected inventory winners with confirmed monitor report.

- InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

- Superior Inventory Screener: Seek for the very best shares based mostly on a whole lot of chosen filters, and standards.

- High Concepts: See what shares billionaire traders corresponding to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the by way of the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco High QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I commonly rebalance my portfolio of particular person shares and ETFs based mostly on ongoing threat evaluation of each the macroeconomic surroundings and corporations’ financials.

The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

Observe Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.