- Jobless claims, Fed audio system, Q3 earnings will probably be in focus this week.

- GE Aerospace is a purchase with upbeat revenue and gross sales progress anticipated.

- UPS is a promote with weak earnings, smooth steering on deck.

- In search of extra actionable commerce concepts to navigate the present market volatility? Unlock entry to InvestingPro for lower than $8 a month!

U.S. shares closed increased on Friday to cap off their sixth profitable week in a row, with the and rallying to new information.

For the week, the benchmark S&P 500 rose 0.9%, the blue-chip Dow climbed 1%, and the tech-heavy gained 0.8%.

Supply: Investing.com

The week forward is anticipated to be an eventful one as buyers assess the outlook for the financial system, inflation, rates of interest and company earnings.

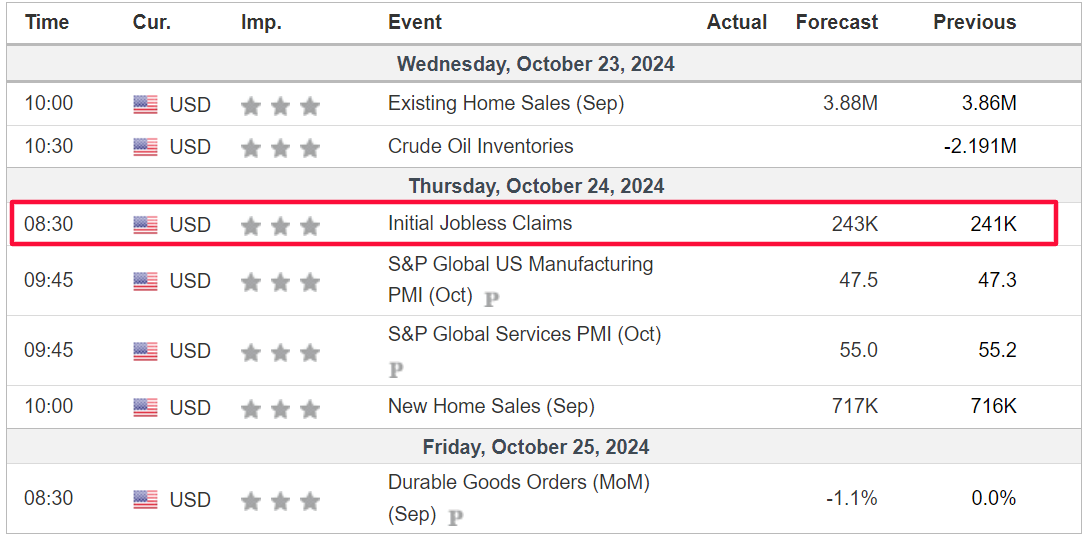

Most necessary on the financial calendar will probably be Thursday morning’s launch of preliminary jobless claims figures at 8:30AM ET, in addition to a pair of flash PMI surveys.

That will probably be accompanied by a heavy slate of Fed audio system, with the likes of district governors Neel Kashkari, Lorie Logan, Mary Daly, and Patrick Harker all set to make public appearances in the course of the week.

Supply: Investing.com

Some 88% of market members count on the Federal Open Market Committee to chop its benchmark rate of interest by 25 foundation factors at its November 7 coverage assembly, whereas almost 12% count on no change, in line with Investing.com’s .

In the meantime, third-quarter earnings season shifts into excessive gear, with studies anticipated from a number of high-profile firms, together with Tesla (NASDAQ:), IBM (NYSE:), and Boeing (NYSE:).

A few of the different notable reporters embody United Parcel Service (NYSE:), Coca-Cola (NYSE:), Basic Motors (NYSE:), AT&T (NYSE:), Verizon (NYSE:), GE Aerospace (NYSE:), 3M (NYSE:), Honeywell (NASDAQ:), Lockheed Martin (NYSE:), American Airways (NASDAQ:), and Southwest Airways (NYSE:).

No matter which path the market goes, under I spotlight one inventory more likely to be in demand and one other which may see recent draw back. Keep in mind although, my timeframe is simply for the week forward, Monday, October 21 – Friday, October 25.

Inventory To Purchase: GE Aerospace

I foresee a robust efficiency for GE Aerospace inventory this week, with a possible breakout to a recent multi-year excessive on the horizon.

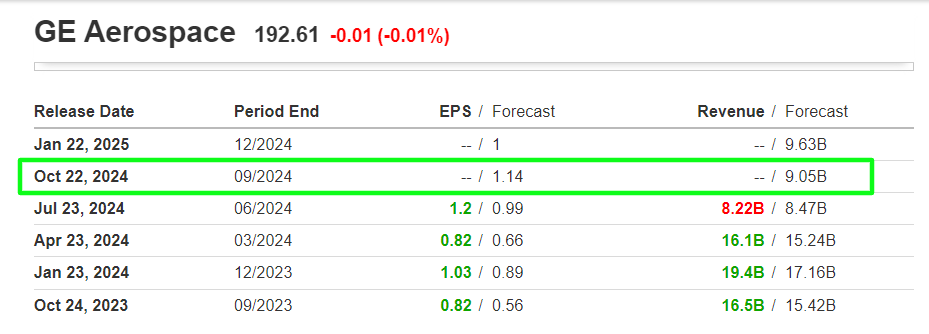

The first catalyst for GE Aerospace is its third-quarter earnings report, set to be launched earlier than the market opens on Tuesday at 6:30AM ET.

Market members count on a large swing in GE inventory after the print drops, in line with the choices market, with a doable implied transfer of 5.3% in both path.

Wall Road analysts are optimistic in regards to the firm’s efficiency, with consensus estimates predicting earnings of $1.14 per share on income of $9.05 billion.

Supply: Investing.com

A number of key elements are anticipated to drive GE Aerospace’s earnings and gross sales progress. First, the corporate is benefiting from a surge in demand for aftermarket providers, which incorporates upkeep, restore, and spare elements. This can be a high-margin enterprise for the corporate and may present a robust enhance to its profitability.

Moreover, there may be robust demand for brand new airplane engines, significantly for narrow-body plane. GE Aerospace, which manufactures the LEAP engine utilized in many of those plane, stands to learn as airways proceed to interchange older fleets with extra fuel-efficient fashions.

GE Aerospace inventory ended at $192.61 on Friday, not removed from a latest peak of $194.80, which was the best stage since Could 2008. At present ranges, the Evendale, Ohio-based firm has a market cap of $210.7 billion.

Supply: Investing.com

Since its spinoff in April, GE has been on a robust upward trajectory, with its refill 40%. Basic Electrical (NYSE:) cut up into three separate firms between November 2021 and April 2024, adopting the commerce title GE Aerospace after divesting its healthcare and power divisions.

InvestingPro highlights GE Aerospace’s promising outlook, emphasizing its favorable positioning within the Aerospace & Protection trade, which has allowed it to leverage a resilient enterprise mannequin and powerful revenue progress.

Remember to try InvestingPro to remain in sync with the market development and what it means on your buying and selling. Subscribe now with an unique 10% low cost and place your portfolio one step forward of everybody else!

Inventory to Promote: UPS

On the flip facet, United Parcel Service is dealing with a tougher outlook, making it a robust promote this week on account of a worrying mixture of rising prices and weakening demand.

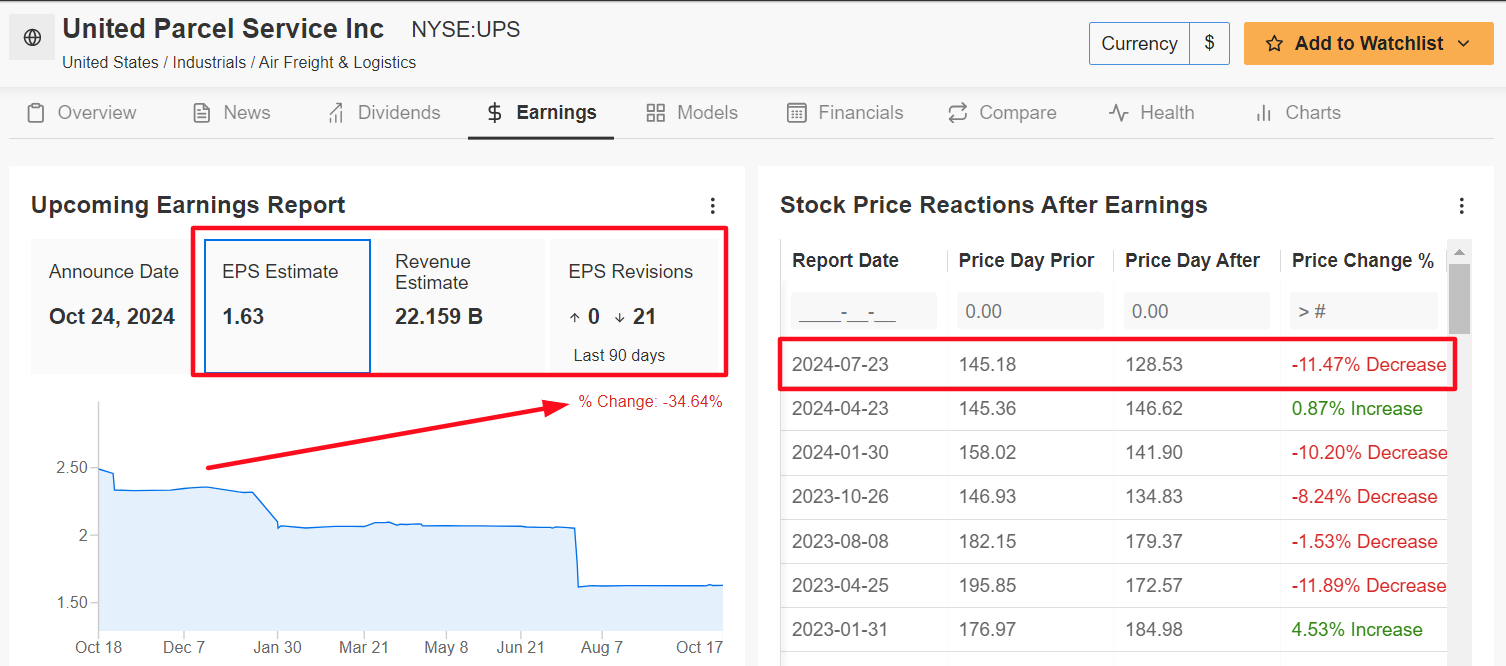

UPS is scheduled to launch its third-quarter earnings report earlier than the market opens at 6:00AM ET on Thursday, however the forecast will not be promising.

A number of headwinds are weighing on UPS’s efficiency. One of the crucial vital challenges is the slowing world financial system. As inflation persists and rates of interest stay elevated, shopper and enterprise spending has slowed, resulting in a drop in bundle volumes for UPS.

In keeping with the choices market, merchants are pricing in a swing of 4.9% in both path for UPS inventory following the print.

Earnings have been catalysts for outsized swings in shares this yr, as per knowledge from InvestingPro, with UPS inventory gapping down 11.5% when the corporate final reported quarterly numbers in July.

Analysts have been steadily revising their estimates downward in latest weeks, with all 21 analysts surveyed by InvestingPro chopping their revenue forecasts by roughly 35% from preliminary expectations.

Supply: InvestingPro

Wall Road sees UPS incomes $1.63 per share, up 3.8% in comparison with EPS of $1.57 within the year-ago interval. In the meantime, income is forecast to tick up 5% year-over-year to $22.1 billion.

The corporate’s heavy reliance on world commerce and delivery means it’s significantly susceptible to those macroeconomic pressures, which have been impacting income.

Along with weaker demand, UPS is dealing with rising prices, significantly in gasoline and labor. These rising bills are squeezing margins and making it tougher for UPS to take care of profitability.

Given these challenges, UPS is anticipated to situation weak steering for the upcoming quarters, additional dampening investor sentiment.

UPS inventory closed Friday’s session at $135.93, not removed from a latest low of $123.12, which was the weakest stage since July 2020. At its present valuation, the Sandy Springs, Georgia-based delivery big has a market cap of $116.4 billion.

Supply: Investing.com

Shares are down 13.5% within the yr thus far.

Not surprisingly, UPS has a below-average InvestingPro ‘Monetary Well being’ rating of two.3 out of 5.0 on account of mounting considerations over its near-term revenue and gross sales progress outlook.

Whether or not you are a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now to get a further 10% off the ultimate value and immediately unlock entry to a number of market-beating options, together with:

- AI ProPicks: AI-selected inventory winners with confirmed monitor file.

- InvestingPro Honest Worth: Immediately discover out if a inventory is underpriced or overvalued.

- Superior Inventory Screener: Seek for the very best shares based mostly on tons of of chosen filters, and standards.

- Prime Concepts: See what shares billionaire buyers akin to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the by way of the SPDR® S&P 500 ETF, and the Invesco QQQ Belief ETF. I’m additionally lengthy on the Know-how Choose Sector SPDR ETF (NYSE:).

I commonly rebalance my portfolio of particular person shares and ETFs based mostly on ongoing threat evaluation of each the macroeconomic setting and firms’ financials.

The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

Comply with Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.