Nexus Pulse Detector — Superior Structural Value Sign System

How It Works

Nexus Pulse Detector just isn’t a repackaged development instrument or a repainter disguised as precision. It is a structurally grounded sign engine that screens directional imbalance inside localized worth compression and growth phases. Each set off is a mirrored image of management shifts between market individuals, validated via a multi-layered evaluation of breakout legitimacy.

Centered on Value Construction, Not Noise

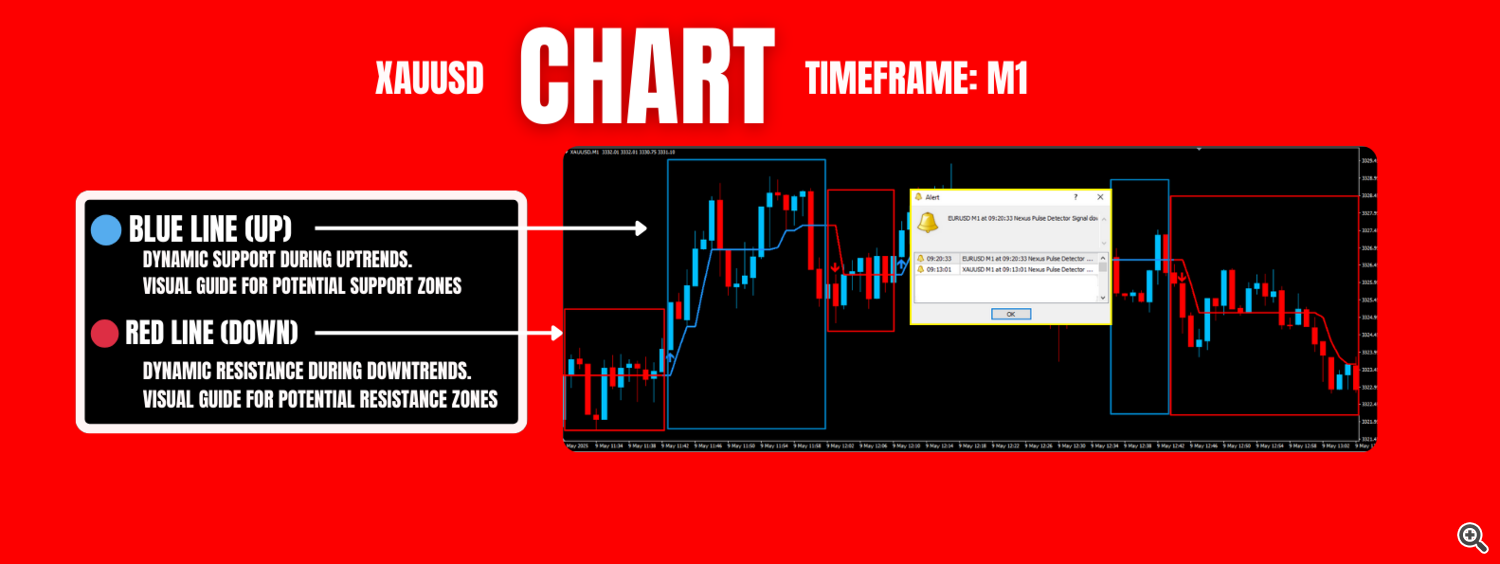

Reasonably than reacting to generic highs and lows, the system isolates stress factors derived from dynamic relationships between current structural extremes and short-range worth averages. It interprets whether or not these ranges have been absorbed, rejected, or damaged with enough power to provoke directional motion — and solely then does it react.

Alerts Solely When the Market Proves It

Alerts don’t seem at each fluctuation. As an alternative, Nexus Pulse Detector waits for a convergence of things: a deviation from prior construction, an inside development transition, and a transparent displacement from current market symmetry. When these converge, the system prints a sign — not as a guess, however as a structural response to market mechanics.

No Indicators, No Smoothing, No Guesswork

There aren’t any smoothed overlays, no oscillators, and no dependence on generally overused indicators. The system avoids lag and noise by relying solely on actual worth habits. What issues right here just isn’t visible consolation — it’s technical readability.

Constructed for Merchants Who Worth Logic and Management

Every arrow represents greater than a visible cue. It is the result of a confirmed polarity shift between buy-side and sell-side momentum zones. The system cross-validates these shifts by analyzing the failure of prior market makes an attempt and the success of breakout follow-through.

Versatile and Adaptive

Whether or not you are concentrating on short-term momentum scalps or larger timeframe structural reversals, Nexus Pulse Detector adapts seamlessly. Its logic is common: stress, imbalance, and shift. That permits it to perform throughout property and timeframes with out requiring any changes to the core logic.

FAQ – Regularly Requested Questions

Does this indicator repaint or backpaint?

No. As soon as a sign is printed, it stays fastened. There is no such thing as a redrawing or back-adjustment.

Is that this primarily based on RSI, ATR, or Bollinger Bands?

Completely not. Nexus Pulse Detector operates independently of conventional retail indicators. Its logic is custom-coded from structural worth ideas.

Can I apply it to any pair or timeframe?

Sure. The logic is timeframe-agnostic and symbol-neutral. Nevertheless, the cleanest indicators usually seem in pairs or devices with clear volatility phases like XAUUSD, GBPJPY, or indices.

Are there alerts included?

Sure. You’ll obtain sound, push, and message alerts for legitimate indicators, with full customization choices.

How ought to I take advantage of this in my technique?

Nexus Pulse Detector excels as a directional affirmation instrument. It’s handiest when mixed along with your present entry logic, particularly for confirming transitions after consolidation or faux breakouts.