U.S. shares closed sharply greater on Friday after a typically upbeat jobs report eased worries in regards to the financial system. The closed above 6,000 for the primary time since February 21, fueled by good points in expertise shares.

The benchmark index, together with the opposite two main indices, additionally posted notable good points for the week. The S&P 500 jumped 1.5%, the climbed 1.2%, whereas the tech-heavy superior 2.2%.

Supply: Investing.com

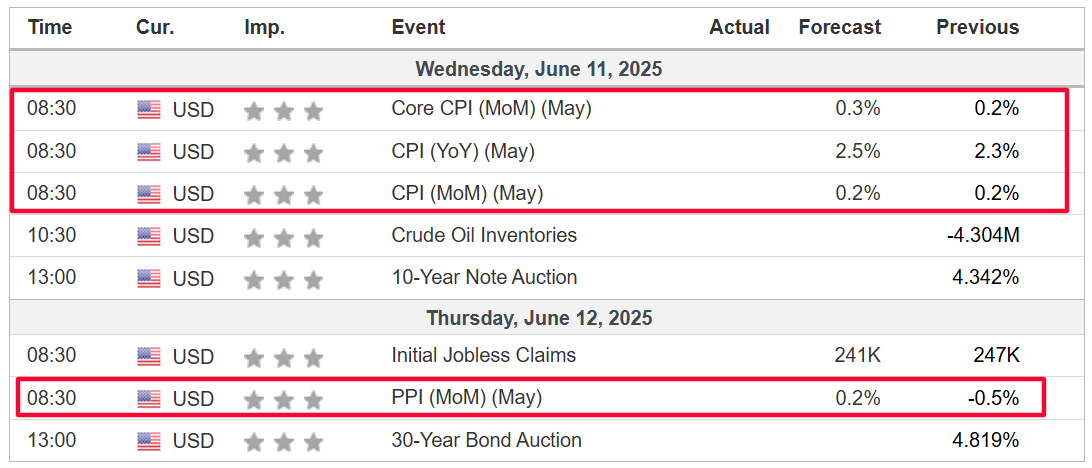

Extra volatility might be in retailer this week as traders proceed to evaluate the outlook for the financial system, inflation, rates of interest and company earnings amid President Donald Trump’s commerce warfare.

Treasury Secretary Scott Bessent and two different high Trump officers will meet Monday with Chinese language counterparts in London, Trump mentioned Friday. That follows Trump’s name with President Xi Jinping on Thursday.

On the financial calendar, most vital will probably be Wednesday’s U.S. client value inflation report for Might, which may spark additional turmoil if it is available in greater than expectations. The CPI knowledge will probably be accompanied by the discharge of the most recent figures on producer costs, which is able to assist fill out the inflation image.

In the meantime, there will probably be no Fed audio system on the agenda because the central financial institution goes into its pre-FOMC blackout mode forward of the June 17-18 coverage assembly.

Supply: Investing.com

And whereas the earnings season is sort of over, a couple of notable firms will report within the coming week, together with tech giants Oracle (NYSE:) and Adobe (NASDAQ:), meme inventory GameStop (NYSE:), and pet e-commerce firm Chewy (NYSE:).

No matter which path the market goes, under I spotlight one inventory more likely to be in demand and one other which may see recent draw back. Keep in mind although, my timeframe is simplyfor the week forward, Monday, June 9 – Friday, June 13.

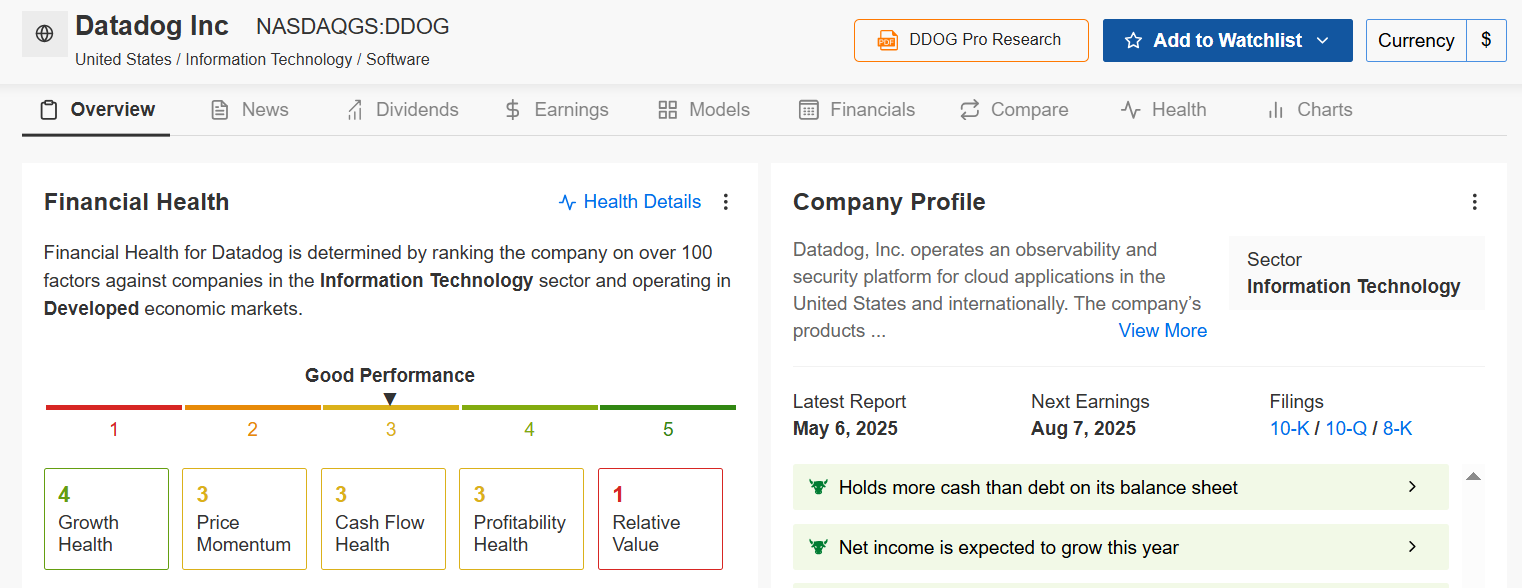

Inventory to Purchase: Datadog

Datadog (NASDAQ:) stands out as a high purchase this week, with its flagship ’Sprint 2025’ occasion set to be a serious catalyst for the inventory. The 2-day convention, beginning Monday, is infamous for product reveals and strategic updates.

DDOG shares have a historical past of rallying throughout the firm’s annual Sprint occasion. Final yr, the inventory surged 10.3% throughout the week of the convention, pushed by constructive bulletins and analyst upgrades. This established sample suggests potential for comparable value motion this yr.

Shares ended Friday’s session at $122.16, valuing the security-software maker at $42.2 billion.

Supply: Investing.com

Chief Government Officer Olivier Pomel, Chief Product Officer Yanbing Li, and different management crew members are anticipated to introduce new AI-driven options for observability and cybersecurity, enhancing Datadog’s potential to detect and resolve points in actual time.

The occasion can be more likely to showcase developments in cloud monitoring, notably for hybrid and multi-cloud environments, as companies more and more depend on complicated cloud infrastructures.

New strategic partnerships that may lengthen the cloud safety firm’s attain and enhance platform capabilities is perhaps revealed as effectively.

Now in its eighth yr, Datadog shares have demonstrated sturdy efficiency throughout the week of the Sprint occasion. The convention typically attracts upgrades from Wall Road analysts, as new product launches and options exhibit the corporate’s innovation and progress potential.

Supply: InvestingPro

As InvestingPro factors out, Datadog has a ‘GOOD’ Monetary Well being Rating of two.9/5.0, supported by its upbeat profitability outlook and robust gross sales progress prospects due to the sturdy adoption of its cloud monitoring options.

Make sure you take a look at InvestingPro to remain in sync with the market pattern and what it means on your buying and selling. Subscribe now for 45% off and place your portfolio one step forward of everybody else!

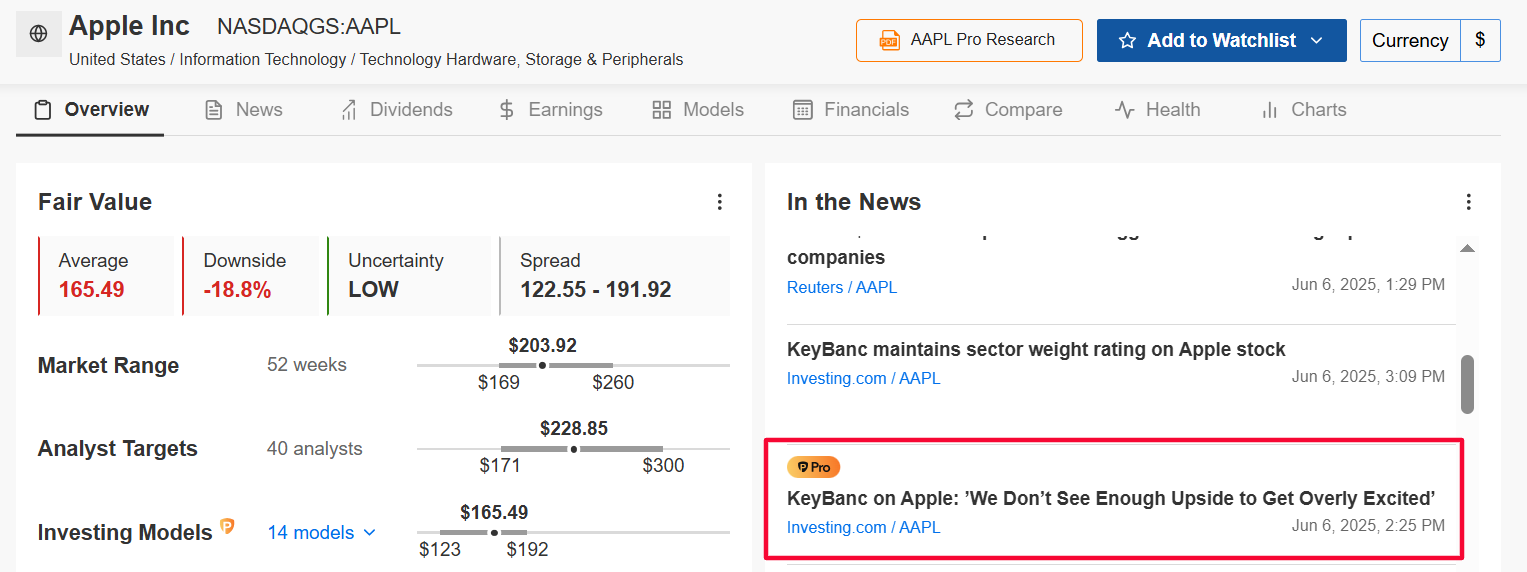

Inventory to Promote: Apple

Conversely, Apple (NASDAQ:) is gearing up for its annual Worldwide Builders Convention (WWDC) 2025 beginning Monday. The five-day occasion will kick off with a keynote deal with by CEO Tim Cook dinner that’s set to happen at 1:00PM ET/10:00AM PT.

With Apple’s AI technique lagging behind rivals like Google (NASDAQ:) and Microsoft (NASDAQ:), the occasion might fail to encourage confidence amongst traders.

AAPL inventory closed at $203.92 on Friday, incomes the tech big a market cap of $3.05 trillion. Shares are down almost 18% year-to-date in 2025, underperforming the S&P 500, as a consequence of tariff threats impacting its China-heavy provide chain and disappointment over its sluggish AI rollout.

Supply: Investing.com

Whereas WWDC normally piques investor curiosity, this yr’s outlook is extra subdued. Though AI developments are anticipated to be highlighted, Apple’s perceived sluggish tempo in AI growth has led to investor disappointment, leaving restricted room for error.

WWDC may also showcase Apple’s software program improvements throughout its ecosystem, together with updates to iOS, iPadOS, macOS, watchOS, tvOS, and visionOS. Nevertheless, {hardware} bulletins, if any, are probably restricted to a brand new Mac Professional with an M4 chip.

Supply: InvestingPro

It must be famous that Apple’s inventory is overvalued as per the AI-backed quantitative fashions in InvestingPro, which level to potential draw back of 18.8% from Friday’s closing value.

Such a transfer would take shares nearer to their ‘Truthful Worth’ value of $165.49.

Make sure you take a look at InvestingPro to remain in sync with the market pattern and what it means on your buying and selling. Whether or not you’re a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

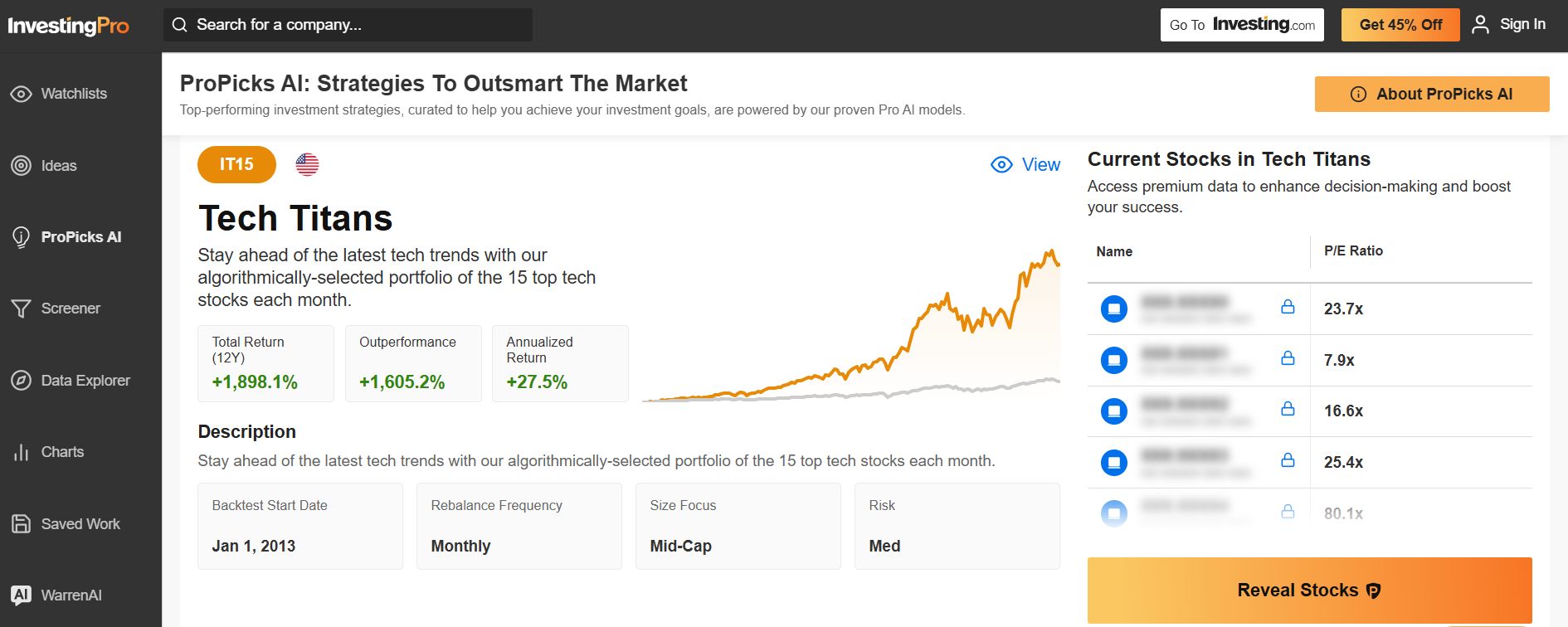

Subscribe now for 45% off and immediately unlock entry to a number of market-beating options, together with:

- ProPicks AI: AI-selected inventory winners with confirmed monitor report.

- InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

- Superior Inventory Screener: Seek for the very best shares primarily based on lots of of chosen filters, and standards.

- High Concepts: See what shares billionaire traders corresponding to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the by way of the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco High QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the by way of the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco High QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I commonly rebalance my portfolio of particular person shares and ETFs primarily based on ongoing danger evaluation of each the macroeconomic setting and corporations’ financials.

The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

Comply with Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.